- Vast Solar Pty Ltd. (“Vast” or the “Company”) has entered into

a Business Combination Agreement with Nabors Energy Transition

Corp. (“NETC”). The combined entity will be named Vast and is

expected to be listed on the New York Stock Exchange (NYSE) under

the ticker symbol “VSTE”, while remaining headquartered in

Australia.

- Vast has developed a proprietary next-generation CSP system

that provides clean, dispatchable renewable energy for

utility-scale power, industrial heat and clean fuel production

applications.

- Vast’s technology is designed to overcome the manufacturability

and reliability issues that slowed the adoption of conventional CSP

technology and deliver a levelized cost of energy that is

competitive with, or superior to, solar PV plus storage.

- The Company’s CSP system uses a distributed modular tower

design and a sodium heat transfer loop to gather energy from the

sun, which is then stored in molten salt for later dispatch as

either power or heat. Sodium is a superior thermal conductor which

is key to enabling Vast’s modular tower design, and the modular

design delivers improved performance, lower cost and reduced risk

relative to previous generations of CSP technology.

- To validate its technology, Vast constructed and operated from

2018 to 2020 a grid-connected 1.1 MW demonstration facility in

Forbes, Australia.

- Vast’s business model is to develop CSP projects using the

Company’s technology, supply the equipment required to construct

those projects, and provide EPC and O&M services to those

projects during and after construction.

- The Company is currently developing 230MW of projects,

including a 30 MW grid-connected facility in Port Augusta,

Australia that is expected to become operational in 2025, and a 20

ton per day solar methanol facility that will be co-located with

and partially powered by the 30MW plant. Vast also has a multi-GW

global pipeline of potential CSP projects.

- The IEA forecasts deployments of up to 430 GW of new CSP

capacity globally by 2050 for on-grid applications alone.

Furthermore, CSP deployment for other applications could reach more

than a terawatt by 20501.

- NETC is an affiliate of Nabors Industries Ltd. (“Nabors”)

(NYSE: NBR), and this transaction underscores Nabors’ commitment to

the energy transition, extending its existing work on internal

technology development and venture investments in clean, baseload

and scalable energy technologies.

- The transaction is expected to provide gross proceeds of up to

USD $351 million to Vast, comprised of up to USD $286 million from

NETC’s trust account (before giving effect to potential

redemptions), USD $15 million from each of Nabors and Vast’s

existing owner (“AgCentral Energy”) to be funded in a combination

of a pre-closing convertible note financing and a private placement

of ordinary shares of Vast at closing, and a targeted minimum of

USD $35 million of capital from third-party investors.

- Vast intends to use the proceeds from the transaction to fund

project development activities in target markets, equity

investments in CSP projects, deployment of manufacturing

facilities, continued investment in research and development, pay

fees and expenses related to the transaction, and for general

corporate purposes.

- AgCentral Energy and the Company’s management will roll 100% of

their interests in Vast into the combined company.

- The implied equity value of the combined company will be

between approximately USD $305 million and USD $586 million

depending on the level of redemptions. The transaction is expected

to be completed during the second or third quarters of 2023.

Vast Solar Pty Ltd, a renewable energy company specializing in

concentrated solar power (CSP) energy systems that generate

zero-carbon, utility-scale electricity and industrial heat, and

Nabors Energy Transition Corp. (NYSE: NETCU, NETC, NETCW) today

announced a definitive agreement for a business combination (the

“Transaction” or the “Business Combination”) that would result in

Vast becoming a publicly-listed company on the NYSE under the

ticker symbol “VSTE”.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230214005416/en/

Vast’s 1.1 MW CSP Demonstration Plant in

Forbes, Australia was in operation for a 32-month period (Photo:

Business Wire)

World-Leading Innovator in Concentrated Solar Power

Founded in Australia in 2009, Vast’s proprietary CSP system uses

a modular tower design and a unique sodium loop for heat transfer

to efficiently capture and store solar heat for conversion into

clean and renewable electricity and heat. The Company’s system is

designed to deliver greater efficiency, simplified permitting,

faster construction and more reliable operations when compared to

conventional central tower CSP plants.

