0000022444FALSE00000224442025-01-062025-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 6, 2025

Commercial Metals Company

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) |

| 1-4304 | | | | 75-0725338 |

(Commission File Number) | | | | (IRS Employer Identification No.) |

| | | | |

| 6565 N. MacArthur Blvd. | | | | |

Irving, Texas | | | | 75039 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

(214) 689-4300

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

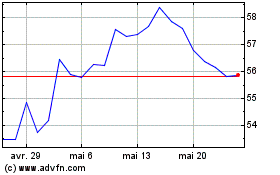

| Common Stock, $0.01 par value | | CMC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On January 6, 2025, Commercial Metals Company (the “Company”) issued a press release announcing its financial results for the first quarter of fiscal year 2025. A copy of the press release is attached hereto as Exhibit 99.1. The press release is incorporated by reference into this Item 2.02, and the foregoing description of the press release is qualified in its entirety by reference to Exhibit 99.1.

The information in this Item 2.02 of Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 7.01 Regulation FD Disclosure.

On January 6, 2025, the Company made available on its website a financial presentation regarding its financial results for the first quarter of fiscal year 2025. A copy of the financial presentation is attached hereto as Exhibit 99.2. The financial presentation is incorporated by reference into this Item 7.01, and the foregoing description of the financial presentation is qualified in its entirety by reference to Exhibit 99.2.

The information in this Item 7.01 of Form 8-K, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section and is not incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01 Financial Statements and Exhibits. |

| (d) | Exhibits |

| The following exhibits are being furnished as part of this Current Report on Form 8-K: |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | COMMERCIAL METALS COMPANY |

| | | |

| Date: January 6, 2025 | | By: /s/ Paul J. Lawrence |

| | Name: Paul J. Lawrence |

| | | Title: Senior Vice President and Chief Financial Officer |

| | |

News Release

CMC REPORTS FIRST QUARTER FISCAL 2025 RESULTS

•First quarter net loss of ($175.7) million, or ($1.54) per diluted share including approximately $265.0 million litigation expense, net of estimated tax; adjusted earnings of $88.5 million, or $0.78 per diluted share

•Consolidated core EBITDA of $210.7 million in the first quarter; core EBITDA margin of 11.0%

•Late season construction activity drove year-over-year and sequential growth in North America finished steel shipment volumes; margins pressured by declines in average steel and downstream product pricing

•North America downstream backlog volumes stable on a year-over-year basis; pipeline of potential future projects remains strong

•Continued disciplined execution of strategic growth plan, including organic growth investments and operational and commercial excellence program (“TAG”), which are expected to provide financial benefits in fiscal 2025

•Generated $213.0 million of cash flow from operating activities in the first quarter, equal to 101% of consolidated core EBITDA; returned $71.0 million in cash to shareholders through dividends and share buybacks

Irving, TX - January 6, 2025 - Commercial Metals Company (NYSE: CMC) today announced financial results for its fiscal first quarter ended November 30, 2024. First quarter net loss was ($175.7) million, or ($1.54) per diluted share, on net sales of $1.9 billion, compared to prior year period net earnings of $176.3 million, or $1.49 per diluted share, on net sales of $2.0 billion.

During the first quarter of fiscal 2025, the Company recorded an estimated net after-tax charge of $265.0 million to reflect a verdict reached in litigation. Excluding this charge, first quarter adjusted earnings were $88.5 million, or $0.78 per diluted share, compared to adjusted earnings of $176.3 million, or $1.49 per diluted share, in the prior year period. "Adjusted EBITDA," "core EBITDA," "core EBITDA margin," "adjusted earnings" and "adjusted earnings per diluted share" are non-GAAP financial measures. Details, including a reconciliation of each such non-GAAP financial measure to the most directly comparable measure prepared and presented in accordance with GAAP, can be found in the financial tables that follow.

Peter Matt, President and Chief Executive Officer, said, “The CMC team executed well across multiple fronts during the first quarter, including a near-record safety performance and effective cost management across our operational footprint. Financial results continued to be hindered by economic uncertainty that has weighed on new construction activity, pressuring steel pricing and margins. We remain confident that this weaker demand environment will be temporary as we expect the underlying drivers across infrastructure, non-residential and residential end markets will provide multiyear support for our business. Our downstream bid levels and several key

(CMC First Quarter Fiscal 2025 - 2)

external indicators continue to evidence a robust pipeline of potential future projects that should translate into construction activity in the coming quarters."

Mr. Matt added, "I am encouraged by the progress being made in the implementation of our operational and commercial excellence program - Transform, Advance, and Grow (TAG). This effort is a key component of our long-term strategic plan and is expected to drive value creation by helping CMC to achieve higher through-the-cycle margins and enhanced efficiencies across the organization. We are seeing strong early results from several recently launched TAG initiatives, which give me confidence that the program will begin to provide financial benefits in fiscal 2025."

The Company's balance sheet and liquidity position remained strong. As of November 30, 2024, cash and cash equivalents totaled $856.1 million, with available liquidity of nearly $1.7 billion. During the quarter, CMC repurchased 919,481 shares of common stock valued at $50.4 million in the aggregate. As of November 30, 2024, $353.4 million remained available under the current share repurchase authorization.

On January 2, 2025, the board of directors declared a quarterly dividend of $0.18 per share of CMC common stock payable to stockholders of record on January 16, 2025, representing an increase of approximately 13% on a year-over-year basis. The dividend to be paid on January 30, 2025, marks the 241st consecutive quarterly payment by the Company.

Business Segments - Fiscal First Quarter 2025 Review

Demand for CMC’s products in North America was strong during the quarter, supported by late season construction activity across several geographical regions as job sites worked to make up for days lost to weather disruptions earlier in calendar 2024. Shipments of finished steel products increased by 4.4% relative to the prior year period. The construction pipeline of potential future projects remained healthy as indicated by CMC’s downstream bidding activity and the Dodge Momentum Index, which measures the value of projects entering the planning phase. Downstream backlog volumes were stable on a year-over-year basis. Shipments of merchant products (MBQ) grew compared to the first quarter of fiscal 2024 as our ability to serve West Coast customers from our Arizona 2 micro mill facility increased.

Adjusted EBITDA for the North America Steel Group decreased to $188.2 million in the first quarter of fiscal 2025 from $266.8 million in the prior year period. The earnings reduction was driven by lower margins over scrap costs on steel products and downstream products. The adjusted EBITDA margin for the North America Steel Group of 12.4% declined from 16.8% in the first quarter of fiscal 2024.

European market conditions in the first quarter were similar to recent periods. Long-steel consumption remained substantially below historical levels. The beneficial impact of improving Polish demand in certain end

(CMC First Quarter Fiscal 2025 - 3)

market applications and regional supply discipline has been largely offset by increased import flows from neighboring nations that have sought an outlet for product not consumed within their home markets. The Europe Steel Group reported adjusted EBITDA of $25.8 million, which includes a $44.1 million annual CO2 credit associated with a government program that extends to 2030. Excluding this credit, financial results deteriorated modestly compared to the prior two quarters due to metal margin compression driven by high import volumes. Within this difficult market environment, the Europe Steel Group has executed on an extensive cost management program that has meaningfully reduced controllable costs. Controllable costs per ton during the first quarter of 2025 declined from the prior year period, excluding energy credits and rebates, despite a nearly 9% reduction in shipment volumes.

Emerging Businesses Group first quarter net sales of $169.4 million decreased by 4.4% compared to the prior year period, while adjusted EBITDA for the segment of $22.7 million was down 26.6% a year-over-year basis. Results were negatively impacted by an increased sales mix of lower margin products and several large project delays within CMC's Tensar division, which are now expected to commence later in fiscal 2025. Additionally, a slowing truck and trailer market has hampered earnings within CMC's Impact Metals business. Strong project related shipments of performance reinforcing steel and healthy activity levels in our Construction Services business helped to offset some of this weakness. Indications of future market conditions remained encouraging during the quarter with pipeline measures such as project quotes and backlog at healthy levels. Adjusted EBITDA margin of 13.4% was down 400 basis points compared to the prior year period.

