Actively managed ETF offers unique investment grade private

credit market exposure with transparency and daily

liquidity

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), announced today the launch of

the SPDR® SSGA Apollo IG Public & Private Credit ETF (PRIV).

Managed by the State Street Global Advisors Active Fixed Income

Team, PRIV allows all investors to gain transparent, tradeable

access to an ETF seeking risk-adjusted returns and current income

that invests in investment-grade private credit, including

asset-based finance, along with investment-grade public credit.

“Historically, the ETF vehicle has been used to unlock market

opportunities for all investors, no matter how big or small. Thanks

to ETFs, all investors have transparent access to traditionally

less-liquid segments of the markets,” said Anna Paglia, chief

business officer at State Street Global Advisors. “We have worked

with Apollo to provide a liquidity solution within PRIV and PRIV

continues the mission of democratizing access to private markets,”

she added.

PRIV seeks to maximize risk-adjusted returns and provide current

income by investing primarily in investment grade debt securities,

including a combination of public and private credit such as

asset-based finance and corporate lending. PRIV uses a risk-aware,

macroeconomic top-down approach combined with bottom-up security

selection to construct a portfolio that seeks to overweight the

most attractive sectors and issuers. PRIV may invest in private

credit instruments sourced by Apollo Global Securities, LLC, an

affiliate of Apollo Global Management, Inc. (NYSE: APO)

(“Apollo”).

Over the last decade, investment demand for private markets

exposure has surged, driven by large institutional investors

seeking higher yields and greater diversification potential. State

Street Global Advisors expects the next wave of private market

demand will include retail investors seeking exposure to this

growing asset class through lower cost investment vehicles that are

tradable, transparent, and provide daily liquidity.

Apollo reported more than $220 billion of origination in 20241

supported by its credit business and broader origination ecosystem

spanning 16 standalone platforms. Apollo estimates the potential

addressable market for private credit is a $40 trillion

market.2

For more information about PRIV, the role private credit can

play in a portfolio, and educational content, visit our dedicated

landing zone.

About State Street Global Advisors

For over four decades, State Street Global Advisors has served

the world’s governments, institutions, and financial advisors. With

a rigorous, risk-aware approach built on research, analysis, and

market-tested experience, and as pioneers in index and ETF

investing, we are always inventing new ways to invest. As a result,

we have become the world’s fourth-largest asset manager3 with US

$4.72 trillion4 under our care.

1 Apollo Global Management as of December 31, 2024. 2 Apollo

Global Management as of September 2024: Leading With Private

Investment-Grade Credit. 3 Pensions & Investments Research

Center, as of 12/31/23. 4 This figure is presented as of December

31, 2024 and includes ETF AUM of $1,577.74 billion USD of which

approximately $82.19 billion USD in gold assets with respect to

SPDR products for which State Street Global Advisors Funds

Distributors, LLC (SSGA FD) acts solely as the marketing agent.

SSGA FD and State Street Global Advisors are affiliated. Please

note all AUM is unaudited.

Disclaimer: Apollo is not a sponsor, distributor,

promoter, or investment adviser to the Fund. Apollo has entered

into a contractual agreement with the Fund whereby it is obligated

to provide firm bids on asset-backed and corporate finance

instruments, sourced by Apollo (each an “AOS Investment”) to the

Fund on a daily basis at certain intervals and is required to

repurchase AOS Investments that the Fund has purchased at the firm

bid price offered by Apollo, subject to, but not limited to,

contractual levels designed to cover the estimated seven-day stress

redemption rate as of the date hereof. The sale of AOS Investments

to Apollo is not exclusive and the Fund may seek to sell AOS

Investments to other counterparties.

Important Risk Information

Investing involves risk including the risk of loss of

principal.

Market Risk: The Fund's investments are subject to

changes in general economic conditions, general market fluctuations

and the risks inherent in investing in markets. Investment markets

can be volatile and prices of investments can change substantially

due to various factors including, but not limited to, economic

growth or recession, changes in interest rates, inflation, changes

in the actual or perceived creditworthiness of issuers, and general

market liquidity

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs net asset value. Brokerage commissions and ETF expenses

will reduce returns.

