FY

2024

--12-31

false

0001649096

NA

NA

366052390

No

131879376

5

3

10

4

1.60

3.60

2.50

0

0

0

1

1

1

1

2

2

1

0

0

0

0

false

false

false

false

00016490962024-01-012024-12-31

thunderdome:item

iso4217:USD

00016490962023-12-31

00016490962024-12-31

00016490962023-01-012023-12-31

00016490962022-12-31

0001649096clpr:LivingstonStreetInBrooklyn141Member2024-12-31

0001649096clpr:LivingstonStreetInBrooklyn250Member2024-12-31

0001649096clpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:ResidentialPropertyAt1010PacificStreetMember2024-12-31

0001649096clpr:PropertyAt10W65thStManhattanNYMember2024-12-31

0001649096clpr:CloverHouseMember2024-12-31

0001649096clpr:FlatbushGardensBrooklynNYMember2024-12-31

0001649096clpr:AspenMember2024-12-31

0001649096clpr:TribecaHousePropertiesMember2024-12-31

0001649096clpr:O2024Q4DividendsMembersrt:ScenarioForecastMember2025-01-012025-03-31

iso4217:USDxbrli:shares

0001649096clpr:O2024Q4DividendsMembersrt:ScenarioForecastMember2025-03-31

0001649096clpr:CentralPensionFundOfTheInternationalUnionOfOperatingEngineersAndParticipatingEmployersMember2023-12-31

0001649096clpr:CentralPensionFundOfTheInternationalUnionOfOperatingEngineersAndParticipatingEmployersMember2024-12-31

0001649096clpr:CentralPensionFundOfTheInternationalUnionOfOperatingEngineersAndParticipatingEmployersMember2023-01-012023-12-31

0001649096clpr:CentralPensionFundOfTheInternationalUnionOfOperatingEngineersAndParticipatingEmployersMember2024-01-012024-12-31

xbrli:pure

0001649096clpr:BuildingService32bjPensionFundMember2023-12-31

0001649096clpr:BuildingService32bjPensionFundMember2024-12-31

0001649096clpr:BuildingService32bjPensionFundMember2023-01-012023-12-31

0001649096clpr:BuildingService32bjPensionFundMember2024-01-012024-12-31

0001649096clpr:ResidentialSegmentMember2023-01-012023-12-31

0001649096clpr:CommercialSegmentMember2023-01-012023-12-31

0001649096clpr:ResidentialSegmentMember2024-01-012024-12-31

0001649096clpr:CommercialSegmentMember2024-01-012024-12-31

0001649096clpr:ResidentialSegmentMember2023-12-31

0001649096clpr:CommercialSegmentMember2023-12-31

0001649096clpr:ResidentialSegmentMember2024-12-31

0001649096clpr:CommercialSegmentMember2024-12-31

0001649096clpr:RentalIncomeMember2023-01-012023-12-31

0001649096clpr:RentalIncomeMemberclpr:ResidentialSegmentMember2023-01-012023-12-31

0001649096clpr:RentalIncomeMemberclpr:CommercialSegmentMember2023-01-012023-12-31

0001649096clpr:RentalIncomeMember2024-01-012024-12-31

0001649096clpr:RentalIncomeMemberclpr:ResidentialSegmentMember2024-01-012024-12-31

0001649096clpr:RentalIncomeMemberclpr:CommercialSegmentMember2024-01-012024-12-31

0001649096clpr:GreenbergTraurigMember2024-01-012024-12-31

0001649096clpr:IronhoundManagementMember2024-10-102024-10-10

0001649096us-gaap:GeneralAndAdministrativeExpenseMemberclpr:ReimbursablePayrollExpenseMember2023-01-012023-12-31

0001649096us-gaap:GeneralAndAdministrativeExpenseMemberclpr:ReimbursablePayrollExpenseMember2024-01-012024-12-31

0001649096us-gaap:GeneralAndAdministrativeExpenseMemberclpr:OverheadChargedRelatedToOfficeExpensesMember2023-01-012023-12-31

0001649096us-gaap:GeneralAndAdministrativeExpenseMemberclpr:OverheadChargedRelatedToOfficeExpensesMember2024-01-012024-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:NewYorkCityMember2023-01-012023-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:ResidentialSegmentMemberclpr:NewYorkCityMember2023-01-012023-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:CommercialSegmentMemberclpr:NewYorkCityMember2023-01-012023-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:NewYorkCityMember2024-01-012024-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:ResidentialSegmentMemberclpr:NewYorkCityMember2024-01-012024-12-31

0001649096clpr:TotalRevenueMemberus-gaap:GeographicConcentrationRiskMemberclpr:CommercialSegmentMemberclpr:NewYorkCityMember2024-01-012024-12-31

0001649096clpr:ObligatedToProvideParkingMember2024-12-31

0001649096clpr:HousingRepairAndMaintenanceLetterAgreementMember2024-12-31

0001649096clpr:NYCDepartmentOfCitywideAdministrativeServicesAuditMember2024-11-222024-11-22

0001649096clpr:AttorneysMember2024-01-012024-12-31

0001649096clpr:PlaintiffsMember2024-01-012024-12-31

0001649096clpr:HornV50MurrayStreetAcquisitionLLCIndexNo15241521Member2023-09-30

0001649096clpr:HornV50MurrayStreetAcquisitionLLCIndexNo15241521Member2023-01-012023-12-31

00016490962021-10-012021-12-31

0001649096clpr:CroweLegalMatterMember2024-08-132024-08-13

0001649096clpr:TheKuzmichCaseMember2024-08-132024-08-13

0001649096clpr:TheKuzmichCaseMember2022-06-232022-06-23

0001649096clpr:TheKuzmichCaseMember2022-05-092022-05-09

0001649096us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMember2023-12-31

0001649096us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MortgagesMember2024-12-31

0001649096us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMember2023-12-31

0001649096us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:MortgagesMember2024-12-31

0001649096clpr:LivingstonStreetBrooklyn141Member2024-01-012024-12-31

0001649096clpr:LivingstonStreetBrooklyn141Member2024-12-31

0001649096clpr:OfficeSpaceAt250LivingstonMember2023-01-012023-12-31

0001649096clpr:OfficeSpaceAt250LivingstonMember2024-02-23

0001649096clpr:TotalRevenueMemberus-gaap:CustomerConcentrationRiskMemberclpr:CityOfNewYorkMember2023-01-012023-12-31

0001649096clpr:TotalRevenueMemberus-gaap:CustomerConcentrationRiskMemberclpr:CityOfNewYorkMember2024-01-012024-12-31

0001649096clpr:ValleyNationalBankMemberus-gaap:LineOfCreditMemberclpr:DeanStreetProspectHeightsMemberus-gaap:PrimeRateMember2023-08-102023-08-10

0001649096clpr:MezzanineNoteAgreementMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096clpr:NotesPayableMember2023-12-31

0001649096clpr:NotesPayableMember2024-12-31

0001649096clpr:MezzanineNoteAgreementMemberclpr:DeanStreetProspectHeightsMember2023-12-312023-12-31

0001649096clpr:MezzanineNoteAgreementMemberclpr:DeanStreetProspectHeightsMember2023-08-102023-08-10

