UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange

Act of 1934

Adecoagro S.A.

(Name of Subject Company)

Adecoagro S.A.

(Name of Persons Filing Statement)

Common Shares, par value $1.50 per share

(Title of Class of Securities)

L00849106

(CUSIP Number of Class of Securities)

Manuela Lamellari

Vertigo Naos Building, 6, Rue Eugène

Ruppert

L - 2453 Luxembourg

Tel: +352.2644.9372

(Name, address, and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

Maurice Blanco

James Dougherty

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

| ☒ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule

14D-9 filing relates solely to preliminary communications concerning the proposal by Tether Investments S.A. de C.V. (“Tether”)

to acquire outstanding Common Shares of Adecoagro S.A (the “Company”) through a tender offer that would result in Tether

holding 51% of the outstanding Common Shares of the Company.

This Schedule

14D-9 filing consists of the following communication listed below related to the proposed tender offer:

| 1. | Press Release

dated February 25, 2025 titled “Adecoagro Engaging In Discussions With Tether” |

No

Offer or Solicitation; Additional Information and Where to Find It

The

tender offer referenced in this communication has not yet commenced. This announcement is for informational purposes only

and is neither an offer to purchase nor a solicitation of an offer to sell securities. The solicitation and offer to buy the

Company’s securities will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time

the tender offer is commenced, Tether will be required to file a tender offer statement on Schedule TO and thereafter the Company will

file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER

OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS

CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF THE COMPANY’S SECURITIES SHOULD

CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. These materials will be made available to the

Company’s stockholders at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement

will be made available for free at the SEC's website at www.sec.gov. Copies

of the documents filed by the Company with the SEC by will be available free of charge on the Company’s internet website at www.adecoagro.com

or by contacting the Company’s investor relations department at ir@adecoagro.com.

Forward

Looking Statements

This

communication contains information that may constitute forward-looking statements for purposes of applicable securities laws. Forward-looking

statements can be identified by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,”

“estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project”

and other words and expressions of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements.

Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including, but not limited to, those set forth in the “Risk Factors” section of the Company’s Form 20-F for the fiscal

year ended December 31, 2023 and subsequent filings with the SEC. The Company may not succeed in addressing these and other risks. Consequently,

all forward-looking statements in this communication are qualified by the factors, risks and uncertainties contained therein. In addition,

the forward-looking statements included in this communication represent the Company’s views as of the date of this communication

and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company

specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should

not be relied upon as representing the Company’s views as of any date subsequent to the date of this communication.

Adecoagro

Engaging In Discussions With Tether

LUXEMBOURG, February 25, 2025/PRNewswire/ -- Adecoagro

S.A. (NYSE: AGRO) (the “Company”), a leading sustainable production company in South America, announces it is engaging in

discussions with Tether Investments S.A. de C.V. (“Tether”) on Tether’s proposal to acquire outstanding Common Shares

of the Company at a price of $12.41 per Common Share through a tender offer that would result in Tether collectively holding 51% of the

outstanding Common Shares of the Company. The Company has entered into an Exclusivity Letter to facilitate further negotiations with Tether.

No assurances can be given that a definitive agreement

will be entered into, that any transaction will be consummated, or the timing, terms or conditions of any such transaction. The

Company’s Board of Directors and management team are committed to enhancing shareholder value.

The Company does not intend to comment further on market

speculation or disclose any developments unless and until it otherwise deems further disclosure is appropriate or required. The

Company’s shareholders are not required to take any action at this time.

About Adecoagro:

Adecoagro is a leading sustainable production company

in South America. Adecoagro owns 210.4 thousand hectares of farmland, and several industrial facilities spread across the most productive

regions of Argentina, Brazil and Uruguay, where it produces over 2.8 million tons of agricultural products and over 1 million MWh of renewable

electricity.

For questions please contact:

Victoria Cabello

IR Officer

Email: ir@adecoagro.com

No Offer or Solicitation; Additional Information

and Where to Find It

The tender offer referenced in this communication

has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation

of an offer to sell securities. The solicitation and offer to buy the Company’s securities will only be made pursuant

to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Tether will be required

to file a tender offer statement on Schedule TO and thereafter the Company will file a Solicitation/Recommendation Statement on Schedule

14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED

LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL

CONTAIN IMPORTANT INFORMATION. THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF THE COMPANY’S SECURITIES SHOULD CONSIDER BEFORE MAKING

ANY DECISION REGARDING TENDERING THEIR SECURITIES. These materials will be made available to the Company’s stockholders

at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for

free at the SEC's website at www.sec.gov. Copies of the documents filed by the Company with the SEC by will be available free

of charge on the Company’s internet website at www.adecoagro.com or

by contacting the Company’s investor relations department at ir@adecoagro.com.

Forward Looking Statements

This release contains information that may constitute

forward-looking statements for purposes of applicable securities laws. Forward-looking statements can be identified by the fact that they

do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,”

“believe,” “will likely result,” “outlook,” “project” and other words and expressions

of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially

from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those

set forth in the “Risk Factors” section of the Company’s Form 20-F for the fiscal year ended December 31, 2023 and subsequent

filings with the SEC. The Company may not succeed in addressing these and other risks. Consequently, all forward-looking statements in

this release are qualified by the factors, risks and uncertainties contained therein. In addition, the forward-looking statements included

in this press release represent the Company’s views as of the date of this press release and these views could change. However,

while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation

to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing

the Company’s views as of any date subsequent to the date of this release.

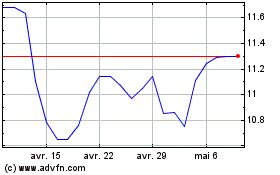

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Adecoagro (NYSE:AGRO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025