Vince Holding Corp. (NYSE: VNCE) ("VNCE" or the "Company"), a

global contemporary retailer, today reported its financial results

for the second quarter 2023 ended July 29, 2023.

In this press release, the Company is presenting its financial

results in conformity with U.S. generally accepted accounting

principles ("GAAP") as well as on an "adjusted" basis. Adjusted

results presented in this press release are non-GAAP financial

measures. See "Non-GAAP Financial Measures" below for more

information about the Company's use of non-GAAP financial measures

and Exhibit 3 to this press release for a reconciliation of GAAP

measures to such non-GAAP measures.

Highlights for the second quarter ended July 29, 2023:

- Net sales were $69.4 million compared to $89.2 million in the

same period last year reflecting a 14.3% decrease in Vince brand

sales and a 98.7% decrease in Rebecca Taylor and Parker segment

sales, combined, driven by the previously announced wind down of

the Rebecca Taylor business.

- Income from operations was $32.9 million compared to loss from

operations of $5.2 million in the same period last year. Adjusted

income from operations* in the second quarter of fiscal 2023, which

excludes the $32.0 million Vince IP Sale Gain as well as $2.0

million of Transaction Expenses (each as defined below) was $2.8

million.

- Net income was $29.5 million or $2.36 per diluted share

compared to a net loss of $15.0 million or $(1.23) per share in the

same period last year. Excluding the Vince IP Sale Gain and the

Transaction Expenses, adjusted net loss* for the second quarter of

fiscal 2023 was $0.5 million or $(0.04) per share.

Jack Schwefel, Chief Executive Officer of VNCE said, "The second

quarter marked an important chapter for Vince. We successfully

closed the previously announced transaction with Authentic Brands

Group and swiftly took actions to strengthen our balance sheet

while enhancing our focus on our strategic growth initiatives and

maintaining a disciplined approach to inventory management and

expenses. Our second quarter sales performance was impacted by the

ongoing macro-related headwinds as well as our strategic decision

to pull back on the off-price wholesale business as our inventory

balance has normalized compared to last year. We are encouraged by

the improvement in trend we delivered in our direct-to-consumer

channel during the period and have maintained this momentum as we

have entered the start of the third quarter. We continue to believe

we are well positioned to execute our initiatives and deliver on

our objectives."

For the second quarter ended July 29, 2023:

- Total Company net sales decreased 22.1% to $69.4 million

compared to $89.2 million in the second quarter of fiscal 2022. The

year-over-year decline was primarily driven by the previously

announced wind down of the Rebecca Taylor business, and to a lesser

extent a decline in Vince brand sales.

- Gross profit was $32.3 million, or 46.6% of net sales, compared

to gross profit of $36.4 million, or 40.8% of net sales, in the

second quarter of fiscal 2022. The increase in gross margin rate

was driven by lower freight costs, favorable year-over-year

adjustments to inventory reserves, as well as approximately 120

basis points related to the wind down of the Rebecca Taylor

business, which historically operated at a lower overall gross

margin, and partially offset by approximately 320 basis points of

royalty expenses associated with the Licensing Agreement (as

defined below).

- Selling, general, and administrative expenses were $31.5

million, or 45.4% of sales, compared to $39.0 million, or 43.7% of

sales, in the second quarter of fiscal 2022. The decrease in

SG&A dollars was primarily driven by the wind down of the

Rebecca Taylor business resulting in a $6.6 million net expense

favorability in the second quarter of fiscal 2023. In addition, the

Company also had lower consulting and other third-party costs as

well as lower expenses related to compensation and benefits and

product development. These lower costs were partially offset by

$2.0 million in transaction related expenses (the "Transaction

Expenses") relating to the Authentic Transaction (as defined

below).

- Income from operations was $32.9 million compared to a loss

from operations of $5.2 million in the same period last year.

Adjusted income from operations* in the second quarter of fiscal

2023, which excludes the gain on sale of intangible assets relating

to the Vince IP Sale (the "Vince IP Sale Gain") as well as

Transaction Expenses was $2.8 million.

- Income tax benefit was $0.6 million as a result of applying the

Company's estimated effective tax rate for the fiscal year to the

three months Income (loss) before income taxes and equity in net

income of equity method investment excluding discrete items.

