UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

|

Preliminary Proxy Statement |

| |

|

| ¨ |

|

Confidential, For Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

|

Definitive Proxy Statement |

| |

|

| ¨ |

|

Definitive Additional Materials |

| |

|

| x |

|

Soliciting Material Pursuant to

§ 240.14a-12 |

AMERICAN AXLE & MANUFACTURING

HOLDINGS,

INC.

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

|

| x |

|

No fee required. |

| |

|

| ¨ |

|

Fee paid previously with preliminary

materials. |

| |

|

| ¨ |

|

Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| Fourth Quarter 2024 Earnings Call |

| Forward-Looking Statements

2

In this presentation, American Axle & Manufacturing Holdings, Inc. (“AAM”) makes statements concerning its and Dowlais’ expectations, beliefs, plans, objectives, goals, strategies, and future events or

performance, including, but not limited to, certain statements related to the ability of AAM and Dowlais to consummate AAM’s business combination with Dowlais (the “Business Combination”) in a timely

manner or at all; future capital expenditures, expenses, revenues, economic performance, synergies, financial conditions, market growth, dividend policy, losses and future prospects and business; and

management strategies and the expansion and growth of AAM’s and the combined company’s operations. Such statements are “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and relate to trends and events that may affect AAM’s or the combined company’s future financial position and operating results. The terms such as “will,” “may,” “could,”

“would,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “project,” "target," and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results

will be achieved. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. These

risks and uncertainties related to AAM include factors detailed in the reports AAM files with the United States Securities and Exchange Commission (the “SEC”), including those described under “Risk

Factors” in its most recent Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this communication. AAM expressly

disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its or Dowlais’ expectations with regard

thereto or any change in events, conditions or circumstances on which any such statement is based.

Additional Information

This presentation may be deemed to be solicitation material in respect of the Business Combination, including the issuance of AAM’s shares of common stock in respect of the Business Combination. In

connection with the foregoing proposed issuance of AAM’s shares of common stock, AAM expects to file a proxy statement on Schedule 14A (together with any amendments and supplements thereto,

the “Proxy Statement”) with the SEC. To the extent the Business Combination is effected as a scheme of arrangement under English law, the issuance of AAM’s shares of common stock in connection

with the Business Combination would not be expected to require registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to an exemption provided by Section

3(a)(10) under the Securities Act. In the event that AAM exercises its right to elect to implement the Business Combination by way of a takeover offer (as defined in the UK Companies Act 2006) or

otherwise determines to conduct the Business Combination in a manner that is not exempt from the registration requirements of the Securities Act, AAM expects to file a registration statement with the

SEC containing a prospectus with respect to the AAM’s shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY

STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE IN THE PROXY

STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS COMBINATION AND

RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents filed by AAM with the SEC at the SEC’s website

at http://www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents filed by AAM with the SEC at

https://www.aam.com/investors. |

| 4Q 2024 and Full Year Financial Highlights

3

* For definitions of Adjusted EBITDA and Adjusted Free Cash Flow and non-GAAP reconciliations, please see the attached appendix.

4Q

2024 Quarterly

Sales

$1.38B $160.8M

Quarterly

Adj. EBITDA

11.6% of Sales

$79.2M

Quarterly

Adj. Free

Cash Flow

$6.12B

Full Year

Sales

$749.2M

Full Year

Adj. EBITDA

12.2% of Sales

$230.3M $311M

Full Year

Adj. Free

Cash Flow

FY

2024 |

| Business Update

4

Maverick & Bronco Sport

Secured core business extension to

deliver power transfer units (PTU) for the

Ford Maverick and Bronco Sport.

AAM & Dowlais Combination

The combination to create a leading

driveline and metal-forming supplier with

size and scale, serving the global

automotive industry.

+

Note: The depicted power transfer unit is for illustrative purposes only. Does not reflect the actual product for the specified programs. |

| 2025 Financial Outlook(as of February 14, 2025)

5

2025 Financial Targets

Full Year Sales $5.8 - $6.05 billion

Adjusted EBITDA $700 - $760 million

Adjusted Free Cash Flow $200 - $230 million

• These targets are based on North American light vehicle production of ~15.1 million units, current customer production

and launch schedules, production estimates of key programs we support, and business environment

• Adjusted Free Cash Flow target assumes capital spending of approximately 5% of sales

• AAM expects restructuring cash payments to be approximately $20 - $30 million

• AAM’s 2025 financial outlook does not account for any changes to future policy, including tariffs, tax and other regulations.

• AAM's outlook assumes the sale of AAM's commercial vehicle axle business in India is completed by July 1, 2025.

• Does not reflect any costs and expenses relating to the announced combination with Dowlais, which will impact actual

results. Reflects guidance for AAM on a stand-alone pre-combination basis only.

Note: For definitions of Adjusted EBITDA and Adjusted Free Cash Flow and Non-GAAP reconciliations, please see the attached appendix.

