Supplemental Information Third Quarter 2023

2 Table of Contents Page Company Highlights 5 Financial Information 8 Debt & Capitalization 23 Leasing Activity & Asset Management 29 Components of Net Asset Value 31 Property Information 33 Portfolio Characteristics 38 Notes & Definitions 58

3 Disclaimer Disclaimer on Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward- looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this document reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: general economic and financial conditions; market volatility; inflation; any potential recession or threat of recession; interest rates; recent and ongoing disruption in the debt and banking markets; occupancy, rent deferrals and the financial condition of our tenants; whether work-from-home trends or other factors will impact the attractiveness of industrial and/or office assets; whether we will be successful in renewing leases as they expire; future financial and operating results, plans, objectives, expectations and intentions; expected sources of financing, including the ability to maintain the commitments under our revolving credit facility, and the availability and attractiveness of the terms of any such financing; legislative and regulatory changes that could adversely affect our business; our future capital expenditures, operating expenses, net income, operating income, cash flow and developments and trends of the real estate industry; whether we will be successful in the pursuit of our business plan, including any dispositions; whether we will succeed in our investment objectives; any fluctuation and/or volatility of the trading price of our common shares; risks associated with our dependence on key personnel whose continued service is not guaranteed; and other factors, including those risks disclosed in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission. While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. The forward-looking statements speak only as of the date of this document. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this document, except as required by applicable law. We caution investors not to place undue reliance on any forward-looking statements, which are based only on information currently available to us. Notice Regarding Non-GAAP Financial Measures. In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published.

Company Highlights

5 High-Quality Portfolio of Office & Industrial Properties Net-Leased to a Diversified Pool of Creditworthy Tenants4 73 Properties 18.1M Square Feet 24 States 96.4%3 Leased 24%/56%/20%1 Industrial/ Office/Other 6.3 Years1 WALT 60.1%1,2 Investment Grade 1.9%1 Avg. Annual Rent Escalations 1 Weighted average based on ABR. 2 Represents ratings of tenants, guarantors or non-guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of investment grade in "Notes and Definitions." 3 Based on rentable square feet. 4 Peakstone Realty Trust has no affiliation, connection or association with and is not sponsored or approved by the tenants of its properties. Peakstone Realty Trust has not approved or sponsored its tenants or their products and services. All product and company names, logos and slogans are the trademarks or service marks of their respective owners. Industrial Office Wholly-Owned Portfolio Snapshot As of September 30, 2023 Unaudited Unaudited AT&T

6 (Unaudited, USD in thousands) Number of Properties Economic Occupancy1 Total Rentable Square Feet WALT (years)2 Annualized Base Rent Investment Grade by Segment3 Industrial4 19 100.0 % 9,001,800 6.3 $ 48,777 58.5 % Office5 36 97.0 5,684,400 7.7 113,528 64.8 TOTAL / WEIGHTED AVERAGE INDUSTRIAL AND OFFICE 55 98.8 % 14,686,200 7.3 $ 162,305 62.9 % Other6 18 83.1 3,413,800 2.7 40,551 48.9 TOTAL / WEIGHTED AVERAGE PORTFOLIO 73 95.9 % 18,100,000 7 6.3 $ 202,856 60.1 % 1 Based on rentable square feet. 2 Weighted average based on ABR. 3 Weighted average based on ABR. Represents ratings of tenants, guarantors or non-guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of investment grade in "Notes and Definitions." 4 The Industrial segment consists of high-quality, well-located industrial properties with modern specifications. 5 The Office segment consists of newer, high-quality, and business-essential office properties. During Q3, the Company reclassified 136 & 204 Capcom as two distinct properties. 6 The Other segment consists of vacant and non-core properties, together with other properties in the same cross-collateralized loan pools. This segment includes properties that are either non-stabilized, leased to tenants with shorter lease terms or are being evaluated for repositioning, re-leasing or potential sale. 7 Includes approximately 4.5K of square feet, from two properties, subject to leases with third parties for building amenities that do not generate net rent (e.g. a health club and a cafe). Wholly-Owned Portfolio As of September 30, 2023

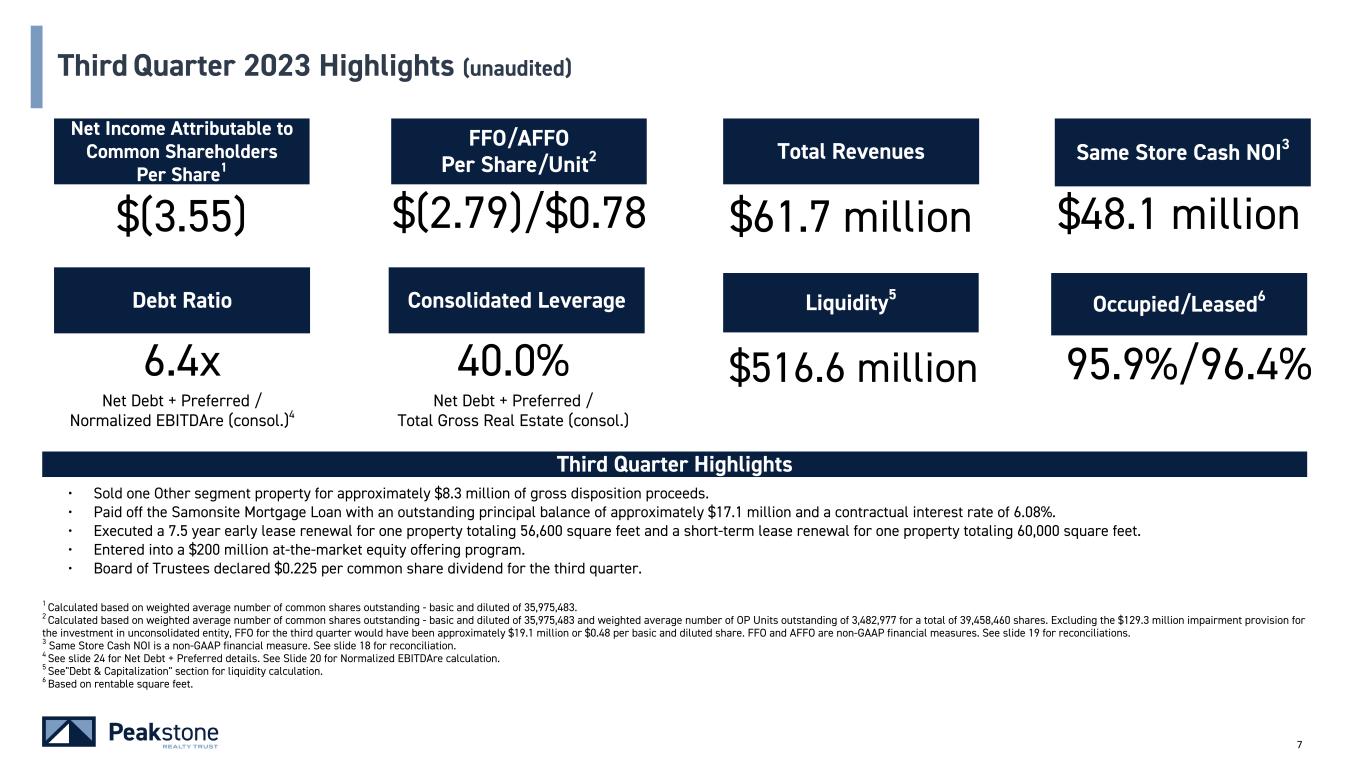

7 Consolidated Leverage $516.6 million40.0% Net Debt + Preferred / Total Gross Real Estate (consol.) $(2.79)/$0.78 FFO/AFFO Per Share/Unit2 6.4x Net Debt + Preferred / Normalized EBITDAre (consol.)4 Total Revenues $61.7 million Same Store Cash NOI3 Liquidity5 1 Calculated based on weighted average number of common shares outstanding - basic and diluted of 35,975,483. 2 Calculated based on weighted average number of common shares outstanding - basic and diluted of 35,975,483 and weighted average number of OP Units outstanding of 3,482,977 for a total of 39,458,460 shares. Excluding the $129.3 million impairment provision for the investment in unconsolidated entity, FFO for the third quarter would have been approximately $19.1 million or $0.48 per basic and diluted share. FFO and AFFO are non-GAAP financial measures. See slide 19 for reconciliations. 3 Same Store Cash NOI is a non-GAAP financial measure. See slide 18 for reconciliation. 4 See slide 24 for Net Debt + Preferred details. See Slide 20 for Normalized EBITDAre calculation. 5 See"Debt & Capitalization" section for liquidity calculation. 6 Based on rentable square feet. 95.9%/96.4% Occupied/Leased6 Third Quarter Highlights • Sold one Other segment property for approximately $8.3 million of gross disposition proceeds. • Paid off the Samonsite Mortgage Loan with an outstanding principal balance of approximately $17.1 million and a contractual interest rate of 6.08%. • Executed a 7.5 year early lease renewal for one property totaling 56,600 square feet and a short-term lease renewal for one property totaling 60,000 square feet. • Entered into a $200 million at-the-market equity offering program. • Board of Trustees declared $0.225 per common share dividend for the third quarter. Third Quarter 2023 Highlights (unaudited) Net Income Attributable to Common Shareholders Per Share1 $(3.55) Debt Ratio $48.1 million

Financial Information

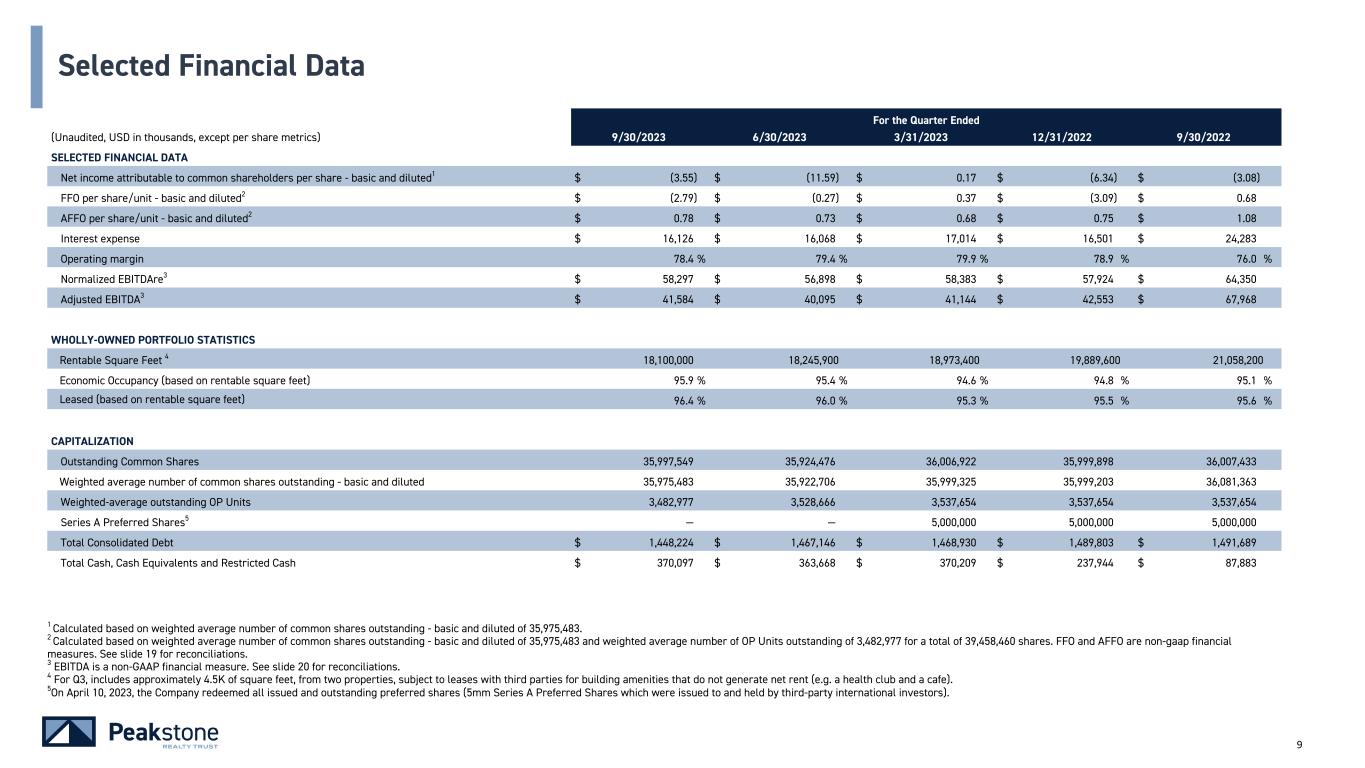

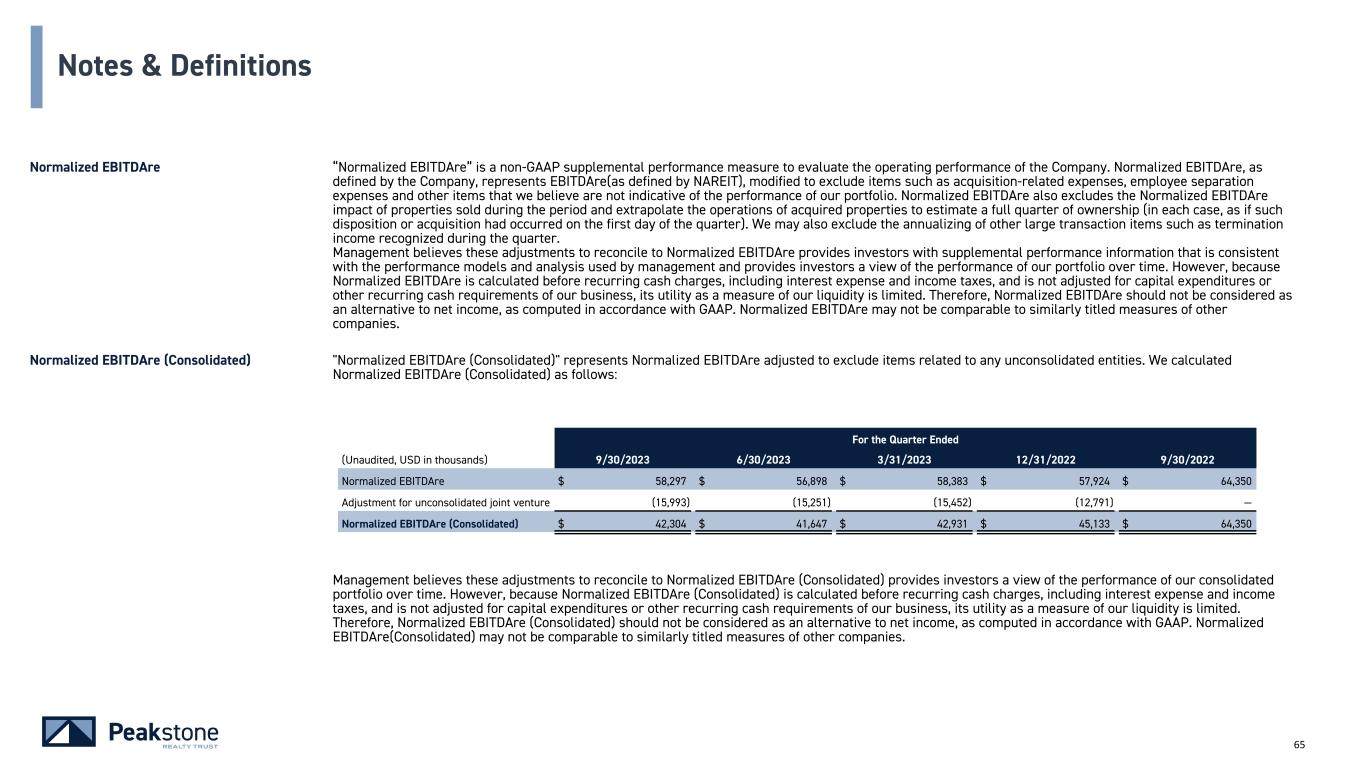

9 1 Calculated based on weighted average number of common shares outstanding - basic and diluted of 35,975,483. 2 Calculated based on weighted average number of common shares outstanding - basic and diluted of 35,975,483 and weighted average number of OP Units outstanding of 3,482,977 for a total of 39,458,460 shares. FFO and AFFO are non-gaap financial measures. See slide 19 for reconciliations. 3 EBITDA is a non-GAAP financial measure. See slide 20 for reconciliations. 4 For Q3, includes approximately 4.5K of square feet, from two properties, subject to leases with third parties for building amenities that do not generate net rent (e.g. a health club and a cafe). 5On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors). For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 SELECTED FINANCIAL DATA Net income attributable to common shareholders per share - basic and diluted1 $ (3.55) $ (11.59) $ 0.17 $ (6.34) $ (3.08) FFO per share/unit - basic and diluted2 $ (2.79) $ (0.27) $ 0.37 $ (3.09) $ 0.68 AFFO per share/unit - basic and diluted2 $ 0.78 $ 0.73 $ 0.68 $ 0.75 $ 1.08 Interest expense $ 16,126 $ 16,068 $ 17,014 $ 16,501 $ 24,283 Operating margin 78.4 % 79.4 % 79.9 % 78.9 % 76.0 % Normalized EBITDAre3 $ 58,297 $ 56,898 $ 58,383 $ 57,924 $ 64,350 Adjusted EBITDA3 $ 41,584 $ 40,095 $ 41,144 $ 42,553 $ 67,968 WHOLLY-OWNED PORTFOLIO STATISTICS Rentable Square Feet 4 18,100,000 18,245,900 18,973,400 19,889,600 21,058,200 Economic Occupancy (based on rentable square feet) 95.9 % 95.4 % 94.6 % 94.8 % 95.1 % Leased (based on rentable square feet) 96.4 % 96.0 % 95.3 % 95.5 % 95.6 % CAPITALIZATION Outstanding Common Shares 35,997,549 35,924,476 36,006,922 35,999,898 36,007,433 Weighted average number of common shares outstanding - basic and diluted 35,975,483 35,922,706 35,999,325 35,999,203 36,081,363 Weighted-average outstanding OP Units 3,482,977 3,528,666 3,537,654 3,537,654 3,537,654 Series A Preferred Shares5 — — 5,000,000 5,000,000 5,000,000 Total Consolidated Debt $ 1,448,224 $ 1,467,146 $ 1,468,930 $ 1,489,803 $ 1,491,689 Total Cash, Cash Equivalents and Restricted Cash $ 370,097 $ 363,668 $ 370,209 $ 237,944 $ 87,883 Selected Financial Data

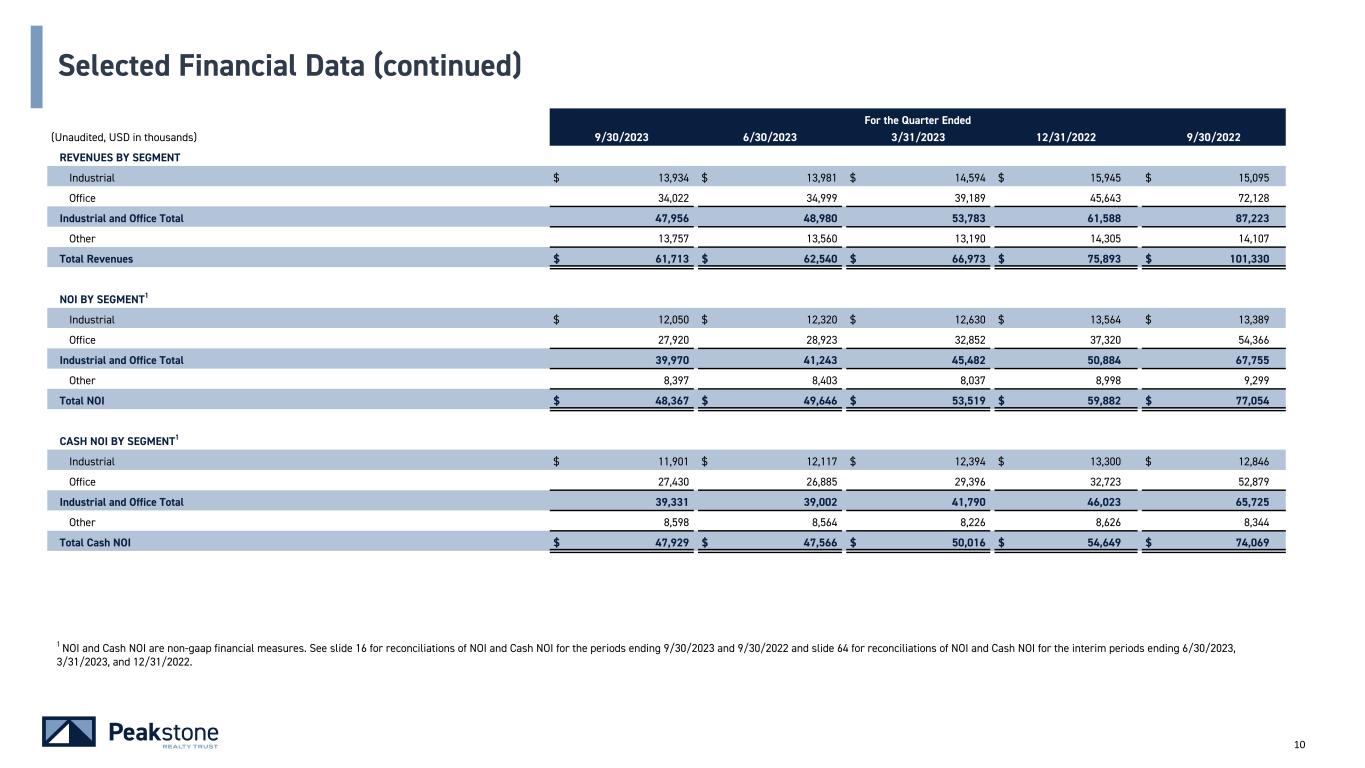

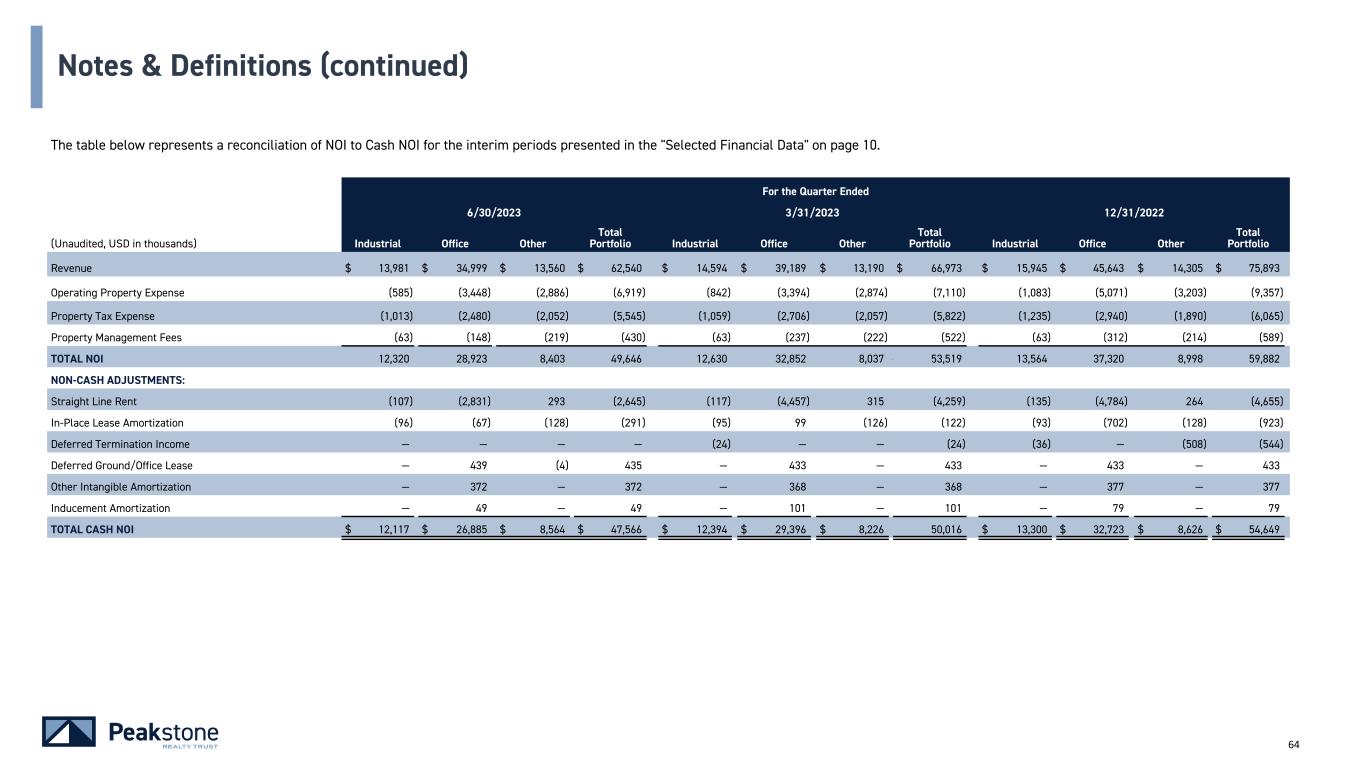

10 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 REVENUES BY SEGMENT Industrial $ 13,934 $ 13,981 $ 14,594 $ 15,945 $ 15,095 Office 34,022 34,999 39,189 45,643 72,128 Industrial and Office Total 47,956 48,980 53,783 61,588 87,223 Other 13,757 13,560 13,190 14,305 14,107 Total Revenues $ 61,713 $ 62,540 $ 66,973 $ 75,893 $ 101,330 NOI BY SEGMENT1 Industrial $ 12,050 $ 12,320 $ 12,630 $ 13,564 $ 13,389 Office 27,920 28,923 32,852 37,320 54,366 Industrial and Office Total 39,970 41,243 45,482 50,884 67,755 Other 8,397 8,403 8,037 8,998 9,299 Total NOI $ 48,367 $ 49,646 $ 53,519 $ 59,882 $ 77,054 CASH NOI BY SEGMENT1 Industrial $ 11,901 $ 12,117 $ 12,394 $ 13,300 $ 12,846 Office 27,430 26,885 29,396 32,723 52,879 Industrial and Office Total 39,331 39,002 41,790 46,023 65,725 Other 8,598 8,564 8,226 8,626 8,344 Total Cash NOI $ 47,929 $ 47,566 $ 50,016 $ 54,649 $ 74,069 Selected Financial Data (continued) 1 NOI and Cash NOI are non-gaap financial measures. See slide 16 for reconciliations of NOI and Cash NOI for the periods ending 9/30/2023 and 9/30/2022 and slide 64 for reconciliations of NOI and Cash NOI for the interim periods ending 6/30/2023, 3/31/2023, and 12/31/2022.

