Technical improvements are continuing through

Covid-19 social distancing restrictions

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF)

(“Fortune” or the “Company”)

(www.fortuneminerals.com) is providing an update of current work to

advance the NICO Cobalt-Gold-Bismuth-Copper Project (“NICO

Project”) in Canada during the Coronavirus pandemic. Fortune is

complying with government protocols, including temporary closure of

the Company’s head office, prohibiting non-essential travel, and

employees are social distancing and working remotely from their

homes. Technical work has advanced on the NICO Project during this

period, primarily by employees with some assistance from

engineering consultants. Fortune has also received financial

assistance through government programs available to it, and has

outstanding applications pending for additional support. The

Company is also reducing costs where it can to preserve cash until

confidence returns to the capital markets, which it normally

depends upon for its source of working capital.

Like our news? Click-to-Tweet.

The NICO Project was assessed in a Feasibility Study prepared by

Micon International Limited (“Micon”) in 2014, based

primarily on the Company’s Front-End Engineering and Design study

led by Aker Solutions and a proposed project financing with Procon

Group which was not completed. The Mineral Reserves for the NICO

Project total 33.1 million tonnes, averaging 1.03 grams of gold per

tonne, 0.11% cobalt, 0.14% bismuth and 0.04% copper (see News

Release, dated April 2, 2014). Cobalt and bismuth are both metals

identified on the United States (“U.S.”) and European Union

Critical Minerals Lists. Minerals considered critical have

essential use in important industrial and security applications,

cannot be easily substituted by other minerals, and their supply

chain is threatened by geographic concentration of production and /

or geopolitical risks. The Canadian and U.S. governments have

signed a Joint Action Plan on Critical Mineral Collaboration to

enable more North American production of minerals identified as

critical to economic and national security, The Mineral Reserves

for the NICO Project also contain more than one million ounces of

gold, a highly liquid and countercyclical co-product that makes

this project stand out relative to other cobalt producers and

development projects.

For more detailed information about the NICO Mineral Reserves

and certain technical information in this news release, please

refer to the Technical Report on the NICO Project, entitled

"Technical Report on the Feasibility Study for the

NICO-Gold-Cobalt-Bismuth-Copper Project, Northwest Territories,

Canada", dated April 2, 2014 and prepared by Micon International

Limited which has been filed on SEDAR and is available under the

Company's profile at www.sedar.com.

After assessing a contemplated 30% expansion of the NICO Project

in 2019, Fortune has refocused the development strategy using a

plan similar to the one used in the 2014 Micon Feasibility Study.

This plan was based on combined open pit and underground mining

transitioning to only open pit mining, a mill throughput rate of

4,650 tonnes of ore per day, and processing of metal concentrates

at a hydrometallurgical refinery in southern Canada. With

development of the NICO project, Fortune would become a Canadian

producer of cobalt sulphate, gold doré, bismuth ingots and copper

precipitate with supply chain transparency and custody control of

the metals from ore through to the production of value-added

products. Before completing an updated Technical Report, Fortune is

pursuing opportunities to improve project economics and this work

is summarized below.

Updated Mineral Resource Model:

An Updated Mineral Resource block model was recently completed

by Fortune and P&E Mining Consultants Inc. (“P&E”)

with a number of improvements made to reduce modeling dilution and

capture mineralized material that was omitted in the previous

Mineral Resource model. A more constrained approach to the

mineralized domain wireframes was applied, eliminating areas with

little or no grade that caused internal and external modeling

dilution and smeared higher grades within the wireframes into areas

that had little or no grade. The wireframes were also extended to

surface where the deposit is known to outcrop and will reduce

near-surface waste rock stripping during operations. The wireframes

were also extended in deeper parts of the deposit where there is

higher grade gold, which was previously too abruptly

terminated.

Open Pit Optimization:

The Updated Mineral Resource model has been subjected to open

pit shell optimization by P&E using ‘Datamine NPV SchedulerTM’

software that determines the open pit limits and tonnages of

mineralized material that would be profitable to mine using

geotechnical criteria (previously determined by Golder Associates

Ltd. (“Golder”)), factored operating costs from previous

studies, and updated metal price and currency exchange rate

estimates. The optimized open pit shell used a Net Smelter Return

(“NSR”) cut-off value of C$60.49 / tonne, derived from the

operating costs, excluding mining, to develop a Net Present Value

(“NPV”) versus pit shell size table and graph to determine

the optimal pit shell for the open pit design and production

schedule.

