Dynacor Announces Total Sales of $112.1 Million and Net Income of

US$ 9.1 Million ($0.25 per Share) in Fiscal 2013

MONTREAL, QUEBEC--(Marketwired - Mar 28, 2014) - Dynacor Gold

Mines Inc. (TSX:DNG) (Dynacor or the Corporation) a Corporation

with gold and silver ore processing operations and exploration

projects in Peru, has released its audited consolidated financial

statements for the year-ended December 31, 2013. The Corporation is

pleased to report that in 2013, it recorded a net income of $9.1 M

($0.25 per share) compared to $7.7 M ($0.22 per share) in 2012 and

cash flow from operating activities before changes in working

capital items of $10.3 M ($0.29 per share) compared to $9.2 M

($0.26 per share) in 2012.

The audited consolidated financial statements along with the

management's discussion and analysis are available on the

Corporation's website www.dynacorgold.com, and the documents have

been filed electronically with SEDAR at www.sedar.com.

All figures in this press release are in millions of US$

except where noted. Earnings per share and gross operating margin

per ounce are in US$. All variance % are calculated with rounded

figures.

2013 HIGHLIGHTS

- Record annual gold production of 76,883 oz compared to 61,274

oz in 2012;

- Record gold and silver sales of $112.1M in 2013 compared to

$105.0M in 2012, a 6.8% increase;

- Net income of $9.1M in 2013 ($0.25 per share) compared to $7.7M

($0.22 per share) in 2012;

- EBITDA of $15.4M compared to $14.0M in 2012;

- Cash flow from operating activities before change in working

capital items of $10.3M ($0.29 per share) (1) in 2013 compared to

$9.2 M ($0.26 per share) (1) in 2012;

- Cash on hand of $8.5 M at year end compared to $3.3 M at

December 31, 2012;

- Exploration: Tumipampa delivers spectacular results in

2013;

|

(1) |

Cash-flow per share is a non-GAAP financial performance measure

with no standard definition under IFRS. It is therefore possible

that this measure could not be comparable with a similar measure of

another Corporation. The Company uses this non-GAAP measure which

can also be helpful to investors as it provides a result which can

be compared with the Company market share price. |

Results from operations:

During the year ended December 31, 2013, the Corporation

increased its net shareholder equity by 42.6% from $22.3 M in 2012

to $31.8 M in 2013. This increase results from the internal growth

generated by the ore processing activities which delivered in 2013

all-time record results.

During 2013, the Huanca plant ran at an average rate of 228 tpd,

since its capacity was raised at 230 tpd and then 240 tpd during

the third and fourth quarter of 2013. This gave way to another

record financial and production year.

The Corporation recorded a net income of $9.1M ($0.25 per share)

compared to $7.7M and $0.22 per share in 2012.

During the year, the Corporation produced 76,883 ounces of gold

compared to 61,264 in 2012 a 25.5% increase. The increase in gold

production compared to 2012 is explained by a higher tonnage and

higher gold content of ore processed. During the year the grades of

ore processed averaged 1.04oz/DMT (32.36 g/t Au) compared 0.9

oz/DMT (28.00 g/t Au) in 2012.

Total sales for the year amounted to $112.1M (77,266 ounces of

gold sold) compared to $105.0M (59,910 ounces sold) in 2012, an

increase of 6.8% over 2012. Variation is explained by increased

gold production of 25.5% which were offset by a decrease in gold

selling price of 15.6%. The average selling price of gold was

$1,412 per ounce in 2013 compared to $1,674 in 2012.

Silver production was down from 157,862 ounces in 2012 to

131,685 ounces in 2013 mainly due to lower silver content in the

ore processed.

The gross operating margin for the period amounted to $20.5 M

(18.3%) compared to $17.8 M (17.0%), an increase of 14.8% over

2012. This increase is explained by higher tonnage processed,

higher grades of ore processed and lower depreciation expense as

tailing pond was completely depreciated before the end of the

year.

The gold cash gross operating margin per ounce was at $264 in

2013 compared to $295 in 2012, a 10.5% decrease over the period,

mainly due to a decrease in the price of gold.

FINANCIAL

HIGHLIGHTS

|

|

For years ended December 31, |

|

|

(in $'000) |

2013 |

|

2012 |

|

|

|

|

|

|

|

|

Sales |

112,127 |

|

104,994 |

|

|

Cost of sales |

91,641 |

|

87,148 |

|

|

Gross operating margin |

20,486 |

|

17,846 |

|

|

General and administrative expenses |

3,932 |

|

3,429 |

|

|

Operating income |

14,819 |

|

12,608 |

|

|

Net income and comprehensive income |

9,125 |

|

7,716 |

|

|

EBITDA(1) |

15,415 |

|

13,957 |

|

|

|

|

|

|

|

|

Net Cash flow from operating activities before changes in working

capital items |

10,307 |

|

9,229 |

|

|

Cash flow from operating activities |

12,518 |

|

3,929 |

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

Basic |

$0.25 |

|

$0.22 |

|

|

Diluted |

$0.24 |

|

$0.21 |

|

|

|

|

|

|

|

|

Reconciliation of Net comprehensive income to EBITDA (1) |

|

|

|

|

|

|

|

|

|

|

|

Net comprehensive income |

9,125 |

|

7,716 |

|

|

Income taxes |

5,179 |

|

4,708 |

|

|

Financial expenses |

182 |

|

398 |

|

|

Depreciation |

1,062 |

|

1,320 |

|

|

Impairment of exploration andevaluation assets |

- |

|

44 |

|

|

Gain on revaluation of asset retirement obligations |

(133 |

) |

- |

|

|

Revaluation of warrants |

- |

|

(229 |

) |

|

EBITDA |

15,415 |

|

13,957 |

|

|

|

|

(1) |

EBITDA: "Earnings before interest, taxes, depreciation and

amortization, revaluation of warrants and impairment" is a non-GAAP

financial performance measure with no standard definition under

IFRS. It is therefore possible that this measure could not be

comparable with a similar measure of another Corporation. The

Corporation uses this non-GAAP measure as an indicator of the cash

generated by the operations and allows investor to compare the

profitability of the Corporation with others by canceling effects

of different assets bases, effects due to different tax structures

as well as the effects of different capital structures. |

CASH FLOW FROM

OPERATING, INVESTING AND FINANCING ACTIVITIES AND WORKING

CAPITAL

Operating Activities

During the year the cash flow from operations before changes in

working capital items amounted to $10.3 M ($0.29 per share)

