- Acquisition of Marathon Oil Corporation is expected to be

immediately accretive to earnings, cash flows and return of capital

per share.

- ConocoPhillips expects to achieve at least $500 million of run

rate cost and capital savings within the first full year following

the closing of the transaction.

- Independent of the transaction, ConocoPhillips expects to

increase its ordinary base dividend by 34% to 78 cents per share

starting in the fourth quarter of 2024.

- Upon closing of the transaction, ConocoPhillips expects share

buybacks to be over $20 billion in the first three years, with over

$7 billion in the first full year, at recent commodity prices.

ConocoPhillips (NYSE: COP) and Marathon Oil Corporation (NYSE:

MRO) announced today that they have entered into a definitive

agreement pursuant to which ConocoPhillips will acquire Marathon

Oil in an all-stock transaction with an enterprise value of $22.5

billion, inclusive of $5.4 billion of net debt. Under the terms of

the agreement, Marathon Oil shareholders will receive 0.2550 shares

of ConocoPhillips common stock for each share of Marathon Oil

common stock, representing a 14.7% premium to the closing share

price of Marathon Oil on May 28, 2024, and a 16.0% premium to the

prior 10-day volume-weighted average price.

“This acquisition of Marathon Oil further deepens our portfolio

and fits within our financial framework, adding high-quality, low

cost of supply inventory adjacent to our leading U.S.

unconventional position,” said Ryan Lance, ConocoPhillips chairman

and chief executive officer. “Importantly, we share similar values

and cultures with a focus on operating safely and responsibly to

create long-term value for our shareholders. The transaction is

immediately accretive to earnings, cash flows and distributions per

share, and we see significant synergy potential.”

“This is a proud moment to look back on what we achieved at

Marathon Oil. Powered by our dedicated employees and contractors,

we built a top performing portfolio with a multi-year track record

of peer-leading operational execution, strong financial results and

compelling return of capital to our shareholders - all while

holding true to our core values of safety and environmental

excellence. ConocoPhillips is the right home to build on that

legacy, offering a truly unique combination of added scale,

resilience and long-term durability. With its premier global asset

base, strong balance sheet and laser focus on operational

excellence, ConocoPhillips’ track record of long-term investments,

differentiated shareholder distributions and active portfolio

management are unmatched. When combined with the global

ConocoPhillips portfolio, I’m confident our assets and people will

deliver significant shareholder value over the long term,” said Lee

Tillman, Marathon Oil chairman, president and chief executive

officer.

Transaction benefits

- Immediately accretive: This acquisition is immediately

accretive to ConocoPhillips on earnings, cash from operations, free

cash flow and return of capital per share to shareholders.

- Delivers significant cost and capital synergies: Given

the adjacent nature of the acquired assets and a common operating

philosophy, ConocoPhillips expects to achieve the full $500 million

of cost and capital synergy run rate within the first full year

following the closing of the transaction. The identified savings

will come from reduced general and administrative costs, lower

operating costs and improved capital efficiencies.

- Further enhances premier Lower 48 portfolio: This

acquisition will add highly complementary acreage to

ConocoPhillips’ existing U.S. onshore portfolio, adding over 2

billion barrels of resource with an estimated average point forward

cost of supply of less than $30 per barrel WTI.

Return of capital update

Independent of the transaction, ConocoPhillips expects to

increase its ordinary base dividend by 34% to 78 cents per share

starting in the fourth quarter of 2024. Upon closing of the

transaction and assuming recent commodity prices, ConocoPhillips

plans to:

- Repurchase over $7 billion in shares in the first full year, up

from over $5 billion standalone.

- Repurchase over $20 billion in shares in the first three

years.

“We remain committed to our differentiated cash from operations

distribution framework of returning greater than 30% to our

shareholders, with a track record of returning over 40% since our

2016 strategy reset,” added Lance. “We plan to raise our ordinary

dividend by 34% in the fourth quarter and we will continue to

target top-quartile dividend growth relative to the S&P 500

going forward. Additionally, we intend to prioritize share

repurchases following the close of the transaction, with a plan to

retire the equivalent amount of newly issued equity in the

transaction in two to three years at recent commodity prices.”