In accordance with Rule 28.1(c)(i) of the Takeover Code, the AAM directors confirm that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has been properly compiled on the basis

of the assumptions stated in the attached appendix and that the basis of accounting used is consistent with AAM's accounting policies. |

| 4Q Financial Results

6

Note: Adjusted earnings (loss) per share are based on weighted average diluted shares outstanding of 117.6 million and 117.1 million for the three months ended December 31, 2024 and 2023 respectively. For

definitions of Adjusted EBITDA, Adjusted EBITDA margin and Adjusted earnings per share and Non-GAAP reconciliations, please see the attached appendix

2024 2023

Net sales $ 1,380.8 $ 1,463.0 $ (82.2)

Gross profit $ 154.3 $ 154.9 $ (0.6)

Gross margin 11.2% 10.6% 0.6%

Selling, general and administrative expenses $ 89.0 $ 95.7 $ (6.7)

SG&A as a % of sales 6.4% 6.5% -0.1%

Amortization of intangible assets $ 20.8 $ 21.4 $ (0.6)

Restructuring and acquisition-related costs $ 8.3 $ 9.0 $ (0.7)

Debt refinancing and redemption costs $ (0.1) $ (1.0) $ 0.9

Pension curtailment and settlement charges $ - $ (1.3) $ 1.3

Gain on equity securities $ - $ 0.1 $ (0.1)

Other income (expense), net $ (5.7) $ 3.0 $ (8.7)

Adjusted EBITDA $ 160.8 $ 169.5 $ (8.7)

Adjusted EBITDA margin 11.6% 11.6% 0%

Net interest expense $ (37.3) $ (42.9) $ 5.6

Income tax expense $ 6.8 $ 5.8 $ 1.0

Effective income tax rate -99% -44% -55%

Net loss $ (13.7) $ (19.1) $ 5.4

Diluted earnings (loss) per share $ (0.12) $ (0.16) $ 0.04

Adjusted EPS (loss) $ (0.06) $ (0.09) $ 0.03

Three Months Ended December 31,

(dollars in millions, except per share data) Difference |

| Full Year Financial Results

7

Note: Adjusted earnings (loss) per share are based on weighted average diluted shares outstanding of 121.9 million and 116.6 million for the twelve months ended December 31, 2024 and 2023,

respectively. For definitions of Adjusted EBITDA, Adjusted EBITDA margin and Adjusted earnings per share (loss) and Non-GAAP reconciliations, please see the attached appendix

2024 2023

Net sales $ 6,124.9 $ 6,079.5 $ 45.4

Gross profit $ 741.4 $ 624.3 $ 117.1

Gross margin 12.1% 10.3% 1.8%

Selling, general and administrative expenses $ 387.1 $ 366.9 $ 20.2

SG&A as a % of sales 6.3% 6.0% 0.3%

Amortization of intangible assets $ 82.9 $ 85.6 $ (2.7)

Impairment charge $ 12.0 $ - $ 12.0

Restructuring and acquisition-related costs $ 18.0 $ 25.2 $ (7.2)

Debt refinancing and redemption costs $ (0.6) $ (1.3) $ 0.7

Loss on equity securities $ (0.1) $ (1.1) $ 1.0

Pension curtailment and settlement charges $ - $ (1.3) $ 1.3

Other income (expense), net $ (20.0) $ 8.1 $ (28.1)

Adjusted EBITDA $ 749.2 $ 693.3 $ 55.9

Adjusted EBITDA margin 12.2% 11.4% 0.8%

Net interest expense $ (157.9) $ (175.5) $ 17.6

Income tax expense $ 27.8 $ 9.1 $ 18.7

Effective income tax rate 44.3% -37.1% 81.4%

Net income (loss) $ 35.0 $ (33.6) $ 68.6

Diluted earnings (loss) per share $ 0.29 $ (0.29) $ 0.58

Adjusted EPS (loss) $ 0.51 $ (0.09) $ 0.60

Twelve Months Ended December 31,

(dollars in millions, except per share data) Difference |

| 4Q 2024 Revenue Walk (Yr/Yr)

8

$ in millions

Note: Chart not to scale. |

| 4Q 2024 Adjusted EBITDA Walk

9

$ in millions

Note: For definition of Adjusted EBITDA and Non-GAAP reconciliation, please see the attached appendix. Chart not to scale. |

| Adjusted Free Cash Flow and Credit Profile

10

Cash Flow and Debt Metrics 4Q 2024

Adjusted Free Cash Flow $79.2 million

Net Debt $2.1 billion

Net Leverage Ratio 2.8x

Liquidity ~$1.5 billion

Note: For definitions of Adjusted Free Cash Flow, Net Debt, Net Leverage Ratio, and Liquidity and reconciliations of non-GAAP financial measures, please

see the attached appendix.

AAM Maintains Strong Liquidity |

| 2025 Sales Target Walk

Note: Chart not to scale. Assumes sale of CV axle business in India by July 1, 2025. 11

$ in millions (unless noted otherwise)

*Approximately at guidance midpoint. |

| 2025 Adjusted EBITDA Target Walk

12

$ in millions

Note: Chart not to scale. For definitions of Adjusted EBITDA and Non-GAAP reconciliations, please see the attached appendix. Assumes sale of CV axle business in India by July 1, 2025.

In accordance with Rule 28.1(c)(i) of the Takeover Code, the AAM directors confirm that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has been properly compiled on the

basis of the assumptions stated in the attached appendix and that the basis of accounting used is consistent with AAM's accounting policies.

*Approximately at guidance midpoint. |

| 2025 Targeted Adj. Free Cash Flow Walk

13

$ in millions

21.0%

Margin

15.1%

Margin

19.0%

Margin

Note: Chart not to scale. For definitions of Adjusted Free Cash Flow and Non-GAAP reconciliations, please see the attached appendix. Assumes sale of CV axle business in India by July 1, 2025.

