RNS Number:4165T

Europa Oil & Gas (Holdings) PLC

01 November 2005

EUROPA OIL & GAS (HOLDINGS) PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 JULY 2005

Europa Oil & Gas (Holdings) plc ("Europa" or the "Company"), the independent oil

& gas exploration and production group with assets in the UK and continental

Europe, today announces its preliminary results for the year ended 31 July 2005.

Financial Highlights

* Turnover of #2.399m (18 months to 31 July 2004 #1.952m)

* Operating profit of #0.842m (18 months to 31 July 2004 #0.694m)

* Profit after tax of #0.354m (18 months to 31 July 2004 #0.298m)

* Cash of #1.977m at 31 July 2005

* Net assets of #8.614m

* Earnings per share of 0.64p

Operational Highlights

* Production from the UK and Ukraine during the period averaged 288 barrels

of oil equivalent per day (boe/d)

* Successful drilling of Bilca-2 in Romania to prove up additional reserves

to the west of Bilca-1. Bilca-2 was retained for use as a future gas

producer

* Drilling of Fratauti-1 discovery well in Romania which tested an aggregate

12.7 million standard cubic feet per day (mmscf/d) (over 2,000 boe/d) from

several zones

* Approval by the Romanian government for the Bilca Area Gas Development

* Costisa-1 well in Romania spudded in early February 2005, currently

drilling at 4,034 metres as at 31 October

* Drilling of West Firsby-8 well, production currently suspended

* Quad 41 preliminary engineering and drilling studies undertaken

* Geochemical survey on UK onshore licence PEDL150 near the Whisby Field

Corporate

* During November 2004 Europa successfully floated on AIM and completed a

placing of 20,000,000 shares at 25p each that raised #4.3m after expenses.

At the time of the placing, one warrant for every two shares placed was also

issued

* Exercise of 1,065,000 warrants raising an additional #319,500 and

increasing the total ordinary shares in issue to 61,065,000

Recent Events

* Award of the Bilca Development construction contract and construction

start-up

* Farm-out of Whisby Exploration Area to Valhalla Oil & Gas Limited. The

agreement with Valhalla covers the seismic and the drilling of the first

exploration well at a cost of under 20p in the pound to Europa

* Approval by UK government as a UK Offshore Operator and two year extension

of Quad 41 North Sea licence

Chairman's Statement

I am very pleased to report Europa's first annual results as a quoted company

and to be able to demonstrate significant progress on a number of key projects.

Over the past year, the management has pursued an active exploration and

development programme, participating in the drilling of four new wells: two

exploration, one development and one appraisal. These included the discovery

well, Fratauti-1 and the successful appraisal well, Bilca-2, both of which are

in Romania. This drilling success further enhances Europa's strong drilling

track record.

Currently, the Company continues to benefit from its UK onshore oil production

operations with steady production and high oil prices. This distinguishes the

Company from many of its peers who are focused on exploration and lack

development and production activities.

The successful wells, Fratauti-1 and Bilca-2, now form part of the Bilca Area

Gas Development. This production is due onstream in 2006 and will add

significantly to Europa's daily production. At a time of high commodity prices

this production, combined with the UK onshore production, will generate

significant cashflows in the coming year to enable us to fulfil our current

exploration and development programme from existing cash reserves.

A third Romanian well, the Costisa-1 well, spudded in February 2005 is currently

drilling. The prospect remains well-defined at the main Badenian target with

other secondary potential.

Europa has an excellent acreage position in the Romanian Carpathians, an area

which has produced 5 billion barrels of oil and 3 trillion cubic feet (tcf) of

gas to date and is still relatively underexplored. The Company is planning to

acquire seismic data in 2006 to assess the southern extension of the proven

Bilca play. Further drilling in the second half of 2006 is anticipated.

The Company drilled the West Firsby Field WF8 development well in the UK in

March 2005, targeting an unproven area of the field. Due to operational

difficulties, the results were inconclusive and hence disappointing. The West

Firsby Field offers undeveloped reserves potential and management is working to

resolve this situation.

Elsewhere, work in the UK onshore is progressing apace. The Directors believe

that Holmwood is one of the strongest undrilled onshore prospects in the UK.

