FALSE000179620900017962092024-11-222024-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

11/22/2024

Date of Report (date of earliest event reported)

___________________________________

APi Group Corporation

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39275 (Commission File Number) | 98-1510303 (I.R.S. Employer Identification Number) |

1100 Old Highway 8 NW New Brighton, MN 55112 |

(Address of principal executive offices and zip code) |

(651) 636-4320 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | APG | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On November 22, 2024, APi Group Corporation (the “Company”) announced that Kevin Krumm, Executive Vice President and Chief Financial Officer, has resigned and will leave the Company effective December 13, 2024 to pursue another professional opportunity.

Appointment of Interim Chief Financial Officer

In connection with the resignation of Mr. Krumm, the Company also announced that David Jackola will serve as Interim Chief Financial Officer upon Krumm’s departure and until a successor is named.

David Jackola, 45, has been the Chief Financial Officer and Vice President of Transformation at APi International since November 2022. Prior to his current role, he held the position of Vice President, Controller and Chief Accounting Officer at the Company from March 2022 to November 2022, and as Vice President, Corporate Planning and Analysis since joining the Company in October 2021. Prior to joining the Company, Mr. Jackola was the Vice President of Finance of James Hardie Building Products where he served as head of finance for the North American business. Prior to that, Mr. Jackola was Vice President of Finance – Europe for Ecolab and also held other roles of significant responsibility within Ecolab since joining in July 2008. Mr. Jackola received his bachelor’s degree in Economics from Carleton College and his Master of Business Administration in Finance from the University of Chicago Booth School of Business.

Compensation Related Matters

While serving as Interim Chief Financial Officer, Mr. Jackola will receive an additional monthly cash stipend of $25,000 effective upon appointment and a one-time grant of restricted stock units valued at $500,000.

The number of restricted stock units granted will be calculated based on the closing stock price of the Company’s common stock on the date of grant. The restricted stock units will vest in three equal tranches annually on the first, second, and third anniversaries of the grant date (or immediately upon death or disability). While serving as the Interim Chief Financial Officer, Mr. Jackola will not be considered an “Eligible Employee” under the Company’s Executive Officer Severance Policy.

Item 7.01 Regulation FD Disclosure.

On November 22, 2024, the Company issued a press release relating to the matters discussed above as well as reaffirming previously released full year 2024 net revenue and adjusted EBITDA guidance. A copy of the press release is furnished as Exhibit 99.1.

The information furnished under this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| APi Group Corporation |

| | |

| Date: November 22, 2024 | By: | /s/ Louis B. Lambert |

| Name: | Louis B. Lambert |

| Title: | Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

APi Group Announces CFO Transition

-Reaffirms 2024 Financial Guidance-

NEW BRIGHTON, Minn. – November 22, 2024 — APi Group Corporation (NYSE: APG) (“APi” or the “Company”) today announced that Kevin Krumm, Chief Financial Officer, will step down from his role on December 13, 2024 to accept another opportunity. David Jackola, current Chief Financial Officer and Vice President of Transformation at APi International, will assume the role of interim Chief Financial Officer upon Krumm’s departure and until a successor is appointed.

Jackola is a seasoned senior finance executive with broad functional and global experience and a deep understanding of APi’s business. Prior to his role as CFO and VP of Transformation at APi International, he held the position of Vice President, Controller and Chief Accounting Officer at APi Group. At APi International, David has helped drive APi’s strategy centered on organic revenue growth and margin expansion supported by improved inspection, service and monitoring revenue mix, customer and project selection, pricing, value capture synergies, and strategic M&A.

Russ Becker, APi’s President and Chief Executive Officer stated: “I’ve appreciated Kevin’s partnership in building upon our solid financial foundation. I’m grateful for his leadership and contributions to APi and wish him success in his next endeavor.”

Becker continued, “We are thrilled to welcome David back to our leadership team at headquarters as interim CFO. David’s extensive experience and familiarity in our finance and global operations uniquely positions him to seamlessly support our continued growth and deliver on our commitments."

Kevin Krumm commented: “It has been a privilege to serve as APi’s Chief Financial Officer. The Company is well positioned to achieve its strategic goals and sustain its upward trajectory. I look forward to supporting David and am confident in his ability to lead APi’s finance team.”

The Company has initiated a search process with a leading search firm to identify a successor for the CFO role. Additionally, the Company has reaffirmed the 2024 net revenue and adjusted EBITDA guidance recently provided on October 31, 2024, and looks forward to providing an additional update in the middle of December as we approach year end 2024.

About APi Group

APi is a global, market-leading business services provider of fire and life safety, security, elevator and escalator, and specialty services with a substantial recurring revenue base and over 500 locations worldwide. APi provides statutorily mandated and other contracted services to a strong base of long-standing customers across industries. We have a winning leadership culture driven by entrepreneurial business leaders to deliver innovative solutions for our customers. More information can be found at www.apigroupcorp.com.

Forward Looking Statements

Please note that in this press release the Company may discuss events or results that have not yet occurred or been realized, commonly referred to as forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of the Company. Such discussion and statements may contain words such as “expect,” “anticipate,” “will,” “should,” “believe,” “intend,” “plan,” “estimate,” “predict,” “seek,” “continue,” “pro forma” “outlook,” “may,” “might,” “should,” “can have,” “have,” “likely,” “potential,” “target,” “indicative,” “illustrative,” and variations of such words and similar expressions, and relate in this press release, without limitation, to statements, beliefs, projections and expectations about future events. Such statements are based on the Company’s expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts. These statements are not guarantees of future

performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including timing of the events, statements about our continued growth, delivery on commitments, accomplishing strategic goals, and reaffirmation of previously issued guidance.

Investor Relations Contact

Adam Fee

Vice President of Investor Relations

Tel: +1 651-240-7252

Email: investorrelations@apigroupinc.us

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

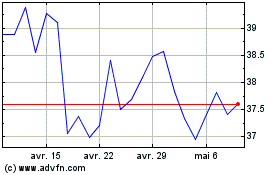

APi (NYSE:APG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

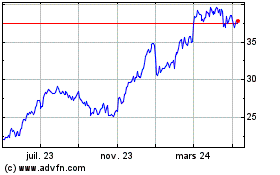

APi (NYSE:APG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024