US Bitcoin Reserve Will Lead To ‘Pain In Under 2 Years,’ Warns Arthur Hayes

06 Février 2025 - 12:00PM

NEWSBTC

In his latest essay entitled “The Genie,” crypto entrepreneur and

former BitMEX CEO Arthur Hayes denounced calls for a United States

Bitcoin Strategic Reserve (BSR), warning that such a program would

create “unnecessary pain in under two years” and transform the

world’s largest cryptocurrency into a potent political weapon.

Hayes also cautioned the industry against pursuing what he deems to

be an overcomplicated “Frankenstein crypto regulatory bill,” which,

he argues, would primarily benefit large centralized institutions

rather than foster true decentralization. A “Terrible Idea” For

Bitcoin? Hayes questions both the feasibility and the long-term

consequences of establishing a national Bitcoin stockpile. He

argues the US government would be motivated by politics rather than

sound financial strategy, potentially leading to manipulation of

the Bitcoin market. In his view, a BSR risks becoming a mechanism

for politicians to raise funds for unrelated agendas: “Let’s assume

that Trump is able to create a BSR. The government buys one million

Bitcoin, as suggested by US Senator Lummis. Boom! The price goes

nuts. Then, the buying concludes, and the up-only trend channel

stops.” Related Reading: Bitcoin to $500,000? Standard Chartered

Exec Predicts Massive Surge By 2028 Hayes envisions a subsequent

administration—one hostile to Bitcoin or crypto in general—deciding

to liquidate this enormous reserve. “What if [the Democrats] got a

veto-proof majority in the House of Representatives? By 2028, what

if a Democrat won the election … finding easy piles of cash to

spend on goodies for their supporters is the first directive. There

are one million Bitcoin just sitting there, ready to be sold… The

market would rightly fear when and how these Bitcoin would be

sold.” Another of Hayes’ key contentions is that regulation shaped

by special interests could inadvertently stifle the very innovation

it aims to promote. According to Hayes, large exchanges and

financial intermediaries with the resources to influence lawmakers

are more likely to drive regulatory outcomes. This, he suggests,

will burden smaller innovators and strengthen the position of major

centralized players: “The crypto regulatory wishes likely to be

granted… will be in the form of overly complicated, prescriptive

rules that only large and wealthy centralized companies can afford…

Is that what the broader crypto community actually desired from the

genie? … Maybe those readers who are shareholders of Coinbase and

BlackRock want a Frankenstein crypto bill. But I believe this type

of regulation does nothing to alter the status quo.” An Alternative

Proposal Rather than a BSR, Hayes proposes a more radical and

complex financial arrangement involving the US Treasury, Bitcoin,

and “century bonds” (100-year zero-coupon bonds). His idea is for

the US to unilaterally devalue its existing Treasury obligations by

announcing that Bitcoin will replace sovereign debt as the neutral

global reserve asset. Related Reading: Why Bitcoin Wins No Matter

The Outcome Of Trump’s Trade War The plan, in his own words, would

involve a public statement from US Treasury Secretary Scott

Bessent, declaring the intention to use Bitcoin as the reserve

asset while retaining the US dollar as the invoicing currency.

Afterward, the Dollar would undergo a progressive devaluation, with

the US Treasury bidding for Bitcoin at increasingly higher prices

while issuing century bonds instead of immediate cash payouts. The

next step would be extending the maturity of Treasury debt, with

the Treasury selling Bitcoin at a profit to buy back and retire

shorter-term obligations, ultimately pushing US debt maturity to

100 years. Additionally, global USD adoption would be accelerated

through stablecoin transfers on social media platforms like

Facebook and X, enabling everyday users to participate in US bond

markets—bypassing conventional banking intermediaries. “That’s it

for the financial history… The additional new goal is to make

Bitcoin the global neutral reserve currency,” Hayes explains. He

believes such a strategy could restore US hegemony by transitioning

from the traditional “petrodollar” or “Treasury-based” system to

one anchored in Bitcoin, all while ensuring large swaths of

Bitcoin’s mining operations remain within US borders. In a more

cautionary afterword, Hayes highlights that crypto voters played a

notable role in returning Donald Trump and the Republican Party to

power. Yet he stresses the slow pace of action on crypto issues,

contrasting it with the administration’s rapid implementation of

tariffs and rollbacks of environmental, social, and governance

(ESG) mandates. “When Trump wants to act, he acts… The removal of

ESG and DEI policies… came swiftly… That’s a shame because on the

margin, the crypto single-issue voter put [the Republicans] in

power.” He also reiterates his forecast that Bitcoin could see a

sharp correction to a range of $70,000 to $75,000 before rallying

higher in the long-term —if there is no immediate, concrete

legislation favoring permissionless innovation or further monetary

stimulus. For now, Hayes urges those “lining up day after day

dressed in a seersucker suit or block heels and a summer dress

hoping to ask the orange genie for a wish” to think carefully:

“Stacking sats is my game, and I hope yours is too. Therefore, if

you find yourself at the genie’s table… please wish for the right

things.” At press time, BTC traded at $98,190. Featured image

created with DALL.E, chart from TradingView.com

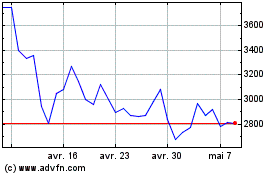

Maker (COIN:MKRUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Maker (COIN:MKRUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025