In the table FY2025 Q2 Outlook - Modeling Items, the row

Gross margin (as a percentage of net sales) should read 43.00% -

44.00% (instead of 43.00% - 4.00%).

The updated release reads:

RBC BEARINGS INCORPORATED ANNOUNCES FISCAL FIRST QUARTER 2025

RESULTS

RBC Bearings Incorporated (NYSE: RBC, RBCP), a leading

international manufacturer of highly engineered precision bearings,

components and essential systems for the industrial, defense and

aerospace industries, today reported results for the first quarter

fiscal 2025.

First Quarter Financial

Highlights

- First quarter net sales of $406.3 million increased 5.0% over

last year, Aerospace/Defense up 23.7% and Industrial down

3.5%.

- Gross margin of 45.3% for the first quarter of fiscal 2025

compared to 43.4% last year.

- First quarter net income attributable to common stockholders as

a percentage of net sales of 13.7% vs 11.4% last year.

- Adjusted EBITDA as a percentage of net sales of 33.0% vs 31.1%

last year.

- First quarter free cash flow conversion of 144.0% vs 110.0%

last year.

Three Month Financial

Highlights

($ in millions)

Fiscal 2025

Fiscal 2024

Change

GAAP

Adjusted (1)

GAAP

Adjusted (1)

GAAP

Adjusted (1)

Net sales

$406.3

$387.1

5.0%

Gross margin

$184.0

$167.9

9.6%

Gross margin %

45.3%

43.4%

Operating income

$97.5

$97.5

$85.0

$85.3

14.7%

14.3%

Operating income %

24.0%

24.0%

22.0%

22.0%

Net income

$61.4

$80.2

$50.0

$67.7

22.8%

18.5%

Net income attributable to common

stockholders

$55.7

$74.5

$44.3

$62.0

25.7%

20.2%

Diluted EPS

$1.90

$2.54

$1.52

$2.13

25.0%

19.2%

(1) Results exclude items in

reconciliation below.

“RBC continued to deliver strong operational performance in the

first quarter with 5.0% sales growth, 11.3% adjusted EBITDA growth

and 19.2% adjusted diluted earnings per share growth,” said Dr.

Michael J. Hartnett, Chairman and Chief Executive Officer.

“Customer demand for our capacity in the Aerospace and Defense end

market remains robust, as evidenced by our 23.7% revenue growth,

and our Industrial business continued to execute well and remains

well poised for any acceleration in industrial end markets as we

progress through the remainder of the year. Profit performance in

the quarter was notable and continues to be driven by ongoing

absorption of our aerospace and defense capacity and continued

Dodge synergies, which are tailwinds that we believe will continue

to benefit us through the remainder of the fiscal year.”

First Quarter Results

Net sales for the first quarter of fiscal 2025 were $406.3

million, an increase of 5.0% from $387.1 million in the first

quarter of fiscal 2024. Net sales for the Industrial segment

decreased 3.5%, while net sales for the Aerospace/Defense segment

increased 23.7%. Gross margin for the first quarter of fiscal 2025

was $184.0 million compared to $167.9 million for the same period

last year.

SG&A for the first quarter of fiscal 2025 was $67.6 million,

an increase of $2.9 million from $64.7 million for the same period

last year. As a percentage of net sales, SG&A was 16.6% for the

first quarter of fiscal 2025 compared to 16.7% for the same period

last year.

Other operating expenses for the first quarter of fiscal 2025

totaled $18.9 million compared to $18.2 million for the same period

last year. For the first quarter of fiscal 2025, other operating

expenses included $17.8 million of amortization of intangible

assets and $1.1 million of other items. For the first quarter of

fiscal 2024, other operating expenses included $17.5 million of

amortization of intangible assets and $0.7 million of other

items.

Operating income for the first quarter of fiscal 2025 was $97.5

million compared to $85.0 million for the same period last year. On

an adjusted basis, operating income was $97.5 million for the first

quarter of fiscal 2025 compared to $85.3 million for the same

period last year. Refer to the tables below for details on the

adjustments made to operating income to arrive at adjusted

operating income.

Interest expense, net, was $17.2 million for the first quarter

of fiscal 2025 compared to $20.5 million for the same period last

year.

Income tax expense for the first quarter of fiscal 2025 was

$18.5 million compared to $14.0 million for the same period last

year. The effective income tax rate for the first quarter of fiscal

2025 was 23.1% compared to 21.9% for the same period last year.

