UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

|

Preliminary

Proxy Statement |

| |

|

| ¨ |

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

|

Definitive

Proxy Statement |

| |

|

| ¨ |

|

Definitive

Additional Materials |

| |

|

| x |

|

Soliciting

Material Pursuant to § 240.14a-12 |

AMERICAN AXLE & MANUFACTURING

HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

|

No

fee required. |

| |

|

| ¨ |

|

Fee

paid previously with preliminary materials. |

| |

|

| ¨ |

|

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AAM

Fourth Quarter 2024 Earnings Conference Call

February 14, 2025, 10:00 AM ET

CORPORATE PARTICIPANTS

David Lim, Head of Investor Relations

David Dauch, Chairman of the Board &

Chief Executive Officer

Chris May, Executive Vice President &

Chief Financial Officer

AAM

February 14, 2025, 10:00 AM ET

PRESENTATION

Operator

Good morning. My name is Rocco, and I will be

your conference facilitator today. At this time, I would like to welcome everyone to the American Axle & Manufacturing

Fourth Quarter 2024 Earnings Conference Call. All lines have been placed on mute to prevent any background noise. After the speaker’s

remarks, there will be a question and answer period. If you would like to ask a question during this time, simply press the “*”

key then the number “1” on your telephone keypad. If you would like to withdraw your question, press the “*”

key then the number “2.” As a reminder, today's call is being recorded. I would now like to turn the call over to Mr. David

Lim, Head of Investor Relations. Please go ahead, Mr. Lim.

David Lim

Thank you, and good morning, and I would like

to welcome everyone who is joining us on AAM's fourth quarter earnings call. Earlier this morning, we released our fourth quarter

of 2024 earnings announcement. You can see this announcement on the Investor Relations page of our website, www.aam.com, and

through the PR Newswire services. You can also find supplemental slides for this conference call on the Investor page of our

website as well. To listen to a replay of this call, you can dial 1 (877) 344-7529, replay access code 268-8905. This replay

will be available through February 21.

Before we begin, I'd like to remind everyone

that the matters discussed on this call may contain comments and forward-looking statements that are subject to risks and uncertainties,

which cannot be predicted or quantified and which may cause future activities and results of operations to differ materially from those

discussed. For additional information, please reference Slide 2 of our investor presentation or the press release that was issued

today related to this earnings deck -- earnings announcement. Also, during the call, we may refer to certain non-GAAP financial

measures, information regarding these non-GAAP measures as well as a reconciliation of the non-GAAP measures to GAAP financial information

is available in the presentation.

Today's call is not intended and does not constitute

an offer to sell or the solicitation of an offer to subscribe for or buy securities of AAM or Dowlais in any jurisdiction where such

offers or solicitations are not permitted by law. The subject matter of today's call will be addressed in a proxy statement that

will be filed with the SEC. Investors should read the information in the proxy statement in its entirety when it becomes available. Information

regarding the participants and the proxy solicitation is contained in AAM's case in AAM's annual proxy materials filed with the SEC and

in Dowlais' case in Dowlais' equivalent filings and announcements made in accordance with applicable U.K. law. With that, let me

turn things over to AAM's Chairman and CEO, David Dauch.

David Dauch

Thank you, David, and good morning, everyone. Thank

you for joining us today to discuss AAM's financial results for the fourth quarter and full year of calendar year 2024. Joining

me on the call today are Chris May, AAM's Executive Vice President and Chief Financial Officer. To begin my comments today, I'll

review the highlights of our fourth quarter and full year 2024 financial performance. Next, I'll cover our 2025 financial outlook. And

after Chris covers the details of our financial results, I'll provide some concluding remarks about our exciting Dowlais combination

and then open it up for questions that you all may have. So, let's begin.

AAM closed the year out strong by continuing to

make good operational progress in generating solid adjusted free cash flow in the quarter. AAM's fourth quarter of 2024 sales were

$1.4 billion, and for the full year, AAM sales were approximately $6.1 billion. From a profitability perspective,

AAM

February 14, 2025, 10:00 AM ET

AAM's adjusted

EBITDA in the fourth quarter was $161 million or 11.6% of sales. For the full year, AAM's adjusted EBITDA was $749 million or 12.2%

of sales.

AAM's adjusted earnings per share in the fourth

quarter of 2024 was a loss of $0.06 per share. For the full year, adjusted EPS was a positive $0.51 per share. Adjusted free

cash flow was $79 million in the quarter and $230 million for the full year in 2024.

For 2024, AAM delivered on the financial targets

that we had outlined at the beginning of the year. We came in at the high end of our original adjusted EBITDA range and exceeded

the midpoint of our adjusted free cash flow target. These were achieved while the industry experienced production revisions throughout

the year. It was a solid performance by AAM as we managed the factors that are under our control and remained focused on operational

efficiency.

Let's talk about a couple of recent business updates

on Slide 4 of our presentation deck. We outlined in the past that it was our near-term objective to secure our core legacy driveline

business. That began with our announcement several years ago where AAM secured contracts of more than $10 billion of lifetime revenues

with next-generation full-size truck axles with multiple customers.

Today, we announced we have secured a contract

extension to supply power transfer units for the Ford Maverick and Bronco Sport vehicles. With this latest award, we have secured

our next-generation core business for years to come. Two weeks ago, we also announced our transformational combination with Dowlais,

which will create a leading global driveline and metal forming supplier with significant size and scale. We have high conviction

that this will create a significant value for our shareholders. I'll talk more about this exciting deal a little bit later today.

From a business perspective, our strategy has

been consistent. We continue to strive to improve and optimize our operations, drive EBITDA and free cash flow generation and manage

factors under our control, and we're going to remain disciplined and focused on these priorities.

