NextSource Materials Inc. (TSX:NEXT) (OTCQB:NSRCF) (“NextSource” or

“the Company”), is pleased to report the results of its 2019

Feasibility Study for its 100%-owned Molo Graphite Project in

southern Madagascar. The FS takes into account updated mine capital

equipment and mining costs, as well as current 12-month rolling

flake graphite pricing on a FOB China basis, supplied by UK-based

battery mineral commodities research firm, Benchmark Minerals

Intelligence.

The FS was based on a Front End Engineering and

Design study (“FEED”), and subsequent Detailed Engineering studies.

The FS incorporates the procurement of all mining equipment,

off-site modular fabrication and assembly, factory acceptance

testing, module disassembly, shipping, plant infrastructure

construction, onsite module re-assembly, commissioning, project

contingencies and working capital. All capital and operating costs

expressed for Phase 1 are considered to be accurate to +/- 10%, and

accurate to +/- 12.5% for Phase 2.

In order to ensure that the Company maintains a

first-mover competitive advantage over the competition and to

appropriately plan for future market demand, the FS was designed to

provide a flexible mine development approach that comprises a

unique, all-modular build solution yielding optimal cashflow and

return metrics with suitable flexibility to enable a rapid response

to the anticipated market demand for graphite.

As previously reported to the market, the

Company has an off-take agreement in place with a prominent

Japanese trader, whom is a major supplier of flake graphite to

Japan’s largest batteryprocessor and manufacturer of graphite anode

material in lithium ion batteries (“LiB”) for electric vehicle

applications. NextSource is currently in the process of formalizing

an additional sales agreement with a leading European trader. As

such, the FS was undertaken to include two phases in order to

account for off-takers’ demand for NextSource’s SuperFlake®

graphite concentrate.

PHASE 1: Production of

17,000 tpa

- The first phase of production will consist of a fully

operational and sustainable graphite mine with a permanent

processing plant capable of processing 240,000 tpa of ore and

producing approximately 17,000 tpa of high-quality SuperFlake™

graphite concentrate.

- The updated build cost of the fully modular process plant

marginally increased from the US$18.4 million reported in the 2017

FS to US$21.0M due to equipment cost inflation.

PHASE 2: Production Expansion to 45,000

tpa in Year 3

- Phase 2 incorporates the processing of 240,000 tpa of ore

(producing 17,000 tpa of SuperFlake® concentrate) for the first two

years of operation and then ramping up to 720,000 tpa of processed

ore in the third year to accommodate additional sales, resulting in

a total of 45,000 tpa of SuperFlake® concentrate being produced for

a mine life of 30 years.

- The costing for Phase 2 is based on the addition of two modules

of the beneficiation plant with a proportional increase in mining

and infrastructure costs.

- The capital mine cost for Phase 2 (with contingency) will be

US$39.1M, for a total project cost (Phase 1 and Phase 2 with

contingency) of US$60.1M.

FS RESULTS SUMMARY

- The Phase 1 production plan of 17,000 tpa of finished

SuperFlake® concentrate for the first two years of production

followed by a ramp-up to Phase 2 production of 45,000 tpa yields

the following financial metrics.

