As filed with the Securities and Exchange Commission

on December 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Oriental Culture Holding LTD

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Room 1402, Richmake Commercial Building

198-200 Queen’s Road Central, Hong Kong

Tel: 852-2110-3909

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Phone: (800) 221-0102

Fax: (800) 944-6607

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Jeffrey Li

FisherBroyles, LLP

1200 G Street NW, Suite 800

Washington, D.C. 20005

(202) 830-5905

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of the registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED december 5, 2024

PRELIMINARY PROSPECTUS

14,000,000 Ordinary Shares

14,000,000 Ordinary Shares Issuable Upon Exercise

of Outstanding Warrants

Offered by the Selling Shareholders of

Oriental Culture Holding LTD.

This prospectus relates to

the offer and sale of up to: (i)14,000,000 ordinary shares of the Company, par value $0.00025 (“Shares”) and (ii)14,000,000

ordinary shares, par value $0.00025 (“Warrant Shares”), issuable upon the exercise of warrants at an exercise price of $0.50

per share (the “Warrants”). We issued the Shares and Warrants in connection with a private placement closed on July 9, 2024.

The Shares and Warrant Shares issuable upon exercise of Warrants may be offered for sale from time to time by the Selling Shareholders.

We will receive proceeds from any cash exercises of the warrants described above, but not from the sale of the underlying shares.

We are not selling any ordinary

shares included in this prospectus and will not receive any of the proceeds from the sale of any ordinary shares by the selling shareholder

pursuant to this prospectus. If any ordinary shares are sold, the selling shareholder will pay any underwriting or brokerage commissions

and/or similar charges incurred for the sale of such shares. We will bear all other costs, fees and expenses incurred in effecting the

registration of ordinary shares covered by this prospectus, including all registration and filing fees and fees and expenses of our counsel

and accountants.

We are a holding company incorporated

in the Cayman Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our business

through our operating subsidiaries in Hong Kong and VIE and its subsidiaries in China. The securities offered in this prospectus are securities

of our Cayman Islands holding company, and we do not have any equity ownership of the VIE, instead we receive the economic benefits of

the VIE’s business operations and become the primary beneficiary of the VIE for accounting purposes through certain contractual

arrangements. VIE structure is used to provide investors with exposure to foreign investment in China-based companies where the business

of the operating companies in China might be prohibited or restricted for foreign investment now or in the future. Investors of our ordinary

shares will not own any equity interests in the VIE and may never hold equity interests in our Chinese operating companies, but instead

own shares of a Cayman Islands holding company. We treat the VIE and its subsidiaries as our consolidated affiliated entities for accounting

purposes under U.S. GAAP and not the entities in which we own equity interest.

There

are legal and operational risks associated with being based in and having a substantial majority of operations in China and Hong Kong.

These risks could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or

completely hinder our ability to offer or continue to offer securities to investors and cause the value of our shares to significantly

decline or be worthless. In the past few years, the PRC government initiated a series of regulatory actions and statements to regulate

business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope

of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist

Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities

in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant

governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over

China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws.

On February 15, 2022, Cybersecurity Review Measures published by Cyberspace Administration of China or the CAC, National Development and

Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry

of Finance, Ministry of Commerce, People’s Bank of China, State Administration of Radio and Television, China Securities Regulatory

Commission (“CSRC”), State Secrecy Administration and State Cryptography Administration became effective, which provides that,

Critical Information Infrastructure Operators (“CIIOs”) that intend to purchase internet products and services and Online

Platform Operators engaging in data processing activities that affect or may affect national security shall be subject to the cybersecurity

review by the Cybersecurity Review Office. On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft

for Public Comments), or the “Cyber Data Security Measure (Draft)”, which requires cyberspace operators with personal information

of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. On July 7,

2022, CAC promulgated the Measures for the Security Assessment of Data Cross-border Transfer, effective on September 1, 2022, which requires

the data processors to apply for data cross-border security assessment coordinated by the CAC under the following circumstances: (i) any

data processor transfers important data to overseas; (ii) any critical information infrastructure operator or data processor who processes

personal information of over 1 million people provides personal information to overseas; (iii) any data processor who provides personal

information to overseas and has already provided personal information of more than 100,000 people or sensitive personal information of

more than 10,000 people to overseas since January 1st of the previous year; and (iv) other circumstances under which the data cross-border

transfer security assessment is required as prescribed by the CAC. On February 17, 2023, the CSRC released New Overseas Listing Rules

with five interpretive guidelines, which took effect on March 31, 2023. The New Overseas Listing Rules require Chinese domestic enterprises

to complete filings with CSRC and report related information under certain circumstances, such as: a) an issuer making an application

for initial public offering and listing in an overseas market; b) an issuer making an overseas securities offering after having been listed

on an overseas market; c) a domestic company seeking an overseas direct or indirect listing of its assets through single or multiple acquisition(s),

share swap, transfer of shares or other means. According to the Notice on Arrangements for Overseas Securities Offering and Listing by

Domestic Enterprises, published by the CSRC on February 17, 2023, a company that (i) has already completed overseas listing or (ii) has

already obtained the approval for the offering or listing from overseas securities regulators or exchanges but has not completed such

offering or listing before effective date of the new rules and also completes the offering or listing before September 30, 2023 are considered

as an existing listed company and is not required to make any filing until it conducts a new offering in the future. Furthermore, upon

the occurrence of any of the material events specified below after an issuer has completed its offering and listed its securities on an

overseas stock exchange, the issuer shall submit a report thereof to the CSRC within 3 business days after the occurrence and public disclosure

of the event: (i) change of control; (ii) investigations or sanctions imposed by overseas securities regulatory agencies or other competent

authorities; (iii) change of listing status or transfer of listing segment; or (iv) voluntary or mandatory delisting. The New Overseas

Listing Rules stipulate the legal consequences to the companies for breaches, including failure to fulfill filing obligations or filing

documents having false statement or misleading information or material omissions, which may result in a fine ranging from RMB1 million

to RMB10 million, and in cases of severe violations, the relevant responsible persons may also be barred from entering the securities

market. On February 24, 2023, the CSRC, the Ministry of Finance, the National Administration of State Secretes Protection and the

National Archives Administration released the Provisions on Strengthening the Confidentiality and Archives Administration Related to the

