0001891856false00018918562023-09-072023-09-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 7, 2023

GEN Restaurant Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-41727 |

87-3424935 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

11480 South Street, Suite 205

Cerritos, CA |

|

90703 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (562) 356-9929

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A Common stock, par value $0.001 per share |

|

GENK |

|

The Nasdaq Stock Market LLC (The Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 7, 2023, certain officers of Gen Restaurant Group, Inc. (the “Company”) will be attending the Benchmark Conference. A copy of the Company’s slides that will be used during the conference, as well as, from time to time, to present and/or distribute to members of the investment community and various other industry conferences, is being furnished as Exhibit 99.1 hereto and is hereby incorporated by reference.

The information included in this Item 7.01 is being furnished to the U.S. Securities and Exchange Commission, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

|

|

|

Exhibit Number |

|

Description |

99.1 |

|

Investor Presentation |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Filed herewith.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Company Name |

|

|

|

|

Date: September 7, 2023 |

|

By: |

/s/ Thomas V. Croal |

|

|

|

Thomas V. Croal |

|

|

|

Chief Financial Officer |

2

Investor Overview September 2023 Exhibit 99.1

This presentation may include “forward-looking statements” with the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Exchange Act of 1934, as amended. All forward-looking statements are subject to a number of risks, uncertainties and assumptions, and you should not rely upon forward-looking statements as predictions of future events. You can identify forward-looking statements by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes. All forward-looking statements will be based upon current estimates and expectations about future events and financial and other trends. There is no guarantee that future results, performance or events reflected in the forward-looking statements will be achieved or occur. No person assumes responsibility for the accuracy and completeness of the forward-looking statements, and, except as required by law, no person undertakes any obligation to update any forward-looking statements for any reason after the date of this presentation. Investors are referred to GEN’s filings with the Securities and Exchange Commission for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement. All third-party brand names and logos appearing in this presentation are trademarks or registered trademarks of their respective holders. Any such appearance does not necessarily imply any affiliation with or endorsement of the Company. Legal Disclaimer 2

Company Overview

Joined GEN shortly after opening of first restaurant in September 2011 Former CEO of La Salsa, Inc. and Baja Fresh Enterprises and seasoned restaurateur and entrepreneur Founder of Kim Family Foundation, supporting various charitable causes related to scholastic achievement and leadership Founder-Led Management Team Joined GEN in July 2021 12+ years of public company experience, serving as CFO and COO of InSight Health Services Corp. 18+ years serving as SVP and CFO at various entities, including the Pancreatic Cancer Action Network and Silverado Senior Living Holdings, Inc. California CPA with Arthur Anderson & Co. and B.S. in Accounting from Loyola Marymount University Founded GEN with the opening of the Company’s first restaurant in Tustin, California 25+ years of entrepreneurial experience in the restaurant and hospitality industry Owner, operator and manager of multiple successful restaurant concepts David Kim | Co-CEO & Director Jae Chang | Co-CEO & Director Thomas V. Croal | CFO 4 Experience Experience Experience

Founded by two Korean immigrants in 2011 Engaging and interactive dining experience where guests serve as their own chefs 34 company-owned restaurants across seven states One of the largest Asian casual dining restaurant concepts by total revenue in the United States Passionate and loyal following of Millennials and Generation Z Extensive menu of traditional Korean and Korean-American food at an affordable, all-inclusive price About Us 4 TX Locations 2 HI Locations 2 AZ Location 3 NV Locations 15 Southern CA Locations FL NY 6 Northern CA Locations 5 1 NYC Location Note: Unit count and location as of 6/30/2023. 1 FL Location

Revenue and Adjusted EBITDA Margin1 by Quarter 6 2020: $62.7M Restaurant-Level Adjusted EBITDA Margin1 Adjusted EBITDA Margin1 COVID-19 Impacted Strong Emergence From COVID-19 $ in Millions 2021: $140.6M 2022: $163.7M YTD 2023: $90.4M Non-GAAP financial measures. See appendix for definitions and reconciliations. YoY % Growth: 124.2% 16.4% 12.3% (17.1)% (0.4)% 14.5% 19.0% 26.9% 26.3% 22.3% 21.2% 21.5% 20.2% 19.3% 19.2% 15.3% 20.4% (28.0)% (11.9)% 6.3% 12.3% 20.5% 20.9% 15.0% 16.2% 15.7% 11.9% 10.3% 12.8% 8.1% 13.2% (57.3)% (26.8)% (3.9%) 2.7% 53.2% 32.0% 39.9% 8.8% 12.8% 5.6% (0.5%) 10.3% (2.0%) 9.6% Net Income Margin

Q3 Q4 Q1 Q1 Q1 Q2 Q3 Q4 Q2 Q3 Q4 Q2 Q2 Q1 Comparable Restaurant Sales Growth1 7 2020 2021 2022 2023 COVID-19 Impacted See page 22 for an explanation of how we calculate Comparable Restaurant Sales Growth. Compared to Corresponding Period in Prior Year Compared to Corresponding Period in 2019