Transaction details

The transaction is subject to the approval of Marathon Oil

stockholders, regulatory clearance and other customary closing

conditions. The transaction is expected to close in the fourth

quarter of 2024.

ConocoPhillips will host a conference call today at 10 a.m.

Eastern time to discuss this announcement. To listen to the call

and view related presentation materials, go to

www.conocophillips.com/investor.

Advisors

Evercore is serving as ConocoPhillips’ financial advisor and

Wachtell, Lipton, Rosen & Katz is serving as ConocoPhillips’

legal advisor for the transaction. Morgan Stanley & Co. LLC is

serving as Marathon Oil’s financial advisor and Kirkland &

Ellis LLP is serving as Marathon Oil’s legal advisor for the

transaction.

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a

globally diversified asset portfolio. Headquartered in Houston,

Texas, ConocoPhillips had operations and activities in 13

countries, $95 billion of total assets, and approximately 10,000

employees at March 31, 2024. Production averaged 1,902 MBOED for

the three months ended March 31, 2024, and proved reserves were 6.8

BBOE as of Dec. 31, 2023. For more information, go to

www.conocophillips.com.

About Marathon Oil

Marathon Oil (NYSE: MRO) is an independent oil and gas

exploration and production (E&P) company focused on four of the

most competitive resource plays in the U.S. - Eagle Ford, Texas;

Bakken, North Dakota; Permian in New Mexico and Texas, and STACK

and SCOOP in Oklahoma, complemented by a world-class integrated gas

business in Equatorial Guinea. The Company's Framework for Success

is founded in a strong balance sheet, ESG excellence and the

competitive advantages of a high-quality multi-basin portfolio. For

more information, please visit www.marathonoil.com.

Forward-Looking Statements

This news release includes “forward-looking statements” as

defined under the federal securities laws. All statements other

than statements of historical fact included or incorporated by

reference in this news release, including, among other things,

statements regarding the proposed business combination transaction

between ConocoPhillips (“ConocoPhillips”) and Marathon Oil

Corporation (“Marathon”), future events, plans and anticipated

results of operations, business strategies, the anticipated

benefits of the proposed transaction, the anticipated impact of the

proposed transaction on the combined company’s business and future

financial and operating results, the expected amount and timing of

synergies from the proposed transaction, the anticipated closing

date for the proposed transaction and other aspects of

ConocoPhillips’ or Marathon’s operations or operating results are

forward-looking statements. Words and phrases such as “ambition,”

“anticipate,” “estimate,” “believe,” “budget,” “continue,” “could,”

“intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,”

“will,” “would,” “expect,” “objective,” “projection,” “forecast,”

“goal,” “guidance,” “outlook,” “effort,” “target” and other similar

words can be used to identify forward-looking statements. However,

the absence of these words does not mean that the statements are

not forward-looking. Where, in any forward-looking statement,

ConocoPhillips or Marathon expresses an expectation or belief as to

future results, such expectation or belief is expressed in good

faith and believed to be reasonable at the time such

forward-looking statement is made. However, these statements are

not guarantees of future performance and involve certain risks,

uncertainties and other factors beyond ConocoPhillips’ or

Marathon’s control. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in the

forward-looking statements.

The following important factors and uncertainties, among others,

could cause actual results or events to differ materially from

those described in forward-looking statements: ConocoPhillips’

ability to successfully integrate Marathon’s businesses and

technologies, which may result in the combined company not

operating as effectively and efficiently as expected; the risk that

the expected benefits and synergies of the proposed transaction may

not be fully achieved in a timely manner, or at all; the risk that

ConocoPhillips or Marathon will be unable to retain and hire key

personnel; the risk associated with Marathon’s ability to obtain

the approval of its stockholders required to consummate the

proposed transaction and the timing of the closing of the proposed

transaction, including the risk that the conditions to the

transaction are not satisfied on a timely basis or at all or the

failure of the transaction to close for any other reason or to

close on the anticipated terms, including the anticipated tax

treatment (and with respect to increases in ConocoPhillips’ share

repurchase program, such increases are not intended to exceed

shares issued in the transaction); the risk that any regulatory

approval, consent or authorization that may be required for the

proposed transaction is not obtained or is obtained subject to

conditions that are not anticipated; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the proposed transaction; unanticipated