Before I hand it over to Chris on the call, let's

talk about our 2025 financial outlook. From an end market perspective, we forecast North American production at approximately 15.1

million units. We are also monitoring multiple factors that can swing production, including interest rates, tariffs, inventory levels

and the overall financial health of the consumer.

Slide 5 illustrates AAM's 2025 financial outlook

where AAM is targeting sales in the range of $5.8 billion to $6.05 billion, adjusted EBITDA of approximately $700 million to $760 million,

and adjusted free cash flow of approximately $200 million to $230 million. As I said earlier, after Chris' financial commentary, I'll

have some additional remarks regarding our recently announced strategic combination with Dowlais. Now let me turn the call over

to Chris. Chris?

Chris May

Thank you, David, and good morning, everyone. I

will cover the financial details of our fourth quarter and full year '24’ results and our 2025 outlook with you today. I will

also refer to the earnings slide deck as part of my prepared comments. So, let's go ahead and begin with sales. In the fourth

quarter of 2024, AAM sales were $1.38 billion compared to $1.46 billion in the fourth quarter of 2023. Slide 8 shows a walk of fourth

quarter 2023 sales to fourth quarter 2024 sales.

Volume mix and other lowered sales by $61 million

as North American production declined by approximately 3% and we were impacted by the timing of launches of new next-generation products. Pricing

was $5 million in the fourth quarter, and metal market pass-throughs and FX

AAM

February 14, 2025, 10:00 AM ET

lowered net sales by approximately $16 million as both were

lower year-over-year. For the full year of 2024, AAM sales were $6.12 billion as compared to $6.08 billion for the full year of

2023. The primary drivers of the increase were volume and mix, partially offset by lower metal market pass-throughs and FX.

Now let's move on to profitability. Gross

profit was $154.3 million in the fourth quarter of 2024 as compared to $154.9 million in the fourth quarter of 2023. Adjusted EBITDA

was $160.8 million in the fourth quarter of 2024 versus $169.5 million last year. You can see the year-over-year walk down of adjusted

EBITDA on Slide 9.

In the quarter, the decline in volume mix and

other impacted adjusted EBITDA by $20 million in the fourth quarter versus the prior year. R&D was slightly lower year over

year and performance was $10 million favorably. For the full year of 2024, AAM’s adjusted EBITDA was $749.2 million and adjusted

EBITDA margin was 12.2% of sales. For the full year, this was an 80 basis point margin improvement as we delivered favorable year-over-year

performance every single quarter this year.

Let me now cover SG&A. SG&A expense,

including R&D in the fourth quarter of 2024 was $89 million or 6.4% of sales. This compares to $95.7 million or 6.5% of sales

in the fourth quarter of 2023. AAM's R&D spending in the fourth quarter of 2024 was approximately $37.7 million, a slight decline

from last year. As we head into 2025, we will continue to focus on controlling our SG&A costs. We expect R&D expense

to be down on a year-over-year basis by approximately $20 million as we optimize our spend in this area to reflect current market requirements.

Let's move on to interest and taxes. Net

interest expense was $37.3 million in the fourth quarter of 2024 compared to $42.9 million in the fourth quarter of 2023. In the

fourth quarter of 2024, we recorded income tax expense of $6.8 million compared to $5.8 million in the fourth quarter of 2023. As

we head into 2025, we expect our adjusted effective tax rate to be approximately 30%.

Taking all these sales and cost drivers into account,

our GAAP net loss was $13.7 million or $0.12 per share in the fourth quarter of 2024 compared to a net loss of $19.1 million or $0.16

per share in the fourth quarter of 2023. Adjusted earnings per share, which excludes the impact of items noted in our earnings press

release, was a loss of $0.06 per share in the fourth quarter of 2024 compared to a loss of $0.09 per share in the fourth quarter of 2023. However,

for the full year of 2024, AAM's adjusted earnings per share was $0.51 versus a loss of $0.09 per share in 2023.

Let's now move to cash flow and the balance sheet. Net

cash provided by operating activities for the fourth quarter of 2024 was $151.2 million compared to $52.9 million in the fourth quarter

of 2023. Capital expenditures, net of proceeds from the sale of property, plant and equipment for the fourth quarter of 2024 were

$77.6 million. Cash payments for restructuring and acquisition-related activity for the fourth quarter of 2024 were $5.6 million.

Reflecting the impact of these activities, AAM

generated adjusted free cash flow of $79.2 million in the fourth quarter of 2024. For the full year of 2024, AAM generated adjusted

free cash flow of $230 million compared to $219 million in 2023. Our increased cash flow was driven by our stronger operational

performance, inventory reductions, and lower interest costs.

From a debt leverage perspective, we ended the

year with a net debt of $2.1 billion and LTM adjusted EBITDA of $749.2 million, calculating a net leverage ratio of 2.8x at December 31. This

is down nearly half a turn from a year ago at December 31, 2023. During 2024, we redeemed all our remaining 2026 senior notes

for a total of nearly $130 million, including approximately $46

AAM

February 14, 2025, 10:00 AM ET

million in the fourth quarter. AAM ended 2024 with total available

liquidity of approximately $1.5 billion, consisting of available cash and borrowing capacity on AAM's global credit facilities.

Before we move to the Q&A portion of the call,

let me provide some thoughts and details on our 2025 financial outlook. In our earnings slide deck, we have included walks from

our '24 actual results to our 2025 financial targets and you can see those starting on Slide 11. 2025 will bring about many exciting

opportunities for AAM to grow and drive value creation. The guidance figures we are providing today are on an AAM stand-alone pre-combination

basis and do not reflect any cost or expenses related to the announced combination with Dowlais. For sales, we are targeting the

range of $5.8 billion to $6.05 billion for 2025.

