Experian: Financial Strain Leads to Breakups for More Than a Quarter of Americans

10 Février 2025 - 12:00PM

Business Wire

Cupid’s arrow points to transparency and

communication as key to avoiding financial heartbreak, according to

new Experian research

As Valentine’s Day approaches, new research1 released today from

Experian® uncovers the critical role of financial transparency and

communication in sustaining romantic relationships. According to

the research, 27% of Americans have had relationships end due to

their own or their partner’s financial issues.

In addition, 1 in 4 U.S. adults have either been on the giving

or receiving end of an ultimatum that finances had to be improved

for the relationship to progress, and 34% of U.S. adults admit

they’ve hidden a purchase from their partner.

“Transparency and open and honest conversations about finances

are crucial for building trust, ensuring a healthy relationship,

and achieving financial goals as a couple," said Christina Roman,

Consumer Education and Advocacy Manager for Experian. “We’re

committed to being a resource for couples or individuals looking to

improve their financial health. By discussing financial goals and

setting clear boundaries, couples can avoid misunderstandings and

work toward a secure financial future together.”

Whether you’re newly matched or in a long-term relationship,

here are three ways to protect your financial health in

relationships, according to Experian:

- Communication is key: Money isn’t meant to be a taboo

topic in relationships. In fact, nearly 80% say they discuss

financial goals with their partner. Make money part of your regular

conversations with your partner.

- Set a budget: More than 3 in 4 (76%) say it’s important

their partner talks to them prior to making any major purchasing

decision and 54% have a monetary threshold at which they need to

consult their partner prior to making a purchase. This is $500 or

more for 33% of couples, and over half (61%) spend $100 or less on

partner gifts for special occasions like birthdays or

anniversaries. Create a budget, revisit it regularly, and determine

a spending style that works for you and your partner.

- Create savings goals together: Saving money is top of

mind for most and this is true in romantic relationships, with 93%

claiming it’s important for them to save money as a couple. Opt for

date nights at home or find other low-cost ways to spend time

together. Experian can also help consumers save money by canceling

unwanted subscriptions, negotiating your bills for lower rates, and

more.2

For additional money-saving tips from Experian and personal

finance experts, join Experian’s upcoming #CreditChat “Breaking Up

with Bad Spending Habits: A Financial Detox Plan” on Feb. 12 at 3

p.m. EST on X or Threads.

Consumers can manage their credit and find other tools to

improve their financial health by downloading Experian’s free

mobile app or visiting www.experian.com.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

______________________ 1 Experian commissioned Atomik Research

to conduct an online survey of 2,004 adults throughout the United

States. The margin of error is +/-2 percentage points with a

confidence level of 95 percent. Fieldwork took place between Jan. 3

and Jan. 6, 2025. 2 Subscription Cancellation and Bill Negotiation

are available with eligible paid memberships and requires

connecting payment account(s) to Experian account. Results will

vary. Not all bills or subscriptions are eligible for

negotiation/cancellation. Savings are not guaranteed, and some may

not see any savings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210947714/en/

Amanda Garofalo Experian Public Relations 1 714 460 3739

amanda.garofalo@experian.com

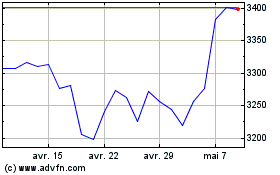

Experian (LSE:EXPN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Experian (LSE:EXPN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025