TIDMAAU

RNS Number : 1799U

Ariana Resources PLC

22 November 2023

22 November 2023

AIM: AAU

DUE DILIGENCE DRILLING COMMENCES IN ZIMBABWE

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to provide an update on the Dokwe

Gold Project of Rockover Holdings Limited ("Rockover"), in which

Ariana has acquired a 1.3% interest and project exclusivity through

the Asgard Metals Fund ("Asgard"). The Company has commenced a due

diligence drilling programme on the asset, while the Company

considers further involvement in the project. Please see

www.asgardmetals.com.au for more information.

Highlights:

-- Up to 1,500m of diamond drilling planned to test two

significant resources at Dokwe North and Dokwe Central.

-- Dokwe Gold Project contains c.1.3Moz gross in JORC Measured,

Indicated and Inferred Resources*.

-- Significant historic intercepts for Dokwe North include:

o 8m @ 197.22g/t Au (inclusive of a 1m intercept of 1,568

g/t)

o 14m @ 54.75g/t Au

o 85m @ 5.23g/t Au, i ncluding 15m @ 13.64g/t Au

-- Significant historic intercepts for Dokwe Central include:

o 49m @ 4.42g/t Au

o 27m @ 6.53g/t Au

o 57m @ 2.72g/t Au, including 17m @ 5.91g/t Au

-- An extensive historical data review is underway by the Ariana

team, utilising the Company's exploration technology and specialist

teams.

* Stated gross with respect to Rockover Holdings Limited of

which Ariana holds 1.3%. The resources quoted includes Dokwe North

and Dokwe Central.

Dr. Kerim Sener, Managing Director, commented:

"We are excited to report the commencement of our highly

anticipated due diligence drilling programme on the Dokwe Gold

Project in Zimbabwe, as previously announced to the AIM market on

13 November . This represents a compelling and unique opportunity

for the Company as we advance on our strategy to become a

multi-asset, multi-jurisdiction gold and copper-focused mid-tier

mining enterprise.

"Building on the operational base we have established in Turkiye

with strong and experienced local partners, we are making strides

to expand our portfolio with the potential addition of the Dokwe

Gold Project. This project represents a potential bulk-tonnage

mining opportunity upon which a positive pre-feasibility study has

been delivered and which could be advanced to feasibility in the

near term.

"At this stage, we see potential at Dokwe to identify further

resources in the vicinity and to develop a multi-decade mining

opportunity in Zimbabwe. This due diligence drilling represents an

essential first step to verify the historical exploration data and

to add to our understanding of the opportunity before we advance

discussions with Rockover with respect to the asset."

Drilling Programme

Ariana Resources has initiated a drilling programme at the Dokwe

North and Dokwe Central areas ("Dokwe" or "Dokwe Project") located

in the Tsholotsho Communal Land 110km WNW of Bulawayo, Zimbabwe

(Figure 1 & 3). The Dokwe Project was discovered by Rockover in

2002, utilising innovative soil geochemical exploration methods

capable of detecting mineralisation beneath cover, subsequently

drill-tested for the first time in 2004.

Dokwe is located in a previously undefined Archaean Greenstone

Belt, extending from the border with Botswana and linking up with

the Bulawayo-Bubi Greenstone Belt to the west. The Archaean

greenstone units are overlain by Karoo and Kalahari sedimentary

units of up to 25-40m in thickness. The east-northeast striking

greenstone belt is accompanied by complex folding and thrust

imbrication and is dissected by a series of major sub-parallel

sinistral shear zones.

At the Dokwe Gold Project area, the barren sedimentary cover is

dominated by calcrete, with a few metres of sand at the surface,

and mudstone and sandstone located towards the base. The basement

Archaean volcanic sequence comprises a series of quartz-rich

volcaniclastic units, tuffs, and agglomerates, that grade into

felsic irregular rhyolitic flows; intermediate vesicular dacite;

agglomerates and andesites. The sequence appears intruded by near

syn-depositional quartz porphyries and later by dolerite. Brittle

deformation, characterised by fracturing, is common in felsic tuff

whilst more ductile deformation characterises the dacitic and

andesitic units.