To begin, the sales target is based upon a North

America production of approximately 15.1 million units at the midpoint, and certain assumptions for our key programs such as we anticipate

GM's full-size pickup truck and SUV production in the range of 1.3 million to 1.4 million units. In addition, we are assuming the

pending sale of our commercial vehicle axle business in India will be completed by the end of the first half of 2025 and our financial

guidance reflects that timing as you can see on our walk.

From an EBITDA perspective, we are expecting adjusted

EBITDA in the range of $700 million to $750 million. Let me provide some color on the key elements of our year-over-year EBITDA

walk that is on Page 12. We expect decremental margins for our volume and mix change to be slightly lower than our average

of 25% to 30% as our India commercial vehicle margins are lower than our overall average. As mentioned earlier, our focus on optimizing

our spend in R&D should yield a year-over-year improvement of $20 million and AAM expects to deliver continued cost reductions, operational

productivity, and deliver year-over-year efficiency gains. And you can see the year-over-year performance improvements as a net

favorable $15 million on our walk.

On Page 10, from an adjusted free cash flow

perspective, we are targeting approximately $200 million to $230 million in 2025. The main factors driving our cash flow changes

are as follows: we have higher capital expenditures stemming from investments for our largest truck platforms, next-generation products. These

are the cornerstones for AAM's revenues and profitability for a long time to come. Even with the scale of these programs, we've

been leveraging our installed capital base, driving purchasing efficiency, and operational effectiveness, and we are targeting CapEx

as a percent of sales in 2025 of approximately 5%.

Lower outstanding debt also means lower cash interest

of approximately $10 million. We do see higher cash taxes in 2025 in the range of $60 million to $70 million in total, which is

approximately $15 million higher than 2024. As for working capital, we believe we have continued opportunities across all areas

of our working capital in 2025 and expect good performance in this area. And lastly, while not included in our adjusted free cash

flow figures, we estimate our restructuring payments to be in the range of $20 million to $30 million for 2025 as we look to further

optimize our business and further reduce fixed costs.

While we do not provide quarterly guidance, we

do want to provide some perspectives on timing in 2025. As it relates to revenue cadence for the year, due to early January downtime

at key customers and the continued ramp curve of a key next-generation program launch in North America, we anticipate the first quarter

sales per production date to be lower relative to the remainder of the year. In addition, we expect a normal seasonal cash flow

use in the first quarter of the year.

AAM

February 14, 2025, 10:00 AM ET

So, taking all that in, what does it mean? It

means on a stand-alone basis, AAM is driving increased margins, delivering strong and steady cash flow, and positioning its portfolio

to support arguably one of the best automotive product franchises around, that being North America light trucks. And when we combine

with Dowlais and its complementary product set and performance capabilities, this will be an even more exciting company.

Thank you for your time and participation on the

call today. I'm going to stop here and turn the call back over to David Dauch for his closing remarks regarding our upcoming combination. David?

David Dauch

Thanks, Chris. And before we go into the Q&A

session, I wanted to discuss our transformational combination with Dowlais that we announced on January 29. This compelling

strategic combination brings together two complementary global Tier 1 suppliers to create a leading global driveline and metal forming

company in the world. Simply, AAM plus Dowlais creates a more balanced and more resilient company with revenues on a non-adjusted

combined basis of approximately $12 billion. Combined adjusted EBITDA margin, including $300 million of run rate synergies of approximately

14% and we anticipate day one net leverage after the impact of the transaction financing of approximately 2.5x, including synergies.

Following the close of the transaction, we expect

strong earnings accretion in the first full year. Upon closing, AAM will become a top 10 North American and top 25 global supplier. From

a diversification standpoint, the combined business benefits greatly from a more balanced customer mix and geographic presence. We

anticipate our GM concentricity to reduce to 25% post close from approximately 40% today.

As to our geographic presence, our North American

dependence reduces to 54% from 73% today, while our European and Asian exposure grows. This improved geographic balance allows us

to better serve our customers, where their operations are located, which positions us to grow the business that we already have and importantly

gain new customers.

In summary, this strategic combination provides

a more robust business model positioned to deliver higher earnings and cash flow. Dowlais is a market leading, high technology engineering

group, which is comprised of two operating business units, GKN Automotive and GKN Powder Metallurgy. GKN Automotive is a leader

in the development and production of side shafts, prop shafts, all-wheel drive systems, e-Drive systems, and e-powertrain components. GKN

Powder Metallurgy is a global leader of high-performance and precision powdered metal products for the automotive and industrial markets.

This transaction brings together a complementary

product portfolio with Dowlais strengths in side shafts coupled with AAM strength in axles. On Slide 18, you'll see that Dowlais

is a pioneer of automotive CV joints and is the #1 global supplier of side shafts in the world. Side shafts casts deliver power

to the wheels for ICE, hybrid and electric vehicles. Dowlais possesses industry-leading technology and strong vertical integration,

which complements and expands AAM's existing capabilities.

As industry transitions to electrification, the

content per vehicle opportunity for side shafts increases. This is another great benefit of this powertrain agnostic product line. This

strategic combination is expected to deliver approximately $300 million of synergies. We expect run rate savings to be approximately

60% achieved after year two and the remainder is substantially achieved by the third year after the deal closes. The transaction

positions AAM for high-margin

AAM

February 14, 2025, 10:00 AM ET

potential, strong earnings accretion, strong cash flow, and a strong balance sheet. We are already

making plans to integrate our two businesses so that, when we close, we will confidently hit the ground running to achieve these synergies,

which we have a solid track record of delivering with other deals that we have completed over the years.

