Pound Rises As BoE Holds Key Rate As Expected

19 Septembre 2024 - 10:02AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Thursday, after the Bank of England decided

to maintain its benchmark rate, after a quarter-point cut last

month and also extended its bond reduction plan for another one

year.

The Monetary Policy Committee headed by Andrew Bailey voted by a

majority of 8-1 to hold the Bank Rate at 5.00 percent.

At the August meeting, the MPC had voted in a tight 5-4 vote to

cut the rate by a quarter point from a 16-year high of 5.25

percent.

Bank staff forecast the UK economy to grow 0.3 percent in the

third quarter, which was weaker than the 0.4 percent estimated in

August.

Inflation is expected to increase to around 2.5 percent towards

the end of this year as declines in energy prices last year fell

out of the annual comparison.

European shares traded higher after the U.S. Federal Reserve

slashed its key rate by 50 basis points and signaled further

easing, raising hopes of a soft landing for the world's largest

economy.

In the European trading now, the pound rose to a 2-1/2 year high

of 1.3314 against the U.S. dollar, from an early 2-day low of

1.3154. The GBP/USD pair may test resistance around the 1.35

region.

Against the euro, the Swiss franc and the yen, the pound

advanced to nearly a 2-month high of 0.8392, nearly a 3-week high

of 1.1261 and more than a 2-week high of 190.38 from early lows of

0.8424, 1.1185 and 188.18, respectively. If the pound extends its

uptrend, it is likely to find resistance around 0.81 against the

euro, 1.16 against the franc and 196.00 against the yen.

Looking ahead, U.S. weekly jobless claims, current account for

the second quarter, U.S. Philadelphia Fed manufacturing index for

September, existing home sales for August and U.S. leading index

for August are slated for release in the New York session.

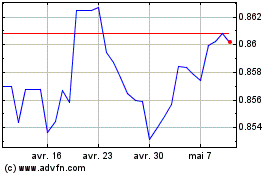

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

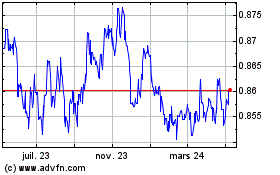

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025