UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under § 240.14a-12 |

AINOS,

INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee

paid previously with preliminary materials: |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-(6)(i)(4) and 0-11. |

Ainos,

Inc.

8880

Rio San Diego Drive, Ste.800,

San

Diego, CA

(858)

869-2986

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

be Held on September 27, 2024

To

the Stockholders of Ainos, Inc.:

NOTICE

IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Ainos, Inc., a Texas corporation (the

“Company”), will be held on September 27, 2024 at 5:30 p.m. Taiwan Standard Time at 10F-2, No. 66, Shengyi 5th

Rd., Zhubei City, Hsinchu County 302, Taiwan (R.O.C.). The meeting will be held for the following purposes:

The

principal business of the meeting will be:

| 1. | To

ratify the appointment of KCCW Accountancy Corp. as our independent registered public accounting

firm for the fiscal year ending December 31, 2024; |

| 2. | To

approve the reservation of up to two (2) million shares of common stock as special stock

awards, which are not issued under the Ainos, Inc. 2023 Stock Incentive Plan, in accordance

with Nasdaq Listing Rule 5635(c). |

| 3. | To

transact such other business as may be properly brought before the Annual Meeting and any

adjournments thereof. |

You

may vote if you were the record owner of shares of the Company’s Common Stock, at the close of business on August 5, 2024.

The Board of Directors of the Company has fixed the close of business on August 5, 2024 as the record date (the “Record

Date”) for the determination of Stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof.

As

of the Record Date, there were 8,045,406 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. The holders

of our Common Stock are entitled to one vote for each share of Common Stock held. The foregoing shares are referred to herein as the

“Shares.” Holders of our Common Stock will vote together as a single class on all matters described in this proxy statement

(the “Proxy Statement”).

All

Stockholders are cordially invited to attend the Annual Meeting. Stockholders who plan to attend the Annual Meeting in person must notify

the Company at least 24 hours prior to the Annual Meeting by contacting the Company’s Investor Relations department at IR@ainos.com.

Whether you plan to attend the Annual Meeting or not, you are requested to vote over the Internet, by telephone, or to complete,

sign, date and return the enclosed proxy card promptly in accordance with the instructions set forth on the proxy card. A pre-addressed,

postage prepaid return envelope is enclosed for your convenience. Voting by using the aforementioned methods will not prevent you from

voting at the annual meeting.

YOUR

VOTE AT THE ANNUAL MEETING IS IMPORTANT

Your

vote is important. Please vote as promptly as possible even if you plan to attend the Annual Meeting.

For

information on how to vote your Shares, please see the instruction from your broker or other fiduciary, as applicable, as well as “How

Do I Vote?” in the Proxy Statement accompanying this notice.

We

encourage you to vote over the Internet, by telephone, or by completing, signing, and dating the proxy card, and returning it in the

enclosed envelope.

If

you have questions about voting your Shares, please contact the Investor Relations department at Ainos, Inc., at email: IR@ainos.com.

If

you decide to change your vote, you may revoke your proxy in the manner described in the attached Proxy Statement at any time before

it is voted.

We

urge you to review the accompanying materials carefully and to vote as promptly as possible. Note that we have enclosed with this notice

a proxy statement.

THE

PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT:

www.ainos.com

By

Order of the Board of Directors of Ainos, Inc.

| Sincerely, |

|

| |

|

| /s/

Chun-Hsien Tsai |

|

| Chun-Hsien

Tsai, Chief Executive Officer |

|

Date:

August 15, 2024

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 27, 2024

The

Notice of 2024 Annual Meeting of Stockholders, Proxy Statement and 2023 Annual Report to Stockholders are available at www.proxyvote.com.

Your

vote is important. We encourage you to review all of the important information contained in the proxy materials before voting.

REFERENCES

TO ADDITIONAL INFORMATION

This

Proxy Statement incorporates important business and financial information about Ainos, Inc. that is not included in or delivered with

this document. You may obtain this information without charge through the Securities and Exchange Commission (“SEC”) website

(www.sec.gov) or upon your written request by contacting the Investor Relations department of Ainos, Inc., at email: IR@ainos.com.

To

ensure timely delivery of these documents, any request should be made no later than September 13, 2024 to receive them before

the Annual Meeting.

For

additional details about where you can find information about Ainos, Inc., please see the section entitled “Where You Can Find

More Information about the Company” in this Proxy Statement.

Ainos,

Inc.

8880

Rio San Diego Drive, Ste.800,

San

Diego, CA

(858)

869-2986

2024

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON September 27, 2024

GENERAL

INFORMATION ABOUT THE ANNUAL MEETING

This

Proxy Statement, along with the accompanying notice of the 2024 Annual Meeting of Stockholders, contains information about the 2024 Annual

Meeting of Stockholders of Ainos, Inc., including any adjournments or postponements thereof (referred to herein as the “Annual

Meeting”). We are holding the Annual Meeting at 5:30 p.m. Taiwan Standard Time on September 27, 2024 or such later date

or dates as such Annual Meeting date may be adjourned or postponed at 10F-2, No. 66, Shengyi 5th Rd., Zhubei City, Hsinchu County

302, Taiwan (R.O.C.).

In

this Proxy Statement, we refer to Ainos, Inc. as “Ainos,” the “Company,” “we,” “us,”

or “our.”

Why

Did You Send Me This Proxy Statement?

We

sent you this Proxy Statement in connection with the solicitation by the board of directors of the Company (referred to herein as the

“Board of Directors” or the “Board”) of proxies, in the accompanying form, to be used at the Annual Meeting to

be held at 5:30 p.m. Taiwan Standard Time on September 27, 2024 and any adjournments thereof. This Proxy Statement along with

the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the Annual Meeting and the information you need

to know to vote at the Annual Meeting.

This

Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), which includes

our financial statements for the fiscal year ended December 31, 2023, are being mailed on or about August 20, 2024 to all Stockholders

entitled to notice of and to vote at the meeting. You can also find a copy of this Proxy Statement and the Annual Report on the Internet

through the Securities and Exchange Commission’s website at www.sec.gov or at our website at www.ainos.com. Information

on our website is not, and will not be deemed, a part of this Proxy Statement or incorporated into any other filings the Company makes

with the SEC.

Who

may attend and how to attend

Our

Board has fixed the close of business on August 5, 2024 as the record date for a determination of stockholders entitled to notice

of, and to vote at, the Annual Meeting or any adjournment or postponement thereof (the “Record Date”). Each share of Common

Stock represents one vote to be voted on each matter presented at the Annual Meeting. Record holders and beneficial owners may attend

the Annual Meeting.

Beneficial

Owners

| |

● |

If

you were a beneficial owner of record as of the Record Date (i.e., you held your Shares in an account at a brokerage firm, bank or

other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal

proxy from your broker, bank or other agent, it should be emailed to the Company and should be labeled “Legal Proxy”

in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from

your broker, bank or other agent with your legal proxy attached, or an image of your valid proxy attached to your email). Requests

for registration must be received by the Company no later than 11:59 p.m. Eastern Time on September 13, 2024. You will

then receive a confirmation of your registration, with a control number, by email. When you arrive at the meeting,

present your unique 12-digit control number. |

Who

Can Vote?

Stockholders

who owned Common Stock at the close of business on August 5, 2024 (the “Record Date”), are entitled to vote at

the Annual Meeting. As of the Record Date, there were 8,045,406 shares of Common Stock outstanding and entitled to vote at the

Annual Meeting.

You

do not need to attend the Annual Meeting to vote your Shares. Shares represented by valid proxies, received in time for the Annual Meeting

and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. A Stockholder may revoke a proxy before the proxy is

voted by delivering to our Secretary a signed statement of revocation or a duly executed proxy card bearing a later date. Any Stockholder

who has executed a proxy card but attends the Annual Meeting may revoke the proxy and vote at the Annual Meeting.

