- Company Reports Profitable Performance,

Maintains Strong Balance Sheet -

The Marygold Companies, Inc. (“TMC” or the “Company”) (NYSE

American: MGLD) (formerly Concierge Technologies, Inc.), a

diversified global holding firm, today reported financial results

for the fiscal year ended June 30, 2023.

Net revenues for the 2023 fiscal year amounted to $34.9 million,

compared with $37.8 million for the 2022 fiscal year. Net income

for fiscal 2023 rose slightly to $1.2 million, equal to $0.03 per

fully diluted share, from $1.1 million, also equal to $0.03 per

fully diluted share, in the prior fiscal year.

For the fourth quarter ended June 30, 2023, revenues were $8.9

million, compared with $9.9 million for the same period last year.

Net income for the most recent fourth quarter was $326 thousand,

equal to $.01 per share, compared with $1.1 million, or $0.3 per

fully diluted share, for the prior year period.

The Company’s balance sheet remained strong at the close of the

2023 fiscal year. Total stockholders’ equity rose to $30.4 million

at June 30, 2023, from $29.0 million a year ago. Total assets at

fiscal year-end remained constant at $35.3 million. Cash and cash

equivalents at the close of fiscal 2023 were $8.2 million, versus

$12.9 million at June 30, 2022, with the decline principally

attributable to a movement of cash to short term equity

investments, which increased to $11.5 million versus $5.1 million

in the prior year, as well as expenses associated with completing

the development of the Company’s mobile fintech app, which recently

was soft-launched by TMC’s subsidiary, Marygold & Co. TMC again

ended the year essentially debt-free.

Lower assets under management (AUM) at TMC’s principal

subsidiary, USCF Investments, along with new fund startup costs,

impacted USCF’s revenues for fiscal 2023, which amounted to $20.9

million, versus $23.8 million for the prior year. USCF had average

AUM of $3.7 billion for fiscal 2023, compared with $4.4 billion

last year.

Results for The Marygold Companies’ other principal operating

subsidiaries – Gourmet Foods, Brigadier Security Systems, Marygold

& Co (UK), and Original Sprout – were impacted by a number of

factors during fiscal 2023, including the inflationary pressures

that affected the cost of raw materials, along with higher shipping

and labor expenses and unfavorable currency translation at the

Company’s New Zealand operation.

“Gourmet Foods, Brigadier Security Systems, and Marygold &

Co (UK) were all profitable for the year, however Original Sprout

sustained an operating loss, as it shifts its business model to

address post-COVID-19 changes in consumer buying habits. While

Original Sprout faced an erosion of profit margins and a fragmented

sales channel during the past year due to online shopping trends

effecting its long-standing domestic distribution model, management

is in the final stages of correcting this situation and expects a

return to growth in the new fiscal year.

“Additionally, we are anticipating moderate growth at Brigadier

through new, focused management initiatives and partnering with

local telecoms and contractors, and we expect Gourmet Foods to be

operating more efficiently, as low margin products are eliminated

and new channels to market are established,” Neibert added.

Nicholas Gerber, TMC’s Chief Executive Officer, said, “Fiscal

2023 marked the completion of the initial development stage and the

nationwide soft launch of our new mobile fintech app, an innovative

digital platform that enables users to spend, invest and save with

FDIC-insured accounts. The launch culminated nearly four years of

development and more than $9 million of investments by TMC,

entirely funded from internal cash flow, while our Company remained

debt-free. We look forward to implementing marketing plans for the

app in the new fiscal year.”

“As CEO, I appreciate the talent and hard work it has taken for

us to reach this product development milestone,” Gerber said. “As

well, I wish to thank our shareholders for their patience and

express my gratitude to the entire Marygold team throughout the

world for their dedication to making our Company a success and for

working collaboratively and diligently to position TMC for future

growth and to create long-term value for of all of our

stakeholders.”

Business Units

The Company’s USCF Investments subsidiary,

www.uscfinvestments.com, acquired in December 2016 and based in

Walnut Creek, Calif., serves as manager, operator or investment

adviser to 15 exchange traded products, structured as limited

partnerships or investment trusts that issue shares trading on the

NYSE Arca.

