Phreesia, Inc. (NYSE: PHR) (“Phreesia” or the "Company")

announced financial results today for the fiscal second quarter

ended July 31, 2024.

"We reached another very important milestone in Phreesia’s

evolution by crossing over to positive Free cash flow1 in the

fiscal second quarter of 2025,” said CEO and Co-Founder Chaim

Indig. “We believe this milestone marks the start of a new era for

Phreesia in which we are able to deploy internally generated cash

to drive stakeholder value.”

Please visit the Phreesia investor relations website at

ir.phreesia.com to view the Company's Q2 Fiscal Year 2025

Stakeholder Letter.

Fiscal Second Quarter Ended July 31, 2024 Highlights

- Total revenue was $102.1 million in the quarter, up 19%

year-over-year.

- Average number of healthcare services clients ("AHSCs") was

4,169 in the quarter, up 21% year-over-year.

- Total revenue per AHSC was $24,494 in the quarter, down 2%

year-over-year. See "Key Metrics" below for additional

information.

- Healthcare services revenue per AHSC was $17,729 in the

quarter, down 3% year-over-year. See "Key Metrics" below for

additional information.

- Net loss was $18.0 million in the quarter compared to net loss

of $36.8 million in the same period in the prior year.

- Adjusted EBITDA was $6.5 million in the quarter compared to

negative $11.5 million in the same period in the prior year.

- Net cash provided by operating activities was $11.1 million for

the three months ended July 31, 2024, as compared to net cash used

in operating activities of $9.3 million for the three months ended

July 31, 2023.

- Free cash flow was $3.7 million for the three months ended July

31, 2024, as compared to negative $15.2 million for the three

months ended July 31, 2023.

- Cash and cash equivalents as of July 31, 2024 was $81.8

million, a decrease of $5.7 million from January 31, 2024 and up

$2.3 million from April 30, 2024.

Fiscal Year 2025 and 2026 Outlook

We are maintaining our revenue outlook for fiscal 2025 of $416

million to $426 million, implying year-over-year growth of 17% to

20%.

We are updating our Adjusted EBITDA outlook for fiscal 2025 to a

range of $26 million to $31 million from a previous range of $21

million to $26 million. Our outlook reflects our strong performance

in the fiscal second quarter and our continued focus on margin

improvement.

We expect AHSCs to reach approximately 4,200 for fiscal 2025

compared to 3,601 for fiscal 2024. We expect Total revenue per AHSC

to increase in fiscal 2025 compared to the $98,944 we achieved in

fiscal 2024.

We expect AHSCs to reach approximately 4,500 in fiscal 2026.

Additionally, we expect Total revenue per AHSC in fiscal 2026 to

increase from fiscal 2025.

We believe our $81.8 million in cash and cash equivalents as of

July 31, 2024, along with cash generated in our normal operations,

gives us sufficient flexibility to reach our fiscal 2025 and fiscal

2026 outlook. Additionally, our available borrowing capacity under

our credit facility with Capital One provides us with an additional

source of capital to pursue future growth opportunities not

incorporated into our fiscal 2025 and fiscal 2026 outlook. As of

July 31, 2024 we have no borrowings outstanding under our credit

facility.

Non-GAAP Financial Measures

We have not reconciled our Adjusted EBITDA outlook to GAAP Net

income (loss) because we do not provide an outlook for GAAP Net

income (loss) due to the uncertainty and potential variability of

Other (income) expense, net and (Benefit from) provision for income

taxes, which are reconciling items between Adjusted EBITDA and GAAP

Net income (loss). Because we cannot reasonably predict such items,

a reconciliation of the non-GAAP financial measure outlook to the

corresponding GAAP measure is not available without unreasonable

effort. We caution, however, that such items could have a

significant impact on the calculation of GAAP Net income (loss).

For further information regarding the non-GAAP financial measures

included in this press release, including a reconciliation of GAAP

to non-GAAP financial measures and an explanation of these

measures, please see “Non-GAAP financial measures” below.