How

Many Votes Do I Have?

Each

holder of Common Stock is entitled to one vote per share of Common Stock. Holders of our Common Stock will vote together as a single

class.

How

Do I Vote?

Whether

you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All Shares represented by valid proxies that we receive through

this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via

Internet or telephone. You may specify whether your Shares should be voted for or against each nominee for director, and whether your

Shares should be voted for, against or abstain with respect to each of the other proposals. Except as set forth below, if you properly

submit a proxy without giving specific voting instructions, your Shares will be voted in accordance with the Board’s recommendations

as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your Shares are registered directly in your

name through our stock transfer agent, Equiniti Trust Company, LLC, or you have stock certificates, you may vote:

| ● |

By

Internet or by telephone. Follow the instructions you received to vote by Internet or telephone. |

| ● |

By

mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance

with your instructions. If you sign the proxy card but do not specify how you want your Shares voted, they will be voted as recommended

by the Board. |

If

your Shares are held in “street name” (held in the name of a bank, broker or other nominee), you must provide the bank, broker

or other nominee with instructions on how to vote your Shares and can do so as follows:

| ● |

By

Internet or by telephone. Follow the instructions you receive from your broker to vote by Internet or telephone. |

| ● |

By

mail. You will receive instructions from your broker or other nominee explaining how to vote your Shares. |

If

you are a beneficial owner of Shares held in street name and do not provide the organization that holds your Shares with specific voting

instructions, under the rules of various national and regional securities exchanges, the organization that holds your Shares may generally

vote on routine matters, but cannot vote on non-routine matters.

How

Does The Board Recommend That I Vote On The Proposals?

The

Board recommends that you vote as follows:

| ● |

“FOR”

the ratification of the selection of KCCW Accountancy Corp. as our independent registered public accounting firm for the fiscal year

ending December 31, 2024; |

| ● |

“FOR”

the approval of the reservation of up to two (2) million shares of common stock as special stock awards, which are not issued under

the Ainos, Inc. 2023 Stock Incentive Plan, in accordance with Nasdaq Listing Rule 5635(c).; |

| ●

|

“FOR”

the approval of the adjournment of the Annual Meeting, if necessary or advisable, to solicit additional proxies in favor of the foregoing

proposals if there are not sufficient votes to approve the foregoing proposals. |

If

any other matter is presented, the proxy card provides that your Shares will be voted by the proxy holder listed on the proxy card in

accordance with his or her best judgment. At the time this Proxy Statement was printed, we knew of no matters that needed to be acted

on at the Annual Meeting, other than those discussed in this Proxy Statement.

May

I Change or Revoke My Proxy?

If

you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any

one of the following ways:

| ● |

by

signing a new proxy card and submitting it as instructed above; |

| ● |

by

re-voting by Internet or by telephone as instructed above - only your latest Internet or telephone vote will be counted; |

| ● |

if

your Shares are registered in your name, by notifying the Company’s Secretary in writing before the Annual Meeting that you

have revoked your proxy; or |

| ● |

by

attending the Annual Meeting and voting; however, attending the Annual Meeting will not in and of itself revoke a previously submitted

proxy unless you specifically request it. |

What

If I Receive More Than One Proxy Card?

You

may receive more than one proxy card or voting instruction form if you hold Shares in more than one account, which may be in registered

form or held in street name. Please vote in the manner described under “How Do I Vote?” on the proxy card for each account

to ensure that all of your Shares are voted.

What

is a Broker Non-Vote?

If

your Shares are held in a fiduciary capacity (typically referred to as being held in “street name”), you must instruct the

organization that holds your Shares how to vote your Shares. If you sign your proxy card but do not provide instructions on how your

broker should vote on “routine” proposals, your broker will vote your Shares as recommended by the Board. If you do not provide

voting instructions, your Shares will not be voted on any “non-routine” proposals. This vote is called a “broker non-vote.”

What

Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal

1: Ratification of the appointment of KCCW Accountancy Corp. as our independent registered public accounting firm for the fiscal

year ending December 31, 2024. |

|

The

affirmative vote of a majority of the Shares present or represented by proxy and entitled to vote on the subject matter at the Annual

Meeting is required to ratify the appointment of KCCW Accountancy Corp. as our independent registered public accounting firm for

the fiscal year ending December 31, 2024. This means that the votes cast by the Stockholders “FOR” the approval of the

proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. If a Stockholder votes to “ABSTAIN,”

it has the same effect as a vote “AGAINST.” If you are a beneficial owner, your broker, bank or other nominee may vote

your Shares on this proposal without receiving voting instructions from you. |

| |

|

|

| Proposal

2: To approve the reservation of up to two (2) million shares of common stock as special stock awards, which are not issued under

the Ainos, Inc. 2023 Stock Incentive Plan, in accordance with Nasdaq Listing Rule 5635(c). |

|

The

affirmative vote of a majority of the Shares present or represented by proxy and entitled to vote on the subject matter at the Annual

Meeting is required to approve this proposal. This means that the votes cast by the Stockholders “FOR” the approval of

the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. If a Stockholder votes to “ABSTAIN,”

it has the same effect as a vote “AGAINST.” Broker non-votes will have no effect on the outcome of this proposal. |

| |

|

|

| Proposal

3: Authorization to adjourn the Annual Meeting. |

|

The

affirmative vote of a majority of the Shares present or represented by proxy and entitled to vote on the subject matter at the Annual

Meeting is required to approve this proposal. This means that the votes cast by the Stockholders “FOR” the approval of

the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. If a Stockholder votes to “ABSTAIN,”

it has the same effect as a vote “AGAINST.” Broker non-votes will have no effect on the outcome of this proposal. |

What

Constitutes a Quorum for the Annual Meeting?

The

presence, in person or by proxy, of the holders of one-third of the outstanding shares of each class or series of voting stock

then entitled to vote at the Annual Meeting constitutes a quorum at the Annual Meeting. Votes of Stockholders of record who are present

at the Annual Meeting or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Do

I Have Dissenters’ Rights of Appraisal?

The

Company’s Stockholders do not have appraisal rights under Texas law or under the Company’s governing documents with respect

to the matters to be voted upon at the Annual Meeting.

Householding

of Annual Disclosure Documents

The

Securities and Exchange Commission (the “SEC”) previously adopted a rule concerning the delivery of annual disclosure documents.

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we are permitted to deliver

a single copy of the Notice of Internet Availability and, if a shareholder requested printed versions by mail, our proxy materials, including

this proxy statement and our annual report, to shareholders sharing the same address who did not otherwise notify us of their desire

to receive multiple copies of our proxy materials. Householding allows us to reduce our printing and postage costs and limits the volume

of duplicative information received at your household. A separate proxy card will continue to be mailed for each registered shareholder

account who requests a paper copy of the proxy materials.

We

will promptly deliver, upon oral or written request, a separate copy of the Notice of Internet Availability and, if a shareholder requested

printed versions by mail, the proxy materials to any shareholder residing at an address to which only one copy was mailed. If you wish

to receive an additional copy of the Notice of Internet Availability or our proxy materials, or if you received multiple copies and wish

to request householding in the future, you may make such request by writing to our Corporate Secretary at 11611 N. Meridian St, Suite

330, Carmel, IN 46032.

If

you are a street name holder and wish to revoke your consent to householding and receive separate copies of our proxy materials for the

annual meeting of shareholders this year or future years, you may call Broadridge Investor Communications Services toll-free at (866)

540-7095 or write to them c/o Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

Who

is Paying for this Proxy Solicitation?

