Generates excellent returns despite higher

catastrophe losses

The Allstate Corporation (NYSE: ALL) today reported financial

results for the third quarter of 2024.

The Allstate Corporation

Consolidated Highlights

Three months ended September

30,

Nine months ended September

30,

($ in millions, except per share data

and ratios)

2024

2023

% / pts

Change

2024

2023

% / pts

Change

Consolidated revenues

$

16,627

$

14,497

14.7

%

$

47,600

$

42,262

12.6

%

Net income (loss) applicable to common

shareholders

1,161

(41

)

NM

2,651

(1,776

)

NM

per diluted common share (1)

4.33

(0.16

)

NM

9.91

(6.76

)

NM

Adjusted net income (loss)*

1,048

214

NM

2,844

(1,290

)

NM

per diluted common share* (1)

3.91

0.81

NM

10.64

(4.91

)

NM

Return on Allstate common shareholders’

equity (trailing twelve months)

Net income (loss) applicable to common

shareholders

26.1

%

(14.7

)%

40.8

Adjusted net income (loss)*

26.1

%

(9.7

)%

35.8

Common shares outstanding (in

millions)

264.8

261.7

1.2

%

Book value per common share

$

70.35

$

47.79

47.2

%

Consolidated premiums written

(2)

$

15,872

$

14,425

10.0

%

$

45,589

$

41,021

11.1

%

Property-Liability insurance premiums

earned

13,694

12,270

11.6

%

39,933

35,826

11.5

%

Property-Liability combined

ratio

Recorded

96.4

103.4

(7.0

)

96.9

109.8

(12.9

)

Underlying combined ratio*

83.2

91.9

(8.7

)

85.1

92.7

(7.6

)

Catastrophe losses

$

1,703

$

1,181

44.2

%

$

4,554

$

5,568

(18.2

)%

Total policies in force (in

thousands)

205,483

190,089

8.1

%

(1)

In periods where a net loss or adjusted net loss is reported,

weighted average shares for basic earnings per share is used for

calculating diluted earnings per share because all dilutive

potential common shares are anti-dilutive and are therefore

excluded from the calculation.

(2)

Includes premiums written for the Allstate Protection and

Protection Services segments and premiums and contract charges for

the Health and Benefits segment.

*

Measures used in this release that are not

based on accounting principles generally accepted in the United

States of America (“non-GAAP”) are denoted with an asterisk and

defined and reconciled to the most directly comparable GAAP measure

in the “Definitions of Non-GAAP Measures” section of this

document.

NM = not meaningful

Third Quarter 2024 Results

- Total revenues of $16.6 billion in the third quarter of 2024

were $2.1 billion or 14.7% above the prior year quarter driven by

increased Property-Liability earned premium.

- Net income applicable to common shareholders was $1.2 billion

in the third quarter of 2024 compared to a net loss of $41 million

in the prior year quarter, as Property-Liability underwriting

results improved. Adjusted net income* was $1.0 billion, or $3.91

per diluted share, compared to adjusted net income* of $214 million

in the prior year quarter.

“Allstate’s focus on near-term performance while implementing

our long-term growth plan resulted in strong financial returns and

an improved strategic position,” said Tom Wilson, Allstate’s Chair,

CEO and President. “Revenues increased by almost 15% from the prior

year, net income was $1.2 billion for the quarter and adjusted net

income return on equity* was 26.1% for the prior twelve months.

Successful execution of the auto insurance profit improvement plan

benefited results generating $486 million of auto insurance

underwriting income. The homeowners insurance business is also

generating good returns with an underwriting profit in the quarter

despite $1.2 billion of catastrophe losses, 40% higher than the

prior year quarter. Third quarter results included Hurricanes

Beryl, Debby, Francine and Helene where we deployed over 5,000

people to handle more than 100,000 claims. Hurricane Milton

impacted customers shortly after the quarter with estimated losses

of approximately $100 million. Strong performance from Protection

Services, Health and Benefits and Investments contributed to

adjusted net income* of $3.91 per share.”

“Progress was also made on implementing the strategy to increase

market share in personal Property-Liability and expand protection

solutions. Allstate Protection auto insurance new business sales

increased 26% with increased advertising and expanded distribution.

However, retention losses reflecting the impact of significant

price increases over the last several years offset this growth

resulting in a decline in auto policies in force. Homeowners

insurance margins improved and policies in force are 2.5% higher

than the prior year. Protection Plans expanded internationally and

acquired Kingfisher to enhance mobile device protection

capabilities. Operational excellence and implementation of the

growth strategy will continue to create shareholder value,”

concluded Wilson.