Available Information

We intend to use our Company website (including our Investor

Relations website) as well as our Facebook, X, LinkedIn and

Instagram accounts as a means of disclosing material non-public

information and for complying with our disclosure obligations under

Regulation FD.

Forward Looking Statements

This press release includes express or implied statements that

are not historical facts and are considered forward-looking within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or our future financial or operating performance and may

contain projections of our future results of operations or of our

financial information or state other forward-looking information.

These statements include, but are not limited to, statements

regarding: our future financial and operating performance,

including our revenue, margins, Adjusted EBITDA, cash flows and

profitability2; our ability to finance our plans to achieve our

fiscal 2025 and fiscal 2026 outlook with our current cash balance

and cash generated in the normal course of business; and our

outlook for fiscal 2025 and fiscal 2026, including our expectations

on AHSCs. In some cases, you can identify forward-looking

statements by the following words: “may,” “will,” “could,” “would,”

“should,” “expect,” “intend,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “project,” “potential,” “continue,”

“ongoing,” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain

these words. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements

relate to future events or our future operational or financial

performance and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by these

forward-looking statements. Furthermore, actual results may differ

materially from those described in the forward-looking statements

and will be affected by a variety of risks and factors that are

beyond our control, including, without limitation, risks associated

with: our ability to effectively manage our growth and meet our

growth objectives; our focus on the long-term and our investments

in growth; the competitive environment in which we operate; our

ability to comply with the covenants in our credit agreement with

Capital One; changes in market conditions and receptivity to our

products and services; our ability to develop and release new

products and services and successful enhancements, features and

modifications to our existing products and services; our ability to

maintain the security and availability of our platform; the impact

of cyberattacks, security incidents or breaches impacting our

business; changes in laws and regulations applicable to our

business model; our ability to make accurate predictions about our

industry and addressable market; our ability to attract, retain and

cross-sell to healthcare services clients; our ability to continue

to operate effectively with a primarily remote workforce and

attract and retain key talent; our ability to realize the intended

benefits of our acquisitions and partnerships; and difficulties in

integrating our acquisitions and investments; and the recent high

inflationary environment and other general, market, political,

economic and business conditions (including as a result of the

warfare and/or political and economic instability in Ukraine, the

Middle East or elsewhere). The forward-looking statements contained

in this press release are also subject to other risks and

uncertainties, including those listed or described in our filings

with the Securities and Exchange Commission (“SEC”), including in

our Quarterly Report on Form 10-Q for the fiscal quarter ended July

31, 2024 that will be filed with the SEC following this press

release. The forward-looking statements in this press release speak

only as of the date on which the statements are made. We undertake

no obligation to update, and expressly disclaim the obligation to

update, any forward-looking statements made in this press release

to reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events, except as required by law.

This press release includes certain non-GAAP financial measures

as defined by SEC rules. We have provided a reconciliation of those

measures to the most directly comparable GAAP measures, with the

exception of our Adjusted EBITDA outlook for the reasons described

above.

Conference Call Information

We will hold a conference call on Wednesday September 4, 2024 at

5:00 p.m. Eastern Time to review our fiscal 2025 second quarter

financial results. To participate in our live conference call and

webcast, please dial (800) 715-9871 (or (646) 307-1963 for

international participants) using conference code number 7404611 or

visit the “Events & Presentations” section of our Investor

Relations website at ir.phreesia.com. A replay of the call will be

available via webcast for on-demand listening shortly after the

completion of the call, at the same web link, and will remain

available for approximately 90 days.

About Phreesia

Phreesia is a trusted leader in patient activation, giving

providers, life sciences companies, payers and other organizations

tools to help patients take a more active role in their care.

Founded in 2005, Phreesia enabled approximately 150 million patient

visits in 2023—more than 1 in 10 visits across the U.S.—scale that

we believe allows us to make meaningful impact. Offering

patient-driven digital solutions for intake, outreach, education

and more, Phreesia enhances the patient experience, drives

efficiency and improves healthcare outcomes.

