Regulatory News:

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA AND JAPAN

Aelis Farma (ISIN: FR0014007ZB4 – Ticker: AELIS – the

"Company"), a clinical-stage biopharmaceutical company

specialized in the development of treatments for brain diseases,

today announces the successful completion of its capital increase

without shareholders’ preferential subscription rights reserved to

specific categories of investors, in accordance with Article L.

225-138 of the French Commercial Code, for a total gross amount of

approximately €4.5 million (the “Reserved Offering”),

through the issuance of 448,824 new ordinary shares (the “New

Shares”), at a price of €10 per New Share (the “Offering

Price”).

The net proceeds from the Reserved Offering, which are estimated

to be approximately €4.0 million, will be used to fund:

- the continued development of its CB1-SSi therapeutic candidates

by performing pre-clinical proof of concept studies to select:

- A new CB1-SSi for obesity related metabolic diseases and

pathological fibrotic conditions

- A new CB1-SSi for Dopamine dependent Brain Disorders as for

example Attention Deficit Hyperactivity Disorders (ADHD) and/or

dopamine hyperactivity related orphan diseases

- working capital and other general corporate purposes.

The Company estimates that, on the basis on the planned

expenditures, the total cash and cash equivalents as at December

31, 2023, of €20.2 million, and the funds raised, will be able to

finance its operations to Q4 2026.

Pier Vincenzo Piazza, CEO of Aelis Farma, commented: “We

sincerely thank the investors that have expressed an interest in

our company triggering the launch and success of this offering.

Their participations allow us to continue to expand our shareholder

base, accommodating new high-quality investors and to accelerate

the development of the new families of CB1-SSi produced by our

platform.”

Main characteristics of the Reserved Offering

The Reserved Offering, for a total amount of €4,488,240,

was carried out by the issue of 448,824 New Shares, without

shareholders’ preferential subscription rights, for the benefit of

specific categories of investors, in accordance with the 15th and

the 23rd resolutions of the annual general meeting of June 4, 2024

(the “AGM”) and pursuant to Article L.225-138 of the French

Commercial Code.

Upon completion of the Reserved Offering, the share capital of

the Company will be composed of 13,706,586 ordinary shares with a

par value of €0.01 each. The 448,824 newly issued ordinary shares,

represent approximately 3.4% of the Company's share capital, on a

non-diluted basis, before completion of the Reserved Offering and

3.3% of the Company's share capital, on a non-diluted basis, after

completion of the Reserved Offering. By way of illustration, a

shareholder holding 1% of the share capital prior to the Reserved

Offering and which did not participate in the Reserved Offering

will hold 0.97% after completion of the Reserved Offering.

The Offering Price has been set at €10 per New Share,

representing a discount of approximately 15% to the Company’s

shares on the Euronext Paris regulated market at the time of the

last trading session preceding its setting (i.e. July 30, 2024) in

accordance with the decisions of the Company's Chief Executive

Officer pursuant to the sub-delegations of authority granted by the

Company's Board of Directors on July 30, 2024, in accordance with

the 15th resolution of the AGM.

To the Company's knowledge, the breakdown of shareholders before

and after completion of the Reserved Offering is as follows:

Shareholder

Pre Reserved Offering

(non-diluted basis)

Post Reserved Offering

(non-diluted basis)

Number of ordinary shares

held

Percentage of share

capital

Number of ordinary shares

held

Percentage of share

capital

Aquitaine Region & the Aquitaine

Regional Funds

3,178,578

23.98%

3,178,578

23.19%

Pier Vincenzo Piazza

2,432,831

18.35%

2,432,831

17.75%

FPS Bpifrance Innovation 1

1,821,553

13.74%

1,821,553

13.29%

Inserm Transfert Initiative

1,604,447

12.10%

1,604,447

11.71%

Aelis Innovation

817,006

6.16%

817,006

5.96%

Indivior PLC

701,469

5.29%

701,469

5.12%

Admission of New Shares

Settlement-delivery of the New Shares and their admission to

trading on the Euronext Paris regulated market are expected to

occur on August 2, 2024. The New Shares will be of the same class

and fungible with the existing shares, will carry all rights

attached to the shares, and will be admitted to trading on the

Euronext Paris regulated market under the same ISIN code

FR0014007ZB4.

