false

0001163165

0001163165

2024-02-09

2024-02-09

0001163165

us-gaap:CommonStockMember

2024-02-09

2024-02-09

0001163165

cop:SevenPercentDebenturesDueTwentyTwentyNineMember

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

February 15, 2024 (February 9, 2024)

ConocoPhillips

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-32395 |

|

01-0562944 |

(State or other

jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S. Employer

Identification No.) |

925 N. Eldridge Parkway

Houston, Texas 77079

(Address

of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 293-1000

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $.01 Par Value |

|

COP |

|

New York Stock Exchange |

| 7% Debentures due 2029 |

|

CUSIP

– 718507BK1 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers. |

On February 9, 2024, Dominic E. Macklon,

executive vice president, strategy, sustainability and technology announced his decision to retire effective May 1, 2024, due to

family medical reasons. The press release issued by the Company on February 15, 2024 announcing Mr. Macklon’s retirement

is filed as Exhibit 99.1 hereto and incorporated herein by reference.

| Item 9.01 | Financial Statements

and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CONOCOPHILLIPS |

| |

|

| |

/s/

Kelly B. Rose |

| |

Kelly B. Rose |

| |

Senior Vice President, Legal, |

| |

General Counsel and Corporate Secretary |

February 15, 2024

Exhibit 99.1

|

925

North Eldridge Parkway

Houston, TX 77079

Media Relations: 281-293-1149

www.conocophillips.com/media |

NEWS RELEASE

Feb. 15,

2024

ConocoPhillips announces Dominic Macklon to retire after 33 years

with the company

HOUSTON – ConocoPhillips

(NYSE: COP) today announced that Dominic Macklon, executive vice president, Strategy, Sustainability and Technology, has elected to retire

effective May 1, 2024, for family medical reasons after 33 dedicated years of service.

Dominic began his career with Conoco in 1991 and held numerous engineering,

business development, operations and leadership roles of increasing responsibility before becoming a valued member of the company’s

executive leadership team in 2018. Since then, he led the company’s Lower 48 business and went on to oversee corporate planning

and development, global technical functions, information technology, sustainable development and low carbon technologies.

“I want to thank Dominic for his leadership, dedication and significant contributions during his distinguished 33 years with ConocoPhillips,”

said Ryan Lance, chairman and chief executive officer. “Dominic has played an important role in identifying and driving value from

low cost of supply opportunities across our global portfolio while positioning our company for the energy transition and accelerating

our emissions reduction initiatives. I wish Dominic the best in retirement as he relocates back to the U.K.”

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a globally diversified asset portfolio. Headquartered in Houston, Texas,

ConocoPhillips had operations and activities in 13 countries, $96 billion of total assets, and approximately 9,900 employees at Dec. 31,

2023. Production averaged 1,826 MBOED for the twelve months ended Dec. 31, 2023, and preliminary proved reserves were 6.8 BBOE as

of Dec. 31, 2023.

For more information, go to www.conocophillips.com.

Contacts

Dennis Nuss (media)

281-293-1149

dennis.nuss@conocophillips.com

Investor Relations

281-293-5000

investor.relations@conocophillips.com

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE "SAFE HARBOR"

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements relate to future events, plans and anticipated results of operations, business

strategies, and other aspects of our operations or operating results. Words and phrases such as “ambition,” “anticipate,"

“estimate,” “believe,” “budget,” “continue,” “could,” “intend,”

“may,” “plan,” “potential,” “predict," “seek,” “should,” “will,”

“would,” “expect,” “objective,” “projection,” “forecast,” “goal,”

“guidance,” “outlook,” “effort,” “target” and other similar words can be used to identify

forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Where, in

any forward-looking statement, the company expresses an expectation or belief as to future results, such expectation or belief is expressed

in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees

of future performance and involve certain risks, uncertainties and other factors beyond our control. Therefore, actual outcomes and results

may differ materially from what is expressed or forecast in the forward-looking statements. Factors that could cause actual results or

events to differ materially from what is presented include changes in commodity prices, including a prolonged decline in these prices

relative to historical or future expected levels; global and regional changes in the demand, supply, prices, differentials or other market

conditions affecting oil and gas, including changes resulting from any ongoing military conflict, including the conflicts in Ukraine

and the Middle East, and the global response to such conflict, security threats on facilities and infrastructure, or from a public health

crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by OPEC and other producing

countries and the resulting company or third-party actions in response to such changes; insufficient liquidity or other factors, such

as those listed herein, that could impact our ability to repurchase shares and declare and pay dividends such that we suspend our share

repurchase program and reduce, suspend, or totally eliminate dividend payments in the future, whether variable or fixed; changes in expected

levels of oil and gas reserves or production; potential failures or delays in achieving expected reserve or production levels from existing

and future oil and gas developments, including due to operating hazards, drilling risks or unsuccessful exploratory activities; unexpected

cost increases, inflationary pressures or technical difficulties in constructing, maintaining or modifying company facilities; legislative

and regulatory initiatives addressing global climate change or other environmental concerns; public health crises, including pandemics

(such as COVID-19) and epidemics and any impacts or related company or government policies or actions; investment in and development

of competing or alternative energy sources; potential failures or delays in delivering on our current or future low-carbon strategy,

including our inability to develop new technologies; disruptions or interruptions impacting the transportation for our oil and gas production;

international monetary conditions and exchange rate fluctuations; changes in international trade relationships or governmental policies,

including the imposition of price caps, or the imposition of trade restrictions or tariffs on any materials or products (such as aluminum

and steel) used in the operation of our business, including any sanctions imposed as a result of any ongoing military conflict, including

the conflicts in Ukraine and the Middle East; our ability to collect payments when due, including our ability to collect payments from

the government of Venezuela or PDVSA; our ability to complete any announced or any future dispositions or acquisitions on time, if at

all; the possibility that regulatory approvals for any announced or any future dispositions or acquisitions will not be received on a

timely basis, if at all, or that such approvals may require modification to the terms of the transactions or our remaining business;

business disruptions following any announced or future dispositions or acquisitions, including the diversion of management time and attention;

the ability to deploy net proceeds from our announced or any future dispositions in the manner and timeframe we anticipate, if at all;

potential liability for remedial actions under existing or future environmental regulations; potential liability resulting from pending

or future litigation, including litigation related directly or indirectly to our transaction with Concho Resources Inc.; the impact of

competition and consolidation in the oil and gas industry; limited access to capital or insurance or significantly higher cost of capital

or insurance related to illiquidity or uncertainty in the domestic or international financial markets or investor sentiment; general

domestic and international economic and political conditions or developments, including as a result of any ongoing military conflict,

including the conflicts in Ukraine and the Middle East; changes in fiscal regime or tax, environmental and other laws applicable to our

business; and disruptions resulting from accidents, extraordinary weather events, civil unrest, political events, war, terrorism, cybersecurity

threats or information technology failures, constraints or disruptions; and other economic, business, competitive and/or regulatory factors

affecting our business generally as set forth in our filings with the Securities and Exchange Commission. Unless legally required, ConocoPhillips

expressly disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or

otherwise.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_CapitalUnitsByClassAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_CapitalUnitsByClassAxis=cop_SevenPercentDebenturesDueTwentyTwentyNineMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

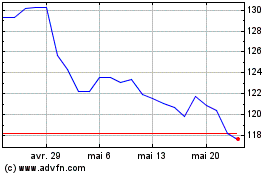

ConocoPhillips (NYSE:COP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

ConocoPhillips (NYSE:COP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024