Phreesia, Inc.

Consolidated Balance

Sheets

(in thousands, except share and

per share data)

July 31, 2024

January 31, 2024

(Unaudited)

Assets

Current:

Cash and cash equivalents

$

81,798

$

87,520

Settlement assets

25,320

28,072

Accounts receivable, net of allowance for

doubtful accounts of $1,365 and $1,392 as of July 31, 2024 and

January 31, 2024, respectively

61,274

64,863

Deferred contract acquisition costs

841

768

Prepaid expenses and other current

assets

11,695

14,461

Total current assets

180,928

195,684

Property and equipment, net of accumulated

depreciation and amortization of $84,295 and $76,859 as of July 31,

2024 and January 31, 2024, respectively

20,955

16,902

Capitalized internal-use software, net of

accumulated amortization of $50,559 and $45,769 as of July 31, 2024

and January 31, 2024, respectively

49,767

46,139

Operating lease right-of-use assets

1,863

266

Deferred contract acquisition costs

742

986

Intangible assets, net of accumulated

amortization of $6,666 and $4,925 as of July 31, 2024 and January

31, 2024, respectively

29,884

31,625

Goodwill

75,845

75,845

Other assets

2,251

2,879

Total Assets

$

362,235

$

370,326

Liabilities and Stockholders’

Equity

Current:

Settlement obligations

$

25,320

$

28,072

Current portion of finance lease

liabilities and other debt

7,161

6,056

Current portion of operating lease

liabilities

989

393

Accounts payable

6,976

8,480

Accrued expenses

32,668

37,130

Deferred revenue

21,370

24,113

Other current liabilities

7,515

5,875

Total current liabilities

101,999

110,119

Long-term finance lease liabilities and

other debt

7,297

5,400

Operating lease liabilities,

non-current

1,075

134

Long-term deferred revenue

63

97

Long-term deferred tax liabilities

390

270

Other long-term liabilities

76

2,857

Total Liabilities

110,900

118,877

Commitments and contingencies

Stockholders’ Equity:

Preferred stock, undesignated, $0.01 par

value—$20,000,000 shares authorized as of both July 31, 2024 and

January 31, 2024; no shares issued or outstanding as of both July

31, 2024 and January 31, 2024

—

—

Common stock, $0.01 par value -

500,000,000 shares authorized as of both July 31, 2024 and January

31, 2024; 59,057,170 and 57,709,762 shares issued as of July 31,

2024 and January 31, 2024, respectively

591

577

Additional paid-in capital

1,076,969

1,039,361

Accumulated deficit

(780,703

)

(742,969

)

Accumulated other comprehensive loss

(2

)

—

Treasury stock, at cost, 1,355,169 shares

as of both July 31, 2024 and January 31, 2024

(45,520

)

(45,520

)

Total Stockholders’ Equity

251,335

251,449

Total Liabilities and Stockholders’

Equity

$

362,235

$

370,326

Phreesia, Inc.

Consolidated Statements of

Operations

(Unaudited)

(in thousands, except share and

per share data)

Three months ended

Six months ended

July 31,

July 31,

2024

2023

2024

2023

Revenue:

Subscription and related services

$

48,612

$

39,301

$

95,354

$

77,188

Payment processing fees

25,300

23,631

52,360

47,884

Network solutions

28,203

22,898

55,618

44,603

Total revenues

102,115

85,830

203,332

169,675

Expenses:

Cost of revenue (excluding depreciation

and amortization)

16,143

14,449

31,866

29,356

Payment processing expense

16,668

15,852

34,965

31,942

Sales and marketing

30,184

37,244

62,195

74,657

Research and development

29,542

27,471

58,423

53,940

General and administrative

19,497

20,988

38,549

40,865

Depreciation

3,921

4,244

7,445

8,748

Amortization

3,382

2,537

6,531

5,023

Total expenses

119,337

122,785

239,974

244,531

Operating loss

(17,222

)

(36,955

)

(36,642

)

(74,856

)