The

Company is paying the cost of preparing, printing and mailing these proxy materials. In addition to mailed proxy materials, our directors,

officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors,

officers and employees any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for

the cost of forwarding proxy materials to beneficial owners. We do not intend, but reserve the right, to use the services of a third

party solicitation firm to assist us in soliciting proxies.

Who

will Count the Votes?

A

representative from Broadridge or an accredited person will act as the inspector of election and count the votes.

When

are Stockholder Proposals due for Next Year’s Annual Meeting?

At

our annual meeting each year, our Board submits matters to the Stockholders for action at the annual meeting.

Pursuant

to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Stockholders may present proper

proposals for inclusion in the Company’s proxy statement for consideration at the 2024 annual meeting of Stockholders by submitting

their proposals to the Company in a timely manner. These proposals must meet the Stockholder eligibility and other requirements of the

SEC. To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing no later than June

28, 2025 to the Company at Ainos, Inc., 8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108; provided, however, if the date

of the Annual Meeting is convened more than 30 days before, or delayed by more than 60 days after the first anniversary of this Annual

Meeting, a Stockholder proposal must be submitted in writing to the Company not less than no later than the later of seventy (70) calendar

days prior to the date of the annual meeting or seven (7) calendar days after the date the Company shall have mailed notice to its shareholders

of the date that the annual meeting of shareholders will be held or shall have issued a press release or otherwise publicly disseminated

notice that an annual meeting of shareholders will be held and the date of the meeting.

What

Interest Do Officers and Directors Have in Matters to Be Acted Upon?

None

of the members of the Board and none of the executive officers of the Company have any interest in any proposal that is not shared by

all other Stockholders of the Company except for Proposal Two regarding the reservation of up to two (2) million shares of common stock

as special stock awards.

Where

Can I Find the Voting Results of the Annual Meeting?

We

will announce preliminary voting results at the annual meeting. We will also disclose voting results in a current report on Form 8-K

filed with the SEC within four business days after the Annual Meeting, which will be available on our website.

WHERE

YOU CAN FIND MORE INFORMATION ABOUT THE COMPANY

The

Company files annual, quarterly and current reports, proxy statements and other information with the SEC. You can read and copy any materials

that the Company files with the SEC, which you can access over the Internet at http://www.sec.gov. The Company’s website address

is www.ainos.com. Information contained on, or that can be accessed through, the Company’s website is not a part of this Proxy

Statement.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding the beneficial ownership of our Common Stock by (i) each person who, to our

knowledge, owns more than 5% of our Common Stock (ii) our current directors and the named executive officers identified under the heading

“Executive Compensation” and (iii) all of our current directors and executive officers as a group. We have determined beneficial

ownership in accordance with applicable rules of the SEC, and the information reflected in the table below is not necessarily indicative

of beneficial ownership for any other purpose. Under applicable SEC rules, beneficial ownership includes any shares as to which a person

has sole or shared voting power or investment power and any shares which the person has the right to acquire within 60 days after August

5, 2024 through the exercise of any option, warrant or right or through the conversion of any convertible security. Unless otherwise

indicated in the footnotes to the table below and subject to community property laws where applicable, we believe, based on the information

furnished to us that each of the persons named in this table has sole voting and investment power with respect to the shares indicated

as beneficially owned.

The

information set forth in the table below is based on 8,045,406 shares of our Common Stock issued and outstanding on August

5, 2024. In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of that person,

we deemed to be outstanding all shares of Common Stock subject to options, warrants, rights or other convertible securities held by that

person that are currently exercisable or will be exercisable within 60 days after August 5, 2024. We did not deem these shares

outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the principal

address of each of the Stockholders below is in care of Ainos, Inc., 8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108.

We

are not aware of any arrangements, including any pledge by any person of securities of our Company or any of its parents, the operation

of which may at a subsequent date result in a change in control of our Company.

| Name of beneficial owner | |

Number of shares beneficially owned

or subject to a voting agreement | | |

Percentage of shares of common stock | |

| | |

| | |

| |

| Security ownership of certain beneficial owners: | |

| | | |

| | |

| Ainos Inc. (“Ainos KY”) (1) | |

| 3,056,898 | | |

| 38.00 | % |

| | |

| | | |

| | |

| Security ownership of management and directors: | |

| | | |

| | |

| Chun-Hsien Tsai(2) | |

| 302,319 | | |

| 3.76 | % |

| Chung-Yi Tsai(2) | |

| 52,932 | | |

| * | % |

| Chun-Jung Tsai(2) | |

| 88,386 | | |

| 1.10 | % |

| Ting-Chuan Lee(2) | |

| 95,231 | | |

| 1.18 | % |

| Wen-Han Chang(3) | |

| 106,265 | | |

| 1.32 | % |

| Yao-Chung Chiang(4) | |

| 54,932 | | |

| * | % |

| Pao-Sheng Wei | |

| 52,932 | | |

| * | % |

| Meng-Lin Sung | |

| 61,050 | | |

| * | % |

| Lawrence K. Lin(5) | |

| 22,098 | | |

| * | |

| All Directors and Executive Officers as a Group (9 persons) | |

| 836,145 | | |

| 10.39 | % |

*Represents

beneficial ownership of less than 1%

| (1) |

Includes

(i) 2,456,319 shares of common stock owned by Ainos KY; (ii) 482,168 shares of common stock pursuant to a Voting Agreement dated

January 26, 2024 (the “2024 Voting Agreement”), by and among the Issuer, Ainos Inc., and Chun-Hsien Tsai, Ting-Chuan

Lee, Chun-Jung Tsai, and Chung-Yi Tsai (the “Tsai Group”); (iii) 89,000 shares of common stock pursuant to a Voting Agreement

dated March 7, 2024 (the “2024 Voting Agreement II”) with Chih-Heng Lu; and (iv) 29,411 shares owned by ASE Test.

The voting agreement dated December 9, 2021 with Stephen T. Chen, Virginia M. Chen, the Stephen T. Chen and Virginia M. Chen

Living Trust, dated April 12, 2018, and Hung Lan Lee terminated on January 26, 2024. Taiwan Carbon Nano Technology Corporation

(TCNT) owns a majority of the outstanding voting securities of Ainos KY and, accordingly, may be deemed, for purposes of Section

13(d) of the Exchange Act, to share beneficial ownership of the shares of common stock held by Ainos KY. TCNT’s address is

10F-2, No. 66, Shengyi 5th Rd., Zhubei City, Hsinchu County 30261, Taiwan (R.O.C.). |

| |

|

| (2) |

Include restricted stock units that will vest within

60 days. |

| |

|

| (3) |

Includes

52,932 shares of common stock directly held by Wen-Han Chang, and 53,333 shares of common stock indirectly through his spouse, Chien-Hsuan

Huang. |

| |

|

| (4) |

Includes

52,932 shares of common stock directly held by Yao-Chung Chiang, and 2,000 shares of common stock indirectly through his spouse,

Hsiu-Hwei Tsai Chiang. |

| |

|

| (5) |

Includes

5,749 shares of common stock and exercisable options to acquire 4,444 shares of common stock, 360 restricted stock units that

will issue and vest within 60 days directly owned by Mr. Lin. Also 5,511 shares of common stock and 6,034 shares of common stock

reserved for warrants both beneficially owned by i2China Management Group, LLC (“i2China), of which Mr. Lin is the sole member. |

CORPORATE

GOVERNANCE

Our

Board of Directors

Director

Independence

Our

board of directors consists of seven (7) members. Our board of directors determined that each of Mr. Wen-Han Chang, Mr. Yao-Chung Chiang

and Mr. Pao-Sheng Wei qualify as an independent director under applicable SEC and Nasdaq rules. Based on information provided by each

director concerning his or her background, employment, and affiliations, our board of directors determined that each of Mr. Wen-Han Chang,

Mr. Yao-Chung Chiang and Mr. Pao-Sheng Wei does not have relationships that would interfere with the exercise of independent judgment

in carrying out the responsibilities of a director and that Mr. Wen-Han Chang, Mr. Yao-Chung Chiang and Mr. Pao-Sheng Wei are “independent”

as that term is defined under applicable SEC and Nasdaq rules. In making these determinations, our board of directors considered the

current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board

of directors deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-employee

director and the transactions described in “Certain Relationships and Related Party Transactions.”