Gourmet Foods, https://gourmetfoodsltd.co.nz/, acquired in

August 2015, is a commercial-scale bakery that produces and

distributes iconic meat pies and pastries throughout New Zealand

under the brand names Pat’s Pantry and Ponsonby Pies. Acquired by

Gourmet Foods in July 2020, Printstock Products Limited

https://www.printstocknz.com/, is a printer of specialized food

wrappers and is located in Napier, New Zealand. Its operations are

consolidated with those of Gourmet Foods.

Brigadier Security Systems, www.brigadiersecurity.com, acquired

in June 2016 and headquartered in Saskatoon, Canada, provides

comprehensive security solutions to homes and businesses,

government offices, schools and other public buildings throughout

the province under the brands Brigadier Security Systems in

Saskatoon and Elite Security in Regina, Canada.

Acquired at the end of 2017, San Clemente, Calif.-based Original

Sprout, www.originalsprout.com, produces and distributes a full

line of vegan, safe, non-toxic hair and skin care products,

including a “reef safe” sun screen, in the U.S. and its

territories, the U.K., E.U., Turkey, Middle East, Africa, Taiwan,

Mexico, South America, Singapore, Hong Kong, Malaysia, New Zealand,

Australia and Canada among other areas.

Marygold & Co., formed in the U.S. during 2019 and operating

from offices in Denver, CO, together with its wholly owned

subsidiary, Marygold & Co. Advisory Services, LLC, was

established to explore opportunities in the financial technology

sector. The company continues further development of a fintech

mobile banking app., having completed the initial development stage

and soft launch in the U.S. in June 2023.

https://marygoldandco.com/

Marygold & Co. (UK) Limited, formed in the U.K. during

August 2021, operates through its subsidiary acquired in 2022,

Tiger Financial & Asset Management Limited (“Tiger”), a U.K.

based investment adviser. Tiger’s core business is managing

clients’ financial wealth across a diverse product range, including

cash, national savings, individual savings accounts, unit trusts,

insurance company products such as investment bonds and other

investment vehicles. http://www.tfam.co.uk/

About The Marygold Companies, Inc.

The Marygold Companies, Inc., which changed its name from

Concierge Technologies, Inc. in March 2022, was founded in 1996 and

repositioned as a global holding firm in 2015. The Company

currently has operating subsidiaries in financial services, food

manufacturing, printing, security systems and beauty products,

under the trade names USCF Investments, Tiger Financial & Asset

Management Limited, Gourmet Foods, Printstock Products, Brigadier

Security Systems and Original Sprout, respectively. Offices and

manufacturing operations are in the U.S., New Zealand, U.K., and

Canada. For more information, visit

www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may” “will,” “could,” “should”

“believes,” “predicts,” “potential,” “continue” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements, including, but not

limited to, a return to growth for the Original Sprout subsidiary,

growth at Brigadier and implanting marketing plans for the

Company’s new fintech mobile banking app, involve significant risks

and uncertainties that could cause actual results to differ

materially from the expected results and, consequently, should not

be relied upon as predictions of future events. These

forward-looking statements, including the factors disclosed in the

Company’s Annual Report on Form 10-K filed with the Securities and

Exchange Commission on September 25, 2023, and in the Company’s

other filings with the Securities and Exchange Commission, are not

exclusive. Readers are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. Except as required by law, the Company disclaims any

obligation to update or publicly announce any revisions to any of

the forward-looking statements contained in this press release.

