TIDMETX

RNS Number : 3275R

e-Therapeutics plc

26 October 2023

e-therapeutics plc

("e-therapeutics" or "ETX" or the "Company")

Interim results for the six months to 31 July 2023

Six months of progress with positive proof-of-concept data

generated with lead GalOmic (TM) RNAi assets in cardiometabolic

disease and haemophilia

Continued integration of generative artificial intelligence into

HepNet (TM)

London, UK, 26 October 2023 - e-therapeutics plc (AIM: ETX;

OTCQX; ETXPF), a company integrating computational power and

biological data to discover life-transforming RNAi medicines,

announces its unaudited interim results for the six months to 31

July 2023.

Operational Highlights

á Continued growth and rapid advancement of GalOmic (TM) RNAi

therapeutics against target genes discovered using our HepNet (TM)

computational platform, including preclinical programs in

cardiometabolic and metabolic disease, haemophilia, and two further

undisclosed programs.

á Generated positive proof-of-concept data for ETX-291 in

cardiometabolic disease and ETX-148 in haemophilia, demonstrating

disease-modifying potential of HepNet (TM) identified targets.

á Increased pool of novel targets identified and assessed in

silico by HepNet (TM) , ensuring a continual supply of in-house

preclinical programs and a variety of partnering opportunities

spanning a broad range of therapeutic areas.

á C ontinued validation of HepNet (TM) , including our

hepatocyte-specific knowledge graph, proprietary target

identification approaches, and siRNA (short interfering RNA)

construct design capabilities.

á Advanced projects developing and implementing generative

artificial intelligence ("AI") including large language models

("LLMs") across ETX processes and systems, further enhancing

computational capabilities, and transforming HepNet (TM) into a

dynamic knowledge resource.

á Continued expansion of AI approaches, enabling the

transformation of siRNA construct design and selection to reduce

timelines and associated costs dramatically.

á Sustained intellectual property ("IP") activity continued,

with priority forming patent applications filed on three new

inventions, and consolidated international filing programs for

eight inventions, all arising from the Company's proprietary

GalNAc-siRNA technology, GalOmic (TM) .

á Strong progress made in immuno-oncology collaboration with

iTeos Therapeutics, Inc. ("iTeos"), with continued delivery against

pre-agreed milestones.

Post Period Highlights

á Effective 20 September 2023, Timothy Bretherton assumed the

role of Chief Financial Officer (non-board). Michael Bretherton

stepped down from his role as interim CFO and will now focus on his

role as a Non-Executive Director of the Company.

Financial Highlights

á Revenue of GBP0.2 million (H1 2022: GBP0.3 million)

á R&D spend of GBP5.3 million (H1 2022: GBP3.1 million)

á Operating loss for the period of GBP7.0 million (H1 2022 loss: GBP4.6 million)

á Loss after tax for the period of GBP5.6 million (H1 2022 loss: GBP3.8 million)

á Cash and cash equivalents as at 31 July 2023 of GBP24.8

million (31 January 2023: GBP31.7 million)

á R&D tax credit receivable as at 31 July 2023 of GBP2.5

million (31 January 2023: GBP1.5 million)

á Headcount (excluding Non-Executive Directors) as at 31 July

2023 of 34 (31 January 2023: 38)

Ali Mortazavi, Chief Executive Officer of e-therapeutics,

commented:

"Despite a severe macroeconomic climate, we have made

significant progress during the past six months. It is a tribute to

our team that we have been able to translate our computational

analyses into tangible assets, generating compelling preclinical

data at a fraction of the R&D spend of any competitor. We look

forward to showcasing additional data from our preclinical pipeline

in the near future.

"It has only been six months since we began incorporating

generative AI into our processes and projects, but the significant

impact of these technologies throughout ETX is already apparent.

Through this work, we continue to address directly the long,

expensive, and risky product lifecycle of drug discovery,

solidifying ourselves as one of the leading companies in the

emerging TechBio sector. A year ago, generative AI technologies did

not exist. Now, we are integrating them into every aspect of our

drug development process, allowing us to develop our

life-transforming RNAi medicines at pace. As we continue to

leverage the most cutting-edge computation, I look forward to the

future with confidence."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

e-therapeutics plc

Ali Mortazavi, CEO Tel: +44 (0)1993 883

Timothy Bretherton, CFO 125

www.etherapeutics.co.uk

------------------------------------------------ -------------------------

SP Angel Corporate Finance LLP Tel: +44(0)20 3470

0470

Nominated Adviser and Broker

Matthew Johnson/Harry Davies-Ball (Corporate

Finance)

Vadim Alexandre/Rob Rees (Corporate Broking)

------------------------------------------------ -------------------------

About e-therapeutics plc

e-therapeutics plc ("ETX") integrates computational power and

biology information to discover life-transforming RNAi medicines.