Overseas Securities Offering and Listing by Domestic Companies, or the Confidentiality and Archives Administration Provisions, which took

effect on March 31, 2023. PRC domestic enterprises seeking to offer securities and list in overseas markets, either directly or indirectly,

shall establish and improve the system of confidentiality and archives work, and shall complete approval and filing procedures with competent

authorities, if such PRC domestic enterprises or their overseas listing entities provide or publicly disclose documents or materials involving

state secrets and work secrets of state organs to relevant securities companies, securities service institutions, overseas regulatory

agencies and other entities and individuals. It further stipulates that (i) providing or publicly disclosing documents and materials which

may adversely affect national security or public interests, and accounting records or photocopies thereof to relevant securities companies,

securities service institutions, overseas regulatory agencies and other entities and individuals shall be subject to corresponding procedures

in accordance with relevant laws and regulations; and (ii) any working papers formed in the territory of the PRC by securities companies

and securities service agencies that provide domestic enterprises with securities services relating to overseas securities issuance and

listing shall be stored in the territory of the PRC, the outbound transfer of which shall be subject to corresponding procedures in accordance

with relevant laws and regulations. As of the date of this prospectus, these new laws and guidelines that became effective have not impacted

the Company’s ability to conduct its business, accept foreign investment or list on a U.S. or other foreign stock exchange except

for the filing requirement under New Overseas Listing Rules. The Company has timely filed with CSRC for its private placement offering

conducted after effectiveness of the New Overseas Listing Rules but has not received final clearance from CSRC as of the date of this

prospectus. We operate our online platform through our subsidiary in Hong Kong which are not subject to the laws and regulations of China,

and the VIE and its subsidiaries in China provide marketing, warehouse storage and technical maintenance services and they are not cyberspace

operators with personal information of more than 1 million users or activities that affect or may affect national security and they don’t

have documents and materials which may adversely affect national security or public interests. In addition, new rules and regulations

could be adopted and there are uncertainties in the interpretation and enforcement of existing laws and guidelines, which could materially

and adversely impact our business and financial outlook and may impact our ability to accept foreign investments or continue to list on

a U.S. or other foreign stock exchange. Any change in foreign investment regulations, and other policies in China or related enforcement

actions by China government could result in a material change in our operations and the value of our securities and could significantly

limit or completely hinder our ability to offer our securities to investors or cause the value of our securities to significantly decline

or be worthless.

Our ordinary shares are listed

on the Nasdaq Capital Market (“Nasdaq”) under the symbol “OCG.” The closing price of the ordinary shares on Nasdaq

on December 4, 2024 was $1.571 per share.

We are an “emerging

growth company” and a “foreign private issuer” as defined under U.S. federal securities laws and, as such, may

elect to comply with reduced public company reporting requirements for this and future filings. See “Prospectus Summary — Implications

of Being an Emerging Growth Company and Foreign Private Issuer.”

Investing in our

securities involves a high degree of risk. See the “Risk Factors” section beginning on page 8 of this prospectus, in any

applicable prospectus supplement and in our Securities and Exchange Commission (“SEC”) filings that are incorporated by

reference herein and in the documents incorporated by reference herein and therein.

Neither the Securities

and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _____, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is filed in

conjunction with a registration statement that we filed with the Securities and Exchange Commission. Under this registration process,

the selling shareholders may from time to time sell up to: (i)14,000,000 ordinary shares of the Company, par value $0.00025 and (ii)14,000,000

ordinary shares, par value $0.00025, issuable upon the exercise of warrants at an exercise price of $0.50 per share, in one or more offerings.

This prospectus provides you with a general description of the securities that our selling shareholders may offer. Specific information

about the offering may also be included in a prospectus supplement, which may update or change information included in this prospectus.

You should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where

You Can Find More Information.”

You should rely only on the

information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us

or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional

information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of,

any other information that others may provide. The selling shareholders are not making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus

or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed

since those dates.

Except as otherwise set forth

in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of these securities outside

the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United

States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering

of these securities and the distribution of this prospectus outside the United States.

As permitted by SEC rules

and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this

prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described

below under “Where You Can Find More Information.”

Unless the context otherwise

requires, all references in this prospectus to “Oriental Culture”, “OCG,” “we,” “us,”

“our,” “the Company,” “the “Registrant”, “holding company” or similar words refer

to Oriental Culture Holding LTD., together with our subsidiaries and consolidated VIE.

“China” or

the “PRC” are to the mainland China, excluding Taiwan and the special administrative regions of Hong Kong and Macau

for the purposes of this prospectus only.

PROSPECTUS SUMMARY

This prospectus summary highlights certain information

about us and selected information contained elsewhere in or incorporated by reference into this prospectus. This prospectus summary is

not complete and does not contain all of the information that you should consider before making an investment decision. For a more complete

understanding of the Company, you should read and consider carefully the more detailed information included or incorporated by reference

in this prospectus and any applicable prospectus supplement or amendment, including the factors described under the heading “Risk

Factors,” beginning on page 8 of this prospectus, as well as the information incorporated herein by reference, before making

an investment decision.

Overview

We were incorporated under the laws of the Cayman

Islands as an offshore holding company and we own 100% of the equity interest in Oriental Culture Development LTD (“Oriental Culture

BVI”), which was incorporated under the laws of British Virgin Islands.

Through Oriental Culture BVI, we own 100% of the

equity interest in HK Oriental Culture Investment Development Limited (“Oriental Culture HK”), a company formed under the

laws of Hong Kong. Through Oriental Culture HK, we own 100% of the equity interest in Nanjing Rongke Business Consulting Service Co.,

Ltd. (the “WFOE” or “Nanjing Rongke”), a wholly-owned PRC subsidiary of Oriental Culture HK. The WFOE entered

into a series of agreements with Jiangsu Yanggu Culture Development Co., Ltd. (“Jiangsu Yanggu” or “VIE”) and

Jiangsu Yanggu’s shareholders, through which we have satisfied conditions for consolidation of the VIE under U.S. GAAP as Jiangsu

Yanggu is considered a VIE under the Statement of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) 810 “Consolidation”, because the equity investments in Jiangsu Yanggu no longer have the characteristics

of a controlling financial interest, and the Company, through its WFOE, becomes the primary beneficiary of the VIE for accounting purposes.

We own 100% equity interest in China International

Assets and Equity of Artworks Exchange Limited (the “International Exchange”), a company incorporated under the laws of Hong

Kong. International Exchange provides an online platform to facilitate collectibles and artwork trading e-commerce. We own 100% equity

interest in HKDAEx Limited (“HKDAEx”), a company incorporated under laws of Hong Kong. HKDAEx provides our customers with

online trading platform for products and commodities other than collectible and artwork in Hong Kong prior to May 13, 2024. Starting from

May 13, 2024, the trading platform operated by HKDAEx merged with our main online platform for collectibles and artwork operated by the

International Exchange to better integrate our resources, reduce costs, and provide better customer services.

Nanjing Yanqing Information Technology Co., Ltd.,

(“Nanjing Yanqing”) and Nanjing Yanyu Information Technology Co., Ltd. (“Nanjing Yanyu”) are wholly-owned subsidiaries

of Jiangsu Yanggu in China. Their primary business is to provide technical and other support for online collectibles and art e-commerce

business for our Hong Kong subsidiaries, and to sell software applications and provide support services to our affiliates and third parties.

