Ease2pay NV successfully completes a 19.99% capital raise via a

rights offering

Rotterdam, the Netherlands - December 19,

2018, 07h00. Ease2pay N.V. ("Ease2pay" or

the "Company") announces it has successfully

raised additional capital of approximately EUR 2.31 million and it

will issue a total number of 1,539,999 new ordinary shares (the

Rights Offering) at the price of EUR 1.50 per

ordinary share (the Offer Price). The proceeds

from the Rights Offering will be used for i) the Company's working

capital to enable growth of the Company’s services and platform,

ii) to repay EUR 1,471,000 nominal shareholder loans to strengthen

the Company's balance sheet and prevent the related burdensome

accounting treatment of these shareholder loans in the future.

The Rights Offering was completed with an

acceptance rate of 81% of the ordinary shares on offer,

representing a total of 1,246,130 ordinary shares (the

Offer Shares). The ordinary shares from the

unexercised rights (the Rump Shares) were offered

via a private placement to selected qualified investors in Europe

who subscribed for 293,869 Rump Shares at the Offer Price, together

with the Offer Shares raising EUR 2,309,998.50 for Ease2pay. The

Company's outstanding share capital after completion of the Rights

Offering will amount to 9,239,998 shares. Issuance of, payment for

and delivery of the Offer Shares and Rump Shares is expected to

take place on or about 21 December 2018. The Company expects that

the listing and trading on Euronext Amsterdam of the Offer Shares

and Rump Shares will take place on or about 21 December 2018.

Mr. Borghuis, director of the Company,

commented: "We are very grateful for the support and trust from our

existing shareholders and new investors. This rights offering

allows us to move forward with further developing our product

offering and considerably expanding marketing efforts in the

Netherlands."

As a result of the repayment of the subordinated

shareholder loans, Ease2pay has an additional interest charge of

EUR 42,098 with which the shareholder loan is repaid at nominal

value. In December 2018 the last part will be recognized as a

charge in the income statement for Ease2pay, this will result in a

higher debt of EUR 42,098, and a lower equity and result of EUR

42,098 for the full year 2018.

NIBC Bank N.V. acted as a subscription, issuing

and settlement agent in relation to the Offer Shares and as a sole

bookrunner in relation to the Rump Shares.

About Ease2payEase2pay is a

payment and loyalty transaction platform with which you can turn

every smartphone into a cash register and a pin terminal. The app

allows consumers to order, pay and save in one operation without

using cash registers or pin terminals.

Ease2pay B.V., a subsidiary of the Company, is

registered with the Dutch Central Bank (De Nederlandsche Bank)

(DNB) as an exempted electronic money institution

(elektronischgeldinstelling) and as an exempted payment service

provider (betaaldienstverlener). Due to the applicable exemptions,

Ease2pay B.V. is not under the supervision of DNB. Ease2pay B.V. is

accredited for Mandate Service Provider and is a certificate holder

Collecting Payment Service Provider (CPSP) iDEAL.

The information communicated through

this press release constitutes inside information (voorwetenschap)

within the meaning of Article 7 of Regulation (EU) No 596/2014

(market abuse regulation).

For more information, please contact:

Jan Borghuis Director

T: +31 (0)10 3074619

DISCLAIMER

These materials are not for release,

distribution or publication, whether directly or indirectly and

whether in whole or in part, in or into the United States, Canada,

Australia or Japan or any other jurisdiction where to do so would

constitute a violation of the relevant laws of such

jurisdiction.

These materials are for information purposes

only and are not intended to constitute, and should not be

construed as, an offer to sell or a solicitation of any offer to

buy the securities of Ease2pay N.V. (the Company, and such

securities, the Securities) in the United States, Canada, Australia

or Japan or in any other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration,

exemption from registration or qualification under the securities

laws of such jurisdiction.

The Securities have not and will not be

registered under the U.S. Securities Act of 1933, as amended (the

Securities Act) and may not be offered or sold in the United States

absent registration or an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act.

The Company has no intention to register any part of the offering

in the United States or make a public offering of Securities in the

United States.

No communication or information relating to any

offer or sale of the Securities of the Company may be disseminated

to the public in jurisdictions, other than The Netherlands, where

prior registration or approval is required for that purpose. No

action has been taken that would permit an offer of the Securities

of the Company in any jurisdiction where action for that purpose is

required, other than in The Netherlands.

The Company has not authorised any offer to the

public of the Securities in any Member State of the European

Economic Area (other than the Netherlands). With respect to any

Member State of the European Economic Area (other than the

Netherlands), and which has implemented the Prospectus Directive

(each a Relevant Member State), no action has been undertaken or

will be undertaken to make an offer to the public of Securities

requiring publication of a prospectus in any Relevant Member State.

As a result, the Securities may only be offered in Relevant Member

States to any legal entity which is a qualified investor as defined

in the Prospectus Directive. For the purpose of this paragraph, the

expression "offer of securities to the public" means the

communication in any form and by any means of sufficient

information on the terms of the offer and the Securities to be

offered so as to enable the investor to decide to exercise,

purchase or subscribe for the Securities, as the same may be varied

in that Member State by any measure implementing the Prospectus

Directive in that Member State and the expression "Prospectus

Directive" means Directive 2003/71/EC (and amendments thereto,

including Directive 2010/73/EU, to the extent implemented in the

Relevant Member State), and includes any relevant implementing

measure in the Relevant Member State.

No action has been taken by the Company that

would permit an offer of Securities or the possession or

distribution of these materials or any other offering or publicity

material relating to such Securities in any jurisdiction where

action for that purpose is required.

The release, publication or distribution of

these materials in certain jurisdictions may be restricted by law

and therefore persons in such jurisdictions into which they are

released, published or distributed, should inform themselves about,

and observe, such restrictions.

This announcement does not constitute a

prospectus.

- Press Release Rump Offering Ease2pay

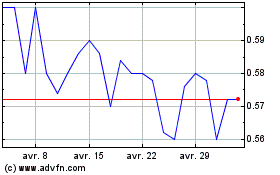

Docdata Nv (EU:EAS2P)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Docdata Nv (EU:EAS2P)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025