Other (expense) income, net

(86

)

50

(117

)

8

Interest income, net

46

786

285

1,504

Total other (expense) income,

net

(40

)

836

168

1,512

Loss before provision for income

taxes

(17,262

)

(36,119

)

(36,474

)

(73,344

)

Provision for income taxes

(750

)

(648

)

(1,260

)

(954

)

Net loss

$

(18,012

)

$

(36,767

)

$

(37,734

)

$

(74,298

)

Net loss per share attributable to

common stockholders, basic and diluted

$

(0.31

)

$

(0.68

)

$

(0.66

)

$

(1.39

)

Weighted-average common shares

outstanding, basic and diluted

57,502,959

53,794,060

57,089,232

53,574,584

(1) Our potential dilutive securities have

been excluded from the computation of diluted net loss per share as

the effect would be to reduce the net loss per share. Therefore,

the weighted-average number of common shares outstanding used to

calculate both basic and diluted net loss per share attributable to

common stockholders is the same.

Phreesia, Inc.

Consolidated Statements of

Comprehensive Loss

(Unaudited)

(in thousands)

Three months ended

Six months ended

July 31,

July 31,

2024

2023

2024

2023

Net loss

$

(18,012

)

$

(36,767

)

$

(37,734

)

$

(74,298

)

Other comprehensive loss, net of tax:

Change in foreign currency translation

adjustments, net of tax

(3

)

—

(2

)

—

Other comprehensive loss, net of

tax

(3

)

—

(2

)

—

Comprehensive loss

$

(18,015

)

$

(36,767

)

$

(37,736

)

$

(74,298

)

Phreesia, Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

(in thousands)

Three months ended

Six months ended

July 31,

July 31,

2024

2023

2024

2023

Operating activities:

Net loss

$

(18,012

)

$

(36,767

)

$

(37,734

)

$

(74,298

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

7,303

6,781

13,976

13,771

Stock-based compensation expense

16,448

18,648

33,288

35,786

Amortization of deferred financing costs

and debt discount

51

84

112

169

Cost of Phreesia hardware purchased by

customers

334

234

677

650

Deferred contract acquisition costs

amortization

192

280

384

620

Non-cash operating lease expense

188

109

361

342

Deferred taxes

56

(75

)

119

142

Changes in operating assets and

liabilities:

Accounts receivable

4,976

(832

)

3,583

(2,370

)

Prepaid expenses and other assets

2,867

(383

)

3,281

769

Deferred contract acquisition costs

(213

)

—

(213

)

—

Accounts payable

1,186

568

(1,750

)

(2,415

)

Accrued expenses and other liabilities

(1,392

)

4,239

(2,547

)

6,061

Lease liabilities

(201

)

(405

)

(420

)

(652

)

Deferred revenue

(2,722

)

(1,812

)

(2,777

)

(1,565

)

Net cash provided by (used in)

operating activities

11,061

(9,331

)

10,340

(22,990

)

Investing activities:

Acquisitions, net of cash acquired

—

(3,873

)

—

(3,873

)

Capitalized internal-use software

(2,976

)

(5,088

)

(7,546

)

(9,820

)

Purchases of property and equipment

(4,427

)

(755

)

(5,303

)

(2,102

)

Net cash used in investing

activities

(7,403

)

(9,716

)

(12,849

)

(15,795

)

Financing activities:

Proceeds from issuance of common stock

upon exercise of stock options

219

426

566

675

Treasury stock to satisfy tax withholdings

on stock compensation awards

—

(3,775

)

—

(10,725

)

Proceeds from employee stock purchase

plan

690

896

1,603

1,863

Finance lease payments

(1,995

)

(1,983

)

(3,275

)

(3,427

)

Constructive financing

—

1,688

—

1,688

Principal payments on financing

agreements

(295

)

(45

)

(584

)

(45

)

Debt issuance costs and loan facility fee

payments

—

(250

)

(152

)

(250

)

Financing payments of acquisition-related

liabilities

—

—

(1,364

)