“Vast’s CSP technology collects and stores the sun’s energy

during the day for delivery at any time, making around-the-clock,

clean power a reality,” said Craig Wood, Chief Executive Officer of

Vast. “While the cost of wind and PV solar have declined

significantly, their intermittency remains a key challenge that can

only be addressed with storage. By providing clean, renewable

energy with low-cost, long-duration storage, our CSP system can be

incorporated as dispatchable generation in a way that is not

possible using PV solar or wind with batteries. We are excited to

partner with NETC to accelerate the deployment of our technology

globally.”

“Vast has the potential to deliver low-cost, clean, renewable

and dispatchable power and heat, a combination that no other

technology has yet been able to achieve,” said Anthony Petrello,

President and CEO of NETC and Chairman, President and CEO of

Nabors. “With our global footprint, technology and operations

expertise, Nabors looks forward to supporting Vast and helping to

extend the leadership role Vast has established in the CSP space.

We believe the transaction will accelerate the deployment of Vast’s

technology, while furthering Nabors’ commitment to 'Energy Without

Compromise' and support of companies on the cutting edge of

advanced energy technology.”

Concentrated Solar Power Market

As the world transitions towards clean energy solutions, the

total addressable market for CSP is poised to grow rapidly, with

the International Energy Agency projecting new CSP deployments of

up to 430 gigawatts by 2050 for on-grid applications alone1.

Further CSP deployment for off-grid baseload-seeking projects,

process heat applications, and as the energy input for green fuel

production could reach more than a terawatt by 20502. Vast is

uniquely positioned to seize opportunities that are in the market

right now, as well as those that will develop as the market for CSP

grows over the coming decades.

Vast Next-Generation CSP Technology

Vast’s proprietary CSP technology reflects and concentrates the

sun’s rays onto solar receivers that capture the sun’s energy as

heat in sodium, then transfer the heat to molten salt for high

density storage. The stored heat can then be used to generate

dispatchable clean power at night by generating steam for a

turbine, produce heat directly for industrial purposes, or to

deliver a mix of power and heat for the efficient production of

green fuels such as green hydrogen, green methanol, sustainable

aviation fuels, among others.

Vast’s CSP technology offers several advantages over

conventional CSP technologies, including:

- Sodium Loop for Heat Transfer – use of sodium as the

heat transfer fluid unlocks Vast’s modular tower design, enables

superior thermal process control, and avoids the need to empty out

and restart the solar receivers on a daily basis due to the risk of

the molten salt freezing, as is the case with central tower

technology. When compared to parabolic trough systems, sodium’s

higher operating temperature relative to mineral oil delivers more

efficient power cycles, and hence cheaper energy.

- Modularity – modular systems make better use of the

heliostats (mirrors), achieving a 10-20% efficiency gain versus

central tower designs, and they remove the single-point-of-failure

risk inherent in central tower technology. Additionally, each

module’s towers are smaller and less complex making them easier to

permit, build, operate and maintain.

Vast’s technology was field validated and proven at the

Company’s Forbes, Australia demonstration plant. The 1.1 MW

facility successfully synchronized with the grid in 2018 and

operated for nearly three years.

Commercial Project Pipeline

The Business Combination will provide Vast with capital to

progress its multi-GW pipeline of projects, including four projects

in various stages of development:

- VS1 Port Augusta – Funded by up to AUD $110 million in

concessional financing from the Australian Government, and up to

AUD $65 million non-dilutive grant from the Australian Renewable

Energy Agency (ARENA), Vast is developing a 30 MW/288MWh CSP

reference plant in Port Augusta, Australia. Utilizing CSP v3.0

technology, the facility will produce dispatchable renewable

electricity on demand for 8 hours overnight.

- SM1 Port Augusta – The SM1 plant, a world-first green

methanol commercial demonstration plant that is designed to produce

20 tons per day of solar methanol, will be fueled in part by the

heat and electricity produced by the co-located VS1 Port Augusta

reference plant. SM1 is being funded in part by the

German-Australian Hydrogen Innovation and Technology Incubator, or

HyGATE, via an approximately AUD $40 million non-dilutive

grant.