Operational Highlights

Diverse Assortment of Side Dishes, or Banchan Family-Style Food Served on Embedded Table-Top Grills Unlimited Amount of Any Food Item for an Affordable, All-Inclusive Price Differentiated Culinary Experience with Enthusiastic Patrons Modern and Vibrant Décor and Atmosphere Engaging the Senses Meaningful Interaction Among Guests who Cook Their Own Food 9 The GEN Dining Experience

Garlic Calamari Marinated Garlic Calamari Cajun Shrimp Marinated Shrimp with Cajun Rub Smoked Garlic Samgyupsal Marinated Pork Belly with Smoked Garlic Spicy Pork Bulgogi Thinly Sliced Marinated Spicy Pork Beef Chadol Thinly Sliced Premium Beef Brisket Spicy Chicken Marinated Spicy Chicken Beef Bulgogi Thinly Sliced Marinated Sweet & Savory Beef Korean Fried Chicken (K.F.C.) Crispy Korean Fried Chicken Unlimited quantities of menu items for a fixed price typically ranging from $17.95 to $21.99 for lunch and $28.95 to $29.95 for dinner1 Popular Menu Items Unlimited Food Items at An Affordable, All-Inclusive Price 10 Pork Poultry Seafood Galbi Marinated Bone-In Short Rib Hangjungsal Premium Pork Jowl Meat Spicy Baby Octopus Marinated Baby Octopus With Onion Garlic Chicken Marinated Chicken With Jalapeno Cheese Fondue Current pricing as of August 2023. Miracle Mile Las Vegas costs $35.95 for dinner. Manhattan, NY location costs $33.95 for dinner, $37.95 for late dinner, and $27.95 for lunch.

Efficient Back-of-House Operations 11 We receive ready-to-serve proteins and fresh produce from our suppliers typically two to three times per week Simple transfer from package to plate Guests grill food to their liking on their table-top grill Established relationships with prospective suppliers Ready-to-serve items minimize kitchen footprint and wait times Received in ready-to-serve format Engaging and interactive dining experience where guests cook their own food New Sysco partnership allows for efficient nation-wide expansion

Greater control than our competition over quality, costs and lead times Well-functioning ventilation systems are critical to Korean barbeque restaurant concepts We do not rely on prohibitively expensive third-party contractors who require lengthy lead times We design and fabricate ventilation systems in-house In-House Design and Fabrication Capabilities 12

Yelp(1) Total Number of Reviews: 87,000+ Average Star Rating: 4.0 Google(1) Total Number of Reviews: 40,000+ Average Star Rating: 4.2 “Food is always so good and it's so much fun making it on your own. Took my family for the first time and they had a blast. Will definitely be going back soon! Service was great, very friendly.” Review for Tempe, AZ Location “Gen Korean BBQ was SO good that I had to visit twice during my week long stay in Texas! If you're like me and have never been to a Korean BBQ, you'll be blown away upon entering.” Review for Carrollton, TX Location “The food was amazing for the price per person, the wait was worth it. I do recommend going, I'm definitely going to go there again, I'm honestly looking forward to it.” Review for Torrance, CA Location “I really enjoy my visit here, it's my go to place for Korean BBQ. They have a great selection of variety of meats on both the lunch & dinner menu.” Review for Cerritos, CA Location Differentiated Guest Experience Drives Positive Customer Ratings 13 As of May 24, 2023.

Expansion Strategy

Flexible Real Estate Footprint 15 Our restaurants fit in a wide variety of retail footprints Henderson, NV Torrance, CA West Covina, CA Tustin, CA Houston, TX Pearlridge, HI Webster, TX Huntington Beach, CA Select Locations Standalone Mid Cap End Cap Chino Hills, CA Las Vegas, NV Carrollton, TX Tempe, AZ Frisco, TX Honolulu, HI Concord, CA New York, NY Alhambra, CA Fremont, CA

Strong Unit Economics 2022 Unit Metrics Targeted New Unit Metrics(1) Average Unit Volume (AUV)(2) $5.9 Million $5.0 Million Revenue per Square Foot(3) $890 $800+ Restaurant-Level Adjusted EBITDA Margin(4) 20.5% 20.0% Cash-on-Cash Returns(5) 85%+ 40%+ Payback Period(6) 1.4 Years 2.5 Years Note: These are Non-GAAP financial measures. See appendix for definitions and reconciliation. Targeted unit level metrics for new units opening in 2023 and beyond. AUVs for historical unit metrics represent 28 units that were opened 18 full months prior to December 31, 2022. Revenue per square foot for 2022 metrics includes 28 units opened 18 full months prior to December 31, 2022. Restaurant-Level Adjusted EBITDA margin for targeted new unit metrics based on targeted net build-out costs of less than $3.0 million. Cash-on-cash returns for historical unit metrics represent average of 28 units open for all of 2022. Payback period for 2022-unit metrics represents average of 21 units that had covered initial investment costs prior to the temporary COVID-19 shutdowns in early 2020. 16

