false

0001005101

0001005101

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): November

8, 2024

The

Marygold Companies, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41318 |

|

90-1133909 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

120 Calle Iglesia

Unit B

San Clemente, CA 92672

(Address of principal executive offices and zip code)

(949) 429-5370

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

MGLD |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule l2b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2024, The Marygold

Companies, Inc. issued a press release announcing its financial results for the three months ended September 30, 2024. A copy of the

press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Pursuant to the rules and regulations of the Securities

and Exchange Commission, such exhibit and the information set forth therein and in this Item 2.02 have been furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to liability under that section, nor shall they be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing regardless of

any general incorporation language.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE MARYGOLD COMPANIES, INC. |

| |

|

|

| Date:

November 12, 2024 |

By: |

/s/ Nicholas Gerber |

| |

|

Nicholas Gerber |

| |

|

Chief Executive Officer |

Exhibit 99.1

The Marygold Companies

Reports Financial Results

for 2025 First Fiscal Quarter

-Company

Continues Investments In Financial Services Sector -

San

Clemente, Calif., November 8, 2024—The Marygold Companies, Inc. (“TMC,” or the “Company”)

(NYSE American: MGLD), a diversified global holding firm, today

reported financial results for its 2025 first fiscal quarter ended September 30, 2024.

Revenue for

the three months ended September 30, 2024 amounted to $7.9 million, compared with $8.2 million last year. The Company sustained a net

loss of $1.6 million, equal to a loss of $0.04 per share, for the first quarter of fiscal year 2025, compared with a net loss of $0.5

million, equal to a loss of $0.01 per share, for the first quarter of fiscal 2024.

TMC’s

balance sheet remained strong at September 30, 2024. Cash and cash equivalents increased to $6.7 million from $5.5 million at June 30,

2024, the close of TMC’s prior fiscal year. Total assets at September 30, 2024, rose to $35.9 million from $32.9 million at year-end,

and total stockholders’ equity declined slightly to $25.5 million at the end of the first quarter, from $26.6 million at fiscal

year-end.

“As

anticipated, the loss for the first quarter was driven by continued investments and expenses in the financial services sector, in particular,

in our proprietary mobile fintech app, and by a slight decrease in average assets under management (AUM) by our largest operating unit,

UCSF Investments,” said David Neibert, TMC’s Chief Operations Officer. “Commodity price fluctuations and the high-interest

rate environment, along with geopolitical and economic uncertainty, likely affected average AUM, which amounted to $3.1 billion for the

most recent quarter vs. $3.5 billion a year ago. Moving into fiscal 2025, additional investments in TMC’s strategic transformation

and emphasis on financial services are expected to continue to negatively impact our bottom line,” Neibert added.

Nicholas Gerber, TMC’s Chief Executive Officer,

said, “We are continuing to put the foundational building blocks together as we transform TMC’s primary focus to financial

services and plan for the rollout of our mobile fintech app in the U.K. Additionally, we acquired a nearly eight percent ownership stake

in Midland Capital Holdings Corporation, a privately owned holding company whose principal operating entity is Midland Federal Savings

and Loan Association, which operates four full-service branch offices in the greater Chicago area. This transaction followed earlier acquisitions

of UK-based investment advisory firms Tiger Financial & Asset Management and Step By Step Financial Planners.

“We are optimistic that our investments we make

today in the financial services sector, although impacting current and near-term operating results and requiring patience by all of us,

will provide tangible benefits and enhanced valuation for all stakeholders over the long-term,” said Gerber.

Business

Units

The

Company’s USCF Investments subsidiary, https://www.uscfinvestments.com/, acquired in 2016 and based in Walnut Creek, Calif.,

serves as manager, operator or investment adviser to 15 exchange traded products, structured as limited partnerships or investment trusts

that issue shares trading on the NYSE Arca.

Gourmet

Foods, https://gourmetfoodsltd.co.nz/, acquired in 2015, is a commercial-scale bakery that produces and distributes iconic meat

pies and pastries throughout New Zealand under the brand names Pat’s Pantry and Ponsonby Pies. Acquired by Gourmet Foods in 2020,

Printstock Products Limited https://www.printstock.co.nz,

is a printer of specialized food wrappers and is located in Napier, New Zealand. Its operations are consolidated with those of Gourmet

Foods.

Brigadier

Security Systems, www.brigadiersecurity.com, acquired in 2016 and headquartered in Saskatoon, Canada, provides comprehensive security

solutions to homes and businesses, government offices, schools and other public buildings throughout the province under the brands Brigadier

Security Systems in Saskatoon and Elite Security in Regina, Canada.