difficulties, liabilities or expenditures relating to the

transaction; the effect of the announcement, pendency or completion

of the proposed transaction on the parties’ business relationships

and business operations generally; the effect of the announcement

or pendency of the proposed transaction on the parties’ common

stock prices and uncertainty as to the long-term value of

ConocoPhillips’ or Marathon’s common stock; risks that the proposed

transaction disrupts current plans and operations of ConocoPhillips

or Marathon and their respective management teams and potential

difficulties in hiring or retaining employees as a result of the

proposed transaction; rating agency actions and ConocoPhillips’ and

Marathon’s ability to access short- and long-term debt markets on a

timely and affordable basis; changes in commodity prices, including

a prolonged decline in these prices relative to historical or

future expected levels; global and regional changes in the demand,

supply, prices, differentials or other market conditions affecting

oil and gas, including changes resulting from any ongoing military

conflict, including the conflicts in Ukraine and the Middle East,

and the global response to such conflict, security threats on

facilities and infrastructure, or from a public health crisis or

from the imposition or lifting of crude oil production quotas or

other actions that might be imposed by Organization of Petroleum

Exporting Countries and other producing countries and the resulting

company or third-party actions in response to such changes;

insufficient liquidity or other factors that could impact

ConocoPhillips’ ability to repurchase shares and declare and pay

dividends such that ConocoPhillips suspends its share repurchase

program and reduces, suspends or totally eliminates dividend

payments in the future, whether variable or fixed; changes in

expected levels of oil and gas reserves or production; potential

failures or delays in achieving expected reserve or production

levels from existing and future oil and gas developments, including

due to operating hazards, drilling risks or unsuccessful

exploratory activities; unexpected cost increases, inflationary

pressures or technical difficulties in constructing, maintaining or

modifying company facilities; legislative and regulatory

initiatives addressing global climate change or other environmental

concerns; public health crises, including pandemics (such as

COVID-19) and epidemics and any impacts or related company or

government policies or actions; investment in and development of

competing or alternative energy sources; potential failures or

delays in delivering on ConocoPhillips’ current or future

low-carbon strategy, including ConocoPhillips’ inability to develop

new technologies; disruptions or interruptions impacting the

transportation for ConocoPhillips’ or Marathon’s oil and gas

production; international monetary conditions and exchange rate

fluctuations; changes in international trade relationships or

governmental policies, including the imposition of price caps, or

the imposition of trade restrictions or tariffs on any materials or

products (such as aluminum and steel) used in the operation of

ConocoPhillips’ or Marathon’s business, including any sanctions

imposed as a result of any ongoing military conflict, including the

conflicts in Ukraine and the Middle East; ConocoPhillips’ ability

to collect payments when due, including ConocoPhillips’ ability to

collect payments from the government of Venezuela or PDVSA;

ConocoPhillips’ ability to complete any other announced or any

other future dispositions or acquisitions on time, if at all; the

possibility that regulatory approvals for any other announced or

any future dispositions or any other acquisitions will not be

received on a timely basis, if at all, or that such approvals may

require modification to the terms of those transactions or

ConocoPhillips’ remaining business; business disruptions following

any announced or future dispositions or other acquisitions,

including the diversion of management time and attention; the

ability to deploy net proceeds from ConocoPhillips’ announced or

any future dispositions in the manner and timeframe anticipated, if

at all; potential liability for remedial actions under existing or

future environmental regulations; potential liability resulting

from pending or future litigation; the impact of competition and

consolidation in the oil and gas industry; limited access to

capital or insurance or significantly higher cost of capital or

insurance related to illiquidity or uncertainty in the domestic or

international financial markets or investor sentiment; general

domestic and international economic and political conditions or

developments, including as a result of any ongoing military

conflict, including the conflicts in Ukraine and the Middle East;