Discrete items for the second quarter included the $32.0 million

Vince IP Sale Gain and $2.0 million in Transaction Expenses. There

was no tax expense associated with these discrete items as the

Company has substantial net operating losses, both at the federal

and state levels, which are currently held in reserve with a

valuation allowance. The tax benefit in the second quarter of

fiscal 2023 compares to an income tax expense of $7.9 million in

the same period last year.

- Net income was $29.5 million or $2.36 per diluted share

compared to a net loss of $15.0 million or $(1.23) per share in the

same period last year. Excluding the Vince IP Sale Gain and the

Transaction Expenses, adjusted net loss* for the second quarter of

fiscal 2023 was $0.5 million or $(0.04) per share.

- The Company ended the quarter with 66 company-operated Vince

stores, a net decrease of 1 store since the second quarter of

fiscal 2022.

Vince Second Quarter Highlights

- Net sales decreased 14.3% to $69.3 million as compared to the

second quarter of fiscal 2022.

- Wholesale segment sales decreased 22.0% to $36.4 million

compared to the second quarter of fiscal 2022.

- Direct-to-consumer segment sales decreased 3.7% to $32.9

million compared to the second quarter of fiscal 2022.

- Income from operations excluding unallocated corporate expenses

was $12.5 million compared to income from operations of $12.2

million in the same period last year.

Rebecca Taylor and Parker Segment Second Quarter

Highlights

- On September 12, 2022, the Company announced the strategic

decision to wind down its Rebecca Taylor business to focus its

resources on the Vince brand. The wind down of the Rebecca Taylor

business is now substantially completed.

- Net sales decreased 98.7% to $0.1 million as compared to the

second quarter of fiscal 2022.

- Income from operations was $1.3 million compared to a loss from

operations of $5.5 million in the same period last year. Income

from operations in the second quarter of fiscal 2023 included a net

benefit of $1.1 million primarily associated with the release of

Rebecca Taylor operating lease liabilities as a result of lease

terminations.

Net Sales and Operating Results by Segment:

Three Months Ended

July 29,

July 30,

(in thousands)

2023

2022

Net Sales:

Vince Wholesale

$

36,407

$

46,692

Vince Direct-to-consumer

32,930

34,200

Rebecca Taylor and Parker

110

8,302

Total net sales

$

69,447

$

89,194

Income (loss) from operations:

Vince Wholesale

$

11,360

$

12,797

Vince Direct-to-consumer

1,098

(617

)

Rebecca Taylor and Parker

1,257

(5,485

)

Subtotal

13,715

6,695

Unallocated corporate (1)

19,135

(11,899

)

Total income (loss) from operations

$

32,850

$

(5,204

)

(1) Unallocated corporate expenses are

related to the Vince brand and are comprised of selling, general

and administrative expenses attributable to corporate and

administrative activities (such as marketing, design, finance,

information technology, legal and human resource departments), and

other charges that are not directly attributable to the Company's

Vince Wholesale and Vince Direct-to-consumer reportable segments.

In addition, unallocated corporate expenses includes the $32.0

million from the Vince IP Sale Gain as well as $2.0 million in

Transaction Expenses.

Balance Sheet

On June 26, 2023, the Company announced that it entered into a

new five-year credit agreement for an $85 million senior secured

asset-based revolving credit facility (“ABL Credit Facility”)

expected to mature in June 2028. The new ABL Credit Facility was

entered into with Bank of America, N.A acting as administrative

agent and replaces the Company's previous senior secured

asset-based revolving credit facility set to mature in June 2024,

which was repaid in full and terminated.

At the end of the second quarter of fiscal 2023, total

borrowings under the Company's debt agreements totaled $67.5

million and the Company had $34.7 million of excess availability

under its revolving credit facility.

Net inventory at the end of the second quarter of fiscal 2023

was $85.1 million compared to $129.5 million at the end of the

second quarter of fiscal 2022. The year-over-year decrease in

inventory was driven by the wind down of the Rebecca Taylor

business as well as a decline in Vince as the Company sold through

higher levels of inventory from the prior year and rebalanced its

inventory purchases for the current season.

During the quarter ended July 29, 2023, the Company did not

issue shares of common stock under the ATM program. The Company

continues to have shares available under the program to exercise

with proceeds to be used as sources, along with cash from

operations, to fund future growth.