During the first quarter, a jury in California reached a verdict in a lawsuit filed by Pacific Steel Group against CMC and certain subsidiaries. Pacific Steel Group claimed, among other things, various restraints on trade by CMC. A trial on Pacific Steel Group’s claims concluded with a verdict and judgment in favor of Pacific Steel Group in the amount of $110 million, which was subsequently trebled as a matter of law. As a result of this judgment, a $350.0 million provision was recorded in the first quarter fiscal 2025 results. CMC is confident in how it conducts its business practices and is deeply disappointed in the outcome of the trial. CMC will be pursuing all reasonably available avenues to appeal the verdict and judgment.

Outlook

Mr. Matt said, “We expect consolidated financial results in our second quarter of fiscal 2025 to decline from the first quarter level. Finished steel shipments within the North America Steel Group are anticipated to follow normal seasonal trends, while adjusted EBITDA margin is expected to decrease sequentially on lower margins over scrap cost on steel and downstream products. Adjusted EBITDA for our Europe Steel Group should be in line with the prior year second quarter as stringent cost management efforts continue to offset a weak market environment. Financial results for the Emerging Businesses Group are anticipated to be impacted by normal seasonality.”

(CMC First Quarter Fiscal 2025 - 4)

Mr. Matt concluded, “We are very encouraged by our recent conversations with customers and the optimism they have voiced about the coming quarters. Key indicators of the construction pipeline also point in a positive direction. Outside of construction, measures of both big and small business confidence have improved significantly over the last two months. The palpable shift in sentiment gives us confidence that current softness is transient and that we should soon enter a period of renewed strength in our core markets.”

Conference Call

CMC invites you to listen to a live broadcast of its first quarter fiscal 2025 conference call today, Monday, January 6, 2025, at 11:00 a.m. ET. Peter Matt, President and Chief Executive Officer, and Paul Lawrence, Senior Vice President and Chief Financial Officer, will host the call. The call is accessible via our website at www.cmc.com. In the event you are unable to listen to the live broadcast, the call will be archived and available for replay on our website on the next business day. Financial and statistical information presented in the broadcast are located on CMC's website under "Investors."

About CMC

CMC is an innovative solutions provider helping build a stronger, safer, and more sustainable world. Through an extensive manufacturing network principally located in the United States and Central Europe, we offer products and technologies to meet the critical reinforcement needs of the global construction sector. CMC’s solutions support construction across a wide variety of applications, including infrastructure, non-residential, residential, industrial, and energy generation and transmission.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and growth provided by acquisitions and strategic investments, demand for our products, shipment volumes, metal margins, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, growth rates in certain reportable segments, product margins within our Emerging Businesses Group segment, share repurchases, legal proceedings, construction activity, international trade, the impact of geopolitical conditions, capital expenditures, tax credits, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the anticipated benefits and timeline for execution of our growth plan and initatives and our expectations or beliefs concerning future events. The statements in this release that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management "expects," "anticipates," "believes," "estimates," "future," "intends," "may," "plans to," "ought," "could," "will," "should," "likely," "appears," "projects," "forecasts," "outlook" or other similar words or phrases, as well as by discussions of strategy, plans or intentions.

(CMC First Quarter Fiscal 2025 - 5)

The Company's forward-looking statements are based on management’s expectations and beliefs as of the time this news release was prepared. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, "Risk Factors" of our annual report on Form 10-K for the fiscal year ended August 31, 2024, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of downstream contracts within our vertically integrated steel operations due to rising commodity pricing; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of geopolitical conditions, including political turmoil and volatility, regional conflicts, terrorism and war on the global economy, inflation, energy supplies and raw materials; increased attention to environmental, social and governance ("ESG") matters, including any targets or other ESG, environmental justice or regulatory initiatives; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; impacts from global public health crises on the economy, demand for our products, global supply chain and on our operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non-compliance with their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our share repurchase program; financial and non-financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third-party consents and approvals; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; the impact of goodwill or other indefinite-lived intangible asset impairment charges; the impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as

(CMC First Quarter Fiscal 2025 - 6)

Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; our ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; our ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks, including those related to the PSG litigation and other legal proceedings discussed in Note 12, Commitments and Contingencies, in Part I, Item 1, Financial Statements and in Part II, Item 1, Legal Proceedings of this Form 10-Q; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots.

(CMC First Quarter Fiscal 2025 - 7)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

FINANCIAL & OPERATING STATISTICS (UNAUDITED) |

| | | Three Months Ended | | |

| (in thousands, except per ton amounts) | | 11/30/2024 | | 8/31/2024 | | 5/31/2024 | | 2/29/2024 | | 11/30/2023 | | | | |

| North America Steel Group | | | | | | | | | | | | | | |

| Net sales to external customers | | $ | 1,518,637 | | | $ | 1,559,520 | | | $ | 1,671,358 | | | $ | 1,486,202 | | | $ | 1,592,650 | | | | | |

| Adjusted EBITDA | | 188,205 | | | 210,932 | | | 246,304 | | | 222,294 | | | 266,820 | | | | | |

| Adjusted EBITDA margin | | 12.4% | | 13.5% | | 14.7% | | 15.0% | | 16.8% | | | | |

| | | | | | | | | | | | | | |

| External tons shipped | | | | | | | | | | | | | | |

| Raw materials | | 339 | | 360 | | 371 | | 347 | | 374 | | | | |

| Rebar | | 549 | | 522 | | 520 | | 460 | | 522 | | | | |

| Merchant bar and other | | 241 | | 237 | | 244 | | 234 | | 230 | | | | |

| Steel products | | 790 | | 759 | | 764 | | 694 | | 752 | | | | |

| Downstream products | | 356 | | 361 | | 371 | | 316 | | 346 | | | | |

| | | | | | | | | | | | | | |

| Average selling price per ton | | | | | | | | | | | | | | |

| Raw materials | | $ | 874 | | $ | 866 | | $ | 970 | | $ | 880 | | $ | 783 | | | | |

| Steel products | | 812 | | 843 | | 891 | | 905 | | 892 | | | | |

| Downstream products | | 1,259 | | 1,311 | | 1,330 | | 1,358 | | 1,389 | | | | |

| | | | | | | | | | | | | | |

| Cost of raw materials per ton | | $ | 677 | | $ | 664 | | $ | 717 | | $ | 658 | | $ | 578 | | | | |

| Cost of ferrous scrap utilized per ton | | $ | 323 | | $ | 321 | | $ | 353 | | $ | 379 | | $ | 343 | | | | |

| | | | | | | | | | | | | | |

| Steel products metal margin per ton | | $ | 489 | | $ | 522 | | $ | 538 | | $ | 526 | | $ | 549 | | | | |

| | | | | | | | | | | | | | |

| Europe Steel Group | | | | | | | | | | | | | | |

| Net sales to external customers | | $ | 209,407 | | $ | 222,085 | | $ | 208,806 | | $ | 192,500 | | $ | 225,175 | | | | |

| Adjusted EBITDA | | 25,839 | | (3,622) | | (4,192) | | (8,611) | | 38,942 | | | | |

| Adjusted EBITDA margin | | 12.3% | | (1.6)% | | (2.0)% | | (4.5)% | | 17.3% | | | | |

| | | | | | | | | | | | | | |

| External tons shipped | | | | | | | | | | | | | | |

| Rebar | | 107 | | 98 | | 80 | | 64 | | 122 | | | | |

| Merchant bar and other | | 206 | | 221 | | 217 | | 211 | | 221 | | | | |

| Steel products | | 313 | | 319 | | 297 | | 275 | | 343 | | | | |

| | | | | | | | | | | | | | |

| Average selling price per ton | | | | | | | | | | | | | | |

| Steel products | | $ | 639 | | $ | 667 | | $ | 681 | | $ | 673 | | $ | 633 | | | | |

| | | | | | | | | | | | | | |

| Cost of ferrous scrap utilized per ton | | $ | 370 | | $ | 383 | | $ | 389 | | $ | 394 | | $ | 365 | | | | |

| | | | | | | | | | | | | | |

| Steel products metal margin per ton | | $ | 269 | | $ | 284 | | $ | 292 | | $ | 279 | | $ | 268 | | | | |

| | | | | | | | | | | | | | |

| Emerging Businesses Group | | | | | | | | | | | | | | |

| Net sales to external customers | | $ | 169,415 | | $ | 195,571 | | $ | 188,593 | | $ | 155,994 | | $ | 177,239 | | | | |

| Adjusted EBITDA | | 22,660 | | 42,519 | | 38,220 | | 17,929 | | 30,862 | | | | |

| Adjusted EBITDA margin | | 13.4% | | 21.7% | | 20.3% | | 11.5% | | 17.4% | | | | |