Furthermore, our confidence to achieve these synergies

is very high based on the robust process that we were required to undertake in order to announce our $300 million synergy number. This

process included detailed in-person diligence sessions for 10 work streams, which were conducted over multiple weeks between AAM and

Dowlais management teams with the support of our respective global consulting firms. This process ultimately resulted in both a

quantified synergy report and a supporting opinion being issued by an outside accounting firm.

Our process is to identify greater opportunities

for what we call a market basket, well in excess of our targets. This supports our ability and our high confidence level to deliver

the synergy opportunities. As such, on Slide 21, you can see the cash flow generation potential is very strong. Based on reported

figures, plus the realization of full synergies or 5% of revenues based on the applied combined market cap of the company, this implies

a very attractive 50%, let me say it again, 50% free cash flow yield.

Now let's transition to financing the balance

sheet and capital allocation. We have fully committed financing in place to support this transaction. and we expect to raise

approximately $2.2 billion of new debt financing to refinance Dowlais' existing debt and fund the cash purchase price of the deal. At

closing, this deal is anticipated to be approximately net leverage neutral before synergies, and we expect to have ample liquidity available

to us.

Regarding capital allocation, historically AAM

is focused on organic growth and debt paydown. That will remain true in the near term. However, the combined organization with

greater size and scale and higher free cash flow generating capability we can now target a more balanced capital allocation policy once

we are below 2.5x net leverage, including a strong consideration of returning capital to our shareholders.

Finally, on the regulatory front, AAM and Dowlais

have already done a significant amount of analysis and preparatory work and have already actioned a number of items. On February 7,

AAM submitted its U.S. regulatory filing. Additionally, AAM is progressing with other country filings and engaging with appropriate

regulators. We expect regulatory approval and closing in the fourth quarter of this year, and we are happy to share that initial

customer feedback has been supportive given the complementary nature of the product and the customer portfolios.

We are extremely excited about the strategic combination

as it will create an organization with meaningful size and scale and synergy opportunities a more robust business model based on compelling

strategic rationale and industrial logic, a powertrain agnostic product portfolio while realizing enhanced diversification a strong experience

and blended management team with a proven track record for success, significant margin and earnings accretion while accelerating opportunities

for growth, and finally, strong value creation for all stakeholders, including an enhanced capital allocation policy in the near future.

In conclusion, AAM delivered strong 2024 financial

results. We are positioned to have a solid year in 2025 as a stand-alone company, and we are excited about the future strategic

combination with Dowlais. So, thank you for your participation today.

AAM

February 14, 2025, 10:00 AM ET

Before I turn it over to David Lim to start the

Q&A portion of the call, we also want to let you know that we are planning to do investor meetings in New York and Boston for current

and prospective shareholders, we have shown interest in AAM. These meetings will be held on February 24 and February 25,

respectively. Please feel free to e-mail david.lim@aam.com to register your interest. I will now turn it back over to David

Lim to start the Q&A portion of our call. David?

QUESTION AND ANSWER

David Lim

Thank you. So, operator, can you start with the

question-and-answer session, please?

Operator

Absolutely. At this time, I would like to

remind everyone, in order to ask a question, please press “*” then the number “1” on your telephone keypad. Today's

first question comes from John Murphy of Bank of America. Please go ahead.

John Murphy

Good morning, guys. I just have a couple here. David,

when you were mentioning -- or Chris, maybe when you're going through the walk on the outlook, you mentioned mix and volume. I'm

just curious if you could talk about sort of that in the context of GM trucks and then also the Ram HD, what your expectations are on

those two specific programs for mix?

Chris May

Yeah. So, the underpinning at the macro level,

John, 15.1 million North American units overall. From the T1 perspective or the GM full-size truck, I should say, think about

the range of our revenue mix anywhere from 1.3 million units to 1.4 million units for the full year. And then some of our other

top platforms, like, for example, the upcoming Ram HD platform, as you know, has been transitioning model years at the end of last year,

beginning of this year. Big picture, we would see that relatively flattish year-over-year because there was declines in the fourth

quarter. We expect lower volumes in the first quarter, but then picking back up the production run rates in the second quarter and

beyond.

John Murphy

Just maybe in that T1, is there something going

on with mix in that platform where you think it might be less rich, maybe less 4x4s? Or is it -- is that mix relatively flat?

Chris May

It's relatively flat. We continue -- from

that perspective, we continue to see strong robust demand on the HD, the heavy-duty side, in terms of, I'd call it, platform mix

inside of that and obviously strong mix still also on the SUV. But from a 4-wheel drive perspective, relatively flat.

John Murphy

Got it. And then just a follow-up on Dowlais. The

R&D, it's down $20 million, and the CapEx is down $50 million in your outlook for 2025. Is that -- is there kind of a -- is

that organic? Or is there some kind of precursor of understanding that you might be able to use some of the capital at Dowlais,

particularly on the capacity side and some of the R&D from some of their products to overlay and save even before you get to

the close? Or is this really stuff that you're doing purely on an organic basis?

Chris May

AAM

February 14, 2025, 10:00 AM ET

Yes. This is purely organic, John. The guidance

is our stand-alone company guidance perspective.

John Murphy

Got it. And then just lastly, Dowlais, you mentioned

the customer reception was pretty good or actually very good, I should say. But can you talk about the customer reception outside

of the D3 and the incumbent European companies? I mean, has there been any your commentary from the Asian brands or the Chinese

brands that might lead you to believe that you might have a real revenue synergy above and beyond what you're talking about so far?