0001649096clpr:MezzanineNoteAgreementMemberclpr:DeanStreetProspectHeightsMember2023-09-30

utr:Y

0001649096clpr:ProjectLoanMemberclpr:DeanStreetProspectHeightsMember2024-01-012024-12-31

0001649096us-gaap:ConstructionLoansMemberclpr:DeanStreetProspectHeightsMember2024-01-012024-12-31

0001649096us-gaap:SeniorNotesMemberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:ProjectLoanMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096us-gaap:ConstructionLoansMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096clpr:BankLeumiNaMemberus-gaap:MortgagesMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096us-gaap:SeniorNotesMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096us-gaap:SeniorNotesMemberclpr:DeanStreetProspectHeightsMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-08-102023-08-10

0001649096us-gaap:SeniorNotesMemberclpr:DeanStreetProspectHeightsMember2023-08-102023-08-10

0001649096clpr:BADF953DeanStreetLenderLLCMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096clpr:ValleyNationalBankMemberclpr:MezzanineNoteAgreementMemberclpr:DeanStreetProspectHeightsMember2023-08-10

0001649096clpr:BankLeumiNaMemberus-gaap:MortgagesMemberclpr:DeanStreetProspectHeightsMember2022-04-012022-04-30

0001649096clpr:BankLeumiNaMemberus-gaap:MortgagesMemberclpr:DeanStreetProspectHeightsMemberus-gaap:PrimeRateMember2021-12-222021-12-22

0001649096clpr:BankLeumiNaMemberus-gaap:MortgagesMembersrt:MinimumMemberclpr:DeanStreetProspectHeightsMember2021-12-22

0001649096clpr:BankLeumiNaMemberus-gaap:MortgagesMemberclpr:DeanStreetProspectHeightsMember2021-12-22

0001649096clpr:CitiRealEstateFundingIncMemberclpr:SecuredFirstMortgageNoteMemberclpr:LivingstonStreetBrooklyn141Member2024-01-012024-12-31

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-02-092023-02-09

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2024-09-15

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-09-152023-09-15

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-06-30

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-04-012023-06-30

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-02-102023-02-10

0001649096clpr:ValleyNationalBankMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-02-10

0001649096clpr:AIGAssetManagementMemberclpr:Mortgages2Membersrt:MinimumMemberclpr:ResidentialPropertyAt1010PacificStreetMember2021-08-10

0001649096clpr:AIGAssetManagementMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMemberclpr:LIBORRateMember2021-08-102021-08-10

0001649096clpr:AIGAssetManagementMemberclpr:Mortgages2Memberclpr:ResidentialPropertyAt1010PacificStreetMemberclpr:LIBORRateMember2021-08-10

0001649096clpr:CitibankNAMemberus-gaap:MortgagesMemberclpr:ResidentialPropertyAt1010PacificStreetMemberclpr:LIBORRateMember2019-12-242019-12-24

0001649096clpr:CitibankNAMemberus-gaap:MortgagesMembersrt:MinimumMemberclpr:ResidentialPropertyAt1010PacificStreetMember2019-12-24

0001649096clpr:CitibankNAMemberus-gaap:ConstructionLoansMemberclpr:ResidentialPropertyAt1010PacificStreetMember2019-12-24

0001649096clpr:CitibankNAMemberus-gaap:MortgagesMemberclpr:ResidentialPropertyAt1010PacificStreetMember2019-12-24

0001649096clpr:NewYorkCommunityBankMemberus-gaap:MortgagesMemberclpr:PropertyAt10W65thStManhattanNYMember2024-12-31

0001649096clpr:NewYorkCommunityBankMemberus-gaap:MortgagesMemberclpr:PropertyAt10W65thStManhattanNYMember2022-08-26

0001649096clpr:NewYorkCommunityBankMemberus-gaap:MortgagesMemberclpr:PropertyAt10W65thStManhattanNYMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-08-262022-08-26

0001649096clpr:NewYorkCommunityBankMemberus-gaap:MortgagesMemberclpr:PropertyAt10W65thStManhattanNYMembersrt:ScenarioForecastMemberus-gaap:PrimeRateMember2022-10-282027-11-01

0001649096clpr:NewYorkCommunityBankMemberus-gaap:MortgagesMemberclpr:PropertyAt10W65thStManhattanNYMember2017-10-27

0001649096clpr:CloverHouseLoansMemberclpr:MetlifeRealEstateLendingLlcMember2019-11-08

0001649096clpr:CapitalOneMultifamilyFinanceLLCMemberus-gaap:MortgagesMemberclpr:AspenMembersrt:ScenarioForecastMember2017-08-012028-07-31

0001649096clpr:CapitalOneMultifamilyFinanceLLCMemberus-gaap:MortgagesMemberclpr:AspenMember2016-06-27

0001649096clpr:FixedInterestRateFinancingMember2018-02-21

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2022-12-31

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2023-12-31

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2024-11-11

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2024-10-282024-10-28

0001649096us-gaap:LetterOfCreditMemberclpr:LivingstonStreetBrooklyn141Member2024-12-31

0001649096clpr:LivingstonStreetBrooklyn141Member2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:LivingstonStreetBrooklyn141Member2024-12-31

0001649096clpr:CitiRealEstateFundingIncMemberclpr:SecuredFirstMortgageNoteMemberclpr:LivingstonStreetBrooklyn141Member2021-02-18

0001649096clpr:NewYorkCommunityBankMemberclpr:Mortgages2Memberclpr:LivingstonStreetBrooklyn141Member2021-02-18

0001649096clpr:OfficeSpaceAt250LivingstonMember2024-10-10

0001649096clpr:LivingstonStreetInBrooklyn250Memberus-gaap:SubsequentEventMember2025-02-14

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:LivingstonStreetInBrooklyn250Member2024-02-23

0001649096clpr:LivingstonStreetInBrooklyn250Member2024-02-232024-02-23

utr:M

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2019-05-312019-05-31

0001649096clpr:CitiRealEstateFundingIncMemberclpr:FirstMortgageLoanWithInterestOnlyPaymentsMember2019-05-31

0001649096clpr:MortgagesAndMezzanineNotes3Memberclpr:DeanStreetProspectHeightsMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes3Memberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes3Memberclpr:DeanStreetProspectHeightsMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:DeanStreetProspectHeightsMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:DeanStreetProspectHeightsMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:DeanStreetProspectHeightsMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:DeanStreetProspectHeightsMemberus-gaap:PrimeRateMember2024-01-012024-12-31

0001649096clpr:MortgagesAndMezzanineNotes3Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes3Memberclpr:ResidentialPropertyAt1010PacificStreetMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:ResidentialPropertyAt1010PacificStreetMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:ResidentialPropertyAt1010PacificStreetMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:ResidentialPropertyAt1010PacificStreetMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:ResidentialPropertyAt1010PacificStreetMemberclpr:LIBORRateMember2024-01-012024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:PropertyAt10W65thStManhattanNYMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:PropertyAt10W65thStManhattanNYMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:PropertyAt10W65thStManhattanNYMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:CloverHouseMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:CloverHouseMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:AspenMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:AspenMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:TribecaHousePropertiesMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:TribecaHousePropertiesMember2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:LivingstonStreetInBrooklyn141Member2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes2Memberclpr:LivingstonStreetInBrooklyn141Member2024-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:LivingstonStreetInBrooklyn250Member2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:LivingstonStreetInBrooklyn250Member2024-12-31