Director

Compensation

The

following table provides information regarding the total compensation that was earned by or paid to each person who served as our directors,

other than executive directors, during the year ended December 31, 2023. Mr. Chun-Hsien Tsai is not included in the table below as he

is employed as our President, Chief Executive Officer and Chairman of our Board whose compensation information is provided in the “Summary

Compensation Table” below.

| Name | |

Fees earned or paid in cash (2) ($) | | |

Stock awards (1) ($) | | |

All other

compensation

($) | | |

Total

($) | |

| Wen-Han Chang | |

$ | 20,500 | | |

$ | 162,250 | | |

$ | - | | |

$ | 182,750 | |

| Yao-Chung Chiang | |

| 16,000 | | |

| 162,250 | | |

| - | | |

| 178,250 | |

| Pao-Sheng Wei | |

| 22,000 | | |

| 162,250 | | |

| - | | |

| 184,250 | |

| Chung-Yi Tsai | |

| 12,000 | | |

| 162,250 | | |

| - | | |

| 174,250 | |

| Chung-Jung Tsai | |

| - | | |

| 162,250 | | |

| - | | |

| 162,250 | |

| Ting-Chuan Lee | |

| - | | |

| 162,250 | | |

| - | | |

| 162,250 | |

| Total | |

$ | 70,500 | | |

$ | 973,500 | | |

$ | - | | |

$ | 1,044,000 | |

| (1) |

The

value shown reflects the grant date fair value in accordance with FASB ASC Topic 718. |

| (2) |

Each

member of the Board of who is not an employee of the Company or any of subsidiaries receives the cash compensation set forth below

the 2021 NEDCP for service on the Board. |

Non-Employee

Director Compensation Policy (the “2021 NEDCP”)

On

September 28, 2021, the Company’s Board of Directors adopted the Company’s Non-Employee Director Compensation Policy (the

“2021 NEDCP” or “Policy”). On appointment to the Board, and without any further action of the Board or compensation

committee of the Board (the “Compensation Committee”), at the close of business on the day of such appointment, each Non-Employee

Director will automatically receive an award of 22,000 restricted stock units (“RSUs”), adjusted to 4,400 shares giving effect

to the 1 for 5 reverse stock split on December 14, 2023, over Common Stock (the “Appointment Grant”). The Appointment Grant

shall vest in three equal annual installments, with the first installment vesting on the last day of the six-month period commencing

on the grant date and each subsequent installment vesting on the last day of the six-month period commencing on the next two subsequent

anniversaries of the grant date, subject to the Director’s continuous service with us on each applicable vesting date. The RSUs

shall be granted pursuant to the Company’s 2021 Stock Incentive Plan and shall be subject to such other provisions set forth in

the agreement evidencing the award of the RSUs, in the form adopted from time to time by the Board or the Compensation Committee of the

Board.

In

addition to the RSU grants, each member of the Board of who is not an employee of the Company or any of subsidiaries will receive the

cash compensation set forth below for service on the Board. The annual cash compensation amounts will be payable in equal quarterly installments,

in arrears following the end of each quarter in which the service occurred, pro-rated for any partial months of service. All annual cash

fees are vested upon payment.

| Annual Board Service Retainer: | |

| |

| All Eligible Directors: | |

$ | 12,000 | |

| Chairperson of the Board: | |

$ | 14,000 | |

| Annual Committee Chair Service Retainer: | |

| | |

| Chairperson of the Audit Committee: | |

$ | 7,000 | |

| Chairperson of the Compensation Committee: | |

$ | 4,500 | |

| Annual Committee Member Service Retainer: | |

| | |

| Member of the Audit Committee: | |

$ | 4,000 | |

| Member of the Compensation Committee: | |

$ | 3,000 | |

Board

Committees

Our

board of directors established an audit committee (the “Audit Committee”) and a Compensation Committee. Our board of directors

adopted a charter for each of these committees, which complies with the applicable requirements of current Nasdaq rules. We intend to

comply with future requirements to the extent they are applicable to us. Copies of the charters for each committee are available on the

investor relations page of our website (www.ainos.com). The inclusion of our website address in this prospectus is an inactive

textual reference only.

Audit

Committee

Our

Audit Committee consists of Mr. Wen-Han Chang, Mr. Yao-Chung Chiang and Mr. Pao-Sheng Wei, each of whom has been determined to be “independent”

under applicable rules and regulations of the SEC and the listing standards of Nasdaq, and also meets the financial literacy requirements

of the listing standards of Nasdaq. Mr. Wei currently serves as Chairperson of our Audit Committee.

Our

Board has determined that the three audit committee members qualify as “audit committee financial experts” as defined in

Item 407(d) of Regulation S-K by considering their formal education and experience in financial management.

The

duties and responsibilities of the Audit Committee are set forth in its charter include the following:

| ● |

selecting

our independent registered public accounting firm and reviewing its qualifications, independence and performance; |

| ● |

reviewing

the audit plans of our internal auditors and any significant reports prepared by our internal auditors as well as management’s

responses; |

| ● |

in

consultation with management and the Company’s internal and external auditors, reviewing the Company’s guidelines and

policies with respect to risk assessment, risk management and internal financial and disclosure controls; and |

| ● |

reviewing

any material written communications between the independent registered public accounting firm and management, including any management

or internal control letter issued or proposed to be issued by the independent registered public accounting firm and management’s

response, if any. |

Compensation

Committee

Our

Compensation Committee currently consists of Mr. Wen-Han Chang and Mr. Pao-Sheng Wei. Mr. Chang currently serves as the Chairperson of

our Compensation Committee. Our Board has determined that each member of our Compensation Committee meets the requirements for independence

for Compensation Committee members under the rules and regulations of the SEC and the listing standards of Nasdaq. Each member of the

Compensation Committee is also a non-employee director, as defined pursuance to Rule 16b-3 promulgated under the Exchange Act.

The

duties and responsibilities of the Compensation Committee are set forth in its charter include the following:

| ● |

reviewing,

modifying (as needed) and approving the salary, variable compensation, equity compensation and any other compensation and terms of

employment of the Company’s Chief Executive Officer; |

| ● |

reviewing

and approving corporate performance goals, the structure and method for determining the terms of overall executive variable compensation

or other compensatory plans, method of determination of individual goals for executives and other senior management, and payment

of individual executive variable compensation to the extent such variable compensation contains a discretionary component; and |

| ● |

reviewing,

modifying (as needed) and approving the Company’s overall compensation plans and structure, including the Company’s overall

compensation philosophy. |

Code

of Business Conduct and Ethics

We

adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal

executive officer or persons performing similar functions. A copy of the code is posted on our corporate website at www.ainos.com and

is filed hereto as Exhibit 14.1 and is incorporated herein by this reference. In addition, we intend to post on our website all disclosures

that are required by law or listing standards concerning any amendments to, or waivers from, any provision of the code. The information

contained in, or accessible through, our website does not constitute a part of this report. We have included our website address in this

report solely as an inactive textual reference.

