UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File

Number: 001-39938

Vinci Partners Investments Ltd.

(Exact name of registrant as specified in its

charter)

Av. Bartolomeu Mitre, 336

Leblon – Rio de Janeiro

Brazil 22431-002

+55 (21) 2159-6240

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Vinci Partners Investments Ltd. |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Sergio Passos Ribeiro |

| |

|

|

|

Name: |

Sergio Passos Ribeiro |

| |

|

|

|

Title: |

Chief Financial Officer |

Date: November 25, 2024

Exhibit 99.1

1 Vinci's Combination with Compass November 2024

2 2 Vinci Partners: Closing a successful first - chapter Growth Avenues since IPO in 2021 Taking advantage of the underpenetration of Alternatives in Brazil to grow the platform organically Leverage fundraising and FRE expansion through GP commitments in proprietary funds 1 3 Opportunistic M&A to complement business strategies and grow business 4 Expand footprint in Latin America

3 Vinci has raised over R$12 billion organically, leveraged by seed investments from our Balance Sheet VCP IV VICC REITs R$1.1 billion in proprietary commitments Credit Infra VFDL VIAS … leveraging our seed investments by ~9x. These commitments enhance our Earnings Power, leveraging FRE and PRE growth , while generating investment income …to drive fundraising in closed - end funds and REITs. Since our IPO, we've capitalized on Brazil's underpenetration in alternatives investments…

4 We used opportunistic M&A to find the best partners, complementing our product offering and capabilities • Opportunistic Credit independent asset manager • Extensive track record in a sizable and unexplored segment of the market • Business model with recurring and high - visibility revenue stream • Strategic partnership to accelerate growth of Vinci’s platform in Latin America • Ares and Vinci to collaborate on fundraising within LatAm and Globally • Representative of Ares joined Vinci’s Board to share best practices, including those related to M&A • Agribusiness focused asset manager • Enhances Vinci’s credit segment offering • More than 35 in - house structured credit operations across several sectors with special focus to Agribusiness • Timberland investment management organization • Forestry vertical to complement Vinci’s Real Asset segment • Strong relationships with Brazilian and European institutional investors • Long - term AUM with 15+ year funds R$2.0 billion AUM $100 million investment R$550 million AUM R$1.5 billion AUM

5 Capital light business model allows the firm to grow while distributing significant cash flow back to shareholders through dividends and share repurchases 300 464 FY'20 3Q'24 LTM 2.97 4.29 FY'20 3Q'24 LTM Vinci has delivered consistent growth since our IPO 50 70 2020 3Q'24 US$2.60 Total Dividend Per share distribution Since IPO Assets Under Management (R$ bn) Fee Related Revenues (R$ mm) Adj. Distributable Earnings per share (R$/share) 41% 55% 44% Notes: As of September 30, 2024. 4.7 million shares repurchased US$50 million capital used for buybacks

6 The next chapter... Our expansion in Latin America

7 Vinci and Compass: A Strategic Combination 6 FOOTPRINT EXPANSION IN LATAM %• Latin America is one of the most attractive and growing markets for the alternative asset class • GDP for the region totals more than US$7 trillion, with a Population that adds up to more than 660 million people • Region remains vastly underpenetrated in alternatives, with overall allocation under 5% BUSINESS COMPLEMENTARITY • Vinci and Compass have limited geographic overlap starting from offices, up to sources of funding and capital allocation standpoints • Core parallel businesses that complement each other, as we combine proprietary investment strategies with 3 rd Party Distribution • Our positioning allows us to address investment needs of our clients on a local, regional and global basis SHARED LONG - TERM VISION • Ambition to become the leading one - stop - shop platform for alternative investments in Latin America • Establish strong presence in local - to - local markets • Ability to import and export capital into and out of LatAm , originating the best investment opportunities across alternative investments for our clients Source: World Bank, Worldometer and Preqin .

8 Compass was founded in 1995 and has been posting consistent growth as it expanded through Latin America 0 0.2 0 1 3 2 2 5 7 8 10 11 15 13 19 26 25 38 51 73 118 107 120 139 154 201 203 172 181 224 1995 1999 2003 2007 2011 2015 2019 2023 R$ Billion Compass was founded in 1995, and has since expanded into eight countries +31% CAGR AUM 1995 - 3Q’24 Notes: Although we don't have an office in England, there is commercial representation; Considering FX exchange rate at the e nd of each year.