In accordance with Rule 28.1(c)(i) of the Takeover Code, the AAM directors confirm that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has been properly compiled on the

basis of the assumptions stated in the attached appendix and that the basis of accounting used is consistent with AAM's accounting policies.

*Approximately at guidance midpoint. |

| AAM and Dowlais Combination

Supplemental Slides |

| Compelling Strategic Combination

15

Creates a

leading global

driveline and

metal forming

supplier with

significant size

and scale

More diversified

customer base

with expanded

and balanced

geographic

presence

High margins

with strong

earnings

accretion, cash

flow and balance

sheet

Compelling

industrial logic

with ~$300M of

synergies

Creates More Robust Business Model That Accelerates Growth

And Value Creation For All Stakeholders

Comprehensive

powertrain

agnostic product

portfolio with

leading

technology

+ |

| Dowlais Combination

16

Revenue1 Synergies3 Combined

Adj. EBITDA Margin

including synergies2

Expected Day One

Net Leverage

including synergies3

~$12B

+

~$300M ~14% ~2.5x

Expect strong earnings accretion in the first full year following the close of the transaction4

(1) Combined revenue number, on a statutory basis for Dowlais, and without adjustments for differences between US GAAP and IFRS. Assumed exchange rate is $1.2434 / £1.00.

(2) Adjusted EBITDA margin is the sum of AAM and Dowlais’ 2023 reported adjusted EBITDA divided by the sum of AAM’s revenue and Dowlais’ adjusted revenue. Adjusted EBITDA margin calculation gives effect to the estimated full run rate

synergies of approximately $300 million. Assumed exchange rate is $1.2434 / £1.00. For definitions of AAM’s and Dowlais’ Adjusted EBITDA, please see the attached appendix.

(3) Net leverage estimate includes the impact of incremental transaction financing and full run rate synergies. Run rate synergies substantially achieved by end of the third year. Please see appendix for net leverage definition.

(4) Excludes transaction-related expenses and deal-related amortization. |

| Dowlais Overview

17

~$6B 2023 Sales

30,000+ Employees1

22 Countries1

Global Leader in Propulsion Agnostic Driveline Solutions

with a Track Record of Innovation

100 Locations1

Automotive

79%

Powder Metal

21%

North

America

37%

South

America

3% Asia

26%

EMEA

34%

Leading Global Driveline Supplier Leading Sinter Metals Supplier

Present in 50% of Vehicles ~10M Components Produced / Day

>90% of Global Auto

Manufacturers Served >2,000 Global Customers

Source: Dowlais 2023 Annual Report

(1) Includes JV operations

A MARKET LEADING,

HIGH-TECHNOLOGY ENGINEERING GROUP |

| Dowlais – Leading Supplier of Sideshafts

18

Source: Dowlais filings. Notes: Vehicle images for illustrative purpose only. (1) Based on 2023 Product Volumes & GKN Auto Internal Data. (2) Sideshafts per vehicle statistics based on

2021 vehicle production data.

DOWLAIS’ SIDESHAFT TECHNOLOGY IS WORLD

LEADING.. ICE VEHICLE BATTERY ELECTRIC VEHICLE …AND 2X THE SIZE OF ITS NEAREST COMPETITOR

• Global, vertically integrated scale

• Pioneers of the Auto CV joint

• 100 joint types & sizes

• ~400 active patents

• ~500 engineers across 18 sites

Market share(1)

#1 2x nearest competitor

~2.1

sideshafts per vehicle(2)

~2.4

sideshafts per vehicle(2)

SIDESHAFT TECHNOLOGY IS WORLD LEADING… ICE VEHICLE BATTERY ELECTRIC VEHICLE

… AND 2X THE SIZE OF ITS NEAREST COMPETITIOR |

| ~$300M of Synergy Potential

19

Targeting 60% of expected

annual run rate savings by

the end of the second full

year. Run Rate savings

substantially achieved by

end of the third year.

We estimate the costs

required to achieve our

synergy plan are

approximately equal to one

year of savings.

Joint plan developed to realize ~$300M of annual run-rate cost synergies

Operations

Purchasing

SG&A

• Leveraging enhanced economies of scale and spend to reduce supply costs

• Utilizing vertical integration capabilities to deliver insourcing initiatives

• Achieving global freight and logistical savings through increased scale, utilization

and benefits from third-party logistics suppliers

• Eliminating duplicate public company and other costs

• Optimization of the combined workforce

• Streamlining of engineering, research, and development expenses

• Elimination of duplicate business and technical offices

~50%

~20%

~30%

CATEGORY DESCRIPTION

• Increasing operating efficiencies through the implementation of a best-of-best

operating system

• Optimizing the combined global manufacturing footprint

TIMING AND COST

TO ACHIEVE |

| Robust Synergy Identification & Validation Process

20

AAM & Dowlais each appointed a global

consulting firm to assist in reviewing

synergy opportunities

Detailed, in-person diligence

sessions were conducted over multiple weeks

between AAM & Dowlais management teams

UK Takeover Code Rule 28 contains

specific requirements regarding cost

savings measures

▪ Quantified synergies to be supported

by a report from a reporting accountant

▪ Deloitte LLP acted as AAM’s reporting

accountant and provided an opinion1

(1) A copy of the Deloitte Opinion (as required by the Takeover Code) is contained in the Rule 2.7 firm offer announcement at https://www.aam.com/investors/offer-for-dowlais-group-plc

Synergies identified across 10 workstreams

using detailed cost information from both

businesses and a clean team approach |

| Substantial Free Cash Flow Generation

21

Combination Enhances Cash Flow Generation

Source: Dowlais public filings or derived therefrom, see appendix.