Hedging

and Stock Ownership Policies

Our

insider trading policy provides that all officers and employees of the Company, all members of the Board, and any consultants and contractors

to the Company that the Company designates, as well as, to the extent controlled by or benefiting any of the foregoing persons, members

of the immediate families (spouse, parents, grandparents, children, grandchildren and siblings, including any such relationships that

arise through marriage or adoption) sharing a household with the officer, employee, director, consultant or contractor, and any other

member of the households of persons directly subject to this Policy, and family trusts (or similar family entities) may not engage in

any transactions that suggest speculation in our stock (that is, an attempt to profit in short-term movements, either increases or decreases,

in the stock price). The policy notes that many “hedging” transactions, such as “collar” transactions, contingent

or forward sales, and other similar or related arrangements, are prohibited. Specifically, our insider trading policy precludes any employee

or Officer from engaging in any “short” sale, “sale against the box” or any equivalent transaction involving

our stock (or the stock of any of our business partners in any of the situations described above).

We

do not have a stock ownership policy.

Indemnification

and Insurance

Our

amended and restated certification of formation and our amended and restated bylaws provide that we shall indemnify our directors and

officers against all actions, proceedings, costs, charges, expenses, losses, damages or liabilities incurred or sustained by such director

or officer, other than such liability (if any) that he or she may incur by reason of his or her own actual fraud or willful default,

in connection with the execution or discharge of his or her duties, powers, authorities or discretions as a director or officer of the

Company.

We

have entered into indemnification agreements with each of our directors and executive officers. Such agreements require us, among other

things, to indemnify our officers and directors, other than for liabilities arising from willful misconduct of a culpable nature, and

to advance their expenses incurred as a result of any proceedings against them as to which they could be indemnified.

In

addition, we maintain standard policies of insurance under which coverage is provided to our directors and officers against loss rising

from claims made by reason of breach of duty or other wrongful act, and to us with respect to payments which may be made by us to such

directors and officers pursuant to the above indemnification provision or otherwise as a matter of law.

EXECUTIVE

OFFICERS

The

following are biographical summaries of our executive officers and their ages:

| Name |

|

Age |

|

Position |

| Chun-Hsien

Tsai |

|

54 |

|

Chairman,

President & Chief Executive Officer |

| Wen-Han

Chang |

|

61 |

|

Director |

| Yao-Chung

Chiang |

|

72 |

|

Director |

| Pao-Sheng

Wei |

|

66 |

|

Director |

| Ting-Chuan

Lee |

|

41 |

|

Director |

| Chun-Jung

Tsai |

|

52 |

|

Director |

| Chung-Yi

Tsai |

|

48 |

|

Director |

| Meng-Lin

Sung |

|

51 |

|

Chief

Financial Officer |

| Lawrence

K. Lin |

|

55 |

|

Executive

Vice President of Operations |

Chun-Hsien

Tsai. Mr. Tsai has served as our Chairman, President, and Chief Executive Officer since April 2021. From April 2021 to August 2021,

he also served as Chief Financial Officer. He has served as the chairman and CEO of Taiwan Carbon Nano Technology Corporation (TCNT)

since July 2018, as a director of Ainos Inc. (Cayman Islands) since October 2017, as director and CEO of AI Nose Corporation since 2016,

and as a director of TCNT since 2012. Mr. Tsai holds an EMBA degree from National Yang Ming Chiao Tung University.

Wen-Han

Chang. Mr. Chang has served as a Director of the Company since April 2021 and has served as the Chairperson of our Compensation Committee

and a member of our Audit Committee since August 2021. He is the superintendent at Mackay Memorial Hospital since May 2023, and was deputy

superintendent between August 2015 and May 2019. He has devoted his expertise at the department of emergency medicine for approximately

30 years. Mr. Chang advocates better public health and AI’s development in the healthcare sector through his leadership roles in

industry groups in Taiwan. Mr. Chang is the current chairman of Health Intelligent Medical Development Society. From 2019 to 2021, he

was the president of the Childhood Burn Foundation of R.O.C. Mr. Chang holds a Ph.D in public health from Saint Louis University.

Yao-Chung

Chiang. Mr. Chiang has served as a Director of the Company since April 2021 and has served as a member of our Audit Committee since

August 2021. Mr. Chiang has served as the chairman of Taiwan High Speed Rail Corporation since October 2016 and as an independent director

for Radiant Opto-Electronics Corporation since June 2012. From June 2015 to July 2021, Mr. Chang was an independent director for Tyntek

Corp. Mr. Chiang served as the chairman for other Taiwan-incorporated companies including China Steel Chemical Corporation, Kaohsiung

Rapid Transit Corporation, China Steel Corporation and China Airlines. Mr. Chiang holds a Ph.D. in Mechanical Engineering from University

of Wisconsin-Madison.

Pao-Sheng

Wei. Mr. Wei has served as a Director of the Company, Chairperson of the Audit Committee and as a member of the Compensation Committee

since June 2022. He has served as the chairman of Shin Kong Life Insurance Co., Ltd since June 2023 and as an independent director of

Nuvoton Technology Corporation since June 2022. From September 2014 to June 2022, Mr. Wei served as the chairman of KGI Bank Co., Ltd.

Mr. Wei held leadership roles in the banking, securities and insurance sectors in Taiwan. He was a securities regulator as the Division

Director of Corporate Finance of the Securities and Futures Bureau of the Financial Supervisory Commission, R.O.C. (Taiwan). Mr. Wei

holds an MBA degree from George Washington University.

Ting-Chuan

Lee. Ms. Lee has served as a Director of the Company since April 2021. She is also a manager at the CEO office. She has served as

the chairperson of AI Nose Corporation since March 2016, and as a member of the board of director of Taiwan Carbon Nano Technology Corporation

(TCNT) since July 2012. Ms. Lee holds a master’s degree of science from National Taiwan University.

Chun-Jung

Tsai. Mr. Tsai has served as a Director of the Company since April 2021. He is also a manager of the Company’s sales team.

He has served as a director of Ainos Inc. (Cayman Islands) since 2019, a director of AI Nose Corporation since March 2016, and a director

of Taiwan Carbon Nano Technology Corporation (TCNT) since July 2012.

Chung-Yi

Tsai. Mr. Tsai has served as a member of our Board of Directors since April 2021 and as a director of TCNT since July 2012. Mr. Tsai

is a seasoned executive in product and business development in the technology hardware sector. From May 2023 to present, he has served

as a senior product marketing director at Alpha & Omega Semiconductor. Prior to that, he has served as a senior product marketing

manager in Renesas Electronics from June 2020 to May 2023, executive business manager at Maxim Integrated from November 2019 to June

2022, and as a senior product marketing manager at Intersil Corporation from October 2013 to November 2019.

Meng-Lin

Sung. Ms. Sung has served as our Chief Financial Officer since May 2023. She previously served as Vice President of Finance at Sercomm

Corporation from September 2021. Prior to joining Sercomm, she held roles at PricewaterhouseCoopers Zhong Tian LLP from October 2018,

conducting audits and advising public companies on U.S. GAAP/IFRS and SEC reporting and listing regulations. Ms. Sung has extensive experience

guiding publicly-traded healthcare and life science companies through the initial public offering and auditing processes, having previously

worked with companies based in the USA and mainland China. She received her MBA degree from National Taiwan University.

