Dollar Weakens As Government Shutdown Seems Likely

20 Décembre 2018 - 3:07PM

RTTF2

The dollar is losing ground against all of its major rivals

Thursday afternoon. While investors are still reeling from

yesterday's hawkish statement from the Federal Reserve, the

potential for a government shutdown seems likely.

President Trump is reportedly considering a veto of the

short-term funding bill that recently passed in the Senate. Trump

is said to be upset over the lack of funding for a wall on the

U.S.-Mexico border.

"When I begrudgingly signed the Omnibus Bill, I was promised the

Wall and Border Security by leadership," Trump tweeted Thursday.

"Would be done by end of year (NOW). It didn't happen! We foolishly

fight for Border Security for other countries - but not for our

beloved U.S.A. Not good!"

Meanwhile, after reporting a notable decrease in first-time

claims for U.S. unemployment benefits in the previous week, the

Labor Department released a report on Thursday showing initial

jobless claims rebounded in the week ended December 15th.

The report said initial jobless claims rose to 214,000, an

increase of 8,000 from the previous week's unrevised level of

206,000. Economists had expected jobless claims to climb to

216,000.

Manufacturing activity in the Philadelphia region continued to

grow but remained subdued in the month of December, according to a

report released by the Federal Reserve Bank of Philadelphia on

Thursday. The report said the diffusion index for current general

activity dropped to 9.4 in December after tumbling to 12.9 in

November.

While a positive reading still indicates growth in regional

manufacturing activity, economists had expected the index to rise

to 15.0.

A report released by the Conference Board on Thursday showed a

modest increase by leading U.S. economic indicators in the month of

November. The Conference Board said its leading economic index rose

by 0.2 percent in November after falling by a revised 0.3 percent

in October.

Economists had expected the index to come in unchanged compared

to the 0.1 percent uptick originally reported for the previous

month.

The dollar has dropped to around $1.1475 against the Euro

Thursday afternoon, from an early high of $1.1377.

Eurozone's current account surplus increased in October after

declining in the previous month, but was lower than the same month

last year. The current account surplus rose to EUR 23 billion from

EUR 18 billion in September, figures from the European Central Bank

showed on Thursday. In October 2017, the surplus was EUR 35

billion.

Bank of England policymakers unanimously left the key interest

rate and asset purchase targets unchanged on Thursday, as expected.

The nine-member Monetary Policy Committee held its key interest

rate unchanged at 0.75 percent in line with economists'

expectations.

Brexit uncertainties have intensified considerably since the

previous policy session and they are weighing on UK financial

markets and on the near-term growth outlook, the bank said.

The bank expects inflation to fall below 2 percent in coming

months due to lower oil prices.

The buck has fallen to around $1.2675 against the pound sterling

this afternoon, from a high of $1.2613 this morning.

UK retail sales rose for the first time in three months in

November to surpass economists' expectations, thanks to Black

Friday promotions and record online spending, while the long term

trend was that of a slowdown, amid the persistent Brexit

uncertainties.

Data from the Office for National Statistics showed on Thursday

that the volume of retail sales including automotive fuel rose 1.4

percent from October, which was much faster than the 0.3 percent

growth economists had predicted.

The Bank of Japan left its ultra-loose monetary policy unchanged

on Thursday, asserting its pledge to keep interest rate extremely

low for an extended period of time amid indications of global

economic slowdown.

The policy board of the BoJ voted 7-2 to purchase government

bonds so that the yield of 10-year JGBs will remain at around zero

percent.

The greenback has tumbled to over a 3-month low of Y111.050

against the Japanese Yen Thursday afternoon, from an early high of

Y112.604.

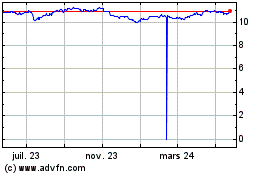

US Dollar vs SEK (FX:USDSEK)

Graphique Historique de la Devise

De Fév 2025 à Mar 2025

US Dollar vs SEK (FX:USDSEK)

Graphique Historique de la Devise

De Mar 2024 à Mar 2025