0001649096clpr:MortgagesAndMezzanineNotesMemberclpr:FlatbushGardensInBrooklynMember2023-12-31

0001649096clpr:MortgagesAndMezzanineNotes1Memberclpr:FlatbushGardensBrooklynNYMember2024-12-31

xbrli:shares

0001649096clpr:ClassBLLCUnitsMember2024-01-012024-12-31

0001649096clpr:LTIPUnitsMember2023-01-012023-12-31

0001649096clpr:LTIPUnitsMemberclpr:NonemployeeDirectorMember2023-01-012023-12-31

0001649096clpr:LTIPUnitsMemberclpr:EmployeesMember2023-01-012023-12-31

0001649096clpr:LTIPUnitsMember2024-01-012024-12-31

0001649096clpr:LTIPUnitsMemberclpr:NonemployeeDirectorMember2024-01-012024-12-31

0001649096clpr:LTIPUnitsMemberclpr:EmployeesMember2023-03-012023-12-31

0001649096clpr:LTIPUnitsMembersrt:MaximumMemberclpr:EmployeesMember2023-03-012023-03-31

0001649096clpr:LTIPUnitsMembersrt:MinimumMemberclpr:EmployeesMember2023-03-012023-03-31

0001649096clpr:LTIPUnitsMemberclpr:NonemployeeDirectorMember2023-03-012023-03-31

0001649096clpr:LTIPUnitsMember2023-03-012023-03-31

0001649096clpr:LTIPUnitsMemberclpr:EmployeesMember2023-03-012023-03-31

0001649096clpr:LTIPUnitsMember2024-12-012024-12-31

0001649096clpr:LTIPUnitsMemberclpr:NonemployeeDirectorMember2024-12-012024-12-31

0001649096clpr:LTIPUnitsMemberclpr:EmployeesMember2024-12-012024-12-31

0001649096clpr:LTIPUnitsMembersrt:MaximumMemberclpr:NonemployeeDirectorMember2024-03-012024-03-31

0001649096clpr:LTIPUnitsMembersrt:MinimumMemberclpr:EmployeesMember2024-03-012024-03-31

0001649096clpr:LTIPUnitsMemberclpr:NonemployeeDirectorMember2024-03-012024-03-31

0001649096clpr:LTIPUnitsMember2024-03-012024-03-31

0001649096clpr:LTIPUnitsMemberclpr:EmployeesMember2024-03-012024-03-31

0001649096clpr:LTIPUnitsMember2024-12-31

0001649096clpr:LTIPUnitsMember2023-12-31

0001649096clpr:LTIPUnitsMember2022-12-31

0001649096clpr:CollectabilityOfLeaseReceivablesMember2023-01-012023-12-31

0001649096clpr:CollectabilityOfLeaseReceivablesMember2024-01-012024-12-31

0001649096us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-12-31

0001649096us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2024-12-31

0001649096us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2024-12-31

0001649096us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2024-12-31

0001649096us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:CorporateJointVentureMember2024-01-012024-12-31

0001649096us-gaap:CorporateJointVentureMember2019-12-31

0001649096srt:RetailSiteMemberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:ResidentialRentalMemberclpr:DeanStreetProspectHeightsMember2024-12-31

0001649096clpr:ResidentialRentalMemberclpr:ResidentialPropertyAt1010PacificStreetMember2024-12-31

0001649096clpr:ResidentialRentalMemberclpr:ResidentialPropertyAt10West65thStreetMember2024-12-31

0001649096srt:ApartmentBuildingMemberclpr:CloverHouseMember2024-12-31

0001649096srt:RetailSiteMemberclpr:AspenMember2024-12-31

0001649096clpr:ResidentialRentalMemberclpr:AspenMember2024-12-31

0001649096clpr:OfficeAndResidentialBuildingMemberclpr:LivingstonStreetInBrooklyn250Member2024-12-31

0001649096srt:OfficeBuildingMemberclpr:LivingstonStreetInBrooklyn141Member2024-12-31

0001649096srt:MultifamilyMemberclpr:FlatbushGardensBrooklynNYMember2024-12-31

0001649096clpr:RentalRetailAndParkingMemberclpr:TribecaHousePropertiesInManhattanBuildingOneMember2024-12-31

0001649096clpr:ResidentialRentalMemberclpr:TribecaHousePropertiesInManhattanMember2024-12-31

0001649096clpr:TribecaHousePropertiesInManhattanBuildingTwoMember2024-12-31

0001649096clpr:TribecaHousePropertiesInManhattanBuildingOneMember2024-12-31

0001649096clpr:TribecaHousePropertiesInManhattanMember2024-12-31

0001649096clpr:DeanStreetProspectHeightsMemberclpr:ResidentialRentalMember2022-02-28

0001649096clpr:PropertyLocatedBrooklynNewYorkMemberclpr:ResidentialRentalMember2019-11-08

0001649096clpr:ResidentialPropertyAt10West65thStreetMemberclpr:ResidentialRentalMember2017-10-27

0001649096srt:ApartmentBuildingMemberclpr:ColumbiaHeightsInBrooklynNYMember2017-05-09

0001649096us-gaap:CommonStockMemberus-gaap:IPOMember2017-02-092017-02-09

0001649096us-gaap:CommonStockMemberus-gaap:IPOMember2017-02-09

00016490962015-08-03

0001649096us-gaap:NoncontrollingInterestMember2024-12-31

0001649096us-gaap:ParentMember2024-12-31

0001649096us-gaap:RetainedEarningsMember2024-12-31

0001649096us-gaap:AdditionalPaidInCapitalMember2024-12-31

0001649096us-gaap:CommonStockMember2024-12-31

0001649096us-gaap:NoncontrollingInterestMember2024-01-012024-12-31

0001649096us-gaap:ParentMember2024-01-012024-12-31

0001649096us-gaap:RetainedEarningsMember2024-01-012024-12-31

0001649096us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-31

0001649096us-gaap:CommonStockMember2024-01-012024-12-31

0001649096us-gaap:NoncontrollingInterestMember2023-12-31

0001649096us-gaap:ParentMember2023-12-31

0001649096us-gaap:RetainedEarningsMember2023-12-31

0001649096us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001649096us-gaap:CommonStockMember2023-12-31

0001649096us-gaap:NoncontrollingInterestMember2023-01-012023-12-31

0001649096us-gaap:ParentMember2023-01-012023-12-31

0001649096us-gaap:RetainedEarningsMember2023-01-012023-12-31

0001649096us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-31

0001649096us-gaap:CommonStockMember2023-01-012023-12-31

0001649096us-gaap:NoncontrollingInterestMember2022-12-31

0001649096us-gaap:ParentMember2022-12-31

0001649096us-gaap:RetainedEarningsMember2022-12-31

0001649096us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001649096us-gaap:CommonStockMember2022-12-31

0001649096us-gaap:CommercialRealEstateMember2023-01-012023-12-31

0001649096us-gaap:CommercialRealEstateMember2024-01-012024-12-31

0001649096clpr:ResidentialRentalMember2023-01-012023-12-31

0001649096clpr:ResidentialRentalMember2024-01-012024-12-31

0001649096clpr:SeriesACumulativeNonvotingPreferredStockMember2021-01-012021-12-31

0001649096clpr:SeriesACumulativeNonvotingPreferredStockMember2024-01-012024-12-31

0001649096clpr:SeriesACumulativeNonvotingPreferredStockMember2023-12-31

0001649096clpr:SeriesACumulativeNonvotingPreferredStockMember2024-12-31

00016490962025-02-14

00016490962024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2024

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 001-38010

CLIPPER REALTY INC.