----------------------------------------------------------------------------------------------------------------------------------------------------------

- Property-Liability earned premiums of $13.7 billion

increased 11.6% in the third quarter of 2024 compared to the prior

year quarter, primarily driven by higher average premium levels.

Underwriting income of $495 million in the quarter was $909 million

better than a $414 million loss in the prior year quarter.

Property-Liability

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions)

2024

2023

% / pts

Change

2024

2023

% / pts

Change

Premiums earned

$

13,694

$

12,270

11.6

%

$

39,933

$

35,826

11.5

%

Premiums written

$

14,707

$

13,304

10.5

%

$

42,169

$

37,707

11.8

%

Underwriting income (loss)

$

495

$

(414

)

NM

$

1,248

$

(3,509

)

NM

Recorded combined ratio

96.4

103.4

(7.0

)

96.9

109.8

(12.9

)

Underlying combined ratio*

83.2

91.9

(8.7

)

85.1

92.7

(7.6

)

- Premiums written increased 10.5% compared to the prior year

quarter reflecting higher premiums for both Allstate and National

General brands.

- Property-Liability combined ratio was 96.4 for the quarter and

96.9 for the first nine months of 2024. This was 7.0 points and

12.9 points better than the prior year as higher average earned

premiums and improved underlying loss experience more than offset

increased catastrophe losses in the third quarter and advertising

expenses.

- Allstate Protection auto insurance results reflect

successful execution of a comprehensive plan to restore margins.

Profitability improvement supported increased growth investments in

rate adequate states and risk segments.

Allstate Protection Auto

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions, except ratios)

2024

2023

% / pts

Change

2024

2023

% / pts

Change

Premiums earned

$

9,270

$

8,345

11.1

%

$

27,127

$

24,374

11.3

%

Premiums written

9,539

8,770

8.8

28,180

25,388

11.0

Policies in Force (in

thousands)

24,998

25,376

(1.5

)

Recorded combined ratio

94.8

102.1

(7.3

)

95.6

104.9

(9.3

)

Underlying combined ratio*

92.0

98.8

(6.8

)

93.5

101.2

(7.7

)

- Earned premiums grew 11.1% compared to the prior year quarter.

The increase was driven by rate increases, partially offset by a

decline in policies in force of 1.5%.

- Allstate brand auto rate increases result in an annualized

total brand premium impact of 2.9% in the quarter and 6.3% through

the first nine months of 2024. National General auto rate increases

result in an annualized total brand premium impact of 1.7% in the

quarter and 7.8% through the first nine months of 2024.

- The recorded auto insurance combined ratio of 94.8 in the third

quarter of 2024 was 7.3 points lower than the prior year quarter,

reflecting higher average earned premiums, improved underlying loss

experience and favorable prior year reserve reestimates.

- The severity estimated for claims reported in the first two

quarters of the year was reduced in the third quarter which had a

favorable impact on quarterly results. Excluding this impact, the

third quarter combined ratio would have been 95.6.

- Prior year non-catastrophe reserve reestimates were favorable

$55 million in the third quarter, reflecting favorable Allstate

brand reserve development, primarily driven by physical damage

coverages.

- Allstate Protection homeowners insurance generates

attractive returns and is an attractive growth opportunity. The

third quarter was profitable despite a 40% increase in catastrophe

losses. Premiums earned increased to $3.4 billion and the recorded

combined ratio was 98.2. Third quarter catastrophe losses were $1.2

billion reflecting four hurricanes and 46 severe weather and other

events. The recorded combined ratio for the first nine months of

2024 was 97.5 which generated $249 million of underwriting income

compared to an underwriting loss of $2.0 billion during the same

period in 2023.

Allstate Protection Homeowners

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions, except ratios)

2024

2023

% / pts

Change

2024

2023

% / pts

Change

Premiums earned

$

3,403

$

2,969

14.6

%

$

9,812

$

8,662

13.3

%

Premiums written

4,073

3,525

15.5

10,792

9,440

14.3

Policies in Force (in

thousands)

7,483

7,297

2.5

Recorded combined ratio

98.2

104.4

(6.2

)

97.5

122.8

(25.3

)

Catastrophe Losses

$

1,231

$

878

40.2

%

$

3,402

$

4,516

(24.7

)%

Underlying combined ratio*

62.1

72.9

(10.8

)

63.6

69.4

(5.8

)

- Earned premiums increased by 14.6% compared to the prior year

quarter, primarily reflecting higher average premium and policies

in force growth of 2.5%.