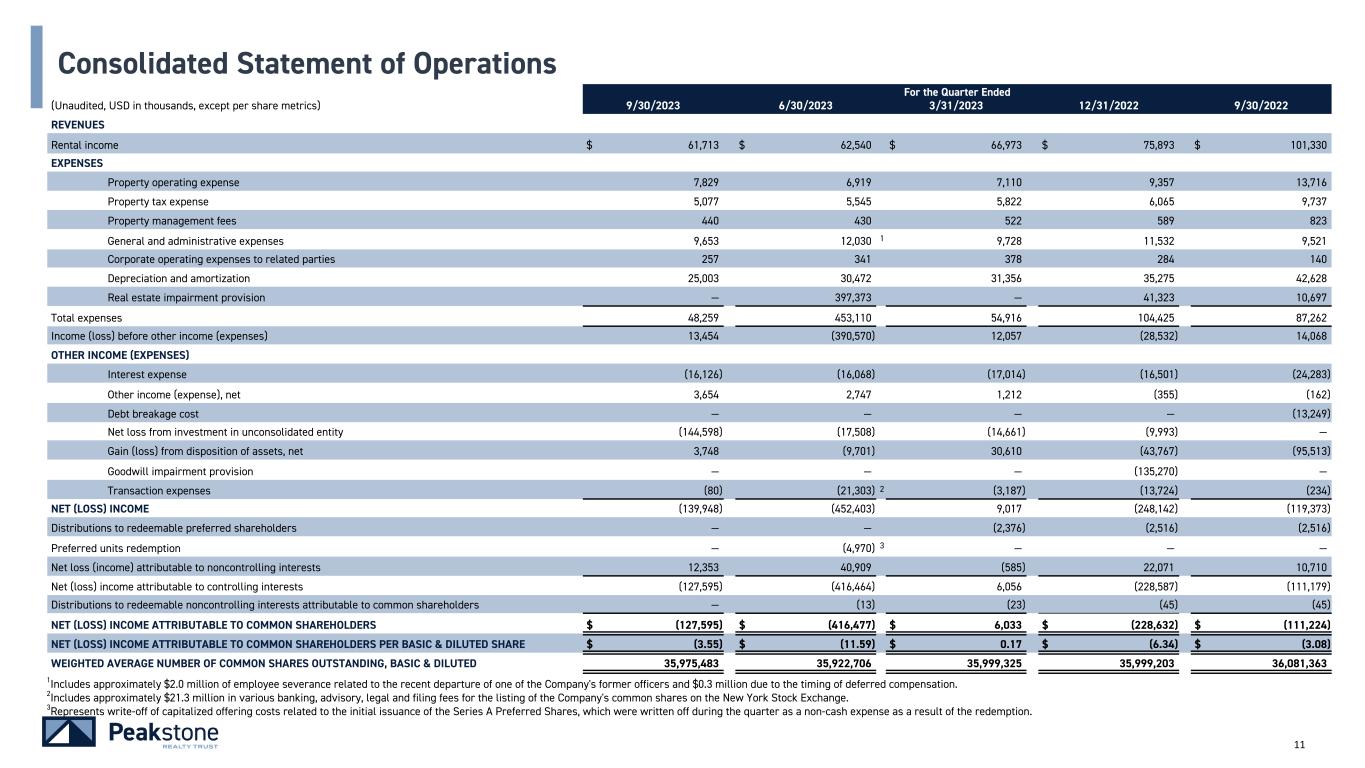

11 For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 REVENUES Rental income $ 61,713 $ 62,540 $ 66,973 $ 75,893 $ 101,330 EXPENSES Property operating expense 7,829 6,919 7,110 9,357 13,716 Property tax expense 5,077 5,545 5,822 6,065 9,737 Property management fees 440 430 522 589 823 General and administrative expenses 9,653 12,030 1 9,728 11,532 9,521 Corporate operating expenses to related parties 257 341 378 284 140 Depreciation and amortization 25,003 30,472 31,356 35,275 42,628 Real estate impairment provision — 397,373 — 41,323 10,697 Total expenses 48,259 453,110 54,916 104,425 87,262 Income (loss) before other income (expenses) 13,454 (390,570) 12,057 (28,532) 14,068 OTHER INCOME (EXPENSES) Interest expense (16,126) (16,068) (17,014) (16,501) (24,283) Other income (expense), net 3,654 2,747 1,212 (355) (162) Debt breakage cost — — — — (13,249) Net loss from investment in unconsolidated entity (144,598) (17,508) (14,661) (9,993) — Gain (loss) from disposition of assets, net 3,748 (9,701) 30,610 (43,767) (95,513) Goodwill impairment provision — — — (135,270) — Transaction expenses (80) (21,303) 2 (3,187) (13,724) (234) NET (LOSS) INCOME (139,948) (452,403) 9,017 (248,142) (119,373) Distributions to redeemable preferred shareholders — — (2,376) (2,516) (2,516) Preferred units redemption — (4,970) 3 — — — Net loss (income) attributable to noncontrolling interests 12,353 40,909 (585) 22,071 10,710 Net (loss) income attributable to controlling interests (127,595) (416,464) 6,056 (228,587) (111,179) Distributions to redeemable noncontrolling interests attributable to common shareholders — (13) (23) (45) (45) NET (LOSS) INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS $ (127,595) $ (416,477) $ 6,033 $ (228,632) $ (111,224) NET (LOSS) INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS PER BASIC & DILUTED SHARE $ (3.55) $ (11.59) $ 0.17 $ (6.34) $ (3.08) WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC & DILUTED 35,975,483 35,922,706 35,999,325 35,999,203 36,081,363 Consolidated Statement of Operations 1Includes approximately $2.0 million of employee severance related to the recent departure of one of the Company's former officers and $0.3 million due to the timing of deferred compensation. 2Includes approximately $21.3 million in various banking, advisory, legal and filing fees for the listing of the Company's common shares on the New York Stock Exchange. 3Represents write-off of capitalized offering costs related to the initial issuance of the Series A Preferred Shares, which were written off during the quarter as a non-cash expense as a result of the redemption.

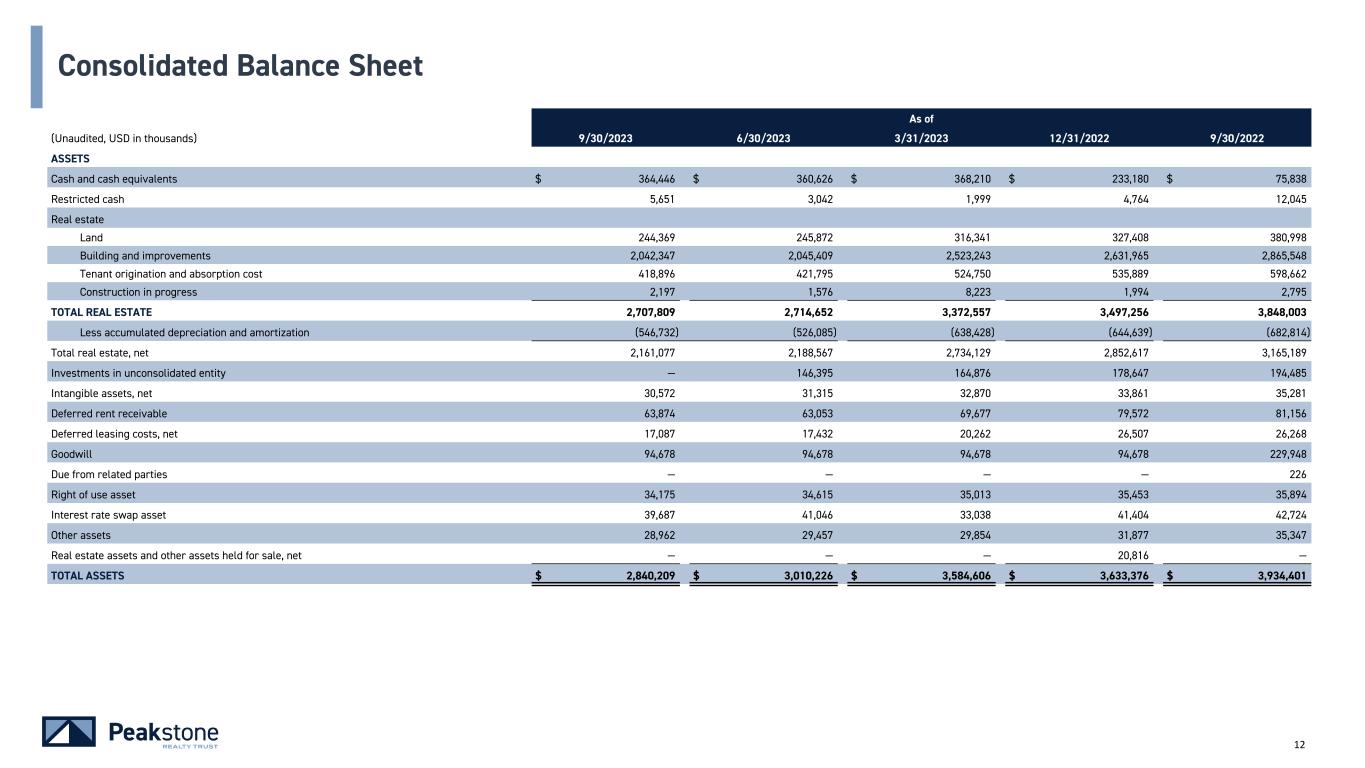

12 As of (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 ASSETS Cash and cash equivalents $ 364,446 $ 360,626 $ 368,210 $ 233,180 $ 75,838 Restricted cash 5,651 3,042 1,999 4,764 12,045 Real estate Land 244,369 245,872 316,341 327,408 380,998 Building and improvements 2,042,347 2,045,409 2,523,243 2,631,965 2,865,548 Tenant origination and absorption cost 418,896 421,795 524,750 535,889 598,662 Construction in progress 2,197 1,576 8,223 1,994 2,795 TOTAL REAL ESTATE 2,707,809 2,714,652 3,372,557 3,497,256 3,848,003 Less accumulated depreciation and amortization (546,732) (526,085) (638,428) (644,639) (682,814) Total real estate, net 2,161,077 2,188,567 2,734,129 2,852,617 3,165,189 Investments in unconsolidated entity — 146,395 164,876 178,647 194,485 Intangible assets, net 30,572 31,315 32,870 33,861 35,281 Deferred rent receivable 63,874 63,053 69,677 79,572 81,156 Deferred leasing costs, net 17,087 17,432 20,262 26,507 26,268 Goodwill 94,678 94,678 94,678 94,678 229,948 Due from related parties — — — — 226 Right of use asset 34,175 34,615 35,013 35,453 35,894 Interest rate swap asset 39,687 41,046 33,038 41,404 42,724 Other assets 28,962 29,457 29,854 31,877 35,347 Real estate assets and other assets held for sale, net — — — 20,816 — TOTAL ASSETS $ 2,840,209 $ 3,010,226 $ 3,584,606 $ 3,633,376 $ 3,934,401 Consolidated Balance Sheet

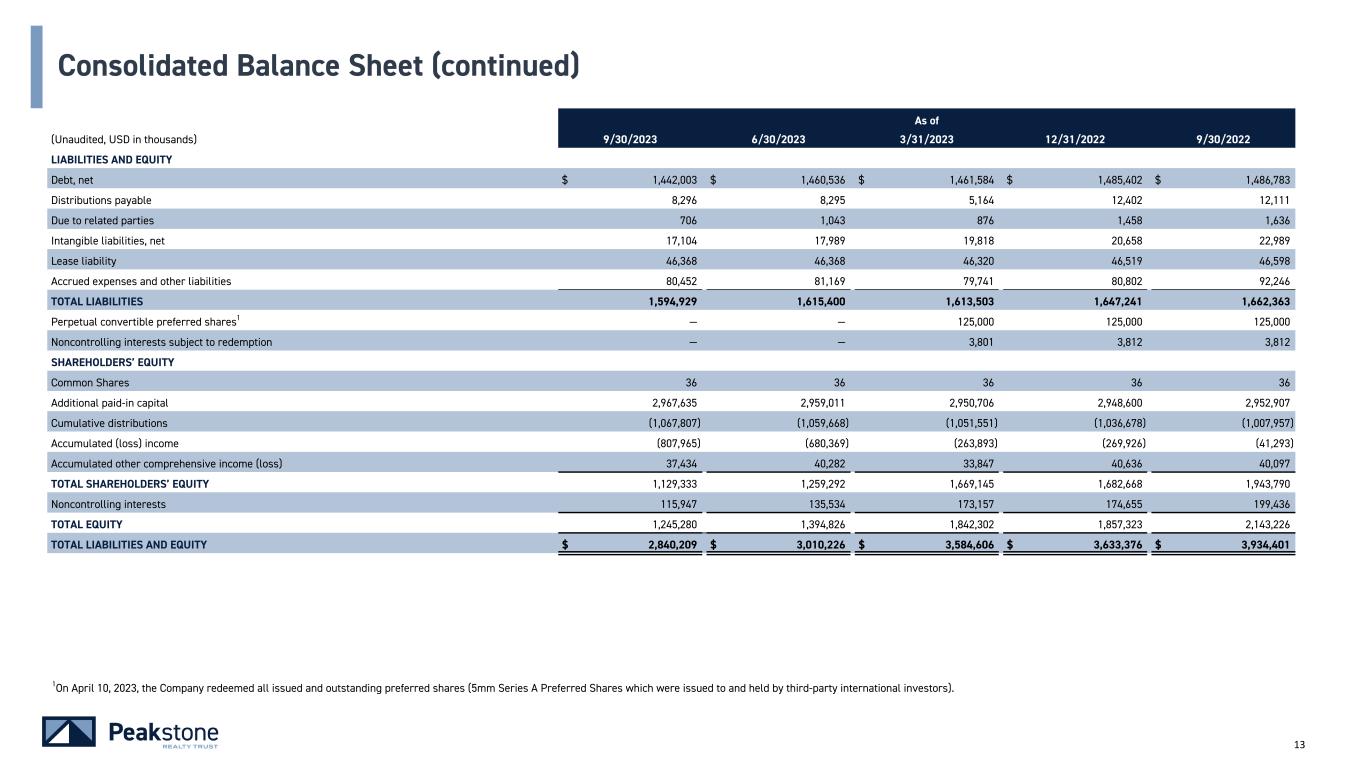

13 As of (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 LIABILITIES AND EQUITY Debt, net $ 1,442,003 $ 1,460,536 $ 1,461,584 $ 1,485,402 $ 1,486,783 Distributions payable 8,296 8,295 5,164 12,402 12,111 Due to related parties 706 1,043 876 1,458 1,636 Intangible liabilities, net 17,104 17,989 19,818 20,658 22,989 Lease liability 46,368 46,368 46,320 46,519 46,598 Accrued expenses and other liabilities 80,452 81,169 79,741 80,802 92,246 TOTAL LIABILITIES 1,594,929 1,615,400 1,613,503 1,647,241 1,662,363 Perpetual convertible preferred shares1 — — 125,000 125,000 125,000 Noncontrolling interests subject to redemption — — 3,801 3,812 3,812 SHAREHOLDERS’ EQUITY Common Shares 36 36 36 36 36 Additional paid-in capital 2,967,635 2,959,011 2,950,706 2,948,600 2,952,907 Cumulative distributions (1,067,807) (1,059,668) (1,051,551) (1,036,678) (1,007,957) Accumulated (loss) income (807,965) (680,369) (263,893) (269,926) (41,293) Accumulated other comprehensive income (loss) 37,434 40,282 33,847 40,636 40,097 TOTAL SHAREHOLDERS’ EQUITY 1,129,333 1,259,292 1,669,145 1,682,668 1,943,790 Noncontrolling interests 115,947 135,534 173,157 174,655 199,436 TOTAL EQUITY 1,245,280 1,394,826 1,842,302 1,857,323 2,143,226 TOTAL LIABILITIES AND EQUITY $ 2,840,209 $ 3,010,226 $ 3,584,606 $ 3,633,376 $ 3,934,401 Consolidated Balance Sheet (continued) 1On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors).

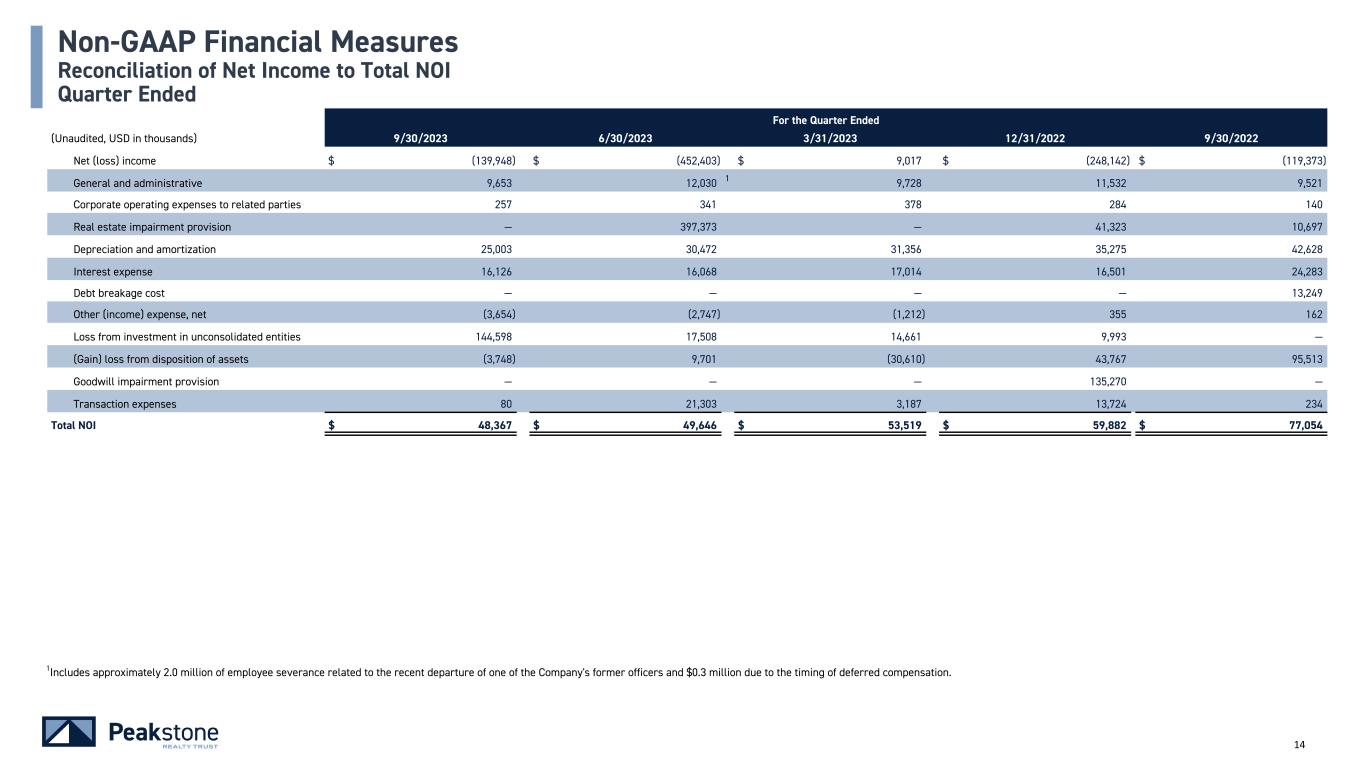

14 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Net (loss) income $ (139,948) $ (452,403) $ 9,017 $ (248,142) $ (119,373) General and administrative 9,653 12,030 1 9,728 11,532 9,521 Corporate operating expenses to related parties 257 341 378 284 140 Real estate impairment provision — 397,373 — 41,323 10,697 Depreciation and amortization 25,003 30,472 31,356 35,275 42,628 Interest expense 16,126 16,068 17,014 16,501 24,283 Debt breakage cost — — — — 13,249 Other (income) expense, net (3,654) (2,747) (1,212) 355 162 Loss from investment in unconsolidated entities 144,598 17,508 14,661 9,993 — (Gain) loss from disposition of assets (3,748) 9,701 (30,610) 43,767 95,513 Goodwill impairment provision — — — 135,270 — Transaction expenses 80 21,303 3,187 13,724 234 Total NOI $ 48,367 $ 49,646 $ 53,519 $ 59,882 $ 77,054 Non-GAAP Financial Measures Reconciliation of Net Income to Total NOI Quarter Ended 1Includes approximately 2.0 million of employee severance related to the recent departure of one of the Company's former officers and $0.3 million due to the timing of deferred compensation.