(Exact name of Registrant as specified in its charter)

|

Maryland

|

|

47-4579660

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

4611 12th Avenue, Suite 1L

Brooklyn, New York 11219

(Address of principal executive offices) (Zip Code)

(718) 438-2804

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

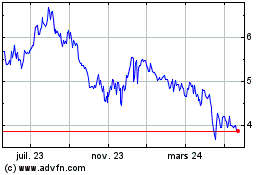

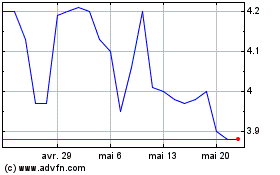

Common Stock, par value $0.01 per share

|

CLPR

|

New York Stock Exchange

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

|

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

|

| |

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant based on the closing price per share of the registrant’s common stock on the New York Stock Exchange as of June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter – $49,096,593

As of February 14, 2025, there were 16,146,546 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file its definitive proxy statement relating to its 2025 Annual Meeting of Stockholders no later than 120 days after the end of its fiscal year, and certain portions of such proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| |

PAGE

|

| |

|

|

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

|

2

|

|

SUMMARY OF RISK FACTORS

|

3

|

|

PART I

|

|

|

ITEM 1. BUSINESS

|

5

|

|

ITEM 1A. RISK FACTORS

|

9

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

34

|

|

ITEM 1C. CYBERSECURITY

|

34

|

|

ITEM 2. PROPERTIES

|

34

|

|

ITEM 3. LEGAL PROCEEDINGS

|

41

|

|

ITEM 4. MINE SAFETY DISCLOSURE

|

41

|

| |

|

|

PART II

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

42

|

|

ITEM 6. RESERVED

|

43

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

43

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

60

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

60 |

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

60 |

|

ITEM 9A. CONTROLS AND PROCEDURES

|

60 |

|

ITEM 9B. OTHER INFORMATION

|

61

|

|

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

|

61

|

| |

|

|

PART III

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

61

|

|

ITEM 11. EXECUTIVE COMPENSATION

|

61

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

62

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

62

|

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

62

|

| |

62

|

|

PART IV

|

|

|

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

62

|

|

ITEM 16. FORM 10-K SUMMARY

|

67

|

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Various statements contained in this Annual Report on Form 10-K, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this Annual Report on Form 10-K speak only as of the date of this Report; we disclaim any obligation to update these statements unless required by law, . We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory, and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “Risk Factors,” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following:

| |

●

|

our dependency on two commercial leases with certain agencies of the City of New York, as a single government tenant in our office buildings, which could cause a material adverse effect on us, including our financial condition, results of operations and cash flow, with one lease terminating effective August 23, 2025 and the other lease expiring on December 27, 2025; |

| |

|

|

| |

●

|

the impact of the increase in inflation in the United States which could increase the cost of acquiring, replacing and operating our properties;

|

| |

|

|

| |

●

|

market and economic conditions, affecting occupancy, rental rates, the overall market value of our properties, our access to capital and the cost of capital, and our ability to refinance indebtedness;

|

| |

|

|

| |

●

|

economic or regulatory developments in New York City;

|

| |

|

|

| |

●

|

changes in rent stabilization regulations or claims by tenants in rent-stabilized units that their rents exceed specified maximum amounts under current regulations;

|

| |

|

|

| |

●

|

our ability to control operating costs to the degree anticipated;

|

| |

|

|

| |

●

|

the risk of damage to our properties, including from severe weather, natural disasters, climate change, and terrorist attacks;

|

| |

|

|

| |

●

|

risks related to financing, cost overruns, and fluctuations in occupancy rates and rents resulting from development or redevelopment activities and the risk that we may not be able to pursue or complete development or redevelopment activities or that such development or redevelopment activities may not be profitable;

|

| |

|

|

| |

●

|

concessions or significant capital expenditures that may be required to attract and retain tenants;

|

| |

|

|

| |

●

|

the relative illiquidity of real estate investments;

|

| |

|

|

| |

●

|

competition affecting our ability to engage in investment and development opportunities or attract or retain tenants;

|

| |

|

|

| |

●

|

unknown or contingent liabilities in properties acquired in formative and future transactions;

|

| |

|

|

| |

●

|

the possible effects of departure of key personnel in our management team on our investment opportunities and relationships with lenders and prospective business partners;

|

| |

|

|

| |

●

|

conflicts of interest faced by members of management relating to the acquisition of assets and the development of properties, which may not be resolved in our favor;

|

| |

●

|

a transfer of a controlling interest in any of our properties that may obligate us to pay transfer tax based on the fair market value of the real property transferred;

|

| |

|

|

| |

●

|

our ability to maintain effective internal control over financial reporting;

|

| |

|

|

| |

●

|

the need to establish litigation reserves, costs to defend litigation and unfavorable litigation settlements or judgments; and

|

| |

|

|

| |

●

|

other risks and risk factors or uncertainties identified from time to time in our filings with the SEC.

|

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed as exhibits to this Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this Annual Report on Form 10-K by these cautionary statements.

SUMMARY OF RISK FACTORS

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, liquidity, results of operations and prospects. These risks are discussed more fully in Item 1A. Risk Factors. These risks include, but are not limited to, the following:

| |

●

|

We depend on two commercial leases with certain agencies of the City of New York (NYC), as a single government tenant in our office buildings, with one lease terminating effective August 23, 2025 and the other lease expiring on December 27, 2025. Our inability to replace NYC as a tenant at rent rates comparable to the rates in the lease that terminates in August 2025 or to negotiate a five-year extension of the lease expiring in December 2025 could cause a material adverse effect on us, including our financial condition, results of operations and cash flow. |

| |

|

|

| |

●

|

Unfavorable market and economic conditions in the United States and globally and in the specific markets or submarkets where our properties are located could adversely affect occupancy levels, rental rates, rent collections, operating expenses, and the overall market value of our assets, impair our ability to sell, recapitalize or refinance our assets and have an adverse effect on our results of operations, financial condition, cash flow and our ability to make distributions to our stockholders;

|

| |

|

|

| |

●

|

Multifamily residential properties are subject to rent stabilization regulations, which limit our ability to raise rents above specified maximum amounts and could give rise to claims by tenants that their rents exceed such specified maximum amounts;

|

| |

|

|

| |

●

|

All of our properties are located in New York City, and adverse economic or regulatory developments in New York City or parts thereof, including the boroughs of Brooklyn and Manhattan, could negatively affect our results of operations, financial condition, cash flow, and ability to make distributions to our stockholders;

|

| |

|

|

| |

●

|

Our portfolio’s revenue is currently generated from eight of our properties;

|

| |

|

|

| |

●

|

We may be unable to renew leases or lease currently vacant space or vacating space on favorable terms or at all as leases expire or terminate, which could adversely affect our financial condition, results of operations and cash flow;