Kashi Longrui Business Management Services Co.,

Ltd. (“Kashi Longrui”) is a wholly-owned subsidiary of Nanjing Yanqing, and its primary business is to provide online and

offline marketing service for our e-commerce platform’s members and other related services.

Kashi Dongfang Cangpin Culture Development Co.,

Ltd. (“Kashi Dongfang”) is a wholly-owned subsidiary of Nanjing Yanqing and its primary focus is to provide online and offline

warehouse management services for our e-commerce platform’s registered members.

Zhongcang Warehouse Co., Ltd. (“Zhongcang”)

is a joint venture by Kashi Longrui with third parties namely Zhonglianxin Industry Group (Hunan) Co., Ltd., Nanjing Zhonghao Culture

Media Limited, and Zhengjiang Culture Tourism International Cultural and Creative Industry Park Development Co., Ltd. to provide warehouse

services to our customers. Kashi Longrui owned 18% of Zhongcang.

We, through our subsidiaries in Hong Kong are

an online provider of collectibles and artwork e-commerce services, which allow collectors, artists and art dealers and owners to access

a much bigger market where they can engage with a wider range of collectibles or artwork investors than they could likely encounter without

our platform. We currently facilitate trading by individual and institutional customers of all kinds of collectibles, artwork and certain

commodities on our leading online platform owned by our subsidiary in Hong Kong, namely the China International Assets and Equity of Artworks

Exchange Limited. We also provide online and offline integrated marketing, warehouse storage and technical maintenance services to our

customers through the VIE and its subsidiaries in China.

We are a holding company incorporated in the Cayman

Islands. Our securities offered in this prospectus are securities of our Cayman Islands holding company. As a holding company with no

material operations of our own, we conduct our business through our operating subsidiaries in Hong Kong and the VIE and its subsidiaries

in China. VIE structure is used to provide investors with exposure to foreign investment in China-based companies where the business of

the operating companies in China might be prohibited or restricted for foreign investment now or in the future. Investors of our ordinary

shares will not own any equity interests in the VIE and may never hold equity interests in our Chinese operating companies, but instead

own shares of a Cayman Islands holding company. Neither we nor our subsidiaries own any shares in the VIE, Jiangsu Yanggu. Instead, we

have satisfied conditions for consolidation of the VIE under U.S. GAAP and become the primary beneficiary of the VIE for accounting purposes

through a series of contractual arrangements (the “VIE Agreements”). We evaluated the guidance in FASB ASC 810 and determined

that Jiangsu Yanggu is a VIE. A VIE is an entity that has either a total equity investment that is insufficient to permit the entity to

finance its activities without additional subordinated financial support, or whose equity investors lack the characteristics of a controlling

financial interest, such as through voting rights, right to receive the expected residual returns of the entity or obligation to absorb

the expected losses of the entity. Our WFOE has the power to direct activities at Jiangsu Yanggu that most significantly impact Jiangsu

Yanggu’s economic performance, and has the right to receive benefits from Jiangsu Yanggu. As such, the WFOE is the primary beneficiary

of the VIE, for accounting purposes, based upon such contractual arrangements. Accordingly, under U.S. GAAP, the financial results of

the VIE are consolidated in our financial statements. In addition, these VIE agreements have not been truly tested in the courts in China.

Investors of our securities of will not own any equity interests in the VIE, but instead own shares of a Cayman holding company. Chinese

regulatory authorities could disallow the VIE structure, which would likely result in a material change in our operations and/or value

of our securities we are registering for sale, including that it could cause the value of our securities to significantly decline or become

worthless.

The VIE structure is subject to various risks.

For example, the contractual arrangements may not be as effective as direct ownership in providing us with control over Jiangsu Yanggu.

We expect to rely on the performance by the VIE shareholders of their respective obligations under the contracts to exercise our rights

over Jiangsu Yanggu. The VIE shareholders may not act in the best interests of our company or may not perform their obligations under

these contracts. Such risks will exist throughout the period in which we operate our business in China through the contractual arrangements.

If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations

of PRC law and arbitration, litigation or other legal proceedings which could be a lengthy process and very costly.

There are

legal and operational risks associated with being based in and having a substantial majority of operations in China and Hong Kong. These

risks could result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of our shares to significantly decline or

be worthless. In the past few years, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central

Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities

market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities

to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed

overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On February 15, 2022, Cybersecurity

Review Measures published by Cyberspace Administration of China or the CAC, National Development and Reform Commission, Ministry of Industry

and Information Technology, Ministry of Public Security, Ministry of State Security, Ministry of Finance, Ministry of Commerce, People’s

Bank of China, State Administration of Radio and Television, China Securities Regulatory Commission (“CSRC”), State Secrecy

Administration and State Cryptography Administration became effective, which provides that, Critical Information Infrastructure Operators

(“CIIOs”) that intend to purchase internet products and services and Online Platform Operators engaging in data processing

activities that affect or may affect national security shall be subject to the cybersecurity review by the Cybersecurity Review Office.

On November 14, 2021, CAC published the Administration Measures for Cyber Data Security (Draft for Public Comments), or the “Cyber

Data Security Measure (Draft)”, which requires cyberspace operators with personal information of more than 1 million users who want

to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. On July 7, 2022, CAC promulgated the Measures for

the Security Assessment of Data Cross-border Transfer, effective on September 1, 2022, which requires the data processors to apply for

data cross-border security assessment coordinated by the CAC under the following circumstances: (i) any data processor transfers important

data to overseas; (ii) any critical information infrastructure operator or data processor who processes personal information of over 1

million people provides personal information to overseas; (iii) any data processor who provides personal information to overseas and has

already provided personal information of more than 100,000 people or sensitive personal information of more than 10,000 people to overseas

since January 1st of the previous year; and (iv) other circumstances under which the data cross-border transfer security assessment

is required as prescribed by the CAC. On February 17, 2023, the CSRC released New Overseas Listing Rules with five interpretive guidelines,

which took effect on March 31, 2023. The New Overseas Listing Rules require Chinese domestic enterprises to complete filings with CSRC

and report related information under certain circumstances, such as: a) an issuer making an application for initial public offering and

listing in an overseas market; b) an issuer making an overseas securities offering after having been listed on an overseas market; c)

a domestic company seeking an overseas direct or indirect listing of its assets through single or multiple acquisition(s), share swap,

transfer of shares or other means. According to the Notice on Arrangements for Overseas Securities Offering and Listing by Domestic Enterprises,

published by the CSRC on February 17, 2023, a company that (i) has already completed overseas listing or (ii) has already obtained the

approval for the offering or listing from overseas securities regulators or exchanges but has not completed such offering or listing before

effective date of the new rules and also completes the offering or listing before September 30, 2023 are considered as an existing listed

company and is not required to make any filing until it conducts a new offering in the future. Furthermore, upon the occurrence of any

of the material events specified below after an issuer has completed its offering and listed its securities on an overseas stock exchange,

the issuer shall submit a report thereof to the CSRC within 3 business days after the occurrence and public disclosure of the event: (i)

change of control; (ii) investigations or sanctions imposed by overseas securities regulatory agencies or other competent authorities;