(CMC First Quarter Fiscal 2025 - 8)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

COMMERCIAL METALS COMPANY AND SUBSIDIARIES

BUSINESS SEGMENTS (UNAUDITED) |

| | Three Months Ended | | |

| (in thousands) | | 11/30/2024 | | 8/31/2024 | | 5/31/2024 | | 2/29/2024 | | 11/30/2023 | | | | |

| Net sales to external customers | | | | | | | | | | | | | | |

| North America Steel Group | | $ | 1,518,637 | | | $ | 1,559,520 | | | $ | 1,671,358 | | | $ | 1,486,202 | | | $ | 1,592,650 | | | | | |

| Europe Steel Group | | 209,407 | | | 222,085 | | | 208,806 | | | 192,500 | | | 225,175 | | | | | |

| Emerging Businesses Group | | 169,415 | | | 195,571 | | | 188,593 | | | 155,994 | | | 177,239 | | | | | |

| Corporate and Other | | 12,143 | | | 18,973 | | | 9,728 | | | 13,591 | | | 7,987 | | | | | |

| Total net sales to external customers | | $ | 1,909,602 | | | $ | 1,996,149 | | | $ | 2,078,485 | | | $ | 1,848,287 | | | $ | 2,003,051 | | | | | |

| | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | |

| North America Steel Group | | $ | 188,205 | | | $ | 210,932 | | | $ | 246,304 | | | $ | 222,294 | | | $ | 266,820 | | | | | |

| Europe Steel Group | | 25,839 | | | (3,622) | | | (4,192) | | | (8,611) | | | 38,942 | | | | | |

| Emerging Businesses Group | | 22,660 | | | 42,519 | | | 38,220 | | | 17,929 | | | 30,862 | | | | | |

| Corporate and Other | | (386,245) | | | (25,189) | | | (37,070) | | | (34,512) | | | (30,987) | | | | | |

| Total adjusted EBITDA | | $ | (149,541) | | | $ | 224,640 | | | $ | 243,262 | | | $ | 197,100 | | | $ | 305,637 | | | | | |

| | | | | | | | | | | | | | |

(CMC First Quarter Fiscal 2025 - 9)

| | | | | | | | | | | | | | | | | | |

COMMERCIAL METALS COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) (UNAUDITED) |

| | | Three Months Ended November 30, | | |

| (in thousands, except share and per share data) | | 2024 | | 2023 | | | | |

| Net sales | | $ | 1,909,602 | | | $ | 2,003,051 | | | | | |

| Costs and operating expenses: | | | | | | | | |

| Cost of goods sold | | 1,601,722 | | | 1,604,068 | | | | | |

| Selling, general and administrative expenses | | 177,858 | | | 162,532 | | | | | |

| Interest expense | | 11,322 | | | 11,756 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Litigation expense | | 350,000 | | | — | | | | | |

| Net costs and operating expenses | | 2,140,902 | | | 1,778,356 | | | | | |

| Earnings (loss) before income taxes | | (231,300) | | | 224,695 | | | | | |

| Income tax expense (benefit) | | (55,582) | | | 48,422 | | | | | |

| Net earnings (loss) | | $ | (175,718) | | | $ | 176,273 | | | | | |

| | | | | | | | |

| Earnings (loss) per share: | | | | | | | | |

| Basic | | $ | (1.54) | | | $ | 1.51 | | | | | |

| Diluted | | (1.54) | | | 1.49 | | | | | |

| | | | | | | | |

| Cash dividends per share | | $ | 0.18 | | | $ | 0.16 | | | | | |

| Average basic shares outstanding | | 114,053,455 | | | 116,771,939 | | | | | |

| Average diluted shares outstanding | | 114,053,455 | | | 118,354,913 | | | | | |

(CMC First Quarter Fiscal 2025 - 10)

| | | | | | | | | | | | | | |

COMMERCIAL METALS COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| | |

| (in thousands, except share and per share data) | | November 30, 2024 | | August 31, 2024 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 856,104 | | | $ | 857,922 | |

| | | | |

Accounts receivable (less allowance for doubtful accounts of $3,254 and $3,494) | | 1,106,139 | | | 1,158,946 | |

| Inventories, net | | 960,088 | | | 971,755 | |

| Prepaid and other current assets | | 294,588 | | | 285,489 | |

| Assets held for sale | | 1,204 | | | 18,656 | |

| Total current assets | | 3,218,123 | | | 3,292,768 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Property, plant and equipment, net | | 2,612,836 | | | 2,577,136 | |

| Intangible assets, net | | 227,153 | | | 234,869 | |

| Goodwill | | 384,249 | | | 385,630 | |

| Other noncurrent assets | | 330,038 | | | 327,436 | |

| Total assets | | $ | 6,772,399 | | | $ | 6,817,839 | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 323,492 | | | $ | 350,550 | |

| Accrued contingent litigation-related loss | | 350,000 | | | — | |

| Other accrued expenses and payables | | 453,377 | | | 445,514 | |

| Current maturities of long-term debt | | 38,561 | | | 38,786 | |

| Total current liabilities | | 1,165,430 | | | 834,850 | |

| Deferred income taxes | | 200,056 | | | 276,908 | |

| Other noncurrent liabilities | | 243,080 | | | 255,222 | |

| Long-term debt | | 1,148,536 | | | 1,150,835 | |

| Total liabilities | | 2,757,102 | | | 2,517,815 | |

| Stockholders' equity: | | | | |

Common stock, par value $0.01 per share; authorized 200,000,000 shares; issued 129,060,664 shares; outstanding 113,919,151 and 114,104,057 shares | | 1,290 | | | 1,290 | |

| Additional paid-in capital | | 384,782 | | | 407,232 | |

| Accumulated other comprehensive loss | | (121,855) | | | (85,952) | |

| Retained earnings | | 4,307,613 | | | 4,503,885 | |

Less treasury stock, 15,141,513 and 14,956,607 shares at cost | | (556,781) | | | (526,679) | |

| Stockholders' equity | | 4,015,049 | | | 4,299,776 | |

| Stockholders' equity attributable to non-controlling interests | | 248 | | | 248 | |

| Total stockholders' equity | | 4,015,297 | | | 4,300,024 | |

| Total liabilities and stockholders' equity | | $ | 6,772,399 | | | $ | 6,817,839 | |

(CMC First Quarter Fiscal 2025 - 11)

| | | | | | | | | | | | | | | | |

COMMERCIAL METALS COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | | |

| | | Three Months Ended November 30, | | |

| (in thousands) | | 2024 | | 2023 | | |

| Cash flows from (used by) operating activities: | | | | | | |

| Net earnings (loss) | | $ | (175,718) | | | $ | 176,273 | | | |

Adjustments to reconcile net earnings (loss) to net cash flows from operating activities: | | | | | | |

| Depreciation and amortization | | 70,437 | | | 69,186 | | | |

| Stock-based compensation | | 10,232 | | | 8,059 | | | |

| Write-down of inventory | | 8,950 | | | 10,655 | | | |

| Deferred income taxes and other long-term taxes | | (76,940) | | | 21,343 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Litigation expense | | 350,000 | | | — | | | |

| Other | | (185) | | | 1,102 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Changes in operating assets and liabilities | | 26,248 | | | (25,558) | | | |