—

Net cash used in financing

activities

(1,381

)

(3,043

)

(3,206

)

(10,221

)

Effect of exchange rate changes on cash

and cash equivalents

(6

)

—

(7

)

—

Net increase (decrease) in cash and

cash equivalents

2,271

(22,090

)

(5,722

)

(49,006

)

Cash and cash equivalents – beginning

of period

79,527

149,767

87,520

176,683

Cash and cash equivalents – end of

period

$

81,798

$

127,677

$

81,798

$

127,677

Supplemental information of non-cash

investing and financing information:

Right of use assets acquired in exchange

for operating lease liabilities

$

1,194

$

—

$

1,958

$

—

Property and equipment acquisitions

through finance leases

$

333

$

—

$

6,862

$

7,067

Purchase of property and equipment and

capitalized software included in current liabilities

$

1,517

$

1,509

$

1,517

$

1,509

Capitalized stock-based compensation

$

315

$

377

$

663

$

714

Issuance of stock to settle liabilities

for stock-based compensation

$

1,649

$

1,924

$

7,826

$

7,221

Issuance of stock as consideration in

business combinations

$

—

$

4,676

$

—

$

4,676

Issuance of liabilities as consideration

in business combinations

$

—

$

91

$

—

$

91

Capitalized software acquired through

vendor financing

$

—

$

2,047

$

—

$

2,047

Cash paid for:

Interest

$

381

$

296

$

864

$

354

Income taxes

$

417

$

13

$

2,010

$

53

Non-GAAP Financial Measures

This press release and statements made during the

above-referenced webcast may include certain non-GAAP financial

measures as defined by SEC rules.

Adjusted EBITDA is a supplemental measure of our performance

that is not required by, or presented in accordance with, GAAP.

Adjusted EBITDA is not a measurement of our financial performance

under GAAP and should not be considered as an alternative to net

income or loss or any other performance measure derived in

accordance with GAAP, or as an alternative to cash flows from

operating activities as a measure of our liquidity. We define

Adjusted EBITDA as net income or loss before interest income, net,

provision for income taxes, depreciation and amortization, and

before stock-based compensation expense and other expense, net.

We have provided below a reconciliation of Adjusted EBITDA to

net loss, the most directly comparable GAAP financial measure. We

have presented Adjusted EBITDA in this press release and our

Quarterly Report on Form 10-Q to be filed after this press release

because it is a key measure used by our management and board of

directors to understand and evaluate our core operating performance

and trends, to prepare and approve our annual budget, and to

develop short and long-term operational plans. In particular, we

believe that the exclusion of the amounts eliminated in calculating

Adjusted EBITDA can provide a useful measure for period-to-period

comparisons of our core business. Accordingly, we believe that

Adjusted EBITDA provides useful information to investors and others

in understanding and evaluating our operating results in the same

manner as our management and board of directors. We have not

reconciled our Adjusted EBITDA outlook to GAAP Net income (loss)

because we do not provide an outlook for GAAP Net income (loss) due

to the uncertainty and potential variability of Other (income)

expense, net and (Benefit from) provision for income taxes, which

are reconciling items between Adjusted EBITDA and GAAP Net income

(loss). Because we cannot reasonably predict such items, a

reconciliation of the non-GAAP financial measure outlook to the

corresponding GAAP measure is not available without unreasonable

effort. We caution, however, that such items could have a

significant impact on the calculation of GAAP Net income

(loss).

Our use of Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation or as a

substitute for analysis of our financial results as reported under

GAAP. Some of these limitations are as follows:

- Although depreciation and amortization expense are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future, and Adjusted EBITDA does not reflect cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements;

- Adjusted EBITDA does not reflect: (1) changes in, or cash

requirements for, our working capital needs; (2) the potentially

dilutive impact of non-cash stock-based compensation; (3) tax

payments that may represent a reduction in cash available to us; or

(4) interest income, net; and

- Other companies, including companies in our industry, may

calculate Adjusted EBITDA or similarly titled measures differently,

which reduces its usefulness as a comparative measure.

