BioSenic S.A. : Positive vote of the majority of creditors in favor of the global restructuring plan of BioSenic covering the years 2024-2032, at the Enterprise Court of Nivelles

27 Mai 2024 - 5:00PM

BioSenic S.A. : Positive vote of the majority of creditors in favor

of the global restructuring plan of BioSenic covering the years

2024-2032, at the Enterprise Court of Nivelles

PRESS RELEASE - PRIVILEGED INFORMATION

After a recent circular consultation of

the creditors, based on XX 83/23 of the Economic Law Code (ELC),

the Enterprise Court of Nivelles registers today the positive votes

of the majority of creditors on the Restructuration Plan presented

by BioSenic and its restructuration practitioner, Maître Yves

Brulard.

Mont-Saint-Guibert, Belgium, 27 May

2024, 5:00pm CET – BioSenic

(Euronext Brussels and Paris: BIOS), the

clinical-stage company specializing in serious autoimmune and

inflammatory diseases and cell therapy announces today that it has

obtained a positive vote of its creditors on its restructuration

Plan within the request referred to in Article XX 83/26 ELC within

the Enterprise Court of Nivelles. The Plan provides for

differentiated treatment of creditors by class. Creditors have been

asked to express their vote on the said Plan in front of the Court,

with the following main points:

- The plan

does not affect the recent financing provided through the

convertible bond facilities.

- Some

obligators are being offered to replace their outstanding loans

granted to BioSenic for a total principal amount of EUR 7.5 million

with new convertible bonds to be issued by BioSenic. The

convertible bonds would be unsecured and would have a maturity date

of 31 December 2030, which could be further extended to 21 December

2032 by BioSenic for up to 24 months depending on its cash balance.

An interest rate of 5% per year, payable annually, with an

additional non-compounding interest of 3% per year, is added to the

principal amount upon conversion or repayment of a convertible

bond. Under the judgement, 200,000 outstanding warrants will be

cancelled; the plan removes the conditions precedent previously

agreed.

- The plan

provides that an outstanding EUR 8 million principal loan will be

replaced by new convertible bonds to be issued by BioSenic. The

convertible bonds are unsecured and have a maturity date of 31

December 2030, which could be further extended by BioSenic for up

to 24 months depending on its cash balance. An interest rate of 5%

per year, payable annually, with an additional non-compounding

interest of 3% per year will be added to the principal amount upon

conversion or repayment of a convertible bond; 800,000 outstanding

warrants are also cancelled.

-

Regarding the ordinary creditors, the plan provides for a payment

by BioSenic of 5% of each accepted claim on the last day of the 5th

year of the plan.

-

Regarding the strategic creditors, the plan provides for 90% over 5

years depending on cash inflows and no later than the last day of

the 5th year of the plan.

- For the

accessory employees, the plan provides for 99%

immediately.

- The plan

provides, for the very useful creditors, for 50% within 2

years.

-

Regarding the InterCo debts, the plan provides for 5%

immediately.

- Finally,

with regard to the shareholders/ Board members, the plan provides

for the allocation of warrants, immediately available for

sale.

The plan includes participation clause at the

restructuring value, payable on the last day of the fifth year

following approval of the plan, based on the average share price

over the preceding 90 days. This participation amount - to be

deducted from the Company's own financing capacity for projects in

the 5th year, with trials on new indications to be initiated or

even maintained - will be due on the last day of the 5th year

following the approval of the plan (27 May 2024) and will be

assessed on the basis of the average share price over the preceding

90 days: the average share price will have to reach the level

observed for the BioSenic share in 2017 while a Phase 3 trial was

ongoing (JTA004). At that time, the share price stood at EUR 10. If

this level is reached, the participation of every creditor will be

increased by 10% of the debt written off. The

increase/participation could reach 20 % of the debt written off if

the price reaches EUR 18, 30% if the price reaches EUR 25 and 50%

if the price reaches EUR 50, which is deemed highly unlikely for a

biotech with no turnover, as indicated in a 2022 MIT study (Singh

et al 2022, PloS-ONE, open access article, "The reaction of sponsor

stock prices to clinical trial outcomes: An event study

analysis").

The plan is based on the maintained non-binding

offer of funding from a fund to finance a Phase 3 clinical trial on

chronic Graft versus Host disease (as announced by BioSenic press

release, on 8 December 2023). The court judgment is currently under

deliberation. Once the decision is made public, the plan can be

implemented immediately and will significantly reduce current debt

and provide a good opportunity for BioSenic to continue operations,

resolve remaining issues and resolutely focus all active forces on

the path to success in the clinical challenges facing the

company.