Note: Assumed exchange rate is $1.2434 / £1.00; 1 Run Rate savings substantially achieved by end of the third year.

$M

American Axle Adj. Free Cash Flow (2023A) ~$219

Dowlais Adj. Free Cash Flow (2023A) ~$203

Run-Rate Cash Flow from Synergies1 ~$300

Less: Interest from Incremental Financing ~($50)

Less: Tax Impact (Illustrative 30% rate) ~($75)

Combined Cash Generation Potential ~$600

% revenue ~5%

% Implied PF mkt. cap. (FCF Yield) ~50% |

| Balance Sheet and Capital Allocation

22

• Committed financing in place for transaction

• Expect $2.2 billion of new debt financing (used

to refinance existing Dowlais debt and fund

the cash purchase price)

• Transaction approximately net leverage

neutral at closing (before synergies)

• Expect ~$2.0 billion of liquidity at closing

BALANCE SHEET

• Support investment for organic growth

• Prioritize debt repayment until 2.5x net

leverage achieved

• Targeting a more balanced capital allocation

policy below 2.5x net leverage

▪ Potential share repurchases or dividends

CAPITAL ALLOCATION |

| Regulatory Update

23

Expect Regulatory Approval And Closing In 4Q 2025

TIMING

▪ Significant regulatory analysis and preparatory

work already undertaken by both parties

▪ US filing (HSR) submitted on February 7, 2025

▪ Progressing with all filings and engaging with

international regulators

▪ Anticipated timing is typical for this type of transaction

STRATEGIC COMBINATION

▪ Complementary product and customer portfolios

▪ Multiple competitors across key products / geographies

▪ Synergies drive competitive cost base and free cash

flow to support product development

▪ Customer feedback has been supportive

BEAM AXLES

US LIGHT TRUCK

SIDE SHAFTS

GLOBAL PASSCAR & CUV |

| Appendix / Supplemental Data |

| Additional Disclosures

25

Participants in the Solicitation

AAM and its directors, executive officers and certain other members of management and employees will be participants in the solicitation of proxies from AAM’s

shareholders in respect of the Business Combination, including the proposed issuance of AAM’s shares of common stock in connection with the Business Combination.

Information regarding AAM’s directors and executive officers is contained in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed

with the SEC on February 16, 2024, the definitive proxy statement on Schedule 14A for AAM’s 2024 annual meeting of stockholders, which was filed with the SEC on March

21, 2024 and the Current Report on Form 8-K of AAM, which was filed with the SEC on May 2, 2024. Additional information regarding the identity of participants, and their

direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. To the extent holdings of AAM’s securities

by its directors or executive officers change from the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial Ownership

on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC by AAM. These documents may be obtained free of charge from the SEC's website at

www.sec.gov and AAM’s website at https://www.aam.com/investors.

No Offer or Solicitation

This presentation is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a

solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

Non-GAAP Financial Information

This presentation refers to certain financial measures, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Earnings per Share, Adjusted Free Cash Flow, Net

Debt, Net Leverage Ratio and Liquidity that are not required by, or presented in accordance with, accounting principles generally accepted in the United States, or GAAP.

These measures are presented to provide additional useful measurements to review AAM’s operations, provide transparency to investors and enable period-to-period

comparability of financial performance. These non-GAAP measures should not be considered a substitute for any GAAP measure. Additionally non-GAAP financial

measures as presented by AAM may not be comparable to similarly titled measures reported by other companies. |

| Additional Disclosures

26

Quantified Financial Benefits Statement

This presentation contains statements of estimated cost savings and synergies arising from the Combination (together, the “Quantified Financial Benefits Statements”).

Statements of estimated cost savings and synergies relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. As a

result, the cost savings and synergies referred to in the Quantified Financial Benefits Statement may not be achieved, may be achieved later or sooner than estimated, or

those achieved could be materially different from those estimated. No statement in the Quantified Financial Benefits Statement, or this presentation generally, should be

construed as a profit forecast or interpreted to mean that the combined company’s earnings in the first full year following the date on which the Combination becomes

effective, or in any subsequent period, would necessarily match or be greater than or be less than those of AAM or Dowlais for the relevant preceding financial period or any

other period. For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement contained in this presentation is the responsibility of AAM and the AAM

Directors.

A copy of the Quantified Financial Benefits Statements, the bases of belief, principal assumptions and sources of information in respect of any quantified financial benefits

statement are set out in appendix 6 of the Rule 2.7 announcement made by AAM and Dowlais on January 29, 2025. |

| Additional Disclosures

27

Profit forecasts and estimates

The statements in this presentation setting out targets for Adjusted EBITDA and Adjusted free cash flow of AAM for FY25 (together, the “AAM FY25 Profit Forecast”) constitute profit

forecasts of AAM for the purposes of Rule 28.1(a) of the UK Takeover Code (Takeover Code). The UK Takeover Panel has granted AAM a dispensation from the requirement to include

reports from reporting accountants and AAM’s financial advisers in relation to the FY25 Profit Forecast because it is an ordinary course profit forecast and Dowlais has agreed to the

dispensation.