David Dauch

Yes, John, this is David. Again, on the Detroit

3, everything is very positive in regards to the initial discussions we had with them. Outside of the Detroit 3 to your question, Again,

people are excited about two complementary businesses coming together. The product portfolio becomes more expansive. Therefore,

we'll be able to cross-sell and have greater opportunities with different customers around the world.

They like the stability and the technology and

the innovation that both companies bring to the table. So that's important. At the same time, remember, Dowlais has a very

important joint venture in China. There's obviously a relationship that we want to maintain and continue there and grow that. There

will be meetings that will be upcoming with respect to the leadership of that joint venture and the ultimate customers. But it's

been overall positively received in Europe, in Asia, and here in North America. So, we're very happy with the initial feedback from

the customers.

John Murphy

That’s great. Thanks very much, guys.

David Dauch

Thank you.

Operator

Thank you. And our next question today comes from

James Picariello with BNP. Please go ahead.

Unknown Speaker

Hey, guys. This is Jake on for James. So, I

think we all appreciate the level of detail you've given us on some of these cost synergies and how that flows through to pro forma free

cash flow. But can you just talk a little bit about maybe any top line synergies you see, especially given the kind of complementary

nature of the portfolios? Thank you.

David Dauch

Well, as I just mentioned, I mean, you're

bringing together two very complementary businesses whose product portfolios, support and are complementary and expansive to one another. So,

there's going to be cross-selling opportunities, we think, with multiple customers globally around the world. So, we definitely

see opportunity for revenue growth that way. We also recognize and understand that they are innovative and technology-leading based

company. We've done similar things. We both have positioned ourselves very well on the electrification front when the markets

take off there. And obviously, that's going to vary by region of the world, where China is already leading that active.

Europe is moving along because the CO2 requirements

changing meaning getting tougher. And then in North America, we know that it's slowing down a little bit here under the Trump

AAM

February 14, 2025, 10:00 AM ET

administration. But

regardless of the administration, we're putting ourselves in a position that we have a product powertrain agnostic product portfolio

that can support the consumer requirements and the market requirements on a go-forward basis. And we see tremendous opportunity

and flexibility and optionality with our portfolio. especially as we bring these two dynamic and positive companies together.

Unknown Speaker

Thanks, David. And could you guys also just kind

of help me with the free cash flow bridge? So, at the midpoint, your EBITDA was down about $30 million, CapEx up about $50 million, and

you've managed to hold free cash flow more or less flat year-over-year. So, is there any working capital benefit that's driving

that? And should we think about some sort of potential unwind in 2026, or is this a number that could potentially continue to move

higher once we get through the next-generation GM full-size launch? Thank you.

Chris May

Yes, Jake, this is Chris. I'll take that.

You can see our free cash flow bridge on Page 13 of our earnings deck. Another contributor to favorable cash flow is we do

expect some favorability as it relates to lower interest expense as we've been paying down our debt. But from a working capital

perspective, that's going to be a key driver for us here in 2025. From an inventory perspective, we see still continued opportunity

there.

From a turns basis, we've been relatively flat

year-over-year, which means we have opportunity to continue to reduce that down to levels we ran pre-COVID as things are stabilizing

across the industry. In addition, from our payables and receivables, or let's call it the traditional type of working capital elements,

we see some additional opportunity inside those sets as well. So, we're excited to get at that working capital. And I would

not really envision any unwind of inventory or others as we clear through '25 on these structural changes for working capital.

Unknown Speaker

Very helpful. Thanks, guys.

David Dauch

Thank you.

Operator

And our next question today comes from Edison

Yu with Deutsche Bank. Please go ahead.

Edison Yu

Hey, thank you for taking our questions, and good

morning. First question is on --

David Dauch

-- Good morning.

Edison Yu

Great. Wanted to ask on the transaction and maybe

more of a strategic or higher level point of view, it seems that we've seen a lot of suppliers kind of go the opposite way, where they're

getting smaller breakout kind of the approach of getting bigger and expanding. So, I'm curious, you look down whatever, three,

four, five years. What do you think the supplier landscape looks like? Is it kind of be more your direction that more people

are going to consolidate? Or do you think that actually this other kind of counter trends that's been happening over the last couple

of years actually is the way it goes?

AAM

February 14, 2025, 10:00 AM ET

David Dauch

Listen, this is David Dauch. I've been saying

for years that I feel that the automotive market needs to consolidate, both at the OEM level as well as and especially at the supplier

level. I'm still true to my convictions that way and my belief in our thought process. Our team feels very strongly about that. That's

why we've done a lot of the acquisitions that we've done. The biggest one to do what we did to as MPG back in 2017, but now this

is even bigger here with Dowlais here in 2025.

We think the markets are very uncertain, very

dynamic, and you need size and scale to be able to weather the storm and be in a position that you can balance the requirements that

are out there. And there's new challenges every day that the market brings or countries or regions bring and we need to be in a

position to leverage those global resources, those expansive resources that we have.

But most importantly, when it's all said and done,

we've got to bring solutions to our customers that meet their needs and ultimately meet the market needs, being in the consumer in what

they want. And we think bringing together two complementary companies with an expansive product portfolio that's very complementary

to one another with very little overlap. We're doing just what the market and what our customers need. And we're very pleased

with the strength that they have with their leadership team, combined with our leadership team, we'll blend that together. We'll

have a leading and proven management team that has tremendous experience, and we'll be able to manage that effectively going forward. Yes,

there are some people that are taking actions to reduce their concentricity in different regions or actually not of certain businesses.