- Policies in force growth reflects improved retention and

increased new policy sales.

- Allstate brand homeowners rate increases result in an

annualized total brand premium impact of 3.1% in the quarter and

7.6% through the first nine months of 2024. Implemented rate

increases and inflation in insured home replacement costs resulted

in a 10.8% increase in homeowners insurance average gross written

premium compared to the prior year quarter.

- National General brand homeowners rate increases result in an

annualized total brand premium impact of 2.2% in the quarter and

6.1% through the first nine months of 2024.

- Catastrophe losses of $1.2 billion in the quarter increased

$353 million compared to the prior year quarter.

- The recorded homeowners insurance combined ratio of 98.2 was

6.2 points below the third quarter of 2023 reflecting higher

average earned premiums and favorable average underlying loss costs

partially offset by higher catastrophe losses. The underlying

combined ratio* of 62.1 decreased by 10.8 points compared to the

prior year quarter.

----------------------------------------------------------------------------------------------------------------------------------------------------------

- Protection Services provides protection solutions and

services through five businesses largely by embedding Allstate

branded offerings in non-insurance purchases. Revenues increased to

$822 million in the third quarter of 2024, 17.9% higher than the

prior year quarter, primarily due to Allstate Protection Plans and

Arity. Adjusted net income of $58 million increased by $31 million

compared to the prior year quarter, driven by Allstate Protection

Plans.

Protection Services

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions)

2024

2023

% / $

Change

2024

2023

% / $

Change

Total revenues (1)

$

822

$

697

17.9

%

$

2,348

$

2,054

14.3

%

Allstate Protection Plans

512

416

23.1

1,459

1,200

21.6

Allstate Dealer Services

146

146

—

440

442

(0.5

)

Allstate Roadside

53

69

(23.2

)

170

199

(14.6

)

Arity

74

29

155.2

165

101

63.4

Allstate Identity Protection

37

37

—

114

112

1.8

Adjusted net income (loss)

$

58

$

27

$

31

$

167

$

102

$

65

Allstate Protection Plans

39

20

19

120

79

41

Allstate Dealer Services

5

5

—

17

18

(1

)

Allstate Roadside

10

7

3

29

17

12

Arity

1

(6

)

7

(5

)

(13

)

8

Allstate Identity Protection

3

1

2

6

1

5

(1) Excludes net gains and losses

on investments and derivatives.

- Allstate Protection Plans continued to grow rapidly by

expanding distribution relationships and protection offerings.

Revenue of $512 million increased $96 million, or 23.1%, compared

to the prior year quarter driven by growth in North American and

international business. Adjusted net income of $39 million in the

third quarter of 2024 was $19 million higher than the prior year

quarter.

- Allstate Dealer Services generated revenue of $146

million and adjusted net income of $5 million which were consistent

with the prior year quarter.

- Allstate Roadside revenue of $53 million in the third

quarter of 2024 decreased 23.2% compared to the prior year quarter

reflecting the discontinuance of a large unprofitable account.

Adjusted net income of $10 million was $3 million higher than the

prior year quarter, primarily driven by increased pricing, improved

provider capacity and lower costs.

- Arity revenue of $74 million increased $45 million

compared to the prior year quarter, due to higher revenue from lead

sales. Adjusted net income of $1 million in the third quarter of

2024 was $7 million higher than prior year quarter.

- Allstate Identity Protection revenue of $37 million in

the third quarter of 2024 was consistent with prior year quarter.

Adjusted net income of $3 million in the third quarter of 2024 was

$2 million higher than prior year quarter driven by lower operating

expenses.

----------------------------------------------------------------------------------------------------------------------------------------------------------

- Allstate Health and Benefits

- Divestiture of these businesses is being pursued to capture

value through greater strategic alignment with acquiring companies.

An agreement to sell the Employer Voluntary Benefits (EVB) business

to StanCorp Financial for $2 billion was finalized and will be

completed upon regulatory approval. As a result, EVB is classified

as “Held For Sale” on the balance sheet while operations are fully

reflected in results. The process to evaluate disposition of the

remaining two businesses is progressing.

- Premiums and contract charges for health and benefits increased

5.2%, or $24 million, compared to the prior year quarter primarily

due to growth in individual health and group health, partially

offset by a decline in employer voluntary benefits. Adjusted net

income of $37 million in the third quarter was $32 million lower

than prior year quarter attributable to increased benefit

utilization across all businesses.