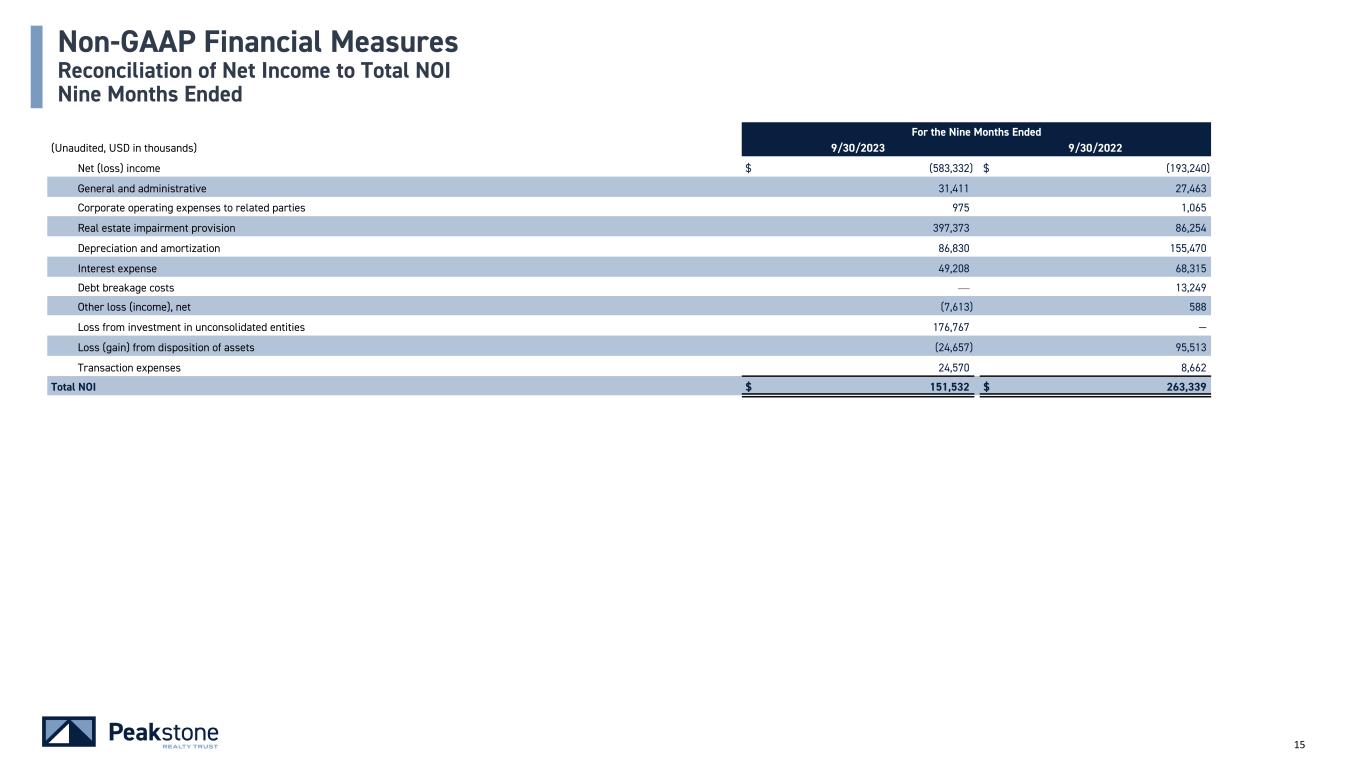

15 For the Nine Months Ended (Unaudited, USD in thousands) 9/30/2023 9/30/2022 Net (loss) income $ (583,332) $ (193,240) General and administrative 31,411 27,463 Corporate operating expenses to related parties 975 1,065 Real estate impairment provision 397,373 86,254 Depreciation and amortization 86,830 155,470 Interest expense 49,208 68,315 Debt breakage costs — 13,249 Other loss (income), net (7,613) 588 Loss from investment in unconsolidated entities 176,767 — Loss (gain) from disposition of assets (24,657) 95,513 Transaction expenses 24,570 8,662 Total NOI $ 151,532 $ 263,339 Non-GAAP Financial Measures Reconciliation of Net Income to Total NOI Nine Months Ended

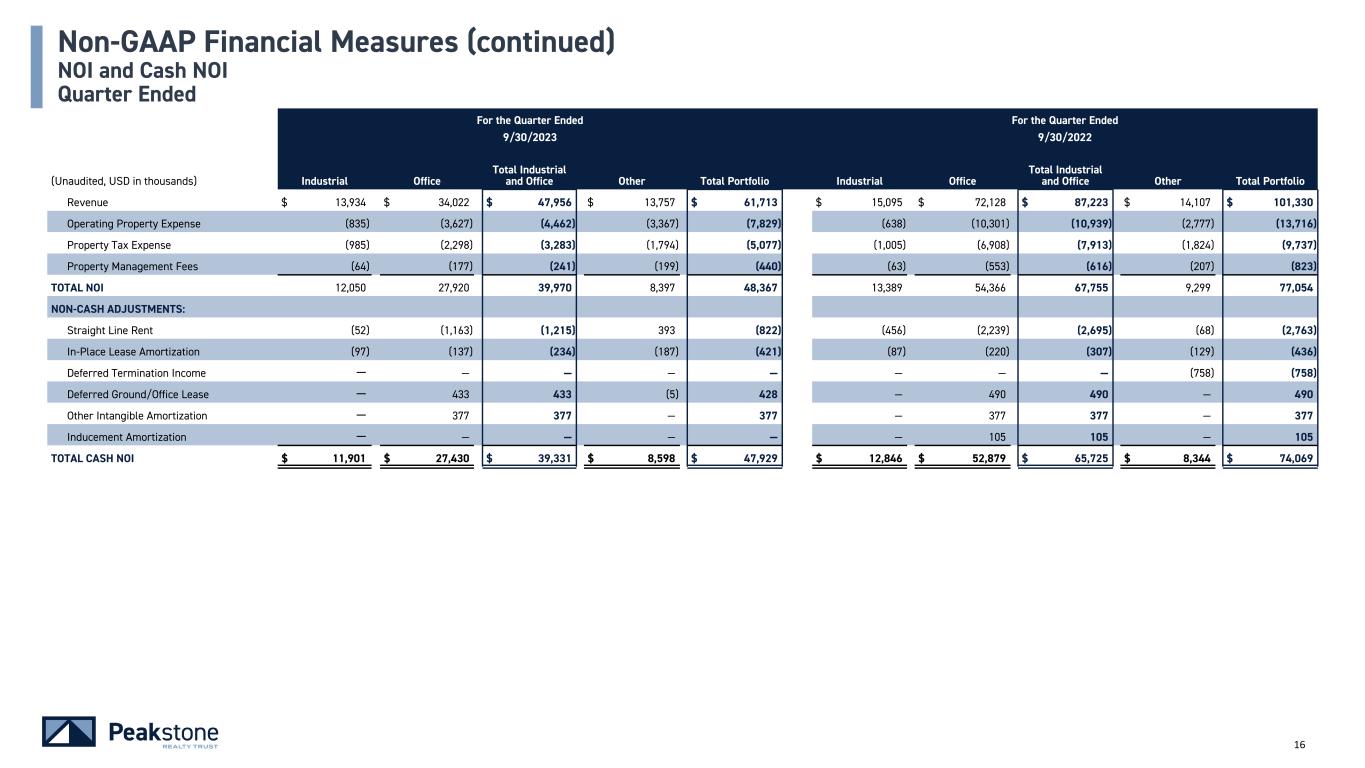

16 For the Quarter Ended For the Quarter Ended 9/30/2023 9/30/2022 (Unaudited, USD in thousands) Industrial Office Total Industrial and Office Other Total Portfolio Industrial Office Total Industrial and Office Other Total Portfolio Revenue $ 13,934 $ 34,022 $ 47,956 $ 13,757 $ 61,713 $ 15,095 $ 72,128 $ 87,223 $ 14,107 $ 101,330 Operating Property Expense (835) (3,627) (4,462) (3,367) (7,829) (638) (10,301) (10,939) (2,777) (13,716) Property Tax Expense (985) (2,298) (3,283) (1,794) (5,077) (1,005) (6,908) (7,913) (1,824) (9,737) Property Management Fees (64) (177) (241) (199) (440) (63) (553) (616) (207) (823) TOTAL NOI 12,050 27,920 39,970 8,397 48,367 13,389 54,366 67,755 9,299 77,054 NON-CASH ADJUSTMENTS: Straight Line Rent (52) (1,163) (1,215) 393 (822) (456) (2,239) (2,695) (68) (2,763) In-Place Lease Amortization (97) (137) (234) (187) (421) (87) (220) (307) (129) (436) Deferred Termination Income — — — — — — — — (758) (758) Deferred Ground/Office Lease — 433 433 (5) 428 — 490 490 — 490 Other Intangible Amortization — 377 377 — 377 — 377 377 — 377 Inducement Amortization — — — — — — 105 105 — 105 TOTAL CASH NOI $ 11,901 $ 27,430 $ 39,331 $ 8,598 $ 47,929 $ 12,846 $ 52,879 $ 65,725 $ 8,344 $ 74,069 Non-GAAP Financial Measures (continued) NOI and Cash NOI Quarter Ended

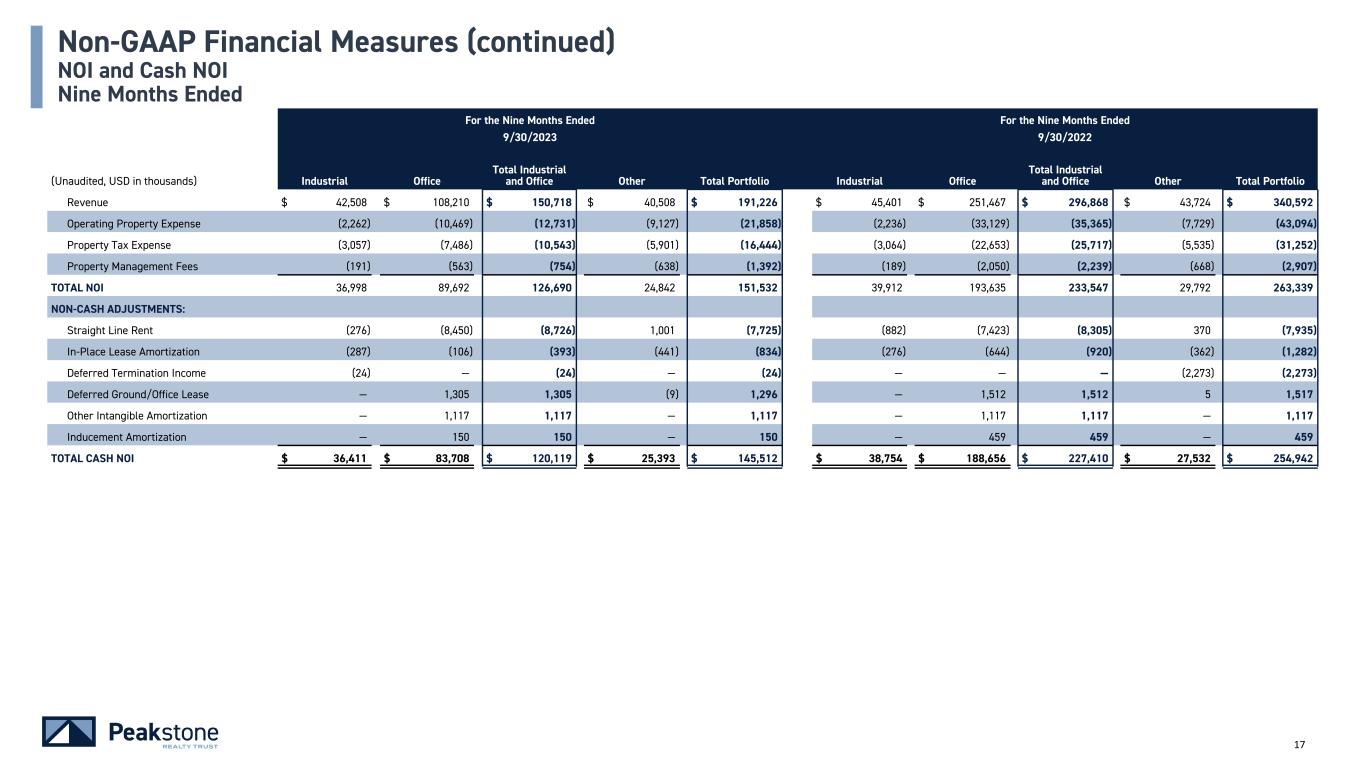

17 For the Nine Months Ended For the Nine Months Ended 9/30/2023 9/30/2022 (Unaudited, USD in thousands) Industrial Office Total Industrial and Office Other Total Portfolio Industrial Office Total Industrial and Office Other Total Portfolio Revenue $ 42,508 $ 108,210 $ 150,718 $ 40,508 $ 191,226 $ 45,401 $ 251,467 $ 296,868 $ 43,724 $ 340,592 Operating Property Expense (2,262) (10,469) (12,731) (9,127) (21,858) (2,236) (33,129) (35,365) (7,729) (43,094) Property Tax Expense (3,057) (7,486) (10,543) (5,901) (16,444) (3,064) (22,653) (25,717) (5,535) (31,252) Property Management Fees (191) (563) (754) (638) (1,392) (189) (2,050) (2,239) (668) (2,907) TOTAL NOI 36,998 89,692 126,690 24,842 151,532 39,912 193,635 233,547 29,792 263,339 NON-CASH ADJUSTMENTS: Straight Line Rent (276) (8,450) (8,726) 1,001 (7,725) (882) (7,423) (8,305) 370 (7,935) In-Place Lease Amortization (287) (106) (393) (441) (834) (276) (644) (920) (362) (1,282) Deferred Termination Income (24) — (24) — (24) — — — (2,273) (2,273) Deferred Ground/Office Lease — 1,305 1,305 (9) 1,296 — 1,512 1,512 5 1,517 Other Intangible Amortization — 1,117 1,117 — 1,117 — 1,117 1,117 — 1,117 Inducement Amortization — 150 150 — 150 — 459 459 — 459 TOTAL CASH NOI $ 36,411 $ 83,708 $ 120,119 $ 25,393 $ 145,512 $ 38,754 $ 188,656 $ 227,410 $ 27,532 $ 254,942 Non-GAAP Financial Measures (continued) NOI and Cash NOI Nine Months Ended

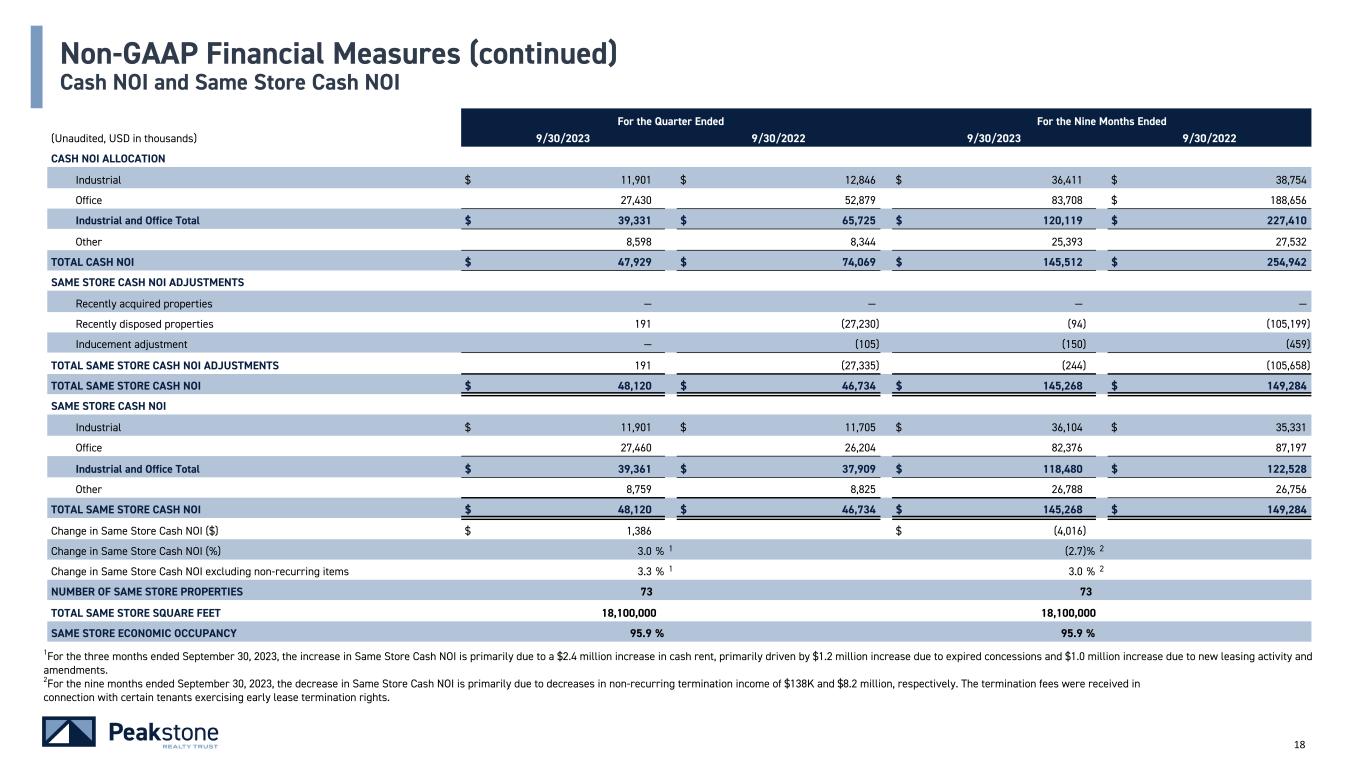

18 For the Quarter Ended For the Nine Months Ended (Unaudited, USD in thousands) 9/30/2023 9/30/2022 9/30/2023 9/30/2022 CASH NOI ALLOCATION � Industrial $ 11,901 $ 12,846 $ 36,411 $ 38,754 Office 27,430 52,879 83,708 $ 188,656 Industrial and Office Total $ 39,331 $ 65,725 $ 120,119 $ 227,410 � Other 8,598 8,344 25,393 27,532 TOTAL CASH NOI $ 47,929 $ 74,069 $ 145,512 $ 254,942 SAME STORE CASH NOI ADJUSTMENTS � � Recently acquired properties — — — — Recently disposed properties 191 (27,230) (94) (105,199) Inducement adjustment — (105) (150) (459) TOTAL SAME STORE CASH NOI ADJUSTMENTS 191 (27,335) (244) (105,658) TOTAL SAME STORE CASH NOI $ 48,120 $ 46,734 $ 145,268 $ 149,284 SAME STORE CASH NOI � Industrial $ 11,901 $ 11,705 $ 36,104 $ 35,331 Office 27,460 26,204 82,376 87,197 Industrial and Office Total $ 39,361 $ 37,909 $ 118,480 $ 122,528 Other 8,759 8,825 26,788 26,756 TOTAL SAME STORE CASH NOI $ 48,120 $ 46,734 $ 145,268 $ 149,284 Change in Same Store Cash NOI ($) $ 1,386 $ (4,016) Change in Same Store Cash NOI (%) 3.0 % 1 (2.7) % 2 Change in Same Store Cash NOI excluding non-recurring items 3.3 % 1 3.0 % 2 NUMBER OF SAME STORE PROPERTIES 73 73 TOTAL SAME STORE SQUARE FEET 18,100,000 18,100,000 SAME STORE ECONOMIC OCCUPANCY 95.9 % 95.9 % Non-GAAP Financial Measures (continued) Cash NOI and Same Store Cash NOI 1For the three months ended September 30, 2023, the increase in Same Store Cash NOI is primarily due to a $2.4 million increase in cash rent, primarily driven by $1.2 million increase due to expired concessions and $1.0 million increase due to new leasing activity and amendments. 2For the nine months ended September 30, 2023, the decrease in Same Store Cash NOI is primarily due to decreases in non-recurring termination income of $138K and $8.2 million, respectively. The termination fees were received in connection with certain tenants exercising early lease termination rights.

19 For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Reconciliation of Net (Loss) Income to Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) NET (LOSS) INCOME $ (139,948) $ (452,403) $ 9,017 $ (248,142) $ (119,373) Depreciation of building and improvements 16,351 19,538 20,054 22,336 26,268 Amortization of leasing costs and intangibles 8,750 11,031 11,397 13,037 16,456 Impairment provision, real estate — 397,373 — 41,323 10,697 Equity interest of depreciation of building and improvements - unconsolidated entity 8,365 9,020 7,238 4,643 — (Gain)/Loss from disposition of assets, net (3,748) 9,701 (30,610) 43,767 95,513 Company's share of loss on sale of unconsolidated entity — — — 3,558 — FFO $ (110,230) $ (5,740) $ 17,096 $ (119,478) $ 29,561 Distribution to redeemable preferred shareholders — — (2,375) (2,515) (2,516) Preferred unit redemption charge — (4,970) — — — FFO attributable to common shareholders and limited partners $ (110,230) $ (10,710) $ 14,721 $ (121,993) $ 27,045 Reconciliation of FFO to AFFO: FFO attributable to common shareholders and limited partners $ (110,230) $ (10,710) $ 14,721 $ (121,993) $ 27,045 Revenues in excess of cash received, net (822) (2,644) (4,283) (5,199) (3,521) Amortization of share-based compensation 2,444 2,626 2,556 3,433 2,698 Deferred rent - ground lease 428 435 433 433 490 Unrealized loss (gain) on investments 89 (5) (32) 15 22 Amortization of above/(below) market rent, net (421) (291) (122) (923) (436) Amortization of debt premium/(discount), net 101 83 102 103 103 Amortization of ground leasehold interests (98) (97) 368 (98) (95) Amortization of below tax benefit amortization 377 372 (96) 377 377 Amortization of deferred financing costs 662 655 1,274 993 920 Company's share of amortization of deferred financing costs- unconsolidated entity 10,774 10,655 9,632 3,740 — Company's share of revenues in excess of cash received (straight-line rents) - unconsolidated entity (631) (750) (826) (257) — Company's share of amortization of above market rent - unconsolidated entity (218) (26) (288) (58) — Write-off of transaction costs 83 — 32 — — Employee separation expense — 2,042 — — — Loss on debt breakage costs — write-off of deferred financing costs — — — — 1,771 Transaction expenses 80 21,303 3,187 13,724 234 Impairment provision, goodwill — — — 135,270 — Debt breakage costs — — — — 13,249 Amortization of lease inducements — 49 101 79 105 Preferred unit redemption charge — 4,970 — — — Impairment provision, investment in unconsolidated entity 129,334 — — — — Write-off of Company's share of accumulated other comprehensive income - unconsolidated entity (1,226) — — — — AFFO available to common shareholders and limited partners $ 30,726 $ 28,667 $ 26,759 $ 29,639 $ 42,962 FFO per share, basic and diluted $ (2.79) 1 $ (0.27) $ 0.37 $ (3.09) $ 0.68 AFFO per share, basic and diluted $ 0.78 $ 0.73 $ 0.68 $ 0.75 $ 1.08 Weighted-average common shares outstanding - basic and diluted EPS 35,975,483 35,922,706 35,999,325 35,999,203 36,081,363 Weighted-average OP Units 3,482,977 3,528,666 3,537,654 3,537,654 3,537,654 Weighted-average common shares and OP Units outstanding - basic and diluted FFO/AFFO 39,458,460 39,451,372 39,536,979 39,536,857 39,619,017 Non-GAAP Financial Measures (continued) FFO and AFFO 1 Excluding the $129.3 million impairment provision for the investment in unconsolidated entity, FFO for the third quarter would have been approximately $19.1 million, or $0.48 per basic and diluted share.