Work is ongoing on planning the drilling operation which we hope can go ahead in

2006. The recent farm-out of a proportion of the Company's interest in the

Whisby Area Exploration Acreage allows the work programme to be undertaken at a

significantly reduced cost to Europa. The excellent terms obtained on the

farm-out demonstrate the quality of the Whisby Area Exploration Acreage and work

has already begun to identify a drilling location.

The Company, now recognised as an offshore operator by the DTI, will be drilling

an appraisal well on the Quad 41 licence during the next two years. The Quad 41

discoveries produced at rates up to 35 mmscf/d (approximately 5,800 boe/d) and

development of these fields would put Europa firmly in a new peer group.

In Ukraine the Company continues to produce and sell gas and awaits the

transition to a full production licence. Further low risk but high reward

opportunities are being pursued in the region.

The Directors are committed to adding further assets to Europa's portfolio, with

both discovered and undiscovered resources. Currently, applications have been

lodged in two EU countries for new exploration acreage and a number of other new

venture and acquisition opportunities are actively being pursued in the region.

The Directors are very pleased with the results of the last year. The activity

has increased reserves with production set to increase significantly in 2006.

The Directors are confident that the coming year will be as successful and that

shareholder value will continue to grow.

Sir Michael Oliver

Chairman

1 November 2005

For further information, contact:

Europa Oil & Gas (00 33 563 33 18 97)

Paul Barrett

Westhouse Securities LLP (0161 838 9140)

Tim Feather

Also see www.europaoil.com

Operational Update

Romania

The Costisa-1 well, the culmination of over five years of exploration effort on

the EPI-3 Block, was spudded in February. Difficult drilling conditions have

led to much slower progress than originally envisaged and, as at 31 October, the

well was at a depth of 4,034 metres. The target is estimated to lie at around

4,250 metres. Nothing seen in the drilling data to date downgrades the primary

target prospectivity.

The Bilca Project, situated in the EIII-1 Brodina Block is on track to achieve

commercial gas production in the first half of calendar year 2006. In this

reporting period, Europa has participated in two wells, a successful appraisal

of the western part of the Bilca feature and the nearby Fratauti-1 discovery

well, the latter flowing at an aggregate rate of 12.7 mmscf/d from three zones.

As a consequence, there are three gas wells, including the Bilca-1 well drilled

in 2004, ready to supply the planned Bilca facilities.

In August 2005, the Romanian Government approved the construction of the Bilca

facilities and, following a tender process, the construction contract was

awarded in October 2005 to Condmag and Inspet. Construction of the facilities

began immediately following the contract award. In parallel, gas sales

arrangements are being finalised and will be announced shortly. The Brodina

Block consortium, in which Europa has a 28.75% interest, is committed to the

commencement of production in the first half of 2006 and maximising sales

volumes. To this end the consortium has obtained permission to drill a fourth

Bilca area well on a strong Bilca-style prospect.

On the Brodina Block 200km of seismic is planned in 2006 in order to evaluate a

large area devoid of seismic and well data between the Bilca area and the

producing Todiresti gasfield to the south.

A seismic acquisition programme is also planned in 2006 over the Bacau and

Cuejdui Blocks, to the south of the Brodina Block. These blocks are relatively

unexplored, though the limited data available indicates that the Bilca play

along with deeper plays are present. It is hoped the 2006 seismic programme

will define at least one drilling location for 2007.

UK North Sea

Europa holds 100% equity in licence P1131, containing the 41/24 and 41/25

discoveries, near shore gas condensate accumulations which flowed on test at

rates of up to 35mmscf/d (approximately 5,800 boe/d). The Company has recently

agreed terms with the DTI to move into the next phase of the licence. It is

anticipated that a high angle appraisal well will be drilled during the current

licence phase and if successful, it will be retained as a future producer in the

field development.

Onshore UK

In the East Midlands Oil Province, the W4 well on the Whisby field produced over

60,000 barrels (bbls) in the year with a continued low water cut, demonstrating

the long term durability of the production stream. On the surrounding Whisby

exploration licence (PEDL150), a geochemical survey undertaken in early 2005

highlighted areas of prospectivity for further work. This work will take the

form of 40 km of new 2D seismic in the second quarter of 2006 followed by an

exploration well. The Company has successfully farmed out a 50% interest to

Valhalla Oil & Gas Limited in return for funding the acquisition of the seismic

and 75% of the well cost.

