UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

|

Preliminary Proxy Statement |

| |

|

| ¨ |

|

Confidential, For Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

|

Definitive Proxy Statement |

| |

|

| ¨ |

|

Definitive Additional Materials |

| |

|

| x |

|

Soliciting Material Pursuant to

§ 240.14a-12 |

AMERICAN AXLE & MANUFACTURING

HOLDINGS,

INC.

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

|

| x |

|

No fee required. |

| |

|

| ¨ |

|

Fee paid previously with preliminary

materials. |

| |

|

| ¨ |

|

Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

RNS Number

: 2372X

American Axle

& Mfg Hldgs, Inc.

14 February

2025

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

14 February 2025

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

PUBLICATION OF FOURTH

QUARTER AND FULL YEAR 2024 FINANCIAL RESULTS

American Axle & Manufacturing Holdings, Inc. ("AAM")

has today published its fourth quarter and full year 2024 financial results and held an earnings presentation. Copies of the fourth quarter

and full year 2024 press release and earnings presentation (including reconciliation of non-GAAP financial measures) are available at

www.aam.com/investors.

During the earnings presentation, the

following statements were made, which for the purposes of Rule 28.1(a) of the City Code on Takeovers and Mergers (the "Code")

constitutes a profit forecast published by AAM during an offer period (the "AAM FY25 Profit Forecast"):

2025 Financial Targets

Full Year Sales $5.8 - $6.05 billion

Adjusted EBITDA $700 - $760 million

Adjusted Free Cash Flow $200 - $230 million

| · | These

targets are based on North American light vehicle production of ~15.1 million units, current

customer production and launch schedules, production estimates of key programs we support,

and business environment |

| · | Adjusted

Free Cash Flow target assumes capital spending of approximately 5% of sales |

| · | AAM

expects restructuring cash payments to be approximately $20 - $30 million |

| · | AAM's

2025 financial outlook does not account for any changes to future policy, including tariffs,

tax and other regulations. |

| · | AAM's

outlook assumes the sale of AAM's commercial vehicle axle business in India is completed

by July 1, 2025. |

| · | Does

not reflect any costs and expenses relating to the announced combination with Dowlais, which

will impact actual results. Reflects guidance for AAM on a stand-alone pre-combination basis

only. |

Supplementary data for GAAP reconciliation:

Adjusted EBITDA

| · | AAM

is estimating net income in the range of $25 - $60 million. |

| · | AAM

is estimating interest expense in the range of $170 - $180 million. |

| · | AAM

is estimating income tax expense in the range of $15 - $30 million. |

| · | AAM

is estimating depreciation and amortization in the range of $465 - $465 million. |

| · | AAM

is estimating full year 2025 EBITDA in the range of $675 - $735 million. |

| · | AAM

is estimating restructuring, acquisition, and other related costs (principally impairment

charge) in the range of $25 - $25 million. |

| · | AAM

is estimating full year 2025 Adjusted EBITDA in the range of $700 - $760 million. |

Adjusted Free Cash Flow

| · | AAM

is estimating net cash provided by operating activities in the range of $475 - $505 million.

|

| · | AAM

is estimating capital expenditures net of proceeds from the sale of property, plant and equipment

and from government grants in the range of ($300) - ($300) million. |

| · | AAM

is estimating full year 2025 free cash flow in the range of $175 - $205 million. |

| · | AAM

is estimating cash payments for restructuring and acquisition-related costs in the range

of $25 -$25 million. |

| · | AAM

is estimating full year 2025 Adjusted free cash flow in the range of $200 - $230 million.

|

Confirmations

Pursuant to Rule 28.1 of the Code, the Panel has

granted AAM a dispensation from the requirement to include reports from reporting accountants and AAM's financial advisers in relation

to the AAM FY25 Profit Forecast because it is an ordinary course profit forecast and Dowlais has agreed to the dispensation.