What we're trying to do is make sure that we have

a powertrain agnostic portfolio that can meet the requirements no matter what the market conditions are on a global basis. And we're

still true to that. At the same time, we recognize that each region requires a different strategy. But holistically, there's

a way that we can bounce that out and be efficient from an operations standpoint and from a product development and from a cash management

standpoint going forward.

So long answer to your question, but the short

answer to it is we feel very strongly that the markets will continue to consolidate going forward. That's the whole premise of our

strategic rationale and industrial logic. Not only do we feel that way, the Dowlais Board and management team feels that way as

well and others that I've talked to in the industry also feel that way.

Edison Yu

Appreciate the insights. A follow-up on the

Dowlais side. For those of us maybe not as close. You've got quite a bit of time to do work. The Chinese business, the

China business under is actually quite strong, I think, maybe to many people surprise. Can you maybe, from your perspective,

maybe describe why that is given just the level of competition there. I think we're kind of from the U.S. perspective under

impression that the local suppliers would be doing much better. So just curious as to why maybe you think they're actually holding

up quite what you're doing quite well there.

David Dauch

Well, I mean, I think you have to recognize,

first and foremost, the two joint venture partners, that being at ASCO and that be in GKN and the management teams and the strategy that

they put together for that JV. That JV is 35 years old. There's been a lot of experience there. They're tailored in design,

China for China as far as support the local market.

AAM

February 14, 2025, 10:00 AM ET

They've got an effective product portfolio heavily

weighted towards half-shaft (sp) but also supporting all-wheel drive and electrification and e-powertrain components for that market,

which is what's in demand. They've got a competitive cost structure and a supportive management team. that is growing both

with the domestic Chinese manufacturers or OEMs as well as with the international or Western OEMs that are doing business in China.

So, credit to those two organizations. So,

we had nothing to do with that. However, what we want to do is make sure that we not only maintain the relationship but build on

that relationship, especially as our product portfolio expands as a combined business. And then we'll look to bring other operational

excellence and support to that joint venture going forward. But don't mess with something, as you said, it's performing very well.

So, we just got to meet that management team that's

over there and that new partner going forward. And appropriate meetings will take place first and foremost between Dowlais and their

existing partner and then we'll follow up with the appropriate meetings with myself and others to meet their leadership team and position

ourselves and talk about what the future holds.

Edison Yu

Great. Thank you very much.

David Dauch

Yeah.

Operator

Thank you. And our next question comes from Doug

Karson of Bank of America. Please go ahead.

Douglas Karson

Hey, guys. Good morning. Thanks for hosting the

call.

David Dauch

Good morning, Doug.

Douglas Karson

I'm kind of excited about the scale getting bigger. In

my career, I think rating agencies kind of like bigger auto suppliers, which helped give you some math relative to the market pressures. And

you're actually merging with a company that had lower leverage than AAM and the combined entity, I think out of the gate, I

think you said to be about 2.5 turns of leverage.

I think you made some comments that, maybe going

forward, you'll be able to harvest some of the cash flow to get back to equity rather than the de-levering that we've seen in the last

few years. So one, want to just kind of explore that a little bit. And then separately, I know the agency has kind of

commented, but do you think longer term, you could safely get the combined entity more into the mid-BB range rather than B range for

ratings given the scale almost double?

Chris May

Yes, Doug, you have a few questions in there. This

is Chris. I'll take a crack at a few of those. First of all, we agree with your enthusiasm about the size and the scale but as it

relates to de-levering, if you listen to some of our comments, we talked about at 2.5x, we would open up to some additional capital allocation

priorities. But before that happens, we will continue to reduce and strengthen our balance sheet down into the 2.5x.

AAM

February 14, 2025, 10:00 AM ET

So, we'll continue to prioritize the organic growth. We'll

continue to prioritize debt repayment and drive a stronger and stronger balance sheet through that process. So, I think that's

a key point to keep in mind. And then we would have a balanced portfolio or balanced capital allocation going forward, which would

still include an element of debt reduction as well. It wouldn't be solely overweight to one versus the other.

Douglas Karson

Right.

Chris May

But longer term, obviously, driving higher ratings

is critical to cost of capital. So, we're focused on the elements of those. Whether the agencies rewrite us or not, that's up to

them. But we're focused on strengthening the balance sheet reducing our leverage, the size and scale, free cash flow to debt ratios,

things of that nature, elements of our business that are good for the business will ultimately drive to a stronger company and hopefully

will reflect in the ratings over time.

Douglas Karson

Great. That's helpful. And then maybe just a quick

follow-up. There's obviously a lot of headlines around tariffs and steel prices. And I know that you've got some pretty good

pass-through capabilities in. Can you just kind of refresh us on how you're looking at some of those commodity risks out there in

the market broadly?

David Dauch

Doug, this is David. I'll take the first

shot and then Chris can comment on it. But I think you know and others know, and we've been very forthright that our long-standing

policy has been to buy and build local in the regions that we support and that we serve, and that's proved very effective to us in mitigating

tariff risk that we're experiencing in the past, but also propensity experience here in the future. We'll obviously look to mitigate

any other impact that may happen once they get announced in regards to what's going on between the U.S. with Canada and Mexico, and we'll

see where that goes in March.

With respect to steel and the aluminum side right

now, we have very minimal exposure as our U.S. deal and our aluminum is sourced here locally. So, we feel very good about where

we are that way. we just got to understand what the details are going to be with respect to the tariff strategy or policies between

the U.S., Mexico and Canada as well as any other countries that may be involved longer term. But overall, like I said, our strategy

is to buy and build local, and that benefits us when you have tariff issues or trade war issues that are taking place. So, Chris,

any other comments on that?

