CTS Corporation (NYSE: CTS), a leading global designer and

manufacturer of custom engineered solutions that “Sense, Connect

and Move,” today announced third quarter 2023 results.

“We managed through a challenging operating

environment in the third quarter, with continued headwinds in

industrial end markets and distribution weighing on our results,”

said Kieran O’Sullivan, CEO of CTS Corporation. “We are continuing

to advance our long-term strategy and secured several wins in both

electrification and non-transportation markets during the quarter.

Our teams remain focused on driving operational improvements to

strengthen profitability as we manage near-term challenges and

generate sustained value for all stakeholders.”

Third Quarter 2023 Results

- Sales were $135

million, down 11% year-over-year. Sales to non-transportation end

markets decreased 20%, and sales to the transportation end market

decreased 3% over the same period.

- Net income was $14

million, or 10.4% of sales, compared to $12 million, or 7.8% of

sales, in the third quarter of 2022.

- Diluted earnings

per share were $0.44, compared to $0.37 per share, in the third

quarter of 2022.

- Adjusted diluted

EPS was $0.54, down from $0.62 in the third quarter of 2022.

- Adjusted EBITDA

margin was 22.5% compared to 22.3% in the third quarter of

2022.

- Operating cash flow

was $22 million compared to $60 million in the third quarter of

2022. The third quarter of 2022 included a one-time cash inflow of

$34 million relating to the US pension plan.

2023 Guidance

As a result of continued headwinds in industrial

and distribution end markets, recent softness in the commercial

vehicle market and the UAW strike, CTS is updating its guidance of

sales from the range of $565 – $585 million to $545 - $555 million,

and adjusted diluted EPS from the range of $2.20 – $2.40 to $2.15 –

$2.25.

CTS does not provide reconciliations of

forward-looking non-GAAP financial measures, such as estimated

adjusted diluted earnings per share, to the most comparable GAAP

financial measures on a forward-looking basis because CTS is unable

to provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without

unreasonable effort. This is due to the inherent difficulty of

forecasting the timing and amount of certain items, such as, but

not limited to, restructuring costs, environmental remediation

costs, acquisition-related costs, foreign exchange rates and other

non-routine costs. Each of such adjustments has not yet occurred,

are out of CTS' control and/or cannot be reasonably predicted. For

the same reasons, CTS is unable to address the probable

significance of the unavailable information.

Conference Call and Supplemental Materials

As previously announced, the Company has scheduled a conference

call for 10:00 a.m. (EDT) today. The dial-in number for the U.S.

and Canada is 833-470-1428 (+1 929-526-1599, if calling from

outside the U.S. and Canada). The passcode is 224664. In addition,

the Company will be using a supplemental slide presentation that

will be referred to during the call. The presentation and a live

audio webcast of the conference call will be available and can be

accessed directly from CTS’ website at

https://www.ctscorp.com/investors/events-presentations/.

About CTS

CTS Corporation (NYSE: CTS) is a leading

designer and manufacturer of products that Sense, Connect and Move.

CTS manufactures sensors, actuators and electronic components in

North America, Europe and Asia, and provides engineered products to

customers in the aerospace/defense, industrial, medical and

transportation markets. For more information, visit

www.ctscorp.com.

Safe Harbor

This document contains statements that are, or

may be deemed to be, forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, any

financial or other guidance, statements that reflect our current

expectations concerning future results and events, and any other

statements that are not based solely on historical fact.