In accordance with Rule 28.1(c)(i) of the Code,

the AAM Directors confirm that, as at the date of this announcement, the AAM FY25 Profit Forecast is valid and has been properly compiled

on the basis of the assumptions stated below and that the basis of accounting used is consistent with AAM's accounting policies.

Basis of preparation

The AAM FY25 Profit Forecast is based on AAM's

current internal forecast for the period up to 31 December 2025, using economic assumptions as at 14 February 2025. The basis of accounting

used for the AAM FY25 Profit Forecast is consistent with AAM's existing accounting policies, which: (i) are in accordance with U.S. GAAP;

(ii) were applied in the preparation of the AAM's financial statements for the year ending 31 December 2024; and (iii) are expected to

be applied in the preparation of the AAM's financial statements for the period up to 31 December 2025.

The AAM FY25 Profit Forecast has

been prepared on the basis referred to above and subject to the principal assumptions set out below. The AAM FY25 Profit Forecast is inherently

uncertain and there can be no guarantee that any of the factors referred to under "Principal assumptions" below will not occur

and/or, if they do, their effect on AAM's results of operations, financial condition, or financial performance, may be material. The AAM

FY25 Profit Forecast should therefore be read in this context and construed accordingly.

Principal assumptions

| (a) | Factors outside the influence

or control of the AAM Directors: |

| (i) | there will be no material change to macroeconomic, political, inflationary, regulatory

or legal conditions in the markets or regions in which AAM operates; |

| (ii) | there will be no material change in current US interest rates, economic growth (GDP), inflation expectations or foreign exchange rates

compared with AAM's estimates; |

| (iii) | there will be no material change in accounting standards; |

| (iv) | there will be no material change in market conditions in relation to customer demand

or the competitive environment; |

| (v) | there will be no material litigation or regulatory investigations, or material unexpected developments in any existing litigation or

regulatory investigation, in relation to any of AAM's operations, products or services; and |

| (vi) | there will be no business disruptions that materially affect

AAM, its customers, operations, supply chain or labour supply, including natural disasters, acts of terrorism, cyber-attack and/or technological

issues. |

| (b) | Factors within the influence or

control of the AAM Directors: |

| (i) | there will be no material acquisitions, disposals, distribution partnerships, joint

ventures or other commercial agreements, other than those already assumed within the forecast; |

| (ii) | there will be no material change in the existing operational strategy of AAM; |

| (iii) | there will be no material changes in AAM's accounting policies and/or the application

thereof; |

| (iv) | there are no material strategic investments or capital expenditure in addition to

those already planned; and |

| (v) | there will be no material change in the management or control of AAM. |

Terms used but not defined in this announcement have the

meaning given to them in the Rule 2.7 announcement released by AAM and Dowlais on 29 January 2025.

| Enquiries |

|

| |

|

| AAM |

|

| |

|

| Christopher M. Son, Vice President, Marketing & Communications |

+1

(313) 758-4814 |

| |

|

| J.P. Morgan (Exclusive financial adviser to AAM) |

|

| |

|

| David Walker / Ian MacAllister |

+1 (212) 270

6000 |

| Robert Constant / Jonty Edwards |

+44 (0) 203 493 8000 |

| FGS Global (PR adviser to AAM) |

|

| |

|

| Jared Levy / Jim Barron |

+1 212 687 8080 |

| Charlie Chichester / Rory King |

+44 20 7251 3801 |

Allen

Overy Shearman Sterling LLP is acting as legal adviser to AAM in connection with the Combination.

Disclaimers

Important notices relating to financial advisers

J.P. Morgan Securities LLC, together

with its affiliate J.P. Morgan Securities plc (which conducts its UK investment banking business as J.P. Morgan Cazenove and which is

authorised in the United Kingdom by the Prudential Regulation Authority and regulated in the United Kingdom by the Prudential Regulation

Authority and the Financial Conduct Authority). J.P. Morgan is acting as financial adviser exclusively for AAM and no one else in connection

with the Combination and will not regard any other person as its client in relation to the Combination and will not be responsible to

anyone other than AAM for providing the protections afforded to clients of J.P. Morgan or its affiliates, nor for providing advice in

relation to the Combination or any other matter or arrangement referred to herein.