9 Compass developed a dominant and differentiated ecosystem in LatAm Global Vision with Local Presence +R$224bn in Assets under Management¹ 7 Countries in LatAm plus USA and UK New York Miami Bogotá Lima Santiago Buenos Aires Montevideo Sao Paulo 19 Executive Partners with an average of 17 years working together +50 Relationship Managers 315 Employees +60 Investment Strategies +50 Portfolio Managers and Analysts +1,700 Institutional LPs and HWNI clients Mexico City Notes: 1 And advisory as of September 2024.

10 Vinci Compass: Unparalleled Differentiated Platform One firm Teams working together on a regional basis Diversification Full - service platform Best - in - class Investment teams covering all the main alternative asset classes combined with outstanding distribution capabilities

11 Combination creates a leading full - service alternative asset manager in Latin America RESEARCH RISK LEGAL & COMPLIANCE CLIENT RELATIONS OPERATIONS ESG R$ 296 bn in AUM¹ Private Equity Credit Equities Global Investment Products and Solutions Real Assets Corporate Advisory Credit solutions developed to meet needs of both mature and growing businesses, through Private and Public Credit, opportunistic credit and agribusiness Strategies focused on growth equity transactions in Brazil, working towards transformational growth in collaboration with management teams and founders Long - term positions based on fundamental analysis of LatAm publicly - traded companies High value - added financial and strategic advisory services, focusing primarily on middle market and M&A transactions Investments focused on tangible, income - generating assets through real estate, infrastructure and forestry strategies Providing access to proprietary investment solutions and world - class managers Notes: ¹Considers Pro Forma assets under management and advisory as of September 2024.

12 Unified Leadership Gilberto Sayão Chairman Alessandro Horta CEO and Head of Real Assets Manuel Balbontin Director Jaime de la Barra Director and Head of Global IP&S Bruno Zaremba Roberto Leuzinger People & Governance Sergio Passos CFO Fernando Lovisotto Global IP&S Leandro Bousquet Head of Credit Matias Rodriguez COO Jaime Martí Head of Client Relations President of Finance and Operations

13 With a well - established, far - reaching client relations team with deep - knowledge of the alternative market … combined with Vinci's institutional reach and proven ability to sell proprietary products... ...uniquely position us, as a combined company, to effectively drive cross - selling opportunities,… Compass distribution team’s exceptional expertise and sophisticated understanding of alternative products and markets… …unlocking the full potential for both new and existing products within Vinci’s extensive product offering. 7 ARGENTINA / URUGUAY 29 BRAZIL 20 CHILE 11 MEXICO 7 PERU / COLOMBIA 5 UNITED STATES NUMBER OF PROFESSIONALS CLIENT RELATIONS GROUP 79 relationship managers across 8 countries

14 Pan - Regional presence with a diversified exposure to product offering, funding and currency Notes: ¹Considers Pro Forma assets under management and advisory as of September 2024; ²Fee Related Revenues as of 3Q24 last twe lve months excluding net advisory revenues from Corporate Advisory segment. 51% 21% 21% 7% 38% 21% 16% 14% 11% 63% 19% 16% 2% Institutional HNWI Intermediaries Public market vehicles Segments Breakdown AUM¹ (%) Fee Related Revenues² (%) Country Breakdown (Funding) Client Profile Breakdown Country Breakdown (Asset Allocation) 41% 16% 19% 8% 7% 4% 3% 2% 42% 28% 9% 7% 6% 5% 2% 1% 65% 25% 4% 2% 2% 1% 1% Global Brazil Chile LatAm Mexico Argentina Peru Uruguay 39% 21% 11% 13% 9% 3% 3% 1% Chile Brazil Global Mexico Colombia Peru Uruguay Argentina 77% 9% 5% 5% 4% Global IP&S Credit Private Equity Equities Real Assets

