First Trust Advisors L.P. ("FTA") announces the declaration of

the Monthly distribution for First Trust Income Opportunities ETF,

a series of First Trust Exchange-Traded Fund VIII.

The following dates apply to today's

distribution declaration:

Expected Ex-Dividend Date:

October 11, 2024

Record Date:

October 11, 2024

Payable Date:

October 31, 2024

Ticker

Exchange

Fund

Name

Frequency

Ordinary

Income

Per

Share

Amount

ACTIVELY MANAGED

EXCHANGE-TRADED FUNDS

First Trust Exchange-Traded

Fund VIII

FCEF

Nasdaq

First Trust Income Opportunities

ETF

Monthly

$0.1350

First Trust Advisors L.P. ("FTA") is a federally registered

investment advisor and serves as the Fund's investment advisor. FTA

and its affiliate First Trust Portfolios L.P. ("FTP"), a FINRA

registered broker-dealer, are privately-held companies that provide

a variety of investment services. FTA has collective assets under

management or supervision of approximately $245 billion as of

September 30, 2024 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. FTA is the supervisor of the First Trust unit investment

trusts, while FTP is the sponsor. FTP is also a distributor of

mutual fund shares and exchange-traded fund creation units. FTA and

FTP are based in Wheaton, Illinois.

You should consider the investment objectives, risks, charges

and expenses of the Fund before investing. The prospectus for the

Fund contains this and other important information and is available

free of charge by calling toll-free at 1-800-621-1675 or

visiting www.ftportfolios.com. The prospectus should

be read carefully before investing.

Principal Risk Factors: You could lose money by investing in

a fund. An investment in a fund is not a deposit of a bank and is

not insured or guaranteed. There can be no assurance that a fund's

objective(s) will be achieved. Investors buying or selling shares

on the secondary market may incur customary brokerage commissions.

Please refer to each fund's prospectus and Statement of Additional

Information for additional details on a fund's risks. The order of

the below risk factors does not indicate the significance of any

particular risk factor.

Past performance is no assurance of future results. Investment

return and market value of an investment in a Fund will fluctuate.

Shares, when sold, may be worth more or less than their original

cost.

A Fund's shares will change in value, and you could lose money

by investing in a Fund. An investment in a Fund is not a deposit of

a bank and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other governmental agency. There can

be no assurance that a Fund's investment objectives will be

achieved. An investment in a Fund involves risks similar to those

of investing in any portfolio of equity securities traded on

exchanges. The risks of investing in each Fund are spelled out in

its prospectus, shareholder report, and other regulatory

filings.

ETF shares may only be redeemed directly from a fund by

authorized participants in very large creation/redemption units.

ETF shares may trade at a discount to net asset value and possibly

face delisting.

All or a portion of a fund's otherwise tax exempt interest

dividends may be taxable to those shareholders subject to the

federal and state alternative minimum tax.

Securities of small- and mid-capitalization companies may

experience greater price volatility and be less liquid than larger,

more established companies whereas large capitalization companies

may grow at a slower rate than the overall market.

A fund that effects all or a portion of its creations and

redemptions for cash rather than in-kind may be less tax

efficient.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. As a means to fight inflation, the

Federal Reserve and certain foreign central banks have raised

interest rates; however, the Federal Reserve has recently lowered

interest rates and may continue to do so. Recent and potential

future bank failures could result in disruption to the broader

banking industry or markets generally and reduce confidence in

financial institutions and the economy as a whole, which may also

heighten market volatility and reduce liquidity. Ongoing armed

conflicts between Russia and Ukraine in Europe and among Israel,

Hamas and other militant groups in the Middle East, have caused and

could continue to cause significant market disruptions and

volatility within the markets in Russia, Europe, the Middle East

and the United States. The hostilities and sanctions resulting from

those hostilities have and could continue to have a significant

impact on certain fund investments as well as fund performance and

liquidity. The COVID-19 global pandemic, or any future public

health crisis, and the ensuing policies enacted by governments and

central banks have caused and may continue to cause significant

volatility and uncertainty in global financial markets, negatively

impacting global growth prospects.

A fund normally distributes income it earns, so a fund may be

required to reduce its distributions if it has insufficient income.

Distributions in excess of a Fund's current and accumulated

earnings and profits will be treated as a return of capital. There

may be other circumstances when all or a portion of a Fund’s

distribution is treated as a return of capital, for example, there

are times when Fund securities are sold to cover a derivative

position that generated all or a portion of the distribution that

could lead to a return of capital.

A fund is susceptible to operational risks through breaches in

cyber security. Such events could cause a fund to incur regulatory

penalties, reputational damage, additional compliance costs

associated with corrective measures and/or financial loss.

In managing a fund's investment portfolio, the portfolio

managers will apply investment techniques and risk analyses that

may not have the desired result.

Market risk is the risk that a particular security, or shares of

a fund in general may fall in value. Securities are subject to

market fluctuations caused by such factors as general economic

conditions, political events, regulatory or market developments,

changes in interest rates and perceived trends in securities

prices. Shares of a fund could decline in value or underperform

other investments as a result. In addition, local, regional or

global events such as war, acts of terrorism, spread of infectious

disease or other public health issues, recessions, natural

disasters or other events could have significant negative impact on

a fund.

A fund with significant exposure to a single asset class,

country, region, industry, or sector may be more affected by an

adverse economic or political development than a broadly

diversified fund.

Commodity prices can have a significant volatility and exposure

to commodities can cause the value of a fund's shares to decline or

fluctuate in a rapid and unpredictable manner.

Certain securities are subject to call, credit, extension,

income, inflation, interest rate, prepayment and zero coupon risks.

These risks could result in a decline in a security's value and/or

income, increased volatility as interest rates rise or fall and

have an adverse impact on a fund's performance.

The use of listed and OTC derivatives, including futures,

options, swap agreements and forward contracts, can lead to losses

because of adverse movements in the price or value of the

underlying asset, index or rate, which may be magnified by certain

features of the derivatives.

Securities of non-U.S. issuers are subject to additional risks,

including currency fluctuations, political risks, withholding, the

lack of adequate financial information, and exchange control

restrictions impacting non-U.S. issuers. These risks may be

heightened for securities of companies located in, or with

significant operations in, emerging market countries.

A fund may invest in the shares of other funds, which involves

additional expenses that would not be present in a direct

investment in the underlying funds. In addition, a fund's

investment performance and risks may be related to the investment

performance and risks of the underlying funds.

First Trust Advisors L.P. (FTA) is the adviser to the First

Trust fund(s). FTA is an affiliate of First Trust Portfolios L.P.,

the distributor of the fund(s).

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241010287982/en/

Press Inquiries: Ryan Issakainen, 630-765-8689 Broker Inquiries:

Sales Team, 866-848-9727 Analyst Inquiries: Stan Ueland,

630-517-7633

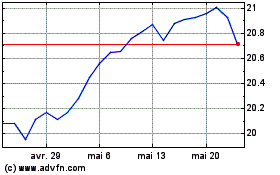

First Trust CEF VIII Fir... (NASDAQ:FCEF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

First Trust CEF VIII Fir... (NASDAQ:FCEF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025