Allstate Health and Benefits

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions)

2024

2023

% Change

2024

2023

% Change

Premiums and contract charges

$

487

$

463

5.2

%

$

1,439

$

1,379

4.4

%

Employer voluntary benefits

248

253

(2.0

)

742

753

(1.5

)

Group health

120

111

8.1

358

328

9.1

Individual health

119

99

20.2

339

298

13.8

Adjusted net income

$

37

$

69

(46.4

)

$

151

$

182

(17.0

)%

-----------------------------------------------------------------------------------------------------------------------------------------------------------

- Allstate Investments pursues a proactive approach to

balancing risk and returns for the $73.6 billion portfolio. In

2023, fixed income duration was extended and public equity holdings

significantly lowered to optimize risk adjusted returns on capital.

Net investment income of $783 million in the third quarter of 2024,

increased by $94 million from the prior year quarter due to

portfolio repositioning into higher yielding fixed income

securities and increased investment balances.

Allstate Investment

Results

Three months ended September

30,

Nine months ended September

30,

($ in millions, except ratios)

2024

2023

$ / pts

Change

2024

2023

$ / pts

Change

Net investment income

$

783

$

689

$

94

$

2,259

$

1,874

$

385

Market-based (1)

708

567

141

2,001

1,610

391

Performance-based (1)

143

186

(43

)

451

439

12

Net gains (losses) on investments and

derivatives

$

243

$

(86

)

$

329

$

(24

)

$

(223

)

$

199

Change in unrealized net capital gains

and losses, pre-tax

$

1,677

$

(855

)

$

2,532

$

1,252

$

(325

)

$

1,577

Total return on investment portfolio

(2)

3.7

%

(0.4

)%

4.1

5.0

%

2.1

%

2.9

Total return on investment portfolio

(2) (trailing twelve months)

9.4

%

4.6

%

4.8

(1) Investment expenses are not allocated between market-based and

performance-based portfolios with the exception of investee level

expenses. (2)

Beginning in the third quarter of 2024, calculations include

investments held for sale.

- Market-based investment income was $708 million in the

third quarter of 2024, an increase of $141 million, or 24.9%,

compared to the prior year quarter, reflecting higher yields and

increased asset balances in the $63.3 billion market-based

portfolio. Fixed income duration was 5.3 years as of September 30,

2024, 0.5 years above prior year end.

- Performance-based investment income totaled $143

million in the third quarter of 2024, a decrease of $43 million

compared to the prior year quarter primarily reflecting lower real

estate investment results. The portfolio allocation to

performance-based assets provides a diversifying source of higher

long-term returns, and volatility in reported results is

expected.

- Net gains on investments and derivatives were $243

million in the third quarter of 2024, compared to losses of $86

million in the prior year quarter. Net gains in the third quarter

of 2024 were driven by valuation gains on equity investments and

sales of fixed income securities.

- Unrealized net capital gains increased by $1.7 billion

from the second quarter of 2024 as lower interest rates resulted in

higher fixed income valuations.

- Total return on the investment portfolio was 3.7% for

the third quarter of 2024 and 9.4% for the latest twelve

months.

Proactive Capital Management

“Allstate continues to be strongly capitalized while generating

attractive returns with adjusted net income return on equity* of

26.1% over the last twelve months. Total estimated statutory

surplus in the insurance companies increased to $17.3 billion and

$3.0 billion of assets are held at the holding company. The

divestiture of the Employer Voluntary Benefits business is expected

in the first half of 2025,” said Jess Merten, Chief Financial

Officer.

Visit www.allstateinvestors.com for

additional information about Allstate’s results, including a

webcast of its quarterly conference call and the call presentation.

The conference call will be at 9 a.m. ET on Thursday, October 31.

Financial information, including material announcements about The

Allstate Corporation, is routinely posted on www.allstateinvestors.com.

Forward-Looking Statements

This news release contains “forward-looking statements” that

anticipate results based on our estimates, assumptions and plans

that are subject to uncertainty. These statements are made subject

to the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements do not relate

strictly to historical or current facts and may be identified by

their use of words like “plans,” “seeks,” “expects,” “will,”

“should,” “anticipates,” “estimates,” “intends,” “believes,”

“likely,” “targets” and other words with similar meanings. We

believe these statements are based on reasonable estimates,

assumptions and plans. However, if the estimates, assumptions or

plans underlying the forward-looking statements prove inaccurate or

if other risks or uncertainties arise, actual results could differ

materially from those communicated in these forward-looking

statements. Factors that could cause actual results to differ

materially from those expressed in, or implied by, the

forward-looking statements may be found in our filings with the

U.S. Securities and Exchange Commission, including the “Risk

Factors” section in our most recent annual report on Form 10-K.

