UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December 2023

SKEENA RESOURCES LIMITED

(Translation of Registrant's Name into English)

001-40961

(Commission File Number)

1133 Melville Street, Suite 2600, Vancouver, British Columbia, V6E 4E5, Canada

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F þ

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibit 99.1 to this report, furnished on Form 6-K, is furnished,

not filed, and will not be incorporated by reference into any registration statement filed by the registrant under the Securities Act

of 1933, as amended.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 18, 2023

| |

SKEENA RESOURCES LIMITED |

| |

|

|

| |

By: |

/s/ Andrew MacRitchie |

| |

|

Andrew MacRitchie |

| |

|

Chief Financial Officer |

Exhibit 99.1

Skeena Closes

C$81 Million Financing with Franco-Nevada

Vancouver, BC

(December 18, 2023) Skeena Resources Limited (TSX: SKE, NYSE: SKE) (“Skeena” or the “Company”)

has closed a financing package of C$81 million with Franco-Nevada Corporation (“Franco-Nevada”) to further develop their

100% owned Eskay Creek Gold-Silver Project (“Eskay Creek”) located in the Golden Triangle of Northwest British Columbia.

The C$81 million

financing package consists of the sale of a 1.0% Net Smelter Return (“NSR”) royalty on Eskay Creek for C$56 million and a

C$25 million unsecured Convertible Debenture (the “Debenture”). With this incremental royalty purchase, Franco-Nevada now

holds a 2.5% NSR on all of Skeena’s Eskay Creek properties.

Walter Coles, Skeena’s

Executive Chairman, commented “Securing funding for the advancement of Eskay Creek to production is critical for Skeena. As a management

team and shareholders ourselves, we are striving to minimize shareholder dilution in what is currently an extremely difficult capital

markets environment for mine developers in Canada. To achieve this, we are pursuing less conventional financing pathways that limit the

issuance of straight common equity. At US$2,000/oz gold, this 1% royalty will add about US$20 to Eskay Creek’s very low All In

Sustaining Cost of US$687/oz, which implies that Skeena will still maintain a very substantial profit margin.”

The Debenture will

carry an interest rate of 7% and mature on the earlier of December 19, 2028, or on the completion of a Board approved project financing

for Eskay Creek. The Debenture will be convertible into common shares at a conversion price of C$7.70, representing a 35% conversion

premium to Skeena’s 5-day TSX volume weighted average price. No commissions or financing fees will be paid in respect of this financing

and interest payments will be capitalized and deferred until maturity.

About Skeena

Skeena Resources

Limited is a Canadian mining exploration and development company focused on revitalizing the Eskay Creek and Snip Projects, two past-producing

mines located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a Definitive Feasibility

Study for Eskay Creek in November 2023 which highlights an after-tax NPV5% of C$2.0B, 43% IRR, and a 1.2-year payback at US$1,800/oz

Au and US$23/oz Ag.

On behalf of the

Board of Directors of Skeena Resources Limited,

| Walter Coles |

Randy Reichert |

| Executive Chairman |

President & CEO |

Contact Information

Investor Inquiries:

info@skeenaresources.com

Office Phone: +1

604 684 8725

Company Website:

www.skeenaresources.com

Cautionary note

regarding forward-looking statements

Certain statements

and information contained or incorporated by reference in this press release constitute “forward-looking information” and

“forward-looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively,

“forward-looking statements”). These statements relate to future events or our future performance. The use of words such

as “anticipates”, “believes”, “proposes”, “contemplates”, “generates”, “progressing

towards”, “in search of”, “targets”, “is projected”, “plans to”, “is planned”,

“considers”, “estimates”, “expects”, “is expected”, “often”, “likely”,

“potential” and similar expressions, or statements that certain actions, events or results “may”, “might”,

“will”, “could”, or “would” be taken, achieved, or occur, may identify forward-looking statements.

All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained

herein include, but are not limited to, statements regarding the availability of the contingent payment, the estimated impact of the

royalty on the all in sustaining cost, the ability of Skeena to maintain a substantial profit margin and the ability of the Company to

obtain final TSX approval for the issuance of the Debentures. Such forward-looking statements represent the Company’s management

expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily

based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees

of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational,

business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements

in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including

permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables;

changes in mine plans, significant legal developments adversely impacting shareholder rights plan generally and other factors, including

accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company;

environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company’s MD&A for the

year ended December 31, 2022, its most recently filed interim MD&A, the AIF dated March 22, 2023, the Company’s short

form base shelf prospectus dated January 31, 2023, and in the Company’s other periodic filings with securities and regulatory

authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

Readers should

not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is

made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by

applicable securities laws.

Non-GAAP Measures

Skeena uses the

indicator “all-in sustaining cost” in this press release which is a non-IFRS financial measure. As this is a non-IFRS performance

measure it does not have a standardized definition prescribed by IFRS, and it may not be comparable to similar measures presented by

other companies. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with IFRS.

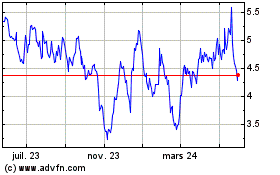

Skeena Resources (NYSE:SKE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

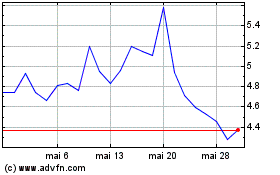

Skeena Resources (NYSE:SKE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024