Equifax Canada Reports Rise in Automotive Fraud

24 Septembre 2024 - 11:30AM

Equifax Canada reports that while application fraud is down in some

areas, automotive lenders are seeing a surge in fraud. According to

new data from Equifax Canada, automotive fraud is up by 54 per cent

year-over-year and is largely driven by falsified credit

applications and the continued prevalence in identity theft.

Ontario has experienced the most significant increase in auto fraud

rates, doubling since Q2 2023.

In addition, first party fraud (fraud in which the borrower

knowingly uses their own personal information to commit fraud)

continues to be the most prevalent type of misrepresentation in

automotive. “Automotive fraud is a significant pain point for both

businesses and consumers,” said Carl Davies, Head of Fraud

and Identity at Equifax Canada. “Consumers choosing to

falsify their income, employment, and financial information to

secure credit are a growing concern for lenders. This deceit may

provide short-term financial gains for the consumer, but certainly

can lead to long-term consequences such as loan denials, damaged

credit, and legal ramifications.”

Synthetic

Identity FraudOverall, the proportion of identity theft in

credit applications continues to grow with 48.3 per cent of all

fraud applications flagged as identity fraud in Q2 2024, up from

42.9 per cent in Q2 2023, according to data from Equifax Canada.

While the proportion of true identity fraud remained the same at

39.4 per cent, there has been a rise in synthetic identity fraud,

where criminals combine real and fake data to create new

identities. The incidence of synthetic identity fraud rose from 2.8

per cent in Q2 2023 to eight per cent in Q2 2024.

“The rise in true

identity fraud along with synthetic identity fraud, underscores the

need for enhanced fraud detection across digital platforms where

these crimes are increasingly being perpetrated,” added Davies.

“The increase in digital transactions has made it easier for

fraudsters to exploit weaknesses in current fraud prevention

measures.”

Other Notable Trends:

- Identity

Fraud: Older consumers with

high credit scores are increasingly being targeted. Forty per cent

of third-party identity fraud cases involved victims with credit

scores above 800 (which is considered excellent), and 76 per cent

of these consumers had no prior delinquency on their credit

files.

- Mortgage Fraud: Across Canada, mortgage

fraud rates have dropped by 16.3 per cent year-over-year. Alberta

is the one exception with mortgage fraud on the rise, often

involving falsified income and employment documentation.

- Deposit Fraud: Deposit fraud, which occurs

when fraudulent transactions or payments are made to recently

opened accounts, has also experienced a sharp increase, growing

from 27.4 per cent of first-party fraud in Q2 2023 to 41.2 per cent

in Q2 2024, much of which was driven by the telco industry.

As fraudsters adapt and refine their tactics, it's important for

businesses and consumers to stay vigilant by using ID theft

protection tools that can detect fraud early through timely alerts

on credit report changes. Effective fraud prevention includes

verifying identities, cross-checking financial documents, and

staying informed about regional fraud trends—key measures that can

help mitigate the growing threat of fraud for Canadian consumers

and businesses alike.

For more information on fraud prevention, visit Equifax Canada's

website and the Canadian Anti-Fraud Centre.

About EquifaxAt Equifax (NYSE:

EFX), we believe knowledge drives progress. As a global data,

analytics, and technology company, we play an essential role in the

global economy by helping financial institutions, companies,

employers, and government agencies make critical decisions with

greater confidence. Our unique blend of differentiated data,

analytics, and cloud technology drives insights to power decisions

to move people forward. Headquartered in Atlanta and supported by

nearly 15,000 employees worldwide, Equifax operates or has

investments in 24 countries in North America, Central and South

America, Europe, and the Asia Pacific region. For more information,

visit Equifax.ca.

Contact:

Andrew FindlaterSELECT Public

Relationsafindlater@selectpr.ca(647) 444-1197

Angie AndichEquifax Canada Media

RelationsMediaRelationsCanada@equifax.com

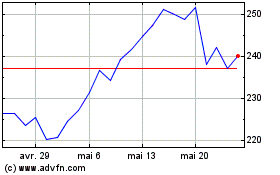

Equifax (NYSE:EFX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Equifax (NYSE:EFX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024