The Fund is actively managed. The Adviser’s judgments about the

attractiveness, relative value, or potential appreciation of a

particular sector, security, commodity or investment strategy may

prove to be incorrect, and may cause the Fund to incur losses.

There can be no assurance that the Adviser’s investment techniques

and decisions will produce the desired results.

Debt Securities: The values of debt securities may

increase or decrease as a result of the following: market

fluctuations, changes in interest rates, actual or perceived

inability or unwillingness of issuers, guarantors or liquidity

providers to make scheduled principal or interest payments or

illiquidity in debt securities markets; the risk of low rates of

return due to reinvestment of securities during periods of falling

interest rates or repayment by issuers with higher coupon or

interest rates; and/or the risk of low income due to falling

interest rates.

Investing in high yield fixed income securities,

otherwise known as “junk bonds”, is considered speculative and

involves greater risk of loss of principal and interest than

investing in investment grade fixed income securities. These

Lower-quality debt securities involve greater risk of default or

price changes due to potential changes in the credit quality of the

issuer.

Privately-issued securities are securities that have not

been registered under the Securities Act and as a result are

subject to legal restrictions on resale. Privately-issued

securities are not traded on established markets and may be

illiquid, difficult to value and subject to wide fluctuations in

value. Limitations on the resale of these securities may have an

adverse effect on their marketability, and may prevent the Fund

from disposing of them promptly at reasonable prices. Private

credit can range in credit quality depending on a variety of

factors, including total leverage, amount of leverage senior to the

security in question, variability in the issuer’s cash flows, the

size of the issuer, the quality of assets securing debt and the

degree to which such assets cover the subject company’s debt

obligations. In addition, there can be no assurance that the

Adviser will be able to secure all of the investment opportunities

that it identifies for the Fund, or that the size of an investment

opportunity available to the Fund will be as large as the Adviser

would desire, on account of general economic conditions, specific

market developments, or other circumstances outside of the

Adviser’s control.

Non-diversified fund may invest in a relatively small

number of issuers. The value of shares of non-diversified funds may

be more volatile than the values of shares of more diversified

funds.

Intellectual Property Information: The S&P 500® Index

is a product of S&P Dow Jones Indices LLC or its affiliates

(“S&P DJI”) and have been licensed for use by State Street

Global Advisors. S&P® , SPDR® , S&P 500® ,US 500 and the

500 are trademarks of Standard & Poor’s Financial Services LLC

(“S&P”); Dow Jones® is a registered trademark of Dow Jones

Trademark Holdings LLC (“Dow Jones”) and has been licensed for use

by S&P Dow Jones Indices; and these trademarks have been

licensed for use by S&P DJI and sublicensed for certain

purposes by State Street Global Advisors. The fund is not

sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones,

S&P, their respective affiliates, and none of such parties make

any representation regarding the advisability of investing in such

product(s) nor do they have any liability for any errors,

omissions, or interruptions of these indices.

Distributor State Street Global Advisors Funds

Distributors, LLC, member FINRA, SIPC, an indirect wholly owned

subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain

State Street affiliates provide services and receive fees from the

SPDR ETFs.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit ssga.com. Read it carefully.

© 2025 State Street Corporation. All Rights Reserved.

Not FDIC Insured – No Bank Guarantee – May Lose Value

State Street Global Advisors, 1 Iron Street, Boston, MA

02210-1641

© 2025 State Street Corporation

All Rights Reserved.

7555407.1.1.AM.RTL Exp. Date: 2/28/2026

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226970654/en/

Deborah Heindel +1 617 662 9927 DHEINDEL@StateStreet.com

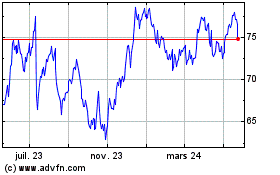

State Street (NYSE:STT)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

State Street (NYSE:STT)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025