Forward-looking statements are as of the date on which they are

made, and we assume no obligation to update or revise any

forward-looking statement.

THE ALLSTATE CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

($ in millions, except par value

data)

September 30, 2024

December 31, 2023

Assets

Investments

Fixed income securities, at fair value

(amortized cost, net $53,447 and $49,649)

$

53,961

$

48,865

Equity securities, at fair value (cost

$1,829 and $2,244)

2,091

2,411

Mortgage loans, net

765

822

Limited partnership interests

8,925

8,380

Short-term, at fair value (amortized cost

$6,995 and $5,145)

6,994

5,144

Other investments, net

866

1,055

Total investments

73,602

66,677

Cash

816

722

Premium installment receivables, net

11,041

10,044

Deferred policy acquisition costs

5,751

5,940

Reinsurance and indemnification

recoverables, net

9,013

8,809

Accrued investment income

603

539

Deferred income taxes

—

219

Property and equipment, net

714

859

Goodwill

3,206

3,502

Other assets, net

5,834

6,051

Assets held for sale

3,163

—

Total assets

$

113,743

$

103,362

Liabilities

Reserve for property and casualty

insurance claims and claims expense

$

42,743

$

39,858

Reserve for future policy benefits

274

1,347

Contractholder funds

—

888

Unearned premiums

27,059

24,709

Claim payments outstanding

1,727

1,353

Other liabilities and accrued expenses

10,644

9,635

Debt

8,083

7,942

Liabilities held for sale

2,164

—

Total liabilities

92,905

85,732

Equity

Preferred stock and additional capital

paid-in, $1 par value, 25 million shares authorized, 82.0 thousand

shares issued and outstanding, $2,050 aggregate liquidation

preference

2,001

2,001

Common stock, $.01 par value, 2.0 billion

shares authorized and 900 million issued, 265 million and 262

million shares outstanding

9

9

Additional capital paid-in

3,987

3,854

Retained income

51,635

49,716

Treasury stock, at cost (635 million and

638 million shares)

(37,006

)

(37,110

)

Accumulated other comprehensive income

(loss):

Unrealized net capital gains and

losses

361

(604

)

Unrealized foreign currency translation

adjustments

(99

)

(98

)

Unamortized pension and other

postretirement prior service credit

12

13

Discount rate for reserve for future

policy benefits

(23

)

(11

)

Total accumulated other comprehensive

income (loss)

251

(700

)

Total Allstate shareholders’

equity

20,877

17,770

Noncontrolling interest

(39

)

(140

)

Total equity

20,838

17,630

Total liabilities and equity

$

113,743

$

103,362

THE ALLSTATE CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

($ in millions, except per share

data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenues

Property and casualty insurance

premiums

$

14,333

$

12,839

$

41,797

$

37,482

Accident and health insurance premiums and

contract charges

487

463

1,439

1,379

Other revenue

781

592

2,129

1,750

Net investment income

783

689

2,259

1,874

Net gains (losses) on investments and

derivatives

243

(86

)

(24

)

(223

)

Total revenues

16,627

14,497

47,600

42,262

Costs and expenses

Property and casualty insurance claims and

claims expense

10,409

10,237

30,711

32,290

Accident, health and other policy benefits

(including remeasurement (gains) losses of $1, $0, $1 and $0)

317

262

904

785

Amortization of deferred policy

acquisition costs

2,037

1,841

5,977

5,374

Operating costs and expenses

2,217

1,771

6,121

5,273

Pension and other postretirement

remeasurement (gains) losses

26

149

15

56

Restructuring and related charges

28

87

51

141

Amortization of purchased intangibles

71

83

210

246

Interest expense

104

88

299

272

Total costs and expenses

15,209

14,518

44,288

44,437

Income (loss) from operations before

income tax expense

1,418

(21

)

3,312

(2,175

)

Income tax expense (benefit)

254

(17

)

603

(475

)

Net income (loss)

1,164

(4

)

2,709

(1,700

)

Less: Net (loss) income attributable to

noncontrolling interest

(26

)

1

(30

)

(23

)

Net income (loss) attributable to

Allstate

1,190

(5

)

2,739

(1,677

)

Less: Preferred stock dividends

29

36

88

99

Net income (loss) applicable to common

shareholders

$

1,161

$

(41

)

$

2,651

$

(1,776

)

Earnings per common share:

Net income (loss) applicable to common

shareholders per common share - Basic

$

4.39

$

(0.16

)

$

10.04

$

(6.76

)

Weighted average common shares - Basic

264.6

261.8

264.1

262.6

Net income (loss) applicable to common

shareholders per common share - Diluted

$

4.33

$

(0.16

)

$

9.91

$

(6.76

)

Weighted average common shares -

Diluted

268.0

261.8

267.4

262.6

Definitions of Non-GAAP Measures

We believe that investors’ understanding of Allstate’s

performance is enhanced by our disclosure of the following non-GAAP

measures. Our methods for calculating these measures may differ

from those used by other companies and therefore comparability may

be limited.