|

| |

|

|

| |

●

|

The actual rents we receive for the properties in our portfolio may be less than market rents, and we may experience a decline in realized rental rates, which could adversely affect our financial condition, results of operations and cash flow. Short-term leases with respect to our residential tenants expose us to the effects of declining market rents;

|

| |

|

|

| |

●

|

We engage in development and redevelopment activities, which could expose us to different risks that could adversely affect us, including our financial condition, cash flow and results of operations;

|

| |

|

|

| |

●

|

We have in the past and we may be required to make rent or other concessions and/or significant capital expenditures to improve our properties in order to retain and attract tenants, generate positive cash flows or to make real estate properties suitable for sale, which could adversely affect us, including our financial condition, results of operations and cash flow;

|

| |

●

|

Real estate investments are relatively illiquid and may limit our flexibility;

|

| |

|

|

| |

●

|

Competition could limit our ability to acquire attractive investment opportunities and increase the costs of those opportunities, which may adversely affect us, including our profitability, and impede our growth;

|

| |

|

|

| |

●

|

Competition may impede our ability to attract or retain tenants or re-lease space, which could adversely affect our results of operations and cash flow;

|

| |

|

|

| |

●

|

We may acquire properties or portfolios of properties through tax-deferred contribution transactions, which could result in stockholder dilution and limit our ability to sell such assets;

|

| |

|

|

| |

●

|

Capital and credit market conditions, including higher interest rates, may adversely affect our access to various sources of capital or financing and/or the cost of capital, which could affect our business activities, dividends, earnings and common stock price, among other things;

|

| |

|

|

| |

●

|

Increased inflation may have a negative effect on rental rates and our results of operations;

|

| |

|

|

| |

●

|

Our subsidiaries may be prohibited from making distributions and other payments to us;.

|

| |

|

|

| |

● |

We are required to comply with Section 404 of the Sarbanes-Oxley Act of 2002, and our inability to maintain effective internal control over financial reporting in the future could result in investors losing confidence in the accuracy and completeness of our financial reports and negatively affect the market price of our common stock; |

| |

|

|

| |

●

|

Our continuing investors hold shares of our special voting stock that entitle them to vote together with holders of our common stock on an as-exchanged basis, based on their ownership of Class B LLC units in our predecessor entities, and are generally able to significantly influence the composition of our board of directors, our management and the conduct of our business;

|

| |

|

|

| |

●

|

Conflicts of interest may exist or could arise in the future between the interests of our stockholders and the interests of holders of OP Units and of LLC units in our predecessor entities, which may impede business decisions that could benefit our stockholders;

|

| |

|

|

| |

●

|

Our charter contains a provision that expressly permits our officers to compete with us;

|

| |

|

|

| |

●

|

We have a substantial amount of indebtedness that may limit our financial and operating activities and may adversely affect our ability to incur additional debt to fund future needs;

|

| |

|

|

| |

●

|

Changing interest rates could increase interest costs and adversely affect our cash flows and the market price of our securities;

|

| |

|

|

| |

●

|

Mortgage debt obligations expose us to the possibility of foreclosure, which could result in the loss of our investment in a property or group of properties subject to mortgage debt;

|

| |

|

|

| |

●

|

System failures or security incidents through cyberattacks, intrusions, or other methods could disrupt our information technology networks, enterprise applications, and related systems, cause a loss of assets or data, give rise to remediation or other expenses, expose us to liability under federal and state laws, and subject us to litigation and investigations, which could result in substantial reputational damage and adversely affect our business and financial condition.

|

| |

|

|

| |

●

|

Failure to qualify or to maintain our qualification as a REIT would have significant adverse consequences to the value of our common stock; and

|

| |

|

|

| |

●

|

Complying with the REIT requirements may cause us to forego otherwise attractive opportunities or liquidate certain of our investments.

|

PART I

ITEM 1. BUSINESS

In this Annual Report on Form 10-K, when we use the terms the “Company,” “Clipper Realty,” “we,” “us,” or “our,” unless the context otherwise requires, we are referring to Clipper Realty Inc. and its consolidated subsidiaries. Certain disclosures included in this Annual Report on Form 10-K constitute forward-looking statements that are subject to risks and uncertainties. See Item 1A, "Risk Factors," and “Cautionary Note Concerning Forward-Looking Statements."

Overview

Clipper Realty Inc. is a self-administered and self-managed real estate company that acquires, owns, manages, operates and repositions multifamily residential and commercial properties in the New York metropolitan area, with a portfolio in Manhattan and Brooklyn. We were formed to continue and expand the commercial real estate business of the 50/53 JV LLC, a Delaware limited liability company, Renaissance Equity Holdings LLC, a Delaware limited liability company, Berkshire Equity LLC, a Delaware limited liability company, and Gunki Holdings LLC, a Delaware limited liability company (collectively referred to as, the "Predecessor” or the "predecessor entities”). These predecessor entities were formed by principals of our management team from 2002 to 2014. Our primary focus is to continue to own, manage and operate our portfolio, and to acquire and re-position additional multifamily residential and commercial properties in the New York metropolitan area.

We were incorporated in the State of Maryland on July 7, 2015. On August 3, 2015, we closed a private offering of shares of our common stock, in which we raised net proceeds of approximately $130.2 million. In connection with the private offering, we consummated a series of investment and other formation transactions that were designed, among other things, to enable us to qualify as a real estate investment trust, or a "REIT,” for U.S. federal income tax purposes, and we elected to be treated as a REIT commencing with the taxable year ended December 31, 2015. We contributed the net proceeds of the private offering to Clipper Realty L.P., our operating partnership subsidiary, or the "Operating Partnership,”, in exchange for units in the Operating Partnership.

On February 9, 2017, we priced an initial public offering, or the "IPO,” of 6,390,149 primary shares of our common stock (including the exercise of the over-allotment option, which closed on March 10, 2017). The net proceeds of the IPO were approximately $78.7 million. We contributed the proceeds of the IPO to the Operating Partnership, in exchange for units in the Operating Partnership.

As of December 31, 2024, the properties owned by the Company consisted of the following:

| |

•

|

Tribeca House in Manhattan, comprising two buildings, one with 21 stories and one with 12 stories, containing residential and retail space with an aggregate of approximately 483,000 square feet of residential rental Gross Leasable Area ("GLA”) and 77,000 square feet of retail rental and parking GLA;

|

| |

•

|

Flatbush Gardens in Brooklyn, a 59-building residential housing complex with 2,494 rentable units and approximately 1,749,000 square feet of residential rental GLA;

|

| |

•

|

141 Livingston Street in Brooklyn, a 15-story office building with approximately 216,000 square feet of GLA;

|

| |

•

|

250 Livingston Street in Brooklyn, a 12-story office and residential building with approximately 370,000 square feet of GLA (fully remeasured);

|

| |

•

|

Aspen in Manhattan, a 7-story building containing residential and retail space with approximately 166,000 square feet of residential rental GLA and approximately 21,000 square feet of retail rental GLA;

|

| |

•

|

Clover House in Brooklyn, a 11-story residential building with approximately 102,000 square feet of residential rental GLA;

|

| |

•

|

10 West 65th Street in Manhattan, a 6-story residential building with approximately 76,000 square feet of residential rental GLA;

|

| |

•

|

1010 Pacific Street in Brooklyn, a 9-story residential building with approximately 119,000 square feet of residential rental GLA; and

|

| |

•

|

The Dean Street property in Brooklyn, which the Company plans to redevelop as a 9-story residential building with approximately 160,000 square feet of residential rental GLA and approximately 9,000 square feet of retail rental GLA.

|

See “Descriptions of Our Properties” in Item 2 for a detailed discussion of the Company’s properties.