Forward-looking statements are based on management’s expectations,

certain assumptions, and currently available information. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof and are based on

various assumptions as to future events, the occurrence of which

necessarily are subject to uncertainties. These forward-looking

statements are made subject to certain risks, uncertainties, and

other factors, which could cause CTS’ actual results, performance,

or achievements to differ materially from those presented in the

forward-looking statements. Examples of factors that may affect

future operating results and financial condition include, but are

not limited to: supply chain disruptions; changes in the economy

generally, including inflationary and/or recessionary conditions,

and in respect to the business in which CTS operates; unanticipated

issues in integrating acquisitions; the results of actions to

reposition CTS’ business; rapid technological change; general

market conditions in the transportation, as well as conditions in

the industrial, aerospace and defense, and medical markets;

reliance on key customers; unanticipated public health crises

(including the effect of the COVID-19 pandemic on CTS’ business,

results of operations or financial condition), natural disasters or

other events; environmental compliance and remediation expenses;

the ability to protect CTS’ intellectual property; pricing

pressures and demand for CTS’ products; and risks associated with

CTS’ international operations, including trade and tariff barriers,

exchange rates and political and geopolitical risks (including,

without limitation, the potential impact U.S./China relations and

the conflict between Russia and Ukraine may have on our business,

results of operations and financial condition). Many of these, and

other risks and uncertainties, are discussed in further detail in

Item 1A. of CTS’ most recent Annual Report on Form 10-K and other

filings made with the SEC. CTS undertakes no obligation to publicly

update CTS’ forward-looking statements to reflect new information

or events or circumstances that arise after the date hereof,

including market or industry changes.

Contact Ashish Agrawal Vice President

and Chief Financial Officer CTS Corporation 4925 Indiana

Avenue Lisle, IL 60532 USA +1 (630)

577-8800 ashish.agrawal@ctscorp.com

|

CTS CORPORATION AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF EARNINGS - UNAUDITED(In

thousands, except per share amounts) |

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September,2023 |

|

|

September 30,2022 |

|

|

September 30,2023 |

|

|

September 30,2022 |

|

|

Net sales |

|

$ |

134,552 |

|

|

$ |

151,911 |

|

|

$ |

425,728 |

|

|

$ |

444,588 |

|

|

Cost of goods sold |

|

|

88,151 |

|

|

|

98,565 |

|

|

|

276,933 |

|

|

|

285,054 |

|

| Gross margin |

|

|

46,401 |

|

|

|

53,346 |

|

|

|

148,795 |

|

|

|

159,534 |

|

|

Selling, general and administrative expenses |

|

|

18,666 |

|

|

|

24,003 |

|

|

|

64,339 |

|

|

|

68,029 |

|

|

Research and development expenses |

|

|

6,321 |

|

|

|

6,207 |

|

|

|

19,628 |

|

|

|

18,695 |

|

|

Restructuring charges |

|

|

3,226 |

|

|

|

492 |

|

|

|

6,033 |

|

|

|

1,434 |

|

| Operating earnings |

|

|

18,188 |

|

|

|

22,644 |

|

|

|

58,795 |

|

|

|

71,376 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(997 |

) |

|

|

(342 |

) |

|

|

(2,509 |

) |

|

|

(1,490 |

) |

|

Interest income |

|

|

952 |

|

|

|

167 |

|

|

|

3,087 |

|

|

|

610 |

|

|

Other income (expense), net |

|

|

594 |

|

|

|

(5,171 |

) |

|

|

(1,847 |

) |

|

|

(10,530 |

) |

|

Total other income (expense), net |

|

|

549 |

|

|

|

(5,346 |

) |

|

|

(1,269 |

) |

|

|

(11,410 |

) |

|

Earnings before income taxes |

|

|

18,737 |

|

|

|

17,298 |

|

|

|

57,526 |

|

|

|

59,966 |

|

| Income tax expense |

|

|

4,766 |

|

|

|

5,500 |

|

|

|

12,314 |

|

|

|

15,331 |

|

| Net

earnings |

|

$ |

13,971 |

|

|

$ |

11,798 |

|

|

$ |

45,212 |

|

|

$ |

44,635 |

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.45 |

|

|

$ |

0.37 |

|

|

$ |

1.44 |

|

|

$ |

1.39 |

|

|

Diluted |

|

$ |

0.44 |

|

|

$ |

0.37 |

|

|

$ |

1.43 |

|

|

$ |

1.38 |

|

| Basic weighted – average

common shares outstanding: |

|

|

31,302 |

|

|

|

31,865 |

|

|

|

31,474 |

|

|

|

32,018 |

|

|

Effect of dilutive securities |

|

|

209 |

|

|

|

225 |

|

|

|

216 |

|

|

|

220 |

|

| Diluted weighted –

average common shares outstanding: |

|

|

31,511 |

|

|

|

32,090 |

|

|

|

31,690 |

|

|

|

32,238 |

|

| Cash dividends declared

per share |

|

$ |

0.04 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

CTS CORPORATION AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands of dollars) |