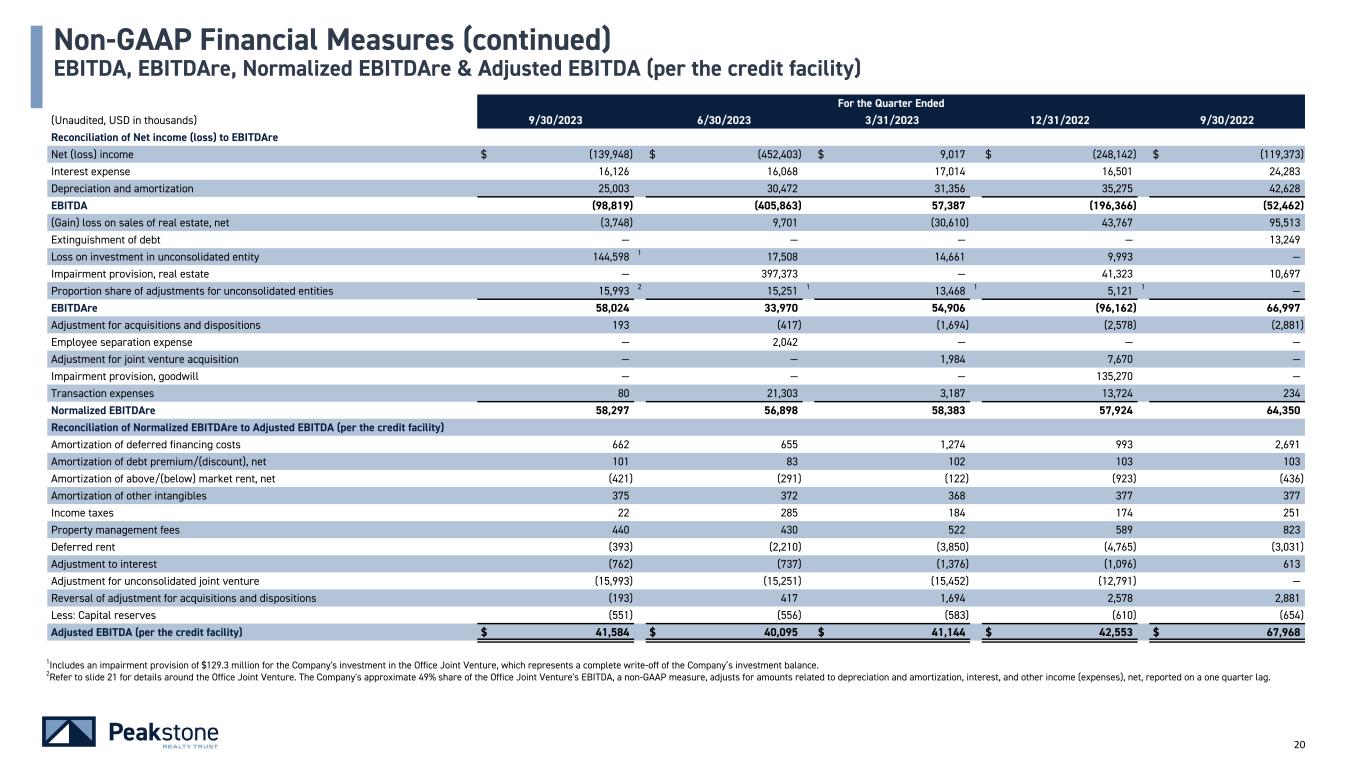

20 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Reconciliation of Net income (loss) to EBITDAre Net (loss) income $ (139,948) $ (452,403) $ 9,017 $ (248,142) $ (119,373) Interest expense 16,126 16,068 17,014 16,501 24,283 Depreciation and amortization 25,003 30,472 31,356 35,275 42,628 EBITDA (98,819) (405,863) 57,387 (196,366) (52,462) (Gain) loss on sales of real estate, net (3,748) 9,701 (30,610) 43,767 95,513 Extinguishment of debt — — — — 13,249 Loss on investment in unconsolidated entity 144,598 1 17,508 14,661 9,993 — Impairment provision, real estate — 397,373 — 41,323 10,697 Proportion share of adjustments for unconsolidated entities 15,993 2 15,251 1 13,468 1 5,121 1 — EBITDAre 58,024 33,970 54,906 (96,162) 66,997 Adjustment for acquisitions and dispositions 193 (417) (1,694) (2,578) (2,881) Employee separation expense — 2,042 — — — Adjustment for joint venture acquisition — — 1,984 7,670 — Impairment provision, goodwill — — — 135,270 — Transaction expenses 80 21,303 3,187 13,724 234 Normalized EBITDAre 58,297 56,898 58,383 57,924 64,350 Reconciliation of Normalized EBITDAre to Adjusted EBITDA (per the credit facility) Amortization of deferred financing costs 662 655 1,274 993 2,691 Amortization of debt premium/(discount), net 101 83 102 103 103 Amortization of above/(below) market rent, net (421) (291) (122) (923) (436) Amortization of other intangibles 375 372 368 377 377 Income taxes 22 285 184 174 251 Property management fees 440 430 522 589 823 Deferred rent (393) (2,210) (3,850) (4,765) (3,031) Adjustment to interest (762) (737) (1,376) (1,096) 613 Adjustment for unconsolidated joint venture (15,993) (15,251) (15,452) (12,791) — Reversal of adjustment for acquisitions and dispositions (193) 417 1,694 2,578 2,881 Less: Capital reserves (551) (556) (583) (610) (654) Adjusted EBITDA (per the credit facility) $ 41,584 $ 40,095 $ 41,144 $ 42,553 $ 67,968 Non-GAAP Financial Measures (continued) EBITDA, EBITDAre, Normalized EBITDAre & Adjusted EBITDA (per the credit facility) 1Includes an impairment provision of $129.3 million for the Company's investment in the Office Joint Venture, which represents a complete write-off of the Company’s investment balance. 2Refer to slide 21 for details around the Office Joint Venture. The Company's approximate 49% share of the Office Joint Venture's EBITDA, a non-GAAP measure, adjusts for amounts related to depreciation and amortization, interest, and other income (expenses), net, reported on a one quarter lag.

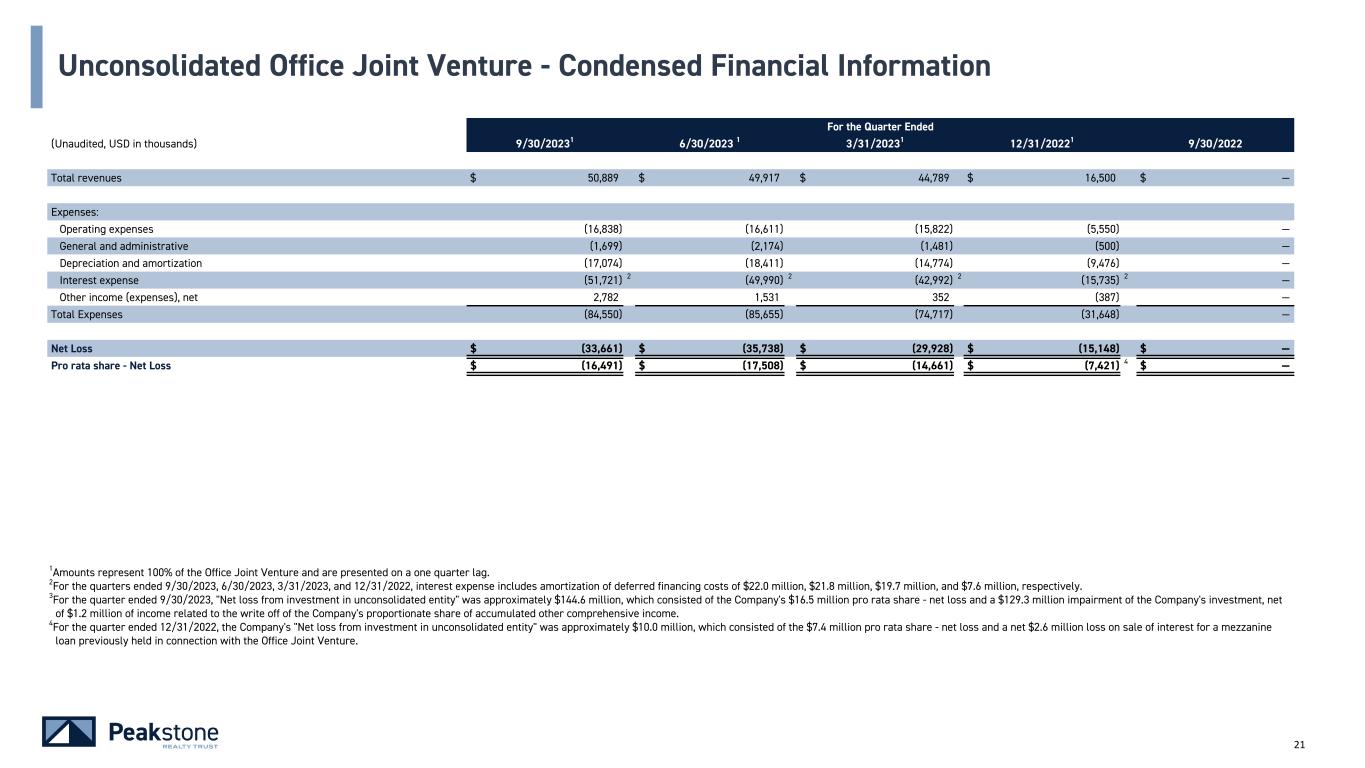

21 For the Quarter Ended (Unaudited, USD in thousands) 9/30/20231 6/30/2023 1 3/31/20231 12/31/20221 9/30/2022 Total revenues $ 50,889 $ 49,917 $ 44,789 $ 16,500 $ — Expenses: Operating expenses (16,838) (16,611) (15,822) (5,550) — General and administrative (1,699) (2,174) (1,481) (500) — Depreciation and amortization (17,074) (18,411) (14,774) (9,476) — Interest expense (51,721) 2 (49,990) 2 (42,992) 2 (15,735) 2 — Other income (expenses), net 2,782 1,531 352 (387) — Total Expenses (84,550) (85,655) (74,717) (31,648) — Net Loss $ (33,661) $ (35,738) $ (29,928) $ (15,148) $ — Pro rata share - Net Loss $ (16,491) $ (17,508) $ (14,661) $ (7,421) 4 $ — Unconsolidated Office Joint Venture - Condensed Financial Information 1Amounts represent 100% of the Office Joint Venture and are presented on a one quarter lag. 2For the quarters ended 9/30/2023, 6/30/2023, 3/31/2023, and 12/31/2022, interest expense includes amortization of deferred financing costs of $22.0 million, $21.8 million, $19.7 million, and $7.6 million, respectively. 3For the quarter ended 9/30/2023, "Net loss from investment in unconsolidated entity" was approximately $144.6 million, which consisted of the Company's $16.5 million pro rata share - net loss and a $129.3 million impairment of the Company's investment, net of $1.2 million of income related to the write off of the Company's proportionate share of accumulated other comprehensive income. 4For the quarter ended 12/31/2022, the Company's "Net loss from investment in unconsolidated entity" was approximately $10.0 million, which consisted of the $7.4 million pro rata share - net loss and a net $2.6 million loss on sale of interest for a mezzanine loan previously held in connection with the Office Joint Venture.

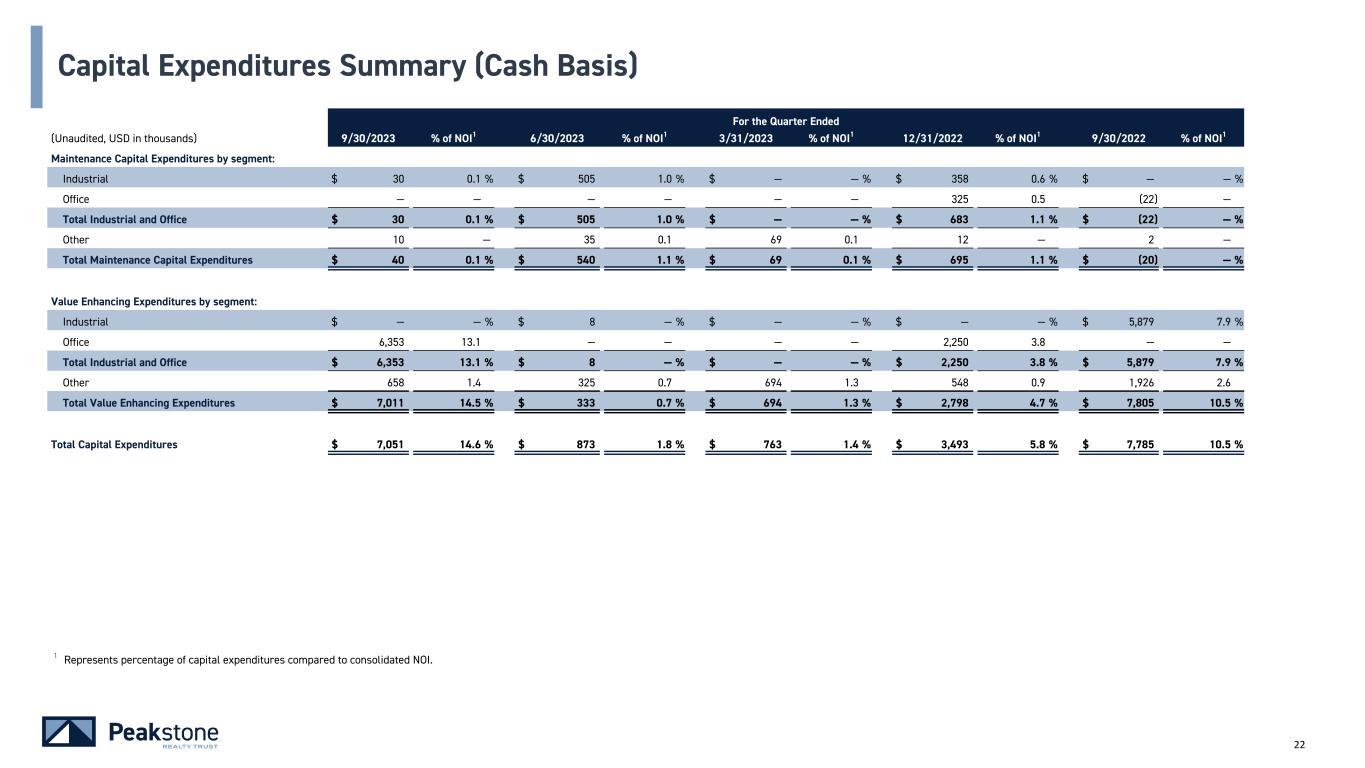

22 For the Quarter Ended (Unaudited, USD in thousands) 9/30/2023 % of NOI1 6/30/2023 % of NOI1 3/31/2023 % of NOI1 12/31/2022 % of NOI1 9/30/2022 % of NOI1 Maintenance Capital Expenditures by segment: Industrial $ 30 0.1 % $ 505 1.0 % $ — — % $ 358 0.6 % $ — — % Office — — — — — — 325 0.5 (22) — Total Industrial and Office $ 30 0.1 % $ 505 1.0 % $ — — % $ 683 1.1 % $ (22) — % Other 10 — 35 0.1 69 0.1 12 — 2 — Total Maintenance Capital Expenditures $ 40 $ — 0.1 % $ 540 1.1 % $ 69 0.1 % $ 695 1.1 % $ (20) — % Value Enhancing Expenditures by segment: Industrial $ — — % $ 8 — % $ — — % $ — — % $ 5,879 7.9 % Office 6,353 13.1 — — — — 2,250 3.8 — — Total Industrial and Office $ 6,353 13.1 % $ 8 — % $ — — % $ 2,250 3.8 % $ 5,879 7.9 % Other 658 1.4 325 0.7 694 1.3 548 0.9 1,926 2.6 Total Value Enhancing Expenditures $ 7,011 14.5 % $ 333 0.7 % $ 694 1.3 % $ 2,798 4.7 % $ 7,805 10.5 % Total Capital Expenditures $ 7,051 14.6 % $ 873 1.8 % $ 763 1.4 % $ 3,493 5.8 % $ 7,785 10.5 % 1 Represents percentage of capital expenditures compared to consolidated NOI. Capital Expenditures Summary (Cash Basis)

Debt & Capitalization

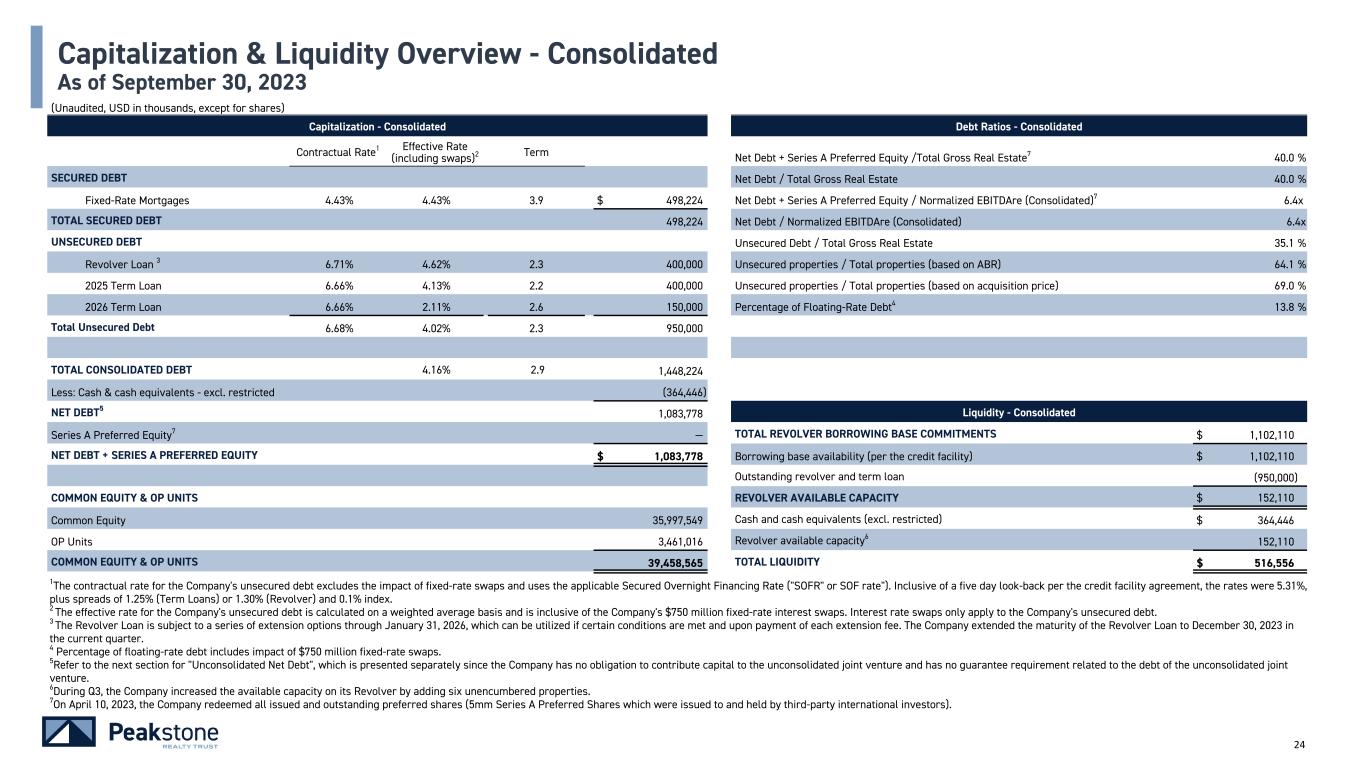

24 1The contractual rate for the Company's unsecured debt excludes the impact of fixed-rate swaps and uses the applicable Secured Overnight Financing Rate ("SOFR" or SOF rate"). Inclusive of a five day look-back per the credit facility agreement, the rates were 5.31%, plus spreads of 1.25% (Term Loans) or 1.30% (Revolver) and 0.1% index. 2 The effective rate for the Company's unsecured debt is calculated on a weighted average basis and is inclusive of the Company's $750 million fixed-rate interest swaps. Interest rate swaps only apply to the Company's unsecured debt. 3 The Revolver Loan is subject to a series of extension options through January 31, 2026, which can be utilized if certain conditions are met and upon payment of each extension fee. The Company extended the maturity of the Revolver Loan to December 30, 2023 in the current quarter. 4 Percentage of floating-rate debt includes impact of $750 million fixed-rate swaps. 5Refer to the next section for "Unconsolidated Net Debt", which is presented separately since the Company has no obligation to contribute capital to the unconsolidated joint venture and has no guarantee requirement related to the debt of the unconsolidated joint venture. 6During Q3, the Company increased the available capacity on its Revolver by adding six unencumbered properties. 7On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors). (Unaudited, USD in thousands, except for shares) Capitalization - Consolidated Debt Ratios - Consolidated Contractual Rate1 Effective Rate (including swaps)2 Term Net Debt + Series A Preferred Equity /Total Gross Real Estate7 40.0 % SECURED DEBT Net Debt / Total Gross Real Estate 40.0 % Fixed-Rate Mortgages 4.43% 4.43% 3.9 $ 498,224 Net Debt + Series A Preferred Equity / Normalized EBITDAre (Consolidated)7 6.4x TOTAL SECURED DEBT 498,224 Net Debt / Normalized EBITDAre (Consolidated) 6.4x UNSECURED DEBT Unsecured Debt / Total Gross Real Estate 35.1 % Revolver Loan 3 6.71% 4.62% 2.3 400,000 Unsecured properties / Total properties (based on ABR) 64.1 % 2025 Term Loan 6.66% 4.13% 2.2 400,000 Unsecured properties / Total properties (based on acquisition price) 69.0 % 2026 Term Loan 6.66% 2.11% 2.6 150,000 Percentage of Floating-Rate Debt4 13.8 % Total Unsecured Debt 6.68% 4.02% 2.3 950,000 TOTAL CONSOLIDATED DEBT 4.16% 2.9 1,448,224 Less: Cash & cash equivalents - excl. restricted (364,446) NET DEBT5 1,083,778 Liquidity - Consolidated Series A Preferred Equity7 — TOTAL REVOLVER BORROWING BASE COMMITMENTS $ 1,102,110 NET DEBT + SERIES A PREFERRED EQUITY $ 1,083,778 Borrowing base availability (per the credit facility) $ 1,102,110 Outstanding revolver and term loan (950,000) COMMON EQUITY & OP UNITS REVOLVER AVAILABLE CAPACITY $ 152,110 Common Equity 35,997,549 Cash and cash equivalents (excl. restricted) $ 364,446 OP Units 3,461,016 Revolver available capacity6 152,110 COMMON EQUITY & OP UNITS 39,458,565 TOTAL LIQUIDITY $ 516,556 Capitalization & Liquidity Overview - Consolidated As of September 30, 2023

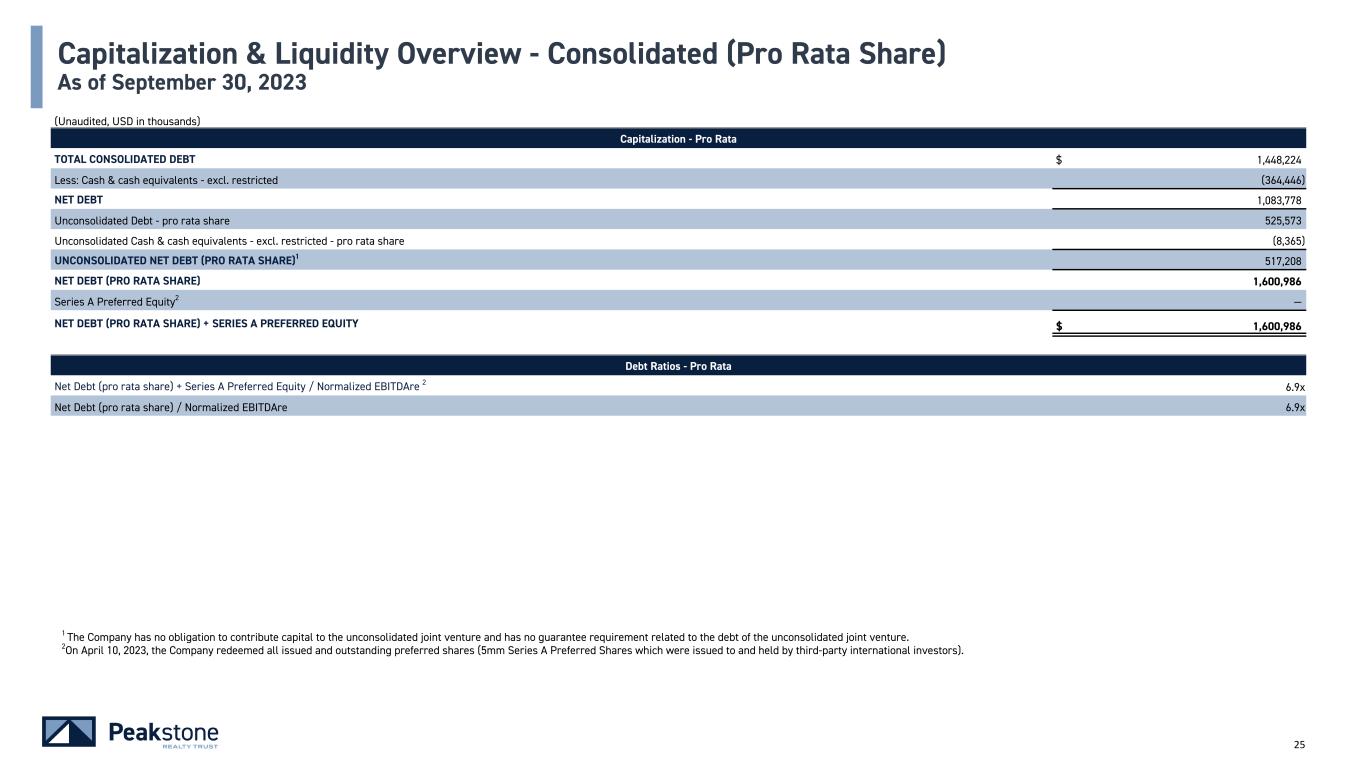

25 1 The Company has no obligation to contribute capital to the unconsolidated joint venture and has no guarantee requirement related to the debt of the unconsolidated joint venture. 2On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors). (Unaudited, USD in thousands) Capitalization - Pro Rata TOTAL CONSOLIDATED DEBT $ 1,448,224 Less: Cash & cash equivalents - excl. restricted (364,446) NET DEBT 1,083,778 Unconsolidated Debt - pro rata share 525,573 Unconsolidated Cash & cash equivalents - excl. restricted - pro rata share (8,365) UNCONSOLIDATED NET DEBT (PRO RATA SHARE)1 517,208 NET DEBT (PRO RATA SHARE) 1,600,986 Series A Preferred Equity2 — NET DEBT (PRO RATA SHARE) + SERIES A PREFERRED EQUITY $ 1,600,986 Debt Ratios - Pro Rata Net Debt (pro rata share) + Series A Preferred Equity / Normalized EBITDAre 2 6.9x Net Debt (pro rata share) / Normalized EBITDAre 6.9x Capitalization & Liquidity Overview - Consolidated (Pro Rata Share) As of September 30, 2023