compared to $9.2M ($0.26 per share) in 2012. Total cash generated

from operating activities amounted to $12.5 M compared to $3.9 M in

2012. Changes in working capital items amounted to $2.2M (-$5.3M in

2012) resulting mainly from a decrease of $6.2 M in inventory, an

increase of $4.3M in trade and other receivables since the

Corporation had accumulated six months of recoverable Peruvian

sales tax credits, for which major part was recovered subsequent to

year-end. At December 31, 2013 ore inventory represented 19 days of

production compared to 24 at year-end 2012.

Investing Activities

During the year the Corporation invested $3.7M ($1.6 M in 2012)

for the acquisition of property, plant and equipment to be used at

the current Huanca plant, including an additional $0.8 M for the

extension of the tailing pond and for pre-construction expenditure

at Chala. Investment to date for Chala amounts to $2.0 M and

includes: environmental, hydrogeological water and tailings

studies, permitting expenses, consultant fees, equipment purchases,

construction of workers camp, water well, a communication tower and

a power line that will connect the site to the national grid.

Additions to exploration and evaluation assets during the year

amounted to $2.3 M ($0.8M in 2012) as the Corporation ran its

planned exploration program at Tumipampa and for which excellent

results were published in 2013 and 2014.

Financing activities

During 2013, the Corporation did not complete any share issue

financing (nil in 2012). A total of 345,944 options were exercised

for proceeds of $0.1M (300,000 options for gross proceeds of $0.1M

in 2012).

The Corporation became debt-free following the payment of the

second quarter interest and reimbursement in June of the

outstanding long term debt which had matured.

Liquidity and working capital

The delay in obtaining the construction permit for the Chala

plant led to an increase in the Corporation's cash balance in 2013.

The Corporation's working capital amounted to $17.4M of which $8.5M

was in cash ($13.3M of which $3.3M in cash at December 31,

2012).

As of December 31, 2013, the Corporation had no financial

commitment besides those disclosed in the section Long Term

Liabilities and Contractual Obligations and has no restrictions in

transferring funds from Peruvian subsidiaries to the parent

Corporation.

2014- Ore processing outlook

During the first quarter of 2014, the Corporation's gold ore

processing operations were slowed down due to energetic and

unprecedented measures taken by the Peruvian Authorities to combat

illegal gold mining and illegal gold exports from Peru.

Consequently and despite the fact that the Corporation is solely

purchasing ore from registered miners, it faced delays, due to

general increased measures at customs, in exporting its gold dore

production. This situation led to a temporary stoppage of ore

purchases and a production slow-down. This situation has temporally

affected the Corporation and accordingly its Q1-2014 financial

results. The Corporation has now resumed its gold ore processing

operations and gold exports and expects the operations to run at

full capacity in the upcoming weeks.

Exploration outlook

Following the excellent exploration results obtained in 2013

from the cross cut and underground drilling of the Manto Dorado and

the three other high grade veins Dynacor is planning to intensify

its exploration of Tumipampa in 2014 and into 2015 with an expected

program of approximately $4.5M.

ABOUT DYNACOR GOLD MINES INC.

Dynacor is a gold and silver ore processing and a gold

exploration and mining Corporation active in Peru through its

subsidiaries since 1996. The Corporation differentiates itself from

pure exploration companies as it also generates income and cash

flow from its wholly owned gold ore processing plant in Peru. The

Corporation's assets include five exploration properties, including

the Tumipampa property, as well as its now 250 tpd gold and silver

ore processing mill at Huanca. Dynacor's mill produces gold from

the processing of ore purchased from many registered miners.

Dynacor's strength and competitive advantage comes with the

experience and knowledge the Corporation has developed while

working in Peru. Its pride remains in maintaining respect and

positive work ethics toward its employees, partners and local

communities.

FORWARD LOOKING INFORMATION

Certain statements in the foregoing may constitute

forward-looking statements, which involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Dynacor, or industry results, to be

materially different from any future result, performance or

achievement expressed or implied by such forward-looking

statements. These statements reflect management's current

expectations regarding future events and operating performance as

of the date of this news release.

Dynacor Gold Mines Inc. (TSX:DNG)

Website: http://www.dynacorgold.com

Twitter: http://twitter.com/DynacorGold

Facebook: facebook.com/DynacorGoldMines

Shares outstanding: 36,373,587

Jean MartineauPresident and CEODynacor Gold Mines

Inc.514-288-3224 ext. 228Dale NejmeldeenInvestor RelationsDynacor

Gold Mines Inc.604.492.0099M:

604.562.1348nejmeldeen@dynacor.com

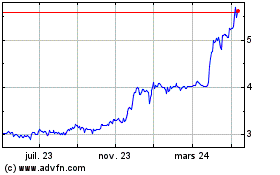

Dynacor (TSX:DNG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Dynacor (TSX:DNG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025