Strategic Partnership with Authentic

Brands Group

On May 25, 2023, the Company announced that it completed the

previously announced transaction with Authentic Brands Group

("Authentic"). As part of the transaction ("Authentic

Transaction"), VNCE and Authentic entered into a strategic

arrangement whereby VNCE contributed its intellectual property to a

newly formed Authentic subsidiary ("ABG Vince") for total

consideration to VNCE of $76.5 million in cash from Authentic and

25% membership interest in ABG Vince. Authentic owns the majority

stake of 75% membership interest in ABG Vince.

With the proceeds from this transaction, VNCE repaid in full the

outstanding balance of $27.7 million under its Term Loan Credit

Facility as well as a portion of the outstanding borrowings under

its Revolving Credit Facility.

In connection with the Authentic Transaction, VNCE entered into

an exclusive, long-term license agreement (the "License Agreement")

with Authentic for usage of the contributed intellectual property

for VNCE's existing business in a manner consistent with the

Company's current wholesale, retail and e-commerce operations. The

License Agreement contains an initial ten-year term and eight

ten-year renewal options allowing VNCE to renew the agreement.

*Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

GAAP, the Company has provided, with respect to the financial

results relating to three and six months ended July 29, 2023,

adjusted income (loss) from operations, adjusted income (loss)

before income taxes and equity in net income of equity method

investment, adjusted (benefit) provision for income taxes, adjusted

income (loss) before equity in net income of equity method

investment, adjusted net income (loss), and adjusted earnings

(loss) per share, which are non-GAAP measures, in order to

eliminate the effect of the Vince IP Sale Gain, Transaction

Expenses, the Parker IP Sale Gain and the Discrete Tax Benefit. The

Company believes that the presentation of these non-GAAP measures

facilitates an understanding of the Company's continuing operations

without the impact associated with the aforementioned items. While

these types of events can and do recur periodically, they are

excluded from the indicated financial information due to their

impact on the comparability of earnings across periods. Non-GAAP

financial measures should not be considered in isolation from, or

as a substitute for, financial information prepared in accordance

with GAAP. A reconciliation of GAAP to non-GAAP results has been

provided in Exhibit 3 to this press release.

Conference Call

A conference call to discuss the second quarter results will be

held today, September 12, 2023, at 8:30 a.m. ET, hosted by Vince

Holding Corp. Chief Executive Officer, Jack Schwefel, and Interim

Chief Financial Officer, Michael Hand. During the conference call,

the Company may make comments concerning business and financial

developments, trends and other business or financial matters. The

Company's comments, as well as other matters discussed during the

conference call, may contain or constitute information that has not

been previously disclosed.

Those who wish to participate in the call may do so by dialing

(833) 470-1428, conference ID 294165. Any interested party will

also have the opportunity to access the call via the Internet at

http://investors.vince.com/. To listen

to the live call, please go to the website at least 15 minutes

early to register and download any necessary audio software. For

those who cannot listen to the live broadcast, a recording will be

available for 12 months after the date of the event. Recordings may

be accessed at http://investors.vince.com.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail company that operates the

Vince brand women's and men's ready to wear business. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Vince Holding Corp. operates

49 full-price retail stores, 17 outlet stores, and its e-commerce

site, vince.com and through its subscription service Vince Unfold,

www.vinceunfold.com, as well as through premium wholesale channels

globally. Please visit www.vince.com for more information.

Forward-Looking Statements: This document, and any statements

incorporated by reference herein contain forward-looking statements

under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding, among

other things, our current expectations about possible or assumed

future results of operations of the Company and are indicated by

words or phrases such as "may," "will," "should," "believe,"

"expect," "seek," "anticipate," "intend," "estimate," "plan,"

"target," "project," "forecast," "envision" and other similar

phrases. Although we believe the assumptions and expectations

reflected in these forward-looking statements are reasonable, these

assumptions and expectations may not prove to be correct and we may

not achieve the results or benefits anticipated. These

forward-looking statements are not guarantees of actual results,

and our actual results may differ materially from those suggested

in the forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

maintain the license agreement with ABG Vince; ABG Vince's

expansion of the Vince brand into other categories and territories;