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

June 30, 2023

June 30, 2022

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

8,161,167

$

12,915,620

Accounts receivable, net

1,352,210

959,350

Accounts receivable - related parties

1,673,895

2,230,874

Inventories

2,254,139

2,200,742

Prepaid income tax and tax receivable

991,797

1,166,318

Investments, at fair value

11,480,981

5,065,931

Other current assets

904,153

699,547

Total current assets

26,818,342

25,238,382

Restricted cash

425,043

1,013,279

Property, plant and equipment, net

1,255,302

1,391,894

Operating lease right-of-use asset

821,021

1,357,686

Goodwill

2,307,202

2,307,202

Intangible assets, net

2,329,970

2,708,896

Deferred tax assets, net - United

States

771,287

753,078

Other assets

552,660

540,160

Total assets

$

35,280,827

$

35,310,577

LIABILITIES AND STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES

Accounts payable and accrued expenses

$

2,711,931

$

2,805,790

Expense waivers – related parties

58,685

70,199

Operating lease liabilities, current

portion

457,309

660,957

Purchase consideration payable

604,990

1,237,207

Loans - property and equipment, current

portion

358,802

33,496

Total current liabilities

4,191,717

4,807,649

LONG-TERM LIABILITIES

Loans - property and equipment, net of

current portion

88,516

459,178

Operating lease liabilities, net of

current portion

380,535

743,923

Deferred tax liabilities, net -

foreign

242,289

260,553

Total long-term liabilities

711,340

1,463,654

Total liabilities

4,903,057

6,271,303

STOCKHOLDERS' EQUITY

Preferred stock, $0.001 par value;

50,000,000 shares authorized

Series B: 49,360 shares issued and

outstanding at June 30, 2023 and at June 30, 2022

49

49

Common stock, $0.001 par value;

900,000,000 shares authorized; 39,383,459 shares issued and

outstanding at June 30, 2023 and at June 30, 2022

39,384

39,384

Additional paid-in capital

12,396,722

12,313,205

Accumulated other comprehensive loss

(144,840

)

(234,790

)

Retained earnings

18,086,455

16,921,426

Total stockholders' equity

30,377,770

29,039,274

Total liabilities and stockholders'

equity

$

35,280,827

$

35,310,577

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

Year Ended June 30,

2023

Year Ended June 30,

2022

Net revenue

Fund management - related party

$

20,862,191

$

23,835,348

Food products

7,631,837

7,930,888

Security systems

2,832,531

2,533,098

Beauty products

3,033,100

3,529,789

Financial services

517,075

-

Net revenue

34,876,734

37,829,123

Cost of revenue

8,750,546

9,194,783

Gross profit

26,126,188

28,634,340

Operating expense

Salaries and compensation

10,042,155

8,812,081

General and administrative expense

7,075,639

6,794,645

Fund operations

4,387,004

4,600,535

Marketing and advertising

2,623,965

2,985,659

Depreciation and amortization

577,086

561,019

Legal settlement

-

2,500,000

Total operating expenses

24,705,849

26,253,939

Income from operations

1,420,339

2,380,401

Other income (expense):

Interest and dividend income

274,932

35,357

Interest expense

(19,940

)

(31,512

)

Other (expense), net

(81,313

)

(26,125

)

Total other income (expense), net

173,679

(22,280

)

Income before income taxes

1,594,018

2,358,121

Provision of income taxes

(428,989

)

(1,212,400

)

Net income

$

1,165,029

$

1,145,721

Weighted average shares of common

stock

Basic

40,370,659

39,034,611

Diluted

40,403,999

39,034,611

Net income per common share

Basic

$

0.03

$

0.03

Diluted

$

0.03

$

0.03

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

Year Ended June 30,

2023

Year Ended June 30,

2022

Net income

$

1,165,029

$

1,145,721

Other comprehensive income:

Foreign currency translation gain

(loss)

89,950

(377,371

)

Comprehensive income

$

1,254,979

$

768,350

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

STOCKHOLDERS' EQUITY

FOR THE YEARS ENDED JUNE 30,

2023 AND 2022

Period Ending June 30, 2023

Preferred Stock (Series

B)

Common Stock

Number of Shares

Amount

Number of Shares

Par Value

Additional Paid - in

Capital

Accumulated Other

Comprehensive Income (Loss)

Retained Earnings

Total Stockholders'

Equity

Balance at July 1, 2021

49,360

$

49

37,485,959

$

37,486

$

9,330,843

$

142,581

$

15,775,705

$

25,286,664

Loss on currency translation

-

-

-

-

-

(377,371

)

-

(377,371

)

Issuance of common stock in public

offering, net of issuance costs $549,090

-

-

1,897,500

1,898

2,982,362

-

-

2,984,260

Net income

-

-

-

-

-

-

1,145,721

1,145,721

Balance at June 30, 2022

49,360

$

49

39,383,459

$

39,384

$

12,313,205

$

(234,790

)