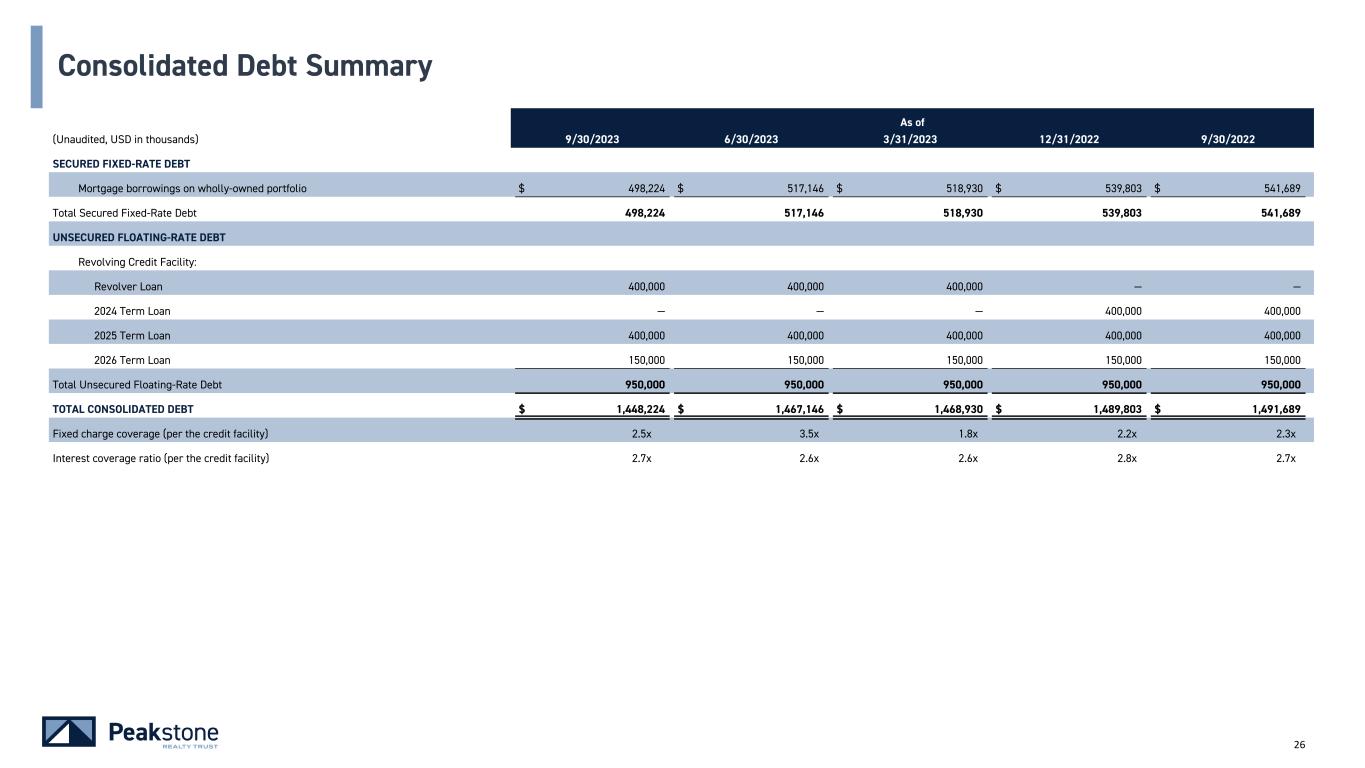

26 As of (Unaudited, USD in thousands) 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 SECURED FIXED-RATE DEBT Mortgage borrowings on wholly-owned portfolio $ 498,224 $ 517,146 $ 518,930 $ 539,803 $ 541,689 Total Secured Fixed-Rate Debt 498,224 517,146 518,930 539,803 541,689 UNSECURED FLOATING-RATE DEBT Revolving Credit Facility: Revolver Loan 400,000 400,000 400,000 — — 2024 Term Loan — — — 400,000 400,000 2025 Term Loan 400,000 400,000 400,000 400,000 400,000 2026 Term Loan 150,000 150,000 150,000 150,000 150,000 Total Unsecured Floating-Rate Debt 950,000 950,000 950,000 950,000 950,000 TOTAL CONSOLIDATED DEBT $ 1,448,224 $ 1,467,146 $ 1,468,930 $ 1,489,803 $ 1,491,689 Fixed charge coverage (per the credit facility) 2.5x 3.5x 1.8x 2.2x 2.3x Interest coverage ratio (per the credit facility) 2.7x 2.6x 2.6x 2.8x 2.7x Consolidated Debt Summary

27 (Unaudited, USD in thousands) SECURED DEBT Collateral Contractual Interest Rate Maturity Date Outstanding Balance INDUSTRIAL AND OFFICE Pepsi Bottling Ventures Mortgage Loan 3.69% 10/1/2024 $ 17,540 BOA II Loan 1 4.32% 5/1/2028 250,000 Total Industrial and Office 267,540 OTHER Highway 94 Mortgage Loan 3.75% 8/1/2024 11,970 AIG Loan II 2 4.15% 11/1/2025 120,556 AIG Loan 3 4.96% 2/1/2029 98,158 Total Other 230,684 Weighted Average 4.43% Total Consolidated Secured Debt $ 498,224 1 The BOA II portfolio includes the following properties: IGT, 3M, Amazon (Etna), and Southern Company. 2 The AIG II portfolio includes the following properties: Owens Corning, Wood Group (Westgate II), Administrative Offices of the Pennsylvania Courts, Wyndham Hotels & Resorts, MGM Corporate Center (880 Grier Drive, 840 Grier Drive and 980 Grier Drive), and Hitachi Astemo. 3 The AIG portfolio includes the following properties: Northrop Grumman, Schlumberger, Raytheon Technologies, Avnet (Chandler), and 30 Independence Boulevard. Consolidated Secured Debt Schedule As of September 30, 2023

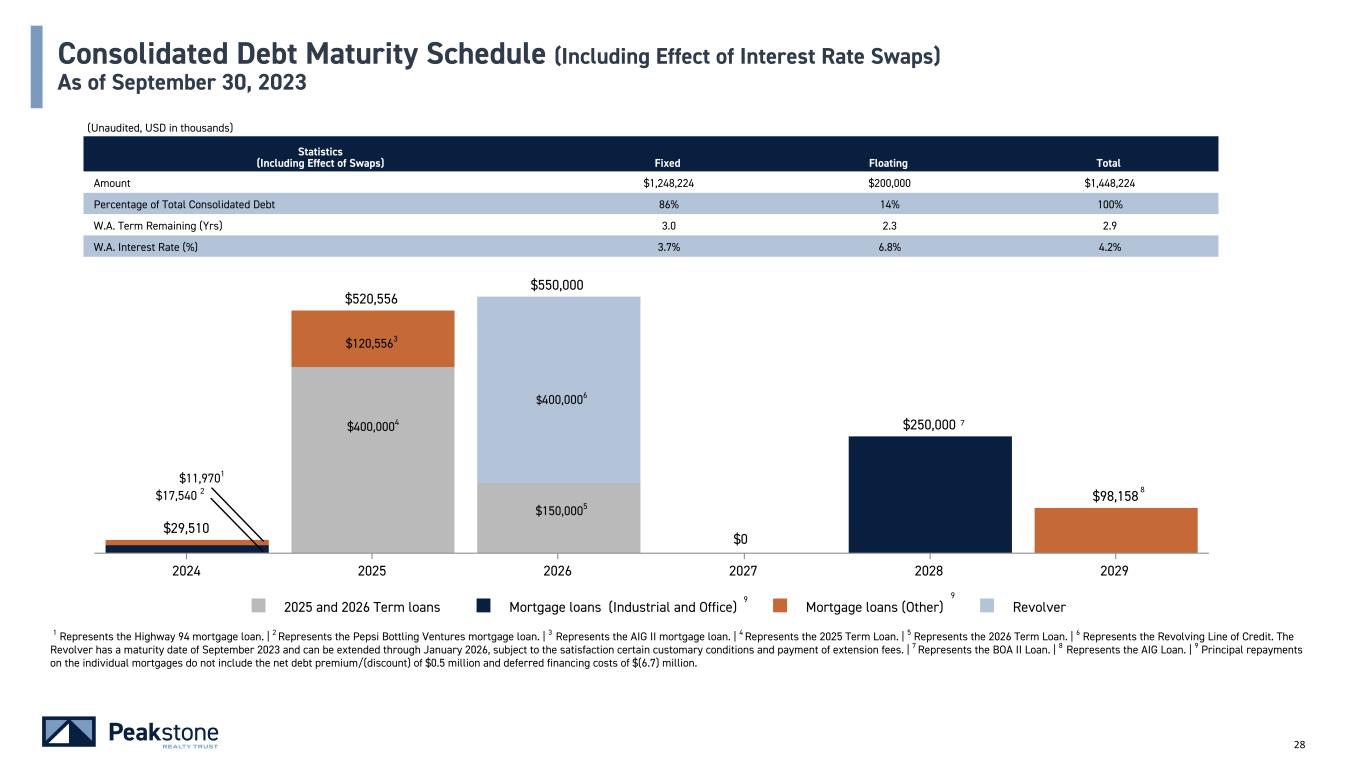

28 1 Represents the Highway 94 mortgage loan. | 2 Represents the Pepsi Bottling Ventures mortgage loan. | 3 Represents the AIG II mortgage loan. | 4 Represents the 2025 Term Loan. | 5 Represents the 2026 Term Loan. | 6 Represents the Revolving Line of Credit. The Revolver has a maturity date of September 2023 and can be extended through January 2026, subject to the satisfaction certain customary conditions and payment of extension fees. | 7 Represents the BOA II Loan. | 8 Represents the AIG Loan. | 9 Principal repayments on the individual mortgages do not include the net debt premium/(discount) of $0.5 million and deferred financing costs of $(6.7) million. $141,194(1) $200,000(3) $400,000(5) $250,000 $29,510 $520,556 $98,158 $550,000 2025 and 2026 Term loans Mortgage loans (Industrial and Office) Mortgage loans (Other) Revolver 2024 2025 2026 2027 2028 2029 (Unaudited, USD in thousands) Statistics (Including Effect of Swaps) Fixed Floating Total Amount $1,248,224 $200,000 $1,448,224 Percentage of Total Consolidated Debt 86% 14% 100% W.A. Term Remaining (Yrs) 3.0 2.3 2.9 W.A. Interest Rate (%) 3.7% 6.8% 4.2% (1) 7 8 $120,5563 $400,0004 $17,540 2 $11,9701 Consolidated Debt Maturity Schedule (Including Effect of Interest Rate Swaps) As of September 30, 2023 $150,0005 $400,0006 9 9 $0

Leasing Activity & Asset Management

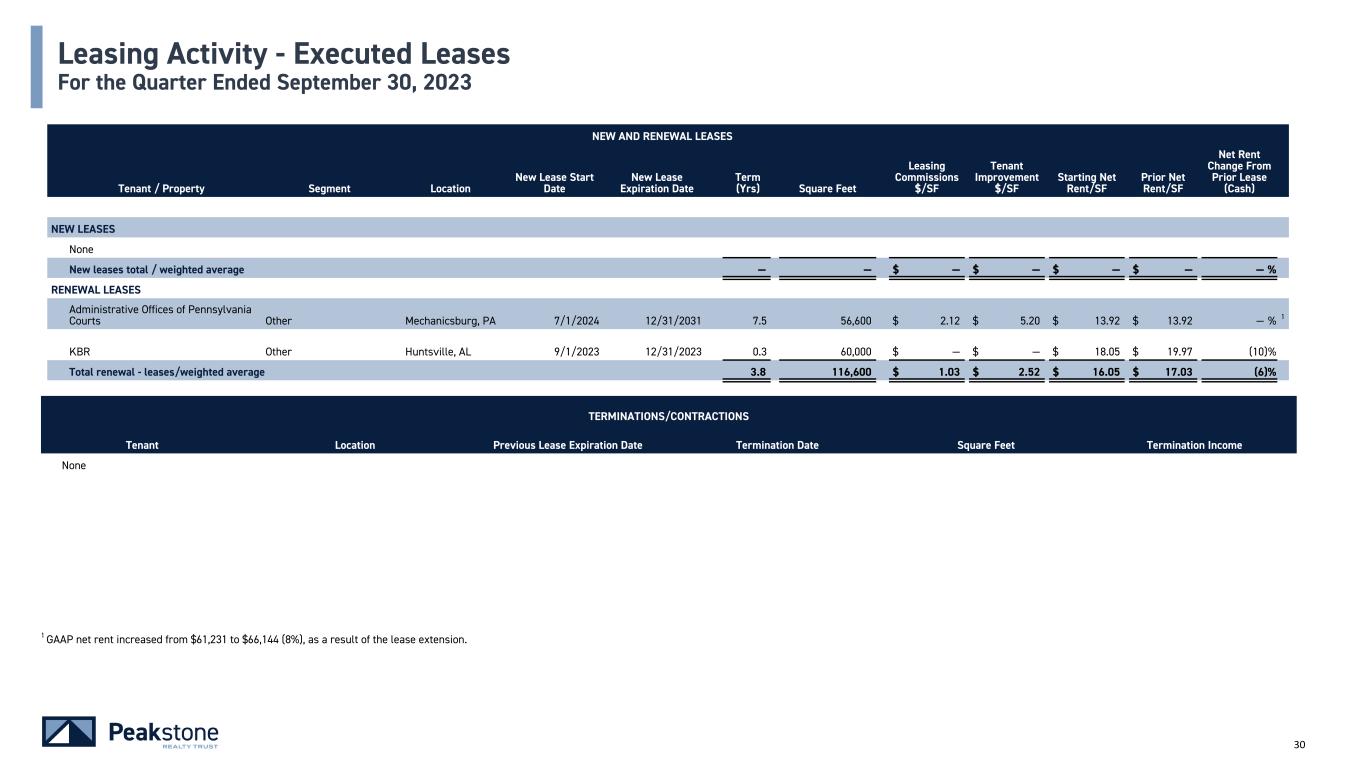

30 NEW AND RENEWAL LEASES Tenant / Property Segment Location New Lease Start Date New Lease Expiration Date Term (Yrs) Square Feet Leasing Commissions $/SF Tenant Improvement $/SF Starting Net Rent/SF Prior Net Rent/SF Net Rent Change From Prior Lease (Cash) NEW LEASES None New leases total / weighted average — — $ — $ — $ — $ — — % RENEWAL LEASES Administrative Offices of Pennsylvania Courts Other Mechanicsburg, PA 7/1/2024 12/31/2031 7.5 56,600 $ 2.12 $ 5.20 $ 13.92 $ 13.92 — % 1 KBR Other Huntsville, AL 9/1/2023 12/31/2023 0.3 60,000 $ — $ — $ 18.05 $ 19.97 (10) % Total renewal - leases/weighted average 3.8 116,600 $ 1.03 $ 2.52 $ 16.05 $ 17.03 (6) % TERMINATIONS/CONTRACTIONS Tenant Location Previous Lease Expiration Date Termination Date Square Feet Termination Income None Leasing Activity - Executed Leases For the Quarter Ended September 30, 2023 1 GAAP net rent increased from $61,231 to $66,144 (8%), as a result of the lease extension.

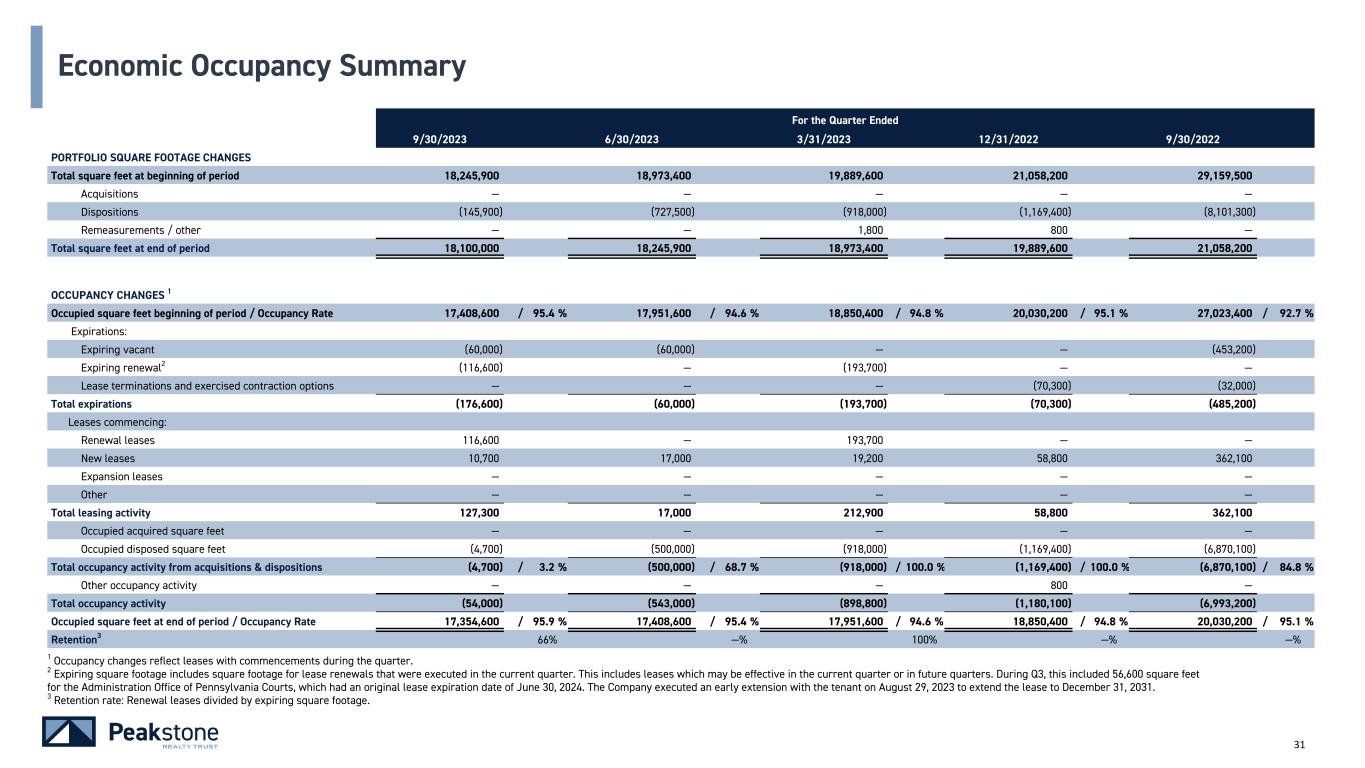

31 1 Occupancy changes reflect leases with commencements during the quarter. 2 Expiring square footage includes square footage for lease renewals that were executed in the current quarter. This includes leases which may be effective in the current quarter or in future quarters. During Q3, this included 56,600 square feet for the Administration Office of Pennsylvania Courts, which had an original lease expiration date of June 30, 2024. The Company executed an early extension with the tenant on August 29, 2023 to extend the lease to December 31, 2031. 3 Retention rate: Renewal leases divided by expiring square footage. For the Quarter Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 PORTFOLIO SQUARE FOOTAGE CHANGES Total square feet at beginning of period 18,245,900 18,973,400 19,889,600 21,058,200 29,159,500 Acquisitions — — — — — Dispositions (145,900) (727,500) (918,000) (1,169,400) (8,101,300) Remeasurements / other — — 1,800 800 — Total square feet at end of period 18,100,000 18,245,900 18,973,400 19,889,600 21,058,200 OCCUPANCY CHANGES 1 Occupied square feet beginning of period / Occupancy Rate 17,408,600 / 95.4 % 17,951,600 / 94.6 % 18,850,400 / 94.8 % 20,030,200 / 95.1 % 27,023,400 / 92.7 % Expirations: Expiring vacant (60,000) (60,000) — — (453,200) Expiring renewal2 (116,600) — (193,700) — — Lease terminations and exercised contraction options — — — (70,300) (32,000) Total expirations (176,600) (60,000) (193,700) (70,300) (485,200) Leases commencing: Renewal leases 116,600 — 193,700 — — New leases 10,700 17,000 19,200 58,800 362,100 Expansion leases — — — — — Other — — — — — Total leasing activity 127,300 17,000 212,900 58,800 362,100 Occupied acquired square feet — — — — — Occupied disposed square feet (4,700) (500,000) (918,000) (1,169,400) (6,870,100) Total occupancy activity from acquisitions & dispositions (4,700) / 3.2 % (500,000) / 68.7 % (918,000) / 100.0 % (1,169,400) / 100.0 % (6,870,100) / 84.8 % Other occupancy activity — — — 800 — Total occupancy activity (54,000) (543,000) (898,800) (1,180,100) (6,993,200) Occupied square feet at end of period / Occupancy Rate 17,354,600 / 95.9 % 17,408,600 / 95.4 % 17,951,600 / 94.6 % 18,850,400 / 94.8 % 20,030,200 / 95.1 % Retention3 66% —% 100% —% —% Economic Occupancy Summary