|

| |

|

(Unaudited)September 30,

2023 |

|

|

December 31, 2022 |

|

| ASSETS |

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

160,112 |

|

|

$ |

156,910 |

|

|

Accounts receivable, net |

|

|

89,556 |

|

|

|

90,935 |

|

|

Inventories, net |

|

|

65,384 |

|

|

|

62,260 |

|

|

Other current assets |

|

|

19,272 |

|

|

|

15,655 |

|

|

Total current assets |

|

|

334,324 |

|

|

|

325,760 |

|

| Property, plant and equipment,

net |

|

|

92,880 |

|

|

|

97,300 |

|

| Operating lease assets, net |

|

|

27,545 |

|

|

|

22,702 |

|

| Other Assets |

|

|

|

|

|

|

|

Goodwill |

|

|

154,130 |

|

|

|

152,361 |

|

|

Other intangible assets, net |

|

|

103,828 |

|

|

|

108,053 |

|

|

Deferred income taxes |

|

|

23,725 |

|

|

|

23,461 |

|

|

Other |

|

|

17,530 |

|

|

|

18,850 |

|

|

Total other assets |

|

|

299,213 |

|

|

|

302,725 |

|

| Total

Assets |

|

$ |

753,962 |

|

|

$ |

748,487 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

49,848 |

|

|

$ |

53,211 |

|

|

Accrued payroll and benefits |

|

|

13,330 |

|

|

|

20,063 |

|

|

Operating lease obligations |

|

|

4,444 |

|

|

|

3,936 |

|

|

Accrued expenses and other liabilities |

|

|

35,804 |

|

|

|

35,322 |

|

|

Total current liabilities |

|

|

103,426 |

|

|

|

112,532 |

|

|

Long-term debt |

|

|

76,665 |

|

|

|

83,670 |

|

|

Long-term operating lease obligations |

|

|

26,016 |

|

|

|

21,754 |

|

|

Long-term pension obligations |

|

|

4,963 |

|

|

|

5,048 |

|

|

Deferred income taxes |

|

|

15,288 |

|

|

|

16,010 |

|

|

Other long-term obligations |

|

|

4,937 |

|

|

|

3,249 |

|

| Total

Liabilities |

|

|

231,295 |

|

|

|

242,263 |

|

| Commitments and

Contingencies |

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

Common stock |

|

|

319,125 |

|

|

|

316,803 |

|

|

Additional contributed capital |

|

|

44,718 |

|

|

|

46,144 |

|

|

Retained earnings |

|

|

588,144 |

|

|

|

546,703 |

|

|

Accumulated other comprehensive loss |

|

|

(675 |

) |

|

|

(671 |

) |

|

Total shareholders’ equity before treasury stock |

|

|

951,312 |

|

|

|

908,979 |

|

|

Treasury stock |

|

|

(428,645 |

) |

|

|

(402,755 |

) |

|

Total shareholders’ equity |

|

|

522,667 |

|

|

|

506,224 |

|

| Total Liabilities and

Shareholders’ Equity |

|

$ |

753,962 |

|

|

$ |

748,487 |

|

CTS CORPORATION AND

SUBSIDIARIESOTHER SUPPLEMENTAL INFORMATION -

UNAUDITED(In millions of dollars, except percentages and

per share amounts)

Non-GAAP Financial Measures

From time to time, CTS may use non-GAAP

financial measures in discussing CTS’ business. These measures are

intended to supplement, not replace, CTS’ presentation of its

financial results in accordance with U.S. GAAP. CTS believes that

the non-GAAP financial measures presented are commonly used by

financial analysts and others in the industries in which CTS

operates, and thus further provide useful information to investors.