|

Description |

Phase 1 and 2 |

|

|

Pre-Tax |

Post-Tax |

|

Post-tax: NPV (8% Discount Cash Flow)(1)(2) |

$237.1m |

$184.3m |

|

Post-tax: IRR (1)(2) |

43.1% |

|

36.2% |

|

|

Payback (2) |

3.4 years |

3.8 years |

|

Capital cost ("CAPEX") |

$60,082,340 |

|

|

|

Owners Contingency |

$6,670,430 |

|

|

|

On-site Operating Costs ("OPEX") per tonne of concentrate, (year 3

onward) |

Mining |

|

|

$82.69 |

|

|

On-site Operating Costs ("OPEX") per tonne of concentrate, (year 3

onward) |

Processing |

|

|

$270.27 |

|

|

Transportation per tonne of concentrate (from mine site to

Madagascar Port year 3 onward) |

$133.01 |

|

|

|

Average annual production of concentrate |

45,136 tonne |

|

|

Life of Mine ("LOM") |

30 years |

|

|

Graphite concentrate sale price (US$/tonne at Start Up - 2017) |

$1,208 |

|

|

|

Average Head Grade |

7.1% |

|

|

|

Average ore mined per annum over Life of Mine |

720,000 tonne |

|

|

Average stripping ratio |

0.53:1 |

|

|

Average carbon recovery |

88.30% |

|

|

|

(1) |

Assumes Project is financed with 100% equity. Unless otherwise

noted, all monetary figures presented throughout this press release

are expressed in US dollars (USD). |

|

(2) |

CAPEX includes process equipment, civil & infrastructure,

mining, buildings, electrical infrastructure, project &

construction services. Values shown are based on real graphite

sales pricing |

CAPEX Summary

|

Capital Cost Breakdown |

|

Phase 1 (240ktpa) |

Phase 2 (720ktpa) |

|

Process Equipment |

|

$8,438,609 |

$25,315,827 |

|

Civil & Infrastructure |

|

$2,103,672 |

$6,661,016 |

|

Tailings |

|

$0.00 |

$0.00 |

|

Mining |

|

$2,574,143 |

$4,913,341 |

|

Buildings |

|

$1,154,609 |

$2,886,523 |

|

Electrical Infrastructure |

|

$128,804 |

$386,412 |

|

Project Services/EPCM |

|

$931,481 |

$2,794,445 |

|

Construction Services |

|

$1,474,775 |

$3,686,937 |

|

Indirect Costs |

|

$372,750 |

$1,118,250 |

|

Environmental & Permitting costs |

|

$729,827 |

$1,459,655 |

|

Owner's Costs |

|

$1,197,000 |

$4,189,500 |

|

Sub-total |

|

$19,105,673 |

$53,411,909 |

|

Contingency (10%/12.5%) |

|

$1,910,567 |

$6,676,488 |

|

3 Months Working Capital |

|

$3,100,000 |

$7,300,000 |

|

CAPEX TOTAL |

|

$24,116,241 |

$67,388,398 |

|

Sustaining CAPEX over Life of Mine |

|

|

$3,300,000 |

OPEX Summary

- Discussions with off takers have indicated their preference is

to purchase Molo graphite concentrate at the local Madagascar port

at freight on board (FOB) China prices. As such, FS Operating

costs (“OPEX”) include the all-in FOB cost to ship Molo SuperFlake®

concentrate to the local port of Fort Dauphin.

|

Category |

|

Phase 1 |

Phase 2 |

|

|

|

Operating cost |

|

Mining (US$/T) |

|

|

102.81 |

|

|

65.34 |

|

|

Processing (US$/T) |

|

|

265.82 |

|

|

265.82 |

|

|

Trucking to local port / Ft. Dauphin (US$/T) |

|

|

133.01 |

|

|

133.01 |

|

|

General and Administration (US$/T) |

|

|

64.29 |

|

|

50.00 |

|

|

TOTAL |

|

|

$565.93 |

|

|

$514.17 |

|

Craig Scherba, P.Geo., President and CEO of

NextSource commented,

“Our Feasibility Study will greatly assist us in

our current discussions with mine financiers, and reconfirms to the

market the economic viability of the Molo project under current

market conditions. Our all-modular build strategy has low capital

and operating costs, and a rapid build time. With our phased

build-out, this will allow our graphite to be easily absorbed into

the current market while maintaining NextSource’s flexibility and

competitive advantage to quickly penetrate the market and generate

revenue, establish strong relationships with as many key buyers as

possible, and verify our product for highly technical markets with

production-run material.”

PROVEN AND PROBABLE MINERAL RESERVES (1)

The Mineral Reserves and Mineral Resources did not change as a

result of the FS. As disclosed in the Company’s 2015 Molo FS,

the following are the proven and probable mineral reserves.

| Category |

|

Tonnage |

|

C Grade (%) |

| Proven |

|

14,170,000 |

|

7.00 |

| Probable |

|

8,367,000 |

|

7.04 |

| Proven and Probable |

|

22,437,000 |

|

7.02 |

| |

|

|

|

|

(1) Proven reserves are reported as the Measured

Resources inside the designed open pit and above the grade cut off

of 4.5% C. Similarly, the Probable Reserves are reported as the

Indicated Resources inside the designed open pit and above the

grade cut-off of 4.5% C. Mineral Reserves are effective as of

August 14, 2014.

MINERAL RESOURCES

The Molo project hosts the following mineral resources:

- Measured mineral resource of 23.62 MT grading 6.32% C.

- Indicated mineral resource of 76.75 MT grading 6.25% C.