Adjusted net income is net income (loss) applicable to

common shareholders, excluding:

- Net gains and losses on investments and derivatives

- Pension and other postretirement remeasurement gains and

losses

- Amortization or impairment of purchased intangibles

- Gain or loss on disposition

- Adjustments for other significant non-recurring, infrequent or

unusual items, when (a) the nature of the charge or gain is such

that it is reasonably unlikely to recur within two years, or (b)

there has been no similar charge or gain within the prior two

years

- Related income tax expense or benefit of these items

Net income (loss) applicable to common shareholders is the GAAP

measure that is most directly comparable to adjusted net

income.

We use adjusted net income as an important measure to evaluate

our results of operations. We believe that the measure provides

investors with a valuable measure of the Company’s ongoing

performance because it reveals trends in our insurance and

financial services business that may be obscured by the net effect

of net gains and losses on investments and derivatives, pension and

other postretirement remeasurement gains and losses, amortization

or impairment of purchased intangibles, gain or loss on disposition

and adjustments for other significant non-recurring, infrequent or

unusual items and the related tax expense or benefit of these

items. Net gains and losses on investments and derivatives, and

pension and other postretirement remeasurement gains and losses may

vary significantly between periods and are generally driven by

business decisions and external economic developments such as

capital market conditions, the timing of which is unrelated to the

insurance underwriting process. Gain or loss on disposition is

excluded because it is non-recurring in nature and the amortization

or impairment of purchased intangibles is excluded because it

relates to the acquisition purchase price and is not indicative of

our underlying business results or trends. Non-recurring items are

excluded because, by their nature, they are not indicative of our

business or economic trends. Accordingly, adjusted net income

excludes the effect of items that tend to be highly variable from

period to period and highlights the results from ongoing operations

and the underlying profitability of our business. A byproduct of

excluding these items to determine adjusted net income is the

transparency and understanding of their significance to net income

variability and profitability while recognizing these or similar

items may recur in subsequent periods. Adjusted net income is used

by management along with the other components of net income (loss)

applicable to common shareholders to assess our performance. We use

adjusted measures of adjusted net income in incentive compensation.

Therefore, we believe it is useful for investors to evaluate net

income (loss) applicable to common shareholders, adjusted net

income and their components separately and in the aggregate when

reviewing and evaluating our performance. We note that investors,

financial analysts, financial and business media organizations and

rating agencies utilize adjusted net income results in their

evaluation of our and our industry’s financial performance and in

their investment decisions, recommendations and communications as

it represents a reliable, representative and consistent measurement

of the industry and the Company and management’s performance. We

note that the price to earnings multiple commonly used by insurance

investors as a forward-looking valuation technique uses adjusted

net income as the denominator. Adjusted net income should not be

considered a substitute for net income (loss) applicable to common

shareholders and does not reflect the overall profitability of our

business.

The following tables reconcile net income (loss) applicable to

common shareholders and adjusted net income (loss). Taxes on

adjustments to reconcile net income (loss) applicable to common

shareholders and adjusted net income (loss) generally use a 21%

effective tax rate.

($ in millions, except per share

data)

Three months ended September

30,

Consolidated

Per diluted common

share

2024

2023

2024

2023

Net income (loss) applicable to common

shareholders (1)

$

1,161

$

(41

)

$

4.33

$

(0.16

)

Net (gains) losses on investments and

derivatives

(243

)

86

(0.91

)

0.33

Pension and other postretirement

remeasurement (gains) losses

26

149

0.10

0.57

Amortization of purchased intangibles

71

83

0.26

0.31

(Gain) loss on disposition

(1

)

5

—

0.02

Income tax expense (benefit)

34

(68

)

0.13

(0.26

)

Adjusted net income (loss) *

$

1,048

$

214

$

3.91

$

0.81

Weighted average dilutive potential common

shares excluded due to net loss applicable to common shareholders

(1)

—

1.5

Nine months ended September

30,

Consolidated

Per diluted common

share

2024

2023

2024

2023

Net income (loss) applicable to common

shareholders (1)