CTS’ definitions of these non-GAAP financial measures may differ

from those terms as defined or used by other companies. Non-GAAP

measures should not be used by investors or third parties as the

sole basis for formulating investment decisions, as they may

exclude a number of important cash and non-cash recurring

items.

CTS has presented these non-GAAP financial

measures as it believes that the presentation of its financial

results that exclude (1) restructuring charges; (2) environmental

charges; (3) acquisition-related costs; (4) inventory fair value

step-up costs; (5) foreign exchange (gains) losses; (6) non-cash

pension expenses (income); and (7) certain discrete tax items are

useful and assist in comparing CTS’ current operating results with

past periods and with the operational performance of other

companies in its industry. Included below is a description of the

expenses that CTS has determined are not normal, recurring cash

operating expenses necessary to operate its business and the

rationale for why providing financial measures for its business

with such expenses excluded or adjusted is useful to investors as a

supplement to the U.S. GAAP measures.

- Restructuring

charges – costs primarily relating to workforce reduction costs,

building and equipment relocation costs, asset impairment charges

and other facility closure costs in connection with our continued

optimization of our organization.

- Environmental

charges – costs associated with our non-operating facilities that

are unrelated to ongoing operations.

- Acquisition-related

costs – diligence and transaction costs related to

acquisitions.

- Inventory fair

value step-up costs – purchase accounting-related inventory costs

from acquisitions.

- Foreign exchange

(gains) losses – remeasurement income and expenses for non-U.S.

subsidiaries with the U.S. dollar as the functional currency.

- Non-cash pension

expenses (income) – pension income and expenses relating to the

non-operating U.S. pension and post-retirement life insurance

plans, including historical plan settlement activities.

- Discrete tax items

– non-recurring, infrequent, or unusual tax adjustments (e.g.,

valuation allowances, uncertain tax position changes, unremitted

assertion changes and discrete impacts associated with pre-tax

non-GAAP items, etc.).

At times, the reconciliations below have been

intentionally rounded to the nearest thousand, or $0.01 for EPS

figures, and, therefore, may not sum.

Adjusted Gross Margin

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Gross margin |

|

$ |

46.4 |

|

|

$ |

53.3 |

|

|

$ |

148.8 |

|

|

$ |

159.5 |

|

|

$ |

210.5 |

|

|

$ |

184.6 |

|

|

$ |

139.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

425.7 |

|

|

$ |

444.6 |

|

|

$ |

586.9 |

|

|

$ |

512.9 |

|

|

$ |

424.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin as a % of

net sales |

|

|

34.5 |

% |

|

|

35.1 |

% |

|

|

35.0 |

% |

|

|

35.9 |

% |

|

|

35.9 |

% |

|

|

36.0 |

% |

|

|

32.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reported gross

margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory fair value step-up (b) |