Other than the AAM FY25 Profit Forecast, nothing in this presentation (including any statement of estimated cost savings or synergies) is intended, or is to be construed, as a profit

forecast or profit estimate for any period or is to be interpreted to mean that earnings or earnings per share of AAM or Dowlais for the current or future financial years will necessarily

match or exceed the published earnings or earnings per share of AAM or Dowlais, as appropriate.

AAM directors’ confirmations

In accordance with Rule 28.1(c)(i) of the Takeover Code, the AAM directors confirm that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has been properly

compiled on the basis of the assumptions stated below and that the basis of accounting used is consistent with AAM's accounting policies.

Basis of preparation

The AAM FY25 Profit Forecast is based on AAM’s current internal forecast for the period up to 31 December 2025, using economic assumptions as at 14 February 2025. The basis of

accounting used for the AAM FY25 Profit Forecast is consistent with AAM’s existing accounting policies, which: (i) are in accordance with U.S. GAAP; (ii) were applied in the preparation

of the AAM’s financial statements for the year ending 31 December 2024; and (iii) are expected to be applied in the preparation of the AAM’s financial statements for the period up to 31

December 2025.

The AAM FY25 Profit Forecast has been prepared on the basis referred to above and subject to the principal assumptions set out below. The AAM FY25 Profit Forecast is inherently

uncertain and there can be no guarantee that any of the factors referred to under "Principal assumptions" below will not occur and/or, if they do, their effect on AAM’s results of operations,

financial condition, or financial performance, may be material. The AAM FY25 Profit Forecast should therefore be read in this context and construed accordingly. |

| Additional Disclosures

28

Principal assumptions

a) Factors outside the influence or control of the AAM Directors:

i. there will be no material change to macroeconomic, political, inflationary, regulatory or legal conditions in the markets or regions in which AAM operates;

ii. there will be no material change in current US interest rates, economic growth (GDP), inflation expectations or foreign exchange rates compared with AAM’s estimates;

iii. there will be no material change in accounting standards;

iv. there will be no material change in market conditions in relation to customer demand or the competitive environment;

v. there will be no material litigation or regulatory investigations, or material unexpected developments in any existing litigation or regulatory investigation, in relation to any of AAM’s

operations, products or services; and

vi. there will be no business disruptions that materially affect AAM, its customers, operations, supply chain or labour supply, including natural disasters, acts of terrorism, cyber-attack

and/or technological issues.

b) Factors within the influence or control of the AAM Directors:

i. there will be no material acquisitions, disposals, distribution partnerships, joint ventures or other commercial agreements, other than those already assumed within the forecast;

ii. there will be no material change in the existing operational strategy of AAM;

iii. there will be no material changes in AAM's accounting policies and/or the application thereof;

iv. there are no material strategic investments or capital expenditure in addition to those already planned; and

v. there will be no material change in the management or control of AAM.

Publication on website

A copy of this presentation will be made available (subject to certain disclaimers) on AAM’s website (at https://www.aam.com/investors) by no later than 12 noon London time on the business

day following the date of this presentation. Neither the contents of this website nor the content of any other website accessible from hyperlinks on such websites is incorporated into, or forms

part of, this presentation. |

| Reconciliation of Non-GAAP Measures

29

In addition to the results reported in accordance with accounting principles generally accepted in the

United States of America (GAAP) included within this presentation, we have provided certain

information, which includes non-GAAP financial measures. Such information is reconciled to its

closest GAAP measure in accordance with Securities and Exchange Commission rules and is

included in the following slides.

Certain of the forward-looking financial measures included in this earnings release are provided on a

non-GAAP basis. A reconciliation of non-GAAP forward-looking financial measures to the most

directly comparable forward-looking financial measures calculated and presented in accordance

with GAAP has been provided. The amounts in these reconciliations are based on our current

estimates and actual results may differ materially from these forward-looking estimates for many

reasons, including potential event driven transactional and other non-core operating items and their

related effects in any future period, the magnitude of which may be significant. |

| Supplemental Data*

30

*Please refer to definition of Non-GAAP measures.

2024 2023 2024 2023

Net income (loss) $ (13.7) $ (19.1) $ 35.0 $ (33.6)

Interest expense 43.9 50.2 186.0 201.7

Income tax expense 6.8 5.8 27.8 9.1

Depreciation and amortization 115.4 121.4 469.7 487.2

EBITDA 152.4 158.3 718.5 664.4

Restructuring and acquisition-related costs 8.3 9.0 18.0 25.2

Debt refinancing and redemption costs 0.1 1.0 0.6 1.3

Impairment charge - - 12.0 -

Loss (gain) on equity securities - (0.1) 0.1 1.1

Pension curtailment and settlement charges - 1.3 - 1.3

Adjusted EBITDA $ 160.8 $ 169.5 $ 749.2 $ 693.3

Sales 1,380.8 1,463.0 6,124.9 6,079.5

as a % of net sales 11.6% 11.6% 12.2% 11.4%

EBITDA and Adjusted EBITDA Reconciliation

($ in millions)

Three Months Ended Twelve Months Ended

December 31, December 31, |

| Supplemental Data*

31

*Please refer to definition of Non-GAAP measures.