(iii) change of listing status or transfer of listing segment; or (iv) voluntary or mandatory delisting. The New Overseas Listing

Rules stipulate the legal consequences to the companies for breaches, including failure to fulfill filing obligations or filing documents

having false statement or misleading information or material omissions, which may result in a fine ranging from RMB1 million to RMB10

million, and in cases of severe violations, the relevant responsible persons may also be barred from entering the securities market. On

February 24, 2023, the CSRC, the Ministry of Finance, the National Administration of State Secretes Protection and the National Archives

Administration released the Provisions on Strengthening the Confidentiality and Archives Administration Related to the Overseas Securities

Offering and Listing by Domestic Companies, or the Confidentiality and Archives Administration Provisions, which took effect on March

31, 2023. PRC domestic enterprises seeking to offer securities and list in overseas markets, either directly or indirectly, shall establish

and improve the system of confidentiality and archives work, and shall complete approval and filing procedures with competent authorities,

if such PRC domestic enterprises or their overseas listing entities provide or publicly disclose documents or materials involving state

secrets and work secrets of state organs to relevant securities companies, securities service institutions, overseas regulatory agencies

and other entities and individuals. It further stipulates that (i) providing or publicly disclosing documents and materials which may

adversely affect national security or public interests, and accounting records or photocopies thereof to relevant securities companies,

securities service institutions, overseas regulatory agencies and other entities and individuals shall be subject to corresponding procedures

in accordance with relevant laws and regulations; and (ii) any working papers formed in the territory of the PRC by securities companies

and securities service agencies that provide domestic enterprises with securities services relating to overseas securities issuance and

listing shall be stored in the territory of the PRC, the outbound transfer of which shall be subject to corresponding procedures in accordance

with relevant laws and regulations. As of the date of this prospectus, these new laws and guidelines that became effective have not impacted

the Company’s ability to conduct its business, accept foreign investment or list on a U.S. or other foreign stock exchange except

for the filing requirement under New Overseas Listing Rules. The Company has timely filed with CSRC for its private placement offering

conducted after effectiveness of the New Overseas Listing Rules but has not received final clearance from CSRC as of the date of this

prospectus. We operate our online platform through our subsidiary in Hong Kong which are not subject to the laws and regulations of China,

and the VIE and its subsidiaries in China provide marketing, warehouse storage and technical maintenance services and they are not cyberspace

operators with personal information of more than 1 million users or activities that affect or may affect national security and they don’t

have documents and materials which may adversely affect national security or public interests. In addition, new rules and regulations

could be adopted and there are uncertainties in the interpretation and enforcement of existing laws and guidelines, which could materially

and adversely impact our business and financial outlook and may impact our ability to accept foreign investments or continue to list on

a U.S. or other foreign stock exchange. Any change in foreign investment regulations, and other policies in China or related enforcement

actions by China government could result in a material change in our operations and the value of our securities and could significantly

limit or completely hinder our ability to offer our securities to investors or cause the value of our securities to significantly decline

or be worthless.

Impact of investigation and charge against

Nanjing Jinwang

On July

1, 2022, Mr. Huajun Gao and Mr. Aiming Kong, each a shareholder of Oriental Culture Holding LTD (the “Company”), were detained

by Nan County Public Safety Bureau of Yiyang City, Hunan Province, China. On July 26, 2022, Nan County People’s Procuratorate (“NCPP”)

approved the arrest of Mr. Gao and Mr. Kong with charge of illegal business operation of Nanjing Jinwang Art Purchase E-commerce Co.,

Ltd., a company controlled by Mr. Gao and Mr. Kong (“Nanjing Jinwang”) and prosecuted them. The Court had the trial in January

2024 and both of them are currently released on bail waiting for the judgement of the Court.

On July

1, 2022, the bank accounts of Nanjing Jinwang were frozen by Nan County Public Safety Bureau, including a trust account into which the

customers of the Company deposit their security deposits in order to trade on the Company’s online trading platform which the Company

has entrusted Nanjing Jinwang for escrow.

Also, on

July 1, 2022, Nan County Public Safety Bureau froze certain bank accounts of Kashi Longrui Business Management Services Co., Ltd. (“Kashi

Longrui”), Kashi Dongfang Cangpin Culture Development Co., Ltd. (“Kashi Dongfang”) and Nanjing Yanyu Information Technology

Co., Ltd. (“Nanjing Yanyu”), all subsidiaries of Jiangsu Yanggu Culture Development Co., Ltd., the variable interest entity

of the Company in China because they, each had business relationship with Nanjing Jinwang.

Neither

the Company nor its VIE or subsidiaries of its VIE has received any notification for enforcement charges from Nan County Public Safety

Bureau, other than cash and short-term investment in the frozen bank accounts with balances totaling approximately $17.3 million and due

from Nangjng Jinwang of approximately $0.1 million relating to the Nanjing Jinwang investigation as described above as of June 30, 2024.

Currently the customers can freely transfer their deposits and make their withdrawals based on their actual needs. Mr. Gao and Mr. Kong

are not officers, directors or employees of the Company, its VIE or subsidiaries of the VIE.

Due to the

Nanjing Jinwang case and frozen bank accounts, the business operations of the Company have been materially and negatively impacted as

its customers experienced difficulties withdrawing their security deposits through online banking and have concerns regarding their deposited

funds. The Company has taken remedial measures to assist its customers in withdrawing security deposits, such as through manual and in

person application with the bank to transfer funds, so that they will have confidence in the Company and continue to list and trade art

and collectible products on the online platforms of the Company. However, the Company’s business has been material and negatively

impacted and there can be no assurance that the Company will be able to restore customer confidence in using the Company’s services

efficiently or at all.

The Company has

and will continue to communicate with Nan County Public Safety Bureau and other government authorities to obtain more information

regarding the investigation and to attempt to unfreeze the bank accounts for the subsidiaries of the VIE. The Company will monitor the

development of the case and will provide additional information concerning its impact on the Company’s business in due course.

This investigation

and case against Nanjing Jinwang and slow recovery of Chinese economy after COVID-19 have negative impacted on our revenue and net income

for the six months ended June 30, 2024. Our revenue decreased approximately $0.4 million from approximately $0.8 million for the six months

ended June 30, 2023 to approximately $0.4 million for the same period of 2024.