The Company's technology uses computation to capture and model

human biology, identify novel targets, and develop RNAi medicines

against those targets that can be rapidly progressed to the

clinic.

ETX's proprietary HepNet (TM) platform enables the generation

and analysis of biological network models, providing a novel and

mechanistic approach to drug discovery. This approach explicitly

considers the true complexity of biology to make more reliable

predictions from large complex data sets and ETX's proprietary

hepatocyte knowledgebase - the world's most comprehensive and

integrated hepatocyte-centric data resource. The Company generates,

prioritises, and tests millions of hypotheses in silico to identify

better therapeutic targets with higher confidence.

GalOmic (TM) , ETX's proprietary RNAi platform, enables targeted

delivery to hepatocytes in the liver and the specific silencing of

novel disease-associated genes, identified by HepNet (TM) . The

focus on hepatocytes offers the opportunity to tackle a wide

variety of diseases. The liver is a highly metabolically active

organ which performs a key role in many biological processes and

vital functions crucial for human health. ETX's GalOmic (TM)

constructs have demonstrated compelling in vivo performance in

terms of depth of gene silencing and duration of action.

The Company is progressing a pipeline of first-in-class RNAi

candidates across a variety of therapeutic areas with high unmet

need, including preclinical programs in cardiometabolic and

metabolic diseases, haemophilia, and other undisclosed indications

. ETX has also partnered with biopharma companies such as Novo

Nordisk, Galapagos NV and iTeos Therapeutics using its

computational network biology approach across a diverse range of

drug discovery projects.

The Company is based in London, UK and listed on the Alternative

Investment Market of the London Stock Exchange ("AIM"), with ticker

symbol ETX. e-therapeutics is also traded on the OTCQX Best Market

(OTCQX) in the United States, under ticker symbol ETXPF.

Chief Executive's Statement

During the past six months, we have concluded the successful

transition into a proven RNAi biotech company. Our lead assets in

cardiometabolic disease and haemophilia have progressed to

preclinical proof-of-concept experiments, validating our HepNet

(TM) computational platform, our GalOmic (TM) chemistry platform,

and delivering proof in support of our goal of Computing the Future

of Medicine (TM) .

While we continue to build our in-house pipeline of assets, we

are progressing HepNet (TM) into the central nexus within

e-therapeutics. By leveraging generative artificial intelligence

("AI") and large language model ("LLM") advances, we have built on

the validated technology and data resources in HepNet-- and are

beginning to unlock next-level predictive power in a truly seamless

system. This transformation will continue to deliver novel

therapeutics at an unprecedented scale, increasing the pace of

target identification and dramatically reducing the time and cost

of developing life-transforming medicines.

GalOmic (TM) RNAi Platform and Continued Execution of

Therapeutic Pipeline

We continue to progress our therapeutic pipeline, with five

assets currently in preclinical studies across a range of

therapeutic areas, including cardiometabolic disease and

haemophilia. During the past six months, we have generated positive

proof-of-concept data for ETX-291 in cardiometabolic disease and

ETX-148 in haemophilia, underscoring the robustness of the GalOmic

(TM) platform and validating HepNet (TM) 's ability to identify

novel genes with therapeutic potential. These proof-of-concept data

are underpinned by the silencing profile of our siRNA platform.

GalOmic (TM) constructs have demonstrated potent and durable

knockdown of target mRNA expression of therapeutically relevant

targets in vivo, supporting infrequent dosing.

ETX-291 for the Treatment of Cardiometabolic Disease

Cardiometabolic diseases are a leading cause of death and

encompass multiple conditions including obesity, cardiovascular

disease, and Type 2 diabetes. ETX-291 targets a gene with human

genetic evidence of disease-modifying benefit. In preclinical

studies in a representative disease model, ETX-291 impacts multiple

cardiometabolic disease drivers resulting in a pleiotropic benefit

and highlighting its potential to treat a broad range of

cardiometabolic indications.