Lawrence

K. Lin. Mr. Lin has served as Executive Vice President of Operations since August 1, 2021. Prior to his appointment, Mr. Lin provided

the Company with management consulting services from May 2018 until August 2021, as the sole member of i2China Management Group, LLC

(“i2China”), and served as Executive Advisor to the previous CEO and Chairman of the Company. Mr. Lin brings more than 30

years of global cross-border strategic management consulting and financial investment experience at leading institutional corporates,

such as Andersen Consulting, Salomon Smith Barney, and Credit Suisse First Boston. Mr. Lin has international management experience across

several geographical locations, including the U.S., China and Taiwan, and advised on several private capital and structured public equity

transactions for issuers in the healthcare and consumer sectors. Mr. Lin has a dual MBA in Finance & International Business from

New York University- Stern School of Business.

EXECUTIVE

COMPENSATION

Named

Executive Officers

As

a “smaller reporting company” under SEC rules, our named executive officers during the fiscal year January 1, 2023 through

December 31, 2023 (collectively, the “Named Executive Officers”) were as follows:

| |

● |

Mr.

Chun-Hsien Tsai, Chairman, President & Chief Executive Officer; |

| |

● |

Ms.

Meng-Lin Sung, Chief Financial Officer; |

| |

● |

Ms.

Hui-Lan Wu, Former Chief Financial Officer; and |

| |

● |

Mr.

Lawrence K. Lin, Executive Vice President of Operations. |

Summary

Compensation Table

The

following table provides information regarding the total compensation awarded to, earned by, and paid to our named executive officers

for services rendered to us for the years set forth below. The amounts below for Stock Awards and Option Awards and reflect the grant

date fair value of these awards during the years:

| Name and principal position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock awards ($) | | |

Options awards ($) | | |

All other compensation ($)(4) | | |

Total ($) | |

Chun-Hsien Tsai (1) President & Chief Executive Officer | |

| 2023 | | |

| 95,912 | | |

| 16,212 | | |

| 1,172,899 | | |

| - | | |

| - | | |

| 1,285,023 | |

| | |

| 2022 | | |

| 101,650 | | |

| 17,145 | | |

| 3,762,496 | | |

| - | | |

| - | | |

| 3,881,291 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Meng-Lin Sung (2) Former Chief Financial Officer | |

| 2023 | | |

| 57,363 | | |

| 9,728 | | |

| 218,910 | | |

| - | | |

| - | | |

| 286,001 | |

| | |

| 2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Hui-Lan Wu (3) Former Chief Financial Officer | |

| 2023 | | |

| 37,341 | | |

| - | | |

| - | | |

| - | | |

| 1,635 | | |

| 38,976 | |

| | |

| 2022 | | |

| 93,518 | | |

| 15,790 | | |

| 1,523,746 | | |

| - | | |

| 2,600 | | |

| 1,635,654 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Lawrence K. Lin

EVP of Operations | |

| 2023 | | |

| 144,000 | | |

| - | | |

| 14,790 | | |

| - | | |

| - | | |

| 158,790 | |

| | |

| 2022 | | |

| 144,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 144,000 | |

| |

(1) |

Includes

$162,250 of special stock awards for the service as chairperson of the board of directors. |

| |

(2) |

Ms.

Sung was appointed Chief Financial Officer, effective as of May 17, 2023. |

| |

(3) |

Ms.

Wu was appointed Chief Financial Officer, effective as of August 11, 2021, and retired on May 16, 2023. |

| |

(4) |

All

other compensation includes commuting expense. |

Narrative

Disclosure to Summary Compensation Table

Chun-Hsien

Tsai

Effective

April 15, 2021, our Board appointed Mr. Chun-Hsien Tsai to serve as Chief Executive Officer. Mr. Tsai receives a monthly salary of NT$250,000

(equivalent to approximately $8,000), a year-end bonus of two months’ salary, and a variable compensation based on Company profit

targets decided by the Company’s Compensation Committee, and payable as 10% to 100% of total annual compensation in the form of

cash, securities and/or other discretionary remuneration. Mr. Tsai was granted RSUs pursuant to 2021 Stock Incentive Plan. Other benefits,

including labor insurance, health insurance and other benefits, will be based on local regulations and the Company’s policies.

In 2023, Mr. Tsai was granted RSUs pursuant to 2023 Stock Incentive Plan and received a special stock award.

Meng-Lin

Sung

We

entered into an employment agreement with Ms. Meng-Lin Sung as Chief Financial Officer in May 2023. The agreement provides for a monthly

salary of NT$230,000 (equivalent to approximately $7,300), a year-end bonus of two months’ salary and other statutory employee

benefits. Ms. Sung was offered a special stock award as the sign-on bonus for her onboarding in late 2023 after shareholder approvals.

Ms. Sung was granted RSUs under 2023 Stock Incentive Plan which will vest in tranches during 3-year service period. Mr. Sung’s

employment agreement is attached hereto as Exhibit 10.25. On March 13, 2024, Ms. Sung resigned from her positions with the Company, effective

as of such date. The departure of Ms. Sung was not related to any disagreement with the Company’s operations, accounting policies

or practices.

Lawrence

K. Lin

Effective

August 1, 2021, we entered into an employment contract with Mr. Lawrence K. Lin in connection with his election as Executive Vice President

of Operations (the “LL Agreement”). The LL Agreement is effective for three years and may be extended for an additional year

on the same terms and conditions upon mutual agreement. Under the LL Agreement, Mr. Lin receives a monthly salary of $12,000, vesting

stock options for 6,666 shares in the Company’s 2018 Officers, Directors, Employees and Consultants Non-Qualified Stock Option

Plan, and a bonus of 2,000 shares in the Company’s common stock upon the Company’s successful listing on a Major National

Exchange (as defined in the LL Agreement), and normal and customary benefits available to the Company’s employees.

Outstanding

Equity Awards at December 31, 2023

The

table below summarizes the number of shares of common stock underlying outstanding equity incentive plan awards for each named executive

officer as of December 31, 2023.

| | |

Option awards | | |

Stock awards | |

| Name | |

Number of securities underlying unexercised options (#) exercisable | | |

Number of securities underlying unexercised options (#) un- exercisable | | |

Equity incentive plan awards: number of securities underlying unexercised unearned options (#) | | |

Option exercise price ($) | | |

Option expiration date | | |

Number of shares or units of stock that have not vested (#) | | |

Market value of shares or units of stock that have not vested (1) ($) | | |

Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) | | |

Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) | |

| Chun-Hsien Tsai | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,000 | (2) | |

| 14,350 | | |

| - | | |

| - | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 174,000 | (3) | |

| 356,700 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Meng-Ling, Sung | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,000 | (3) | |

| 14,350 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lawrence K. Lin | |

| 4,444 | (4) | |

| 2,222 | (4) | |

| - | | |

| 28.50 | | |

| 2031/8/1 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| 6,034 | (5) | |

| - | | |

| - | | |

| 19.88 | | |

| 2025/11/24 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,400 | (3) | |

| 4,920 | | |

| - | | |

| - | |

| (1) |

The

market value is based on $2.05 of closing price as of December 31, 2023. |

| (2) |

Represents

RSUs granted under the 2021 SIP that vest over a three-year period, with 15% of the awards vesting after six months and one year,

the remainder vesting on an annually basis through the third anniversary of the grant. |

| (3) |

Represents

RSU granted under the 2023 SIP that vest over a three-year period, with 15% of the awards vesting after six months and one year,

the remainder vesting on an annually basis through the third anniversary of the grant. |

| (4) |

Represents

option granted under the Company’s 2018 Officers, Directors, Employees and Consultants Non-Qualified Stock Option Plan. |

| (5) |

Represents

warrants issued in November 2020 under an agreement with i2China Management Group, LLC of which Mr. Lin is the sole member. |

PAY

VERSUS PERFORMANCE

As

required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are

providing the following information about the relationship between executive compensation actually paid and certain financial performance

of the Company. For further information concerning the Company’s variable pay-for-performance philosophy and how the Company aligns

executive compensation with the Company’s performance, refer to “Executive Compensation – Compensation Discussion and

Analysis.”

