UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated 6 February 2025

Commission File Number 001-31318

Gold Fields Limited

(Translation of registrant’s name into English)

150 Helen Rd.

Sandown, Sandton 2196

South Africa

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Gold Fields Limited |

| | |

| Date: 6 February 2025 | By: | /s/ Mike Fraser |

| | Name: | Mike Fraser |

| | Title: | Chief Executive Officer |

INDEX TO EXHIBITS

Gold Fields Limited

Reg. No. 1968/004880/06)

Incorporated in the Republic of South Africa)

JSE, NYSE, DIFX Share Code: GFI

ISIN Code:ZAE000018123

(“Gold Fields” or the “Company” or the “Group”)

TRADING STATEMENT AND OPERATIONAL PERFORMANCE UPDATE FOR THE TWELVE MONTHS ENDED 31 DECEMBER 2024 (FY 2024)

Gold Fields is pleased to advise that the Company has delivered Group production, all-in-costs (AIC) and all-in-sustaining costs (AISC) in line with the Company’s revised 2024 guidance.

FY 2024 operational performance

Following strong delivery across all our operations in the fourth quarter of 2024 (Q4 2024), attributable gold equivalent production for FY 2024 is expected to be 2,071koz (FY 2023: 2,304koz), in line with the revised Group guidance of 2,050koz – 2,150koz. Salares Norte mine recommenced ramp up at the end of September 2024, delivering gold equivalent production of 45koz, in line with the revised guidance of 40koz to 50koz for 2024.

AIC for FY 2024 is expected to be within the guided range of US$1,820/oz – US$1,910/oz at US$1,873/oz (FY 2023: US$1,512/oz).

AISC for FY 2024 is also expected to be within the guided range, of US$1,580/oz – US$1,670/oz at US$1,629/oz and 26% higher YoY (FY 2023: US$1,295/oz).

The 24% and 26% YoY increase in AIC and AISC, respectively, is mainly due to a 10% decrease in gold sold, additional non-cash gold inventory charge to costs, higher sustaining capital expenditure, increased royalties in line with the higher gold prices and an increase in operating costs due to inflationary cost pressures.

Q4 2024 operational performance

Q4 2024, attributable gold equivalent production was 26% higher QoQ at 643koz (Q3 2024: 510koz) and 8% higher YoY (Q4 2023 excluding Asanko production: 594koz).

AIC for Q4 2024 is expected to be US$1,575/oz, 17% lower QoQ (Q3 2024: US$1,909/oz) and 3% lower YoY (Q4 2023: US$1,618/oz excluding Asanko), while AISC for the quarter is expected to be US$1,410/oz, 17% lower QoQ (Q3 2024: US$1,694/oz) and 4% higher YoY (Q4 2023: US$1,356/oz excluding Asanko).

Trading statement

Headline earnings

Headline earnings per share for FY 2024 are expected to range from US$1.28 -1.38 per share (US$0.34-0.44 per share higher), which is 36% to 47% higher than the headline earnings of US$0.94 per share reported for FY 2023. The increase in headline earnings was driven by the higher realised gold price.

Headline earnings per share for continuing operations for FY 2024 are expected to range from US$1.28 -1.38 per share (US$0.37-0.47 per share higher), which is 41% to 52% higher than the headline earnings for continuing of US$0.91 per share reported for FY 2023.

Headline earnings per share for discontinued operations for FY 2024 are expected to be US$nil compared to US$0.03 per share reported for FY 2023.

Basic earnings

Basic earnings per share for FY 2024 are expected to range from US$1.34 -1.44 per share (US$0.55-0.65 per share higher), which is 70% to 82% higher than the basic earnings of US$0.79 per share reported for FY 2023. FY 2024 basic earnings included higher revenue driven by the higher gold price and lower impairments of assets of US$4m compared to US$156m in FY 2023.

Basic earnings per share for continuing operations for FY 2024 are expected to range from US$1.34 -1.44 (US$0.53-0.63 per share higher), which is 65% to 78% higher than the headline earnings for continuing operations of US$0.81 per share reported for FY 2023.

Basic earnings per share for discontinued operations for FY 2024 are expected to be US$nil compared to a basic loss of US$0.02 per share reported for FY 2023.

Normalised profit

Normalised profit per share for FY 2024 is expected to range from US$1.32-1.42 per share (US$0.31-0.41 per share higher), which is 31% to 41% higher than the normalised profit of US$1.01 per share reported for FY 2023.

Gold Fields expects to release FY 2024 financial results on Thursday, 20 February 2025.

6 February 2025

Sponsor:

J.P. Morgan Equities South Africa (Pty) Ltd

Investor enquiries:

Jongisa Magagula

Tel: +27 11 562 9775

Mobile: +27 67 419 9503

Email: Jongisa.Magagula@goldfields.com

Thomas Mengel

Tel: +27 11 562 9849

Mobile: +27 72 493 5170

Email: Thomas.Mengel@goldfields.com

Financial information

This trading statement includes certain non-International Financial Reporting Standards (IFRS) financial measures, including AISC, AIC and normalised profit. These measures may not be comparable to similarly-titled measures used by other companies and are not measures of Gold Fields’ financial performance under IFRS. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

The financial and operational information on which this trading statement is based has not been reviewed, nor reported on by the Company’s external auditors.

Forward-looking statements

This trading statement contains forward-looking statements within the meaning of the “safe harbour” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this trading statement may be forward-looking statements. Forward-looking statements may be identified by the use of words such as “aim”, “anticipate”, “will”, “would”, “expect”, “may”, “could”, “believe”, “target”, “estimate”, “project” and words of similar meaning.

These forward-looking statements, including among others, those relating to Gold Fields’ future business strategy, development activities and other initiatives, business prospects, financial positions, production and operational guidance are necessary estimates reflecting the best judgement of the senior management of Gold Fields and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in Gold Fields’ Integrated Annual Report 2023 filed with the Johannesburg Stock Exchange and the Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) on 28 March 2024 (SEC File no. 001-31318). Readers are cautioned not to place undue reliance on such statements. These forward-looking statements speak only as of the date they are made. Gold Fields undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this trading statement or to reflect the occurrence of unanticipated events. These forward-looking statements have not been reviewed or reported on by the Company’s external auditors.

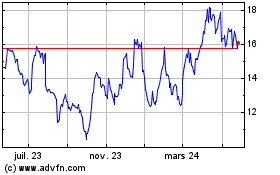

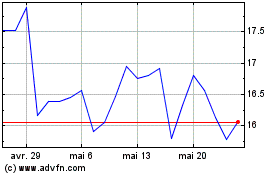

Gold Fields (NYSE:GFI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Gold Fields (NYSE:GFI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025