Pre-planning work, including ecological, archaeological and engineering surveys,

has been undertaken on the Holmwood licence (PEDL143) in the Weald Basin.

Planning permission to drill a well on the Holmwood Prospect, a robust four-way

dip closure at Portland Sandstone level, is expected to be submitted in the

fourth quarter of 2005 and it is hoped that the well will be drilled in 2006.

During the financial year, Europa drilled the West Firsby field WF8 well, a

sidetrack of a watered-out producer. This sidetrack encountered significant

reservoir sands, but produced water when put onto production. Remedial work was

undertaken to shut off the water zone, but operational difficulties prevented

the work from being completed. Further remedial options are being evaluated.

Ukraine

The Europa-operated pilot production scheme on the Horodok gas field produced 80

million cubic feet (mmcf) over the period. The Company has applied to convert

the pilot production on the Horodok gas field to a full production licence

giving the right to operate the field for the next 15 years. The field is

currently producing 35 boe/d, net to Europa, and further drilling is planned to

realise the full potential of the field following granting of the long term

licence.

Forward Programme

The Company is looking forward to another active year, primarily in Romania and

the UK. We expect to be participating in at least two wells, and potentially as

many as four, in 2006, along with seismic surveys and other exploration

activity. A key milestone will be first gas from the Bilca Project, which is

expected to take the Company towards the 1,000 boe/d mark by the end of 2006.

The Company continues to pursue new venture opportunities. Currently

applications for new acreage have been lodged in several jurisdictions with more

pending. The Company is focused on the Europe/North Africa region for these new

venture opportunities.

Presented below are the Financial Review and Results.

Paul Barrett

Managing Director

1 November 2005

Financial Review

Results for the year

Turnover for the year was #2.399m (2004: #1.952m) mainly from UK onshore oil

production. UK sales barrels during 2005 were 92,510 bbls (253 bbls/d) achieving

an average price of $46.58/bbl (#25.10/bbl). Prices achieved have risen sharply

and during the month of September oil sales have averaged $62.08/bbl.

In Ukraine, Europa sold the equivalent of 12,787 boe (35 boe/d) during the year

achieving sales of #0.077m (#6.00/boe).

The results for the year to 31 July 2005 show a profit after tax of #0.354

million compared to #0.298 million for the 18 months to 31 July 2004. Total

production and sales volumes during the year were similar to the prior 18 month

period and consequently the increase in gross profit reflects improved commodity

prices particularly for oil. This improvement in the underlying performance of

the business has been offset by an increase in administrative expenses

reflecting the cost of becoming a quoted company. In addition increased

interest charges have been incurred under the terms of a loan from Gemini Oil &

Gas Limited in connection with the West Firsby licence. During the fourth

quarter of 2005 a trigger point will be achieved which will result in a

substantially reduced future interest charge on the loan.

Placing & AIM Admission

In November 2004 Europa successfully floated on AIM raising #4.29m net of

expenses through a placing of 20,000,000 shares at 25p each. At that time one

warrant for every two shares placed was also issued. The 10,000,000 warrants

are exercisable at 30 pence per share. During March 2005 1,065,000 of these

warrants were exercised raising an additional #319,500. Total shares currently

in issue are 61,065,000. Certain members of the board, management and employees

of the company have rights in respect of options totalling 1,065,000 shares

exercisable at 25p each.

Cash flow

Net cash inflow from oil and gas production operations after administrative

expenses was #953,631 (2004: #1,005,076).

The outflow from capital expenditure of #2,492,947 (2004: #3,379,586) relates

mainly to exploration and development activities in the UK and Romania.

Servicing of finance resulted in cash outflow of #454,074 (2004: #375,101) being

principally the net position of interest payments on a loan and interest earned

on cash deposits.

Taking into account the money received from the placing and subsequent exercise

of warrants, the net cash inflow during the year was #2,230,608 (2004: outflow

of #267,476).

The cash balance at the end of the year was #1,977,117 (2004: #48,789).