Components of Net Asset Value

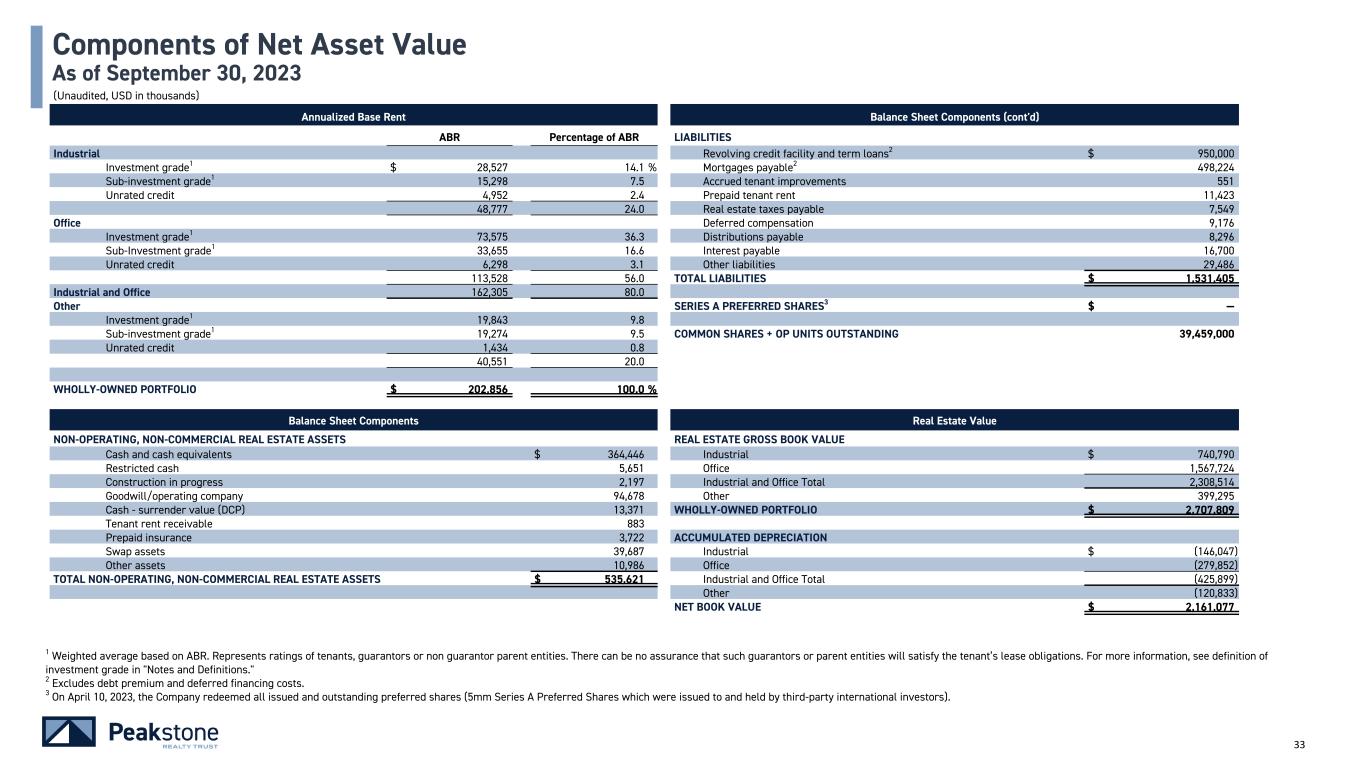

33 (Unaudited, USD in thousands) Annualized Base Rent Balance Sheet Components (cont'd) ABR Percentage of ABR LIABILITIES Industrial � � � Revolving credit facility and term loans2 $ 950,000 Investment grade1 $ 28,527 14.1 % Mortgages payable2 498,224 � Sub-investment grade1 15,298 7.5 Accrued tenant improvements 551 Unrated credit 4,952 2.4 � Prepaid tenant rent 11,423 48,777 24.0 Real estate taxes payable 7,549 Office Deferred compensation 9,176 Investment grade1 73,575 36.3 � Distributions payable 8,296 Sub-Investment grade1 33,655 16.6 Interest payable 16,700 Unrated credit 6,298 3.1 Other liabilities 29,486 113,528 56.0 TOTAL LIABILITIES $ 1,531,405 Industrial and Office 162,305 80.0 Other SERIES A PREFERRED SHARES3 $ — Investment grade1 19,843 9.8 Sub-investment grade1 19,274 9.5 COMMON SHARES + OP UNITS OUTSTANDING 39,459,000 Unrated credit 1,434 0.8 40,551 20.0 WHOLLY-OWNED PORTFOLIO $ 202,856 100.0 % Balance Sheet Components Real Estate Value NON-OPERATING, NON-COMMERCIAL REAL ESTATE ASSETS REAL ESTATE GROSS BOOK VALUE � Cash and cash equivalents $ 364,446 Industrial $ 740,790 Restricted cash 5,651 Office 1,567,724 � Construction in progress 2,197 Industrial and Office Total 2,308,514 Goodwill/operating company 94,678 Other 399,295 � Cash - surrender value (DCP) 13,371 WHOLLY-OWNED PORTFOLIO $ 2,707,809 Tenant rent receivable 883 � Prepaid insurance 3,722 ACCUMULATED DEPRECIATION Swap assets 39,687 Industrial $ (146,047) Other assets 10,986 Office (279,852) TOTAL NON-OPERATING, NON-COMMERCIAL REAL ESTATE ASSETS $ 535,621 Industrial and Office Total (425,899) Other (120,833) NET BOOK VALUE $ 2,161,077 Components of Net Asset Value As of September 30, 2023 1 Weighted average based on ABR. Represents ratings of tenants, guarantors or non guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of investment grade in "Notes and Definitions." 2 Excludes debt premium and deferred financing costs. 3 On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors).

Property Information

35 USD in thousands, except Annualized Base Rent / SF metrics Segment Property/Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %2 Property Sub Type Year Built/ Renovated1 Property WALT3 % of Total ABR3 1 Industrial RH 825 Rogers Road Stockton/Modesto CA 1,501,400 Single Tenant 100.0 % Warehouse 2015 6.9 3.7 % 2 Industrial Amazon (Etna) 11999 National Road Columbus OH 856,300 Single Tenant 100.0 % Warehouse 2016 — 4 3.0 % 3 Industrial 3M 1650 Macom Drive Chicago IL 978,100 Single Tenant 100.0 % Warehouse 2016 3.1 2.4 % 4 Industrial Samsonite 10480 Yeager Road Jacksonville FL 817,700 Single Tenant 100.0 % Warehouse 2008 1.2 2.0 % 5 Industrial Shaw Industries 445 Northport Parkway Savannah GA 1,001,500 Single Tenant 100.0 % Warehouse 2018 9.5 1.6 % 6 Industrial PepsiCo 8060 State Road 33 North Tampa FL 605,400 Single Tenant 100.0 % Warehouse 2018 4.8 1.6 % 7 Industrial Amcor 975 West Main Street Cleveland OH 586,700 Single Tenant 100.0 % Manufacturing 1986 9.1 1.3 % 8 Industrial Amazon (Arlington Heights) 1455 West Cellular Drive Chicago IL 182,900 Single Tenant 100.0 % Warehouse 2020 — 4 1.2 % 9 Industrial Pepsi Bottling Ventures 390 Business Park Drive Winston-Salem NC 526,300 Single Tenant 100.0 % Warehouse 2008 8.8 1.0 % 10 Industrial Roush Industries 333/777 Republic Drive Detroit MI 169,200 Single Tenant 100.0 % Industrial/R&D 2000 5.2 0.8 % 11 Industrial OceanX 6390 Commerce Court Columbus OH 312,000 Single Tenant 100.0 % Warehouse 2015 5.8 0.7 % 12 Industrial Berry Global 1515 Franklin Boulevard Chicago IL 193,700 Single Tenant 100.0 % Manufacturing 2003 9.3 0.7 % 13 Industrial Atlas Copco 3301 Cross Creek Parkway Detroit MI 120,000 Single Tenant 100.0 % Industrial/R&D 2014 2.0 0.7 % 14 Industrial Huntington Ingalls (500 W. Park Lane) 500 West Park Lane Hampton Roads VA 258,300 Single Tenant 100.0 % Warehouse 1999 4.3 0.6 % 15 Industrial Huntington Ingalls (300 W. Park Lane) 300 West Park Lane Hampton Roads VA 257,200 Single Tenant 100.0 % Warehouse 2000 4.3 0.6 % 16 Industrial ZF WABCO 8225 Patriot Boulevard Charleston SC 145,200 Single Tenant 100.0 % Warehouse 2016 9.9 0.6 % 17 Industrial TransDigm 110 Algonquin Parkway Northern New Jersey NJ 114,300 Single Tenant 100.0 % Manufacturing 1986 4.5 0.6 % 18 Industrial Hopkins 428 Peyton Street Emporia KS 320,800 Single Tenant 100.0 % Manufacturing 2000 13.3 0.5 % 19 Industrial Fidelity Building Services 25 Loveton Circle Baltimore MD 54,800 Single Tenant 100.0 % Industrial/R&D 1981 11.3 0.4 % INDUSTRIAL TOTAL 9,001,800 100.0 % 6.3 $ 48,777 (1) Year shown is either the year built or year substantially renovated. (2) Total calculated as a weighted average based on rentable square feet. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures. Property List As of September 30, 2023

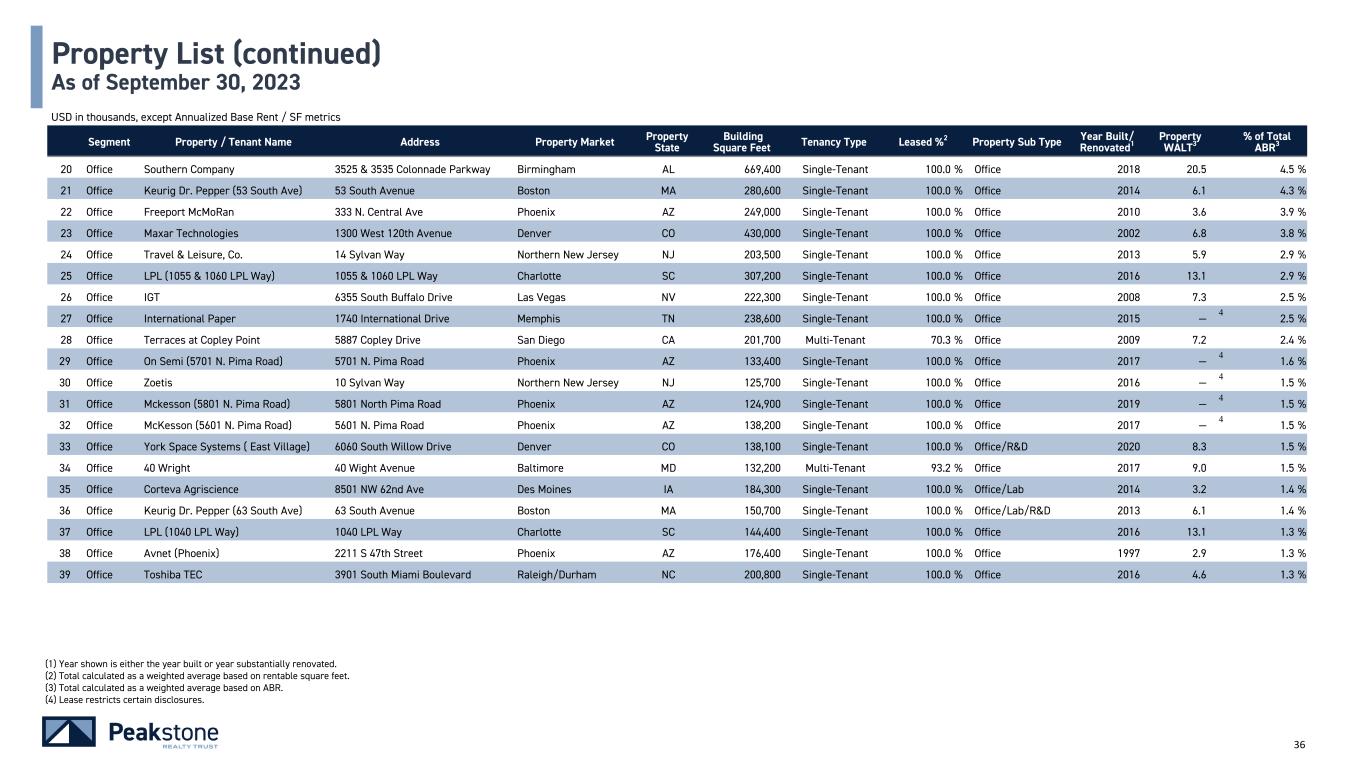

36 USD in thousands, except Annualized Base Rent / SF metrics Segment Property / Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %2 Property Sub Type Year Built/ Renovated1 Property WALT3 % of Total ABR3 20 Office Southern Company 3525 & 3535 Colonnade Parkway Birmingham AL 669,400 Single-Tenant 100.0 % Office 2018 20.5 4.5 % 21 Office Keurig Dr. Pepper (53 South Ave) 53 South Avenue Boston MA 280,600 Single-Tenant 100.0 % Office 2014 6.1 4.3 % 22 Office Freeport McMoRan 333 N. Central Ave Phoenix AZ 249,000 Single-Tenant 100.0 % Office 2010 3.6 3.9 % 23 Office Maxar Technologies 1300 West 120th Avenue Denver CO 430,000 Single-Tenant 100.0 % Office 2002 6.8 3.8 % 24 Office Travel & Leisure, Co. 14 Sylvan Way Northern New Jersey NJ 203,500 Single-Tenant 100.0 % Office 2013 5.9 2.9 % 25 Office LPL (1055 & 1060 LPL Way) 1055 & 1060 LPL Way Charlotte SC 307,200 Single-Tenant 100.0 % Office 2016 13.1 2.9 % 26 Office IGT 6355 South Buffalo Drive Las Vegas NV 222,300 Single-Tenant 100.0 % Office 2008 7.3 2.5 % 27 Office International Paper 1740 International Drive Memphis TN 238,600 Single-Tenant 100.0 % Office 2015 — 4 2.5 % 28 Office Terraces at Copley Point 5887 Copley Drive San Diego CA 201,700 Multi-Tenant 70.3 % Office 2009 7.2 2.4 % 29 Office On Semi (5701 N. Pima Road) 5701 N. Pima Road Phoenix AZ 133,400 Single-Tenant 100.0 % Office 2017 — 4 1.6 % 30 Office Zoetis 10 Sylvan Way Northern New Jersey NJ 125,700 Single-Tenant 100.0 % Office 2016 — 4 1.5 % 31 Office Mckesson (5801 N. Pima Road) 5801 North Pima Road Phoenix AZ 124,900 Single-Tenant 100.0 % Office 2019 — 4 1.5 % 32 Office McKesson (5601 N. Pima Road) 5601 N. Pima Road Phoenix AZ 138,200 Single-Tenant 100.0 % Office 2017 — 4 1.5 % 33 Office York Space Systems ( East Village) 6060 South Willow Drive Denver CO 138,100 Single-Tenant 100.0 % Office/R&D 2020 8.3 1.5 % 34 Office 40 Wright 40 Wight Avenue Baltimore MD 132,200 Multi-Tenant 93.2 % Office 2017 9.0 1.5 % 35 Office Corteva Agriscience 8501 NW 62nd Ave Des Moines IA 184,300 Single-Tenant 100.0 % Office/Lab 2014 3.2 1.4 % 36 Office Keurig Dr. Pepper (63 South Ave) 63 South Avenue Boston MA 150,700 Single-Tenant 100.0 % Office/Lab/R&D 2013 6.1 1.4 % 37 Office LPL (1040 LPL Way) 1040 LPL Way Charlotte SC 144,400 Single-Tenant 100.0 % Office 2016 13.1 1.3 % 38 Office Avnet (Phoenix) 2211 S 47th Street Phoenix AZ 176,400 Single-Tenant 100.0 % Office 1997 2.9 1.3 % 39 Office Toshiba TEC 3901 South Miami Boulevard Raleigh/Durham NC 200,800 Single-Tenant 100.0 % Office 2016 4.6 1.3 % Property List (continued) As of September 30, 2023 (1) Year shown is either the year built or year substantially renovated. (2) Total calculated as a weighted average based on rentable square feet. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures.

37 USD in thousands, except Annualized Base Rent / SF metrics Segment Property/Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %2 Property Sub Type Year Built/ Renovated1 Property WALT3 % of Total ABR3 40 Office Occidental Petroleum 501 North Division Street Platteville CO 114,500 Single Tenant 100.0 % Office 2013 10.0 1.1 % 41 Office PPG 400 Bertha Lamme Drive Pittsburgh PA 118,000 Single Tenant 100.0 % Office 2010 7.3 1.1 % 42 Office MISO 720 City Center Drive Indianapolis IN 133,400 Single Tenant 100.0 % Office 2016 4.6 1.0 % 43 Office Amentum (Heritage II) 13500 Heritage Parkway Dallas/Fort Worth TX 119,000 Single Tenant 100.0 % Office 2006 — 4 1.0 % 44 Office Fresenius Medical Care 3355 Earl Campbell Pkwy Tyler TX 81,000 Single Tenant 100.0 % Office 2016 8.1 0.9 % 45 Office Cigna (500 Great Circle Road) 500 Great Circle Road Nashville TN 72,200 Single Tenant 100.0 % Office 2012 3.8 0.7 % 46 Office Cigna (Express Scripts) 501 Ronda Court Pittsburgh PA 70,500 Single Tenant 100.0 % Office/Data Center 2015 1.8 0.7 % 47 Office AT&T (14500 NE 87th Street) 14500 NE 87th Street Seattle/Puget Sound WA 60,000 Single Tenant 100.0 % Office/Data Center 1995 3.9 0.7 % 48 Office AT&T (14520 NE 87th Street) 14520 NE 87th Street Seattle/Puget Sound WA 59,800 Single Tenant 100.0 % Office/Data Center 1995 3.9 0.7 % 49 Office Parallon 6451 126th Avenue North Tampa FL 83,200 Single Tenant 100.0 % Office 2013 1.5 0.7 % 50 Office Tech Data Corp. 19031 Ridgewood Parkway San Antonio TX 58,000 Single Tenant 100.0 % Office 2014 1.2 0.5 % 51 Office Rapiscan Systems 23 Frontage Road Boston MA 64,200 Single Tenant 100.0 % Office/Lab 2014 3.7 0.5 % 52 Office AT&T (14560 NE 87th Street) 14560 NE 87th Street Seattle/Puget Sound WA 36,000 Single Tenant 100.0 % Office/Data Center 1995 3.9 0.4 % 53 Office 136 Capcom 136 Capcom Avenue Raleigh/Durham NC 31,000 Single Tenant 100.0 % Office/R&D 2014 1.3 0.2 % 54 Office 204 Capcom 204 Capcom Avenue Raleigh/Durham NC 32,000 Single Tenant 100.0 % Office/R&D 2010 3.8 0.2 % 55 Office 530 Great Circle Road 530 Great Circle Road Nashville TN 100,200 Single Tenant 100.0 % Office/Lab 2011 — 4 — % OFFICE TOTAL 5,684,400 98.8 % 7.7 7.7 $ 113,528 (1) Year shown is either the year built or year substantially renovated. (2) Total calculated as a weighted average based on rentable square feet. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures. Property List (continued) As of September 30, 2023

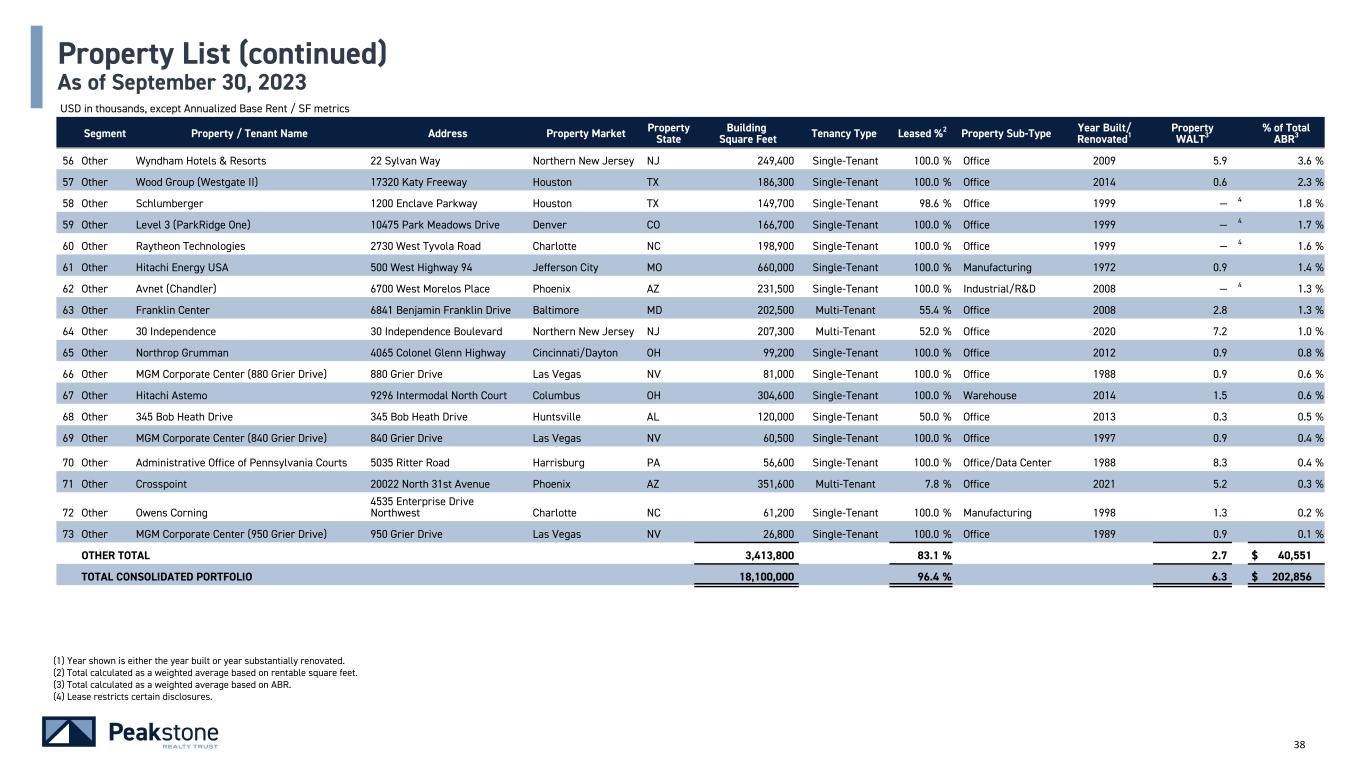

38 Property List (continued) As of September 30, 2023 (1) Year shown is either the year built or year substantially renovated. (2) Total calculated as a weighted average based on rentable square feet. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures. USD in thousands, except Annualized Base Rent / SF metrics Segment Property / Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %2 Property Sub-Type Year Built/ Renovated1 Property WALT3 % of Total ABR3 56 Other Wyndham Hotels & Resorts 22 Sylvan Way Northern New Jersey NJ 249,400 Single-Tenant 100.0 % Office 2009 5.9 3.6 % 57 Other Wood Group (Westgate II) 17320 Katy Freeway Houston TX 186,300 Single-Tenant 100.0 % Office 2014 0.6 2.3 % 58 Other Schlumberger 1200 Enclave Parkway Houston TX 149,700 Single-Tenant 98.6 % Office 1999 — 4 1.8 % 59 Other Level 3 (ParkRidge One) 10475 Park Meadows Drive Denver CO 166,700 Single-Tenant 100.0 % Office 1999 — 4 1.7 % 60 Other Raytheon Technologies 2730 West Tyvola Road Charlotte NC 198,900 Single-Tenant 100.0 % Office 1999 — 4 1.6 % 61 Other Hitachi Energy USA 500 West Highway 94 Jefferson City MO 660,000 Single-Tenant 100.0 % Manufacturing 1972 0.9 1.4 % 62 Other Avnet (Chandler) 6700 West Morelos Place Phoenix AZ 231,500 Single-Tenant 100.0 % Industrial/R&D 2008 — 4 1.3 % 63 Other Franklin Center 6841 Benjamin Franklin Drive Baltimore MD 202,500 Multi-Tenant 55.4 % Office 2008 2.8 1.3 % 64 Other 30 Independence 30 Independence Boulevard Northern New Jersey NJ 207,300 Multi-Tenant 52.0 % Office 2020 7.2 1.0 % 65 Other Northrop Grumman 4065 Colonel Glenn Highway Cincinnati/Dayton OH 99,200 Single-Tenant 100.0 % Office 2012 0.9 0.8 % 66 Other MGM Corporate Center (880 Grier Drive) 880 Grier Drive Las Vegas NV 81,000 Single-Tenant 100.0 % Office 1988 0.9 0.6 % 67 Other Hitachi Astemo 9296 Intermodal North Court Columbus OH 304,600 Single-Tenant 100.0 % Warehouse 2014 1.5 0.6 % 68 Other 345 Bob Heath Drive 345 Bob Heath Drive Huntsville AL 120,000 Single-Tenant 50.0 % Office 2013 0.3 0.5 % 69 Other MGM Corporate Center (840 Grier Drive) 840 Grier Drive Las Vegas NV 60,500 Single-Tenant 100.0 % Office 1997 0.9 0.4 % 70 Other Administrative Office of Pennsylvania Courts 5035 Ritter Road Harrisburg PA 56,600 Single-Tenant 100.0 % Office/Data Center 1988 8.3 0.4 % 71 Other Crosspoint 20022 North 31st Avenue Phoenix AZ 351,600 Multi-Tenant 7.8 % Office 2021 5.2 0.3 % 72 Other Owens Corning 4535 Enterprise Drive Northwest Charlotte NC 61,200 Single-Tenant 100.0 % Manufacturing 1998 1.3 0.2 % 73 Other MGM Corporate Center (950 Grier Drive) 950 Grier Drive Las Vegas NV 26,800 Single-Tenant 100.0 % Office 1989 0.9 0.1 % OTHER TOTAL 3,413,800 83.1 % 2.7 $ 40,551 TOTAL CONSOLIDATED PORTFOLIO 18,100,000 96.4 % 6.3 $ 202,856

