Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the second quarter and first six months of

fiscal 2023.

Fiscal 2023 Second Quarter Results

For the three months ended December 31, 2022, revenue increased

13% to $12,390,000, compared to $10,922,000 for the same quarter

last year, driven by a 43% increase in revenue in the Company’s

manufacturing segment.

Reflecting the growth in revenue and an increase in gross margin

for the second quarter to 27% of revenue compared to 26% of revenue

for the second quarter of fiscal 2022, operating income surged 63%

to $1,069,000 compared to $656,000 last year.

Net income for the second quarter of fiscal 2023 was $507,000,

or $0.12 per diluted share, compared to net income of $855,000, or

$0.20 per diluted share, for the second quarter of fiscal 2022. Net

income for this year’s second quarter was affected by a non-cash

currency exchange loss of $349,000 associated with a weakening of

the US dollar against the Singapore dollar during the quarter. This

compares to an exchange loss of $38,000 for the second quarter of

fiscal 2022.

Shareholders' equity at December 31, 2022 increased to

$29,973,000, or $7.35 per outstanding share, compared to

$28,002,000, or $6.88 per outstanding share, at June 30, 2022.

There were approximately 4,076,680 and 4,071,680 shares of common

stock outstanding at December 31, 2022 and June 30, 2022,

respectively.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, “We are pleased by growth in

revenue and operating income that we delivered for the first half

of the new fiscal year. Looking ahead, despite the potential impact

of semiconductor industry capacity adjustments on our business in

the second half, we remain optimistic that we will achieve our

goals for long-term growth and profitability as we remain focused

on improving operating efficiency, controlling expenses, and

working closely with current and prospective customers to expand

our business opportunities.”

Fiscal 2022 First Half Results

For the first six months of fiscal 2023, revenue increased 15%

to $24,329,000 compared to $21,093,000 for the same period last

year.

Gross margin for the first six months of fiscal 2023 increased

15% to $6,957,000 compared to $6,069,000 for the same period last

year and represented approximately 29% of revenue for both

periods.

Income from operations increased 31% to $2,136,000, or 9% of

revenue, compared to $1,626,000, or 8% of revenue, for the same

period last year.

Net income for the first half of fiscal 2023 was $1,389,000, or

$0.33 per diluted share, compared to $1,772,000, or $0.43 per

diluted share, for the same period last year. Net income for this

year’s first half reflected a non-cash currency exchange loss of

$279,000 versus an exchange loss of $4,000 for the first six months

of fiscal 2022.

About Trio‑Tech

Established in 1958, Trio-Tech International is located in Van

Nuys, California, with its Principal Executive Office and regional

headquarters in Singapore. Trio-Tech International is a diversified

business group with interests in semiconductor testing services,

manufacturing and distribution of semiconductor testing equipment,

and real estate. Our subsidiary locations include Tianjin, Suzhou,

Chongqing and Jiangsu in China, as well as Kuala Lumpur, Malaysia

and Bangkok, Thailand. Further information about Trio-Tech's

semiconductor products and services can be obtained from the

Company's Web site at www.triotech.com and

www.universalfareast.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company's products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications which could affect the market for

the Company's products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Asia, including currency fluctuations and devaluation, currency

restrictions, local laws and restrictions and possible social,

political and economic instability; changes in U.S. and global

financial and equity markets, including market disruptions and

significant interest rate fluctuations; on-going public health

issues related to the COVID-19 pandemic; geopolitical conflicts,

including the current war in Ukraine; political and trade tension

between U.S and China, other economic, financial and regulatory

factors beyond the Company's control and, uncertainties relating to

our ability to operate our business in China; uncertainties

regarding the enforcement of laws and the fact that rules and

regulation in China can change quickly with little advance notice,

along with the risk that the Chinese government may intervene or

influence our operation at any time, or may exert more control over

offerings conducted overseas and/or foreign investment in

China-based issuers could result in a material change in our

operations, financial performance and/or the value of our common

stock or impair our ability to raise money. Other than statements

of historical fact, all statements made in this Quarterly Report

are forward looking, including, but not limited to, statements

regarding industry prospects, future results of operations or

financial position, and statements of our intent, belief and

current expectations about our strategic direction, prospective and

future financial results and condition. In some cases, you can

identify forward looking statements by the use of terminology such

as "may," "will," "expects," "plans," "anticipates," "estimates,"

"potential," "believes," "can impact," "continue," or the negative

thereof or other comparable terminology. Forward looking statements

involve risks and uncertainties that are inherently difficult to

predict, which could cause actual outcomes and results to differ

materially from our expectations, forecasts and assumptions.