Further information

This announcement is for information

purposes only and is not intended to, and does not, constitute or form part of any offer or invitation to purchase, otherwise acquire,

subscribe for, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction pursuant

to the Combination or otherwise. In particular, this announcement is not an offer of securities for sale into the U.S. No offer of securities

shall be made in the U.S. absent registration under the U.S. Securities Act, or pursuant to an exemption from, or in a transaction not

subject to, such registration requirements. The Combination will be made solely through the Scheme Document (or, if the Combination is

implemented by way of a Takeover Offer, the Takeover Offer documents), which, together with the accompanying Forms of Proxy and Forms

of Election in relation to the Mix and Match Facility, which will contain the full terms and conditions of the Combination, including

details of how to vote in respect of the Combination. Any decision in respect of the Combination should be made only on the basis of

the information in the Scheme Document (or, if the Combination is implemented by way of a Takeover Offer, the Takeover Offer documents).

Dowlais will prepare the Scheme Document

to be distributed to Dowlais Shareholders. Dowlais and AAM urge Dowlais Shareholders to read the Scheme Document (or any other document

by which the Combination is made) in full when it becomes available because it will contain important information relating to the Combination,

including details of how to vote in respect of the Scheme.

The statements contained in this

announcement are made as at the date of this announcement, unless some other time is specified in relation to them, and publication of

this announcement shall not give rise to any implication that there has been no change in the facts set forth in this announcement since

such date.

This announcement does not constitute a prospectus or a prospectus

equivalent document.

This announcement has been prepared

for the purpose of complying with English law and the Code and the information disclosed may not be the same as that which would have

been disclosed if this announcement had been prepared in accordance with the laws of jurisdictions outside England.

The Combination will be subject to

the applicable requirements of English law, the Code, the Panel, the London Stock Exchange and the FCA.

Neither the SEC nor any U.S. state

securities commission has approved, disproved or passed judgment upon the fairness or the merits of the Combination or determined if

this announcement is adequate, accurate or complete. Any representation to the contrary is a criminal offence in the U.S.

Overseas Shareholders

The release, publication or distribution of

this announcement in jurisdictions other than the UK, and the availability of the Combination to Dowlais Shareholders who are not resident

in the UK, may be restricted by law and therefore any persons who are not resident in the UK or who are subject to the laws of any jurisdiction

other than the UK (including Restricted Jurisdictions) should inform themselves about, and observe, any applicable legal or regulatory

requirements. In particular, the ability of persons who are not resident in the UK or who are subject to the laws of another jurisdiction

to participate in the Combination or to vote their Dowlais Shares in respect of the Scheme at the Court Meeting, or to execute and deliver

Forms of Proxy appointing another to vote at the Court Meeting on their behalf, may be affected by the laws of the relevant jurisdictions

in which they are located or to which they are subject. Any failure to comply with applicable legal or regulatory requirements of any

jurisdiction may constitute a violation of securities laws in that jurisdiction. To the fullest extent permitted by applicable law, the

companies and persons involved in the Combination disclaim any responsibility or liability for the violation of such restrictions by

any person.

Unless otherwise determined by AAM or required

by the Code, and permitted by applicable law and regulation, the Combination shall not be made available, directly or indirectly, in,

into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction and no person may vote in favour of

the Combination by any such use, means, instrumentality or form within a Restricted Jurisdiction or any other jurisdiction if to do so

would constitute a violation of the laws of that jurisdiction.

