ALPHAMIN FILES Q3 2024 FINANCIAL STATEMENTS AND MD&A

06 Novembre 2024 - 2:30PM

Alphamin Resources Corp. (AFM:TSXV, APH:JSE AltX)( “Alphamin” or

the “Company”) announced today the filing of its unaudited

condensed consolidated financial statements and accompanying

Management’s Discussion and Analysis (“MD&A”) for the quarter

ended 30 September 2024 on SEDAR+ at www.sedarplus.ca. EBITDA and

AISC for the quarter are in line with guidance announced on 3

October 2024.

Highlights:

- Interim FY2024 dividend

increased to CAD$0.06 per share (previously CAD$0.03 per

share) and paid on 4 November 2024

- Record quarterly tin

production of 4,917 tonnes, up 22% from the prior

quarter

- Q3

EBITDA3 of US$91.6m

(Guidance: US$91.5m), up 69% from the prior

quarter

- AISC per tonne of tin sold

of US$15,728 (Guidance US$15,700), in line with the prior

quarter

Operational and Financial Summary for

the Quarter ended September 20241

|

Description |

Units |

Quarter ended September 2024 |

Quarter ended June 2024 |

Change |

|

Ore Processed |

Tonnes |

229,107 |

166,676 |

37 |

% |

|

Tin Grade Processed |

% Sn |

2.9 |

3.2 |

-9 |

% |

|

Overall Plant Recovery |

% |

73.5 |

75.4 |

-3 |

% |

|

Contained Tin Produced |

Tonnes |

4,917 |

4,028 |

22 |

% |

|

Contained Tin Sold |

Tonnes |

5,552 |

3,245 |

71 |

% |

|

EBITDA2 |

US$'000 |

91,567 |

54,242 |

69 |

% |

|

AISC2 |

US$/t sold |

15,728 |

15,556 |

1 |

% |

|

Average Tin Price Achieved |

US$/t |

31,757 |

32,314 |

-2 |

% |

1Information is disclosed on a 100% basis.

Alphamin indirectly owns 84.14% of its operating subsidiary to

which the information relates. 2This is not a standardized

financial measure and may not be comparable to similar financial

measures of other issuers.See “Use of Non-IFRS Financial Measures”

below and “Selected Consolidated Financial Information” in

Company’s Q3 2024 MD&A for the composition and calculation of

this financial measure and a reconciliation to its most comparable

IFRS measure.

FOR MORE INFORMATION, PLEASE

CONTACT:

Maritz

Smith CEO Alphamin

Resources

Corp. Tel:

+230 269 4166E-mail: msmith@alphaminresources.com

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

USE OF NON-IFRS FINANCIAL PERFORMANCE

MEASURES

This announcement refers to the following

non-IFRS financial performance measures:

EBITDA

EBITDA is profit before net finance expense,

income taxes and depreciation, depletion, and amortization. EBITDA

provides insight into our overall business performance (a

combination of cost management and growth) and is the corresponding

flow driver towards the objective of achieving industry-leading

returns. This measure assists readers in understanding the ongoing

cash generating potential of the business including liquidity to

fund working capital, servicing debt, and funding capital

expenditures and investment opportunities.

This measure is not recognized under IFRS as it

does not have any standardized meaning prescribed by IFRS and is

therefore unlikely to be comparable to similar measures presented

by other issuers. EBITDA data is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

CASH COSTS

This measures the cash costs to produce and sell

a tonne of contained tin. This measure includes mine operating

production expenses such as mining, processing, administration,

indirect charges (including surface maintenance and camp and head

office costs), and smelting, refining and freight, distribution and

royalties. Cash Costs do not include depreciation, depletion, and

amortization, reclamation expenses, capital sustaining, borrowing

costs and exploration expenses. On mine costs, exclusive of stock

movement, are calculated on a cost per tonne produced basis, off

mine costs are calculated on a cost per tonne sold basis.

AISC

This measures the cash costs to produce and sell

a tonne of contained tin plus the capital sustaining costs to

maintain the mine, processing plant and infrastructure. This

measure includes the Cash Cost per tonne and capital sustaining

costs together divided by tonnes of contained tin produced. All-In

Sustaining Cost per tonne does not include depreciation, depletion,

and amortization, reclamation, borrowing costs, foreign exchange

gains and losses, exploration expenses and expansion capital

expenditures.

Sustaining capital expenditures are defined as

those expenditures which do not increase payable mineral production

at a mine site and excludes all expenditures at the Company’s

projects and certain expenditures at the Company’s operating sites

which are deemed expansionary in nature.

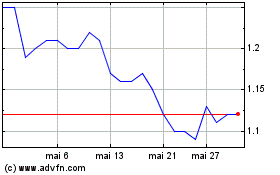

Alphamin Resources (TSXV:AFM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Alphamin Resources (TSXV:AFM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025