François Rieger, PhD, President of the

Board and CEO of the BioSenic Group, said: "The continued

reorganisation of BioSenic's assets is now being accompanied by a

creditors' vote that will allow significant adjustments to the

company's liabilities. Once the court's decision is final, this

should enable our biotech to regain essential momentum by focusing

its efforts on its most promising projects, in particular a phase 3

clinical trial for the treatment of chronic Graft-versus-Host

disease. These projects, most of which are at a crucial and late

stage of clinical development, should quickly generate value for

all those who have invested financially in the adventure that is

now taking shape. Our aim is to deliver breakthrough results for

patients suffering from chronic diseases of the immune system for

which there is currently no medical need, and to develop our

therapeutic tools for the benefit of patients with high medical

expectations."

About BioSenic

BioSenic is a leading biotech company

specializing in the development of clinical assets issued from its

Medsenic’s arsenic trioxide (ATO) platform. Key target indications

for the autoimmune platform include graft-versus-host-disease

(GvHD), systemic lupus erythematosus (SLE), and now systemic

sclerosis (SSc).Following the merger in October 2022, BioSenic

combined the strategic positionings and strengths of Medsenic and

Bone Therapeutics. The merger specifically enables

Medsenic/Biosenic to develop an entirely new arsenal of various

anti-inflammatory and anti-autoimmune formulations using the

immunomodulatory properties of ATO/oral ATO (OATO).

BioSenic is based in the Louvain-la-Neuve

Science Park in Mont-Saint-Guibert, Belgium. Further information is

available at http://www.biosenic.com.

About the main Medsenic/BioSenic

technology platform

The ATO platform provides

derived active products with immunomodulatory properties and

fundamental effects on the activated cells of the immune system.

One direct application is its use in onco-immunology to treat GvHD

(Graft-versus-Host Disease) in its chronic, established stage.

cGvHD is one of the most common and clinically significant

complications affecting long-term survival of allogeneic

hematopoietic stem cell transplantation (allo-HSCT).

Medsenic has been successful in a phase 2 trial

with its intravenous formulation, Arscimed®, which

has orphan drug designation status by FDA and EMA. The company is

heading towards an international phase 3 confirmatory study, with

its new, IP-protected, OATO formulation. Another selected target is

moderate-to-severe forms of systemic lupus erythematosus (SLE),

using the same oral formulation. ATO has shown good safety and

significant clinical efficacy on several affected organs (skin,

mucosae, and the gastrointestinal tract). Systemic sclerosis is now

full part of the clinical pipeline of Medsenic/BioSenic. This

serious chronic disease badly affects skin, lungs, or

vascularization, and has no current effective treatment.

Preclinical studies on pertinent animal models are positive, giving

good grounds to launch a phase 2 clinical protocol, using new

immunomodulatory formulations of APIs recognized to be active on

the immune system.

The company is currently focusing its present

R&D and clinical activities on a selective, accelerated

development of its autoimmune platform.

Note: The allogeneic cell therapy

platform-originating from the previous listed company Bone

Therapeutics company, may be of renewed interest by using isolated

and purified differentiated bone marrow Mesenchymal Stromal Cells

(MSCs) as a starting material for further isolation of passive or

active biological subcellular elements. Indeed, these cells may

provide new subcellular vesicles potentially able to deliver a

unique and proprietary approach to organ repair. BioSenic is now

involved in determining new patentable approaches in this complex

area of cell therapy.

For further information, please

contact:

BioSenic SAFrançois Rieger, PhD,

CEOTel: +33 (0)671 73 31 59investorrelations@biosenic.com

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the company or, as

appropriate, the company directors’ current expectations and

projections about future events. By their nature, forward-looking

statements involve a number of risks, uncertainties and assumptions

that could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties and assumptions could adversely affect the

outcome and financial effects of the plans and events described

herein. A multitude of factors including, but not limited to,

changes in demand, competition and technology, can cause actual

events, performance or results to differ significantly from any

anticipated development. Forward looking statements contained in

this press release regarding past trends or activities should not

be taken as a representation that such trends or activities will

continue in the future. As a result, the company expressly

disclaims any obligation or undertaking to release any update or

revisions to any forward-looking statements in this press release

as a result of any change in expectations or any change in events,

conditions, assumptions or circumstances on which these

forward-looking statements are based. Neither the company nor its

advisers or representatives nor any of its subsidiary undertakings

or any such person’s officers or employees guarantees that the

assumptions underlying such forward-looking statements are free

from errors nor does either accept any responsibility for the

future accuracy of the forward-looking statements contained in this

press release or the actual occurrence of the forecasted

developments. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

press release.

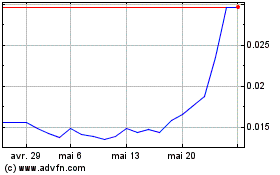

Biosenic (EU:BIOS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Biosenic (EU:BIOS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024