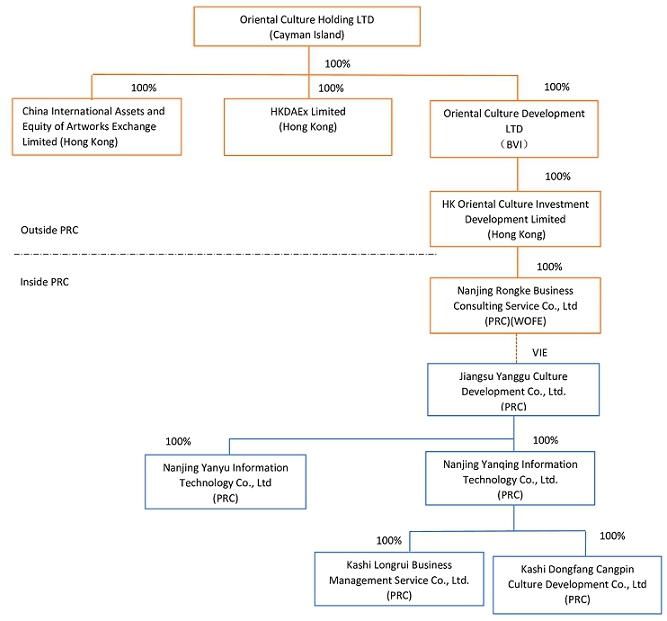

Our Organizational Structure

The Company’s organizational chart as of

the date of this prospectus is as follows:

Variable Interest Entity Arrangements

In establishing our business, we have used a variable

interest entity, or VIE, structure. In the PRC, investment activities by foreign investors are principally governed by Special Administrative

Measures (Negative List) for Foreign Investment Access, which was promulgated and is amended from time to time by the PRC Ministry of

Commerce, or MOFCOM, and the PRC National Development and Reform Commission, or NDRC. Our Company and the WFOE are considered as foreign

investors or foreign invested enterprises under PRC law. These contractual arrangements with our variable interest entity and its shareholders

enable us to satisfy conditions for consolidation of the VIE under U.S. GAAP as Jiangsu Yanggu is considered a VIE under the Statement

of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810 “Consolidation”,

because the equity investments in Jiangsu Yanggu no longer have the characteristics of a controlling financial interest, and the Company,

through its WFOE, becomes the primary beneficiary of the VIE for accounting purposes.

The WFOE effectively assumed management of the

business activities of our variable interest entity through a series of agreements which are referred to as the VIE Agreements, including

a Technical Consultation and Service Agreement, a Business Cooperation Agreement, an Equity Pledge Agreement, an Equity Option Agreement,

and a Voting Rights Proxy and Financial Supporting Agreement. Through the VIE Agreements, the WFOE has the right to advise, consult, manage

and operate the variable interest entity for an annual consulting service fee in the amount of 100% of the variable interest entity’s

net profit. The shareholders of the variable interest entity have pledged all of their right, title and equity interest in the variable

interest entity as security for the WFOE to collect consulting services fees provided to the variable interest entity through the Equity

Pledge Agreement. In addition, the variable interest entity’s shareholders have granted the WFOE an exclusive right and option to

acquire all of their equity interests in the variable interest entity through the Equity Option Agreement.

The material terms of the

VIE Agreements by WFOE, Jiangsu Yanggu and its shareholders are as follows:

Technical Consultation and Service Agreement. Pursuant to the

Technical Consultation and Service Agreement between the WFOE and Jiangsu Yanggu dated May 8, 2019, the WFOE has the exclusive right to

provide consultation and services to Jiangsu Yanggu in the areas of funding, human resources, technology and intellectual property rights.

For such services, Jiangsu Yanggu agrees to pay service fees in the amount of 100% of its net income and also has the obligation to absorb

100% of its own losses. The WFOE exclusively owns any intellectual property rights arising from the performance of this Technical Consultation

and Service Agreement. The amount of service fees and the payment term can be amended by the WFOE with Jiangsu Yanggu’s consultation

and implementation. The term of the Technical Consultation and Service Agreement is 20 years. The WFOE may terminate this agreement at

any time by giving 30 days’ written notice to Jiangsu Yanggu.

Equity Pledge Agreement. Pursuant to those

Equity Pledge Agreements among the WFOE, Jiangsu Yanggu and Jiangsu Yanggu’s shareholders dated May 8, 2019, amended on January

28, 2021 (collectively, the “Pledge”), each of Jiangsu Yanggu’s shareholders pledged all of its equity interests in

Jiangsu Yanggu to the WFOE to guarantee Jiangsu Yanggu’s performance of relevant obligations and indebtedness under the Technical

Consultation and Service Agreement and other VIE agreements (collectively, the “VIE Agreement”). If Jiangsu Yanggu breaches

its obligations under the VIE Agreement, the WFOE, as pledgee, will be entitled to certain rights, including the right to dispose of the

pledged equity interests in order to recover the damages associated with such breaches. The Pledge shall be continuously valid until all

of Jiangsu Yanggu’s shareholders are no longer shareholders of Jiangsu Yanggu, or until the satisfaction of all Jiangsu Yanggu’s

obligations under the VIE Agreement.

Equity Option Agreement. Pursuant

to those Equity Option Agreements among the WFOE, Jiangsu Yanggu and Jiangsu Yanggu’s shareholders dated May 8, 2019, amended on

January 28, 2021, WFOE has the exclusive right to require that Jiangsu Yanggu’s shareholders fulfill and complete all approval and

registration procedures required under PRC laws for the WFOE to purchase, or designate one or more persons to purchase, such shareholders’

equity interests in Jiangsu Yanggu, in one or multiple transactions, at any time or from time to time, at the WFOE’s sole and absolute

discretion. The purchase price shall be the lowest price allowed by PRC laws. The Equity Option Agreements shall remain effective until

all of the equity interests owned by Jiangsu Yanggu’s shareholders have been legally transferred to the WFOE or its designee(s).

Voting Rights Proxy and Financial Supporting

Agreement. Pursuant to those Voting Rights Proxy and Financial Supporting Agreements among the WFOE, Jiangsu Yanggu and Jiangsu

Yanggu’s shareholders dated May 8, 2019, amended on January 28, 2021, Jiangsu Yanggu’s shareholders irrevocably appointed

the WFOE or the WFOE’s designee to exercise all of his or her rights as a shareholder of Jiangsu Yanggu under the Articles of Association

of Jiangsu Yanggu, including but not limited to the power to exercise all such shareholder’s voting rights with respect to all matters

to be discussed and voted in Jiangsu Yanggu shareholder meetings. The term of the Voting Rights Proxy and Financial Supporting Agreements

is 20 years.

Although the VIE Contractual Arrangements have

been widely adopted by PRC companies seeking for listing aboard, such arrangements have not been truly tested in any of the PRC courts.