Net income for the first quarter of fiscal 2025 was $61.4

million compared to $50.0 million for the same period last year. On

an adjusted basis, net income was $80.2 million for the first

quarter of fiscal 2025 compared to $67.7 million for the same

period last year. Refer to the tables below for details on the

adjustments made to net income to arrive at adjusted net income.

Net income attributable to common stockholders for the first

quarter of fiscal 2025 was $55.7 million compared to $44.3 million

for the same period last year. On an adjusted basis, net income

attributable to common stockholders for the first quarter of fiscal

2025 was $74.5 million compared to $62.0 million for the same

period last year.

Diluted EPS attributable to common stockholders for the first

quarter of fiscal 2025 was $1.90 compared to $1.52 for the same

period last year. On an adjusted basis, diluted EPS attributable to

common stockholders was $2.54 for the first quarter of fiscal 2025

compared to $2.13 for the same period last year.

Backlog as of June 29, 2024, was $825.8 million compared to

$821.5 million as of March 30, 2024 and $765.2 million as of July

1, 2023.

Preferred Stock Conversion in Fiscal

2025

The Company’s Series A mandatory convertible preferred stock is

set to automatically convert to common stock on October 15, 2024,

at which point the Company will no longer be required to pay a 5.0%

dividend ($5.7 million per quarter), which reduces net income

attributable to common stockholders. This will lead to $23.0

million of annual cash savings in future periods. Fiscal 2025 will

include the final three quarterly dividend payments, the first of

which was made in the first quarter.

If the preferred stock conversion were to have taken place

during the first quarter of fiscal 2025, it would have resulted in

an additional 2,029,980 shares of outstanding common stock. If

these 2,029,980 shares were added to the total diluted shares

outstanding in lieu of the preferred stock quarterly dividend of

$5.7 million, diluted EPS for this quarter would have been $1.96

rather than the reported $1.90, and adjusted diluted EPS would have

been $2.56 rather than the reported $2.54.

Outlook for the Second Quarter Fiscal

2025

The Company expects net sales to be approximately $395.0 million

to $405.0 million in the second quarter of fiscal 2025, compared to

$385.6 million last year, a growth rate of 2.4% to 5.0%.

Live Webcast

RBC Bearings Incorporated will host a webcast on Friday, August

2nd, 2024, at 11:00 a.m. ET to discuss the quarterly results. To

access the webcast, go to the investor relations portion of the

Company’s website, www.rbcbearings.com, and click on the webcast

icon. If you do not have access to the Internet and wish to listen

to the call, dial 877-407-4019 (international callers dial +1

201-689-8337) and provide conference ID # 13747958. Investors are

advised to dial into the call at least ten minutes prior to the

call to register. An audio replay of the call will be available

from 2:00 p.m. ET August 2nd, 2024, until 2:00 p.m. ET August 16th,

2024. The replay can be accessed by dialing 877-660-6853

(international callers dial +1 201-612-7415) and providing

conference ID # 13747958.

Non-GAAP Financial

Measures

In addition to disclosing results of operations that are

determined in accordance with U.S. generally accepted accounting

principles (GAAP), this press release also discloses non-GAAP

results of operations that exclude certain items. These non-GAAP

measures adjust for items that management believes are unusual, as

well as other non-cash items including but not limited to

depreciation, amortization, and equity-based incentive

compensation. Management believes that the presentation of these

non-GAAP measures provides useful information to investors

regarding the Company’s results of operations as these non-GAAP

measures allow investors to better evaluate ongoing business

performance. Investors should consider non-GAAP measures in

addition to, not as a substitute for, financial measures prepared

in accordance with GAAP. A reconciliation of the non-GAAP measures

disclosed in this press release with the most comparable GAAP

measures are included in the financial table attached to this press

release.

Free Cash Flow Conversion Free cash flow conversion measures our

ability to convert operating profits into free cash flow and is

calculated as free cash flow (cash provided by operating activities

less capital expenditures) divided by net income.

Adjusted Gross Margin and Adjusted Operating Income Adjusted

gross margin excludes the impact of restructuring costs associated

with the closing of a plant. Adjusted operating income excludes

acquisition expenses (including the impact of acquisition-related

fair value adjustments in connection with purchase), restructuring

and other similar charges, and other non-operational, non-cash or

non-recurring losses. We believe that adjusted operating income is

useful in assessing our financial performance by excluding items

that are not indicative of our core operating performance or that

may obscure trends useful in evaluating our continuing results of

operations.