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Six Months Ended

December 31,

December 31,

Revenue

2022

2021

2022

2021

Manufacturing

$

5,044

$

3,528

$

8,629

$

7,090

Testing services

5,648

4,966

12,012

9,566

Distribution

1,694

2,420

3,676

4,418

Real estate

4

8

12

19

12,390

10,922

24,329

21,093

Cost of Sales

Cost of manufactured products sold

3,849

2,874

6,374

5,308

Cost of testing services rendered

3,747

3,089

7,873

5,972

Cost of distribution

1,441

2,050

3,089

3,706

Cost of real estate

18

19

36

38

9,055

8,032

17,372

15,024

Gross Margin

3,335

2,890

6,957

6,069

Operating Expenses:

General and administrative

1,919

1,947

4,224

3,927

Selling

193

156

366

303

Research and development

151

131

224

213

Gain on disposal of property, plant and

equipment

3

--

7

--

Total operating expenses

2,266

2,234

4,821

4,443

Income from Operations

1,069

656

2,136

1,626

Other Income (Expenses)

Interest expenses

(10

)

(28

)

(54

)

(56

)

Other income, net

(243

)

381

(64

)

542

Total other income

(253

)

353

(118

)

486

Income from Continuing Operations before

Income Taxes

816

1,009

2,018

2,112

Income Tax Expenses

(241

)

(153

)

(466

)

(333

)

Income from Continuing Operations before

Non-controlling Interest, Net of Tax

575

856

1,552

1,779

(Loss) Income from Discontinued

Operations, Net of Tax

(10

)

--

(9

)

5

NET INCOME

565

856

1,543

1,784

Less: Income Attributable to

Non-controlling Interest

58

1

154

12

Net Income Attributable to Trio-Tech

International

507

855

1,389

1,772

Net Income Attributable to Trio-Tech

International:

Income from Continuing Operations, Net of

Tax

512

856

1,394

1,770

(Loss) Income from Discontinued

Operations, Net of Tax

(5

)

(1

)

(5

)

2

Net Income attributable to Trio-Tech

International

$

507

$

855

$

1,389

$

1,772

Basic Earnings per Share

$

0.12

$

0.22

$

0.34

$

0.46

Diluted Earnings per share

$

0.12

$

0.20

$

0.33

$

0.43

Weighted Average Shares Outstanding -

Basic

4,074

3,923

4,074

3,923

Weighted Average Shares Outstanding -

Diluted

4,162

4,242

4,160

4,129

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

UNAUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE)

Three Months Ended

Six Months Ended

December 31,

December 31,

2022

2021

2022

2021

Comprehensive Income Attributable to

Trio-Tech International Common Shareholders:

Net income

$

565

$

856

$

1,543

$

1,784

Foreign Currency Translation, Net of

Tax

1,568

251

355

(38

)

Comprehensive Income

2,133

1,107

1,898

1,746

Less: Comprehensive income (loss)

Attributable to Non-controlling Interest

133

2

212

6

Comprehensive Income Attributable to

Trio-Tech International Common Shareholders

$

2,000

$

1,105

$

1,686

$

1,740

TRIO‑TECH INTERNATIONAL AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(IN THOUSANDS, EXCEPT NUMBER OF

SHARES)

Dec. 31,

June 30,

2022

2022

ASSETS

(Unaudited)

(Audited)

CURRENT ASSETS:

Cash and cash equivalents

$

6,379

$

7,698

Short-term deposits

4,995

5,420

Trade account receivables, net

13,332

11,592

Other receivables

728

998

Inventories, net

3,219

2,258

Prepaid expenses and other current

assets

610

1,215

Financed sales receivable

21

21

Restricted term deposit

747

--

Total current assets

30,031

29,202

Deferred tax assets

93

169

Investment properties, net

533

585

Property, plant and equipment, net

11,070

8,481

Operating lease right-of-use assets

2,580

3,152

Other assets

141

137

Financed sales receivable

6

17

Restricted term deposits

1,742

1,678

Total non-current assets

16,165

14,219

TOTAL ASSETS

$

46,196

$

43,421

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Lines of credit

--

$

929

Accounts payable

3,067

2,401

Accrued expense

6,807

6,004

Income taxes payable

461

787

Current portion of bank loans payable

511

472

Current portion of finance leases

101

118

Current portion of operating leases

1,140

1,218

Total current liabilities

12,087

11,929

Bank loans payable, net of current

portion

1,185

1,272

Finance leases, net of current portion

69

119

Operating leases, net of current

portion

1,440

1,934

Income taxes payable

255

137

Deferred tax liabilities

15

--

Other non-current liabilities

1,172

28

Total non-current liabilities

4,136

3,490

TOTAL LIABILITIES

16,223

15,419

EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS'

EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 4,076,680 and 4,071,680 shares issued and

outstanding at December 31, 2022 and June 30, 2022,

respectively

12,769

12,750

Paid-in capital

4,762

4,708

Accumulated retained earnings

10,608

9,219

Accumulated other comprehensive

gain-translation adjustments

1,494

1,197

Total Trio-Tech International

shareholders' equity

29,633

27,874

Non-controlling interest

340

128

TOTAL EQUITY

29,973

28,002

TOTAL LIABILITIES AND EQUITY

$

46,196

$

43,421

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230210005113/en/

Company Contact: A. Charles Wilson Chairman (818)

787-7000 Investor Contact: Berkman Associates (310) 927-3108

robert.jacobs@jacobscon.com

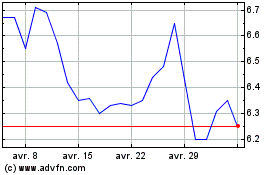

Trio Tech (AMEX:TRT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Trio Tech (AMEX:TRT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025