Net cash flows from operating activities | | 213,024 | | | 261,060 | | | |

| Cash flows from (used by) investing activities: | | | | | | |

| Capital expenditures | | (118,187) | | | (66,991) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Proceeds from the sale of property, plant and equipment | | 5,167 | | | — | | | |

| Other | | (467) | | | 518 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net cash flows used by investing activities | | (113,487) | | | (66,473) | | | |

| Cash flows from (used by) financing activities: | | | | | | |

| | | | | | |

| Repayments of long-term debt | | (10,940) | | | (9,276) | | | |

| Debt issuance costs | | (38) | | | — | | | |

| | | | | | |

| Proceeds from accounts receivable facilities | | 13,303 | | | 9,421 | | | |

| Repayments under accounts receivable facilities | | (13,303) | | | (17,471) | | | |

| Treasury stock acquired | | (50,417) | | | (28,408) | | | |

| Tax withholdings related to share settlements, net of purchase plans | | (19,560) | | | (19,535) | | | |

| Dividends | | (20,554) | | | (18,748) | | | |

| | | | | | |

Net cash flows used by financing activities | | (101,509) | | | (84,017) | | | |

| Effect of exchange rate changes on cash | | (695) | | | 819 | | | |

Increase (decrease) in cash, restricted cash, and cash equivalents | | (2,667) | | | 111,389 | | | |

| Cash, restricted cash and cash equivalents at beginning of period | | 859,555 | | | 595,717 | | | |

| Cash, restricted cash and cash equivalents at end of period | | $ | 856,888 | | | $ | 707,106 | | | |

| | | | | | |

| Supplemental information: | | | | | | |

| Cash paid (refund received) for income taxes | | $ | (3,031) | | | $ | 1,398 | | | |

| Cash paid for interest | | 11,270 | | | 10,888 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Cash and cash equivalents | | $ | 856,104 | | | $ | 704,603 | | | |

| Restricted cash | | 784 | | | 2,503 | | | |

| Total cash, restricted cash and cash equivalents | | $ | 856,888 | | | $ | 707,106 | | | |

(CMC First Quarter Fiscal 2025 - 12)

COMMERCIAL METALS COMPANY

NON-GAAP FINANCIAL MEASURES (UNAUDITED)

This press release contains financial measures not derived in accordance with U.S. generally accepted accounting principles ("GAAP"). Reconciliations to the most comparable GAAP measure are provided below.

Adjusted EBITDA, core EBITDA, core EBITDA margin and adjusted earnings are non-GAAP financial measures. Adjusted earnings per diluted share is defined as adjusted earnings on a diluted per share basis. Core EBITDA margin is defined as core EBITDA divided by net sales. The adjustment “Settlement of New Markets Tax Credit transactions” represents the recognition of deferred revenue from 2016 and 2017 resulting from the Company’s participation in the New Markets Tax Credit program provided for in the Community Renewal Tax Relief Act of 2000 during the development of a micro mill, spooler and T-post shop located in eligible zones as determined by the Internal Revenue Service. In prior periods, the Company included within the

definition of core EBITDA, core EBITDA margin, adjusted earnings and adjusted earnings per diluted share an adjustment for “Mill operational commissioning costs” related to the Company’s third micro mill, which was placed into service during the fourth quarter of fiscal 2023. Periods commencing subsequent to February 29, 2024 no longer include an adjustment for mill operational commissioning costs. Accordingly, the Company has recast core EBITDA, core EBITDA margin, adjusted earnings and adjusted earnings per diluted share for all prior periods to conform to this presentation.

Non-GAAP financial measures should be viewed in addition to, and not as alternatives for, the most directly comparable measures derived in accordance with GAAP and may not be comparable to similar measures presented by other companies. However, we believe that the non-GAAP financial measures provide relevant and useful information to management, investors, analysts, creditors and other interested parties in our industry as they allow: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our underlying business operational performance; and (iii) the assessment of period-to-period performance trends. Management uses non-GAAP financial measures to evaluate financial performance and set target benchmarks for annual and long-term cash incentive performance plans.

A reconciliation of net earnings (loss) to adjusted EBITDA and core EBITDA is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| (in thousands) | | 11/30/2024 | | 8/31/2024 | | 5/31/2024 | | 2/29/2024 | | 11/30/2023 | | | | |

| Net earnings (loss) | | $ | (175,718) | | | $ | 103,931 | | | $ | 119,440 | | | $ | 85,847 | | | $ | 176,273 | | | | | |

| Interest expense | | 11,322 | | | 12,142 | | | 12,117 | | | 11,878 | | | 11,756 | | | | | |

| Income tax expense (benefit) | | (55,582) | | | 29,819 | | | 40,867 | | | 31,072 | | | 48,422 | | | | | |

| Depreciation and amortization | | 70,437 | | | 72,190 | | | 70,692 | | | 68,299 | | | 69,186 | | | | | |

| Asset impairments | | — | | | 6,558 | | | 146 | | | 4 | | | — | | | | | |

| | | | | | | | | | | | | | |

| Adjusted EBITDA | | (149,541) | | | 224,640 | | | 243,262 | | | 197,100 | | | 305,637 | | | | | |

| Non-cash equity compensation | | 10,232 | | | 9,173 | | | 12,846 | | | 14,988 | | | 8,059 | | | | | |

| Settlement of New Markets Tax Credit transactions | | — | | | (6,748) | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Litigation expense | | 350,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | | |

| Core EBITDA | | $ | 210,691 | | | $ | 227,065 | | | $ | 256,108 | | | $ | 212,088 | | | $ | 313,696 | | | | | |

| | | | | | | | | | | | | | |

| Net sales | | $ | 1,909,602 | | | $ | 1,996,149 | | | $ | 2,078,485 | | | $ | 1,848,287 | | | $ | 2,003,051 | | | | | |

| | | | | | | | | | | | | | |

| Core EBITDA margin | | 11.0% | | 11.4% | | 12.3% | | 11.5% | | 15.7% | | | | |

(CMC First Quarter Fiscal 2025 - 13)

A reconciliation of net earnings (loss) to adjusted earnings is provided below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| (in thousands, except per share data) | | 11/30/2024 | | 8/31/2024 | | 5/31/2024 | | 2/29/2024 | | 11/30/2023 | | | | |

| Net earnings (loss) | | $ | (175,718) | | | $ | 103,931 | | | $ | 119,440 | | | $ | 85,847 | | | $ | 176,273 | | | | | |

| Asset impairments | | — | | | 6,558 | | | 146 | | | 4 | | | — | | | | | |

| Settlement of New Markets Tax Credit transactions | | — | | | (6,748) | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Litigation expense | | 350,000 | | | — | | | — | | | — | | | — | | | | | |

| Total adjustments (pre-tax) | | $ | 350,000 | | | $ | (190) | | | $ | 146 | | | $ | 4 | | | $ | — | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Related tax effects on adjustments | | (85,750) | | | 40 | | | (31) | | | (1) | | | — | | | | | |

| | | | | | | | | | | | | | |

| Adjusted earnings | | $ | 88,532 | | | $ | 103,781 | | | $ | 119,555 | | | $ | 85,850 | | | $ | 176,273 | | | | | |

| | | | | | | | | | | | | | |

| Net earnings (loss) per diluted share | | $ | (1.54) | | | $ | 0.90 | | | $ | 1.02 | | | $ | 0.73 | | | $ | 1.49 | | | | | |

| Adjusted earnings per diluted share | | $ | 0.78 | | | $ | 0.90 | | | $ | 1.02 | | | $ | 0.73 | | | $ | 1.49 | | | | | |

Media Contact:

Susan Gerber

(214) 689-4300

Q1 FY 2025 Supplemental Slides

2Q1 FY25 Supplemental Slides January 6, 2025 This presentation contains forward-looking statements within the meaning of the federal securities laws with respect to general economic conditions, key macro-economic drivers that impact our business, the effects of ongoing trade actions, the effects of continued pressure on the liquidity of our customers, potential synergies and growth provided by acquisitions and strategic investments, demand for our products, shipment volumes, metal margins, the ability to operate our steel mills at full capacity, future availability and cost of supplies of raw materials and energy for our operations, growth rates in certain reportable segments, product margins within our Emerging Businesses Group, share repurchases, legal proceedings, construction activity, international trade, the impact of geopolitical conditions, capital expenditures, tax credits, our liquidity and our ability to satisfy future liquidity requirements, estimated contractual obligations, the expected capabilities and benefits of new facilities, the timeline for execution of our growth plan and our expectations or beliefs concerning future events. The statements in this presentation that are not historical statements, are forward-looking statements. These forward-looking statements can generally be identified by phrases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “future,” “intends,” “may,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases, as well as by discussions of strategy, plans or intentions. Our forward-looking statements are based on management’s expectations and beliefs as of the date of this presentation. Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to have been correct, and actual results may vary materially. Except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or circumstances or any other changes. Important factors that could cause actual results to differ materially from our expectations include those described in our filings with the Securities and Exchange Commission, including, but not limited to, in Part I, Item 1A, “Risk Factors” of our annual report on Form 10-K for the fiscal year ended August 31, 2024, as well as the following: changes in economic conditions which affect demand for our products or construction activity generally, and the impact of such changes on the highly cyclical steel industry; rapid and significant changes in the price of metals, potentially impairing our inventory values due to declines in commodity prices or reducing the profitability of downstream contracts within our vertically integrated steel operations due to rising commodity pricing; excess capacity in our industry, particularly in China, and product availability from competing steel mills and other steel suppliers including import quantities and pricing; the impact of geopolitical conditions, including political turmoil and volatility, regional conflicts, terrorism and war on the global economy, inflation, energy supplies and raw materials; increased attention to environmental, social and governance (“ESG”) matters, including any targets or other ESG, environmental justice or regulatory initiatives; operating and startup risks, as well as market risks associated with the commissioning of new projects could prevent us from realizing anticipated benefits and could result in a loss of all or a substantial part of our investments; impacts from global public health crises on the economy, demand for our products, global supply chain and on our operations; compliance with and changes in existing and future laws, regulations and other legal requirements and judicial decisions that govern our business, including increased environmental regulations associated with climate change and greenhouse gas emissions; involvement in various environmental matters that may result in fines, penalties or judgments; evolving remediation technology, changing regulations, possible third-party contributions, the inherent uncertainties of the estimation process and other factors that may impact amounts accrued for environmental liabilities; potential limitations in our or our customers' abilities to access credit and non-compliance with their contractual obligations, including payment obligations; activity in repurchasing shares of our common stock under our share repurchase program; financial and non- financial covenants and restrictions on the operation of our business contained in agreements governing our debt; our ability to successfully identify, consummate and integrate acquisitions and realize any or all of the anticipated synergies or other benefits of acquisitions; the effects that acquisitions may have on our financial leverage; risks associated with acquisitions generally, such as the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation and other regulatory and third-party consents and approvals; lower than expected future levels of revenues and higher than expected future costs; failure or inability to implement growth strategies in a timely manner; the impact of goodwill or other indefinite-lived intangible asset impairment charges; the impact of long-lived asset impairment charges; currency fluctuations; global factors, such as trade measures, military conflicts and political uncertainties, including changes to current trade regulations, such as Section 232 trade tariffs and quotas, tax legislation and other regulations which might adversely impact our business; availability and pricing of electricity, electrodes and natural gas for mill operations; our ability to hire and retain key executives and other employees; competition from other materials or from competitors that have a lower cost structure or access to greater financial resources; information technology interruptions and breaches in security; our ability to make necessary capital expenditures; availability and pricing of raw materials and other items over which we exert little influence, including scrap metal, energy and insurance; unexpected equipment failures; losses or limited potential gains due to hedging transactions; litigation claims and settlements, court decisions, regulatory rulings and legal compliance risks, including risks related to the recent unfavorable judgment against us in the Pacific Steel Group litigation; risk of injury or death to employees, customers or other visitors to our operations; and civil unrest, protests and riots. Forward-Looking Statements

3 Q1 FY25 Supplemental Slides January 6, 2025 Leading positions in core solutions and geographies Focused strategy that leverages capabilities, competitive strengths, and market knowledge Strong balance sheet and cash generation provide flexibility to execute on strategy Vertical structure optimizes returns through the entire value chain Disciplined capital allocation focused on maximizing returns for our shareholders Increasing Shareholder Value With a Winning Formula

4 Uncertainty continued to impact new construction activity • Long steel pricing and metal margins softened during the quarter • Encouragingly, customer optimism has improved in recent months Positive underlying fundamentals remain intact • CMC downstream bids and Dodge Momentum Index point to resilient construction pipeline • Well-positioned to benefit from long-term structural trends Focused on executing strategic plan to drive value generation for years to come • Far-reaching program aimed at driving higher sustained margins by lowering costs, increasing efficiency, and better capturing commercial opportunities across our business • Strong early results provide confidence that CMC’s operational and commercial excellence (TAG program) efforts will yield financial benefits in FY 2025 Good cash flow generation during the quarter; returned $71 million in cash to shareholders Recognized $350 million charge ($265 million after-tax) for litigation expense; CMC plans to vigorously appeal verdict and judgment Strong financial position • Balance sheet strength and cash flow profile continue to provide capital allocation flexibility Q1 FY25 Supplemental Slides January 6, 2025 [1] Adjusted earnings, core EBITDA, core EBITDA margin, and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. ($176M) Q1 Net Loss $89M Q1 Adjusted Earnings $211M Q1 Core EBITDA1 11.0% Q1 Core EBITDA Margin1 8.4% Last 12 Months ROIC1 $50M Q1 Share Repurchases Key Takeaways From Today’s Call

5 6% 6% 6% 10% 8% 9% 9% 12% 12% 17% 16% 13% – 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% • Strategic transformation has brought significant scale and earnings growth • Industry landscape has dramatically improved over the last five years • CMC has leveraged growth to generate higher, more sustainable margins • Margins are normalizing well above pre-pandemic levels • Returns on invested capital have been substantially above cost of capital • CMC is creating significant value for shareholders Structurally Improved Margins and Return Profile 5% 6% 6% 5% 4% 9% 11% 12% 15% 26% 17% 10% – 5% 10% 15% 20% 25% 30% % CMC Consolidated Core EBITDA Margin1 CMC Return on Invested Capital1 Normalizing above historical levels Normalizing above historical levels Margins and return levels are normalizing above historical levels [1] Core EBITDA margin and return on invested capital are non-GAAP financial measures. For definitions and reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Q1 FY25 Supplemental Slides January 6, 2025 Transformational rebar asset acquisition Transformational rebar asset acquisition

6 Temporary Uncertainty Impacting Results, But Sentiment Is Improving Construction industry sentiment has improved in recent months Q1 FY25 Supplemental Slides January 6, 2025 20 30 40 50 60 70 80 ENR Construction Confidence Index1 • The ENR Construction Confidence Index reached its highest level in over two years after a sharp increase in the calendar Q4 reading. Above 50 signals an expectation for growth among industry executives. • The Dodge Momentum Index (DMI) remains 55% above its pre-pandemic average and hit an all-time high during August 2024. The DMI captures the value of construction projects in the planning phase and leads spending by approximately 12 months. • CMC’s downstream bid activity remains at historically high levels and above our five-year average. • Conversations with customers point to renewed optimism. Highest level in over two years 70 75 80 85 90 95 100 105 110 115 NIFB Small Business Optimism Index2 Optimism has grown across both small and large businesses • In November 2024, the NFIB Small Business Optimism Index hit its highest level since mid-2021 and registered the third largest monthly increase in its 50-year history. Survey respondents cited a lifting of uncertainty, and favorable tax and regulatory policies as reasons for optimism. • Business Roundtable’s CEO Outlook3 measure increased to the highest level in over two years, citing expectations for an improved regulatory environment, tax reforms, and job creation. • Chief Executive Group’s CEO confidence metric4 improved meaningfully over the last two months, driven by similar factors. Construction customers remained hesitant to award projects during the quarter and are waiting for greater clarity to emerge on interest rates and policy implementation Uncertainty continued to weigh on long steel pricing during the first fiscal quarter Customers have turned more optimistic in recent months We remain confident in the long-term tailwinds for construction; strength should re-emerge as uncertainty lifts [1] Source: Engineering News-Record (ENR) Q4 Construction Index Confidence Index [2] Source: National Federation of Independent Businesses (NFIB) Small Business Optimism report for November 2024 [3] Source: Business Roundtable Q4 2024 CEO Economic Outlook Index report [4] Source: Chief Executive Group’s CEO Business Conditions Outlook for December 2024 Calendar Quarters