Adjusted Net Income Attributable to Common Stockholders and

Adjusted Earnings Per Share Attributable to Common Stockholders

Adjusted net income attributable to common stockholders and

adjusted earnings per share attributable to common stockholders

(calculated on a diluted basis) exclude non-cash expenses for

amortization related to acquired intangible assets, stock-based

compensation, amortization of deferred finance fees, acquisition

expenses (including the impact of acquisition-related fair value

adjustments in connection with purchase), restructuring and other

similar charges, gains or losses on divestitures, discontinued

operations, gains or losses on extinguishment of debt, and other

non-operational, non-cash or non-recurring losses, net of their

income tax impact. We believe that adjusted net income and adjusted

earnings per share are useful in assessing our financial

performance by excluding items that are not indicative of our core

operating performance or that may obscure trends useful in

evaluating our continuing results of operations.

Adjusted EBITDA We use the term “Adjusted EBITDA” to describe

net income adjusted for the items summarized in the “Reconciliation

of GAAP to Non-GAAP Financial Measures” table below. Adjusted

EBITDA is intended to show our unleveraged, pre-tax operating

results and therefore reflects our financial performance based on

operational factors, excluding non-operational, non-cash or

non-recurring losses or gains. In view of our debt level, Adjusted

EBITDA aids our investors in understanding our compliance with our

debt covenants. Management and various investors use the ratio of

total debt less cash to Adjusted EBITDA, or “net debt leverage,” as

a measure of our financial strength and ability to incur

incremental indebtedness when making investment decisions and

evaluating us against peers. Lastly, management and various

investors use the ratio of the change in Adjusted EBITDA divided by

the change in net sales (referred to as “incremental margin” in the

case of an increase in net sales or “decremental margin” in the

case of a decrease in net sales) as an additional measure of our

financial performance and some investors utilize it when making

investment decisions and evaluating us against peers.

Adjusted EBITDA is not a presentation made in accordance with

GAAP, and our definition of Adjusted EBITDA may vary from the

definition used by others in our industry. Adjusted EBITDA should

not be considered as an alternative to net income, income from

operations, or any other performance measures derived in accordance

with GAAP. Adjusted EBITDA has important limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for analysis of our results as reported under GAAP.

For example, Adjusted EBITDA does not reflect (a) our capital

expenditures, future requirements for capital expenditures or

contractual commitments; (b) changes in, or cash requirements for,

our working capital needs; (c) the significant interest expenses,

or the cash requirements necessary to service interest or principal

payments, on our debt; (d) tax payments that represent a reduction

in cash available to us; (e) any cash requirements for the assets

being depreciated and amortized that may have to be replaced in the

future; or (f) the impact of earnings or charges resulting from

matters that we and the lenders under our credit agreement may not

consider indicative of our ongoing operations. In particular, our

definition of Adjusted EBITDA adds back certain non-cash,

non-operating or non-recurring charges that are deducted in

calculating net income, even though these are expenses that may

recur or vary greatly, are difficult to predict, and can represent

the effect of long-term strategies as opposed to short-term

results. In addition, certain of these expenses can represent the

reduction of cash that could be used for other corporate purposes.

Further, although not included in the calculation of Adjusted

EBITDA below, the measure may at times (i) include estimated cost

savings and operating synergies related to operational changes

ranging from acquisitions to dispositions to restructurings and/or

(ii) exclude one-time transition expenditures that we anticipate we

will need to incur to realize cost savings before such savings have

occurred.

About RBC Bearings

RBC Bearings Incorporated is an international manufacturer and

marketer of highly engineered precision bearings, components and

essential systems. Founded in 1919, the Company is primarily

focused on producing highly technical or regulated bearing products

and components requiring sophisticated design, testing, and

manufacturing capabilities for the diversified industrial,

aerospace and defense markets. The Company is headquartered in

Oxford, Connecticut.