Financial Intermediaries

Stifel Europe Bank AG (“Stifel”) is acting as Sole Global

Coordinator and Sole Bookrunner in connection with the Reserved

Offering. Stifel is also acting as Centralizing Agent. The Reserved

Offering is subject to a placement agreement entered into between

the Company and Stifel dated July 30, 2024 and has been completed

by a term of issue on pricing. Such agreement does not constitute a

firm undertaking (garantie de bonne fin) within the meaning of

article L. 225-145 of the French Commercial Code.

Lock-up undertakings

In connection with the Reserved Offering, the Company has

undertaken with Stifel to refrain from issuing shares for a period

of 90 calendar days from the settlement-delivery date of the

Reserved Offering, subject to customary exceptions. In connection

with the Reserved Offering, management has entered into a lock-up

agreement with Stifel for a period ending 90 calendar days after

the settlement-delivery date of the Reserved Offering, subject to

customary exceptions.

Prospectus

The Reserved Offering is not subject to a prospectus requiring

an approval from the French Financial Markets Authority (Autorité

des Marchés Financiers) (the "AMF").

Risk factors

The investors’ attention is drawn to the risk factors relating

to the Company and its business, presented in chapter 3 of the

universal registration document 2023 approved by the AMF on April

24, 2024 under number R.24-004, which is available free of charge

on the Company's website (www.aelisfarma.com/investors) and on the

AMF’s website (www.amf-france.org). The occurrence of any or all of

these risks could have an adverse effect on the Company's business,

financial situation, results, development or prospects.

In addition, investors are invited to consider the following

risks specific to the issue: (i) the market price of the Company's

shares could fluctuate and fall below the Offering Price of the

shares issued under the Reserved Offering, (ii) the volatility and

liquidity of the Company's shares could fluctuate significantly,

(iii) sales of the Company's shares could occur on the market and

have an unfavorable impact on the Company's share price, and (iv)

the Company's shareholders could suffer potentially significant

dilution as a result of any future capital increases made necessary

by the Company's search for financing.

About AELIS FARMA

Founded in Bordeaux in 2013, Aelis Farma is a biopharmaceutical

company that is developing a new class of drugs, the

Signaling-Specific inhibitors of the CB1 receptor of the

endocannabinoid system (CB1-SSi). CB1-SSi have been developed by

Aelis Farma based on the discovery of a natural regulatory

mechanism of CB1 hyperactivity made by the team led by Dr. Pier

Vincenzo Piazza, the Company’s CEO, when he was director of

Neurocentre Magendie of the INSERM in Bordeaux. By mimicking this

natural mechanism, CB1-SSi appear to selectively inhibit the

disease-related activity of the CB1 receptor without disrupting its

normal physiological activity. CB1-SSi have consequently the

potential to provide new safe treatments for several brain

diseases.

Aelis Farma is currently developing two first-in-class

clinical-stage drug candidates: AEF0117 for the treatment of

cannabis use disorder (CUD), that has just completed a phase 2b

study in the United States with results expected to be released in

September 2024; and AEF0217 for cognitive disorders, including

those of Down Syndrome (Trisomy 21), that has completed the

recruitement of a phase 1/2 study in Spain in people with Down

syndrome, and which results are expected to be released in Q4 2024.

The Company also has a portfolio of new innovative CB1-SSi for the

treatment of other disorders associated with a dysregulation of the

activity of the CB1 receptor.

Aelis Farma draws on the talents of more than 25 highly

qualified employees.

For more information, visit www.aelisfarma.com and follow us on

LinkedIn and Twitter.

ISIN: FR0014007ZB4 Ticker: AELIS B Compartment

of Euronext Paris

Disclaimer

In France, the offer of Aelis Farma shares described below will

be made in the context of a reserved offering to the benefit of

categories of persons in accordance with Article L.225-138 of the

French Commercial Code (Code de commerce). Pursuant to article

211-3 of the General regulations of the French financial markets

authority (Autorité des marchés financiers) (the “AMF”), articles

1(4) and 3 of the Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017, as amended (the

“Prospectus Regulation”) and any applicable regulation, the offer

of Aelis Farma shares will not require the publication of a

prospectus approved by the AMF.

