Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 Novembre 2024 - 11:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of November 2024

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th Floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR HOLDINGS INC.

TABLE OF CONTENTS

ITEM

ULTRAPAR PARTICIPAÇÕES S.A.

Construction of LPG port terminal

São Paulo, November 29, 2024 – Ultrapar Participações S.A. (B3: UGPA3 / NYSE: UGP, “Ultrapar”), in compliance with CVM Resolution 44/21, announces that it submitted for approval by the Administrative Council for Economic Defense (CADE) the partnership to be developed between its subsidiary Companhia Ultragaz S.A. (“Ultragaz”) and Supergasbrás Energia Ltda., through the establishment of an special purpose entity (“SPE”) with an equal stake among shareholders, for the construction and operation of a terminal at the Port of Pecém (state of Ceará) for handling LPG (“Project”). In addition to CADE’s approval, the transaction is subject to other precedent conditions, common for this type of transaction.

Once approved, a structure with a storage capacity of approximately 62 thousand tons will be built, and is expected to be concluded in 2028. For this Project, investments of R$ 1.2 billion are estimated to be divided equally between the parties. The Project will promote greater security in the supply of LPG to the North and Northeast regions of the country, where national production of LPG is historically deficient.

This move demonstrates Ultragaz’s continued ability to pursue efficiencies and Ultrapar’s willingness to make strategic partnerships in its business portfolio.

Rodrigo de Almeida Pizzinatto

Chief Financial and Investor Relations Officer

Ultrapar Participações S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 29, 2024

|

ULTRAPAR HOLDING INC. |

|

By: /s/ Rodrigo de Almeida Pizzinatto

|

|

Name: Rodrigo de Almeida Pizzinatto

|

|

Title: Chief Financial and Investor Relations Officer

|

(Market announcement)

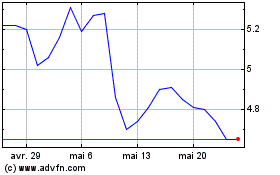

Ultrapar Participacoes (NYSE:UGP)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ultrapar Participacoes (NYSE:UGP)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025