15 R$226 billion in AUM¹ Global Investment Products and Solutions (Global IP&S) Notes: ¹Pro Forma assets under management and advisory as of September 2024; TPD stands for Third Party Distribution. Providing access to a network of world - class GPs and top - tier asset managers, we deliver bespoke global and local investment solutions, granting unparalleled access to opportunities worldwide. 64% 21% 15% AUM Breakdown by Client Profile Institutional HNWI Intermediaries R$225.7 bn AUM 63% 22% 9% 5% 1% Fee Related Revenues by Country Breakdown (Asset Allocation) Global Brazil Mexico Chile Uruguay Argentina 30% 20% 18% 7% 6% 6% 13% Fee Related Revenues Breakdown by Product Type TPD Liquid Separate Mandate TPD Alternative Commingled Funds Brokerage Pension Plans Other

16 R$27 billion in AUM¹ Credit Notes: ¹Pro Forma AUM as of September 2024. 44% 24% 12% 9% 6% 5% AUM Breakdown By Geography Brazil LatAm Argentina Mexico Peru Chile 53% 29% 15% 3% AUM Breakdown by Client Profile Institutional Intermediaries HNWI Public Market Vehicles Local Currency High Grade & High Yield Structured Credit & Confirming Infrastructure Credit Diversified Private Credit Agribusiness SPS Real Estate Credit Local currency Hard currency Local currency Private and Liquid Credit Opportunistic Capital Solutions Hard Currency High Grade & High Yield Diversified credit platform with local and hard currency strategies R$11.2 bn R$2.5 bn R$2.4 bn R$2.3 bn R$1.0 bn R$0.7 bn R$6.1 bn R$0.9 bn +50 Portfolio Managers and Analysts

17 Private Equity Notes: As of September 2024; ¹Gross IRR and Gross MOIC in Brazilian Reais. R$16 billion in AUM 2.5x Gross MOIC¹ 64.6% Gross IRR¹ 66% 23% 10% Client Profile Breakdown Institutional HNWI Intermediaries Turnaround VIR Strategy Minority Growth R$15.8 bn AUM &UHDWHG�E�&KDQXW�LV�,QGXVWULHV IURP�WKH�1RXQ�3URMHFW &UHDWHG�E�'LQRVRIW/DEV IURP�WKH�1RXQ�3URMHFW VIR VCP Impact guidelines Sector Company Size Influence ESG Guidelines as risk mitigators drivers of long - term value creation Agnostic R$ 1 – 2 billion EV Control and co - control Business Services Specialized Retailing Healthcare R$ 300 – 700 million EV Minority The mandate includes generating both ESG impact and attractive returns 20+ 1.6x Gross MOIC¹ 22.4% Gross IRR¹ year track record Buyout Growth Turnaround Minority Growth VCP Strategy

18 85% 10% 5% Client Profile Breakdown Institutional HNWI Intermediaries R$14.8 bn AUM R$15 billion in AUM¹ Equities Brazil R$10.9 bn in AUM • Long Only • Dividends • Small Caps • Long Biased • Others Chile R$2.1 bn in AUM • Long Only • Small Caps Strategies Overview Mexico R$1.0 bn in AUM • Long Only LatAm R$0.6 bn in AUM • Long Only LatAm Equity Argentina R$0.4 bn in AUM • Long Only • Small Caps Country - Specific Equity Leverage the region’s advantages without the idiosyncratic risks of each country By capitalizing on country - specific expertise and targeting assets often overlooked by regional investors, we unlock opportuniti es in niche markets with fewer participants 85%+ of our combined investor base consists of Institutional Investors +30 Portfolio Managers and Analysts Notes: ¹Pro Forma AUM as of September 2024.

19 R$12 billion in AUM¹ Real Assets Notes: ¹Pro Forma AUM as of September 2024. 47% 42% 7% 4% Client Profile Breakdown Public Market Vehicles Institutional HNWI Intermediaries Forestry R$1.6 bn • Investments in major real estate segment • Seven Listed REITs in Brazilian Stock Market • Opportunistic Development Strategy with closed - end funds in Brazil, Uruguay and Peru Real Estate R$6.4 bn Infrastructure R$4.0 bn • Focus on the key infrastructure themes in Brazil: Power, Water & Sanitation and Transport & Logistics • Six structured funds and one perpetual listed vehicle • VICC, our Article 9 compliant fund, is currently fundraising • Strategy includes Greenfield and Brownfield projects with Eucalyptus, Pine and Native Forests in Brazil • Three vintages raised since 2009, with the fourth currently being raised and in process of becoming Article 9 • Carbon credits offer a significant return potential on top of traditional forestry revenues 130,000 ha Net Planted Area in Brazil +590,000 investors 38 Companies/Assets R$12.2 bn AUM of our AUM is in vehicles with 10+ years lock - ups ~ 65 %