Dokwe North is characterised as a large low-grade deposit

containing relatively few quartz veins, containing several very

high-grade zones including visible gold. Dokwe Central is a smaller

higher-grade pipe-like deposit containing abundant quartz veins and

defined by several long high-grade zones. The two deposits are

located a few kilometres apart and appear to be strongly

structurally controlled, occupying two distinct structural domains

within a broad ENE trending shear zone. Gold mineralisation at

Dokwe North is associated with silicified zones containing thin

quartz-carbonate pyrite veins in addition to strongly disseminated

and fine-grained pyrite in the host rocks. Much of the economic

gold mineralisation occurs in the dacitic unit and in the overlying

felsic tuff, with lesser mineralisation in the quartz porphyries

and andesite.

Up to five diamond drill holes (for 1,500m) have been planned to

support Ariana's due diligence review of the Dokwe Project (Figure

1). This review is designed to test historical data and to provide

additional information to characterise the structural geological

controls on gold mineralisation. Up to three holes will be focused

on testing Dokwe North, which represents the largest resource

defined to date. Dokwe North has a JORC (2012) Measured, Indicated

and Inferred Resource of 35.7Mt @ 1.05g/t Au for 1,210,000 oz gold

(Figure 1 & 2). Up to the two remaining holes will be completed

at the less drilled Dokwe Central project area, which is located

approximately 2km to the SSE of Dokwe North. Dokwe Central has a

JORC (2004) Measured, Indicated and Inferred Resource of 1.14Mt @

2.17g/t Au for 80,000 oz gold (Figure 1 & 2). The Dokwe Central

resource is treated here as a historical estimate as it is not in

accordance with an AIM reporting standard and should be treated

with caution. From the initial reviews, both project areas show

significant scope for further exploration upside.

Figure 1: Summary map of Dokwe North and Central showing the

outline of the designed pre-feasibility pit for Dokwe North and the

optimised pit (not included in the pre-feasibility) for Dokwe

Central. Certain previous drill intercepts are also identified,

with details provided in the inset table. The 2023 planned drill

collars are also shown in light blue.

Figure 2: Summary cross sections through Dokwe North and Dokwe

Central showing grade block models (based on prior drilling) and

the positions of certain planned due diligence drill holes (in

blue). Swath width at Dokwe North is significantly wider than at

Dokwe Central, causing more overlap of colours within a

semi-transparent block model.

Figure 3: Drill rig positioned and being prepared for the

commencement of the first due diligence drill hole at Dokwe.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited (Joint Tel: +44 (0) 20 7886 2500

Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell / George

Krokos Tel: +44 (0) 7983 521 488

Yellow Jersey PR Limited (Financial

PR)

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Editors' Note:

The information in this announcement that relates to exploration

results is based on information compiled by Dr. Kerim Sener BSc

(Hons), MSc, PhD, Managing Director of Ariana Resources plc. Dr.

Sener is a Fellow of The Geological Society of London and a Member

of The Institute of Materials, Minerals and Mining and has

sufficient experience relevant to the styles of mineralisation and

type of deposit under consideration and to the activity that has

been undertaken to qualify as a Competent Person as defined by the

2012 edition of the Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

and under the AIM Rules - Note for Mining and Oil & Gas

Companies. Dr. Sener consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million ounces silver (as at November 2022). Following

the approval of its Environmental Impact Assessment and associated

permitting, Tavsan is being developed as the second gold mining

operation in Turkey and is currently in construction. A NSR royalty

of up to 2% on future production is payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey, UK, and Zimbabwe.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Mining Corporation

(www.newmont.com) and is separately earning-in to up to 85% of the

Slivova Gold Project.

Ariana owns 58% of UK-registered Venus Minerals Ltd ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 17Mt @ 0.45% to 1.10% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Au" chemical symbol for gold;

"g/t" grams per tonne;

"JORC" the Joint Ore Reserves Committee;

"m" Metres;

"oz" Troy ounces;

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFLFESLDLLFIV

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

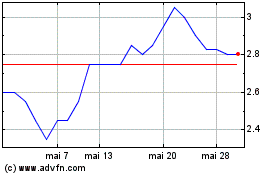

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025