changes in fiscal regime or tax, environmental and other laws

applicable to ConocoPhillips’ or Marathon’s businesses; disruptions

resulting from accidents, extraordinary weather events, civil

unrest, political events, war, terrorism, cybersecurity threats or

information technology failures, constraints or disruptions; and

other economic, business, competitive and/or regulatory factors

affecting ConocoPhillips’ or Marathon’s businesses generally as set

forth in their filings with the Securities and Exchange Commission

(the “SEC”). The registration statement on Form S-4 and proxy

statement/prospectus that will be filed with the SEC will describe

additional risks in connection with the proposed transaction. While

the list of factors presented here is, and the list of factors to

be presented in the registration statement on Form S-4 and proxy

statement/prospectus are considered representative, no such list

should be considered to be a complete statement of all potential

risks and uncertainties. For additional information about other

factors that could cause actual results to differ materially from

those described in the forward-looking statements, please refer to

ConocoPhillips’ and Marathon’s respective periodic reports and

other filings with the SEC, including the risk factors contained in

ConocoPhillips’ and Marathon’s most recent Quarterly Reports on

Form 10-Q and Annual Reports on Form 10-K. Forward-looking

statements represent current expectations and are inherently

uncertain and are made only as of the date hereof (or, if

applicable, the dates indicated in such statement). Except as

required by law, neither ConocoPhillips nor Marathon undertakes or

assumes any obligation to update any forward-looking statements,

whether as a result of new information or to reflect subsequent

events or circumstances or otherwise.

No Offer or Solicitation

This news release is not intended to and shall not constitute an

offer to buy or sell or the solicitation of an offer to buy or sell

any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the

U.S. Securities Act of 1933, as amended.

Additional Information about the Merger and Where to Find

It

In connection with the proposed transaction, ConocoPhillips

intends to file with the SEC a registration statement on Form S-4,

which will include a proxy statement of Marathon that also

constitutes a prospectus of ConocoPhillips common shares to be

offered in the proposed transaction. Each of ConocoPhillips and

Marathon may also file other relevant documents with the SEC

regarding the proposed transaction. This news release is not a

substitute for the proxy statement/prospectus or registration

statement or any other document that ConocoPhillips or Marathon may

file with the SEC. The definitive proxy statement/prospectus (if

and when available) will be mailed to stockholders of Marathon.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies

of the registration statement and proxy statement/prospectus (if

and when available) and other documents containing important

information about ConocoPhillips, Marathon and the proposed

transaction, once such documents are filed with the SEC through the

website maintained by the SEC at www.sec.gov. Copies of the

documents filed with the SEC by ConocoPhillips will be available

free of charge on ConocoPhillips’ website at www.conocophillips.com

or by contacting ConocoPhillips’ Investor Relations Department by

email at investor.relations@conocophillips.com or by phone at

281-293-5000. Copies of the documents filed with the SEC by

Marathon will be available free of charge on Marathon’s website at

ir.marathonoil.com or by contacting Marathon at 713-629-6600.

Participants in the Solicitation

ConocoPhillips, Marathon and certain of their respective

directors and executive officers may be deemed to be participants

in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers

of ConocoPhillips is set forth in (i) ConocoPhillips’ proxy

statement for its 2024 annual meeting of stockholders under the

headings “Executive Compensation”, “Item 1: Election of Directors

and Director Biographies” (including “Related Party Transactions”

and “Director Compensation”), “Compensation Discussion and

Analysis”, “Executive Compensation Tables” and “Stock Ownership”,

which was filed with the SEC on April 1, 2024 and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000130817924000384/cop4258041-def14a.htm,

(ii) ConocoPhillips’ Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, including under the headings “Item 10.

Directors, Executive Officers and Corporate Governance”, “Item 11.

Executive Compensation”, “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters”

and “Item 13. Certain Relationships and Related Transactions, and

Director Independence”, which was filed with the SEC on February

15, 2024 and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000116316524000010/cop-20231231.htm

and (iii) to the extent holdings of ConocoPhillips securities by

its directors or executive officers have changed since the amounts

set forth in ConocoPhillips’ proxy statement for its 2024 annual

meeting of stockholders, such changes have been or will be

reflected on Initial Statement of Beneficial Ownership of

Securities on Form 3, Statement of Changes in Beneficial Ownership

on Form 4 or Annual Statement of Changes in Beneficial Ownership of

Securities on Form 5, filed with the SEC (which are available at

EDGAR Search Results

https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0001163165&entityName=CONOCOPHILLIPS%2520(COP)%2520(CIK%25200001163165)).