20 Asset Management Construction Management Property Management Source acquisitions and oversee assets through disposition Ensure projects align with requirements, assist with due diligence and oversee constructions Manage Leasing activity, strive for optimal tenant mix and maintain tenant relationships CCLA Group Overview CCLA is an investment manager, developer and operator of modern and well - amenitized multifamily properties in Latin America. It was established in 2016 as a joint venture between Compass and CIM Group. Vertically Integrated Platform Oversee performance of portfolios and asset management responsibilities Oversee the planning, design, and construction of projects through completion Supervise day - to - day operations and maintenance of properties Units under development Investments Development Leasing Properties are located in fast - growing, urban and central areas of LatAm (Chile, Colombia, Mexico, and Peru). + 130 Employees in Latin America +4,650 Residential Units in Operation Assets Under Management +R$6.5 billion +1,950 Notes: As of September 2024.

21 Consolidating Vinci Compass’ position as the gateway to alternative investments in Latin America Vinci Compass’ offices +600 Employees LPs Global to Local Local to Global Local to Local Global to Regional Years Providing Investment Solutions in LatAm 7 Countries in LatAm plus USA and UK Strong diversification effect through complementary products and solutions with a broader geographic coverage. Combination opens a vast pipeline of opportunities for add - on M&A deals in LatAm . Expansion of geographic footprint into a true Pan - regional platform. Providing global solutions to Latin American investors through cross - selling across different distribution channels. +25 +2,600 Notes : As of September 2024 .

22 AUM Rollforward Pro Forma Total Real Assets Equities Private Equity Credit Global IP&S In R$ millions 246,577 9,282 17,737 13,971 21,353 184,234 AUM - As of September 2023 2,794 1,573 – 498 183 540 (+/ - ) Capital Subscription / (capital return) 4,334 2,213 – 808 765 548 (+) Capital Subscription (1,540) (640) – (310) (582) (8) ( - ) Capital Return 1,557 1,557 – – 540 – (+) Acquisitions 6,673 99 (4,670) – 3,484 7,760 (+/ - ) Net Inflow / (outflow) 37,495 (303) 1,795 1,334 1,461 33,209 (+/ - ) Appreciation / (depreciation) 295,636 12,208 14,861 15,803 27,021 225,743 AUM - As of September 2024 For the Twelve Months Ended September 30, 2024 Total Real Assets Equities Private Equity Credit Global IP&S In R$ millions 249,166 11,288 18,727 14,593 20,370 184,189 AUM - As of December 2023 935 (323) – 422 296 540 (+/ - ) Capital Subscription / (capital return) 2,028 173 – 542 765 548 (+) Capital Subscription (1,093) (496) – (120) (468) (8) ( - ) Capital Return 2,097 1,557 – – 540 – (+) Acquisitions 8,751 117 (4,156) – 3,000 9,790 (+/ - ) Net Inflow / (outflow) 34,687 (430) 290 788 2,816 31,224 (+/ - ) Appreciation / (depreciation) 295,636 12,208 14,861 15,803 27,021 225,743 AUM - As of September 2024 For the Nine Months Ended September 30, 2024 Notes: Appreciation or depreciation include FX exchange variation.