|

$ |

— |

|

|

$ |

2.2 |

|

|

$ |

— |

|

|

$ |

3.3 |

|

|

$ |

4.0 |

|

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross

margin |

|

$ |

46.4 |

|

|

$ |

55.6 |

|

|

$ |

148.8 |

|

|

$ |

162.9 |

|

|

$ |

214.5 |

|

|

$ |

184.6 |

|

|

$ |

139.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross margin

as a % of net sales |

|

|

34.5 |

% |

|

|

36.6 |

% |

|

|

35.0 |

% |

|

|

36.6 |

% |

|

|

36.5 |

% |

|

|

36.0 |

% |

|

|

32.8 |

% |

Adjusted Operating Earnings

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Operating earnings |

|

$ |

18.2 |

|

|

$ |

22.6 |

|

|

$ |

58.8 |

|

|

$ |

71.4 |

|

|

$ |

93.0 |

|

|

$ |

76.5 |

|

|

$ |

45.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

425.7 |

|

|

$ |

444.6 |

|

|

$ |

586.9 |

|

|

$ |

512.9 |

|

|

$ |

424.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings as

a % of net sales |

|

|

13.5 |

% |

|

|

14.9 |

% |

|

|

13.8 |

% |

|

|

16.1 |

% |

|

|

15.8 |

% |

|

|

14.9 |

% |

|

|

10.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reported

operating earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges (c) |

|

|

3.2 |

|

|

|

0.5 |

|

|

|

6.0 |

|

|

|

1.4 |

|

|

|

1.9 |

|

|

|

1.7 |

|

|

|

1.8 |

|

|

Environmental charges (a) |

|

|

0.4 |

|

|

|

0.3 |

|

|

|

3.1 |

|

|

|

1.8 |

|

|

|

2.8 |

|

|

|

2.3 |

|

|

|

2.8 |

|

|

Acquisition-related costs (a) |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.8 |

|

|

|

0.8 |

|

|

|

— |

|

|

|

0.3 |

|

|

Inventory fair value step-up (b) |

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

|

|

3.3 |

|

|

|

4.0 |

|

|

|

— |

|

|

|

— |

|

| Total adjustments to reported

operating earnings |

|

$ |

3.6 |

|

|

$ |

3.0 |

|

|

$ |

9.3 |

|

|

$ |

7.3 |

|

|

$ |

9.5 |

|

|

$ |

3.9 |

|

|

$ |

4.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating

earnings |

|

$ |

21.8 |

|

|

$ |

25.7 |

|

|

$ |

68.1 |

|

|

$ |

78.7 |

|

|

$ |

102.5 |

|

|

$ |

80.4 |

|

|

$ |

50.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating

earnings as a % of net sales |

|

|

16.2 |

% |

|

|

16.9 |

% |

|

|

16.0 |

% |

|

|

17.7 |

% |

|

|

17.5 |

% |

|

|

15.7 |

% |

|

|

11.8 |

% |

Adjusted EBITDA Margin

|

|

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Net earnings (loss) |

|

$ |

14.0 |

|

|

$ |

11.8 |

|

|

$ |

45.2 |

|

|

$ |

44.6 |

|

|

$ |

59.6 |

|

|

$ |

(41.9 |

) |

|

$ |

34.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

425.7 |

|

|

$ |

444.6 |

|

|

$ |

586.9 |

|

|

$ |

512.9 |

|

|

$ |

424.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss)

margin |

|

|

10.4 |

% |

|

|

7.8 |

% |

|

|

10.6 |

% |

|

|

10.0 |

% |

|

|

10.2 |

% |

|

|

-8.2 |

% |

|

|

8.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization

expense |

|

|

7.3 |

|

|

|

8.0 |

|

|

|

21.4 |

|

|

|

21.7 |

|

|

|

29.8 |

|

|

|

26.9 |

|

|

|

26.7 |

|

| Interest expense |

|

|

1.0 |

|

|

|

0.3 |

|

|

|

2.5 |

|

|

|

1.5 |

|

|

|

2.2 |

|

|

|

2.1 |

|

|

|

3.3 |

|

| Tax expense (benefit) |

|

|

4.8 |

|

|

|

5.5 |

|

|

|

12.3 |

|

|

|

15.3 |

|

|

|

21.2 |

|

|

|

(19.0 |

) |

|

|

10.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

27.0 |

|

|

|

25.6 |

|

|

|

81.5 |

|

|

|

83.2 |

|

|

|

112.7 |

|

|

|

(31.8 |

) |

|

|

75.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges (c) |

|

|

3.2 |

|

|

|

0.5 |

|

|

|

6.0 |

|

|

|

1.4 |

|

|

|

1.9 |

|

|

|

1.7 |

|

|

|

1.8 |

|

|

Environmental charges (a) |

|

|

0.4 |

|

|

|

0.3 |

|

|

|

3.1 |

|

|

|

1.8 |

|

|

|

2.8 |

|

|

|

2.3 |

|

|

|

2.8 |

|

|

Acquisition-related costs (a) |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