7 Infrastructu re 4 0 % Privatenon-re s 3 7 % R e si de ntia l 24% Highways and stre e ts Individual markets Broad market segmentD o m e s ti c R e b a r C o n s u m p ti o n B re a k d o w n 3 Highway Construction Outlook Remains Positive Q1 FY25 Supplemental Slides January 6, 2025 27 0 5 10 15 20 25 30 Im p ro ve m e n ts S in g le f a m ily M u lt i- fa m ily P u b lic u ti lit y E d u c a ti o n a l O ff ic e L o d g in g H e a lt h c a re C o m & I n d u s tr ia l S e w e r s ys te m s H ig h w a ys C o n s e rv a ti o n Residential Nonresidential Infra R e b a r C o n s u m p ti o n In te n s it y4 (t o n s p e r $ m ill io n ) Average: 6 +8% Forecasted growth in transportation construction spending per ARTBA1 $41B New state and local ballot initiatives approved during November 2024 election, 88% related to highways and bridges1 +8% Forecasted increase in new construction starts for highways and streets2 Highway construction is the largest and most rebar intensive end market 2025 outlook is positive for transportation construction [1] Source: American Road and Transportation Builders Association [2] Source: Dodge Analytics 3Q 2024 Nonbuilding Construction Outlook [3] Based on data from the Construction Reinforcing Steel Institute [4] Rebar intensities equal to consumption by structure type per Concrete Reinforcing Steel Institute divided by total construction spending by structure type per the U.S. Census Bureau • Activity within highway markets remains encouraging − Shipments to highway projects are increasing − There is a healthy pipeline of future projects, and CMC is seeing good letting activity across many of its key states • Rebar demand from highway sector should continue to grow in FY 2025 as projects mature into construction phase and begin receiving steel • Anticipate multi-year period of consumption growth, driven by strong state DOT budgets and rising spending levels related to the Infrastructure Investment and Jobs Acts

8 Forecasted Construction Starts – inflation adjusted (% change compared to average of 2019 to 20222) (10%) – 10% 20% 30% 2023 2024 2025 2026 2027 – 10% 20% 30% 40% 2023 2024 2025 2026 2027 – 10% 20% 30% 40% 50% 60% 2023 2024 2025 2026 2027 (5%) – 5% 10% 15% 20% 25% 2023 2024 2025 2026 2027 Estimated Potential Impact on Rebar Demand1 Government Support for Investment Powerful Structural Trends Remain Intact RESHORING AND SUPPLY CHAIN REALIGNMENT ENERGY TRANSITION AND LNG INVESTMENTS Significant structural investment is expected to power domestic construction and rebar consumption over a multi-year period. In addition to direct investments, the follow-on indirect impact should be meaningful as many large-scale projects will require local investments in infrastructure, non-residential structures, and residential dwellings. [1] Company estimates; potential increase to demand is at full run-rate of programs and relative to current annual domestic demand of ~9 million tons [2] Dodge Analytics Construction Starts Forecast – Q3 2024 Edition INFRASTRUCTURE INVESTMENT $550B from Infrastructure Investment and Jobs Act $52B CHIPS Act $250B Inflation Reduction Act $12B DOE loans Funding from IRA Q1 FY25 Supplemental Slides January 6, 2025 +8% to 12% +3% to 5% +2% to 4% Public Works Manufacturing Power & Utilities Execution of CMC’s strategic plan should amplify the benefit of these multi-year construction trends ADDRESSING U.S. HOUSING SHORTAGE +2% to 5% Residential

9 The Path Ahead – Running and Growing a Great Business Q1 FY25 Supplemental Slides January 6, 2025 • Focus on people to ensure safety and provide talent development opportunities • Enact operational and commercial excellence (TAG program) efforts that span all levels of the enterprise • Drive to achieve sustainably higher, less volatile, through-the-cycle margins Running a Great Business • Successful commissioning of micro mill projects; capture available internal synergies • Investment to support growth in high margin proprietary solutions • Investment in automation and efficiency gains, including to support operational and commercial excellence efforts Value Accretive Organic Growth • Broaden CMC’s commercial portfolio and improve customer value proposition through expansion into adjacent markets • Strengthen existing business through commercial synergies or internal demand pull • Meaningfully extend CMC’s growth runway Capability Enhancing Inorganic Growth Following the strategic transformation of the last decade, CMC is charting the course for its next phase of growth

10 GDP Growth Outlook Polish economy is expected to grow by 3.3% in 2025 per S&P Recent Market Developments European Market Environment Remains Challenging [1] Data from S&P Global manufacturing PMI report [2] Data from Statistics Poland for August 2024 to October 2024 vs. August 2023 to October 2023 [3] Based on data from Statistics Poland (calendar year-to-date to October 2024 vs. calendar year-to-date to October 2023) Emerging green shoots: • Residential construction market is recovering; new housing permits and the number of units under construction have rebounded • Expected release of €65 billion to Poland from the EU Recovery and Resilience fund Demand has improved from the lows of early fiscal 2024, while domestic producers have demonstrated supply discipline. However, the relative health of the Polish market has attracted aggressive levels of imports, pressuring margins. Demand Supply Costs Macroeconomic Backdrop Manufacturing Germany and Poland PMIs below 50 for 29 consecutive months1 Energy Costs Received annual CO2 credit during Q1 in the amount of $44M Natural Gas Pricing Contract pricing reset on October 1st, de minimis impact on cost per ton Cost Position Leading cost position in Europe; controllable costs (ex energy rebates) per ton down y/y Inflation November ’24 reading of 4.2% y/y increase was down significantly from 2023 high of 18.4% Q1 FY25 Supplemental Slides January 6, 2025 Residential Construction Housing permits granted up 8% y/y2 Long Product Imports Polish imports of rebar are up 50% y/y3 on a calendar YTD basis Total Construction Polish cement sales up 4% y/y; still down 6% vs 2021/22 seasonal average2 Long Product Production Polish long steel production flat y/y; still down 20% from 2021/22 seasonal average Interest Rates Residential mortgage rates and corporate borrowing rates flat for 13 months Supply Chain Inventory Supply chain inventories are at healthy levels