23 Combination with Compass is immediately accretive to FRE per Share Notes: 1 Pro forma unaudited figures. 3Q'24 YTD PF¹ 3Q’24 PF¹ 3Q'24 YTD 3Q’24 Unit 667 229 345 113 R$ mm Fee Related Revenues 218 72 169 54 R$ mm Pre - Tax FRE 32.6% 31.3% 49.1% 47.7% % FRE Margin 3.36 1.11 3.20 1.02 (R$/share) FRE per share 201 70 165 57 R$ mm Adj. Distributable Earnings 3.17 1.08 3.12 1.08 (R$/share) Adj. DE per share 9% accretion in FRE per share for the combined company in 3Q’24 Reporting currency will continue to be BRL Compass expected to contribute to 4Q’24 results with R$15 million in FRE

24 Management Focus for Future Growth Expansion of Alternatives across LatAm Revenue Enhancement to Drive Margin Expansion Inorganic Growth to Accelerate Region Expansion

25 Growth Opportunities for Vinci Compass Source : Preqin x Private Credit and Real Estate present the highest demand from local investors into country - specific strategies Increase in allocation to Alternatives from local LPs into Country - specific funds • Although ~50% of LATAM LPs invest in alternatives, Private Equity, Infra, Private Credit and Real Estate account for only ~1% of their AUM x Regional strategy presents diversification compared to country - specific market risk and a broader capacity for deployment x We believe the combination of strong investment track records with local knowledge will allow us to growth our regional strategies over time Capture Global Investment Capital into new Regional Mandates • Substantial opportunity to increase the size of our existing Private Equity and Infrastructure strategies by expanding to regional mandates • Regional mandates in LatAm represent over US$70 billion in AUM x Change in regulation increased the maximum allocation to alternative investments from Mexican Pension funds from 15% to 30% x 2020 pension reform expected to positively impact net flows for alternatives in the coming years Local regulation trends represent a significant opportunity for growth in alternatives • We believe the potential allocation to alternatives in 2024 of US$50 billion should reach up to US$140 billion in 2028 • There is additional upside for the minimum allocation to local alternatives to increase from 10% for up to 30% Expansion of Alternative Investments into LatAm Local - to - Local Global - to - Regional Mexico expansion

26 Growth Opportunities for Vinci Compass Source : Preqin and Abrapp x Raising capital from Compass’ existing relationships to SPS IV and Equities Brazil x Increase average fee in Global IP&S by allocating to proprietary products Leverage Compass’ Relationship network in Latin America to distribute Vinci’s products • We see a significant opportunity to roll out additional regional strategies to offer to Latin American LPs x Expand Compass’ Third - Party Distribution services in Brazil to Vinci’s clients looking to invest in global GPs x Leverage Compass’ broker - dealer in the US to Vinci’s local clients looking to increase allocation in global assets directly Continuous trend for the increase in allocation to global assets, especially for Brazilian investors • Total addressable market of ~R$430 billion, which is expected to double in the next 4 years • Closed Pension fund market in Brazil of more than R$1 trillion in AUM allocation to foreign investments of only 1% Revenue Enhancement to Drive Margin Expansion Short Term Mid - Long Term

27 Growth Opportunities for Vinci Compass x During the integration process Vinci and Compass teams have screened out ~30 potentially attractive AAM partners across main alternative asset classes, such as Private Equity, Infrastructure, Private Credit and Real Estate x In countries with limited opportunities for inorganic expansion, hiring local talent/teams is a potential strategy for tapping into new markets Inorganic efforts are the preferred strategy to accelerate successful market entry • Narrowed universe of potential targets for M&A represent over US$100 billion in AUM Inorganic Growth: Accelerate region - expansion by partnering with LatAm AAMs M&A

28 Key Takeaways Combining the expertise of two investment leaders to create a unique full - service investment platform in Latin America , serving the whole spectrum of the alternative asset class with local, regional and global solutions . 1 2 3 4 There is significant opportunity to grow the platform by leveraging Vinci and Compass’ complementary capabilities by cross - selling Brazilian products into LatAm and bringing global investment solutions to Brazilian investors Vinci Compass will continue its growth trajectory by leveraging on the continuous trend for expansion on alternatives in Latin America, by expanding existing strategies into regional mandates , developing new strategies for local markets, combined with country - specific growth drivers . Transaction is immediately accretive to FRE/Share and we see substantial upside to drive margin expansion through revenue enhancement and inorganic M&A activity .

29

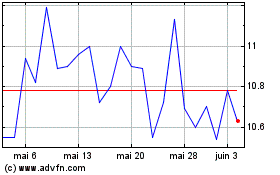

Vinci Partners Investments (NASDAQ:VINP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Vinci Partners Investments (NASDAQ:VINP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024