Accordingly, copies of this announcement and

any formal documentation relating to the Combination are not being, and must not be, directly or indirectly, mailed or otherwise forwarded,

distributed or sent in or into or from any Restricted Jurisdiction or any jurisdiction where to do so would constitute a violation of

the laws of such jurisdiction and persons receiving such documents (including custodians, nominees and trustees) must not mail or otherwise

forward, distribute or send them in or into or from any Restricted Jurisdiction. Doing so may render invalid any related purported vote

in respect of acceptance of the Combination.

Further details in relation to Dowlais Shareholders

in overseas jurisdictions will be contained in the Scheme Document (or, if the Combination is implemented by way of a Takeover Offer,

the Takeover Offer documents).

Additional information for U.S. investors in Dowlais

The Combination relates to an offer for the

shares of an English company and is proposed to be implemented by means of a scheme of arrangement provided for under English company

law. The Combination, implemented by way of a scheme of arrangement, is not subject to the tender offer rules or the related proxy solicitation

rules under the U.S. Exchange Act. Accordingly, the Combination is subject to the disclosure requirements and practices applicable to

a scheme of arrangement involving a target company in the UK listed on the London Stock Exchange, which differ from the disclosure requirements

of the U.S. tender offer and related proxy solicitation rules. If, in the future, AAM exercises its right to elect to implement the Combination

by way of a Takeover Offer and determines to extend the Takeover Offer into the U.S., such Takeover Offer will be made in compliance

with applicable U.S. laws and regulations.

The New AAM Shares to be issued pursuant to

the Combination have not been and will not be registered under the U.S. Securities Act, and may not be offered or sold by AAM in the

U.S. absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act. The New AAM Shares

to be issued pursuant to the Combination will be issued pursuant to the exemption from registration set forth in Section 3(a)(10) of

the U.S. Securities Act. If, in the future, AAM exercises its right to elect to implement the Combination by way of a Takeover Offer

or otherwise determines to conduct the Combination in a manner that is not exempt from the registration requirements of the U.S. Securities

Act, it will file a registration statement with the SEC that will contain a prospectus with respect to the issuance of New AAM Shares.

In this event, Dowlais Shareholders are urged to read these documents and any other relevant documents filed with the SEC, as well as

any amendments or supplements to all such documents, because they will contain important information, and such documents will be available

free of charge at the SEC's website at www.sec.gov or by directing a request to AAM's contact for enquiries identified above.

This announcement contains, and the Scheme

Document will contain certain unaudited financial information relating to Dowlais that has been prepared in accordance with UK-endorsed

International Financial Reporting Standards ("IFRS") and thus may not be comparable to financial information of U.S. companies

or companies whose financial statements are prepared in accordance with U.S. generally accepted accounting principles. U.S. generally

accepted accounting principles differ in certain significant respects from IFRS.

Dowlais is incorporated under the laws of

a non-U.S. jurisdiction, some or all of Dowlais' officers and directors reside outside the U.S., and some or all of Dowlais' assets are

or may be located in jurisdictions outside the U.S. Therefore, U.S. Dowlais Shareholders (defined as Dowlais Shareholders who are U.S.

persons as defined in the U.S. Internal Revenue Code or "IRC") may have difficulty effecting service of process within the

U.S. upon those persons or recovering against Dowlais or its officers or directors on judgments of U.S. courts, including judgments based

upon the civil liability provisions of the U.S. federal securities laws. Further, it may be difficult to compel a non-U.S. company and

its affiliates to subject themselves to a U.S. court's judgment. It may not be possible to sue Dowlais or its officers or directors in

a non-U.S. court for violations of the U.S. securities laws.

The receipt of New AAM Shares and cash by

Dowlais Shareholders as consideration for the transfer of Dowlais Shares pursuant to the Combination may be a taxable transaction for

U.S. federal income tax purposes and under applicable U.S. state and local, as well as foreign and other, tax laws. Such consequences,

if any, are not generally described herein. Each Dowlais Shareholder is urged to consult with legal, tax and financial advisers in connection

with making a decision regarding the Combination, including in light of the potential application of Section 304 of the IRC to the Combination.