- VS2 Mount Isa – The 50 MW North West Queensland Hybrid

Power Project will combine a solar PV system for daytime power

generation, CSP storage for night-time supply, and large-scale

batteries and gas turbines for grid firming.

- VS3 Port Augusta – Permitting is already in place for an

expected 150MW CSP plant that will be built on the same site as VS1

and SM1 following successful completion of those projects.

Alignment with Nabors’ Energy Transition Commitment

The Business Combination with Vast demonstrates the commitment

that Nabors has made over the past several years to utilize its

resources to support the energy transition and reduce carbon

footprints globally. Since making this commitment to “Energy

Without Compromise”, Nabors has utilized a three-pronged approach,

pursuing internal technology development to decarbonize its

operations and those of its customers, creating an ecosystem of

venture investments in early stage advanced technology companies,

and now lending support to Vast’s clean energy mission through the

Business Combination with Nabors Energy Transition Corp.

“This transaction lies at the center of what we have been

carefully creating and curating at Nabors over the past few years

through investing in clean, baseload, scalable energy technologies”

said Guillermo Sierra, VP of Energy Transition for NETC and VP of

Strategic Initiatives for Nabors. “This transaction should allow

Vast’s proprietary CSP technology to be scaled and accelerated by

leveraging our global energy technology and operational platform.

We believe that Vast will play a key role in solving the storage

and dispatch challenges faced by renewable energy and in

facilitating the transition to green fuels by providing clean

process heat.”

Transaction Overview

Subject to certain conditions, affiliates of Nabors and

AgCentral Energy each committed up to $15 million of capital in a

combination of a pre-closing convertible note financing and a

private placement of ordinary shares of Vast at closing. The

Company is targeting a minimum of USD 35 million of additional

capital from other third-party investors.

At closing, the balance of NETC’s trust account, net of any

redemptions and payment of transaction expenses, will be released

to Vast. AgCentral Energy and management will roll 100% of their

interests in Vast into the combined company, which the Company

believes reflects their support for the combination, as well as

confidence in the go-forward prospects for the combined

company.

The implied pro forma equity value of Vast is expected to be

between USD $305 million and USD $586 million depending on the

level of redemptions. Vast’s existing management team will continue

to lead the Company following the completion of the

transaction.

Vast is expected to remain headquartered in Sydney,

Australia.

The Transaction was unanimously approved by the Boards of

Directors of NETC and Vast. Completion of the proposed Transaction

is subject to customary closing conditions and is anticipated to

occur in the second or third quarters of 2023.

Additional information about the proposed Transaction, including

a copy of the business combination agreement and the investor

presentation, will be provided in a Current Report on Form 8-K to

be filed by NETC with the U.S. Securities and Exchange Commission

(the “SEC”) and available at www.sec.gov.

Extension

Under NETC’s amended and restated certificate of incorporation,

Nabors Energy Transition Sponsor LLC (the “NETC Sponsor”), may

deposit into the NETC’s trust account $2,760,000 to extend the date

NETC has to consummate its initial business combination by an

additional three months, up to two times. Affiliates of NETC

Sponsor expect to deposit $2,760,000 into NETC’s trust account

prior to February 18, 2023 to extend the date by which NETC has to

consummate its initial business combination from February 18, 2023

to May 18, 2023.

Advisors

Guggenheim Securities, LLC acted as exclusive financial advisor

to NETC. Vinson & Elkins L.L.P. and King & Wood Mallesons

acted as legal advisors to NETC. Milbank LLP acted as legal advisor

to Nabors. White & Case LLP and Gilbert + Tobin acted as legal

advisors to Vast.

Investor Conference Call Information

Vast and NETC will host a joint investor conference call to

discuss the proposed Transaction today, February 14, 2023 at 8:30AM

ET.

To listen to the prepared remarks via telephone from the U.S.,

dial 1-877-407-3982 and an operator will assist you. The call may

also be accessed through the following link:

https://callme.viavid.com/viavid/?callme=true&passcode=13735972&h=true&info=company&r=true&B=6

A telephone replay will be available by dialing 1-844-512-2921

if in the U.S, and by dialing 1-412-317-6671 from outside the U.S.