Safe Harbor for Forward Looking

Statements

Certain statements in this press release contain

“forward-looking statements.” All statements other than statements

of historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including the following: the

section of this press release entitled “Outlook”; any projections

of earnings, revenue or other financial items relating to the

Company, any statement of the plans, strategies and objectives of

management for future operations; any statements concerning

proposed future growth rates in the markets we serve; any

statements of belief; any characterization of and the Company’s

ability to control contingent liabilities; anticipated trends in

the Company’s businesses; and any statements of assumptions

underlying any of the foregoing. Forward-looking statements may

include the words “may,” “would,” “estimate,” “intend,” “continue,”

“believe,” “expect,” “anticipate,” and other similar words.

Although the Company believes that the expectations reflected in

any forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties

beyond the control of the Company. These risks and uncertainties

include, but are not limited to, risks and uncertainties relating

to general economic conditions, geopolitical factors, future levels

of aerospace/defense and industrial market activity, future

financial performance, our use of information technology systems,

our disclosure controls and procedures and internal control over

financial reporting, our debt level, our level of goodwill, market

acceptance of new or enhanced versions of the Company’s products,

the pricing of raw materials, changes in the competitive

environments in which the Company’s businesses operate, increases

in interest rates, the Company’s ability to acquire and integrate

complementary businesses, and risks and uncertainties listed or

disclosed in our reports filed with the Securities and Exchange

Commission, including, without limitation, the risks identified

under the heading “Risk Factors” set forth in the Company’s most

recent Annual Report on Form 10-K filed with the SEC. The Company

does not intend, and undertakes no obligation, to update or alter

any forward-looking statements.

RBC Bearings Incorporated

Consolidated Statements of

Operations

(dollars in millions, except per share

data)

Three Months Ended

(Unaudited)

June 29,

July 1,

2024

2023

Net sales

$

406.3

$

387.1

Cost of sales

222.3

219.2

Gross margin

184.0

167.9

Operating expenses:

Selling, general and administrative

67.6

64.7

Other, net

18.9

18.2

Total operating expenses

86.5

82.9

Operating income

97.5

85.0

Interest expense, net

17.2

20.5

Other non-operating expense

0.4

0.5

Income before income taxes

79.9

64.0

Provision for income taxes

18.5

14.0

Net income

61.4

50.0

Preferred stock dividends

5.7

5.7

Net income attributable to common

stockholders

$

55.7

$

44.3

Net income per common share attributable

to common stockholders:

Basic

$

1.92

$

1.53

Diluted

$

1.90

$

1.52

Weighted average common shares:

Basic

29,054,820

28,846,874

Diluted

29,294,998

29,114,819

Segment Data:

Three Months Ended

June 29,

July 1,

Net External Sales:

2024

2023

Aerospace and defense segment

$

149.1

$

120.5

Industrial segment

257.2

266.6

Total net external sales

$

406.3

$

387.1

Three Months Ended

Reconciliation of Reported Operating

Income to

June 29,

July 1,

Adjusted Operating Income:

2024

2023

Reported operating income

$

97.5

$

85.0

Restructuring and consolidation

-

0.3

Adjusted operating income

$

97.5

$

85.3

Three Months Ended

Reconciliation of Reported Net Income

to Adjusted Net

June 29,

July 1,

Income Attributable to Common

Stockholders:

2024

2023

Reported net income

$

61.4

$

50.0

Restructuring and consolidation

-

0.3

M&A related amortization

16.4

16.3

Stock compensation expense

6.5

5.4

Amortization of deferred finance fees

0.6

0.9

Tax impact of adjustments and other tax

matters

(4.7)

(5.2)

Adjusted net income

$

80.2

$

67.7

Preferred stock dividends

5.7

5.7

Adjusted net income attributable to

common stockholders

$

74.5

$

62.0

Adjusted net income per common share

attributable

to common stockholders:

Basic

$

2.56

$

2.15

Diluted

$

2.54

$

2.13

Weighted average common shares:

Basic

29,054,820

28,846,874

Diluted

29,294,998

29,114,819

Three Months Ended

Reconciliation of Reported Net Income

to

June 29,

July 1,

Adjusted EBITDA:

2024

2023

Reported net income

$

61.4

$

50.0

Interest expense, net

17.2

20.5

Provision for income taxes

18.5

14.0

Stock compensation expense

6.5

5.4

Depreciation and amortization

30.0

29.7

Other non-operating expense

0.4

0.5

Restructuring and consolidation

-

0.3

Adjusted EBITDA

$

134.0

$

120.4

Consolidated Balance Sheets

(dollars in millions, except per share

data)