11 • Consolidated financial results in the second quarter are anticipated to decline from the first quarter level • North America Steel Group finished steel shipments should follow typical seasonal patterns in the second quarter, while adjusted EBITDA margin is expected to decline sequentially • Adjusted EBITDA for Europe Steel Group should be in line with the prior year second quarter as stringent cost management efforts continue to offset a weak market environment • Financial results for the Emerging Businesses Group are anticipated to decline due to normal seasonality • Demand for rebar in North America benefited from strong construction activity late in the season as projects worked to catch up on days lost earlier in the year − Finished steel shipments increased 4.4% y/y • North America Steel Group steel product margin declined both sequentially and year-over-year, driven by lower average steel pricing − Steel product metal margin declined $60 per ton from the prior year period • Downstream product margins over scrap1 remained well above historical levels, but decreased $113 per ton from the prior year period • Controllable costs in the North America Steel Group declined from the prior year period, driven by lower freight costs, better cost performance at our Arizona 2 micro mill, and improved fixed cost leverage across CMC’s mill footprint • Market conditions for the Europe Steel Group were largely consistent with the prior quarter, and remained challenging – domestic producers continue to demonstrate supply discipline, which has been largely offset by increased rebar import flows from neighboring countries − Received annual CO2 credit of $44.1M during the quarter. The prior year included a CO2 credit of $27.7 million and a one-time cost reimbursement of $38.6 million − Steel product margins over scrap cost decreased by $15 per ton from the sequential quarter and were flat y/y − Shipments decreased by 1.9% from the sequential quarter and by 8.7% on a year-over-year basis • Emerging Businesses Group net sales were down 4.4% y/y while adjusted EBITDA declined by 26.6% − Geogrid shipments and profitability were negatively impacted by several large project delays, which are now expected to commence later in fiscal 2025, while earnings within CMC Impact Metals were hindered by lower truck and trailer order activity − Partially offset by strong shipments of CMC’s Performance Reinforcing Steel and healthy activity levels within the CMC Construction Services business P e rf o rm a n c e D ri v e rs O u tl o o k Q1 Operational Update [1] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter Q1 FY25 Supplemental Slides January 6, 2025

12 314 211 (79) (13) (8) (5) 2 0 50 100 150 200 250 300 350 Q1 2024 NA Steel Group EBITDA Europe Steel Group EBITDA Emerging Businesses Group EBITDA Corp & Eliminations Other Non- Op Items Q1 2025 Q1 Consolidated Operating Results Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 External Finished Steel Tons Shipped1 1,441 1,285 1,432 1,439 1,459 Core EBITDA2 $313,696 $212,088 $256,108 $227,065 $210,691 Core EBITDA per Ton of Finished Steel Shipped2 $218 $165 $179 $158 $144 Core EBITDA Margin2 15.7% 11.5% 12.3% 11.4% 11.0% Net Earnings $176,273 $85,847 $119,440 $103,931 ($175,718) Adjusted Earnings2 $176,273 $85,850 $119,555 $103,781 $88,532 Performance Summary Units in 000’s except per ton amounts and margin • The first quarter of fiscal 2025 includes a $350 million expense (pre-tax) to reflect an unfavorable judgment against CMC in the Pacific Steel Group litigation − After-tax expense of approximately $265 million − CMC intends to vigorously appeal the verdict and judgment Non-recurring items [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Core EBITDA, core EBITDA margin, core EBITDA per ton of finished steel shipped, and adjusted earnings are non-GAAP measures. For reconciliations of non- GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Core EBITDA Bridge2 – Q1 2024 to Q1 2025 $ Millions Q1 FY25 Supplemental Slides January 6, 2025 Excludes litigation expense of $350 million, which was recorded within the Corporate and Other segment during Q1 2025

13 243 164 (12) (40) (40) 13 100 125 150 175 200 225 250 Q1 '24 Adj EBITDA per Ton Raw Materials Steel Products Downstream Other Q1 '25 Adj EBITDA per Ton 243 220 217 188 164 1,051 1,015 951 958 938 549 526 538 522 489 0 50 100 150 200 250 300 0 200 400 600 800 1,000 1,200 Q1' 24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Adjusted EBITDA per Ton of Finished Steel Shipped Downstream Product Margin Over Scrap (1 Qtr Lag) Steel Product Margin Over Scrap Key Performance Drivers Q1 2025 vs Q1 2024 Q1 North America Steel Group Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 External Finished Steel Tons Shipped1 1,098 1,010 1,135 1,120 1,146 Adjusted EBITDA $266,820 $222,294 $246,304 $210,932 $188,205 Adjusted EBITDA per Ton of Finished Steel Shipped $243 $220 $217 $188 $164 Adjusted EBITDA Margin 16.8% 15.0% 14.7% 13.5% 12.4% Performance Summary Units in 000’s except per ton amounts and margin • Decline in steel product margins over scrap cost − Down $60 per ton y/y • Downstream product margins2 over scrap cost remained well above historical levels, but declined by approximately $113 per ton from a year ago − Full value chain profitability on sales of downstream products above long-term average • Controllable costs declined from the prior year period, driven by lower freight costs, better cost performance at Arizona 2, and improved fixed cost leverage across CMC’s mill footprint [1] External Finished Steel Tons Shipped equal to shipments of Steel Products plus Downstream Products [2] Downstream Product Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized during the prior quarter [3] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized North America Steel Group – Key Margins $ / ton S P a n d D P M a rg in O ve r S c ra p A d ju s te d E B IT D A p e r to n Adjusted EBITDA Per Ton Bridge – Q1 2024 to Q1 2025 $ / ton of external finished steel shipped 2 3 2 Impact of Volume and Margin Over Scrap Cost Q1 FY25 Supplemental Slides January 6, 2025

14 191,374 225,182 169,171 234,630 410,863 46% 34% 36% 56% 65% 0% 10% 20% 30% 40% 50% 60% 70% 0 100,000 200,000 300,000 400,000 500,000 Jan-Oct 2020 Jan-Oct 2021 Jan-Oct 2022 Jan-Oct 2023 Jan-Oct 2024 Imports from Germany % of Total Imports 268 279 292 284 269 114 (31) (14) (11) 83 (50) 0 50 100 150 200 250 300 350 Q1' 24 Q2 '24 Q3 '24 Q4 '24 Q1 '25 Steel Products Margin Over Scrap Adjusted EBITDA per Ton Key Performance Drivers Q1 2025 vs Q1 2024 Q1 Europe Steel Group Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 External Finished Steel Tons Shipped1 343 275 297 319 313 Adjusted EBITDA $38,942 ($8,611) ($4,192) ($3,622) $25,839 Adjusted EBITDA per Ton of Finished Steel Shipped $114 ($31) ($14) ($11) $83 Adjusted EBITDA Margin 17.3% (4.5%) (2.0%) (1.6%) 12.3% Performance Summary Units in 000’s except per ton amounts and margin • Recognized an annual CO2 credit of approximately $44.1 million, down from $66.3 million in energy rebates received from two programs during the prior year period. The prior year period included a CO2 credit of $27.7 million and a cost reimbursement of $38.6 million • Strong cost performance − Benefit driven by cost management measures and decreased energy pricing − Controllable cost reduction on a per ton basis drove y/y adjusted EBITDA improvement (excl. energy cost rebates) of $9.2 million despite lower volumes and flat margin over scrap cost • Shipment volumes declined 8.7% from the prior year period − Rebar volumes hindered by sharp rise of import flows, particularly from Germany • Incurred planned outage and severance costs of $5.9 million during the quarter Europe Steel Group – Key Margins $ / ton Polish Rebar Imports from Germany3 Imports in short tons (left-axis), % of total imports (right-axis) 2 [1] External Finished Steel Tons Shipped equal to shipments of Steel Products [2] Steel Products Margin Over Scrap equals Average Selling Price minus cost of ferrous scrap utilized [3] Source: Statistics Poland M a rg in O ve r S c ra p a n d A d ju s te d E B IT D A p e r to n Q1 FY25 Supplemental Slides January 6, 2025

15 177 169 (0.7%) (0.9%) (4.6%) 4.6% (2.8%) 100 110 120 130 140 150 160 170 180 190 Q1 2024 Geogrids & Geopiers Construction Services Impact Metals Performance Reinforcing Steel Anchoring Systems Q1 2025 Key Performance Drivers Q1 2025 vs Q1 2024 Q1 Emerging Businesses Group Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 Net sales to external customers $177,239 $155,994 $188,593 $195,571 $169,415 Adjusted EBITDA $30,862 $17,929 $38,220 $42,519 $22,660 Adjusted EBITDA Margin 17.4% 11.5% 20.3% 21.7% 13.4% Performance Summary Units in 000’s except margins • Geogrid profitability was negatively impacted by an increased sales mix of lower margin product and several large project delays within CMC's Tensar division, which are now expected to commence later in fiscal 2025 • CMC Impact Metals profitability weakened due to slower truck and trailer market • Solid shipment volumes of performance reinforcing steel • Healthy activity levels and stable performance within CMC Construction Services division Contribution to Net Sales Change – Q1 2024 to Q1 2025 Quarterly net sales figures in $ million, contribution to net sales changes provided in percentages Q1 FY25 Supplemental Slides January 6, 2025 Q u a rt e rl y n e t s a le s in $ m ill io n ; n e t s a le s c h a n g e s in p e rc e n ta g e s Net sales down 4.4% Directional Change in Underlying Margin Performance