These properties are located in the most densely populated major city in the United States, each with immediate access to mass transportation.

Our ownership interest in our initial portfolio of properties (Tribeca House, Flatbush Gardens, 141 Livingston Street and 250 Livingston Street) was acquired in the formation transactions in connection with the private offering of shares of our common stock on August 3, 2015. These properties are owned by the predecessor entities, which after the formation transactions are referred to as the "LLC subsidiaries.” Upon completion of the private offering and the formation transactions described above, we assumed responsibility for managing the LLC subsidiaries, which are managed by us through the Operating Partnership. The Operating Partnership is the managing member of the LLC subsidiaries and owns Class A units in such LLC subsidiaries. The Operating Partnership’s interests in the LLC subsidiaries generally entitle the Operating Partnership to all cash distributions from, and the profits and losses of, the LLC subsidiaries, other than the preferred distribution to the continuing investors who hold Class B LLC units in these LLC subsidiaries. In connection with the formation transactions, holders of interests in the predecessor entities received Class B LLC units in the LLC Subsidiaries and an equal number of special, non-economic, voting stock in the Company. The Class B LLC units, together with the special voting shares, are convertible into shares of our common stock on a one-for-one basis. As of December 31, 2024, the continuing investors owned an aggregate amount of 26,317,396 Class B LLC units, representing 62.0% of our common stock on a fully diluted basis. Accordingly, the Operating Partnership’s interests in the LLC subsidiaries entitle it to receive 38.0% of the aggregate distributions from the LLC subsidiaries.

We have two reportable operating segments: residential rental properties and commercial rental properties. Our revenue consists primarily of rents received from our residential, commercial and, to a lesser extent, retail tenants. We derive approximately 74% of our revenues from rents received from residents in our apartment rental properties and the remainder from commercial and retail rental customers. As of December 31, 2024, agencies of the City of New York leased an aggregate of 548,580 rentable square feet of commercial space at our commercial office properties at 141 Livingston Street and 250 Livingston Street, representing approximately 22% of our total revenues for the year ended December 31, 2024.

As of February 23, 2024, the City of New York notified the Company of its intention to terminate its lease for 342,496 square feet of office space located at 240-250 Livingston Street effective August 23, 2025. The Lease generally provides for rent payments in the amount of $9.9 million through the end of the term. Additionally, the Company and the City of New York are negotiating the terms of a five-year extension of its current 206,084 square foot lease at 141 Livingston Street that expires in December of 2025. There can be no assurance that the negotiations will conclude with an agreement. The current lease at 141 Livingston Street provides for $10.3 million rent per annum.

Business and Growth Strategies

Our primary business objective is to enhance stockholder value by increasing cash flow from operations and total return to stockholders through the following strategies:

| |

●

|

Increase existing below-market rents – capitalize on the successful repositioning of our portfolio and solid market fundamentals to increase rents at several of our properties.

|

| |

●

|

Disciplined acquisition strategy – opportunistically acquire additional properties, with a focus on premier submarkets and assets, by utilizing the significant experience of our senior management team.

|

| |

●

|

Proactive asset and property management – utilize our proactive, service-intensive approach to help increase occupancy and rental rates and manage operating expenses.

|

| |

●

|

Redevelop assets – execute on our targeted capital program to selectively redevelop properties and achieve rent growth in an expedited fashion.

|

Competitive Strengths

We believe that the following competitive strengths distinguish us from other owners and operators of multifamily residential and commercial properties:

| |

●

|

Diverse portfolio of properties in the New York metropolitan area, which is characterized by supply constraints, high barriers to entry, near- and long-term prospects for job creation, vacancy absorption and long-term rental rate growth.

|

| |

●

|

Expertise in redeveloping and managing multifamily residential properties.

|

| |

●

|

Experienced management team with a proven track record over generations in New York real estate.

|

| |

●

|

Balance sheet well-positioned for future growth.

|

| |

●

|

Strong internal rent growth prospects.

|

Regulation

Environmental and Related Matters

Under various federal, state and local laws, ordinances and regulations, as a current or former owner and operator of real property, we may be liable for costs and damages resulting from the presence or release of hazardous substances (such as lead, asbestos and polychlorinated biphenyls), waste, petroleum products and other miscellaneous products (including but not limited to natural products such as methane and radon gas) at, on, in, under or from such property, including costs for investigation or remediation, natural resource damages or third-party liability for personal injury or property damage.

In addition, our properties are subject to various federal, state and local environmental and health and safety laws and regulations. As the owner or operator of real property, we may also incur liability based on various building conditions. We are not presently aware of any material liabilities related to building conditions, including any instances of material noncompliance with asbestos requirements or any material liabilities related to asbestos.

In addition, our properties may contain or develop harmful mold or suffer from other indoor air quality issues, which could lead to liability for adverse health effects or property damage, or costs for remediation. We are not presently aware of any material adverse indoor air quality issues at our properties.

Americans with Disabilities Act and Similar Laws

Our properties must comply with Title III of Americans with Disabilities Act of 1990 (“ADA”) to the extent that such properties are “public accommodations” as defined by the ADA. We have not conducted a recent audit or investigation of all of our properties to determine our compliance with these or other federal, state or local laws. Noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and to make alterations as appropriate in this respect.

New York Regulation

The Company and its properties are subject to government regulations including, but not limited to real property, rental and environmental regulations such as the New York State Real Property Law and the New York State Real Property Tax Law. Additionally, numerous municipalities, including New York City where our multi-family residential properties are located, impose rent control or rent stabilization on apartment buildings including, as discussed below, the Housing Stability and Tenant Protection Act of 2019 which affects rent-stabilized apartments in New York City. The update to the New York eviction laws for the so-called “Good Cause-Eviction” law limits evictions for certain tenants that failed to pay what is deemed “unreasonable” rent increases. The Americans With Disabilities Act requires us to meet federal requirements related to access and use by disabled persons and the FHAA (as defined below) requires our buildings to comply with design and construction requirements for disabled access. Our buildings are also subject to certain New York City environmental regulations which require us to meet certain environmental criteria over various periods of time.

Environmental Social and Governance

The health and safety of the Company’s employees and their families remains a top priority, along with the health and safety of the Company’s tenants and the communities they serve.

The Company has also been working to identify areas where it can improve the carbon footprint of its properties. This includes complying with NYC Local Law 97 (LL97) that requires most buildings over 25 thousand square feet meet stringent carbon emissions caps starting in 2024. As such, the Company has replaced certain roofs, including the upgrading of the roofing insulation, changed light fixtures to LED lighting and insulated building piping.

On June 29, 2023, the Company’s Flatbush Gardens property entered into a 40 year regulatory agreement under Article 11 of the Private Housing Finance Law with the New York City Department of Housing Preservation and Development ( the “Article 11 Agreement”). The Company committed to maintain rents with existing area median income groups, to lease 249 units to formerly homeless families and provide certain services as units become vacant, committed to pay prevailing wage rates to employees of the property as defined under New York City regulations and committed to a 3-year capital improvements plan.