Forward-looking statements

In this announcement, AAM makes statements

concerning its and Dowlais' expectations, beliefs, plans, objectives, goals, strategies, and future events or performance, including,

but not limited to, certain statements related to the ability of AAM and Dowlais to consummate AAM's business combination with Dowlais

(the "Business Combination") in a timely manner or at all; future capital expenditures, expenses, revenues, economic performance,

synergies, financial conditions, market growth, dividend policy, losses and future prospects and business; and management strategies

and the expansion and growth of AAM's and the combined company's operations. Such statements are "forward-looking" statements

within the meaning of the Private Securities Litigation Reform Act of 1995 and relate to trends and events that may affect AAM's or the

combined company's future financial position and operating results. The terms such as "will," "may," "could,"

"would," "plan," "believe," "expect," "anticipate," "intend," "project,"

"target," and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking

statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be

accurate indications of the times at, or by, which such performance or results will be achieved. These forward-looking statements involve

certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements.

These risks and uncertainties related to AAM include factors detailed in the reports AAM files with the United States Securities and

Exchange Commission (the "SEC"), including those described under "Risk Factors" in its most recent Annual Report

on Form 10-K and its Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this communication.

AAM expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained

herein to reflect any change in its or Dowlais' expectations with regard thereto or any change in events, conditions or circumstances

on which any such statement is based.

Additional Information

This announcement may be deemed to be solicitation

material in respect of the Business Combination, including the issuance of AAM's shares of common stock in respect of the Business Combination.

In connection with the foregoing proposed issuance of AAM's shares of common stock, AAM expects to file a proxy statement on Schedule

14A (together with any amendments and supplements thereto, the "Proxy Statement") with the SEC. To the extent the Business

Combination is effected as a scheme of arrangement under English law, the issuance of AAM's shares of common stock in connection with

the Business Combination would not be expected to require registration under the U.S. Securities Act of 1933, as amended (the "Securities

Act"), pursuant to an exemption provided by Section 3(a)(10) under the Securities Act. In the event that AAM exercises its right

to elect to implement the Business

Combination by way of a takeover offer (as defined in

the UK Companies Act 2006) or otherwise determines to conduct the Business Combination in a manner that is not exempt from the registration

requirements of the Securities Act, AAM expects to file a registration statement with the SEC containing a prospectus with respect to

the AAM's shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT,

THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE IN THE PROXY

STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS COMBINATION

AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other

documents filed by AAM with the SEC at the SEC's website at http://www.sec.gov. In addition, investors and shareholders will be

able to obtain free copies of the Proxy Statement, the scheme document, and other documents filed by AAM with the SEC at https://www.aam.com/investors.

Participants in the Solicitation

AAM and its directors, executive officers and certain

other members of management and employees will be participants in the solicitation of proxies from AAM's shareholders in respect of the

Business Combination, including the proposed issuance of AAM's shares of common stock in connection with the Business Combination. Information

regarding AAM's directors and executive officers is contained in its Annual Report on Form 10-K for the fiscal year ended December 31,

2023, which was filed with the SEC on February 16, 2024, the definitive proxy statement on Schedule 14A for AAM's 2024 annual meeting

of stockholders, which was filed with the SEC on March 21, 2024 and the Current Report on Form 8-K of AAM, which was filed with the SEC

on May 2, 2024. Additional information regarding the identity of participants, and their direct or indirect interests, by security holdings

or otherwise, will be set forth in the Proxy Statement when it is filed with the SEC. To the extent holdings of AAM's securities by its

directors or executive officers change from the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements

of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC by AAM. These documents may be obtained

free of charge from the SEC's website at www.sec.gov and AAM's website at https://www.aam.com/investors.

No Offer or Solicitation

This announcement is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction.