ETX-148 for the Treatment of Haemophilia

ETX-148 is our preclinical pan-haemophilia asset. We have

generated data that suggests it is safe, effective, and able to

address a key remaining unmet need in haemophilia: protection from

joint bleeds. Histological data from a preclinical joint bleed

model suggests ETX-148 can protect against bleed-induced joint

damage. Importantly, this protection is achieved without an

increased risk of thrombosis, which has been characterised in a

variety of safety experiments.

ETX-291 and ETX-148 are due to complete preclinical

proof-of-concept studies by the end of the year and we are looking

forward to presenting further details of our preclinical data

packages in the near future. Additionally, we continue to add to

our pool of novel targets, ensuring our early pipeline is populated

and generating additional partnering opportunities.

Non-dilutive funding opportunities via collaborations and

partnerships remain a key component of the Company's strategy.

Successfully demonstrating preclinical proof-of-concept for our

first RNAi assets is fuelling partnering and out-licensing

conversations both for individual assets and platform access,

striking a balance between preclinical assets to partner and assets

that we will progress to early clinical trials to reach a more

significant value inflection point.

HepNet-- and Integration of Large Language Models

We continue to strengthen, innovate, and validate HepNet (TM) ,

the most comprehensive hepatocyte data and analytics resource in

the world. This has included the generation of positive

proof-of-concept data for our in-house GalOmic (TM) pipeline

programs, validating HepNet (TM)' s ability to reliably identify

novel gene targets and design potent siRNA constructs. Furthermore,

we have continued to expand our knowledgebase, initiating

partnerships that will provide access to proprietary data assets

that will support disease-related process and target discovery.

We are fully embracing generative AI and LLMs by creating

specialised LLM "agents" and transforming HepNet (TM) into a

dynamic knowledge resource. Over the past six months, this

ambitious agenda has driven design and development of

infrastructure and model development and refinement. Over the

coming months it will deliver a unifying framework driving every

aspect of our pipeline, solidifying e-therapeutics' position as a

global leader in AI-driven drug development.

Our projects include our "Straight to In Vivo" efforts, which

will allow us to bypass in vitro screening and move straight to in

vivo models. This will dramatically reduce timelines and costs

associated with identifying optimal siRNA constructs to silence any

hepatocyte-expressed target gene. We ultimately aim to create a

robust pipeline and business model leveraging the full potential of

Generative AI and LLM to continue breaking new ground in drug

discovery, creating novel therapeutics, and improving patient

outcomes.

Intellectual Property

The Company continues to execute its very active IP strategy

that is indicative of both the high volume of novel innovations

being generated and the critical importance ETX attributes to

protecting its inventions. The patent applications filed over the

period 31 January 2023 to 31 July 2023 cover eleven inventions

arising from the Company's innovation around novel target ideas,

novel siRNA therapeutics, and novel siRNA chemistries.

Partnerships and Collaborations

We continue to deliver on our collaboration with iTeos

Therapeutics, leveraging our unique computational methodology to

enable the discovery of highly differentiated novel immuno-oncology

therapeutics. The work is progressing well against pre-defined

plans and milestones, successfully passing decision gates. As well

as receiving near-term cash payments material to the revenue of the

Company, we are eligible to receive undisclosed milestone payments

through preclinical and clinical development, in addition to

regulatory milestones, per programme.

Organisation

ETX continues to invest in and attract leading industry talent,

adding to an existing world class multi-disciplinary team of

experts in computational biology and RNAi therapeutics. This is

exemplified by our recent hires in the USA, driven by our desire to

hire the best talent and resulting in a lean presence on the East

Coast, a major biotech hub.

The team has worked hard to deliver the progress highlighted in

this statement and I should like to thank them for their continued

commitment and dedication in helping ETX to deliver on its strategy

and key objectives.

At a Board level, there is an open position for an additional

independent NED to broaden the Board experience further and adhere

to best practice corporate governance guidelines.

Post Period

On 20 September 2023, ETX announced that Michael Bretherton had

stepped down from his role as interim CFO and will now focus on his

role as a Non-Executive Director of the Company. Timothy

Bretherton, Director of Finance and Operations, assumed the CFO

role (non-board) with immediate effect.