ABG Vince's approval rights and other actions; our ability to

maintain adequate cash flow from operations or availability under

our revolving credit facility to meet our liquidity needs; our

ability to realize the benefits of our strategic initiatives;

general economic conditions; further impairment of our goodwill;

the execution and management of our direct-to-consumer business

growth plans; our ability to make lease payments when due; our

ability to maintain our larger wholesale partners; our ability to

remediate the identified material weakness in our internal control

over financial reporting; our ability to comply with domestic and

international laws, regulations and orders; our ability to

anticipate and/or react to changes in customer demand and attract

new customers, including in connection with making inventory

commitments; our ability to remain competitive in the areas of

merchandise quality, price, breadth of selection and customer

service; our ability to attract and retain key personnel; seasonal

and quarterly variations in our revenue and income; our ability to

mitigate system security risk issues, such as cyber or malware

attacks, as well as other major system failures; our ability to

optimize our systems, processes and functions; our ability to

comply with privacy-related obligations; our ability to ensure the

proper operation of the distribution facilities by third-party

logistics providers; fluctuations in the price, availability and

quality of raw materials; commodity, raw material and other cost

increases; the extent of our foreign sourcing; our reliance on

independent manufacturers; other tax matters; and other factors as

set forth from time to time in our Securities and Exchange

Commission filings, including those described under "Item 1A—Risk

Factors" in our Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q. We intend these forward-looking statements to speak only

as of the time of this release and do not undertake to update or

revise them as more information becomes available, except as

required by law.

Vince Holding Corp. and

Subsidiaries

Exhibit (1)

Condensed Consolidated Statements of

Operations

(Unaudited, amounts in thousands except

percentages, share and per share data)

Three Months Ended

Six Months Ended

July 29,

July 30,

July 29,

July 30,

2023

2022

2023

2022

Net sales

$

69,447

$

89,194

$

133,503

$

167,570

Cost of products sold

37,099

52,822

71,563

95,563

Gross profit

32,348

36,372

61,940

72,007

as a % of net sales

46.6

%

40.8

%

46.4

%

43.0

%

Impairment of intangible assets

—

1,700

—

1,700

Impairment of long-lived assets

—

866

—

866

Gain on sale of intangible assets

(32,043

)

—

(32,808

)

—

Selling, general and administrative

expenses

31,541

39,010

64,274

79,930

as a % of net sales

45.4

%

43.7

%

48.1

%

47.7

%

Income (loss) from operations

32,850

(5,204

)

30,474

(10,489

)

as a % of net sales

47.3

%

(5.8

)%

22.8

%

(6.3

)%

Interest expense, net

4,137

1,882

7,427

3,766

Income (loss) before income taxes and

equity in net income of equity method investment

28,713

(7,086

)

23,047

(14,255

)

(Benefit) provision for income taxes

(592

)

7,903

(5,877

)

7,903

Income (loss) before equity in net income

of equity method investment

29,305

(14,989

)

28,924

(22,158

)

Equity in net income of equity method

investment

207

—

207

—

Net income (loss)

$

29,512

$

(14,989

)

$

29,131

$

(22,158

)

Earnings (loss) per share:

Basic earnings (loss) per share

$

2.37

$

(1.23

)

$

2.35

$

(1.83

)

Diluted earnings (loss) per share

$

2.36

$

(1.23

)

$

2.34

$

(1.83

)

Weighted average shares

outstanding:

Basic

12,428,339

12,220,693

12,385,347

12,125,759

Diluted

12,479,667

12,220,693

12,470,085

12,125,759

Vince Holding Corp. and

Subsidiaries

Exhibit (2)

Condensed Consolidated Balance

Sheets

(Unaudited, amounts in

thousands)

July 29,

January 28,

July 30,

2023

2023

2022

ASSETS

Current assets:

Cash and cash equivalents

$

869

$

1,079

$

1,073

Trade receivables, net

20,859

20,733

27,469

Inventories, net

85,079

90,008

129,472

Prepaid expenses and other current

assets

11,148

3,515

4,179

Total current assets

117,955

115,335

162,193

Property and equipment, net

8,345

10,479

15,590

Operating lease right-of-use assets

75,286

72,616

82,437

Intangible assets, net

—

70,106

73,807

Goodwill

31,973

31,973

31,973

Assets held for sale

—

260

—

Equity method investment

26,232

—

—

Other assets

2,595

2,576

3,218

Total assets

$

262,386

$

303,345

$

369,218

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

39,170

$

49,396

$

80,309

Accrued salaries and employee benefits

2,764

4,301

6,259

Other accrued expenses

9,022

15,020

12,148

Short-term lease liabilities

18,250

20,892

22,860

Current portion of long-term debt

—

3,500

2,625

Total current liabilities

69,206

93,109

124,201

Long-term debt

67,204

108,078

111,992

Long-term lease liabilities

72,901

72,098

83,109

Deferred income tax liability and other

liabilities

2,976

9,803

14,469

Stockholders' equity

50,099

20,257

35,447

Total liabilities and stockholders'

equity

$

262,386

$

303,345

$

369,218

Vince Holding Corp. and

Subsidiaries

Exhibit (3)

Reconciliation of GAAP to Non-GAAP

measures

(Unaudited, amounts in thousands except

share and per share amounts)

For the three months ended

July 29, 2023

As Reported (GAAP)

Gain on Sale of Vince Intangible

Assets

Transaction Related Expenses

Associated with the Authentic Transaction

Gain on Sale of Parker Intangible

Assets

Transaction Related Expenses

Associated with the sale of Parker Intangible Assets

Discrete Tax Benefit Associated

with Classification Change

As Adjusted (Non-GAAP)

Income (loss) from operations

$

32,850

$

32,043

$

(2,041

)

$

—

$

—

$

—

$

2,848

Interest expense, net

4,137

—

—

—

—

—

4,137

Income (loss) before income taxes and

equity in net income of equity method investment

28,713

32,043

(2,041

)

—

—

—

(1,289

)

(Benefit) provision for income taxes

(592

)

—

—

—

—

—

(592

)

Income (loss) before equity in net income

of equity method investment

29,305

32,043

(2,041

)

—

—

—

(697

)

Equity in net income of equity method

investment

207

—

—

—

—

—

207

Net income (loss)

$

29,512

$

32,043

$

(2,041

)

$

—

$

—

$

—

$

(490

)

Earnings (loss) per share (1)

$

2.36

$

2.57

$

(0.16

)

$

—

$

—

$

—

$

(0.04

)

For the six months ended July

29, 2023

As Reported (GAAP)

Gain on Sale of Vince Intangible

Assets

Transaction Related Expenses

Associated with the Authentic Transaction

Gain on Sale of Parker Intangible

Assets

Transaction Related Expenses

Associated with the sale of Parker Intangible Assets

Discrete Tax Benefit Associated

with Classification Change

As Adjusted (Non-GAAP)

Income (loss) from operations

$

30,474

$

32,043

$

(4,782

)

$

765

$

(150

)

$

—

$

2,598

Interest expense, net

7,427

—

—

—

—

—

7,427

Income (loss) before income taxes and

equity in net income of equity method investment

23,047

32,043

(4,782

)

765

(150

)

—

(4,829

)

(Benefit) provision for income taxes

(5,877

)

—

—

—

—

(6,127

)

250

Income (loss) before equity in net income

of equity method investment

28,924

32,043

(4,782

)

765

(150

)

6,127

(5,079

)

Equity in net income of equity method

investment

207

—

—

—

—

—

207

Net income (loss)

$

29,131

$

32,043

$

(4,782

)

$

765

$

(150

)

$

6,127

$

(4,872

)

Earnings (loss) per share (2)

$

2.34

$

2.57

$

(0.38

)

$

0.06

$

(0.01

)

$

0.49

$

(0.39

)

(1) As reported is based on diluted

weighted-average shares outstanding of 12,479,667 and as adjusted

is based on basic weighted average shares outstanding of 12,428,339

for the three months ended July 29, 2023.

(2) As reported is based on diluted

weighted-average shares outstanding of 12,470,085 and as adjusted

is based on basic weighted average shares outstanding of 12,385,347

for the six months ended July 29, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230912271210/en/

Investor Relations: ICR, Inc. Caitlin Churchill,

646-277-1274 Caitlin.Churchill@icrinc.com

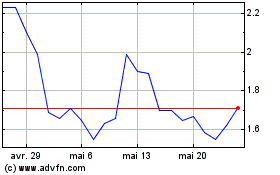

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025