This type of corporate structure may affect you and the value of your investment in the Company including that the Company may incur substantial

costs to enforce the terms of the VIE arrangements. The PRC legal system could limit our ability to enforce the VIE agreements, through

arbitration, litigation, and other legal proceedings, which could limit our ability to enforce the VIE agreements and consolidate the

VIE under U.S. GAAP. Furthermore, these contracts may not be enforceable in the PRC if the PRC government authorities or courts take a

view that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event

we are unable to enforce the VIE agreements or assert our contractual rights over the business and assets of VIE and its subsidiaries

that conduct our operations, our securities may decline in value or become worthless.

Corporate Information

Our principal executive office is located on the

Room 1402, Richmake Commercial Building, 198-200 Queen’s Road Central, Hong Kong. Our telephone number is +852-21103909. We maintain

a website at www.ocgroup.hk that contains information about our Company, though no information contained on our website is part of this

prospectus.

Securities Purchase Agreement

On May 31, 2024, the Company entered into a Securities

Purchase Agreement (the “Agreement”) with the selling shareholders identified in this prospectus (the “Purchasers”),

pursuant to which the Company agreed to sell to the Purchasers in a private placement 14,000,000 ordinary shares (the “Shares”)

of the Company, at a purchase price of $0.50 per share for an aggregate price of $7,000,000 (the “Private Placement”). In

connection with offering, the Company has also agreed to issue the warrants to the Purchasers to purchase up to an aggregate of 14,000,000

ordinary shares at an exercise price of $0.50 per share (the “Warrants”). The Warrants have a term of two years and are exercisable

by the holder at any time on or after six months after the issuance date. The Private Placements was completed on July 9, 2024, pursuant

to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as amended.

Transfer Agent and Registrar

The transfer agent and registrar for our Ordinary

Shares is VStock Transfer, LLC at 18 Lafayette Place, Woodmere, New York 11598.

NASDAQ Capital Market Listing

Our Ordinary Shares are listed on the NASDAQ Capital

Market under the symbol “OCG”

About

This Offering

The selling shareholders identified in this prospectus are offering

on a resale basis up to 28,000,000 ordinary shares of the Company.

Securities Offered by the Selling

Shareholders |

Up to 14,000,000 ordinary shares and up to 14,000, 000 ordinary shares issuable upon the exercise of the Warrants. |

| |

|

| Use of Proceeds |

We will not receive any proceeds from the offering of the Shares and

Warrant Shares by the Selling Shareholders. See “Use of Proceeds” on page 10. |

| |

|

| Risk Factors |

See “Risk Factors” on page 8 and other information we include or incorporate by reference in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

| |

|

| Trading market and symbol |

The Company’s ordinary shares are traded on the Nasdaq Capital Market under the symbol “OCG.” |

RISK FACTORS

Investing in our securities involves a high degree

of risk. You should carefully consider the risk factors set forth under “Risk Factors” described in our most recent annual

report on Form 20-F, filed on April 25, 2024, as supplemented and updated by subsequent current reports on Form 6-K that we have

filed with the SEC, together with all other information contained or incorporated by reference in this prospectus and any applicable

prospectus supplement, before making an investment decision. Each of the risk factors could materially and adversely affect our business,

operating results, financial condition and prospects, as well as the value of an investment in our securities, and the occurrence of

any of these risks might cause you to lose all or part of your investment.

Nan County Public Safety Bureau has frozen

certain bank accounts of the subsidiaries of Jiangsu Yanggu due to the investigation of major shareholders of the Company and its related

party Nanjing Jinwang which has and could continue to materially and negatively impact the business operations and financial results of

the Company..

On July 1, 2022, Mr. Huajun Gao and Mr. Aiming

Kong, each was a major shareholder of the Company, were detained by Nan County Public Safety Bureau of Yiyang City, Hunan Province, China.

On July 26, 2022, Nan County People’s Procuratorate (“NCPP”) approved the arrest of Mr. Gao and Mr. Kong, charging them

with assisting in illegal online business operation of Nanjing Jinwang Art Purchase E-commerce Co., Ltd. (“Nanjing Jinwang”)

and prosecuted them to Nan County People’s Court (the “Court”) in August 2023. The Court had the trial in January 2024

and both of them are currently released on bail waiting for the judgement of the Court.

On July 1, 2022, the bank accounts of Nanjing

Jinwang were frozen by Nan County Public Safety Bureau, including a trust account into which the customers of the Company deposit their

security deposits in order to trade on the Company’s online trading platform which the Company has entrusted Nanjing Jinwang for

escrow.

Also, on July 1, 2022, Nan County Public Safety

Bureau froze certain bank accounts of Kashi Longrui Business Management Services Co., Ltd. (“Kashi Longrui”), Kashi Dongfang

Cangpin Culture Development Co., Ltd. (“Kashi Dongfang”) and Nanjing Yanyu Information Technology Co., Ltd. (“Nanjing

Yanyu”), all subsidiaries of Jiangsu Yanggu Culture Development Co., Ltd., the variable interest entity of the Company in China

(the “VIE”) because they, each had business relationship with Nanjing Jinwang.

Neither the Company nor its VIE or subsidiaries

of its VIE has received any notification for enforcement charges from Nan County Public Safety Bureau, other than cash and short-term

investment in the frozen bank accounts with balances totaling approximately $17.3 million and due from Nangjng Jinwang of approximately

$0.1 million relating to the Nanjing Jinwang investigation as described above as of June 30, 2024. Currently the customers can freely

transfer their deposits and make their withdrawals based on their actual needs. Mr. Gao and Mr. Kong are not officers, directors or employees

of the Company, its VIE or subsidiaries of the VIE.

Due to the Nanjing Jinwang case and frozen bank

accounts, the business operations of the Company have been materially and negatively impacted as its customers experienced difficulties

withdrawing their security deposits through online banking and had concerns regarding their deposited funds. The frozen accounts of the

subsidiaries of the VIE have also negatively impacted cash flow for these companies although they have other bank accounts that operate

normally for their daily business operations. The Company has taken remedial measures to assist its customers in withdrawing security

deposits, such as through manual and in person application with the bank to transfer funds, so that they will have confidence in the Company

and continue to list and trade art and collectible products on the online platform of the Company. Currently the customers can freely

transfer their deposits out of the trust account. The Company has also taken measures to reduce the cost and expenses for the subsidiaries

of the VIE to respond to cash flow issues. However, there can be no assurance that these measures will restore customer confidence in

using the Company’s services efficiently or at all and the Company cannot reasonably estimate when the bank accounts for the subsidiaries

of the VIE will be unfrozen by the Nan County Public Safety Bureau.