Publication on website

This announcement is required to

be published pursuant to Rule 26 of the Code and will be available, subject to certain restrictions relating to persons resident in Restricted

Jurisdictions, on AAM's website at https://www.aam.com/investors promptly and in any event by no later than 12 noon (London time)

on the business day (as defined in the Code) following the date of this announcement. Neither the content of the websites referred to

in this announcement nor the content of any website accessible from hyperlinks in this announcement is incorporated into, or forms part

of, this announcement.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for the same category presented in different tables may vary slightly and

figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

General

If you are in any doubt about the contents of this announcement

or the action you should take, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank

manager, solicitor, accountant or independent financial adviser duly authorised under FSMA if you are resident in the United Kingdom

or, if not, from another appropriately authorised independent financial adviser.

This

information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to

act as a Primary Information Provider in the United Kingdom. Terms and conditions

relating

to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

RNS

may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained

in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further

information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

Forward-Looking Statements

In this announcement, American Axle &

Manufacturing Holdings, Inc. (“AAM”) makes statements concerning its and Dowlais’ expectations, beliefs, plans,

objectives, goals, strategies, and future events or performance, including, but not limited to, certain statements related to the ability

of AAM and Dowlais to consummate AAM’s business combination with Dowlais (the “Business Combination”) in a timely manner

or at all; future capital expenditures, expenses, revenues, economic performance, synergies, financial conditions, market growth, dividend

policy, losses and future prospects and business; and management strategies and the expansion and growth of AAM’s and the combined

company’s operations. Such statements are “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and relate to trends and events that may affect AAM’s or the combined company’s future financial

position and operating results. The terms such as “will,” “may,” “could,” “would,” “plan,”

“believe,” “expect,” “anticipate,” “intend,” “project,” “target,”

and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the

times at, or by, which such performance or results will be achieved. These forward-looking statements involve certain risks and uncertainties

that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties

related to AAM include factors detailed in the reports AAM files with the United States Securities and Exchange Commission (the “SEC”),

including those described under “Risk Factors” in its most recent Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q. These forward-looking statements speak only as of the date of this communication. AAM expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its

or Dowlais’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is

based.

Additional Information

This

announcement may be deemed to be solicitation material in respect of the Business Combination, including the issuance of AAM’s

shares of common stock in respect of the Business Combination. In connection with the foregoing proposed issuance of AAM’s shares

of common stock, AAM expects to file a proxy statement on Schedule 14A (together with any amendments and supplements thereto, the “Proxy

Statement”) with the SEC. To the extent the Business Combination is effected as a scheme of arrangement under English law, the

issuance of AAM’s shares of common stock in connection with the Business Combination would not be expected to require registration

under the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to an exemption provided by Section 3(a)(10) under

the Securities Act. In the event that AAM exercises its right to elect to implement the Business Combination by way of a takeover offer

(as defined in the UK Companies Act 2006) or otherwise determines to conduct the Business Combination in a manner that is not exempt

from the registration requirements of the Securities Act, AAM expects to file a registration statement with the SEC containing a prospectus

with respect to the AAM’s shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ

THE PROXY STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE

IN THE PROXY STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS

COMBINATION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document,

and other documents filed by AAM with the SEC at the SEC’s website at http://www.sec.gov.

In addition, investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents

filed by AAM with the SEC at https://www.aam.com/investors.

Participants in the Solicitation

AAM

and its directors, executive officers and certain other members of management and employees will be participants in the solicitation

of proxies from AAM’s shareholders in respect of the Business Combination, including the proposed issuance of AAM’s shares

of common stock in connection with the Business Combination. Information regarding AAM’s directors and executive officers is contained

in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 16,

2024, the definitive proxy statement on Schedule 14A for AAM’s 2024 annual meeting of stockholders, which was filed with the SEC

on March 21, 2024 and the Current Report on Form 8-K of AAM, which was filed with the SEC on May 2, 2024. Additional information

regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth

in the Proxy Statement when it is filed with the SEC. To the extent holdings of AAM’s securities by its directors or executive

officers change from the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC by AAM. These documents may be obtained

free of charge from the SEC's website at www.sec.gov and AAM’s website at https://www.aam.com/investors.