Because of these and other limitations, you should consider

Adjusted EBITDA along with other GAAP-based financial performance

measures, including various cash flow metrics, net loss, and our

GAAP financial results. The following table presents a

reconciliation of Adjusted EBITDA to net loss for each of the

periods indicated:

Phreesia, Inc.

Adjusted EBITDA

(Unaudited)

Three months ended

Six months ended

July 31,

July 31,

(in thousands)

2024

2023

2024

2023

Net loss

$

(18,012

)

$

(36,767

)

$

(37,734

)

$

(74,298

)

Interest income, net

(46

)

(786

)

(285

)

(1,504

)

Provision for income taxes

750

648

1,260

954

Depreciation and amortization

7,303

6,781

13,976

13,771

Stock-based compensation expense

16,448

18,648

33,288

35,786

Other expense (income), net

86

(50

)

117

(8

)

Adjusted EBITDA

$

6,529

$

(11,526

)

$

10,622

$

(25,299

)

We calculate Free cash flow as Net cash provided by (used in)

operating activities less capitalized internal-use software

development costs and purchases of property and equipment.

Additionally, Free cash flow is a supplemental measure of our

performance that is not required by, or presented in accordance

with, GAAP. We consider Free cash flow to be a liquidity measure

that provides useful information to management and investors about

the amount of cash generated by our business that can be used for

strategic opportunities, including investing in our business,

making strategic investments, partnerships and acquisitions and

strengthening our financial position.

The following table presents a reconciliation of Free cash flow

from Net cash provided by (used in) operating activities, the most

directly comparable GAAP financial measure, for each of the periods

indicated:

Phreesia, Inc.

Free cash flow

(Unaudited)

Three months ended

Six months ended

July 31,

July 31,

(in thousands, unaudited)

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

$

11,061

$

(9,331

)

$

10,340

$

(22,990

)

Less:

Capitalized internal-use software

(2,976

)

(5,088

)

(7,546

)

(9,820

)

Purchases of property and equipment

(4,427

)

(755

)

(5,303

)

(2,102

)

Free cash flow

$

3,658

$

(15,174

)

$

(2,509

)

$

(34,912

)

Phreesia, Inc.

Reconciliation of GAAP and

Adjusted Operating Expenses

(Unaudited)

Three months ended

Six months ended

July 31,

July 31,

(in thousands)

2024

2023

2024

2023

GAAP operating expenses

General and administrative

$

19,497

$

20,988

$

38,549

$

40,865

Sales and marketing

30,184

37,244

62,195

74,657

Research and development

29,542

27,471

58,423

53,940

Cost of revenue (excluding depreciation

and amortization)

16,143

14,449

31,866

29,356

$

95,366

$

100,152

$

191,033

$

198,818

Stock compensation included in GAAP

operating expenses

General and administrative

$

6,276

$

5,747

$

12,485

$

11,625

Sales and marketing

5,303

7,111

11,069

13,528

Research and development

3,629

4,563

7,256

8,441

Cost of revenue (excluding depreciation

and amortization)

1,240

1,227

2,478

2,192

$

16,448

$

18,648

$

33,288

$

35,786

Adjusted operating expenses

General and administrative

$

13,221

$

15,241

$

26,064

$

29,240

Sales and marketing

24,881

30,133

51,126

61,129

Research and development

25,913

22,908

51,167

45,499

Cost of revenue (excluding depreciation

and amortization)

14,903

13,222

29,388

27,164

$

78,918

$

81,504

$

157,745

$

163,032

Phreesia, Inc.

Key Metrics

(Unaudited)

Three months ended

Six months ended

July 31,

July 31,

2024

2023

2024

2023

Key Metrics:

Average number of healthcare services

clients ("AHSCs")

4,169

3,445

4,117

3,377

Healthcare services revenue per AHSC

$

17,729

$

18,268

$

35,879

$

37,036

Total revenue per AHSC

$

24,494

$

24,914

$

49,388

$

50,244

The definitions of our key metrics are presented below.