Underground Stope Design:

New preliminary underground stope designs have been completed

from the Updated Mineral Resource model by Fortune and P&E

using ‘DeswikTM’ software. Potential underground stopes were

identified based on geotechnical studies by Golder, information

gained from the earlier underground test mining by Procon, and the

mineralized material that would be profitable to mine by

underground methods using an NSR cut-off of $150 / tonne. The stope

designs used in the 2014 Micon Feasibility Study were used as a

guide in the new preliminary design, which was also focused on

potential stopes located close to the existing ramp system that was

constructed during earlier test mining in order to minimize

underground pre-production development costs.

New Mine Plan and Schedule:

Fortune is now developing a new mine plan and schedule based on

the Updated Mineral Resource model, open pit optimization, and

preliminary underground stope designs. This work will focus on

gaining early access to higher grade material using a combination

of open pit and underground mining methods similar to the approach

used in the 2014 Micon Feasibility Study. Open pit material will be

augmented with higher-grade, gold-rich material sourced from deeper

parts of the deposit in stopes designed close to the existing

underground access ramp system. The mine plan will also include a

grade control and stockpiling strategy to defer processing of lower

quality ores until later in the mine life and accelerate processing

of higher margin ores. This is a strategy that was being pursued in

2019 before the Company terminated the expanded project study. The

new mine plan and schedule is expected to be completed this month

and will be used to determine concentrate specifications required

to predict refinery feed criteria.

Capital Cost Optimization and Procurement Strategy

Fortune is conducting an analysis of capital costs previously

estimated by Hatch Ltd. for the recent expansion study that was

carried out in 2019, including a breakdown of their estimates and a

comparison with quotes subsequently obtained directly from

suppliers. This work is still in progress, however, the Company has

identified several opportunities to reduce capital and operating

costs, plus associated contingencies, given new supplier

information and market trends. This work will be used as a guide to

a more disciplined approach to capital cost estimation in any

updated Technical Report.

Fortune has also identified opportunities to lower capital costs

for the NICO Project using different approaches to the design

criteria. An example is replacing the primary crusher with a lower

cost mobile system, which will also reduce installation and

earthworks capital. Other opportunities are also being pursued.

Refinery Sites

Fortune is evaluating a number of sites in southern Canada to

construct the NICO Project refinery, including a site in

Saskatchewan where it already holds an option to purchase the

lands. The Company is also considering other potential sites,

including three serviced brownfield locations with permitted

process equipment that could materially reduce the capital costs

for the vertically integrated development. Fortune will provide an

update of these locations when discussions are more advanced with

the owners or as further information becomes available.

Some improvements for the NICO refinery were identified for the

2019 study that was terminated and will be considered in any

updated Technical Report at the 4,650 tonnes per day mill

throughput rate.

Tlicho Road

Construction of the C$200 million Tlicho All-Season Road to the

community of Whati is ahead of schedule. However, work on the road

has been temporarily suspended by North Star, the P3 consortium led

by Peter Kiewit Sons ULC, to mitigate the spread of the

Coronavirus. Fortune will provide an update of the Tlicho Road when

construction resumes. Notably, the NICO Project includes

construction of a 50-kilometre spur road from Whati to the mine to

enable truck haulage of metal concentrates to the railway at Hay

River and delivery to the refinery for processing during

operations. With greater certainty of the availability of this

road, the Company is now planning to align NICO Project

construction using the all-weather roads instead of winter ice

roads to reduce capital costs and supply chain risks during

construction.

Financing:

The Canadian and U.S. Government Joint Action Plan on Critical

Mineral Collaboration advances both countries’ interest in securing

supply chains for the critical minerals needed in important

manufacturing sectors, including communication technology,

aerospace, defense, and clean technology. The plan guides

cooperation in areas including industry engagement and efforts to

secure critical mineral supply chains for strategic industries, and

promotes increased support for industry. Fortune has been in

discussions with both governments regarding financial support for

the NICO Project, including a joint proposal with an existing

refinery to the Government of Canada, and a proposal to the U.S.

for support of an updated Technical Report to enable project

financing.

Fortune is also continuing its discussions with various private

sector sources of capital including potential strategic partners in

the gold and base metals mining industry, battery materials and

electric-vehicle sectors, and private equity. While interest is

strong from some of these companies, discussions have not advanced

materially during the current Covid-19 pandemic.

The disclosure of scientific and technical information contained

in this news release has been approved by Robin Goad, M.Sc.,

P.Geo., President and Chief Executive Officer of Fortune, and

Dustin Reinders, B.Sc., P.Eng., Project Engineer, who are

"Qualified Persons" under National Instrument 43-101.