Portfolio Characteristics

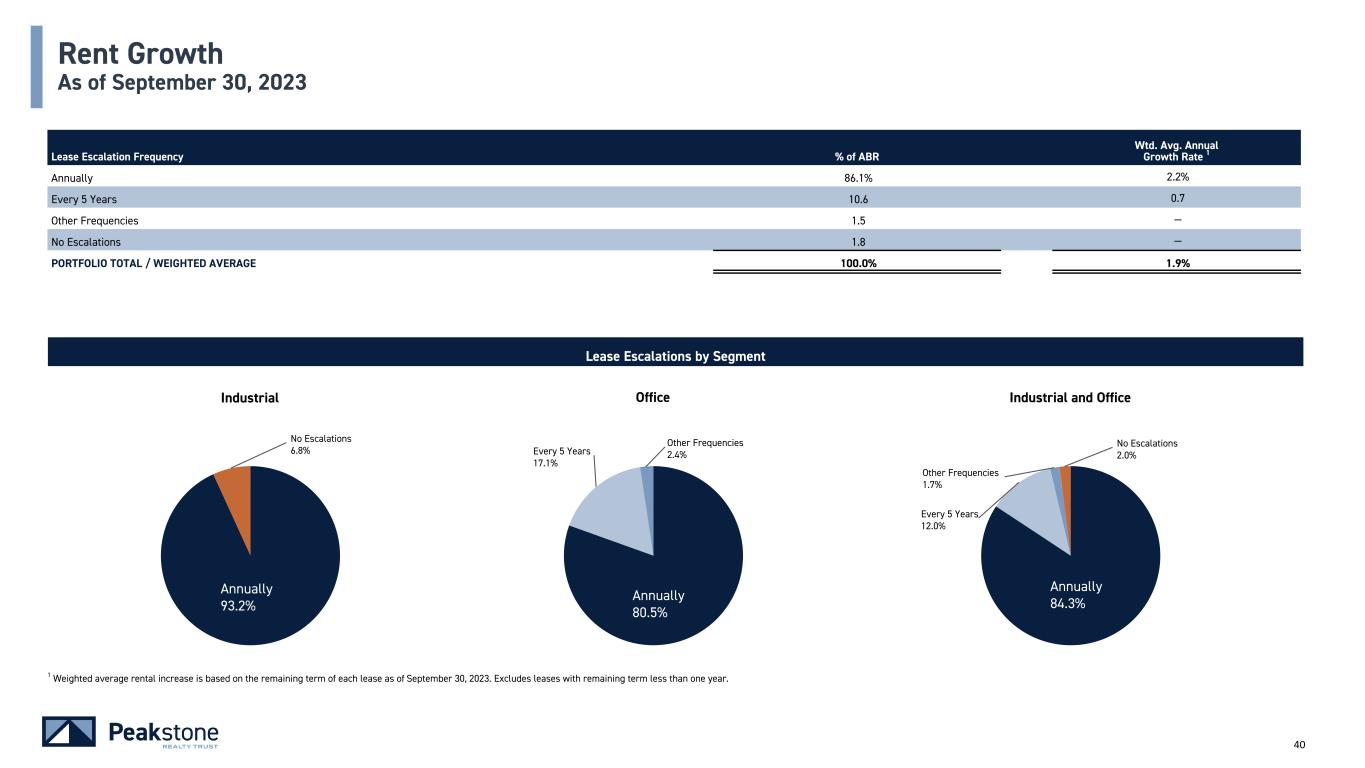

40 1 Weighted average rental increase is based on the remaining term of each lease as of September 30, 2023. Excludes leases with remaining term less than one year. Lease Escalation Frequency % of ABR Wtd. Avg. Annual Growth Rate 1 Annually 86.1% 2.2% Every 5 Years 10.6 0.7 Other Frequencies 1.5 — No Escalations 1.8 — PORTFOLIO TOTAL / WEIGHTED AVERAGE 100.0% 1.9% Rent Growth As of September 30, 2023 Annually 84.3% Every 5 Years 12.0% Other Frequencies 1.7% No Escalations 2.0% Annually 93.2% No Escalations 6.8% Annually 80.5% Every 5 Years 17.1% Other Frequencies 2.4% Industrial Industrial and OfficeOffice Lease Escalations by Segment

41 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper Baa14 5.7% 6.1 2 Southern Company Services BBB+ 4.5 20.5 3 LPL Holdings BBB- 4.2 13.1 4 Amazon5 AA 4.2 7.8 5 Freeport McMoRan Baa24 3.9 3.6 6 Maxar Technologies HY56 3.8 6.8 7 RH HY16 3.7 6.9 8 Wyndham Hotels & Resorts BB- 3.6 5.9 9 McKesson A- 3.0 5.0 10 Travel & Leisure, Co. BB- 2.9 5.9 Top 10 Total/Average Lease Term 39.5% 8.5 Investment Grade Calculation Based On:2 Tenant Profile Tenant 31.3 % Number of Tenants 70 Guarantor 9.1 Average Square Footage Leased per Tenant 249,314 Tenant/Guarantor 40.4 Average ABR per Sq Ft - Industrial $5.42 Non-Guarantor Parent 19.7 Average ABR per Sq Ft - Office $19.97 Total Investment Grade 60.1 % Average ABR per Sq Ft - Other $11.88 Weighted Average Lease Term (WALT)3 6.3 Tenant Concentration: Consolidated As of September 30, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant as compared to consolidated total. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents the combined base rental revenue for two properties leased to the tenant/major tenant. 6 Represents a rating issued by Bloomberg services.

42 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper Baa14 7.1% 6.1 2 Southern Company Services BBB+ 5.7 20.5 3 LPL Holdings BBB- 5.3 13.1 4 Amazon5 AA 5.3 7.8 5 Freeport McMoRan Baa24 4.8 3.6 6 Maxar Technologies HY56 4.8 6.8 7 RH HY16 4.6 6.9 8 McKesson A- 3.8 5.0 9 Travel & Leisure, Co. BB- 3.6 5.9 10 IGT BB+ 3.2 7.3 Top 10 Total/Average Lease Term 48.2% 8.6 Investment Grade Calculation Based On:2 Tenant Profile Tenant 32.7 % Number of Tenants 48 Guarantor 9.7 Average Square Footage Leased per Tenant 304,525 Tenant/Guarantor 42.4 Average ABR per Sq Ft: Industrial and Office $11.05 Non-Guarantor Parent 20.6 Weighted Average Lease Term (WALT)3 7.3 Total Investment Grade 63.0 % Tenant Concentration: Industrial and Office As of September 30, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for industrial and office segments. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents the combined base rental revenue for two properties leased to the tenant/major tenant. 6 Represents a rating issued by Bloomberg services.

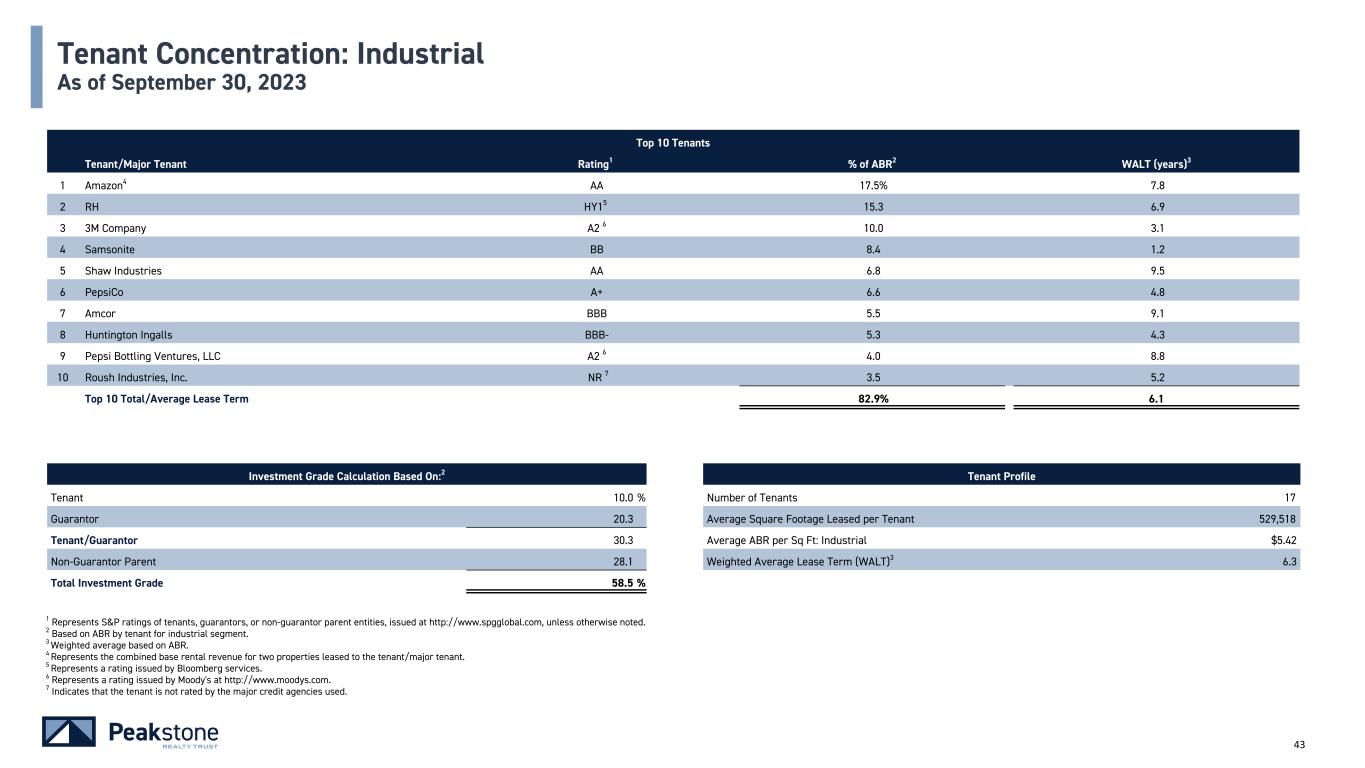

43 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Amazon4 AA 17.5% 7.8 2 RH HY15 15.3 6.9 3 3M Company A2 6 10.0 3.1 4 Samsonite BB 8.4 1.2 5 Shaw Industries AA 6.8 9.5 6 PepsiCo A+ 6.6 4.8 7 Amcor BBB 5.5 9.1 8 Huntington Ingalls BBB- 5.3 4.3 9 Pepsi Bottling Ventures, LLC A2 6 4.0 8.8 10 Roush Industries, Inc. NR 7 3.5 5.2 Top 10 Total/Average Lease Term 82.9% 6.1 Investment Grade Calculation Based On:2 Tenant Profile Tenant 10.0 % Number of Tenants 17 Guarantor 20.3 Average Square Footage Leased per Tenant 529,518 Tenant/Guarantor 30.3 Average ABR per Sq Ft: Industrial $5.42 Non-Guarantor Parent 28.1 Weighted Average Lease Term (WALT)3 6.3 Total Investment Grade 58.5 % Tenant Concentration: Industrial As of September 30, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for industrial segment. 3 Weighted average based on ABR. 4 Represents the combined base rental revenue for two properties leased to the tenant/major tenant. 5 Represents a rating issued by Bloomberg services. 6 Represents a rating issued by Moody's at http://www.moodys.com. 7 Indicates that the tenant is not rated by the major credit agencies used.

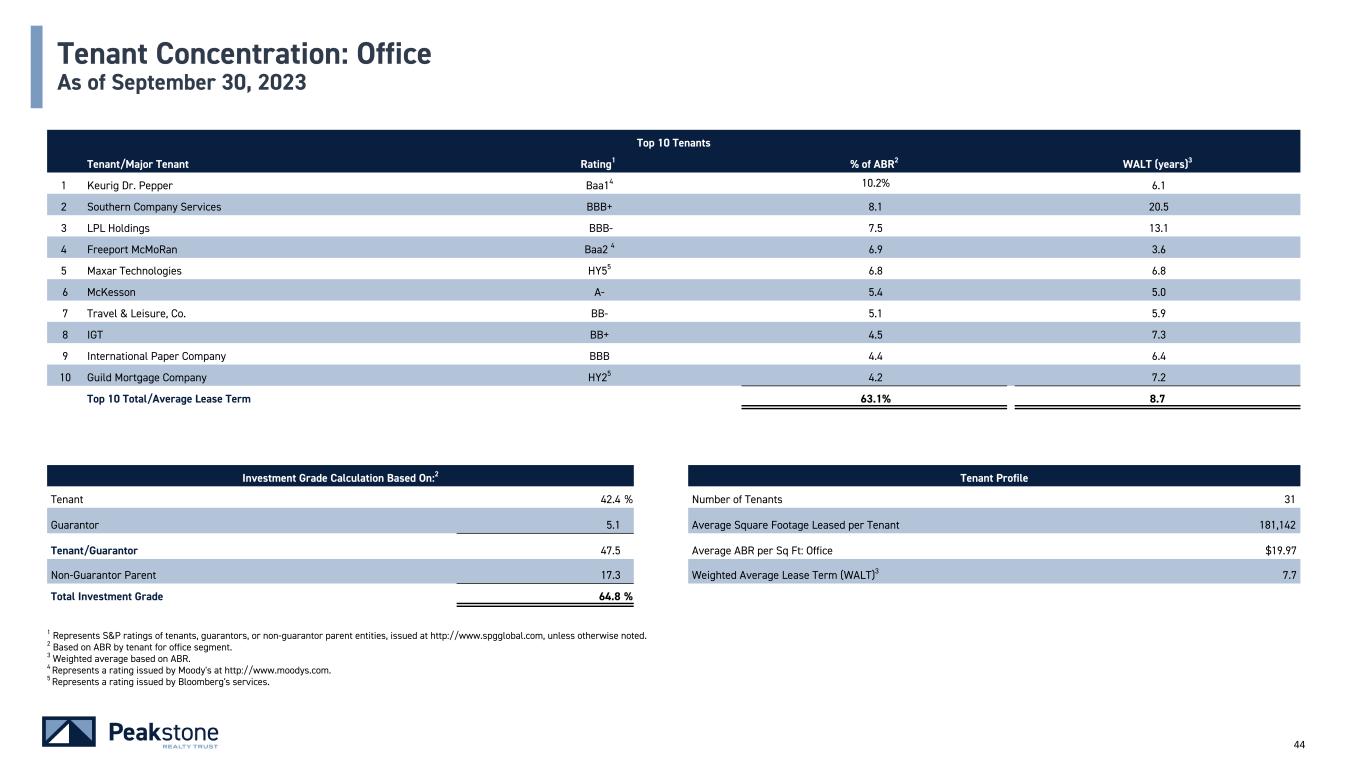

44 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper Baa14 10.2% 6.1 2 Southern Company Services BBB+ 8.1 20.5 3 LPL Holdings BBB- 7.5 13.1 4 Freeport McMoRan Baa2 4 6.9 3.6 5 Maxar Technologies HY55 6.8 6.8 6 McKesson A- 5.4 5.0 7 Travel & Leisure, Co. BB- 5.1 5.9 8 IGT BB+ 4.5 7.3 9 International Paper Company BBB 4.4 6.4 10 Guild Mortgage Company HY25 4.2 7.2 Top 10 Total/Average Lease Term 63.1% 8.7 Investment Grade Calculation Based On:2 Tenant Profile Tenant 42.4 % Number of Tenants 31 Guarantor 5.1 Average Square Footage Leased per Tenant 181,142 Tenant/Guarantor 47.5 Average ABR per Sq Ft: Office $19.97 Non-Guarantor Parent 17.3 Weighted Average Lease Term (WALT)3 7.7 Total Investment Grade 64.8 % Tenant Concentration: Office As of September 30, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for office segment. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents a rating issued by Bloomberg's services.

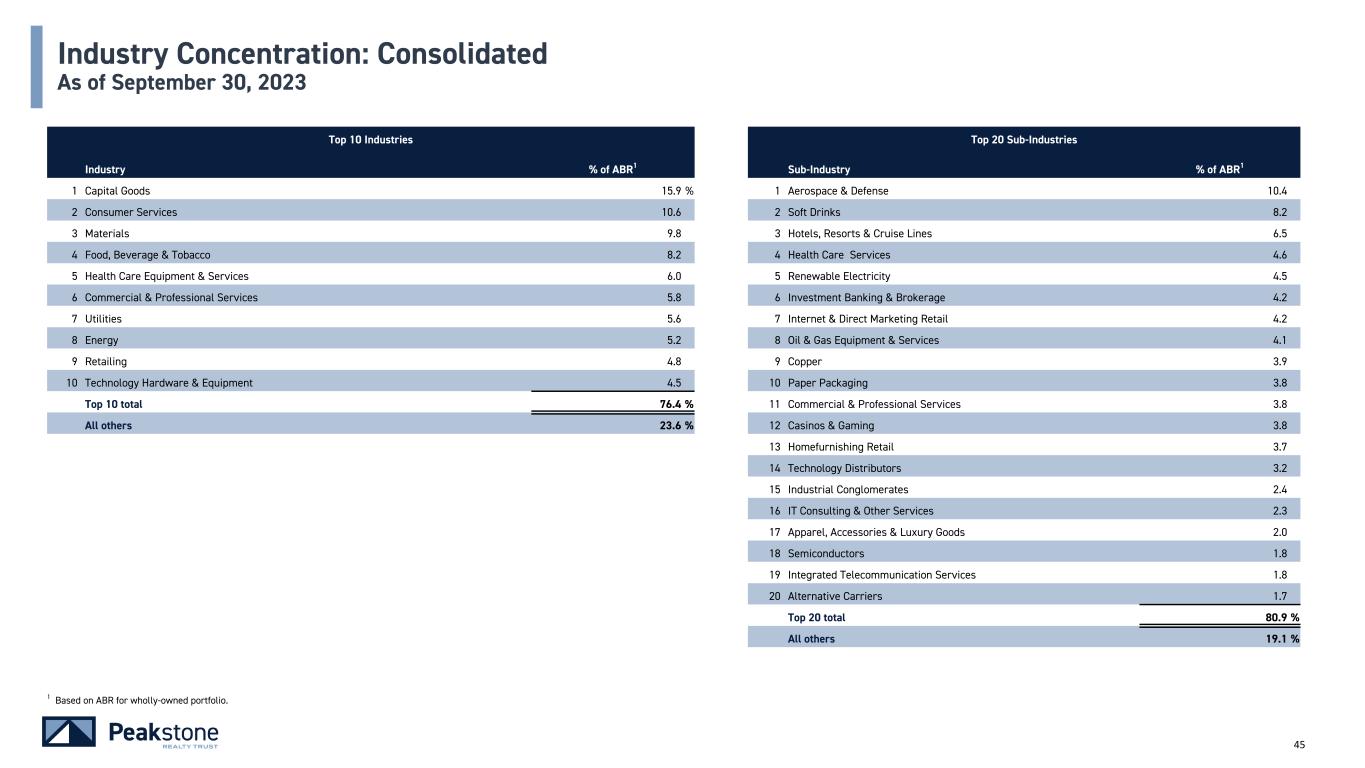

45 Industry Concentration: Consolidated As of September 30, 2023 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 15.9 % 1 Aerospace & Defense 10.4 2 Consumer Services 10.6 2 Soft Drinks 8.2 3 Materials 9.8 3 Hotels, Resorts & Cruise Lines 6.5 4 Food, Beverage & Tobacco 8.2 4 Health Care Services 4.6 5 Health Care Equipment & Services 6.0 5 Renewable Electricity 4.5 6 Commercial & Professional Services 5.8 6 Investment Banking & Brokerage 4.2 7 Utilities 5.6 7 Internet & Direct Marketing Retail 4.2 8 Energy 5.2 8 Oil & Gas Equipment & Services 4.1 9 Retailing 4.8 9 Copper 3.9 10 Technology Hardware & Equipment 4.5 10 Paper Packaging 3.8 � Top 10 total 76.4 % 11 Commercial & Professional Services 3.8 All others 23.6 % 12 Casinos & Gaming 3.8 � � � 13 Homefurnishing Retail 3.7 14 Technology Distributors 3.2 � ������ � 15 Industrial Conglomerates 2.4 16 IT Consulting & Other Services 2.3 � � � 17 Apparel, Accessories & Luxury Goods 2.0 18 Semiconductors 1.8 � � � 19 Integrated Telecommunication Services 1.8 20 Alternative Carriers 1.7 � � � � Top 20 total 80.9 % All others 19.1 % 1 Based on ABR for wholly-owned portfolio.