Insurance

We carry commercial general liability insurance coverage on our properties, with limits of liability customary within the industry to insure against liability claims and related defense costs. Similarly, we are insured against the risk of direct and indirect physical damage to our properties including coverage for the perils of flood and earthquake shock. Our policies also cover the loss of rental revenue during any reconstruction period. Our policies reflect limits and deductibles customary in the industry and specific to the buildings and portfolio. We also obtain title insurance policies when acquiring new properties, which insure fee title to our real properties. We currently have coverage for losses incurred in connection with both domestic and foreign terrorist-related activities. While we do carry commercial general liability insurance, property insurance and terrorism insurance with respect to our properties, these policies include limits and terms we consider commercially reasonable. In addition, there are certain losses (including, but not limited to, losses arising from known environmental conditions or acts of war) that are not insured, in full or in part, because they are either uninsurable or the cost of insurance makes it, in our belief, economically impractical to maintain such coverage. Should an uninsured loss arise against us, we would be required to use our own funds to resolve the issue, including litigation costs. In addition, for properties we may self-insure certain portions of our insurance program, and therefore, use our own funds to satisfy those limits, when applicable. We believe the policy specifications and insured limits are adequate given the relative risk of loss, the cost of the coverage and industry practice and, in the opinion of our management, the properties in our portfolio are adequately insured.

Competition

The leasing of real estate is highly competitive in Manhattan, Brooklyn and the greater New York metropolitan market in which we operate. We compete with numerous acquirers, developers, owners and operators of commercial and residential real estate, many of which own or may seek to acquire or develop properties similar to ours in the same markets in which our properties are located. The principal means of competition are rents charged, location, services provided and the nature and condition of the facility to be leased.

In addition, we face competition from numerous developers, real estate companies and other owners and operators of real estate for buildings for acquisition and pursuing buyers for dispositions. We expect competition from other real estate investors, including other REITs, private real estate funds, domestic and foreign financial institutions, life insurance companies, pension trusts, partnerships, individual investors and others, that may have greater financial resources or access to capital than we do or that are willing to acquire properties in transactions which are more highly leveraged or are less attractive from a financial viewpoint than we are willing to pursue.

Human Capital Resources

As of December 31, 2024, we had 171 employees who provide property management, maintenance, landscaping, construction management and accounting services. Certain of these employees are covered by union-sponsored, collectively bargained, multiemployer defined benefit pension and profit-sharing plans, and health insurance, legal and training plans. Contributions to the plans are determined in accordance with the provisions of the negotiated labor contracts. The Local 94 International Union of Operating Engineers contract is in effect through December 31, 2026. The Local 32BJ Service Employees International Union apartment building contract is in effect through April 20, 2026. The Local 32BJ Service Employees International Union commercial building contract in effect through December 31, 2027. The Building Maintenance Employees Union, Local 486 contract is in effect through February 28, 2026.

The Company believes that its success is dependent upon the diverse backgrounds of its employees and strives to build a culture that is collaborative, diverse, supportive and inclusive. In furtherance of that goal, the Company provides diversity equity and inclusion training as part of its annual harassment training for both supervisors and non-supervisors.

The Company places a high value on the physical and mental health of its employees. The Company provides employees with competitive compensation and a wide range of benefits including comprehensive medical and dental insurance coverage, short and long-term disability benefits, a 401(K) retirement program with matching, vacation, sick and personal leave, flexible work arrangements, flexible savings accounts, and other benefits.

Company Information

Our principal executive offices are located at 4611 12th Avenue, Brooklyn, New York 11219. Our current facilities are adequate for our present and future operations. Our telephone number is (718) 438-2804. Our website address is www.clipperrealty.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. Our electronic filings with the SEC (including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to these reports), including the exhibits, are available free of charge through our website as soon as reasonably practicable after we electronically file them with or furnish them to the SEC.

ITEM 1A. RISK FACTORS

Set forth below are certain risk factors that could harm our business, results of operations and financial condition. You should carefully read the following risk factors, together with the financial statements, related notes and other information contained in this Annual Report on Form 10-K. Our business, financial condition and operating results may suffer if any of the following risks are realized. If any of these risks or uncertainties occur, the trading price of our common stock could decline and you might lose all or part of your investment. This Annual Report on Form 10-K contains forward-looking statements that involve risks see "Cautionary Note Concerning Forward-Looking Statements."

Risks Related to Real Estate

We depend on two commercial leases with certain agencies of the City of New York (NYC), as a single government tenant in our office buildings, with one lease terminating effective August 23, 2025 and the other lease expiring on December 27, 2025. Our inability to replace NYC as a tenant at rent rates comparable to the rates in the lease that terminates in August 2025 or to negotiate a five-year extension of the lease expiring in December 2025 could cause a material adverse effect on us, including our financial condition, results of operations and cash flow.

Our rental revenue depends on entering into leases with and collecting rents from tenants. As of December 31, 2024, Kings County Court, the Human Resources Administration, and the Department of Environmental Protection, all of which are agencies of the City of New York, leased an aggregate of 548,580 rentable square feet of commercial space at our commercial office properties at 141 Livingston Street and 250 Livingston Street, the rents from which represented approximately 22% of our total revenues for the year-ended December 31, 2024. We are also subject to covenants covering these leases in our loan agreements related to our commercial office properties located at 250 Livingston Street and 141 Livingston Street. Breaches of these covenants could result in defaults under the loan agreements.

As of February 23, 2024, The City of New York, a municipal corporation acting through the Department of Citywide Administrative Services ("NYC”), notified us of its intention to terminate its lease at 250 Livingston Street effective August 23, 2025. The lease generally provides for rent payments in the amount of $15.4 million per annum. We may be unable to replace NYC as a tenant or unable to replace it with other commercial tenants at comparable rent rates, may incur substantial costs to improve the vacated space or may have to offer significant inducements to fill the space, all of which may have an adverse effect on our financial condition, results of operations and cash flow. In connection with the termination of the 250 Livingston Street lease, pursuant to the terms of the loan agreement related to $125 million building mortgage, we have established a cash management account for the benefit of the lender, into which we will be obligated to deposit all revenue generated by the building at 250 Livingston Street. All amounts remaining in such cash management account after the lender’s allocations set forth in the loan agreement will be disbursed to us once the tenant cure conditions are satisfied under the loan agreement. As of February 14, 2025, we are required to deposit into such cash management account approximately $5.7 million upon demand by the lender. If we are unable to replace the NYC lease at comparable rents, we may not be able to cure the conditions listed in the loan agreement. If the excess cash is not released to us, it could impact our available cash to fund corporate operations and pay dividends and distributions to our stockholders.

On January 2, 2025, we were notified that the loan servicing of the loan related to the 250 Livingston Street property was transferred, at our request, to LNR Partners (“LNR”) to serve as special servicer in order for us to engage in negotiations on a modification of our loan. On January 6, 2025, we and LNR signed a Pre-Negotiation Letter Agreement to discuss our request for a reduction in the loan. These negotiations continue and there can be no guarantee that they will conclude with an agreement.