Ainos,

Inc. Pay Versus Performance Table

| Year | |

Summary Compensation Table Total for CEO Tsai | | |

Summary Compensation Table Total for CEO Chen | | |

Compensation Actually Paid to CEO Tsai | | |

Compensation Actually Paid to CEO Chen | | |

Average Summary Compensation Table Total for Non-PEO

Named Executive Officers | | |

Average Compensation Actually Paid to Non-PEO Named

Executive Offices | | |

Value of Initial Fixed $100 Investment Based on Total

Shareholder Return | | |

Net Income | |

| a | |

| b-1 | | |

| b-2 | | |

| c-1 | | |

| c-2 | | |

| d | | |

| e | | |

| f | | |

| g | |

| 2023 | |

| 1,285,023 | | |

| NA | | |

| 987,417 | | |

| NA | | |

| 160,711 | | |

| 146,931 | | |

| (84 | ) | |

| (13,770,549 | ) |

| 2022 | |

| 3,816,959 | | |

| NA | | |

| 777,962 | | |

| NA | | |

| 850,226 | | |

| 111,812 | | |

| (76 | ) | |

| (14,006,690 | ) |

| 2021 | |

| 63,058 | | |

| 34,308 | | |

| 63,058 | | |

| 34,308 | | |

| 201,149 | | |

| 183,872 | | |

| 394 | | |

| (3,888,661 | ) |

We

are a smaller reporting company and, accordingly, we have not included any information in this table for 2020.

Column

a

2023:

January 1, 2023 to December 31, 2023

2022:

January 1, 2022 to December 31, 2022

2021:

January 1, 2021 to December 31, 2021

Column

b-1

In

2023, Chun-Hsien Tsai served as CEO and earned $95,912 base salary, $16,212 bonus, and Stock Awards valued at $1,172,899. Mr. Chun-Hsien

Tsai was appointed CEO effective April 15, 2021. In 2021, Mr. Tsai earned $45,044 base salary, $18,014 bonus, and no stock awards.

Column

b-2

In

2023 and 2022, Stephen T. Chen did not serve as CEO as a result of his resignation on April 15, 2021.

Column

c-1

Calculation

of Compensation Actually Paid to CEO Tsai

| Adjustments to Determine Compensation “Actually Paid” for PEO | |

2023 | | |

2022 | | |

2021 | |

| Total Compensation | |

$ | 1,285,023 | | |

$ | 3,816,959 | | |

$ | 63,058 | |

| Deduct the grant date fair value of equity award amounts reported in the summary

compensation table | |

$ | (1,172,899 | ) | |

$ | (3,699,996 | ) | |

$ | - | |

| Add the change in fair value of any awards granted in prior years that are

outstanding and unvested as of the end of the fiscal year | |

$ | 356,700 | | |

$ | 31,000 | | |

$ | - | |

| Add the change in fair value of any awards granted in prior years that are

outstanding and unvested as of the end of the fiscal year | |

$ | (7,350 | ) | |

$ | - | | |

$ | - | |

| Add for award that are granted and vest in the same year, the fair value as

of the vesting date | |

$ | 525,272 | | |

$ | 629,999 | | |

$ | - | |

| Add for awards granted in prior years that vest in the fiscal year, the change

in the fair value from the end of the prior fiscal year to the vesting date | |

$ | 671 | | |

$ | - | | |

$ | - | |

| Add for awards granted in prior years that vest in the fiscal year, the change

in the fair value from the end of the prior fiscal year to the vesting date | |

$ | - | | |

$ | - | | |

$ | - | |

| Total Adjustments | |

$ | (297,607 | ) | |

$ | (3,038,997 | ) | |

$ | - | |

| Total Compensation Actually Paid, Net of Adjustments | |

$ | 987,417 | | |

$ | 777,962 | | |

$ | 63,058 | |

Column

c-2

Calculation

of Compensation Actually Paid to CEO Chen

| Adjustments to Determine Compensation “Actually Paid” for PEO | |

2023 | | |

2022 | | |

2021 | |

| Total Compensation | |

$ | - | | |

$ | - | | |

$ | 34,308 | |

| Deduct the grant date fair value of equity award amounts reported in the summary

compensation table | |

$ | - | | |

$ | - | | |

$ | - | |

| Add the change in fair value of any awards granted in prior years that are

outstanding and unvested as of the end of the fiscal year | |

$ | - | | |

$ | - | | |

$ | - | |

| Add the change in fair value of any awards granted in prior years that are

outstanding and unvested as of the end of the fiscal year | |

$ | - | | |

$ | - | | |

$ | - | |

| Add for award that are granted and vest in the same year, the fair value as

of the vesting date | |

$ | - | | |

$ | - | | |

$ | - | |

| Add for awards granted in prior years that vest in the fiscal year, the change

in the fair value from the end of the prior fiscal year to the vesting date | |

$ | - | | |

$ | - | | |

$ | - | |

| Add for awards granted in prior years that vest in the fiscal year, the change

in the fair value from the end of the prior fiscal year to the vesting date | |

$ | - | | |

$ | - | | |

$ | - | |

| Total Adjustments | |

$ | - | | |

$ | - | | |

$ | - | |

| Total Compensation Actually Paid, Net of Adjustments | |

$ | - | | |

$ | - | | |

$ | 34,308 | |

Column

(d)

Average

Summary Compensation Table Total for Non-PEO Named Executive Officers.

In

2023, our non-PEO NEOs consisted of Meng-Ling, Sung Chief Financial Officer, Hui-Lan Wu, former Chief Financial Officer and Lawrence

K. Lin, Executive Vice President of Operations. In 2023, the non-PEO NEOs were paid a total compensation of $482,132 resulting in an

average compensation of $160,711.

In

2022, our non-PEO NEOs consisted of Hui-Lan Wu, Chief Financial Officer and Lawrence K. Lin, Executive Vice President of Operations.

In 2022, the non-PEO NEOs were paid a total compensation of $1,700,451 resulting in an average compensation of $850,226.

In

2021, our non-PEO NEOs consisted of Hui-Lan Wu, Chief Financial Officer, Lawrence K. Lin, Executive Vice President of Operations, and

Bernard Cohen, Vice President of Operations. In 2021 non-PEO NEOs were paid a total of $603,446 resulting in an average compensation

of $201,149.

Column

(e)

Calculation

of Average Compensation Actually Paid to Non-PEO NEOs

| Adjustments to Determine Compensation “Actually Paid” for NEOs | |

2023 | | |

2022 | | |

2021 | |

| Total Compensation | |

$ | 482,132 | | |

$ | 1,700,451 | | |

$ | 603,446 | |

| Deduct the grant date fair value of equity award amounts reported in the summary

compensation table | |

$ | (233,700 | ) | |

$ | (1,479,996 | ) | |

$ | (468,950 | ) |

| Add the year-end fair value of any equity awards granted during the covered

fiscal year that are outstanding and unvested as of the fiscal year | |

$ | 19,270 | | |

$ | 21,700 | | |

$ | 417,119 | |

| Add the change in fair value of any awards granted in prior years that are

outstanding and unvested as of the end of the fiscal year | |

$ | (2,970 | ) | |

$ | (264,442 | ) | |

$ | - | |

| Add for award that are granted and vest in the same year, the fair value as

of the vesting date | |

$ | 5,969 | | |

$ | 251,999 | | |

$ | - | |

| Add for awards granted in prior years that vest in the fiscal year, the change

in the fair value from the end of the prior fiscal year to the vesting date | |

$ | 9,090 | | |

$ | (6,088 | ) | |

$ | - | |

| For awards granted in prior years that are determined to fail to meet the

applicable vesting conditions (i.e., are forfeited), deduct the amount equal to the fair value at the end of the prior fiscal year | |