- Inferred mineral resource of 40.91 MT at 5.78% C.

Effective date of the Mineral Resource

tabulation is August 14, 2014. The Mineral Resources are classified

according to the Canadian Institute of Mining definitions. A

cut-off grade of 4% C was used for the “higher grade” zones and 2%

C for the “lower grade” zones. Please note that while the

‘high’ grade resource occurs within the ‘low’ grade resource, each

was estimated and reported separately. A relative density of 2.36

tonnes per cubic metre was assigned to the mineralized zones for

the resource estimation. The resource remains open along

strike and to depth. The Mineral Resources are inclusive of the

Mineral Reserves above. Mineral Resources reported herein

include Mineral Reserves. Mineral Resources that are not Mineral

Reserves do not have demonstrated economic viability.

|

Classification |

Material Type |

Tonnes |

|

Grade - C% |

Graphite - T |

|

Measured |

"Low Grade" |

13 048 373 |

|

4.64 |

605 082 |

|

Measured |

"High Grade" |

10 573 137 |

|

8.4 |

887 835 |

|

Total Measured |

23 621 510 |

|

6.32 |

1 492 916 |

|

Indicated |

"Low Grade" |

39 539 403 |

|

4.73 |

1 871 075 |

|

Indicated |

"High Grade" |

37 206 550 |

|

7.86 |

2 925 266 |

|

Total Indicated |

76 745 953 |

|

6.25 |

4 796 341 |

|

Measured + Indicated |

"Low Grade" |

52 587 776 |

|

4.71 |

2 476 157 |

|

Measured + Indicated |

"High Grade" |

47 779 687 |

|

7.98 |

3 813 101 |

|

Total Measured + Indicated |

100 367 464 |

|

6.27 |

6 289 257 |

|

Inferred |

"Low Grade" |

24 233 267 |

|

4.46 |

1 080 677 |

|

Inferred |

"High Grade" |

16 681 453 |

|

7.70 |

1 285 039 |

|

Total Inferred |

|

40 914 721 |

|

5.78 |

2 365 716 |

C% = carbon percentage; Graphite – T = Tonnes of

graphite

|

(1) |

Mineral Resources are classified according to the Canadian

Institute of Mining definitions. |

|

(2) |

Mineral Resources are reported Inclusive of Mineral Reserves. |

|

(3) |

“Low Grade” Resources are stated at a cut-off grade of 2% C. |

|

(4) |

“High grade” Resources are stated at a cut-off grade of 4% C. |

|

(5) |

Eastern and Western high-grade assays are capped at 15% C. |

|

(6) |

A relative density of 2.36 tonnes per cubic metre (t/m3) was

assigned to the mineralised zones for the resource tonnage

estimation. |

METALLURGY & PRICING

The FS is based on a full suite of metallurgical

test work performed by SGS Canada Metallurgical Services Inc. in

Lakefield, Ontario, Canada. These tests included lab and bench

scale process development work, a bulk sample/pilot plant program,

and metallurgical variability testing. The overall graphitic carbon

recovery into the final concentrate is 88.3%.

Metallurgical Data – Flake Size

Distribution and Product Grade

|

Product Size |

% Distribution |

Product Grade (% Carbon) |

|

|

|

|

|

+48 mesh (jumbo flake) |

23.6 |

96.9 |

|

+65 mesh (coarse flake) |

14.6 |

97.1 |

|

+80 mesh (large flake) |

8.2 |

97.0 |

|

+100 mesh (medium flake) |

6.9 |

97.2 |

|

+150 mesh (medium flake) |

15.5 |

97.3 |

|

+200 mesh (small flake) |

10.1 |

98.1 |

|

-200 mesh (fine flake) |

21.1 |

97.5 |

Pricing Matrix - Flake Size Distribution

Grouping and Product Grade

|

Product Size |

% Distribution |

Product Grade (% Carbon) |

|

|

>50 mesh |

23.6 |

96.9 |

|

|

-50 to +80 mesh |

22.7 |

97.1 |

|

|

-80 to +100 mesh |

6.9 |

97.2 |

|

|

-100 mesh |

46.8 |

97.6 |

|

The selling price used in the FS is the volume

weighted average sales price for the various flake sizes and grades

of SuperFlake™ graphite concentrate that are expected to be

produced from the Molo deposit. This price is based on 12-month

rolling graphite prices provided by UK-based Benchmark Minerals

Intelligence who are recognized as leaders in providing independent

and unbiased market research, pricing trends and demand and supply

analysis for the natural flake graphite market.