No Offer or Solicitation

This announcement is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation

of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Non-GAAP Financial Information

This announcement refers to certain financial

measures, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Earnings per Share, Adjusted Free Cash Flow, Net Debt, Net Leverage

Ratio and Liquidity that are not required by, or presented in accordance with, accounting principles generally accepted in the United

States, or GAAP. These measures are presented to provide additional useful measurements to review AAM’s operations, provide transparency

to investors and enable period-to-period comparability of financial performance. These non-GAAP measures should not be considered a substitute

for any GAAP measure. Additionally, non-GAAP financial measures as presented by AAM may not be comparable to similarly titled measures

reported by other companies.

Quantified Financial Benefits Statement

This announcement contains statements of estimated

cost savings and synergies arising from the Business Combination (together, the “Quantified Financial Benefits Statements”).

Statements of estimated cost savings and synergies

relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. As a result, the cost

savings and synergies referred to in the Quantified Financial Benefits Statement may not be achieved, may be achieved later or sooner

than estimated, or those achieved could be materially different from those estimated. No statement in the Quantified Financial Benefits

Statement, or this announcement generally, should be construed as a profit forecast or interpreted to mean that the combined company’s

earnings in the first full year following the date on which the Business Combination becomes effective, or in any subsequent period, would

necessarily match or be greater than or be less than those of AAM or Dowlais for the relevant preceding financial period or any other

period. For the purposes of Rule 28 of the Code, the Quantified Financial Benefits Statement contained in this announcement is the

responsibility of AAM and the AAM board of directors.

A copy of the Quantified Financial Benefits Statements,

the bases of belief, principal assumptions and sources of information in respect of any quantified financial benefits statement are set

out in appendix 6 of the Rule 2.7 announcement made by AAM and Dowlais on January 29, 2025.

Profit Forecasts and Estimates

The statements in this announcement setting out

targets for Adjusted EBITDA and Adjusted free cash flow of AAM for FY25 (together, the “AAM FY25 Profit Forecast”) constitute

profit forecasts of AAM for the purposes of Rule

28.1(a) of the UK Takeover Code (the “Code”).

The UK Takeover Panel has granted AAM a dispensation from the requirement to include reports from reporting accountants and AAM’s

financial advisers in relation to the FY25 Profit Forecast because it is an ordinary course profit forecast, and Dowlais has agreed to

the dispensation.

Other than the AAM FY25 Profit Forecast, nothing

in this announcement (including any statement of estimated cost savings or synergies) is intended, or is to be construed, as a profit

forecast or profit estimate for any period or is to be interpreted to mean that earnings or earnings per share of AAM or Dowlais for the

current or future financial years will necessarily match or exceed the published earnings or earnings per share of AAM or Dowlais, as

appropriate.

AAM Directors’ Confirmation

In accordance with Rule 28.1(c)(i) of

the Code, the AAM board of directors confirms that, as at the date of this announcement, the AAM FY25 Profit Forecast is valid and has

been properly compiled on the basis of the assumptions stated in AAM’s RNS announcement on or around the date of this announcement

and that the basis of accounting used is consistent with AAM’s accounting policies.

Publication on Website

A

copy of this announcement will be made available (subject to certain disclaimers) on AAM’s website (at https://www.aam.com/investors)

by no later than 12 noon London time on the business day following the date of this announcement. Neither the contents of this website

nor the content of any other website accessible from hyperlinks on such websites is incorporated into, or forms part of, this announcement.

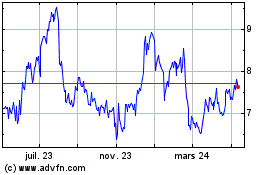

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

American Axle and Manufa... (NYSE:AXL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025