$ | - | | |

$ | - | | |

$ | - | |

| Total Adjustments | |

$ | (41,337 | ) | |

$ | (1,476,826 | ) | |

$ | (51,831 | ) |

| Total Compensation Actually Paid, Net of Adjustments | |

$ | 440,794 | | |

$ | 223,625 | | |

$ | 551,615 | |

| Average Compensation Actually Paid to Non-PEO NEOs | |

$ | 136,202 | | |

$ | 111,812 | | |

$ | 183,872 | |

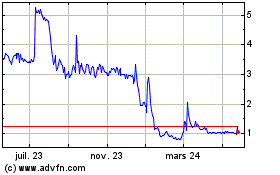

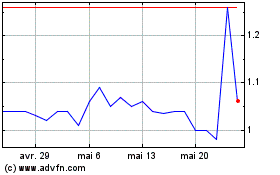

Column

(f)

The

Value of Initial Fixed $100 Investment Based on Total Shareholder Return (“TSR”) is calculated based on a hypothetical $100

investment beginning at the market close on the last trading day before the earliest fiscal year included in the table; as of market

close on December 31, 2020, the last trading day in 2020, through and including the end of the indicated year. The TSR is reported on

a cumulative basis over the fiscal years presented on the table and is inclusive of a share adjustment for a 1:15 reverse stock split

on August 9, 2022. And 1-5 reverse stock split on December 14, 2023.

Column

(g)

2023,

2022, and 2021 Net Income as reported in our Form 10-K Annual Reports for the years ending December 31, 2023, 2022 and 2021 respectively,

calculated in accordance with U.S. GAAP.

Financial

Performance Measures

We

do not currently use financial performance measures to link executive compensation actually paid to our NEOs to our performance. However,

we do utilize non-financial measures such as clinical development progress and timelines and progress towards commercialization.

Analysis

of the Information Presented in the Pay Versus Performance Table

As

described in more detail above under “Compensation Discussion and Analysis” our executive compensation is designed to (1)

attract, motivate and retain talented executives with total compensation that is competitive in our industry; (2) align the interests

of our executives and our stockholders; and (3) award behavior which results in optimizing the commercial potential of our development

program. We use various performance measures to align executive compensation with our performance which are not presented in the Pay

Versus Performance table. In accordance with Item 402(v) of Regulation S-K, we are providing the following description of the relationships

between the information presented in the Pay Versus Performance table.

Table

Compensation Actually Paid and Cumulative TSR

The

amount of compensation actually paid to Mr. Tsai and Dr. Chen is aligned with our TSR over the three years presented in the table, reflecting

the impact of the hiring of Mr. Tsai as Chief Executive Officer and the transition of Dr. Chen from CEO to senior consultant. A substantial

amount of Mr. Tsai’s compensation in 2023 was in the form of restricted stock unit awards under our 2023 Stock Incentive Plan,

Special Stock Awards in 2023, and 2021 Stock Incentive Plan; 2022 was in the form of restricted stock unit awards under our 2021 Stock

Incentive Plan. As the trading price of our common stock fluctuates so does the value of the stock awards and, accordingly, the amount

of the compensation actually paid to Mr. Tsai and Dr. Chen. The amount of compensation actually paid to Mr. Tsai for 2021, 2022 and 2023

and Dr. Chen in 2021 is more closely aligned to our TSR as a great portion of his compensation was in the form of stock awards.

The

amount of compensation actually paid to the Other NEOs is aligned with our TSR over the three years presented in the table. Each of the

Other NEOs were NEOs for 2023, 2022 and 2021; with the exception of Bernard Cohen who resigned as Vice President of Operations as of

April 15, 2022. A significant portion of the compensation actually paid to the Other NEOs is composed of either restricted stock units

that vest overtime or stock option awards.

Compensation

Actually Paid and Net Income

The

amount of compensation actually paid to Mr. Tsai and Dr. Chen and to the Other NEOs is not aligned with our net income over the three

years presented in the table. As a clinical stage biotechnology and medical device company, we have incurred substantial operating losses,

principally from expenses associated with the Company’s research and development programs, clinical trials conducted in connection

with the Company’s drug candidates, and applications and submissions to regulatory authorities. We have substantial future capital

requirements to continue our research and development activities and advance our drug candidates through various development stages.

Accordingly, net income is not a performance measure we use in determining executive compensation. We use a number of corporate goals

that may include research and development, regulatory, manufacturing, organization and financial goals which we believe are important

to building stockholder value.

Net

losses decrease in 2023 over 2022 slightly due to selling, general and administrative expenses related to Share-based compensation expense

fee; increased in 2022 over 2021 largely due to expenses related research and development, commercialization of our product candidates,

and acquisition of strategic intellectual property.

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

We

describe below transactions and series of similar transactions, during our last three fiscal years or currently proposed, to which we

were a party or will be a party, in which:

| ● |

the

amounts involved exceeded or will exceed the lesser of $120,000 or 1% of the average of our total assets at year-end for the last

two completed fiscal years; and |

| ● |

any

of our directors, executive officers or beneficial holders of more than 5% of any class of our voting securities had or will have

a direct or indirect material interest. |

In

addition to the executive officer and director compensation arrangements discussed above under “Executive Compensation”,

since January 1, 2022, the following are the only transactions or series of similar transactions to which we were or will be a party

in which the amount involved exceeds $120,000 and in which any director, nominee for director, executive officer, beneficial holder of

more than 5% of our common stock or any member of their immediate family or any entity affiliated with any of the foregoing persons had

or will have a direct or indirect material interest, other than equity and other compensation, termination, change of control and other

arrangements, which are described under “Executive Compensation.

Purchase

of intangible assets and equipment

Asset

Purchase Agreement

Ainos

KY and the Company entered into an Asset Purchase Agreement dated as of November 18, 2021 (the “Asset Purchase Agreement”),

as modified by an Amended and Restated Asset Purchase Agreement dated as of January 29, 2022 (the “Amended Asset Purchase Agreement”).

Pursuant

to the Asset Purchase Agreement, the Company acquired certain intellectual property assets and certain manufacturing, testing, and office

equipment for a total purchase price of $26,000,000 that included $24,886,023 for intangible intellectual property assets and $1,113,977

for equipment. As consideration, the Company issued to Ainos KY a convertible promissory note in the principal amount of $26,000,000

upon closing on January 30, 2022 (the “APA Convertible Note”). Ainos KY converted all of the APA Convertible Note on or about

August 8, 2022, upon the Company’s up-listing to the Nasdaq Capital Market.

On

August 6, 2024, the Company entered into a patent license agreement (the “License Agreement”) with Taiwan Carbon Nano

Technology Corporation (“TCNT”), pursuant to the License Agreement, TCNT has agreed to assign and grant, exclusive,

irrevocable, and perpetual license of certain invention patents and patent applications related to gas sensors and medical devices (the

“Licensed Patents”), in exchange for 5,500,000 shares of the Company’s common stock, at a price per share of 1.05 times

the highest closing sale price of the common stock during the 30-trading day period preceding the effective date of the License Agreement.

The License Agreement shall remain in effect until terminated by mutual written agreement of the parties, or until the expiration of

the Licensed Patents, or all claims for alleged infringement of the Licensed Patents are barred by applicable laws.

Working

Capital Advances

Ainos

KY provided $800,000 in cash in exchange of a promissory note to support working capital of the Company in March 2022 (the “KY