No pricing premium for valued-added applications

was applied on any sales. Furthermore, no financial or operational

calculations and/or scenarios in the FS financial model with

regards to downstream value-added processing of SuperFlake™

graphite concentrate were included. This includes purification,

spherodization coating for battery-grade graphite and thermal

expansion for specialty graphite applications, such as foils.

SOCIAL RESPONSIBILITY &

ENVIRONMENT

All environmental and social responsibility

information for the Molo Project has been completed to Equator

Principles, which are the standards adopted by the majority of

international commercial banks, as well as the International

Finance Corporation’s (IFC) Performance Standards. They are the

highest environmental and social standards in the world. These

standards have been incorporated into the design of the Molo

Project’s facilities and operations given NextSources’ commitment

to follow international best practices. There is a global

consumer shift to take social responsibility into account when

developing projects and NextSource has worked hard to ensure that

it met this requirement.

TECHNICAL REPORT FILING

This FS technical report has been filed under

the Company’s profile and on SEDAR at www.sedar.com, and will be

posted on NextSource’s website at

www.nextsourcematerials.com

Please see “Molo Feasibility Study, National

Instrument 43-101 Technical Report on the Molo Graphite Project

located near the village of Fotadrevo in the Province of Toliara,

Madagascar Prepared by Erudite Strategies (Pty) Ltd” dated May 31,

2019 for certain other details and assumptions relating to the

above mineral resource and reserve estimates and data verification

procedures.

BOARD of DIRECTORS

The Company announces the resignation of Mr.

Quentin Yarie as a director of the Company, effective September 27,

2019. With NextSource now solely focused on mine development, Mr.

Yarie will be concentrating more of his time on exploration-based

projects and to explore other opportunities.

“On behalf of the board of directors and the

management team, I would like to thank Mr. Yarie for his

contribution to the Company and wish him well in his future

endeavours”, said Craig Scherba, President and CEO of

NextSource.

QUALIFIED PERSONS

The FS was prepared in accordance with National

Instrument 43-101 standards by Mr. Johann de Bruin, Pr. Eng.

Mr. de Bruin is the Qualified Person who verified the technical

data using industry acceptable standards and signed off on the

relevant sections in the 43-101 report to be filed on SEDAR.

Mr. Craig Scherba, P.Geo., President and CEO of

NextSource, is the qualified person who reviewed and approved the

technical information provided in this press release.

ABOUT NEXTSOURCE MATERIALS

INC.

NextSource Materials Inc. is a mine development

company based in Toronto, Canada, that is developing its 100%-owned

Molo Graphite Project in southern Madagascar. The Molo Graphite

Project is a fully permitted, feasibility-stage project high

quality flake graphite deposit.

To learn more, please visit the Company’s

website at www.nextsourcematerials.com or email investor relations

at info@nextsourcematerials.com

For further information contact:

+1.416.364.4911Brent Nykoliation, Senior Vice President, Corporate

Development at brent@nextsourcematerials.com or Craig

Scherba, President and CEO at craig@

nextsourcematerials.com

Safe Harbour: This press release contains

statements that may constitute “forward-looking statements” within

the meaning of applicable Canadian and United States securities

legislation. Readers are cautioned not to place undue reliance on

such forward-looking statements. Forward-looking statements in this

release relate to the results of the Feasibility Study,

funding of the development of the Molo Project,

implementation and commencement of the build-out of the Molo

Project, commencement of production at the Molo Project,

commencement of procurement for mine infrastructure, the

procurement of equipment to construct a mine, value engineering,

any and all product test results and product analysis, and the

permit application. These are based on current expectations,

estimates and assumptions that involve a number of risks, which

could cause actual results to vary and in some instances to differ

materially from those anticipated by the Company and described in

the forward-looking statements contained in this press release. No

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur or, if any of

them do so, what benefits the Company will derive there from. The

forward-looking statements contained in this news release are made

as at the date of this news release and the Company does not

undertake any obligation to update publicly or to revise any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities laws.

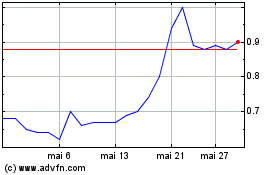

NextSource Materials (TSX:NEXT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

NextSource Materials (TSX:NEXT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024