2.5 |

|

|

|

2.5 |

|

|

|

— |

|

|

|

0.3 |

|

|

Inventory fair value step-up (b) |

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

|

|

3.3 |

|

|

|

4.0 |

|

|

|

— |

|

|

|

— |

|

|

Non-cash pension and related expense (d) |

|

|

— |

|

|

|

4.7 |

|

|

|

— |

|

|

|

4.8 |

|

|

|

4.8 |

|

|

|

132.4 |

|

|

|

2.5 |

|

|

Foreign currency loss (gain) (d) |

|

|

(0.3 |

) |

|

|

0.5 |

|

|

|

2.3 |

|

|

|

4.0 |

|

|

|

4.9 |

|

|

|

3.3 |

|

|

|

(5.3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to

EBITDA |

|

|

3.3 |

|

|

|

8.2 |

|

|

|

11.7 |

|

|

|

17.8 |

|

|

|

20.9 |

|

|

|

139.7 |

|

|

|

2.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

$ |

30.3 |

|

|

$ |

33.8 |

|

|

$ |

93.1 |

|

|

$ |

101.0 |

|

|

$ |

133.6 |

|

|

$ |

107.9 |

|

|

$ |

77.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA

Margin |

|

|

22.5 |

% |

|

|

22.3 |

% |

|

|

21.9 |

% |

|

|

22.7 |

% |

|

|

22.8 |

% |

|

|

21.0 |

% |

|

|

18.3 |

% |

Adjusted Net Earnings

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Net earnings (loss) (A) |

|

$ |

14.0 |

|

|

$ |

11.8 |

|

|

$ |

45.2 |

|

|

$ |

44.6 |

|

|

$ |

59.6 |

|

|

$ |

(41.9 |

) |

|

$ |

34.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

425.7 |

|

|

$ |

444.6 |

|

|

$ |

586.9 |

|

|

$ |

512.9 |

|

|

$ |

424.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) as

a % of net sales |

|

|

10.4 |

% |

|

|

7.8 |

% |

|

|

10.6 |

% |

|

|

10.0 |

% |

|

|

10.2 |

% |

|

|

-8.2 |

% |

|

|

8.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reported net

earnings (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges (c) |

|

|

3.2 |

|

|

|

0.5 |

|

|

|

6.0 |

|

|

|

1.4 |

|

|

|

1.9 |

|

|

|

1.7 |

|

|

|

1.8 |

|

|

Environmental charges (a) |

|

|

0.4 |

|

|

|

0.3 |

|

|

|

3.1 |

|

|

|

1.8 |

|

|

|

2.8 |

|

|

|

2.3 |

|

|

|

2.8 |

|

|

Acquisition-related costs (a) |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

2.5 |

|

|

|

2.5 |

|

|

|

— |

|

|

|

0.3 |

|

|

Inventory fair value step-up (b) |

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

|

|

3.3 |

|

|

|

4.0 |

|

|

|

— |

|

|

|

— |

|

|

Non-cash pension and related expense (d) |

|

|

— |

|

|

|

4.7 |

|

|

|

— |

|

|

|

4.8 |

|

|

|

4.8 |

|

|

|

132.4 |

|

|

|

2.5 |

|

|

Foreign currency loss (gain) (d) |

|

|

(0.3 |

) |

|

|

0.5 |

|

|

|

2.3 |

|

|

|

4.0 |

|

|

|

4.9 |

|

|

|

3.3 |

|

|

|

(5.3 |

) |

| Total adjustments to reported

net earnings (loss) |

|

$ |

3.3 |

|

|

$ |

8.2 |

|

|

$ |

11.7 |

|

|

$ |

17.8 |

|

|

$ |

20.9 |

|

|

$ |

139.7 |

|

|

$ |

2.1 |

|

| Total adjustments, tax

affected(B) |

|

$ |

3.0 |

|

|

$ |

8.0 |

|

|

$ |

10.2 |

|

|

$ |

16.6 |

|

|

$ |

19.3 |

|

|

$ |

108.6 |

|

|

$ |

0.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in valuation allowances (e) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.9 |

|

|

|

0.2 |

|

|

Other discrete tax items (e) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