34 Units in 7 States(1) Potential for 250+ Restaurants in the U.S.(3) = 17 Proven Existing Markets Near-Term New Markets FL VA NY CA NV AZ TX OR WA UT D.C. CO NJ MA OK Expansion Strategy To Achieve Long-Term Potential 3-4 Additional Units in 2023(2) Current Footprint 10-12 Units in 2024 Near-Term Growth + + Long-Term Opportunity Underpenetrated Existing Markets Untapped New Markets GA MI

Westheimer (Houston) Arlington Dallas 18 9 signed leases across 5 states Locations Texas Florida Washington Hawaii Maui Kapolei TX Proven Existing Markets Near-Term New Markets WA HI New York Jacksonville Orlando New York City Seattle NY Signed Leases For Additional Restaurants

Appendix 19

Adjusted EBITDA is not recognized under GAAP. We define Adjusted EBITDA as net income (loss) before net interest expense, income taxes, depreciation and amortization and consulting fees paid to a related party. We also exclude non-recurring items, such as gain on extinguishment of debt, and Restaurant Revitalization Fund, or RRF, grants, employee retention credits, litigation accruals, aborted deferred IPO costs written off and non-cash lease expenses. Adjusted EBITDA is intended as a supplemental measure of our performance that is neither required by, nor presented in accordance with, GAAP. We are presenting Adjusted EBITDA because we believe that it provides useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. We believe that the use of Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of this measure may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion. Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using this non-GAAP measure on a supplemental basis. Restaurant-Level Adjusted EBITDA is intended as a supplemental measure of our performance that is neither required by, nor presented in accordance with, GAAP. Restaurant-Level Adjusted EBITDA is revenue less recurring expenses incurred at the restaurants, such as food costs, payroll and benefits costs, occupancy and operating expenses, but excluding restaurant-level depreciation and amortization and preopening costs. Restaurant-Level Adjusted EBITDA Margin is the calculation of Restaurant-Level Adjusted EBITDA divided by revenue. We believe that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results, as this measure depicts normal, recurring cash operating expenses essential to supporting the operations of our restaurants. We expect Restaurant-Level Adjusted EBITDA to increase in proportion to the number of new restaurants we open and with our comparable restaurant sales growth. However, you should be aware that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are financial measures which are not indicative of overall results for our company, and Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin in the same fashion. Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Non-GAAP Financial Measures 20

Non-GAAP Financial Measures 21 The following tables reconcile revenue to Restaurant-Level Adjusted EBITDA and net income to Adjusted EBITDA for the years ended December 31, 2022, December 31, 2021, December 31, 2020, Year-to-date as of June 30, 2022 and 2023 and Last Twelve Months as of June 30, 2023 respectively:

Non-GAAP Financial Measures 22 The following tables reconcile revenue to Restaurant-Level Adjusted EBITDA and net income to Adjusted EBITDA for each quarter of 2020, 2021, 2022 and 2023 respectively:

Additional Financial Metrics and Other Data “Average Unit Volume” or “AUV” means the average annual restaurant sales for all restaurants open for a full 18 months before the end of the period measured. We have not made any adjustments to exclude restaurants in 2021 that experienced temporary closures and mandated capacity limitations caused by the COVID-19 pandemic “Cash-On-Cash Returns” means Restaurant-Level Adjusted EBITDA divided by Net Build-Out Costs “Net Build-Out Costs” means all capitalized construction and construction-related costs plus pre-opening costs associated with a new restaurant; less tenant improvement allowances provided by the landlord “Payback Period” means the length of time, in years, required to recoup Net Build-Out Costs after the restaurant opening date “Restaurant-Level Adjusted EBITDA” means Income (loss) from operations plus adjustments to add-back the following expenses: depreciation and amortization, pre-opening costs, general and administrative expenses, related party consulting fees, management fees and non-cash lease expense. “Restaurant-Level Adjusted EBITDA Margin” means Restaurant-Level Adjusted EBITDA divided by revenue. “Comparable Restaurant Sales Growth” means change in year-over-year sales for the comparable restaurant base. A restaurant is considered “comparable” if it has been in operation for at least 18 full months prior to the accounting period presented. Once a restaurant has been open 18 full months, it must have had continuous operations during both the current period and the prior year period being measured to remain a comparable restaurant. 23

Investor Relations Contact 24 Investor Relations Contact: Jeff Priester ICR investor@genbbqoffice.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

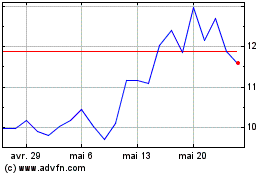

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

GEN Restaurant (NASDAQ:GENK)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025