Financial Risk

Europa's activities are subject to a range of financial risks the main ones

being commodity prices, liquidity within the business and of counterparties,

exchange rates and loss of operational equipment or wells. These risks are

managed through ongoing review taking into account the operational, business and

economic circumstances at that time.

Commodity Price

With the rise in commodity prices, Europa has not considered it necessary to use

financial instruments to hedge sales generated by its oil or gas production

activities.

Liquidity

Cash forecasts are prepared frequently and reviewed by management and the board.

The board is keen to ensure that adequate financial headroom exists at least a

year ahead.

In order to ensure that funds remain liquid and available for operational

requirements or business opportunities, cash balances are put on short term

deposit.

Currency Risk

Sales revenue is generated primarily in US dollars and these funds have been

matched against capital expenditure and payments on the loan. Sterling

expenditure is provided from existing cash balances in this currency.

Operational Risk

Appropriate insurance cover is obtained annually for all of Europa's

exploration, development and production activities.

Accounting Policies

The accounting policies for the year remain unchanged from those used in 2004.

Europa in consultation with its advisors will prepare to report consolidated

financial statements in conformity with International Financial Reporting

Standards (IFRS) for the year ending 31 July 2008 at the latest.

Summary

The financial results for the year to 31 July 2005 are in line with the

Company's expectations.

Europa is well placed to continue the growth of its projects in the UK and

continental Europe.

Ewen Ainsworth

Finance Director

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended 31 July 2005

18 Months

Ended 31

July

2005 2004

# #

Turnover 2,399,014 1,952,051

Cost of sales

- Operating costs (504,908) (476,745)

- Depletion and amortisation (754,441) (665,722)

1,259,349 1,142,467

Gross profit 1,139,665 809,584

Administrative expenses (297,337) (115,900)

Operating profit 842,328 693,684

Interest receivable 179,809 493

Interest payable and similar charges (666,011) (375,594)

Profit on ordinary activities before taxation 356,126 318,583

Tax on profit on ordinary activities (2,226) (20,539)

Retained profit for the financial year 353,900 298,044

Basic Earnings per share 0.64p 0.75p

Diluted Earnings per share 0.64p 0.75p

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 31 July 2005

18 Months

Ended 31

July

2005 2004

# #

Profit on ordinary activities after taxation 353,900 298,044

Currency translation difference on foreign currency net investment 18,233 (2,462)

Total recognised gains and losses relating to the period 372,133 295,582

CONSOLIDATED BALANCE SHEET as at 31 July 2005

18 Months

Ended 31

July

2005 2004

# #

Fixed assets

Intangible assets 4,478,852 2,958,861

Tangible assets 3,256,512 3,019,071

7,735,364 5,977,932

Current assets

Debtors 580,218 284,433

Cash at bank and in hand 1,977,117 48,789

2,557,335 333,222

Creditors: amounts falling due within one year (525,037) (3,792,621)

Net current assets/(liabilities) 2,032,298 (3,459,399)

Total assets less current liabilities 9,767,662 2,518,533

Creditors: amounts falling due after more than one year (883,906) (1,191,158)

Provision for liabilities and charges (269,430) (300,000)

Net assets 8,614,326 1,027,375

Capital and reserves

Called up share capital 610,650 1,000

Share premium 4,406,560 669,425

Merger reserve 2,868,033 -

Profit and loss account 729,083 356,950

Shareholders' funds 8,614,326 1,027,375

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 July 2005

18 Months

Ended 31

July

2005 2004

# #

Net cash inflow from operating activities 953,631 1,005,076

Returns on investments and servicing of finance

Interest received & similar income 88,003 493

Interest paid & similar charges (542,077) (375,594)

Net cash outflow from returns on investments and servicing of (454,074) (375,101)

finance

Taxation

Tax paid (3,180) (29,343)

Net cash outflow from taxation (3,180) (29,343)

Capital expenditure

Purchase of fixed assets (2,492,947) (3,379,586)

Net cash outflow from capital expenditure (2,492,947) (3,379,586)

Net cash outflow before financing (1,996,570) (2,778,954)