Acquired

in 2017, San Clemente, Calif.-based Original Sprout, www.originalsprout.com,

produces and distributes a full line of vegan, safe, non-toxic hair and skin care products, including a “reef safe” sun screen,

throughout the U.S. and in many regions throughout the world.

About Marygold & Co. and Marygold & Co.

(UK)

Marygold & Co., https://marygoldandco.com/,

headquartered in Denver, Colo., is a wholly owned TMC subsidiary established in 2019 to explore opportunities in the financial technology

sector. Marygold & Co. (UK) Limited, https://marygoldandco.uk/,

also a wholly owned TMC subsidiary, was established in the

U.K. in 2021 and operates through two U.K.-based investment advisory business units: Tiger Financial & Asset Management Limited (“Tiger”),

acquired in 2022, http://www.tfam.co.uk/, and

Step-by Step Financial Planners, acquired in 2024, https://www.sbsfp.co.uk/,

that manage clients’ financial wealth across a diverse product range.

About The Marygold Companies, Inc.

The

Marygold Companies was founded in 1996 and repositioned as a global holding firm in 2015. The Company currently has operating subsidiaries

in financial services, food manufacturing, printing, security systems and beauty products, under the trade names USCF Investments, Marygold

& Co., Tiger Financial & Asset Management Limited, Step By Step Financial Planners, Gourmet Foods, Printstock Products, Brigadier

Security Systems and Original Sprout, respectively. Offices and manufacturing operations are in the U.S., New Zealand, U.K., and Canada.

For more information, visit www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of U.S. federal securities laws. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may” “will,”

“could,” “should” “believes,” “predicts,” “potential,” “continue”

and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ materially from the expected results and, consequently, you should

not rely on these forward-looking statements as predictions of future events. These forward-looking statements and factors that may cause

such differences include, without limitation, satisfaction of customary closing conditions related to the offering, the expected timing

of the closing of the offering and the risks disclosed in the Company’s Annual Report on Form 10-K filed with the Securities and

Exchange Commission and in the Company’s other filings with the Securities and Exchange Commission. The foregoing list of factors

is not exclusive. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date

made. Except as required by law, the Company disclaims any obligation to update or publicly announce any revisions to any of the forward-looking

statements contained in this press release.

| |

Media and investors, for more Information, contact: |

| |

Roger S. Pondel |

| |

PondelWilkinson Inc. |

| |

310-279-5965 |

| |

rpondel@pondel.com |

| |

|

| |

Contact the Company: |

| |

David Neibert, Chief Operations Officer |

| |

949-429-5370 |

| |

dneibert@themarygoldcompanies.com |

THE MARYGOLD COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

| | |

September 30, 2024 | | |

June 30, 2024 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 6,665 | | |

$ | 5,461 | |

| Accounts receivable, net (of which $1,578 and $1,455, respectively, due from related parties) | |

| 2,507 | | |

| 2,678 | |

| Inventories | |

| 2,175 | | |

| 2,191 | |

| Prepaid income tax and tax receivable | |

| 1,751 | | |

| 1,338 | |

| Investments, at fair value | |

| 10,807 | | |

| 9,551 | |

| Other current assets | |

| 1,096 | | |

| 3,034 | |

| Total current assets | |

| 25,001 | | |

| 24,253 | |

| | |

| | | |

| | |

| Restricted cash | |

| 64 | | |

| 62 | |

| Property and equipment, net | |

| 1,144 | | |

| 1,166 | |

| Operating lease right-of-use assets | |

| 1,518 | | |

| 974 | |

| Goodwill | |

| 2,481 | | |

| 2,481 | |

| Intangible assets, net | |

| 1,296 | | |

| 1,375 | |

| Deferred tax assets, net | |

| 1,969 | | |

| 1,969 | |

| Other assets | |

| 2,402 | | |

| 619 | |

| Total assets | |

$ | 35,875 | | |

$ | 32,899 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 4,125 | | |

$ | 4,021 | |

| Lease liabilities, current portion | |

| 698 | | |

| 620 | |

| Purchase consideration payable, current portion | |

| 251 | | |

| 277 | |

| Notes payable, current portion | |

| 2,800 | | |

| 315 | |

| Total current liabilities | |

| 7,874 | | |

| 5,233 | |

| | |

| | | |

| | |

| Notes payable, net of current portion | |

| 910 | | |

| - | |

| Purchase consideration payable, net of current portion | |

| 251 | | |

| 237 | |

| Lease liabilities, net of current portion | |

| 949 | | |

| 455 | |

| Deferred tax liabilities, net | |

| 360 | | |

| 360 | |

| Total long-term liabilities | |

| 2,470 | | |

| 1,052 | |

| Total liabilities | |

| 10,344 | | |

| 6,285 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock, par value $0.001; 50,000 shares authorized | |