Chris May

Yeah. And when you referred to, Doug, some of

the pass-through mechanisms, if this activity brings more volatility to the input costs, not tariff-related, but that are driving the

commodity costs that go into our product, as you know, we pass around 80% plus up and down to the customer by contract on this. So,

we are insulated and protected from some of that side, not tariffs, but the market inputs that impact our purchases through our supply

base. So that's a nice protection mechanism for the company.

Douglas Karson

Yes. That is good. Well, thanks, guys. That's

it from me.

David Dauch

AAM

February 14, 2025, 10:00 AM ET

Yes. Thanks, Doug. Appreciate it.

Operator

Thank you. And gentlemen, your last question today

comes from Dan Levy with Barclays. Please go ahead.

Unknown Speaker

Hi. Josh on for Dan today. Thanks for taking

my question. I had a question on just backlog and bidding dynamics. I know you've said in the past couple of quarters that there's

a bit of air pocket while the OEMs consider the EV plans. And I saw today that there is an extension on the Ford program, which, I

guess, would not be included in backlog just wanted to see how things are going with bidding and if you're seeing a greater extension

interest right now?

David Dauch

Yeah. So, this is David, and I'll let Chris talk

from there. As we've said all along, with the OEMs reevaluating their product portfolios right now, it is creating a bit of an air

pocket in regards to some of the sourcing here in the initial years, meaning, let's say, over the next three years. But at the same

time, we've been very forthright in regards to what our backlog has been over the last three years, and there's not a meaningful change

there for '25, slightly lower just based on some of the retiming and re-volumes of some of the programs that the customers put forward.

I think the most important thing for us and the

big swing that we're seeing right now is we're still actively quoting about $1.5 billion of new and incremental opportunities. And

again, our backlog is only new and incremental. We don't count any replacement business in that. But on that new and incremental

business that we're quoting, in the past couple of years, that was heavily weighted towards electrification, like 75% to 80%. Today,

that has swung the other way, where we still have some electrification in it, but it's more heavily weighted towards ICE and hybrid applications

going forward.

So, what we're very excited about is the fact

that, one, we've got our next-generation business essentially and substantially secured, which I covered in my earlier remarks. Two,

we're actively quoting on $1.5 billion of new and incremental business and it's right in our wheelhouse of our ICE and hybrid business

today.

But at the same time, three, we have -- already

have an existing portfolio, and that portfolio will expand with Dowlais that better positions us for the powertrain agnostic portfolio

to quote on more electrification requirements as they evolve based on the different markets globally around the world. And then

we'll also be able to leverage the global footprint of the two organizations to better position ourselves from a cost effectiveness standpoint

so that we improve our hit rate of trying to win that new business going forward.

But overall, and we feel good about the market

basket of opportunities. There is an air pocket going through the industry, not only for AAM but many suppliers. But most importantly,

a lot of the programs are being extended which is a positive because that allows us to continue to drive operational efficiency and financial

performance which we delivered in '24, and we were positioned to deliver as a stand-alone company in '25. And obviously, we've conveyed

what we think the synergies are and the incremental opportunities when we bring Dowlais and American Axle together.

Unknown Speaker

AAM

February 14, 2025, 10:00 AM ET

As a quick follow-up on that, of the R&D decline

year-over-year, would you say a lot of that is within EV spending given the slowdown? And assuming there's an uptick in hybrid over the

next couple of years, would that require any incremental spending beyond your current portfolio, or is that kind of already included

in what you already have?

Chris May

Yeah. I would say -- Josh, this is Chris. The

R&D decline is to align really with current market requirements, demands of our customers. Part of our elevated spend over

the past year or two has been to build out our e-Drive portfolio, which we now have in place. and has gained a lot of traction in

China and other markets as well. So that's sort of done and behind us, so we can now start to reap the cost benefits of sort of

repositioning with the current market dynamics and harvest those savings this year and, we would, expect going forward.

The nice thing about the hybrid applications for

us, in many cases, uses the exact same product as our ICE vehicle products. So, there's not a lot of R&D associated with that. So

that's a perfect alignment of some of that powertrain applications between ICE and a hybrid perspective.

CONCLUSION

David Lim

Thank you. I think that was our last question,

and we thank all of you who have participated on this call and appreciate your interest in AAM. We certainly look forward to talking

with you in the future.

Operator

Thank you. This concludes today's conference call.

You may now disconnect your lines, and have a wonderful day.

AAM

February 14, 2025, 10:00 AM ET

Forward-Looking Statements

In this filing, American Axle & Manufacturing

Holdings, Inc. (“AAM”) makes statements concerning its and Dowlais’ expectations, beliefs, plans, objectives, goals,

strategies, and future events or performance, including, but not limited to, certain statements related to the ability of AAM and Dowlais

to consummate AAM’s business combination with Dowlais (the “Business Combination”) in a timely manner or at all; future

capital expenditures, expenses, revenues, economic performance, synergies, financial conditions, market growth, dividend policy, losses

and future prospects and business; and management strategies and the expansion and growth of AAM’s and the combined company’s

operations. Such statements are “forward-looking” statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and relate to trends and events that may affect AAM’s or the combined company’s future financial position and

operating results. The terms such as “will,” “may,” “could,” “would,” “plan,”

“believe,” “expect,” “anticipate,” “intend,” “project,” “target,”

and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the

times at, or by, which such performance or results will be achieved. These forward-looking statements involve certain risks and uncertainties

that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties

related to AAM include factors detailed in the reports AAM files with the United States Securities and Exchange Commission (the “SEC”),

including those described under “Risk Factors” in its most recent Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q. These forward-looking statements speak only as of the date of this communication. AAM expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its

or Dowlais’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is

based.

