Puma Exploration Inc. (TSX-V: PUMA, OTCQB: PUMXF) (the

“

Company” or “

Puma”) reports the

execution of definitive sale agreements dated March 1, 2024

(collectively, the “

Raptor

Agreements”) to welcome a new explorer in New

Brunswick: Raptor Resources Limited (“

Raptor”).

In 2021, in accordance with Puma’s

“DEAR” (Development,

Exploration, Acquisition and

Royalties) business strategy to generate maximum

value for its shareholders with low share dilution, the Company’s

non-core base metals assets (collectively, the

“Copper Projects”) were optioned

to Canadian Copper Inc. (CSE: CCI) (“Canadian

Copper” or “CCI”) pursuant to an option

agreement dated June 30, 2021, as amended (the “Option

Agreement”) in order to provide the Copper Projects with

the visibility and attention that they deserved (see Puma’s news

release dated July 6, 2021).

More particularly, the Turgeon, Chester, Murray

Brook West and Legacy Projects formed part of the Copper Projects.

Following satisfaction of all closing conditions under the Option

Agreement, this transaction closed on June 2, 2022 (the

“Option Closing Date”). Before the execution of

the Raptor Agreements, Puma was holding a 100% interest in each of

the Projects. Canadian Copper’s right to earn a 100% interest in

the Projects was contingent on two (2) remaining payments of

CAD$1,000,000 each payable to Puma at the latest on the second

(2nd) and third (3rd) anniversary of the Option Closing Date,

either in cash or in common shares of Canadian Copper.

In connection with Canadian Copper’s recent

acquisition of the Murray Brook deposit (see Canadian Copper’s news

release dated February 1, 2024), Canadian Copper has identified an

opportunity to sell its interests in the Chester and Turgeon

Projects to focus on developing the Murray Brook deposit and

surrounding property. Following the execution of the Raptor

Agreements, Canadian Copper retains its option rights on the highly

prospective Murray Brook West Project and now controls over 15km of

the favourable Caribou Mine horizon (see Figure 1).

The sale of the Chester and Turgeon Projects to

Raptor will allow Puma to further monetize its copper assets and

unlock their value. To earn a 100% interest in the Chester and

Turgeon Projects, Raptor will make non-dilutive cash payments and

issue common shares to Puma over the next two (2) years in place

and in lieu of the payments initially payable by Canadian Copper

under the terms of the Option Agreement. With large equity

positions in both Canadian Copper and Raptor, Puma will benefit

from both companies’ valuation growth as it continues to focus on

developing the Williams Brook Gold Project.

Puma’s President and CEO Marcel Robillard

stated, “I’m delighted to welcome Raptor to the Bathurst Mining

Camp! Having a new player actively exploring in the region is great

news. An Australian explorer also brings exposure to new

exploration methodologies, connections to other explorers down

under, and increased visibility. That could translate into

potential new investors and funding partners for Puma. We’re always

looking to increase shareholder value and creative ways to finance

and control share dilution. The new agreements with Raptor bring in

cash in the coffers at a time when markets are down and gives

shareholders significant upside - with a stake in two other

companies, we’re multiplying the odds for success and share

appreciation.”

Figure 1: Puma’s assets and landholdings in Northern New

Brunswick

Particulars of the Raptor Agreements

Chester Project

Subject to completion of due diligence and

satisfaction of certain other conditions, including a capital

raising by Raptor by way of prospectus of at least AUD$10,000,000

and receipt of a conditional approval to list its securities on the

Australian Securities Exchange (the “ASX”) on or

before June 30, 20241, Raptor has agreed to acquire a 100% interest

in the Chester Project.

The consideration payable to Puma for the

acquisition of the Chester Project will be as follows2:

- AUD$500,000 in cash

- 4,000,000 shares of Raptor at a

deemed value of at least AUD$0.20 per share (AUD$800,000)3

- If the closing conditions are not

satisfied or waived on or before June 30, 2024, Raptor may elect,

by paying an extension fee of $20,000, to extend the period during

which the closing conditions must be satisfied by a further period

of two (2) months.

- A separate consideration will be

payable by Raptor to Canadian Copper as follows: a non-refundable

fee of $100,000, 4,000,000 shares of Raptor and a cash amount

capped at a maximum of $750,000 by way of reimbursement of

exploration expenditures incurred by Canadian Copper on the Chester

Project.

- ASX listing rules mandate a minimum

issue price of AUD$0.20 per share. Consideration value assumes a

AUD$0.20 price per share.