About Fortune Minerals

Fortune is a Canadian mining company focused on developing the

NICO Cobalt-Gold-Bismuth-Copper Project in the Northwest

Territories. The Company has an option to purchase lands in

Saskatchewan where it may build the hydrometallurgical plant to

process NICO metal concentrates. Fortune also owns the Sue-Dianne

Copper-Silver-Gold Deposit located 25 km north of the NICO Project,

which is a potential future source of incremental mill feed to

extend the life of the NICO Project mill.

Follow Fortune Minerals:

Click here to subscribe to Fortune’s email list.

Click here to follow Fortune on LinkedIn.

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities legislation. This forward-looking information includes

statements with respect to, among other things, the construction of

the Tlicho All-Season Road, the Company’s plans to develop the NICO

Project, the preparation of an updated Technical Report for the

NICO Project, the Joint Action Plan on Critical Mineral

Collaboration (the “Joint Action Plan”) and the potential for the

Sue-Dianne property to provide incremental mill feed to the NICO

Project. Forward-looking information is based on the opinions and

estimates of management as well as certain assumptions at the date

the information is given (including, in respect of the

forward-looking information contained in this press release,

assumptions regarding: the timing of completion of the Tlicho

All-Season Road; the timing of the updated Technical Report for the

NICO Project and the results thereof; the Company’s ability to

secure a site in southern Canada for the construction of a NICO

Project refinery; the Company’s ability to arrange the necessary

financing to continue operations and develop the NICO Project; the

receipt of all necessary regulatory approvals for the construction

and operation of the NICO Project and the related

hydrometallurgical refinery and the timing thereof; growth in the

demand for cobalt; the time required to construct the NICO Project;

and the economic environment in which the Company will operate in

the future, including the price of gold, cobalt and other

by-product metals, anticipated costs and the volumes of metals to

be produced at the NICO Project). However, such forward-looking

information is subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

These factors include the risks that the Tlicho All-Season Road may

not be completed in the anticipated time frame, the updated

Technical Report for the NICO Project may take longer than

anticipated and the results thereof may not be as positive as

anticipated, the NICO Project may not receive the benefit of any

financing under the Joint Action Plan or any other benefits

therefrom, the Company may not be able to secure a site for the

construction of a refinery, the Company may not be able to finance

and develop NICO on favourable terms or at all, uncertainties with

respect to the receipt or timing of required permits, approvals and

agreements for the development of the NICO Project, including the

related hydrometallurgical refinery, the construction of the NICO

Project may take longer than anticipated, the Company may not be

able to secure offtake agreements for the metals to be produced at

the NICO Project, the Sue-Dianne Property may not be developed to

the point where it can provide mill feed to the NICO Project, the

inherent risks involved in the exploration and development of

mineral properties and in the mining industry in general, the

market for products that use cobalt or bismuth may not grow to the

extent anticipated, the future supply of cobalt and bismuth may not

be as limited as anticipated, the risk of decreases in the market

prices of cobalt, bismuth and other metals to be produced by the

NICO Project, discrepancies between actual and estimated Mineral

Resources or between actual and estimated metallurgical recoveries,

uncertainties associated with estimating Mineral Resources and

Reserves and the risk that even if such Mineral Resources prove

accurate the risk that such Mineral Resources may not be converted

into Mineral Reserves once economic conditions are applied, the

Company’s production of cobalt, bismuth and other metals may be

less than anticipated and other operational and development risks,

market risks and regulatory risks. Readers are cautioned to not

place undue reliance on forward-looking information because it is

possible that predictions, forecasts, projections and other forms

of forward-looking information will not be achieved by the Company.

The forward-looking information contained herein is made as of the

date hereof and the Company assumes no responsibility to update or

revise it to reflect new events or circumstances, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200507005553/en/

Fortune Minerals Limited Troy Nazarewicz Investor

Relations Manager info@fortuneminerals.com Tel.: (519) 858-8188

www.fortuneminerals.com

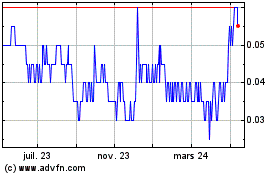

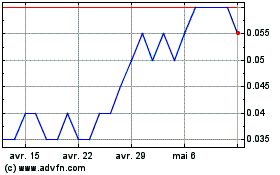

Fortune Minerals (TSX:FT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Fortune Minerals (TSX:FT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024