The PIN for access to the replay is 13736336. The replay will be

available through March 14, 2023.

About Vast

Vast is a world-leading renewable energy company that has

developed concentrated solar power (CSP) systems to generate, store

and dispatch carbon free, utility-scale electricity, industrial

heat, and to enable the production of green fuels. Vast’s unique

approach to CSP utilizes a proprietary, modular sodium loop to

efficiently capture and convert solar heat into these end products.

Vast’s “CSP v3.0” system is easier to permit, build and maintain

than larger central tower CSP systems, and it is more

efficient.

About Nabors Energy Transition Corp.

Nabors Energy Transition Corp. (NYSE: NETCU, NETC, NETCW) is a

blank check company formed for the purpose of effecting a merger,

capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more

businesses or entities. NETC was formed to identify solutions,

opportunities, companies or technologies that focus on advancing

the energy transition; specifically, ones that facilitate, improve

or complement the reduction of carbon or greenhouse gas emissions

while satisfying growing energy consumption across markets

globally.

NETC is an affiliate of Nabors Industries, Ltd., a leading

provider of advanced technology for the energy industry. By

leveraging its core competencies, particularly in drilling,

engineering, automation, data science and manufacturing, Nabors,

which owns the global industry’s largest fleet of land drilling

rigs and equipment, is committed to innovate the future of energy

and enable the transition to a lower-carbon world

Important Information about the Business Combination and

Where to Find It

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or constitute a

solicitation of any vote or approval.

In connection with the proposed Business Combination, Vast will

file with the SEC a registration statement on Form F-4 (the

“Registration Statement”), which will include (i) a preliminary

prospectus of Vast relating to the offer of securities to be issued

in connection with the proposed Business Combination and (ii) a

preliminary proxy statement of NETC to be distributed to holders of

NETC’s capital stock in connection with NETC’s solicitation of

proxies for vote by NETC’s stockholders with respect to the

proposed Business Combination and other matters described in the

Registration Statement. NETC and Vast also plan to file other

documents with the SEC regarding the proposed Business Combination.

After the Registration Statement has been declared effective by the

SEC, a definitive proxy statement/prospectus will be mailed to the

stockholders of NETC. INVESTORS AND SECURITY HOLDERS OF NETC AND

VAST ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY

STATEMENT/PROSPECTUS CONTAINED THEREIN (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS RELATING TO THE

PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS

COMBINATION.

Investors and security holders will be able to obtain free

copies of the proxy statement/prospectus and other documents

containing important information about NETC and Vast once such

documents are filed with the SEC, through the website maintained by

the SEC at http://www.sec.gov. In addition, the documents filed by

NETC may be obtained free of charge from NETC’s website at

www.nabors-etcorp.com or by written request to NETC at 515 West

Greens Road, Suite 1200, Houston, TX 77067.

Participants in the Solicitation

NETC, Nabors Industries, Ltd. (“Nabors”), Vast and their

respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from the stockholders

of NETC in connection with the proposed Business Combination.

Information about the directors and executive officers of NETC is

set forth in NETC’s Annual Report on Form 10-K for the year ended

December 31, 2021, filed with the SEC on March 28, 2022. To the

extent that holdings of NETC’s securities have changed since the

amounts printed in NETC’s Annual Report on Form 10-K for the year

ended December 31, 2021, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement/prospectus and other relevant materials to be

filed with the SEC when they become available. You may obtain free

copies of these documents as described in the preceding

paragraph.