$

16,921,426

$

29,039,274

Gain on currency translation

-

-

-

-

-

89,950

-

89,950

Stock-based compensation

-

-

-

-

83,517

-

-

83,517

Net income

-

-

-

-

-

-

1,165,029

1,165,029

Balance at June 30, 2023

49,360

$

49

39,383,459

$

39,384

$

12,396,722

$

(144,840

)

$

18,086,455

$

30,377,770

THE MARYGOLD COMPANIES, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

For the Year Ended

June 30,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

1,165,029

$

1,145,721

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

577,086

561,019

Bad debt expense

1,427

4,350

Impairment of inventory value and

provision

2,698

10,509

Deferred taxes

(36,474

)

51,689

Stock-based compensation

83,517

-

Unrealized loss (gain) on investments

125,570

(28,474

)

Gain on disposal of equipment

-

(17,455

)

Operating lease right-of-use asset -

non-cash lease cost

656,600

764,311

Decrease (increase) in current assets:

Accounts receivable

(411,175

)

44,356

Accounts receivable - related party

556,979

(192,820

)

Prepaid income taxes and tax

receivable

172,592

(431,005

)

Inventories

(81,868

)

(379,905

)

Other current assets

(204,417

)

(287,750

)

(Decrease) increase in operating

liabilities:

Accounts payable, accrued expenses and

legal settlement

(74,022

)

(1,048,279

)

Operating lease liabilities

(670,639

)

(777,082

)

Expense waivers - related party

(11,514

)

515

Net cash provided by (used in) operating

activities

1,851,389

(580,300

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Cash paid for acquisition of business,

net

-

(508,851

)

Proceeds from sale of property, plant and

equipment

-

31,612

Purchase of property, plant and

equipment

(94,730

)

(44,041

)

Payment of purchase consideration

payable

(623,592

)

-

Proceeds from sale of investments

9,281,197

508,122

Purchase of investments

(15,855,058

)

(3,712,250

)

Net cash used in investing activities

(7,292,183

)

(3,725,408

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Repayment of related party loans

-

(603,500

)

Repayment of property and equipment

loans

(14,732

)

(41,884

)

Principal payments of finance lease

liability

(5,573

)

-

Proceeds from issuance of common stock,

net of issuance costs

-

2,984,260

Net cash (used in) provided by financing

activities

(20,305

)

2,338,876

Effect of exchange rate change on cash and

cash equivalents

118,410

(191,213

)

NET DECREASE IN CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

(5,342,689

)

(2,158,045

)

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, BEGINNING BALANCE

13,928,899

16,086,944

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, ENDING BALANCE

$

8,586,210

$

13,928,899

Cash and cash equivalents

8,161,167

12,915,620

Restricted cash

425,043

1,013,279

Total cash, cash equivalents and

restricted cash shown in statement of cash flows

$

8,586,210

$

13,928,899

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Interest paid

$

15,493

$

16,401

Income taxes paid, net

$

231,693

$

1,704,970

NON CASH INVESTING AND FINANCING

ACTIVITIES:

Purchase consideration payable

$

-

$

1,237,207

Acquisition of operating right-of-use

assets through operating lease liability

$

103,603

$

1,057,965

Fair value of warrants of common stock

issued to underwriters

$

-

$

132,000

Acquisition of equipment through finance

lease liability

$

-

$

150,625

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230925004802/en/

Media and investors, for more Information, contact: Roger

S. Pondel PondelWilkinson Inc. 310-279-5965 rpondel@pondel.com

Contact the Company: David Neibert, Chief Operations

Officer 949-429-5370 dneibert@themarygoldcompanies.com

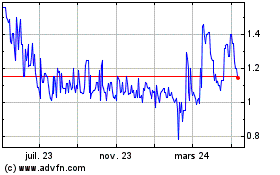

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

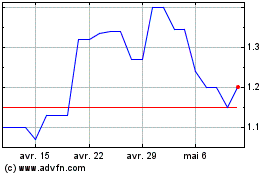

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025