In addition, upon acquisition by Raptor of a

100% interest in the Chester Project, Puma will be granted a 2% NSR

royalty on all saleable production, half of which (1%) can be

bought back for CAD$1,000,000 on Big Sevogle River Property

(7045).

Turgeon ProjectSubject to

completion of due diligence and satisfaction of certain other

conditions by March 1, 2025, at the latest, Raptor has agreed to

acquire a 100% interest in the Turgeon Project.

The consideration payable to Puma for the

acquisition of the Turgeon Project will be as follows1:

- AUD$375,000 in cash

- AUD$375,000 worth in shares of

Raptor2.

- A separate consideration of

AUD$750,000 will be payable by Raptor to Canadian Copper in cash or

Raptor Shares.

- The number of shares to be issued

to Puma will be calculated using a 10-day VWAP.

Amendment to Option Agreement between Canadian Copper

and Puma

Concurrently with the execution of the Raptor

Agreements, to accommodate the new structured deal with Raptor,

Puma and Canadian Copper have agreed to amend the Option Agreement

to allow Canadian Copper to (a) sell to Raptor its interests in the

Chester and Turgeon Projects and (b) maintain its option to acquire

a 100% interest on the Murray Brook West Project. In addition, the

Legacy Project will no longer be subject to the Option Agreement

(see Figure 1).

As the consideration under the Raptor Agreements

will be payable by Raptor to Puma in Australian dollars, Canadian

Copper has agreed to compensate Puma for any difference in value

resulting from the exchange rate between Canadian and Australian

dollars in cash or the issuance of additional shares of Canadian

Copper. The objective for Puma is to receive from Raptor the same

consideration value as the one that it negotiated in its initial

option deal with Canadian Copper, of which CAD $2M remains

receivable.

In addition, if Raptor does not proceed with any

of the payments as stipulated under the Raptor Agreements for the

acquisition of the Chester and the Turgeon Project, Canadian Copper

will have to satisfy the aggregate consideration payable to Puma

under the terms of the Option Agreement as amended, to acquire a

100% interest thereto or abandon its option rights thereunder.

The transactions described in this news release

are subject to approval from the TSX Venture Exchange.About

Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral

exploration company with a copper and base metals portfolio of

historical resources and grassroots projects. Canadian Copper is

focused on the prolific Bathurst Mining Camp (“BMC”) of New

Brunswick, Canada. There are currently 90,044,760 shares issued and

outstanding in the Company. Visit www.canadiancopper.com for more

information.

About Puma Exploration

Puma Exploration is a Canadian-based mineral

exploration company with precious metals projects in Northern New

Brunswick. Puma’s flagship Williams Brook Gold Project comprises

four properties covering more than 49,000 ha near paved roads and

with excellent infrastructure nearby. The land package is located

near the Rocky Brook Millstream Fault (“RBMF”), a major regional

structure formed during the Appalachian Orogeny and a significant

control for gold deposition in the region.

Since 2021 and with less than C$12.5M of

exploration investment. Puma has made multiple gold discoveries at

the Williams Brook property and believes that the property hosts an

extensive orogenic gold system.

Qualified Person

Dominique Gagné, P.Geo., a Puma consultant and a

qualified person as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects, reviewed and approved

this release's technical information.

Connect with us on Facebook / X/ LinkedIn.

Visit www.explorationpuma.com for more

information or contact:

Marcel Robillard, President and

CEO, (418) 750-8510; president@explorationpuma.com

Mia Boiridy, Head of Investor Relations and

Corporate Development, (250) 575-3305;

mboiridy@explorationpuma.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Statements: This press release

may contain forward-looking statements. Such forward-looking

statements involve several known and unknown risks, uncertainties,

and other factors that may cause the actual results, performance,

or achievements of Puma to be materially different from actual

future results and achievements expressed or implied by such

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date the statements were made, except as required by

law. Puma undertakes no obligation to publicly update or revise any

forward-looking statements. The quarterly and annual reports and

the documents submitted to the securities administration describe

these risks and uncertainties.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/53f7125b-e16f-4f93-a3b4-5b29d6a4ad33

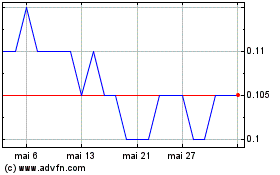

Puma Exploration (TSXV:PUMA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Puma Exploration (TSXV:PUMA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025