NCPP has prosecuted Mr. Gao and Mr. Kong

to the Court and the Court had the trial in January 2024 and both of them are currently released on bail waiting for the judgement of

the Court. The Company has and will continue to communicate with Nan County Public Safety Bureau and other government authorities

to obtain more information regarding the development of the case and to attempt to unfreeze the bank accounts for the subsidiaries of

the VIE. Although neither the Company, nor its VIE or subsidiaries of its VIE has received any notification from Nan County Public Safety

Bureau indicating it is a part of the current case, we cannot assure you that they won’t be subject to the investigation in the

future, if that happens, we might face penalties, negative publicity and loss of business which could which will materially and adversely

affect our business operations and financial results.

In addition,

if Mr. Gao and Mr. Kong are convicted for any crimes that are disruptive to the order of the socialist market economy and are considered

as controlling persons for the domestic operating companies in China under the New Overseas Listing Rules, it could significantly limit

or completely hinder our ability to offer or continue to offer our securities to investors and cause the value of our securities to significantly

decline or become worthless.

A filing with the China Securities Regulatory

Commission (“CSRC”) is required in connection with any offering under New Overseas Listing Rules, and we cannot assure you

that we will be able to timely make such filing or eventually receive the final clearance from CSRC, in which case we may face sanctions

by the CSRC or other PRC regulatory agencies for failure to timely file with the CSRC for this offering..

On February

17, 2023, the CSRC released New Overseas Listing Rules with five interpretive guidelines, which took effect on March 31, 2023. The New

Overseas Listing Rules require Chinese domestic enterprises to complete filings with CSRC and report related information under certain

circumstances, such as: a) an issuer making an application for initial public offering and listing in an overseas market; b) an issuer

making an overseas securities offering after having been listed on an overseas market; c) a domestic company seeking an overseas direct

or indirect listing of its assets through single or multiple acquisition(s), share swap, transfer of shares or other means. According

to the Notice on Arrangements for Overseas Securities Offering and Listing by Domestic Enterprises, published by the CSRC on February

17, 2023, a company that (i) has already completed overseas listing or (ii) has already obtained the approval for the offering or listing

from overseas securities regulators or exchanges but has not completed such offering or listing before effective date of the new rules

and also completes the offering or listing before September 30, 2023 are considered as an existing listed company and is not required

to make any filing until it conducts a new offering in the future. Furthermore, upon the occurrence of any of the material events specified

below after an issuer has completed its offering and listed its securities on an overseas stock exchange, the issuer shall submit a report

thereof to the CSRC within 3 business days after the occurrence and public disclosure of the event: (i) change of control; (ii) investigations

or sanctions imposed by overseas securities regulatory agencies or other competent authorities; (iii) change of listing status or transfer

of listing segment; or (iv) voluntary or mandatory delisting. The New Overseas Listing Rules stipulate the legal consequences to

the companies for breaches, including failure to fulfill filing obligations or filing documents having false statement or misleading

information or material omissions, which may result in a fine ranging from RMB1 million to RMB10 million, and in cases of severe violations,

the relevant responsible persons may also be barred from entering the securities market. The Company has timely filed with CSRC for its

private placement offering conducted after effectiveness of the New Overseas Listing Rules but has not received final clearance from

CSRC as of the date of this prospectus. In addition, new rules and regulations could be adopted and there are uncertainties in the interpretation

and enforcement of existing laws and guidelines, which could materially and adversely impact our business and financial outlook and may

impact our ability to accept foreign investments or continue to list on a U.S. or other foreign stock exchange. Any change in foreign

investment regulations, and other policies in China or related enforcement actions by China government could result in a material change

in our operations and the value of our securities and could significantly limit or completely hinder our ability to offer our securities

to investors or cause the value of our securities to significantly decline or be worthless.

Our ordinary shares

may be delisted from the NASDAQ Stock Market (“NASDAQ”).

On November 9, 2022, the Company received a letter

from the Nasdaq Stock Market (“Nasdaq”) notifying the Company that, because the closing bid price for the Company’s

ordinary shares listed on Nasdaq was below $1.00 for 30 consecutive trading days, the Company no longer meets the minimum bid price requirement

for continued listing on Nasdaq under Nasdaq Marketplace Rule 5550(a)(2), which requires a minimum bid price of $1.00 per share

(the “Minimum Bid Price Requirement”).

The notification has no immediate effect on the

listing of the Company’s ordinary shares. In accordance with Nasdaq Marketplace Rule 5810(c)(3)(A), the Company had a period of

180 calendar days from the date of notification, until May 8, 2023 (the “Compliance Period”), to regain compliance with the

Minimum Bid Price Requirement. On May 10, 2023, the Company received a written notification from the NASDAQ Stock Market

Listing Qualifications Staff (the “Staff”) indicating that the Company had been granted an additional 180 calendar day period

or until November 6, 2023, to regain compliance with the $1.00 minimum closing bid price requirement for continued listing on the NASDAQ

Capital Market pursuant to NASDAQ Listing Rule.

On October 10, 2023, the shareholders of the Company

approved the resolution of a share consolidation (the “Share Consolidation”) of the issued and authorized ordinary shares

of the Company at a ratio between one (1)-for-three (3) and one (1)-for-ten (10), accompanied by a corresponding increase in the

par value of the ordinary shares, with the exact ratio to be set at a whole number within this range and at such time and date after the

passing of the resolution but before October 18, 2023, to be determined by the Board of Directors of the Company (the “Board”)

in its discretion. On October 10, 2023, the Board determined the ratio for Share Consolidation to be one (1)- for five -(5). The Share

Consolidation is primarily being effectuated to regain compliance with Nasdaq Marketplace Rule 5550(a)(2) related to the minimum bid price

per share of the Company’s ordinary shares.

On November 1, 2023, the Company received a written

notification from Nasdaq’s Listing Qualifications Department stating that the closing bid price of the Company’s common stock

has been $1.00 per share or greater for 10 consecutive trading days, from October 18, 2023 to October 31, 2023. Accordingly, the Company

has regained compliance with Nasdaq Listing Rule 5550(a)(2).

FORWARD-LOOKING STATEMENTS

Some of the statements

contained or incorporated by reference in this prospectus may be “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act and may involve

material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,”

“will,” “should,” “believe,” “might,” “expect,” “anticipate,”

“intend,” “plan,” “estimate” and similar words, although some forward-looking statements are expressed

differently.