Last Twelve

Months Ended

March 31, June 30, September 30, December 31, December 31,

2024 2024 2024 2024 2024

Net income (loss) $ 20.5 $ 18.2 $ 10.0 $ (13.7) $ 35.0

Interest expense 49.0 47.9 45.2 43.9 186.0

Income tax expense (benefit) 15.9 17.2 (12.1) 6.8 27.8

Depreciation and amortization 117.8 119.6 116.9 115.4 469.7

EBITDA 203.2 202.9 160.0 152.4 718.5

Restructuring and acquisition-related costs 2.5 5.0 2.2 8.3 18.0

Debt refinancing and redemption costs - 0.3 0.2 0.1 0.6

Impairment charge - - 12.0 - 12.0

Loss (gain) on equity securities (0.1) 0.2 - - 0.1

Adjusted EBITDA $ 205.6 $ 208.4 $ 174.4 $ 160.8 $ 749.2

Sales 1,606.9 1,632.3 1,504.9 1,380.8 6,124.9

as a % of net sales 12.8% 12.8% 11.6% 11.6% 12.2%

EBITDA and Adjusted EBITDA for the Last Twelve Months Ended December 31, 2024

($ in millions)

Quarter Ended |

| Supplemental Data*

32

*Please refer to definition of Non-GAAP measures.

2024 2023 2024 2023

Diluted earnings (loss) per share $ (0.12) $ (0.16) $ 0.29 $ (0.29)

Restructuring and acquisition-related costs 0.07 0.07 0.14 0.22

Debt refinancing and redemption costs - 0.01 0.01 0.01

Impairment charge - - 0.10 -

Loss on equity securities - - - 0.01

Pension curtailment and settlement charges - 0.01 - 0.01

Tax effect of adjustments (0.01) (0.02) (0.03) (0.05)

Adjusted earnings (loss) per share $ (0.06) $ (0.09) $ 0.51 $ (0.09)

Adjusted Earnings (Loss) Per Share Reconciliation

Three Months Ended Twelve Months Ended

December 31, December 31, |

| Supplemental Data*

33

*Please refer to definition of Non-GAAP measures.

2024 2023 2024 2023

Net cash provided by operating activities $ 151.2 $ 52.9 $ 455.4 $ 396.1

Less: Capital expenditures net of proceeds from the sale of property, plant and

equipment and from government grants (77.6) (55.9) (242.0) (193.7)

Free cash flow 73.6 (3.0) 213.4 202.4

Cash payments for restructuring and acquisition-related costs 5.6 7.5 16.9 23.6

Insurance proceeds related to Malvern fire, net - - - (7.0)

Adjusted free cash flow $ 79.2 $ 4.5 $ 230.3 $ 219.0

Free Cash Flow and Adjusted Free Cash Flow Reconciliation

($ in millions)

Three Months Ended Twelve Months Ended

Decemeber 31, Decemeber 31, |

| Supplemental Data*

34

*Please refer to definition of Non-GAAP measures.

December 31,

2024

Current portion of long term debt $ 47.9

Long-term debt, net 2,576.9

Total debt, net 2,624.8

Less: Cash and cash equivalents 552.9

Net debt at end of period 2,071.9

Adjusted LTM EBITDA $ 749.2

Net Leverage Ratio 2.8x

Net Debt and Net Leverage Ratio

($ in millions) |

| Supplemental Data*

35

*Please refer to definition of Non-GAAP measures.

2024 2023 2024 2023

Segment Sales

Driveline $ 979.6 $ 1,015.2 $ 4,253.3 $ 4,176.7

Metal Forming 520.6 576.2 2,414.3 2,454.3

Total Sales 1,500.2 1,591.4 6,667.6 6,631.0

Intersegment Sales (119.4) (128.4) (542.7) (551.5)

Net External Sales $ 1,380.8 $ 1,463.0 $ 6,124.9 $ 6,079.5

Segment Adjusted EBITDA

Driveline $ 133.3 $ 140.1 $ 578.2 $ 543.6

Metal Forming 27.5 29.4 171.0 149.7

Total Segment Adjusted EBITDA $ 160.8 $ 169.5 $ 749.2 $ 693.3

Segment Financial Information

($ in millions)

December 31,

Three Months Ended Twelve Months Ended

December 31, |

| Supplemental Data*

36

*Please refer to definition of Non-GAAP measures.

In accordance with Rule 28.1(c)(i) of the Takeover Code, the AAM directors confirm that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has been properly compiled on

the basis of the assumptions stated in the attached appendix and that the basis of accounting used is consistent with AAM's accounting policies.