June 29,

March 30,

2024

2024

Assets

Cash and cash equivalents

$

76.8

$

63.5

Accounts receivable, net of allowance for

doubtful accounts

254.7

255.2

Inventory

635.0

622.8

Prepaid expenses and other current

assets

27.7

24.0

Total current assets

994.2

965.5

Property, plant and equipment, net

356.8

361.0

Operating lease assets, net

50.9

41.4

Goodwill

1,874.2

1,874.9

Intangible assets, net

1,375.9

1,391.9

Other noncurrent assets

44.5

43.9

Total assets

$

4,696.5

$

4,678.6

Liabilities and Stockholders'

Equity

Liabilities

Accounts payable

$

127.5

$

116.2

Accrued expenses and other current

liabilities

190.5

167.3

Current operating lease liabilities

8.5

7.0

Current portion of long-term debt

3.8

3.8

Total current liabilities

330.3

294.3

Long-term debt, less current portion

1,127.6

1,188.1

Non-current operating lease

liabilities

42.9

35.3

Deferred income taxes

280.2

284.2

Other noncurrent liabilities

111.6

124.8

Total liabilities

1,892.6

1,926.7

Stockholders' equity

Preferred stock, $.01 par value

0.0

0.0

Common stock, $.01 par value

0.3

0.3

Additional paid‑in capital

1,630.6

1,625.2

Accumulated other comprehensive

income/(loss)

(0.4)

0.7

Retained earnings

1,272.5

1,216.8

Treasury stock, at cost

(99.1)

(91.1)

Total stockholders' equity

2,803.9

2,751.9

Total liabilities and stockholders'

equity

$

4,696.5

$

4,678.6

Consolidated Statements of Cash

Flows

(dollars in millions)

(Unaudited)

June 29,

July 1,

2024

2023

Cash flows from operating

activities:

Net income

$

61.4

$

50.0

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

30.0

29.7

Deferred income taxes

(4.1)

(2.6)

Amortization of deferred financing

costs

0.6

0.9

Stock-based compensation

6.5

5.4

Noncash operating lease expense

1.7

1.7

Loss on disposition of assets

-

0.2

Consolidation, restructuring, and other

noncash charges

-

0.3

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable

0.5

(12.0)

Inventory

(12.1)

(15.6)

Prepaid expenses and other current

assets

(3.8)

(2.1)

Other noncurrent assets

(0.6)

(2.6)

Accounts payable

11.3

(6.8)

Accrued expenses and other current

liabilities

23.9

13.0

Other noncurrent liabilities

(17.9)

2.2

Net cash provided by operating

activities

97.4

61.7

Cash flows from investing

activities:

Capital expenditures

(9.0)

(6.7)

Proceeds from sale of assets

-

0.2

Net cash used in investing activities

(9.0)

(6.5)

Cash flows from financing

activities:

Repayments of term loans

(60.0)

(50.0)

Repayments of notes payable

(1.1)

(1.1)

Principal payments on finance lease

obligations

(1.1)

(1.0)

Preferred stock dividends paid

(5.7)

(5.7)

Exercise of stock options

1.2

1.0

Repurchase of common stock

(8.0)

(6.8)

Net cash used in financing activities

(74.7)

(63.6)

Effect of exchange rate changes on

cash

(0.4)

(0.3)

Cash and cash equivalents:

Increase / (decrease) during the

period

13.3

(8.7)

Cash and cash equivalents, at beginning of

period

63.5

65.4

Cash and cash equivalents, at end of

period

$

76.8

$

56.7

Supplemental disclosures of cash flow

information:

Cash paid for:

Income taxes

$

12.5

$

1.1

Interest

22.0

25.1

FY2025 Q2 Outlook - Modeling

Items:

Net sales

$395.0 - $405.0

Gross margin (as a percentage of net

sales)

43.00% - 44.00%

SG&A (as a percentage of net

sales)

17.25% -17.75%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802051463/en/

Rob Moffatt Director of Investor Relations

investors@rbcbearings.com

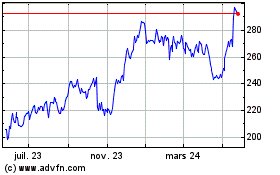

RBC Bearings (NYSE:RBC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

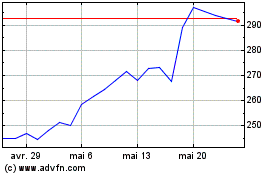

RBC Bearings (NYSE:RBC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024