0000798081false00007980812024-12-122024-12-12iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 12, 2024

Lakeland Industries, Inc. |

(Exact name of registrant as specified in its charter) |

Delaware | | 0-15535 | | 13-3115216 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

1525 Perimeter Parkway, Suite 325 Huntsville, AL 35806

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (256) 350-3873

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 Par Value | LAKE | NASDAQMarket |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Acquisition of Veridian

On December 16, 2024, Lakeland Industries, Inc. (the “Company”) and William A. Van Lent (the “Seller”) entered into a Stock Purchase Agreement (the “Purchase Agreement”) pursuant to which the Company agreed to purchase, and the Seller agreed to sell, all of the issued and outstanding shares of stock (the “Shares”) of Veridian Limited, an Iowa corporation (“Veridian”). The closing of the transaction (the “Closing”) also occurred on December 16, 2024. Veridian is in the business of designing, manufacturing, producing, distributing and selling fire-fighter protective clothing and gear.

Pursuant to the Purchase Agreement, the Company acquired the business of Veridian through the acquisition of the Shares for an aggregate purchase price (the “Purchase Price”) of $25.0 million, subject to post-closing adjustments and a $2.5 million holdback to secure the Seller’s indemnification obligations. The Purchase Agreement contains customary representations, warranties, and covenants, including a restrictive covenant that limits the Seller from engaging in certain business activities for three years following the Closing. In addition, the Company and the Seller have each agreed to indemnify one another for losses resulting from (i) any inaccuracy in or breach of the representations and warranties contained in the Purchase Agreement, the ancillary documents or any certificate or instrument pursuant to the Purchase Agreement and (ii) any breach or non-fulfillment of their covenants, agreements and other obligations pursuant to the Purchase Agreement and, for the Seller, its related ancillary agreements and any certificate or instrument delivered by or on behalf of the Seller pursuant the Purchase Agreement. The Seller has also agreed to indemnify the Company and its representatives for losses resulting from certain pre-closing tax matters and certain environmental and product liability matters. The parties’ indemnification obligations are subject to certain limitations, including a cap equal to $2.5 million for losses relating to any inaccuracy in or breach of any representation or warranty. The transaction was funded through the Company’s credit facility, as discussed in further detail under Item 2.03 below.

Amendment to Credit Agreement

On December 12, 2024 (the “Effective Date”), the Company and Bank of America, N.A. (the “Lender”) entered into Amendment No. 5 to Loan Agreement (the “Fifth Amendment”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Fifth Amendment.

Pursuant to the Fifth Amendment, the Lender and the Company agreed to, among other things, (i) increase the availability under the revolving credit facility from $40.0 million to $60.0 million from the Effective Date through January 31, 2026, and to $50.0 million from February 1, 2026 through January 31, 2027 (in each case, subject to reduction to no less than $40.0 million from the net proceeds of equity issuances if the Company raises capital during such periods), (ii) extend the expiration date of the credit facility to December 12, 2029; (iii) modify the Funded Debt to EBITDA Ratio covenant so that such ratio may not exceed 3.5x from the Effective Date through January 31, 2026 (with step-downs to 3.25x and 3.0x on February 1, 2026 and February 1, 2027, respectively), (iv) include a springing Asset Coverage Ratio covenant of at least 1.10x, but only to the extent that the maximum Funded Debt to EBITDA Ratio exceeds 3.25x for any reporting period, and (v) increase the size of Permitted Acquisitions, without prior consent from the Lender (but subject to the satisfaction of certain deliverables), to $26.0 million per occurrence and $36.0 million in the aggregate.

The Fifth Amendment also provided for the reaffirmation of representations, warranties and covenants under the Loan Agreement as is customary in connection with similar amendments of credit documents.

Other than the changes described above, the terms and conditions of the Loan Agreement remain in full force and effect.

The above descriptions of the Purchase Agreement and the Fifth Amendment are summaries and are not complete. They are qualified in their entirety by reference to the Purchase Agreement and the Fifth Amendment, each of which will be filed by the Company with the Company’s Annual Report on Form 10-K for the fiscal year ending January 31, 2025.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 is incorporated into this Item 2.03 by reference.

On December 16, 2024, the Company borrowed $25 million under its revolving credit facility in accordance with the Loan Agreement, dated as of June 25, 2020 and as amended by Amendment Nos. 1 - 5 thereto, by and between the Company and the Lender (as so amended, the “Loan Agreement”). The Company used the borrowings under the revolving credit facility to fully fund the acquisition of Veridian. Borrowings under the revolving credit facility established by the Loan Agreement are due upon maturity of the Loan Agreement on December 12, 2029 (subject to the required reduction in principal as discussed above in Item 1.01) and may be repaid at any time before the maturity date without prepayment penalties. Interest only payments are due monthly.

The description of the Loan Agreement in this Item 2.03 is qualified in its entirety by reference to the full text of the Fifth Amendment, which will be filed by the Company with the Company’s Annual Report on Form 10-K for the fiscal year ending January 31, 2025; the full text of Amendment No. 4 to Loan Agreement, dated as of March 28, 2024, which is filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended April 30, 2024; the full text of Amendment No. 3 to Loan Agreement, dated as of November 29, 2023, which is filed as Exhibit 10.37 to the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024; the full text of Amendment No. 2 to Loan Agreement, dated as of March 3, 2023, which is filed as Exhibit 10.36 to the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2024; the full text of Amendment No. 1 to Loan Agreement, dated as of June 18, 2021, which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 24, 2021; and the full text of the initial Loan Agreement, dated as of June 25, 2020, which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 30, 2020.

Item 7.01. Regulation FD Disclosure.

On December 16, 2024, the Company issued a press release, attached hereto as Exhibit 99.1, announcing the entry into the Purchase Agreement.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| LAKELAND INDUSTRIES, INC. | |

| | |

| /s/ Roger D. Shannon | |

| Roger D. Shannon | |

| Chief Financial Officer | |

| | |

| Date: December 16, 2024 | |

null

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

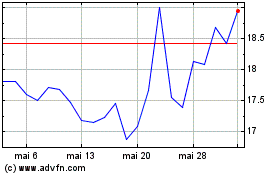

Lakeland Industries (NASDAQ:LAKE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Lakeland Industries (NASDAQ:LAKE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024