Full Year 2025 Financial Outlook

($ in millions)

Low End High End

Net Income $ 25 $ 60

Interest expense 170 180

Income tax expense 15 30

Depreciation and amortization 465 465

Full year 2025 targeted EBITDA 675 735

Restructuring costs 25 25

Full year 2025 targeted Adjusted EBITDA $ 700 $ 760

Adjusted EBITDA

Low End High End

Net cash provided by operating activities $ 475 $ 505

Capital expenditures net of proceeds from the sale of property,

plant and equipment

(300) (300)

Full year 2025 targeted Free Cash Flow 175 205

Cash payments for restructuring costs 25 25

Full year 2025 targeted Adjusted Free Cash Flow $ 200 $ 230

Adjusted Free Cash Flow |

| Supplemental Data*

Source: Dowlais’ public filings or derived therefrom. 37

Dowlais Adjusted EBITDA and Adjusted Free Cash Flow Calculation Detail

in £MM

2023

Net cash from operating activities £239

Capital expenditures net of proceeds from the sale of property, plant and equipment (262)

Dividends received from equity accounted investments 63

Interest received 5

Free Cash Flow 45

De-merger costs 48

Restructuring outflows 70

Adjusted Free Cash Flow £163

2023

Purchase of property, plant and equipment -£279

Proceeds from disposal of property, plant and equipment and intangible assets 33

Purchase of computer software and capitalized development costs (16)

Capital expenditures net of proceeds from the sale of property, plant and equipment -£262 |

| Definition of Non-GAAP Measures

38

EBITDA and Adjusted EBITDA

We define EBITDA to be earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of restructuring and acquisition-related costs, debt

refinancing and redemption costs, gains or losses on equity securities, pension curtailment and settlement charges, impairment charges and non-recurring items. We believe that EBITDA and Adjusted EBITDA are

meaningful measures of performance as they are commonly utilized by management and investors to analyze operating performance and entity valuation. Our management, the investment community and the banking

institutions routinely use EBITDA and Adjusted EBITDA, together with other measures, to measure our operating performance relative to other Tier 1 automotive suppliers. We also use Segment Adjusted EBITDA as the

measure of earnings to assess the performance of each segment and determine the resources to be allocated to the segments. EBITDA and Adjusted EBITDA are also key metrics used in our calculation of incentive

compensation. EBITDA and Adjusted EBITDA should not be construed as income from operations, net income or cash flow from operating activities as determined under GAAP. Other companies may calculate EBITDA

and Adjusted EBITDA differently.

Adjusted Earnings (Loss) Per Share

We define Adjusted earnings (loss) per share to be diluted earnings (loss) per share excluding the impact of restructuring and acquisition-related costs, debt refinancing and redemption costs, gains or losses on equity

securities, pension curtailment and settlement charges, impairment charges and non-recurring items, including the tax effect thereon. We believe Adjusted earnings (loss) per share is a meaningful measure as it is commonly

utilized by management and investors in assessing ongoing financial performance that provides improved comparability between periods through the exclusion of certain items that management believes are not indicative of

core operating performance and which may obscure underlying business results and trends. Other companies may calculate Adjusted earnings (loss) per share differently.

Free Cash Flow and Adjusted Free Cash Flow

We define free cash flow to be net cash provided by operating activities less capital expenditures net of proceeds from the sale of property, plant and equipment and government grants. Adjusted free cash flow is defined as

free cash flow excluding the impact of cash payments for restructuring and acquisition-related costs and cash payments related to the Malvern fire, including payments for capital expenditures, net of recoveries. We believe

free cash flow and Adjusted free cash flow are meaningful measures as they are commonly utilized by management and investors to assess our ability to generate cash flow from business operations to repay debt and return

capital to our stockholders. Free cash flow and Adjusted free cash flow are also key metrics used in our calculation of incentive compensation. Other companies may calculate free cash flow and Adjusted free cash flow

differently.

Net Debt and Net Leverage Ratio

We define net debt to be total debt, net less cash and cash equivalents. We define Net Leverage Ratio to be net debt divided by the trailing 12 months of Adjusted EBITDA. We believe that Net Leverage Ratio is a

meaningful measure of financial condition as it is commonly used by management, investors and creditors to assess capital structure risk. Other companies may calculate Net Leverage Ratio differently.

Liquidity

We define Liquidity as cash on hand plus amounts available on our revolving credit facility and non-U.S. credit facilities. |

Forward-Looking Statements

In this presentation, American Axle &

Manufacturing Holdings, Inc. (“AAM”) makes statements concerning its and Dowlais’ expectations, beliefs, plans,

objectives, goals, strategies, and future events or performance, including, but not limited to, certain statements related to the ability

of AAM and Dowlais to consummate AAM’s business combination with Dowlais (the “Business Combination”) in a timely manner

or at all; future capital expenditures, expenses, revenues, economic performance, synergies, financial conditions, market growth, dividend

policy, losses and future prospects and business; and management strategies and the expansion and growth of AAM’s and the combined

company’s operations. Such statements are “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and relate to trends and events that may affect AAM’s or the combined company’s future financial

position and operating results. The terms such as “will,” “may,” “could,” “would,” “plan,”

“believe,” “expect,” “anticipate,” “intend,” “project,” “target,”

and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the

times at, or by, which such performance or results will be achieved. These forward-looking statements involve certain risks and uncertainties

that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties

related to AAM include factors detailed in the reports AAM files with the United States Securities and Exchange Commission (the “SEC”),

including those described under “Risk Factors” in its most recent Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q. These forward-looking statements speak only as of the date of this communication. AAM expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its

or Dowlais’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is

based.