$

2,651

$

(1,776

)

$

9.91

$

(6.76

)

Net (gains) losses on investments and

derivatives

24

223

0.09

0.85

Pension and other postretirement

remeasurement (gains) losses

15

56

0.06

0.21

Amortization of purchased intangibles

210

246

0.79

0.94

(Gain) loss on disposition

(6

)

4

(0.02

)

0.02

Non-recurring costs (2)

—

90

—

0.34

Income tax expense (benefit)

(50

)

(133

)

(0.19

)

(0.51

)

Adjusted net income (loss) *

(1)

$

2,844

$

(1,290

)

$

10.64

$

(4.91

)

Weighted average dilutive potential common

shares excluded due to net loss applicable to common shareholders

(1)

—

1.9

_____________ (1)

In periods where a net loss or adjusted net loss is reported,

weighted average shares for basic earnings per share is used for

calculating diluted earnings per share because all dilutive

potential common shares are anti-dilutive and are therefore

excluded from the calculation.

(2)

Relates to settlement costs for

non-recurring litigation that is outside of the ordinary course of

business.

Adjusted net income (loss) return on Allstate common

shareholders’ equity is a ratio that uses a non-GAAP measure.

It is calculated by dividing the rolling 12-month adjusted net

income by the average of Allstate common shareholders’ equity at

the beginning and at the end of the 12-months, after excluding the

effect of unrealized net capital gains and losses. Return on

Allstate common shareholders’ equity is the most directly

comparable GAAP measure. We use adjusted net income as the

numerator for the same reasons we use adjusted net income, as

discussed previously. We use average Allstate common shareholders’

equity excluding the effect of unrealized net capital gains and

losses for the denominator as a representation of common

shareholders’ equity primarily applicable to Allstate's earned and

realized business operations because it eliminates the effect of

items that are unrealized and vary significantly between periods

due to external economic developments such as capital market

conditions like changes in equity prices and interest rates, the

amount and timing of which are unrelated to the insurance

underwriting process. We use it to supplement our evaluation of net

income (loss) applicable to common shareholders and return on

Allstate common shareholders’ equity because it excludes the effect

of items that tend to be highly variable from period to period. We

believe that this measure is useful to investors and that it

provides a valuable tool for investors when considered along with

return on Allstate common shareholders’ equity because it

eliminates the after-tax effects of realized and unrealized net

capital gains and losses that can fluctuate significantly from

period to period and that are driven by economic developments, the

magnitude and timing of which are generally not influenced by

management. In addition, it eliminates non-recurring items that are

not indicative of our ongoing business or economic trends. A

byproduct of excluding the items noted above to determine adjusted

net income return on Allstate common shareholders’ equity from

return on Allstate common shareholders’ equity is the transparency

and understanding of their significance to return on common

shareholders’ equity variability and profitability while

recognizing these or similar items may recur in subsequent periods.

We use adjusted measures of adjusted net income return on Allstate

common shareholders’ equity in incentive compensation. Therefore,

we believe it is useful for investors to have adjusted net income

return on Allstate common shareholders’ equity and return on

Allstate common shareholders’ equity when evaluating our

performance. We note that investors, financial analysts, financial

and business media organizations and rating agencies utilize

adjusted net income return on common shareholders’ equity results

in their evaluation of our and our industry’s financial performance

and in their investment decisions, recommendations and

communications as it represents a reliable, representative and

consistent measurement of the industry and the company and

management’s utilization of capital. We also provide it to

facilitate a comparison to our long-term adjusted net income return

on Allstate common shareholders’ equity goal. Adjusted net income

return on Allstate common shareholders’ equity should not be

considered a substitute for return on Allstate common shareholders’

equity and does not reflect the overall profitability of our

business.

The following tables reconcile return on Allstate common

shareholders’ equity and adjusted net income (loss) return on

Allstate common shareholders’ equity.