Outlook

Despite a severe macroeconomic climate, we have made significant

progress during the past six months. It is a tribute to our team

that we have been able to translate our computational analyses into

tangible assets, generating compelling preclinical data at a

fraction of the R&D spend of any competitor. We look forward to

showcasing additional data from our preclinical pipeline in the

near future.

It has only been six months since we began incorporating

generative AI into our processes and projects, but the significant

impact of these technologies throughout ETX is already apparent.

Through this work, we continue to address directly the long,

expensive, and risky product lifecycle of drug discovery,

solidifying ourselves as one of the leading companies in the

emerging TechBio sector. A year ago, generative AI technologies did

not exist. Now, we are integrating them into every aspect of our

drug development process, allowing us to develop our

life-transforming RNAi medicines at pace. As we continue to

leverage the most cutting-edge computation, I look forward to the

future with confidence.

Ali Mortazavi

Chief Executive Officer

Financial Review

Period end cash of GBP24.8m and operating loss of GBP7.0m in H1,

FY2024.

The Company continues to manage the underlying cash burn

carefully whilst focusing on the development of ETX engineered

large language models ("LLMs") to enhance and expand our

computational capabilities leading to development of multiple

preclinical assets across a variety of therapeutic areas with unmet

medical needs.

Revenue

The Company reached another milestone with iTeos in May this

year, resulting in the recognition of GBP0.2 million of revenue (H1

2022: GBP0.3 million including remaining Galapagos milestone). This

collaboration is focusing on the discovery of novel therapeutic

approaches and targets in immuno-oncology. The last phase of this

project is underway and is expected to be completed during Q1 of

FY2025.

Research and Development

R&D expenditure in H1 2023 increased to GBP5.3 million (H1

2022: GBP3.1 million). This mainly reflects an increase in

outsourced CRO costs to progress the execution of preclinical

targets, together with additional cost in relation to our

computational and RNAi platforms and associated patent

applications. Through increased expenditure, we have made

compelling advancements in our goal of Computing the Future of

Medicine (TM) .

During H2, we are expecting a further increase in R&D costs

as we continue to focus on the development of our LLMs, alongside

progressing the execution of preclinical targets and growing our

in-house pipelines across a variety of therapeutic areas.

General and Administrative Expenses

General and administrative expenses have remained broadly

in-line with the prior half year and amounted to GBP1.8 million (H1

2022: GBP1.7 million). We continue to monitor and control these

costs closely to ensure maximum cash availability for R&D

expenditure to help us accomplish our mission to discover

life-transforming RNAi medicines.

R&D tax credits and loss for the half year

The income statement includes an R&D tax credit of GBP1.0

million (H1 2022: GBP0.7 million) in relation to the current year,

bringing down the loss after tax for the half year to GBP5.6

million (H1 2022: GBP3.8 million). The increase in tax credit from

the prior half year reflects the increase in qualifying R&D

spend in the period.

Cash flow

Cash as at 31 July 2023 stood at GBP24.8 million, which is

GBP6.8 million lower than the start of the year. The reduction

reflects an operating cash outflow of GBP6.6 million, net of

non-cash share-based employee option charges, depreciation and

amortisation, coupled with working capital outflows of GBP0.2

million, property lease liability payments of GBP0.2 million and

purchase additions of GBP0.1 million to fixed and intangible

assets, partially offset by interest income receipts of GBP0.3

million. Cash balances are expected to benefit by a cash receipt of

GBP1.5 million in the last quarter of the current financial year in

respect of the R&D tax credit relating to FY2023.

Financial Outlook

Our current expectations for the underlying cash burn in the

second half of the financial year will be higher than that incurred

in H1 2023. This is due to our planned increase in R&D spend to

continue the expansion of our AI capabilities and progress the

identification and execution of preclinical targets, together with

sustaining our active IP strategy as novel inventions are

generated.