Additional Information

This

presentation may be deemed to be solicitation material in respect of the Business Combination, including the issuance of AAM’s

shares of common stock in respect of the Business Combination. In connection with the foregoing proposed issuance of AAM’s shares

of common stock, AAM expects to file a proxy statement on Schedule 14A (together with any amendments and supplements thereto, the “Proxy

Statement”) with the SEC. To the extent the Business Combination is effected as a scheme of arrangement under English law, the

issuance of AAM’s shares of common stock in connection with the Business Combination would not be expected to require registration

under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to an exemption provided by Section 3(a)(10) under

the Securities Act. In the event that AAM exercises its right to elect to implement the Business Combination by way of a takeover offer

(as defined in the UK Companies Act 2006) or otherwise determines to conduct the Business Combination in a manner that is not exempt

from the registration requirements of the Securities Act, AAM expects to file a registration statement with the SEC containing a prospectus

with respect to the AAM’s shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ

THE PROXY STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE

IN THE PROXY STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS

COMBINATION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document,

and other documents filed by AAM with the SEC at the SEC’s website at http://www.sec.gov.

In addition, investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents

filed by AAM with the SEC at https://www.aam.com/investors.

Participants in the Solicitation

AAM

and its directors, executive officers and certain other members of management and employees will be participants in the solicitation

of proxies from AAM’s shareholders in respect of the Business Combination, including the proposed issuance of AAM’s shares

of common stock in connection with the Business Combination. Information regarding AAM’s directors and executive officers is contained

in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 16,

2024, the definitive proxy statement on Schedule 14A for AAM’s 2024 annual meeting of stockholders, which was filed with the SEC

on March 21, 2024 and the Current Report on Form 8-K of AAM, which was filed with the SEC on May 2, 2024. Additional information

regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth

in the Proxy Statement when it is filed with the SEC. To the extent holdings of AAM’s securities by its directors or executive

officers change from the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC by AAM. These documents may be obtained

free of charge from the SEC's website at www.sec.gov and AAM’s website at https://www.aam.com/investors.

No Offer or Solicitation

This presentation is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation

of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Non-GAAP Financial Information

This presentation refers to certain financial

measures, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Earnings per Share, Adjusted Free Cash Flow, Net Debt, Net Leverage

Ratio and Liquidity that are not required by, or presented in accordance with, accounting principles generally accepted in the United

States, or GAAP. These measures are presented to provide additional useful measurements to review AAM’s operations, provide transparency

to investors and enable period-to-period comparability of financial performance. These non-GAAP measures should not be considered a substitute

for any GAAP measure. Additionally, non-GAAP financial measures as presented by AAM may not be comparable to similarly titled measures

reported by other companies.

Quantified Financial Benefits Statement

This presentation contains statements of estimated

cost savings and synergies arising from the Business Combination (together, the “Quantified Financial Benefits Statements”).

Statements of estimated cost savings and synergies

relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. As a result, the cost

savings and synergies referred to in the Quantified Financial Benefits Statement may not be achieved, may be achieved later or sooner

than estimated, or those achieved could be materially different from those estimated. No statement in the Quantified Financial Benefits

Statement, or this presentation generally, should be construed as a profit forecast or interpreted to mean that the combined company’s

earnings in the first full year following the date on which the Business Combination becomes effective, or in any subsequent period, would

necessarily match or be greater than or be less than those of AAM or Dowlais for the relevant preceding financial period or any other

period. For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement contained in this presentation is the

responsibility of AAM and the AAM board of directors.

A copy of the Quantified Financial Benefits Statements,

the bases of belief, principal assumptions and sources of information in respect of any quantified financial benefits statement are set

out in appendix 6 of the Rule 2.7 announcement made by AAM and Dowlais on January 29, 2025.

Profit Forecasts and Estimates

The statements in this presentation setting out

targets for Adjusted EBITDA and Adjusted free cash flow of AAM for FY25 (together, the “AAM FY25 Profit Forecast”) constitute

profit forecasts of AAM for the purposes of Rule 28.1(a) of the UK Takeover Code (the “Code”). The UK Takeover Panel

has granted AAM a dispensation from the

requirement to include reports from reporting accountants and AAM’s financial advisers in

relation to the FY25 Profit Forecast because it is an ordinary course profit forecast, and Dowlais has agreed to the dispensation.

Other than the AAM FY25 Profit Forecast, nothing

in this presentation (including any statement of estimated cost savings or synergies) is intended, or is to be construed, as a profit

forecast or profit estimate for any period or is to be interpreted to mean that earnings or earnings per share of AAM or Dowlais for the

current or future financial years will necessarily match or exceed the published earnings or earnings per share of AAM or Dowlais, as

appropriate.

AAM Directors’ Confirmation

In accordance with Rule 28.1(c)(i) of

the Code, the AAM board of directors confirms that, as at the date of this presentation, the AAM FY25 Profit Forecast is valid and has

been properly compiled on the basis of the assumptions stated in AAM’s RNS announcement on or around the date of this presentation

and that the basis of accounting used is consistent with AAM’s accounting policies.

Publication on Website

A

copy of this presentation will be made available (subject to certain disclaimers) on AAM’s website (at https://www.aam.com/investors)

by no later than 12 noon London time on the business day following the date of this presentation. Neither the contents of this website

nor the content of any other website accessible from hyperlinks on such websites is incorporated into, or forms part of, this presentation.

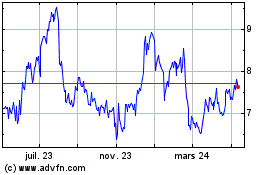

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025