16 • First quarter 2025 capital expenditures of $118.2 million • FY 2025 capex expected in a range of $630 million to $680 million − $350 million to $400 million related to Steel West Virginia • Targeting growth expenditures on key mill projects that will strengthen market presence and lower cost Disciplined Capital Allocation Strategy CMC will prudently allocate capital while maintaining a strong and flexible balance sheet Q1 FY25 Supplemental Slides January 6, 2025 [1] Defined as dividend payments divided by net earnings 2 31 Value-Generating Growth Shareholder Distributions Debt ManagementCMC Capital Allocation Priorities: Capital Expenditures Acquisitions Share Repurchases Dividends • No acquisitions in FY 2024 • Acquisitions totaling $235 million completed in FY 2023 • Targeting opportunities to: − Strengthen existing businesses − Expand commercial portfolio − Add operational capabilities • Disciplined approach to valuation • Increased share repurchase authorization by $500 million in January 2024 − $353.4 million remaining as of November 30, 2024 • Repurchased 919,481 shares during the first quarter valued at $50.4 million • Repurchased $204.9 million during the last 12 months (ended November 30), up 154% compared to the comparable prior year period • Increased quarterly dividend per share to $0.18 in March 2024 − Represented growth of 13% compared to previous quarterly rate • Fiscal 2024 payout ratio1 of 16% • Quarterly dividend per share has increased by 50% since October 2021 • CMC has paid 241 consecutive quarterly dividends Focus on Growth Targeting value accretive growth that strategically strengthens our business Competitive Cash Distributions Goal is to provide an attractive rate of cash distributions to our shareholders

17 Discretionary Cash Flow1 (in millions) Capital Deployed for Capital Expenditures, Acquisitions, and Cash Distributions to Shareholders (in millions) $5 $37 $2 $141 $155 $279 $380 $997 $911 $450 $349 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 ($400) ($200) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Capital Expenditures Acquisitions Share Repurchases Dividends Sale of Assets Excludes litigation expense Cash Generation Profile and Capital Deployment Source: Public filings, Internal data [1] Discretionary Cash Flow is a non-GAAP financial measure. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. CMC’s cash flow capabilities have been greatly enhanced through our strategic transformation Gain on California land sale Q1 FY25 Supplemental Slides January 6, 2025 Last six years: • $3.4 billion for growth and reinvestment (e.g. capital expenditures and acquisitions) • $840 million in cash returned to shareholders • $360 million of cash generated from asset sales CMC has prudently deployed capital to grow through acquisitions and organic projects that advance our strategy and strengthen our core business Transformational rebar asset acquisition Tensar acquisition Includes investment in two micro mills California land sale Strong earnings and cash flow capabilities give CMC the flexibility to pursue a dual-pronged capital allocation approach of 1) targeting value-accretive growth opportunities and 2) providing an attractive level of cash distributions to our shareholders

18 $300 $300 $300 $145 $600 2024 2025 2026 2027 2028 2029 2030 2031 2032 2047 $71 $145 $599 $856 Balance Sheet Strength [1] 2047 tax-exempt bonds were priced to yield 3.5%; coupon rate is 4.0% Revolver Poland Credit Facilities (US$ in millions) Revolving Credit Facility 4.125% Notes Cash and Cash Equivalents 3.875% Notes Debt maturity profile provides strategic flexibility Debt Maturity Profile Q1 FY’25 Liquidity (US$ in millions) 4.375% Notes 4.0% Bond1 Poland Accounts Receivable Facility Q1 FY25 Supplemental Slides January 6, 2025 Total liquidity of nearly $1.7 billion

19 3 .8 x 3 .9 x 3 .2 x 2 .5 x 1 .9 x 1 .6 x 1 .2 x 0 .9 x 1 .1 x 1 .2 x 1 .0 x 0 .8 x 0 .7 x 0 .5 x 0 .7 x 0 .5 x 0 .4 x 0 .5 x 0 .5 x 0 .4 x 0 .3 x 0 .4 x 0 .5 x 0 .3 x 0 .6 x NM 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 4 5 % 4 6 % 4 2 % 3 7 % 3 3 % 3 2 % 2 4 % 1 8 % 2 1 % 2 2 % 2 0 % 1 7 % 1 8 % 1 4 % 2 4 % 1 7 % 1 5 % 1 5 % 1 3 % 1 1 % 8 % 1 0 % 9 % 6 % 6 % 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Source: Public filings, Internal data Notes: 1. Total debt is defined as long-term debt plus current maturities of long-term debt and short-term borrowings. 2. Net Debt is defined as total debt less cash & cash equivalents. 3. EBITDA depicted is adjusted EBITDA from continuing operations on a trailing 12-month basis 4. Net debt-to-capitalization is defined as net debt on CMC’s balance sheet divided by the sum of total debt and stockholders’ equity. For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures, see the appendix to this document. Leverage Profile Financial strength gives us the flexibility to fund our announced projects, pursue opportunistic M&A, and distribute cash to shareholders Net Debt1,2 / EBITDA3 Net Debt-to-Capitalization4 Transformational rebar asset acquisition Tensar acquisition Construction of Arizona 2 Transformational rebar asset acquisition Tensar acquisition Construction of Arizona 2 Q1 FY25 Supplemental Slides January 6, 2025

1.18 28.60 CMCGlobal Industry 3.76 21.27 CMCGlobal Industry 0.73 1.92 CMCGlobal Industry Clear Sustainability Leader Q1 FY25 Supplemental Slides │ January 6, 2025 20 Note: GHG emissions statistics for CMC include only steel mill operations, which represents over 95% of CMC’s emissions footprint Sources: CMC 2024 Sustainability Report; virgin material content for industry based on data from Bureau of International Recycling; all other industry data sourced from the World Steel Association CMC plays a key role in the circular steel economy, turning end of life metals into the steel that forms the backbone of modern society ACCOUNTABILITY FOR OUR ACTIONS RESPECT FOR OUR ENVIRONMENT ACTING WITH INTEGRITY 2.2 1.8 1.0 0.42 Integrated Average Global Average U.S. Average CMC Scopes 1&2 Greenhouse Gas Emissions (GHG) Intensity tC O 2 e p e r M T o f s te e l Energy Intensity G J p e r M T o f s te e l Water Withdrawal Intensity C u b ic m e te r p e r M T o f s te e l 2% 69% CMCGlobal Industry Virgin Materials Used in Steelmaking % o f s te e l c o n te n t Scopes 1-3 GHG Emissions Intensity tC O 2 e p e r M T o f s te e l

© CMC Appendix: Non-GAAP Financial Reconciliations

22 Adjusted EBITDA, Core EBITDA, and Core EBITDA margins – Last 5 Quarters [1] See page 27 for definitions of non-GAAP measures Q1 FY25 Supplemental Slides January 6, 2025

23 Adjusted Earnings [1] See page 27 for definitions of non-GAAP measures Q1 FY25 Supplemental Slides January 6, 2025

24 Return on Invested Capital [1] Federal statutory rate of 21% plus approximate impact of state level income tax [2] See page 27 for definitions of non-GAAP measures Q1 FY25 Supplemental Slides January 6, 2025

25 [1] See page 27 for definitions of non-GAAP measures Discretionary Cash Flows Q1 FY25 Supplemental Slides January 6, 2025

26 Net Debt to Adjusted EBITDA and Net Debt to Capitalization [1] See page 27 for definitions of non-GAAP measures Q1 FY25 Supplemental Slides January 6, 2025