Financing

Loans (redeemed)/received (275,966) 2,511,478

Issue of share capital net of issue costs 4,503,144 -

Net cash inflow from financing 4,227,178 2,511,478

Increase/(decrease) in cash in the year 2,230,608 (267,476)

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 July 2005

Reconciliation of operating profit to net cash outflow from operating activities

18 Months

Ended 31

July

2005 2004

# #

Operating profit 842,328 693,684

Depreciation 754,441 665,722

(Increase)/decrease in debtors (260,446) 93,391

Decrease in creditors (339,833) (747,721)

Increase/(decrease) in Provision (42,859) 300,000

Net cash inflow from operating activities 953,631 1,005,076

Reconciliation of net cash flow to movement in net (debt) /funds

# #

Increase/(decrease) in cash in the period 2,229,975 (267,476)

Net cash inflow/(outflow) from changes in debt 265,788 (2,577,362)

Change in net funds resulting from cash flows 2,495,763 (2,844,838)

Currency translation adjustment 10,810 251,548

Non cash movement 2,584,974 -

Net debt at 1 August 2004/1 February 2003 (4,237,032) (1,643,742)

Net funds/(debt) at 31 July 2005/31 July 2004 854,515 (4,237,032)

Analysis of changes in net debt Exchange

At 31 July Cash Non Cash Gain/ At 31 July

2004 Flow Movement (Loss) 2005

# # # # #

Cash at bank and in hand 48,789 1,927,695 - 633 1,977,117

Overdrafts (302,280) 302,280 - - -

(253,491) 2,229,975 - 633 1,977,117

Loans due within one year (2,792,383) (32,144) 2,584,974 857 (238,696)

Loans due after one year (1,191,158) 297,932 - 9,320 (883,906)

(3,983,541) 265,788 2,584,974 10,177 (1,122,602)

Net debt (4,237,032) 2,495,763 2,584,974 10,810 854,515

NOTES TO THE ACCOUNTS

For the year ended 31 July 2005

1. The results for the period are all derived from continuing operations.

2. The results have been prepared on the basis of the accounting policies

adopted in the annual accounts for the 18 month period ended 31 July 2004.

3. The preliminary report for the year to 31 July 2005 was approved by the

Directors on 1 November 2005.

4. The calculation of basic earnings per share is based on the weighted

average shares in issue throughout the 12 month period. The diluted earnings

per share include employee share options.

5. The summarised financial information has been extracted from the

unaudited accounts of the Group for the year ended 31 July 2005. The above

information does not amount to statutory accounts within the meaning of the

Companies Act 1985. The statutory accounts for the period ended 31 July 2004

have been delivered to the Registrar of Companies. The auditors reported on

those accounts; their report was unqualified and did not contain a statement

under either section 237 (2) or section 237 (3) of the Companies Act 1985. The

auditors have not reported on the accounts for the year ended 31 July 2005, nor

have any such accounts been delivered to the Registrar of Companies as at the

date of this announcement.

6. At the time of the placing and admission to AIM, the shareholders of

Europa Oil & Gas Limited exchanged their entire shareholding for 39,999,998

ordinary shares in Europa Oil & Gas (Holdings) plc. Merger accounting has been

adopted in respect of this transaction. Accordingly, the accounts have been

prepared as if Europa Oil & Gas (Holdings) plc had been in existence throughout

the period.

The comparative figures for the prior 18 month period are based on those

consolidated figures published for Europa Oil & Gas Limited. The profit and

loss account for the current 12 month period reflects the result of Europa Oil &

Gas (Holdings) plc from the date of its incorporation on 31 August 2004 and

those of its subsidiaries for the 12 month period to 31 July 2005.

7. The consolidated cash flow statement for the year to 31 July 2005

includes in the reconciliation of net cash flow to movement in net (debt)/funds

and analysis of changes in net debt a non cash movement of #2,584,974. This

represents loans and other funds due to directors which were converted to shares

at the time Europa Oil & Gas Limited exchanged their entire shareholding for

ordinary shares in Europa Oil & Gas (Holdings) plc.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAXEFDDFSFFE

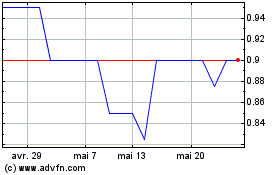

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024