Information about the directors and executive officers of Marathon

is set forth in (i) Marathon’s proxy statement for its 2024 annual

meeting of stockholders under the headings “Proposal 1: Election of

Directors”, “Director Compensation”, “Security Ownership of Certain

Beneficial Owners and Management”, “Compensation Discussion and

Analysis”, “Executive Compensation” and “Transactions with Related

Persons”, which was filed with the SEC on April 10, 2024 and is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000082/mro-20240405.htm,

(ii) Marathon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, including under the headings “Item 10.

Directors, Executive Officers and Corporate Governance”, “Item 11.

Executive Compensation”, “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters”

and “Item 13. Certain Relationships and Related Transactions, and

Director Independence”, which was filed with the SEC on February

22, 2024 and is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000023/mro-20231231.htm

and (iii) to the extent holdings of Marathon securities by its

directors or executive officers have changed since the amounts set

forth in Marathon’s proxy statement for its 2024 annual meeting of

stockholders, such changes have been or will be reflected on

Initial Statement of Beneficial Ownership of Securities on Form 3,

Statement of Changes in Beneficial Ownership on Form 4, or Annual

Statement of Changes in Beneficial Ownership of Securities on Form

5, filed with the SEC (which are available at EDGAR Search Results

https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0000101778&entityName=MARATHON%2520OIL%2520CORP%2520(MRO)%2520(CIK%25200000101778)).

Other information regarding the participants in the proxy

solicitations and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement/prospectus and other relevant materials to be

filed with the SEC regarding the proposed transaction when such

materials become available. Investors should read the proxy

statement/prospectus carefully when it becomes available before

making any voting or investment decisions. Copies of the documents

filed with the SEC by ConocoPhillips and Marathon will be available

free of charge through the website maintained by the SEC at

www.sec.gov. Additionally, copies of documents filed with the SEC

by ConocoPhillips will be available free of charge on

ConocoPhillips’ website at www.conocophillips.com/ and those filed

by Marathon will be available free of charge on Marathon’s website

at ir.marathonoil.com/.

Use of Non-GAAP Financial Information and Other Terms –

This news release contains certain financial measures that are not

prepared in accordance with GAAP, including cash from operations

(CFO), free cash flow and net debt. CFO is calculated by removing

the impact from operating working capital from cash provided by

operating activities. Free cash flow is CFO net of capital

expenditures and investments. Net debt is total balance sheet debt

less cash, cash equivalents and short-term investments. This news

release also contains the terms enterprise value, cost of supply

and return of capital. Enterprise value included in this release is

calculated based on the sum of net debt as of March 31, 2024, and

anticipated shares to be issued at the fixed exchange ratio of

0.2550 measured at ConocoPhillips' closing share price on May 28,

2024. Cost of supply is the WTI equivalent price that generates a

10 percent after-tax return on a point-forward and fully burdened

basis. Fully burdened includes capital infrastructure, foreign

exchange, price-related inflation, G&A and carbon tax (if

currently assessed). If no carbon tax exists for the asset, carbon

pricing aligned with internal energy scenarios are applied. All

barrels of resource are discounted at 10 percent. Return of capital

is defined as the total of the ordinary dividend, share repurchases

and variable return of cash (VROC).

Cautionary Note to U.S. Investors – The SEC permits oil

and gas companies, in their filings with the SEC, to disclose only

proved, probable and possible reserves. We may use the term

“resource” in this release that the SEC’s guidelines prohibit us

from including in filings with the SEC. U.S. investors are urged to

consider closely the oil and gas disclosures in our Form 10-K and

other reports and filings with the SEC. Copies are available from

the SEC and from the ConocoPhillips website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529051958/en/

ConocoPhillips Dennis Nuss (media) 281-293-1149

dennis.nuss@conocophillips.com

Investor Relations 281-293-5000

investor.relations@conocophillips.com

Marathon Oil Karina Brooks (media) 713-296-2191

Investor Relations Guy Baber: 713-296-1892 John Reid:

713-296-4380

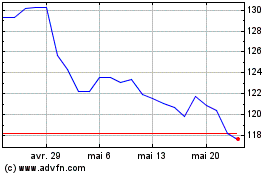

ConocoPhillips (NYSE:COP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

ConocoPhillips (NYSE:COP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024