($ in millions)

For the twelve months ended

September 30,

2024

2023

Return on Allstate common

shareholders’ equity

Numerator:

Net income (loss) applicable to common

shareholders

$

4,111

$

(2,079

)

Denominator:

Beginning Allstate common shareholders’

equity

$

12,592

$

15,713

Ending Allstate common shareholders’

equity (1)

18,876

12,592

Average Allstate common shareholders’

equity

$

15,734

$

14,153

Return on Allstate common shareholders’

equity

26.1

%

(14.7

)%

($ in millions)

For the twelve months ended

September 30,

2024

2023

Adjusted net income (loss) return on

Allstate common shareholders’ equity

Numerator:

Adjusted net income (loss) *

$

4,385

$

(1,641

)

Denominator:

Beginning Allstate common shareholders’

equity

$

12,592

$

15,713

Less: Unrealized net capital gains and

losses

(2,512

)

(2,929

)

Adjusted beginning Allstate common

shareholders’ equity

15,104

18,642

Ending Allstate common shareholders’

equity (1)

18,876

12,592

Less: Unrealized net capital gains and

losses

361

(2,512

)

Adjusted ending Allstate common

shareholders’ equity

18,515

15,104

Average adjusted Allstate common

shareholders’ equity

$

16,810

$

16,873

Adjusted net income (loss) return on

Allstate common shareholders’ equity *

26.1

%

(9.7

)%

_____________

(1)

Excludes equity related to preferred stock

of $2,001 million as of September 30, 2024 and 2023.

Combined ratio excluding the effect of catastrophes, prior

year reserve reestimates and amortization or impairment of

purchased intangibles (“underlying combined ratio”) is a

non-GAAP ratio, which is computed as the difference between four

GAAP operating ratios: the combined ratio, the effect of

catastrophes on the combined ratio, the effect of prior year

non-catastrophe reserve reestimates on the combined ratio, and the

effect of amortization or impairment of purchased intangibles on

the combined ratio. We believe that this ratio is useful to

investors, and it is used by management to reveal the trends in our

Property-Liability business that may be obscured by catastrophe

losses, prior year reserve reestimates and amortization or

impairment of purchased intangibles. Catastrophe losses cause our

loss trends to vary significantly between periods as a result of

their incidence of occurrence and magnitude, and can have a

significant impact on the combined ratio. Prior year reserve

reestimates are caused by unexpected loss development on historical

reserves, which could increase or decrease current year net income.

Amortization or impairment of purchased intangibles relates to the

acquisition purchase price and is not indicative of our underlying

insurance business results or trends. We believe it is useful for

investors to evaluate these components separately and in the

aggregate when reviewing our underwriting performance. The most

directly comparable GAAP measure is the combined ratio. The

underlying combined ratio should not be considered a substitute for

the combined ratio and does not reflect the overall underwriting

profitability of our business.

The following tables reconcile the respective combined ratio to

the underlying combined ratio. Underwriting margin is calculated as

100% minus the combined ratio.

Property-Liability

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Combined ratio

96.4

103.4

96.9

109.8

Effect of catastrophe losses

(12.4

)

(9.6

)

(11.4

)

(15.5

)

Effect of prior year non-catastrophe

reserve reestimates

(0.4

)

(1.4

)

—

(1.1

)

Effect of amortization of purchased

intangibles

(0.4

)

(0.5

)

(0.4

)

(0.5

)

Underlying combined ratio*

83.2

91.9

85.1

92.7

Effect of prior year catastrophe reserve

reestimates

(0.1

)

0.1

(0.8

)

—

Allstate

Protection - Auto Insurance

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Combined ratio

94.8

102.1

95.6

104.9

Effect of catastrophe losses

(3.0

)

(2.6

)

(2.7

)

(2.7

)

Effect of prior year non-catastrophe

reserve reestimates

0.6

(0.3

)

1.0

(0.5

)

Effect of amortization of purchased

intangibles

(0.4

)

(0.4

)

(0.4

)

(0.5

)

Underlying combined ratio*

92.0

98.8

93.5

101.2

Effect of prior year catastrophe reserve

reestimates

(0.1

)

0.1

(0.1

)

(0.1

)

Allstate

Protection - Homeowners Insurance

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Combined ratio

98.2

104.4

97.5

122.8

Effect of catastrophe losses

(36.2

)

(29.6

)

(34.7

)

(52.1

)

Effect of prior year non-catastrophe

reserve reestimates

0.4

(1.5

)

1.1

(0.9

)

Effect of amortization of purchased

intangibles

(0.3

)

(0.4

)

(0.3

)

(0.4

)

Underlying combined ratio*

62.1

72.9

63.6

69.4

Effect of prior year catastrophe reserve

reestimates

—

0.6

(2.8

)

0.7

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030167165/en/

Nick Nottoli Media Relations (847) 402-5600

Allister Gobin Investor Relations (847) 402-2800

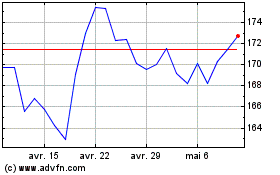

Allstate (NYSE:ALL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Allstate (NYSE:ALL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024