(4.7 |

) |

|

|

1.2 |

|

| Total tax

adjustments(C) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.2 |

|

|

$ |

(3.8 |

) |

|

$ |

1.4 |

|

| Adjusted net earnings

(A+B+C) |

|

$ |

17.0 |

|

|

$ |

19.8 |

|

|

$ |

55.4 |

|

|

$ |

61.3 |

|

|

$ |

79.1 |

|

|

$ |

63.0 |

|

|

$ |

36.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net earnings

as a % of net sales |

|

|

12.6 |

% |

|

|

13.0 |

% |

|

|

13.0 |

% |

|

|

13.8 |

% |

|

|

13.5 |

% |

|

|

12.3 |

% |

|

|

8.6 |

% |

(a) reflected in selling, general and administrative and other

(expense) income, net.(b) reflected in cost of goods sold.(c)

reflected in restructuring charges.(d) reflected in other (expense)

income, net.(e) reflected in income tax expense (income).

Adjusted Diluted Earnings Per Share

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

GAAP diluted earnings (loss) per share |

|

$ |

0.44 |

|

|

$ |

0.37 |

|

|

$ |

1.43 |

|

|

$ |

1.38 |

|

|

$ |

1.85 |

|

|

$ |

(1.30 |

) |

|

$ |

1.06 |

|

| Tax affected charges to reported

diluted earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

0.10 |

|

|

|

0.01 |

|

|

|

0.17 |

|

|

|

0.04 |

|

|

|

0.05 |

|

|

|

0.06 |

|

|

|

0.04 |

|

|

Foreign currency (gain) loss |

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

0.07 |

|

|

|

0.12 |

|

|

|

0.15 |

|

|

|

0.10 |

|

|

|

(0.16 |

) |

|

Non-cash pension expense |

|

|

— |

|

|

|

0.16 |

|

|

|

— |

|

|

|

0.16 |

|

|

|

0.16 |

|

|

|

3.13 |

|

|

|

0.06 |

|

|

Environmental charges |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.08 |

|

|

|

0.04 |

|

|

|

0.07 |

|

|

|

0.05 |

|

|

|

0.07 |

|

|

Acquisition-related costs |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

0.07 |

|

|

|

0.07 |

|

|

|

— |

|

|

|

0.01 |

|

|

Inventory fair value step-up |

|

|

— |

|

|

|

0.06 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

0.10 |

|

|

|

— |

|

|

|

— |

|

|

Discrete tax items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

(0.11 |

) |

|

|

0.04 |

|

| Adjusted diluted earnings

per share |

|

$ |

0.54 |

|

|

$ |

0.62 |

|

|

$ |

1.75 |

|

|

$ |

1.90 |

|

|

$ |

2.46 |

|

|

$ |

1.93 |

|

|

$ |

1.12 |

|

NOTE: CTS believes that adjusted gross margin,

adjusted operating earnings, adjusted EBITDA margin, adjusted net

earnings and adjusted diluted earnings per share provide useful

information to investors regarding its operational performance

because they enhance an investor’s overall understanding of CTS’

core financial performance and facilitate comparisons to historical

results of operations, by excluding items that are not related

directly to the underlying performance of CTS’ fundamental business

operations (such as those items noted above in the paragraph titled

“Non-GAAP Financial Measures”) or were not part of CTS’ business

operations during a comparable period.