| | | |

| | |

| Series B: 49 issued and outstanding at September 30, 2024 and June 30, 2024 | |

| - | | |

| - | |

| Common stock, $0.001 par value; 900,000 shares authorized; 40,326 and 40,096 shares issued and outstanding at September 30, 2024 and June 30, 2024, respectively | |

| 40 | | |

| 40 | |

| Additional paid-in capital | |

| 13,285 | | |

| 12,825 | |

| Accumulated other comprehensive loss | |

| (226 | ) | |

| (269 | ) |

| Retained earnings | |

| 12,432 | | |

| 14,018 | |

| Total stockholders’ equity | |

| 25,531 | | |

| 26,614 | |

| Total liabilities and stockholders’ equity | |

$ | 35,875 | | |

$ | 32,899 | |

THE MARYGOLD COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | |

Quarters Ended September 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue | |

| | | |

| | |

| Fund management - related party | |

$ | 4,591 | | |

$ | 5,049 | |

| Food products | |

| 1,822 | | |

| 1,730 | |

| Beauty products | |

| 597 | | |

| 775 | |

| Security systems | |

| 690 | | |

| 554 | |

| Financial services | |

| 210 | | |

| 127 | |

| Revenue | |

| 7,910 | | |

| 8,235 | |

| | |

| | | |

| | |

| Cost of revenue | |

| 2,128 | | |

| 2,037 | |

| | |

| | | |

| | |

| Gross profit | |

| 5,782 | | |

| 6,198 | |

| | |

| | | |

| | |

| Operating expense | |

| | | |

| | |

| Salaries and compensation | |

| 3,147 | | |

| 2,590 | |

| General and administrative expense | |

| 2,565 | | |

| 2,248 | |

| Fund operations | |

| 1,412 | | |

| 1,270 | |

| Marketing and advertising | |

| 669 | | |

| 972 | |

| Depreciation and amortization | |

| 159 | | |

| 154 | |

| Total operating expenses | |

| 7,952 | | |

| 7,234 | |

| | |

| | | |

| | |

| Loss from operations | |

| (2,170 | ) | |

| (1,036 | ) |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| Interest and dividend income | |

| 151 | | |

| 193 | |

| Interest expense | |

| (31 | ) | |

| (4 | ) |

| Other (expense) income, net | |

| (19 | ) | |

| 44 | |

| Total other income (expense), net | |

| 101 | | |

| 233 | |

| | |

| | | |

| | |

| Loss before income taxes | |

| (2,069 | ) | |

| (803 | ) |

| | |

| | | |

| | |

| Benefit from income taxes | |

| 483 | | |

| 303 | |

| | |

| | | |

| | |

| Net loss | |

$ | (1,586 | ) | |

$ | (500 | ) |

| | |

| | | |

| | |

| Weighted average shares of common stock | |

| | | |

| | |

| Basic | |

| 40,848 | | |

| 40,397 | |

| Diluted | |

| 40,848 | | |

| 40,397 | |

| | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | |

| Basic | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

| Diluted | |

$ | (0.04 | ) | |

$ | (0.01 | ) |

v3.24.3

Cover

|

Nov. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2024

|

| Entity File Number |

001-41318

|

| Entity Registrant Name |

The

Marygold Companies, Inc.

|

| Entity Central Index Key |

0001005101

|

| Entity Tax Identification Number |

90-1133909

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

120 Calle Iglesia

|

| Entity Address, Address Line Two |

Unit B

|

| Entity Address, City or Town |

San Clemente

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92672

|

| City Area Code |

(949)

|

| Local Phone Number |

429-5370

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

MGLD

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

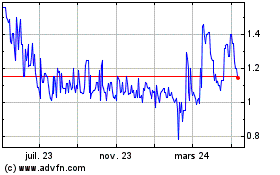

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

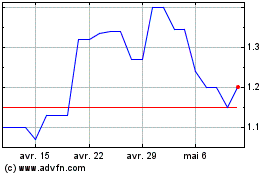

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025