The 141 Livingston Street lease expires on December 27, 2025, and if NYC were to decide not to renew or extend such lease on its stated termination date, pursuant to the terms of the lease, we would be at risk of not being able to replace NYC as a tenant, leasing the space below the current rates, incurring costs to improve the space or offer other inducements to fill the space, all of which may have an adverse effect on our financial condition, results of operations and cash flow. We and NYC are in the process of negotiating the terms of a five-year extension of the current lease upon its expiration in December 2025. There can be no assurance that the negotiations will conclude with an agreement.

Our subsidiary, 141 Livingston Owner LLC (the “Borrower”) and Citi Real Estate Funding Inc. entered into the loan agreement related to a $100 million loan. The loan is evidenced by promissory mortgage notes and secured by the 141 Livingston Street property. We and our Operating Partnership subsidiary serve as limited guarantors of certain obligations under the loan, including those related to the reserve monthly deposit discussed below.

If we are not able to extend or replace the NYC lease at our 141 Livingston Street property for a minimum of a five-year term, we will be required to either fund a reserve account in the amount of $10 million payable in equal monthly payments over the 18 months after lease expiration or deliver to the lender a letter of credit in the amount of $10 million

On October 28, 2024, we received notice that, as of October 7, 2024, the servicing of the mortgage notes was transferred to a special servicer (the “Special Servicer”) due to our alleged failure to make certain required payments under the loan agreement, including, but not limited to, the reserve deposit starting on July 7, 2024. The Special Servicer demanded that we pay (i) $2.2 million of reserve payments into a reserve account immediately (for July-October 2024) and continued monthly payments of $555,555 for an additional 14 months, (ii) $1.2 million of default interest and late charges through October 7, 2024, and (iii) an additional $10,417 per diem interest for each day thereafter.

On November 11, 2024, the Special Servicer notified the Borrower that, due to its alleged event of default under the Loan Agreement, as a result of the failure to make the payments described above, the mortgage notes have been accelerated, and all amounts under the loan agreement were due and payable. Such amounts include, but are not limited to, $100.0 million principal amount of the mortgage notes, approximately $5.0 million of default yield maintenance premium, $10.0 million aggregate reserve deposit, and the above-described penalty default interest and penalties.

We believe that (i) we have made timely payments under the loan agreement, (ii) the servicer and the Special Servicer have misinterpreted the terms of the loan agreement requiring monthly reserve payments beginning on July 7, 2024, (iii) we have no current obligation to make such reserve payments under the loan agreement and (iv) we should not be obligated to pay the default interest and late charges. We and the Special Servicer have entered into a pre-negotiation agreement and as such are engaged in good faith discussions regarding the terms of the loan agreement related to the monthly reserve deposit, among other matters. However, if we are unable to resolve this matter in a manner favorable to us, the lender may also seek to exercise any of its other rights or remedies under the loan agreement.

On December 18, 2024, we received notice from the Special Servicer that due to its allegation that Clipper Realty (the “Guarantor”) did not maintain a net worth of not less than $100 million as of December 31, 2022 and 2023, respectively, as required under the loan agreement, we are in default on the loan. We replied to the Special Servicer disputing such calculation and alleging that the Special Servicer did not calculate net worth in a reasonable manner. We provided the Special Servicer with our own calculation of net worth that shows a net worth in excess of the required amount. We await a response from the Special Servicer.

On January 21, 2025, we received notice from the Special Servicer alleging that certain elements of our insurance on the building at 141 Livingston Street are not in compliance with the loan agreement requirements, including, but not limited to, due to a deductible in excess of what is permitted under the terms of the loan agreement and the use of an insurance carrier with a rating agency rating below that which is permitted under the terms of the loan agreement.

Unfavorable market and economic conditions in the United States and globally and in the specific markets or submarkets where our properties are located could adversely affect occupancy levels, rental rates, rent collections, operating expenses, and the overall market value of our assets, impair our ability to sell, recapitalize or refinance our assets and have an adverse effect on our results of operations, financial condition, cash flow and our ability to make distributions to our stockholders.

Unfavorable market conditions in the areas in which we operate and unfavorable economic conditions in the United States and/or globally may significantly affect our occupancy levels, rental rates, rent collections, operating expenses, the market value of our assets and our ability to strategically acquire, dispose, recapitalize or refinance our properties on economically favorable terms or at all. Our ability to lease our properties at favorable rates may be adversely affected by increases in supply of commercial, retail and/or residential space in our markets and is dependent upon overall economic conditions, which are adversely affected by, among other things, job losses and increased unemployment levels, recession, stock market volatility and uncertainty about the future. Some of our major expenses, including mortgage payments and real estate taxes, generally do not decline when related rents decline. We expect that any declines in our occupancy levels, rental revenues and/or the values of our buildings would cause us to have less cash available to pay our indebtedness, fund necessary capital expenditures and to make distributions to our stockholders, which could negatively affect our financial condition and the market value of our common stock. Our business may be affected by volatility and illiquidity in the financial and credit markets, a general global economic recession and other market or economic challenges experienced by the real estate industry or the U.S. economy as a whole. Our business may also be adversely affected by local economic conditions, as all of our revenue is currently derived from properties located in New York City, with our entire portfolio located in Manhattan and Brooklyn.

Factors that may affect our occupancy levels, our rental revenues, our income from operations, our funds from operations (“FFO”), our adjusted funds from operations (“AFFO”), our adjusted earnings before interest, income tax, depreciation and amortization (“Adjusted EBITDA”), our net operating income (“NOI”), our cash flow and/or the value of our properties include the following, among others:

| |

●

|

downturns in global, national, regional and local economic and demographic conditions;

|

| |

|

|

| |

●

|

the Housing Stability and Tenant Protection Act of 2019, which was signed into law in New York in June 2019, as well as other rent control or stabilization laws, or other laws regulating rental housing, which could prevent us from raising rents to offset increases in operating costs;

|

| |

|

|

| |

●

|

declines in the financial condition of our tenants, which may result in tenant defaults under leases due to bankruptcy, lack of liquidity, operational failures or other reasons, and declines in the financial condition of buyers and sellers of properties;

|

| |

|

|

| |

●

|

declines in local, state and/or federal government budgets and/or increases in local, state and/or federal government budget deficits, which among other things could have an adverse effect on the financial condition of our only office tenant, the agencies of the City of New York, and may result in tenant defaults under leases and/or cause such tenant to seek alternative office space arrangements;

|

| |

|

|

| |

●

|

the inability or unwillingness of our tenants to pay rent increases, or our inability to collect rents and other amounts due from our tenants;

|

| |

|

|

| |

●

|

significant job losses in the industries in which our commercial and/or retail tenants operate, and/or from which our residential tenants derive their incomes, which may decrease demand for our commercial, retail and/or residential space, causing market rental rates and property values to be affected negatively;

|

| |

|

|

| |

●

|

an oversupply of, or a reduced demand for, commercial and/or retail space and/or apartment homes;

|

| |

|

|

| |

●

|

declines in household formation;

|

| |

|

|

| |

●

|

unfavorable residential mortgage rates;

|

| |

|

|

| |

●

|

changes in market rental rates in our markets and/or the attractiveness of our properties to tenants, particularly as our buildings continue to age, and our ability to fund repair and maintenance costs;

|

| |

|

|

| |

●

|