Additional Information

This

filing may be deemed to be solicitation material in respect of the Business Combination, including the issuance of AAM’s shares

of common stock in respect of the Business Combination. In connection with the foregoing proposed issuance of AAM’s shares of common

stock, AAM expects to file a proxy statement on Schedule 14A (together with any amendments and supplements thereto, the “Proxy

Statement”) with the SEC. To the extent the Business Combination is effected as a scheme of arrangement under English law, the

issuance of AAM’s shares of common stock in connection with the Business Combination would not be expected to require registration

under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to an exemption provided by Section 3(a)(10) under

the Securities Act. In the event that AAM exercises its right to elect to implement the Business Combination by way of a takeover offer

(as defined in the UK Companies Act 2006) or otherwise determines to conduct the Business Combination in a manner that is not exempt

from the registration requirements of the Securities Act, AAM expects to file a registration statement with the SEC containing a prospectus

with respect to the AAM’s shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ

THE PROXY STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE

IN THE PROXY STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS

COMBINATION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document,

and other documents filed by AAM with the SEC at the SEC’s website at http://www.sec.gov.

In addition, investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents

filed by AAM with the SEC at https://www.aam.com/investors.

Participants in the Solicitation

AAM

and its directors, executive officers and certain other members of management and employees will be participants in the solicitation of

proxies from AAM’s shareholders in respect of the Business Combination, including

the

proposed issuance of AAM’s shares of common stock in connection with the Business Combination. Information regarding AAM’s

directors and executive officers is contained in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023,

which was filed with the SEC on February 16, 2024, the definitive proxy statement on Schedule 14A for AAM’s 2024 annual meeting

of stockholders, which was filed with the SEC on March 21, 2024 and the Current Report on Form 8-K of AAM, which was filed

with the SEC on May 2, 2024. Additional information regarding the identity of participants, and their direct or indirect interests,

by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. To the extent holdings of

AAM’s securities by its directors or executive officers change from the amounts set forth in the Proxy Statement, such changes

will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed

with the SEC by AAM. These documents may be obtained free of charge from the SEC's website at www.sec.gov and AAM’s website at

https://www.aam.com/investors.

No Offer or Solicitation

This filing is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction.

Non-GAAP Financial Information

This filing refers to certain financial measures,

including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Earnings per Share, Adjusted Free Cash Flow, Net Debt, Net Leverage Ratio

and Liquidity that are not required by, or presented in accordance with, accounting principles generally accepted in the United States,

or GAAP. These measures are presented to provide additional useful measurements to review AAM’s operations, provide transparency

to investors and enable period-to-period comparability of financial performance. These non-GAAP measures should not be considered a substitute

for any GAAP measure. Additionally, non-GAAP financial measures as presented by AAM may not be comparable to similarly titled measures

reported by other companies.

Quantified Financial Benefits Statement

This filing contains statements of estimated cost

savings and synergies arising from the Business Combination (together, the “Quantified Financial Benefits Statements”).

Statements of estimated cost savings and synergies

relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. As a result, the cost

savings and synergies referred to in the Quantified Financial Benefits Statement may not be achieved, may be achieved later or sooner

than estimated, or those achieved could be materially different from those estimated. No statement in the Quantified Financial Benefits

Statement, or this filing generally, should be construed as a profit forecast or interpreted to mean that the combined company’s

earnings in the first full year following the date on which the Business Combination becomes effective, or in any subsequent period, would

necessarily match or be greater than or be less than those of AAM or Dowlais for the relevant preceding financial period or any other

period. For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement contained in this filing is the responsibility

of AAM and the AAM board of directors.

A copy of the Quantified Financial Benefits Statements,

the bases of belief, principal assumptions and sources of information in respect of any quantified financial benefits statement are set

out in appendix 6 of the Rule 2.7 announcement made by AAM and Dowlais on January 29, 2025.

Profit Forecasts and Estimates

The statements in this filing setting out targets

for Adjusted EBITDA and Adjusted free cash flow of AAM for FY25 (together, the “AAM FY25 Profit Forecast”) constitute profit

forecasts of AAM for the purposes of Rule 28.1(a) of the UK Takeover Code (the “Code”). The UK Takeover Panel has

granted AAM a dispensation from the requirement to include reports from reporting accountants and AAM’s financial advisers in relation

to the FY25 Profit Forecast because it is an ordinary course profit forecast, and Dowlais has agreed to the dispensation.

Other than the AAM FY25 Profit Forecast, nothing

in this filing (including any statement of estimated cost savings or synergies) is intended, or is to be construed, as a profit forecast

or profit estimate for any period or is to be interpreted to mean that earnings or earnings per share of AAM or Dowlais for the current

or future financial years will necessarily match or exceed the published earnings or earnings per share of AAM or Dowlais, as appropriate.

AAM Directors’ Confirmation

In accordance with Rule 28.1(c)(i) of

the Code, the AAM board of directors confirms that, as at the date of this filing, the AAM FY25 Profit Forecast is valid and has been

properly compiled on the basis of the assumptions stated in AAM’s RNS announcement on or around the date of this filing and that

the basis of accounting used is consistent with AAM’s accounting policies.

Publication on Website

A

recording of the earnings call to which this filing relates will be made available (subject to certain disclaimers) on AAM’s website

(at https://www.aam.com/investors) by no later than 12 noon London time on the

business day following the date of this filing. Neither the contents of this website nor the content of any other website accessible

from hyperlinks on such websites is incorporated into, or forms part of, this filing.

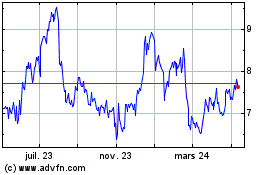

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025