- AHSCs. We define AHSCs as the average number of clients that

generate subscription and related services or payment processing

revenue each month during the applicable period. In cases where we

act as a subcontractor providing white-label services to our

partner's clients, we treat the contractual relationship as a

single healthcare services client. We believe growth in AHSCs is a

key indicator of the performance of our business and depends, in

part, on our ability to successfully develop and market our

solutions to healthcare services organizations that are not yet

clients. While growth in AHSCs is an important indicator of

expected revenue growth, it also informs our management of the

areas of our business that will require further investment to

support expected future AHSC growth. For example, as AHSCs

increase, we may need to add to our customer support team and

invest to maintain effectiveness and performance of our solutions

for our healthcare services clients and their patients.

- Healthcare services revenue per AHSC. We define Healthcare

services revenue as the sum of subscription and related services

revenue and payment processing revenue. We define Healthcare

services revenue per AHSC as Healthcare services revenue in a given

period divided by AHSCs during that same period. We are focused on

continually delivering value to our healthcare services clients and

believe that our ability to increase Healthcare services revenue

per AHSC is an indicator of the long-term value of our

solutions.

- Total revenue per AHSC. We define Total revenue per AHSC as

Total revenue in a given period divided by AHSCs during that same

period. Our healthcare services clients directly generate

subscription and related services and payment processing revenue.

Additionally, our relationships with healthcare services clients

who subscribe to our solutions give us the opportunity to engage

with life sciences companies, health plans and other payer

organizations, patient advocacy, public interest and other

not-for-profit organizations who deliver direct communication to

patients through our solutions. As a result, we believe that our

ability to increase Total revenue per AHSC is an indicator of the

long-term value of our solutions.

Additional Information

(Unaudited)

Three months ended

Six months ended

July 31,

July 31,

2024

2023

2024

2023

Patient payment volume (in millions)

$

1,093

$

989

$

2,259

$

2,005

Payment facilitator volume percentage

81

%

82

%

81

%

82

%

- Patient payment volume. We believe that patient payment volume

is an indicator of both the underlying health of our healthcare

services clients’ businesses and the continuing shift of healthcare

costs to patients. We measure patient payment volume as the total

dollar volume of transactions between our healthcare services

clients and their patients utilizing our payment platform,

including via credit and debit cards that we process as a payment

facilitator as well as cash and check payments and credit and debit

transactions for which we act as a gateway to other payment

processors.

- Payment facilitator volume percentage. We define payment

facilitator volume percentage as the volume of credit and debit

card patient payment volume that we process as a payment

facilitator as a percentage of total patient payment volume.

Payment facilitator volume is a major driver of our payment

processing revenue. Our payment facilitator volume percentage could

decline slightly over time should we increase our penetration of

enterprise customers that are less likely to use Phreesia as a

payment facilitator.

______________________________ 1 During the second quarter of

fiscal 2025, our net cash provided by operating activities was

$11.1 million and our Free cash flow was $3.7 million. We define

Free cash flow as net cash provided by (used in) operating

activities less cash paid for capitalized internal-use software

development costs and cash paid for purchases of property and

equipment. See “Non-GAAP Financial Measures” for a reconciliation

of Free cash flow to the closest GAAP measure. 2 We define

“profitability,” discussed herein, in terms of Adjusted EBITDA. See

‘Non-GAAP Financial Measures’ for a reconciliation of our Net loss

to Adjusted EBITDA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904933358/en/

Investor Relations Contact:

Balaji Gandhi Phreesia, Inc. investors@phreesia.com (929)

506-4950

Media Contact:

Nicole Gist Phreesia, Inc. nicole.gist@phreesia.com (407)

760-6274

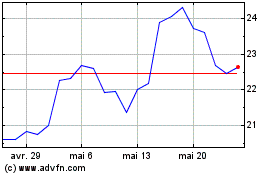

Phreesia (NYSE:PHR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Phreesia (NYSE:PHR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024