One Liberty Properties Purchases Two Premium Industrial Properties for $49 Million

22 Janvier 2025 - 10:10PM

One Liberty Properties, Inc. (NYSE: OLP), a real estate investment

trust focused on net leased industrial properties, today announced

the completion of the previously announced acquisition of two Class

A industrial properties located in the Mobile, Alabama MSA, for $49

million. The two properties comprise an aggregate of 371,586 square

feet and are located on approximately 31 acres. There are four

tenants—Simpson Manufacturing (NYSE:SSD), Veyer LLC, a wholly owned

subsidiary of The ODP Corporation (NASDAQ:ODP), Chadwell Supply, a

supplier of materials for the multi-family industry, and DC Safety

Sales Co., Inc, a supplier of safety equipment to various

industries, including the automotive industry. The aggregate annual

base rent is approximately $3.1 million, with approximate annual

rental increases ranging from 2.3% to 3.5%, and a weighted average

remaining lease term approaching seven years. OLP financed the

acquisition with cash and a ten-year $29 million mortgage (interest

only for five years and then amortizing on a 30-year schedule)

bearing an interest rate of 6.12%.

Patrick J. Callan, Jr., President and Chief Executive Officer of

One Liberty stated, “This acquisition of two modern distribution

centers in Mobile, Alabama marks a compelling start to the year.

These premium industrial assets, secured with long-term leases and

built-in annual escalators, not only deliver immediate cash flow

accretion but also strengthen our foothold in a growing logistics

hub in the Southeast. Mobile's emergence as an important link in

the national supply chain, coupled with these modern facilities,

positions us to capture the demand for modern industrial space

while delivering sustained value to our stockholders.”

The Class A warehouses were built in 2022 and 2023 and features

ample clear height of 32’ to 36’, concrete tilt-wall construction,

a total of 70 dock high loading doors, LED lighting and ESFR

sprinklers. The properties are located in Theodore, AL, which is

part of the Mobile MSA. The properties are adjacent to

Interstate-10, one of the largest interstate highways in the

country, stretching East-West from California to Florida. Mobile is

a growing Southeast distribution hub due to its strategic location

as a deep port on the Gulf of Mexico.

On December 27, 2024, OLP completed the previously announced

sale of the LA Fitness property located in Secaucus, New Jersey,

for a sales price of $21.4 million. The Company realized net

proceeds from the sale of approximately $13.0 million, after paying

off mortgage debt of $6.7 million, and anticipates realizing a gain

of approximately $6.4 million.

On December 10, 2024, OLP completed the previously announced

sale of the Advance Auto retail property located in Hilliard, Ohio,

for a sales price of $1.6 million. The Company realized net

proceeds from the sale of approximately $704,000 after paying off

mortgage debt of $771,000 and anticipates realizing a gain of

approximately $224,000.

Forward Looking Statement:

Certain information contained in this press release, together

with other statements and information publicly disseminated by One

Liberty Properties, Inc. is forward looking within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. We

intend such forward looking statements to be covered by the safe

harbor provision for forward looking statements contained in the

Private Securities Litigation Reform Act of 1995 and include this

statement for the purpose of complying with these safe harbor

provisions. Forward looking statements, which are based on certain

assumptions and describe our future plans, strategies and

expectations, are generally identifiable by use of the words “may,”

“will,” “could,” “believe,” “expect,” “intend,” “anticipate,”

“estimate,” “project,” or similar expressions or variations

thereof. Information regarding important factors that could cause

actual outcomes or other events to differ materially from any such

forward looking statements appear in the Company's Annual Report on

Form 10-K for the year ended December 31, 2023 and the reports

filed with the Securities and Exchange Commission thereafter; in

particular, the sections of such reports entitled “Cautionary Note

Regarding Forward Looking Statements”, “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations”, included therein. In addition, estimates of

rental income for 2024 exclude any related variable rent,

anticipated property purchases, sales, financings and/or

refinancings may not be completed during the period or on the terms

indicated or at all, and estimates of gains from property sales or

proceeds from financing or refinancing transactions are subject to

adjustment, among other things, because actual closing costs may

differ from the estimated costs. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which are, in some cases,

beyond the Company’s control and which could materially affect the

Company’s results of operations, financial condition, cash flows,

performance or future achievements or events.

About One Liberty Properties:

One Liberty is a self-administered and

self-managed real estate investment trust incorporated in Maryland

in 1982. The Company acquires, owns and manages a geographically

diversified portfolio consisting primarily of industrial

properties. Many of these properties are subject to long-term net

leases under which the tenant is typically responsible for the

property’s real estate taxes, insurance and ordinary maintenance

and repairs.

Contact: One Liberty Properties Investor

Relations Phone: (516) 466-3100www.1liberty.com

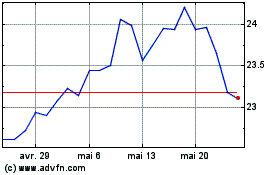

One Liberty Properties (NYSE:OLP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

One Liberty Properties (NYSE:OLP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025