Forward Looking Statements

The information included herein and in any oral statements made

in connection herewith include “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of present or

historical fact included herein, regarding the proposed Business

Combination, NETC’s and Vast’s ability to consummate the proposed

Business Combination, the benefits of the proposed Business

Combination and NETC’s and Vast’s future financial performance

following the proposed Business Combination, as well as NETC’s and

Vast’s strategy, future operations, financial position, estimated

revenues and losses, projected costs, prospects, plans and

objectives of management are forward-looking statements. When used

herein, including any oral statements made in connection herewith,

the words “could,” “should,” “will,” “may,” “believe,”

“anticipate,” “intend,” “estimate,” “expect,” “project,” the

negative of such terms and other similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These

forward-looking statements are based on NETC and Vast management’s

current expectations and assumptions about future events and are

based on currently available information as to the outcome and

timing of future events. Except as otherwise required by applicable

law, NETC and Vast disclaim any duty to update any forward-looking

statements, all of which are expressly qualified by the statements

in this section, to reflect events or circumstances after the date

hereof. NETC and Vast caution you that these forward-looking

statements are subject to risks and uncertainties, most of which

are difficult to predict and many of which are beyond the control

of NETC and Vast. These risks include, but are not limited to,

general economic, financial, legal, political and business

conditions and changes in domestic and foreign markets; the

inability to complete the Business Combination or the convertible

debt and equity financings contemplated in connection with the

proposed Business Combination (the “Financing”) in a timely manner

or at all (including due to the failure to receive required

stockholder or shareholder, as applicable, approvals, or the

failure of other closing conditions such as the satisfaction of the

minimum trust account amount following redemptions by NETC’s public

stockholders and the receipt of certain governmental and regulatory

approvals), which may adversely affect the price of NETC’s

securities; the inability of the Business Combination to be

completed by NETC’s business combination deadline and the potential

failure to obtain an extension of the business combination deadline

if sought by NETC; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

Business Combination or the Financing; the inability to recognize

the anticipated benefits of the proposed Business Combination; the

inability to obtain or maintain the listing of Vast’s shares on a

national exchange following the consummation of the proposed

Business Combination; costs related to the proposed Business

Combination; the risk that the proposed Business Combination

disrupts current plans and operations of Vast, business

relationships of Vast or Vast’s business generally as a result of

the announcement and consummation of the proposed Business

Combination; Vast’s ability to manage growth; Vast’s ability to

execute its business plan, including the completion of the Port

Augusta project, at all or in a timely manner and meet its

projections; potential disruption in Vast’s employee retention as a

result of the proposed Business Combination; potential litigation,

governmental or regulatory proceedings, investigations or inquiries

involving Vast or NETC, including in relation to the proposed

Business Combination; changes in applicable laws or regulations and

general economic and market conditions impacting demand for Vast’s

products and services. Additional risks are set forth in the

section of the Appendix titled "Summary Risk Factors" attached to

this Presentation and will be set forth in the section titled "Risk

Factors" in the proxy statement/prospectus that will be filed with

the U.S. Securities and Exchange Commission (the “SEC”) in

connection with the proposed Business Combination. Should one or

more of the risks or uncertainties described herein and in any oral

statements made in connection therewith occur, or should underlying

assumptions prove incorrect, actual results and plans could differ

materially from those expressed in any forward-looking statements.

Additional information concerning these and other factors that may

impact NETC’s expectations and projections can be found in NETC’s

periodic filings with the SEC, including NETC’s Annual Report on

Form 10-K filed with the SEC on March 28, 2022 and any subsequently

filed Quarterly Reports on Form 10-Q. NETC’s SEC filings are

available publicly on the SEC’s website at www.sec.gov.

1Per Company Data 2IEA World Energy Outlook 2022, p448 3As

Prepared by a Top Tier International Management Consulting Firm

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230214005416/en/

Vast

For Investors: Caldwell Bailey ICR,

Inc. VastIR@icrinc.com

For Media: Matt Dallas ICR, Inc.

VastPR@icrinc.com

Nabors Energy Transition Corp. Contacts

For Investors: William C. Conroy,

CFA Vice President – Corporate Development & Investor Relations

William.conroy@nabors.com

For Media: Brian Brooks Senior

Director, Corporate Communications Brian.brooks@nabors.com

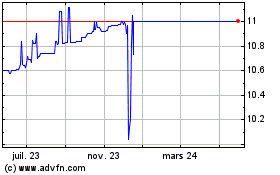

Nabors Energy Transition (NYSE:NETC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Nabors Energy Transition (NYSE:NETC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025