Although we believe that

the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance

and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results to differ materially

from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only as of the date on

which they are made and except as required by law, we undertake no obligation to publicly release the results of any revision or update

of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one

or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto or

with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and

events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and in the “Risk

Factors” section of this prospectus.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the Shares and Warrant Shares covered by this prospectus. The selling shareholders will receive all of the proceeds. However, we may

receive proceeds from the exercise of the Warrants by the selling shareholder to the extent they are exercised for cash. We estimate that

the maximum proceeds that we may receive from the exercise of the Warrants, assuming the Warrants are exercised for cash at an exercise

price of $0.5 per share, will be approximately $7 million. We do not know, however, whether the Warrants will be exercised or, if the

Warrants are exercised, when it will be exercised. It is possible that the Warrants will expire and never be exercised. There are also

circumstances under which the Warrants may be exercised on a cashless basis. In these circumstances, even if the Warrants are exercised,

we may not receive any proceeds, or the proceeds that we do receive may be significantly less than what we might expect. However, we will

pay all costs, fees and expenses incurred in connection with the registration of the Shares and Warrant Shares covered by this prospectus.

DESCRIPTION OF SHARE CAPITAL

The following is a summary of our share capital

and certain provisions of our current Memorandum and Articles of Association. This summary does not purport to be complete and is qualified

in its entirety by the provisions of our current Memorandum and Articles of Association and applicable provisions of the laws of the Cayman

Islands. You are encouraged to read the relevant provisions of the Companies Act and of our current Memorandum and Articles of Association

as they relate to the following summary.

See “Where You Can Find More Information”

elsewhere in this prospectus for information on where you can obtain copies of our current Memorandum and Articles of Association, which

have been filed with and are publicly available from the SEC.

Our authorized share capital is $50,000.00 divided

into 280,000,000 shares comprising of (i) 180,000,000 ordinary shares of a nominal or par value of $0.00025 each; and (ii) 100,000,000

preferred shares of a nominal or par value of $0.00005 each.

SELLING SHAREHOLDERS

The ordinary shares of being offered by the selling

shareholders listed below were issued in, or are underlying the Warrants issued in connection with a private placement which closed on

July 9, 2024. Other than the relationship between our company and the selling shareholders as described below under “Securities

Purchase Agreement”, to our knowledge, no material relationships exist between the selling shareholders and us nor have any such

material relationships existed within the past three years.

We are registering the Shares and Warrant Shares

to permit the Selling Shareholders and their pledgees, donees, assignees, transferees or other successors-in-interest that receive their

ordinary shares after the date of this prospectus to resell or otherwise dispose of the shares in the manner contemplated under “Plan

of Distribution” below.

As used herein, the term “Selling Shareholders”

means the selling shareholders listed below and the selling shareholders donees, pledgees, transferees, or other successors-in-interest

selling shares of Shares or Warrant Shares received after the date of this prospectus from the selling shareholders as a gift, pledge,

partnership distribution or other transfer.

The Selling Shareholders may from time to time

offer and sell pursuant to this prospectus any or all of the shares owned by them. The selling shareholders, however, make no representations

that the shares will be offered for sale. The tables below present information regarding the selling shareholders and the shares that

each such selling shareholder may offer and sell from time to time under this prospectus.

Unless otherwise indicated,

all information with respect to ownership of our shares of the selling shareholders has been furnished by or on behalf of the selling

shareholders and is as of December 4, 2024. We believe, based on information supplied by the selling shareholders, that except as may

otherwise be indicated in the footnotes to the tables below, the selling shareholders have sole voting and dispositive power with respect

to the shares reported as beneficially owned by them. Because the selling shareholders identified in the tables may sell some or all of

the shares owned by them which are included in this prospectus, and because, except as set forth herein, there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares, no estimate can be given as to the number of shares available

for resale hereby that will be held by the selling shareholders upon termination of this offering. In addition, the selling shareholders

may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time,

the shares they hold in transactions exempt from the registration requirements of the Securities Act after the date on which they provided

the information set forth on the table below. We have, therefore, assumed for the purposes of the following table, that the selling shareholders

will sell all of the shares owned beneficially by them that are covered by this prospectus, but will not sell any other shares that they

presently own. However, we are not aware of any agreements, arrangements or understandings with respect to the sale of any of the shares

by any of the selling shareholders. Beneficial ownership for the purposes of this table is determined in accordance with the rules and

regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares

the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers

within 60 days.

The selling shareholders and

intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act

with respect to the shares offered by this prospectus, and any profits realized or commissions received may be deemed underwriting compensation.

Additional selling shareholders not named in this prospectus will not be able to use this prospectus for resales until they are named

in the tables by prospectus supplement or post-effective amendment. Transferees, successors and donees of identified selling shareholders

will not be able to use this prospectus for resales until they are named in the tables by prospectus supplement or post-effective amendment.

If required, we will add transferees, successors and donees by prospectus supplement in instances where the transferee, successor or donee

has acquired its shares from holders named in this prospectus after the effective date of this prospectus. Applicable percentages based

on 18,569,340 ordinary shares of the Company outstanding as of December 4, 2024.

The following table sets forth:

| |

● |

the name of each selling shareholder holding shares; |

| |

|

|

| |

● |

the number of shares beneficially owned by each selling shareholder prior to the sale of the shares covered by this prospectus and it also includes the Warrant Shares underlying the Warrants, each of which are exercisable within 60 days of the date of this prospectus; |

| |

|

|

| |

● |

the number of shares that may be offered by each selling shareholder pursuant to this prospectus; |

| |

|

|

| |

● |

the number of shares to be beneficially owned by each selling shareholder following the sale of the shares covered by this prospectus; and |

| |

|

|

| |

● |

the percentage of our issued and outstanding shares to be owned by each selling shareholder before and after the sale of the shares covered by this prospectus. |

| Name Of Selling Shareholder |

|

Number Of

Shares

Beneficially

Owned

Prior

To This

Offering |

|

|

% Of

Outstanding

Shares

Beneficially

Owned

Before

Sale Of

Shares |

|

|

Number Of

Shares

Available

Pursuant To

This Prospectus |

|

|

Number Of

Shares

Beneficially

Owned

After Sale

Of Shares |

|

|

% Of

Outstanding

Shares

Beneficially

Owned After

Sale Of

Shares |

|

| JAMES GUI BAUDOUY (1) |

|

|

3,200,000 |

|

|

|

17.2 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| MATTHIAS DORIAN LENGELSEN (2) |

|

|

3,080,000 |

|

|

|

16.6 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| SHEENA ELIZABETH DAVIS(3) |

|

|

3,060,000 |

|

|

|

16.5 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| FABIAN ARNOLD(4) |

|

|

3,060,000 |

|

|

|

16.5 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| STEPHANIE ANN GEB.DAMBOLOT POLLMÜLLER(5) |

|

|

3,060,000 |

|

|

|

16.5 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| GRAHAM DUFFY(6) |

|

|

3,040,000 |

|

|

|

16.4 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| ETERNAL BLESSING HOLDINGS LIMITED(7) |

|

|

3,160,000 |

|

|

|

17.0 |

% |

|

|

|

|

|

|

0 |

|

|

|

|

* |

| Centurion Tech Holdings Limited (8) |

|

|

3,160,000 |

|

|