- Firms to launch first-of-its-kind model portfolio solution

streamlining retail wealth access to private equity, private

credit, and real assets

- Will enable advisors to deliver a one-stop multi-private

markets portfolio managed by two global asset managers

- Positions BlackRock and Partners Group to capture accelerating

growth in private markets and managed models

BlackRock (NYSE: BLK) and Partners Group (SIX: PGHN) have teamed

up to launch a multi-private markets models solution set to

transform how retail investors access alternative investments. The

solution will provide access to private equity, private credit and

real assets in a single portfolio – currently not available to the

U.S. wealth market – managed by BlackRock and Partners Group. This

first-of-its-kind solution will empower advisors to offer a

diversified alternatives portfolio with the simplicity, efficiency

and practice management benefits of a traditional public markets

model.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240911376934/en/

The strategic partnership combines BlackRock’s experienced

alternatives team, operational expertise, and whole portfolio

capabilities powered by Aladdin technology with Partners Group’s

long track record of innovation in bringing private markets to the

wealth market, leveraging its extensive investment platform and

portfolio management capabilities.

“We are simplifying how individual investors and advisors access

private markets,” said Mark Wiedman, Head of BlackRock’s

Global Client Business. “In a world where private markets are

growing by $1 trillion or more every year, many financial advisors

still find it too difficult to help their clients participate. We

aim to crack that. With Partners Group, we are creating a single,

managed account with unified portfolio construction and management.

The result? Simplified, efficient access for financial advisors and

their clients.”

The solution will enable ease of access through a single

subscription document versus requiring subscription documents for

each underlying fund. It will feature robust operating procedures

and risk management, including model rebalancing and comprehensive

private markets asset allocation. Retail wealth investors will

choose from three risk profiles to determine allocations to

BlackRock and Partners Groups funds, including BlackRock’s private

equity, private credit and systematic funds and Partners Group’s

private equity, growth equity and infrastructure funds.

“This separately managed account solution has the potential to

revolutionize the wealth management industry, setting a new

benchmark for institutional-quality programs that meet wealth

investors’ private markets portfolio needs,” said Steffen

Meister, Partners Group's Executive Chairman. “The financing of

business has undergone a major transformation in recent decades

with private markets playing a key role in the real economy, so it

is vital that investors have access to private markets investments

as part of a balanced portfolio.”

Retail wealth investors are leading the adoption of private

markets as they seek portfolios offering exposure to the companies

and assets they cannot access via public markets and therefore the

potential for uncorrelated returns. These investors allocated $2.3T

to private markets in 2020 and are expected to increase their

allocations to $5.1T by 2025 according to a Morgan Stanley/Oliver

Wyman Study. Managed models also present a significant growth

opportunity. BlackRock expects managed model portfolios to roughly

double in AUM over the next five years, growing into a $10-trillion

business.

Overall, BlackRock sees significant growth opportunity in U.S.

private wealth and is actively positioning the firm to become an

integral, whole portfolio partner to advisors in an increasingly

complex market. BlackRock’s U.S. Wealth Advisory business is a key

growth-driver for the firm, generating a quarter of BlackRock’s

revenues in 2023.

Partners Group has accumulated more than two decades of

leadership in managing private markets evergreen solutions since

launching its first such product in 2001. The firm launched the

first U.S. private equity evergreen fund in 2009, which today

remains the largest in the market with a total fund size of USD

15.5 billion. As of 30 June 2024, evergreen funds accounted for 30%

of Partners Group's global AUM.

To learn more about the opportunity in private markets, read

BlackRock and Partners Group's recent paper: Solving the private

markets allocation gap: From products to portfolio

construction.

Forward-Looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified

by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,”

“achieve,” and similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “may” and similar

expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate

About Partners Group

Partners Group is one of the largest firms in the global private

markets industry. The firm has investment programs and custom

mandates spanning private equity, private credit, infrastructure,

real estate, and royalties. With its heritage in Switzerland and

its primary presence in the Americas in Colorado, Partners Group is

built differently from the rest of the industry. The firm leverages

its differentiated culture and its operationally oriented approach

to identify attractive investment themes and to build businesses

and assets into market leaders. For more information, please visit

www.partnersgroup.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911376934/en/

BlackRock Christa Zipf christa.zipf@blackrock.com

+1-646-231-0013 +1-347-814-3447 Partners Group Jenny Blinch

jenny.blinch@partnersgroup.com +44 207 575 2571 +44 7825 035184

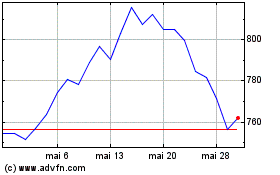

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

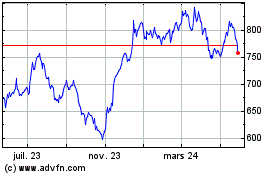

BlackRock (NYSE:BLK)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024