With respect to Member States of the European Economic Area, no

action has been taken or will be taken to permit a public offering

of the securities referred to in this press release requiring the

publication of a prospectus in any Member State. Therefore, such

securities may not be and shall not be offered in any Member State

other than in accordance with the exemptions of Article 1(4) of the

Prospectus Regulation or, otherwise, in cases not requiring the

publication of a prospectus under Article 3 of the Prospectus

Regulation and/or the applicable regulations in such Member

State.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom and are (i)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Order”), (ii) high net worth entities and

other such persons falling within Article 49(2)(a) to (d) of the

Order (“high net worth companies”, “unincorporated associations”,

etc.) or (iii) other persons to whom an invitation or inducement to

participate in investment activity (within the meaning of Section

21 of the Financial Services and Market Act 2000) may otherwise

lawfully be communicated or caused to be communicated (all such

persons in (y)(i), (y)(ii) and (y)(iii) together being referred to

as “Relevant Persons”). Any invitation, offer or agreement to

subscribe, purchase or otherwise acquire securities to which this

press release relates will only be engaged with Relevant Persons.

Any person who is not a Relevant Person should not act or rely on

this press release or any of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained herein does not, and will not, constitute

an offer of Aelis Farma’s shares for sale or subscription, nor the

solicitation of an offer to subscribe for or to purchase, such

shares in the United States or any other jurisdiction where

restrictions may apply. Securities may not be offered or sold in

the United States absent registration or an exemption from

registration under the U.S. Securities Act of 1933, as amended (the

“Securities Act”). The shares of Aelis Farma have not been and will

not be registered under the Securities Act, and Aelis Farma does

not intend to conduct a public offering in the United States.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Aelis Farma must be made solely based on information

publicly available about Aelis Farma. Such information is not the

responsibility of Stifel and has not been independently verified by

Stifel.

Forward-looking statements

This press release contains certain forward-looking statements

about Aelis Farma. These statements include financial projections

and estimates and their underlying assumptions, statements

regarding plans, objectives, intentions and anticipated results as

well as events, operations, future services or product development

and potential or future performance. Forward-looking statements are

generally identified by the words “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “anticipates”, “projects”,

“seeks”, “endeavors”, “strives”, “aims”, “hopes”, “plans”, “may”,

“goal”, “objective”, “projection”, “outlook” and similar

expressions. Although the management of Aelis Farma believes that

these forward-looking statements are reasonably made, investors and

holders of the Company’s securities are cautioned that these

forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors, a large number of

which are difficult to predict and generally outside the control of

Aelis Farma, that may cause actual results, performance or

achievements to be materially different from any future results,

performance or achievement expressed or implied by these

forward-looking statements. These risks and uncertainties include

those developed or identified in any public documents approved by

the French financial markets authority (the Autorité des marchés

financiers – the “AMF”) made or to be made by the group, in

particular those described in Chapter 3 “Risk factors” of the 2023

universal registration document approved by the AMF on April 24,

2024 under number R.24-004.

These forward-looking statements are given only as of the date

of this press release and Aelis Farma expressly declines any

obligation or commitment to publish updates or corrections of the

forward-looking statements included in this press release in order

to reflect any change affecting the forecasts or events, conditions

or circumstances on which these forward-looking statements are

based. Any information relating to past performance contained

herein is not a guarantee of future performance. Nothing herein

should be construed as an investment recommendation or as legal,

tax, investment or accounting advice.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731212744/en/

AELIS FARMA Arsène Guekam Chief Corporate Development

Officer contact@aelisfarma.com

NewCap Dusan Oresansky / Aurélie Manavarere Investor

Relations aelis@newcap.eu +33 1 44 71 94 92

NewCap Arthur Rouillé Media Relations aelis@newcap.eu +33

1 44 71 00 15

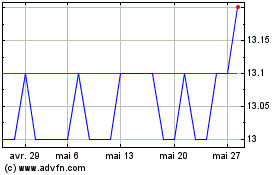

Aelis Farma (EU:AELIS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Aelis Farma (EU:AELIS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025