INCOME STATEMENT FOR THE PERIODED 31 JULY 2023

---------------------------------------------------------------------------------------------------

6 months

6 months ended ended 31 Year ended

31 July 2023 July 2022 31 January

2023

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 160 295 475

Cost of sales - - -

-------------------------------------- ---------------- -------------------- -------------------

Gross profit 160 295 475

Research and development expenditure (5,324) (3,123) (7,224)

Administrative expenses (1,806) (1,727) (3,490)

-------------------------------------- ---------------- -------------------- -------------------

Operating loss (6,970) (4,555) (10,239)

Interest income 343 46 490

Interest expense (4) (12) (23)

-------------------------------------- ---------------- -------------------- -------------------

Loss before tax (6,631) (4,521) (9,772)

Taxation 1,037 709 1,498

-------------------------------------- ---------------- -------------------- -------------------

Loss for the period/year attributable

to equity holders of the Company (5,594) (3,812) (8,274)

-------------------------------------- ---------------- -------------------- -------------------

Loss per share: basic and diluted (0.97)p (0.74)p (1.54)p

-------------------------------------- ---------------- -------------------- -------------------

STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHSED 31 JULY

2023

-----------------------------------------------------------------------------------

Year ended

6 months ended 6 months ended 31 January

31 July 2023 31 July 2022 2023

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Loss for the period (5,594) (3,812) (8,274)

Other comprehensive income - - -

--------------------------------- ---------------- ---------------- ------------

Total comprehensive income for

the period/year attributable to

equity

holders of the Company (5,594) (3,812) (8,274)

--------------------------------- ---------------- ---------------- ------------

STATEMENT OF CHANGES IN EQUITY FOR THE PERIODED 31 JULY

2023

----------------------------------------------------------------------------------------------

Share capital Share Retained

premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

As at 1 February 2022 515 99,243 (72,032) 27,726

Total comprehensive income for

the period

Loss for the period - - (3,812) (3,812)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period - - (3,812) (3,812)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares - 8 - 8

Equity-settled share-based payment

transactions - - 196 196

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners - 8 196 204

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 July 2022 515 99,251 (75,648) 24,118

Total comprehensive income for

the period

Loss for the period - - (4,462) (4,462)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period (4,462) (4,462)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares 67 13,362 - 13,429

Equity-settled share-based payment

transactions - - (41) (41)

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners 67 13,362 (41) 13,388

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 January 2023 582 112,613 (80,151) 33,044

Total comprehensive income for

the period

Loss for the period - - (5,594) (5,594)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period - - (5,594) (5,594)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares 1 21 - 22

Equity-settled share-based payment

transactions - - 59 59

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners 1 21 59 81

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 July 2023 583 112,634 (85,686) 27,531

---------------------------------------- ---------------- ------------- ---------- -------

STATEMENT OF FINANCIAL POSITION AS AT 31 JULY 2023

-------------------------------------------------------------------------------------

31 July 31 July 31 January

2023 2022 2023

Note (un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 301 182 239

Property, plant and equipment 175 617 400

------------------------------ --- ------------------- ------------- ------------

476 799 639

------------------------------ --- ------------------- ------------- ------------

Current assets

Tax receivable 2,537 2,184 1,500

Trade and other receivables 302 192 259

Prepayments 647 563 553

Cash and cash equivalents 24,845 21,561 31,689

28,331 24,500 34,001

------------------------------ --- ------------------- ------------- ------------

Total assets 28,807 25,299 34,640

------------------------------ --- ------------------- ------------- ------------

Current liabilities

Trade and other payables 1,186 687 1,301

Lease Liability 90 405 295

Contract liabilities - - -

------------------------------ --- ------------------- ------------- ------------

1,276 1,092 1,596

------------------------------ --- ------------------- ------------- ------------

Non-current liabilities

Lease Liability - 89 -

------------------------------ --- ------------------- ------------- ------------

Total liabilities 1,276 1,181 1,596

------------------------------ --- ------------------- ------------- ------------

Net assets 27,531 24,118 33,044

------------------------------ --- ------------------- ------------- ------------

Equity

Share capital 2 583 515 582

Share premium 112,634 99,251 112,613

Retained earnings (85,686) (75,648) (80,151)

------------------------------ --- ------------------- ------------- ------------

Total equity attributable to

equity

holders of the Company 27,531 24,118 33,044

------------------------------ --- ------------------- ------------- ------------

CASH FLOW STATEMENT FOR THE PERIOD ENDED 31 JULY 2023

6 months ended 6 months ended Year ended

31 July 31 July 31 January

2023 2022 2023

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Loss for the period/year (5,594) (3,812) (8,274)

Adjustments for:

Depreciation, amortisation and impairment 271 242 468

Loss on disposal of fixed assets - - 10

Interest income (343) (46) (490)

Interest expense 4 12 23

Equity-settled share-based payment

expenses 59 196 155

Taxation (1,037) (709) (1,522)

-------------------------------------------- ------------ ---------------- ------------

Operating cash flows before movements

in working capital (6,640) (4,117) (9,630)

(Increase)/Decrease in trade and

other receivables (137) (19) (75)

Increase/(Decrease) in trade and

other payables (110) (608) 198

Tax received - - 1,496

-------------------------------------------- ------------ ---------------- ------------

Net cash from operating activities (6,887) (4,744) (8,011)

-------------------------------------------- ------------ ---------------- ------------

Interest received 343 46 490

Interest paid (4) (12) (23)

Acquisition of property, plant and

equipment (5) (51) (68)

Acquisition of other intangible

assets (103) (83) (142)

Movement in short term investments - 15,051 15,051

-------------------------------------------- ------------ ---------------- ------------

Net cash from investing activities 231 14,951 15,308

-------------------------------------------- ------------ ---------------- ------------

Net proceeds from issue of share

capital 22 8 13,437

Payments under lease liabilities - - -

Repayment of lease liability (210) - (391)

-------------------------------------------- ------------ ---------------- ------------

Net cash from financing activities (188) 8 13,046

-------------------------------------------- ------------ ---------------- ------------

Net decrease in cash and cash equivalents (6,844) 10,215 20,343

Cash and cash equivalents at the

beginning of the period/year 31,689 11,346 11,346

-------------------------------------------- ------------ ---------------- ------------

Cash and cash equivalents at the

end of the period/year 24,845 21,561 31,689

-------------------------------------------- ------------ ---------------- ------------

Notes

1. Basis of Preparation

These unaudited interim financial statements do not comprise

statutory accounts as defined within section 434 of the Companies

Act 2006. The Company is a public limited company; it is listed on

the London Stock Exchange's AIM market and is incorporated and

domiciled in the United Kingdom. The address of its registered

office is 4 Kingdom Street, Paddington, London, W2 6BD, UK.

Statutory accounts for the year ended 31 January 2023 were

approved by the Board of Directors on 4 May 2023 and delivered to

the Registrar of Companies. The report of the Auditor on the

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006.

While this interim statement, which is neither audited nor

reviewed, has been prepared in accordance with the recognition and

measurement criteria of international accounting standards in

conformity with the requirements of the Companies Act 2006 this

announcement does not in itself contain sufficient information to

comply with IFRS. It does not include all the information required

for the full annual financial statements and should be read in

conjunction with the financial statements as at, and for the year

ended, 31 January 2023. It does not comply with International

Accounting Standard ("IAS") 34 'Interim Financial Reporting' as is

permissible under the rules of AIM.

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 January 2023 (as defined therein) other than standards,

amendments and interpretations which became effective after

1 February 2023.

New standards, amendments and interpretations not adopted in the

current financial year have not been disclosed as they are not

expected to have a material impact on the Company's financial

statements.

2. Share Capital

31 July 2023 31 July 2022 31 January

2023

(unaudited) (un audited) (audited)

------------------ ----------------------- ---------------------

In issue - fully paid

Ordinary shares of GBP0.001

each (number) 582,694,162 514,614,982 582,159,332

-------------------------------- ------------------ ----------------------- ---------------------

Allotted, called up and fully

paid

Ordinary shares of GBP0.001

each (GBP'000) 583 515 582

-------------------------------- ------------------ ----------------------- ---------------------

During the six-month period to 31 July 2023, 500,000 new

ordinary shares of 0.1p each were issued following the exercise of

share options at a price of 2.8p per share by a former employee and

34,830 new ordinary shares of 0.1p each were issued at a price of

21.71p each in lieu of fees payable to a non-executive director in

accordance with his service agreement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGRUUUPWPWA

(END) Dow Jones Newswires

October 26, 2023 02:38 ET (06:38 GMT)

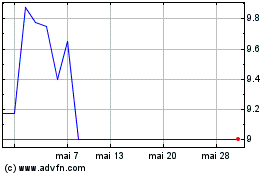

E-therapeutics (LSE:ETX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

E-therapeutics (LSE:ETX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024