Controllable Working Capital

|

|

|

September 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Net accounts receivable |

|

$ |

89.6 |

|

|

$ |

97.0 |

|

|

$ |

90.9 |

|

|

$ |

82.2 |

|

|

$ |

81.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net inventory |

|

$ |

65.4 |

|

|

$ |

63.5 |

|

|

$ |

62.3 |

|

|

$ |

49.5 |

|

|

$ |

45.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

(49.8 |

) |

|

$ |

(65.7 |

) |

|

$ |

(53.2 |

) |

|

$ |

(55.5 |

) |

|

$ |

(50.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Controllable working

capital |

|

$ |

105.1 |

|

|

$ |

94.8 |

|

|

$ |

100.0 |

|

|

$ |

76.2 |

|

|

$ |

76.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

142.3 |

|

|

$ |

132.5 |

|

|

$ |

123.0 |

|

| Multiplied by 4 |

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

| Annualized sales |

|

$ |

538.2 |

|

|

$ |

607.6 |

|

|

$ |

569.1 |

|

|

$ |

530.0 |

|

|

$ |

492.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Controllable working

capital as a % of annualized sales |

|

|

19.5 |

% |

|

|

15.6 |

% |

|

|

17.6 |

% |

|

|

14.4 |

% |

|

|

15.5 |

% |

NOTE: CTS believes the controllable working

capital ratio is a useful measure because it provides an objective

measure of the efficiency with which CTS manages its short-term

capital needs.

Free Cash Flow

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Net cash provided by operating activities |

|

$ |

22.1 |

|

|

$ |

60.4 |

|

|

$ |

56.7 |

|

|

$ |

95.7 |

|

|

$ |

121.2 |

|

|

$ |

86.1 |

|

|

$ |

76.8 |

|

|

Capital expenditures |

|

|

(2.7 |

) |

|

|

(2.3 |

) |

|

|

(11.2 |

) |

|

|

(9.3 |

) |

|

|

(14.3 |

) |

|

|

(15.6 |

) |

|

|

(14.9 |

) |

| Free cash flow |

|

$ |

19.4 |

|

|

$ |

58.1 |

|

|

$ |

45.5 |

|

|

$ |

86.5 |

|

|

$ |

106.9 |

|

|

$ |

70.5 |

|

|

$ |

61.9 |

|

NOTE: CTS believes that free cash flow is a

useful measure because it demonstrates the company’s ability to

generate cash. Free cash flow is a non-GAAP measure and should be

considered in addition to, but not as a substitute for, information

contained in the company's condensed consolidated statement of cash

flows as a measure of liquidity.

Capital Expenditures

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Capital expenditures |

|

$ |

2.7 |

|

|

$ |

2.3 |

|

|

$ |

11.2 |

|

|

$ |

9.3 |

|

|

$ |

14.3 |

|

|

$ |

15.6 |

|

|

$ |

14.9 |

|

| Net sales |

|

$ |

134.6 |

|

|

$ |

151.9 |

|

|

$ |

425.7 |

|

|

$ |

444.6 |

|

|

$ |

586.9 |

|

|

$ |

512.9 |

|

|

$ |

424.1 |

|

| Capex as % of net

sales |

|

|

2.0 |

% |

|

|

1.5 |

% |

|

|

2.6 |

% |

|

|

2.1 |

% |

|

|

2.4 |

% |

|

|

3.0 |

% |

|

|

3.5 |

% |

Additional Information

The following table includes other financial information not

presented in the preceding financial statements.

|

|

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

Twelve Months EndedDecember

31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Depreciation and amortization expense |

|

$ |

7.3 |

|

|

$ |

8.0 |

|

|

$ |

21.4 |

|

|

$ |

21.7 |

|

|

$ |

29.8 |

|

|

$ |

26.9 |

|

|

$ |

26.7 |

|

| Stock-based compensation

expense |

|

$ |

1.4 |

|

|

$ |

2.2 |

|

|

$ |

4.6 |

|

|

$ |

5.8 |

|

|

$ |

7.7 |

|

|

$ |

6.1 |

|

|

$ |

3.4 |

|

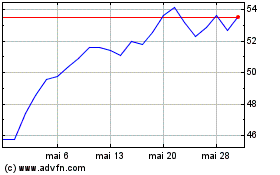

CTS (NYSE:CTS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

CTS (NYSE:CTS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024