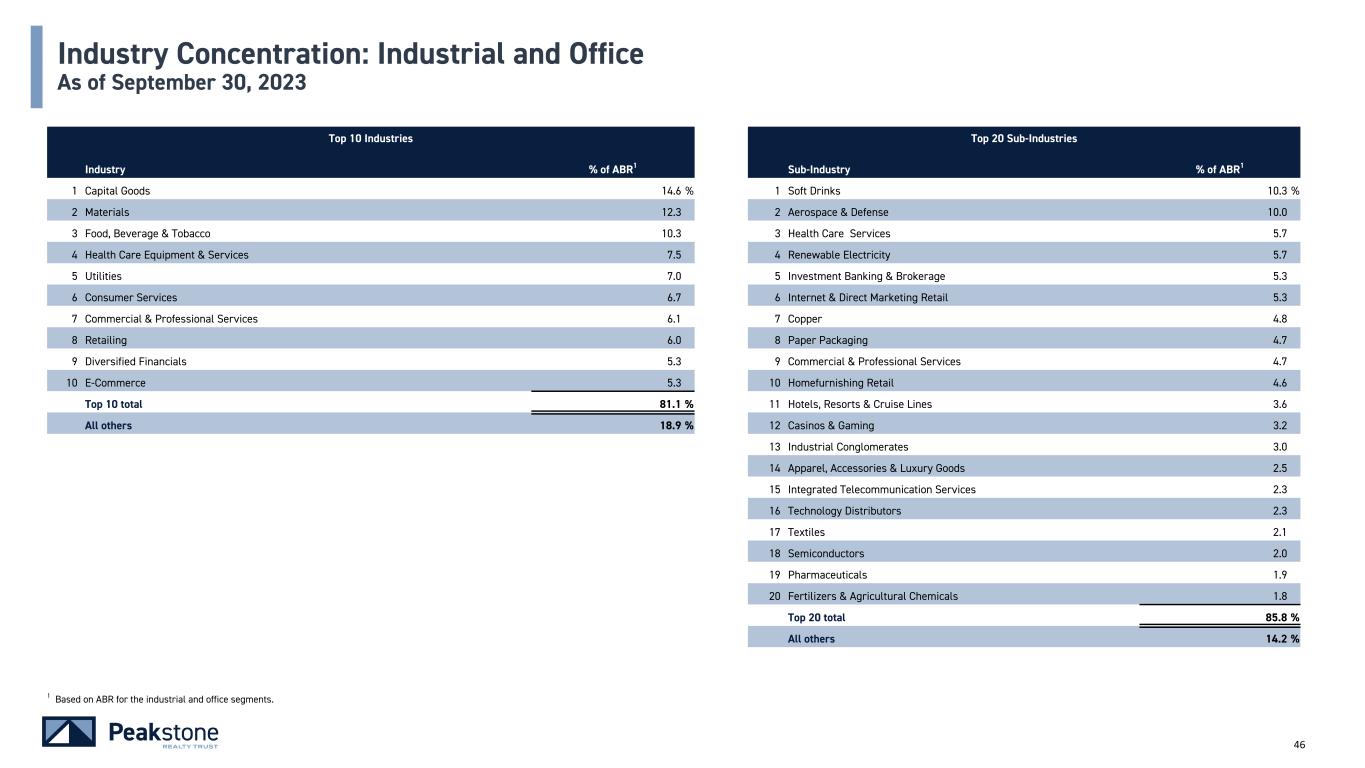

46 Industry Concentration: Industrial and Office As of September 30, 2023 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 14.6 % 1 Soft Drinks 10.3 % 2 Materials 12.3 2 Aerospace & Defense 10.0 3 Food, Beverage & Tobacco 10.3 3 Health Care Services 5.7 4 Health Care Equipment & Services 7.5 4 Renewable Electricity 5.7 5 Utilities 7.0 5 Investment Banking & Brokerage 5.3 6 Consumer Services 6.7 6 Internet & Direct Marketing Retail 5.3 7 Commercial & Professional Services 6.1 7 Copper 4.8 8 Retailing 6.0 8 Paper Packaging 4.7 9 Diversified Financials 5.3 9 Commercial & Professional Services 4.7 10 E-Commerce 5.3 10 Homefurnishing Retail 4.6 � Top 10 total 81.1 % 11 Hotels, Resorts & Cruise Lines 3.6 All others 18.9 % 12 Casinos & Gaming 3.2 � � � 13 Industrial Conglomerates 3.0 14 Apparel, Accessories & Luxury Goods 2.5 � � � 15 Integrated Telecommunication Services 2.3 16 Technology Distributors 2.3 � � � 17 Textiles 2.1 18 Semiconductors 2.0 � � � 19 Pharmaceuticals 1.9 20 Fertilizers & Agricultural Chemicals 1.8 � � � � Top 20 total 85.8 % All others 14.2 % 1 Based on ABR for the industrial and office segments.

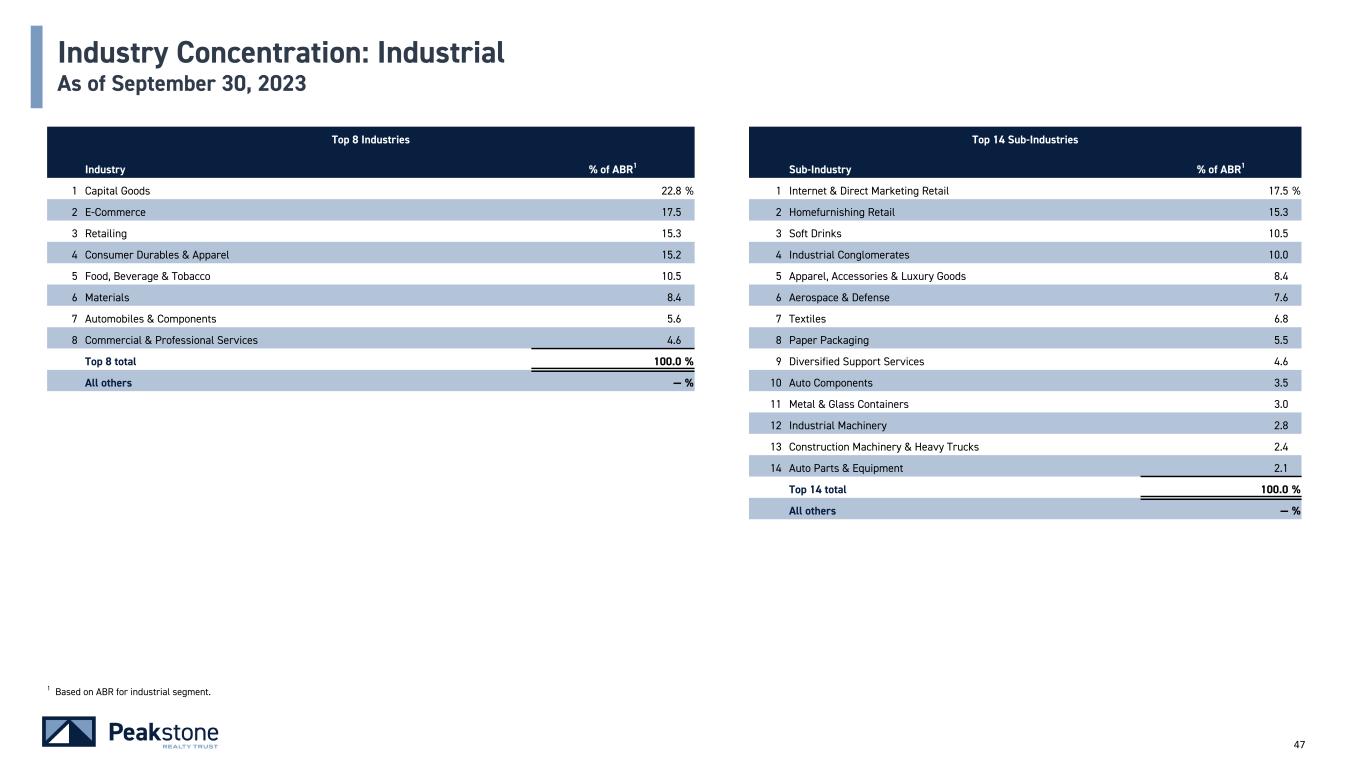

47 Industry Concentration: Industrial As of September 30, 20232021 Top 8 Industries Top 14 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 22.8 % 1 Internet & Direct Marketing Retail 17.5 % 2 E-Commerce 17.5 2 Homefurnishing Retail 15.3 3 Retailing 15.3 3 Soft Drinks 10.5 4 Consumer Durables & Apparel 15.2 4 Industrial Conglomerates 10.0 5 Food, Beverage & Tobacco 10.5 5 Apparel, Accessories & Luxury Goods 8.4 6 Materials 8.4 6 Aerospace & Defense 7.6 7 Automobiles & Components 5.6 7 Textiles 6.8 8 Commercial & Professional Services 4.6 8 Paper Packaging 5.5 � Top 8 total 100.0 % 9 Diversified Support Services 4.6 All others — % 10 Auto Components 3.5 � � � 11 Metal & Glass Containers 3.0 12 Industrial Machinery 2.8 � � � 13 Construction Machinery & Heavy Trucks 2.4 14 Auto Parts & Equipment 2.1 Top 14 total 100.0 % � � � All others — % 1 Based on ABR for industrial segment.

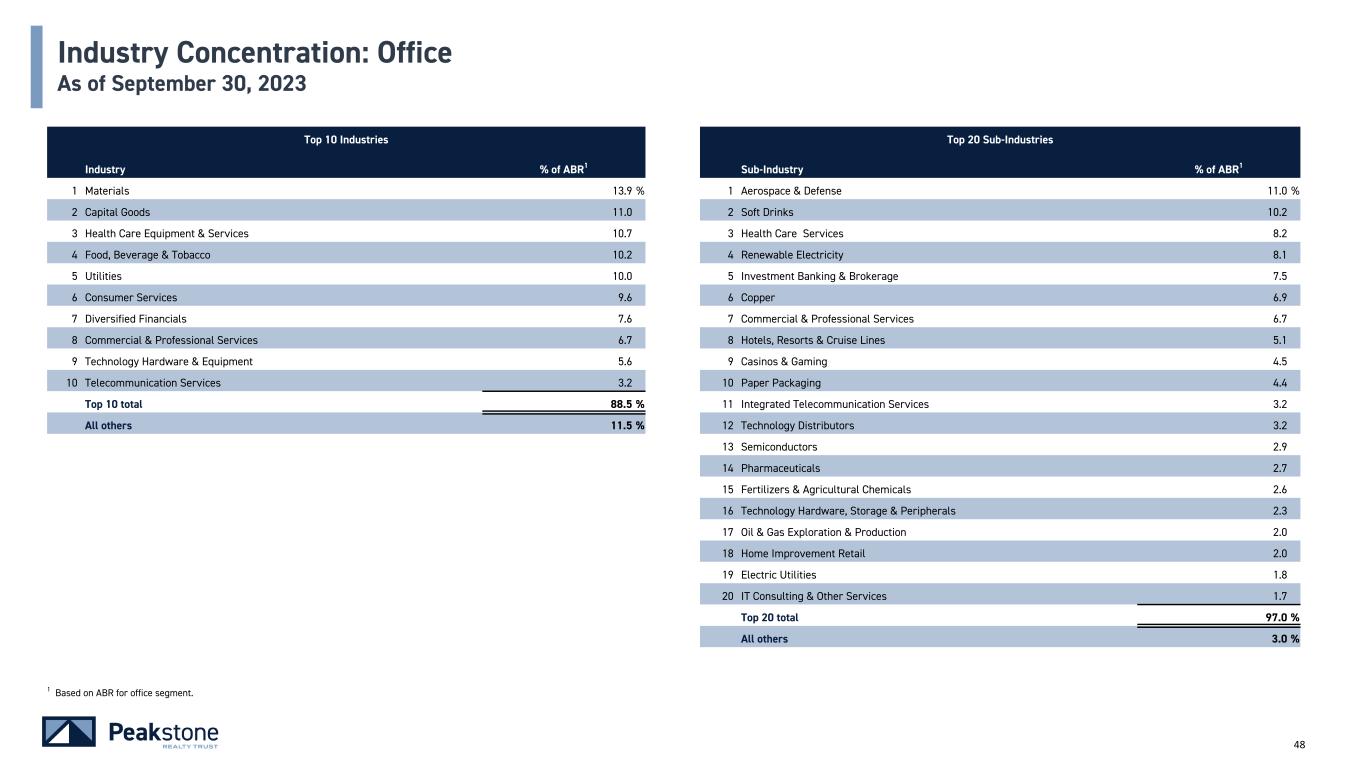

48 Industry Concentration: Office As of September 30, 2023 2021 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Materials 13.9 % 1 Aerospace & Defense 11.0 % 2 Capital Goods 11.0 2 Soft Drinks 10.2 3 Health Care Equipment & Services 10.7 3 Health Care Services 8.2 4 Food, Beverage & Tobacco 10.2 4 Renewable Electricity 8.1 5 Utilities 10.0 5 Investment Banking & Brokerage 7.5 6 Consumer Services 9.6 6 Copper 6.9 7 Diversified Financials 7.6 7 Commercial & Professional Services 6.7 8 Commercial & Professional Services 6.7 8 Hotels, Resorts & Cruise Lines 5.1 9 Technology Hardware & Equipment 5.6 9 Casinos & Gaming 4.5 10 Telecommunication Services 3.2 10 Paper Packaging 4.4 Top 10 total 88.5 % 11 Integrated Telecommunication Services 3.2 All others 11.5 % 12 Technology Distributors 3.2 13 Semiconductors 2.9 14 Pharmaceuticals 2.7 15 Fertilizers & Agricultural Chemicals 2.6 16 Technology Hardware, Storage & Peripherals 2.3 17 Oil & Gas Exploration & Production 2.0 18 Home Improvement Retail 2.0 19 Electric Utilities 1.8 20 IT Consulting & Other Services 1.7 � � Top 20 total 97.0 % All others 3.0 % 1 Based on ABR for office segment.

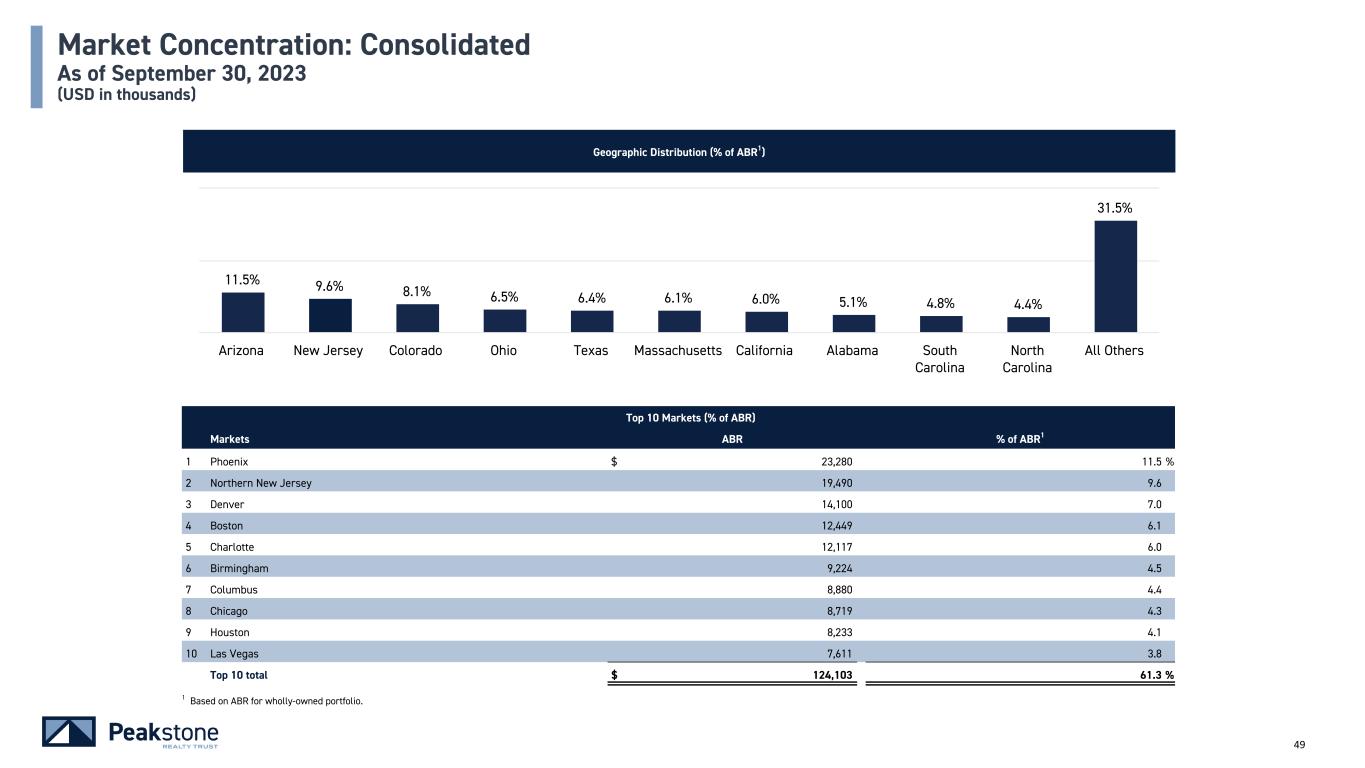

49 Geographic Distribution (% of ABR1) Market Concentration: Consolidated As of September 30, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 23,280 11.5 % 2 Northern New Jersey 19,490 9.6 3 Denver 14,100 7.0 4 Boston 12,449 6.1 5 Charlotte 12,117 6.0 6 Birmingham 9,224 4.5 7 Columbus 8,880 4.4 8 Chicago 8,719 4.3 9 Houston 8,233 4.1 10 Las Vegas 7,611 3.8 Top 10 total $ 124,103 61.3 % 11.5% 9.6% 8.1% 6.5% 6.4% 6.1% 6.0% 5.1% 4.8% 4.4% 31.5% Arizona New Jersey Colorado Ohio Texas Massachusetts California Alabama South Carolina North Carolina All Others 1 Based on ABR for wholly-owned portfolio.

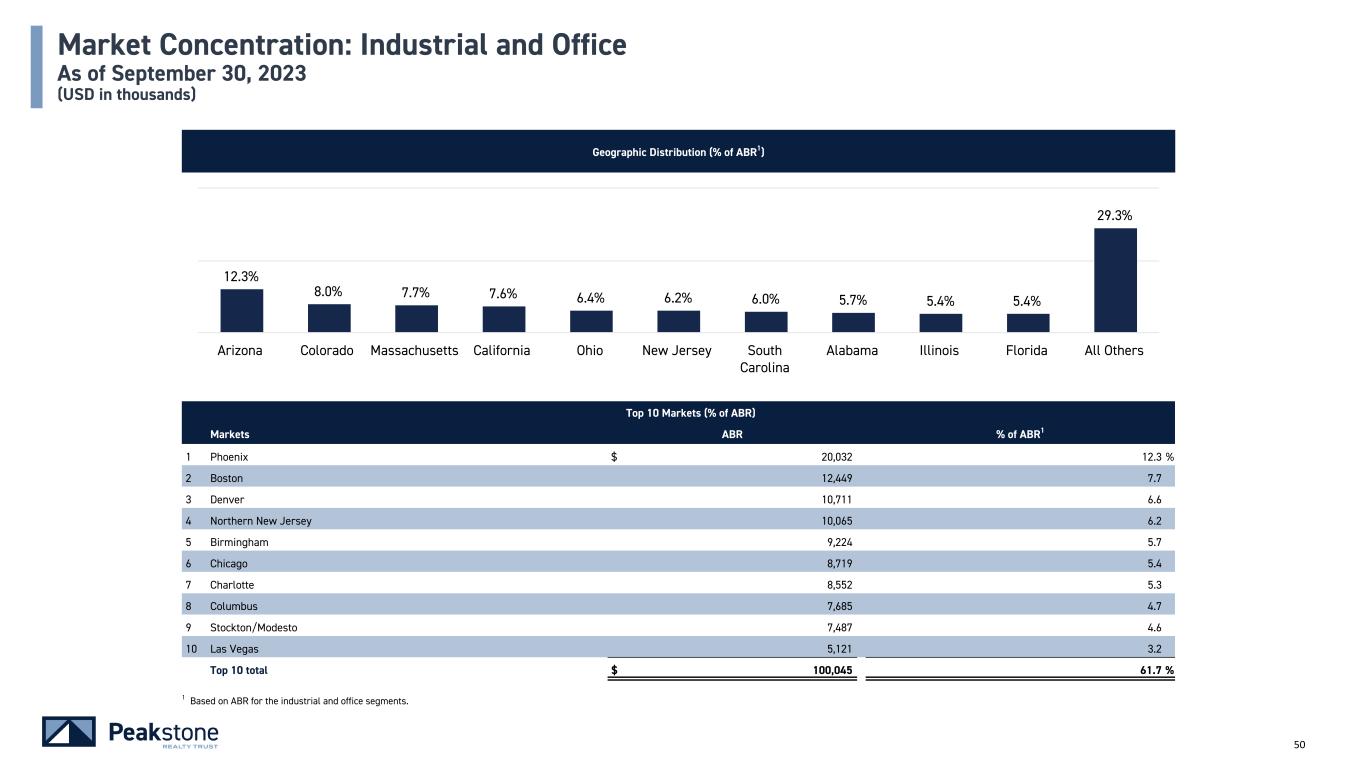

50 Geographic Distribution (% of ABR1) Market Concentration: Industrial and Office As of September 30, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 20,032 12.3 % 2 Boston 12,449 7.7 3 Denver 10,711 6.6 4 Northern New Jersey 10,065 6.2 5 Birmingham 9,224 5.7 6 Chicago 8,719 5.4 7 Charlotte 8,552 5.3 8 Columbus 7,685 4.7 9 Stockton/Modesto 7,487 4.6 10 Las Vegas 5,121 3.2 Top 10 total $ 100,045 61.7 % 12.3% 8.0% 7.7% 7.6% 6.4% 6.2% 6.0% 5.7% 5.4% 5.4% 29.3% Arizona Colorado Massachusetts California Ohio New Jersey South Carolina Alabama Illinois Florida All Others 1 Based on ABR for the industrial and office segments.

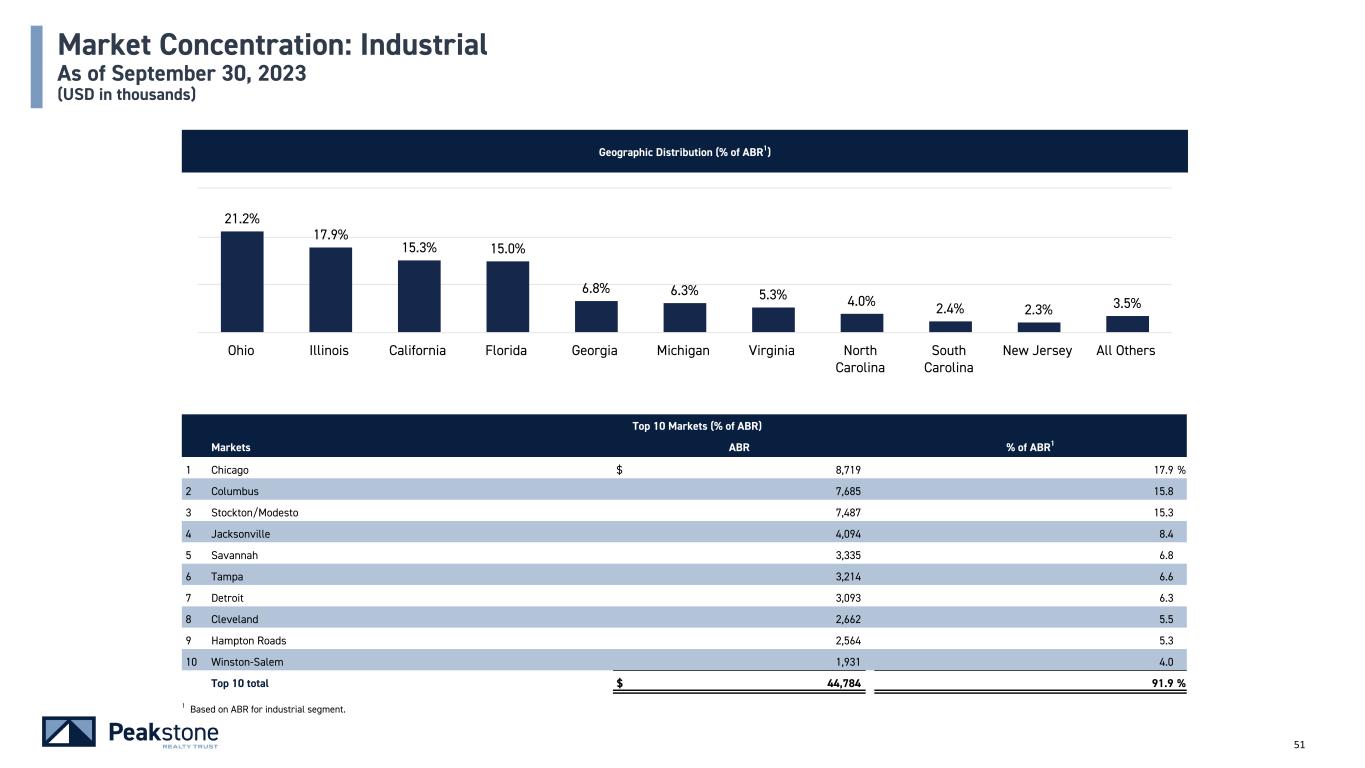

51 Geographic Distribution (% of ABR1) Market Concentration: Industrial As of September 30, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Chicago $ 8,719 17.9 % 2 Columbus 7,685 15.8 3 Stockton/Modesto 7,487 15.3 4 Jacksonville 4,094 8.4 5 Savannah 3,335 6.8 6 Tampa 3,214 6.6 7 Detroit 3,093 6.3 8 Cleveland 2,662 5.5 9 Hampton Roads 2,564 5.3 10 Winston-Salem 1,931 4.0 Top 10 total $ 44,784 91.9 % 21.2% 17.9% 15.3% 15.0% 6.8% 6.3% 5.3% 4.0% 2.4% 2.3% 3.5% Ohio Illinois California Florida Georgia Michigan Virginia North Carolina South Carolina New Jersey All Others 1 Based on ABR for industrial segment.

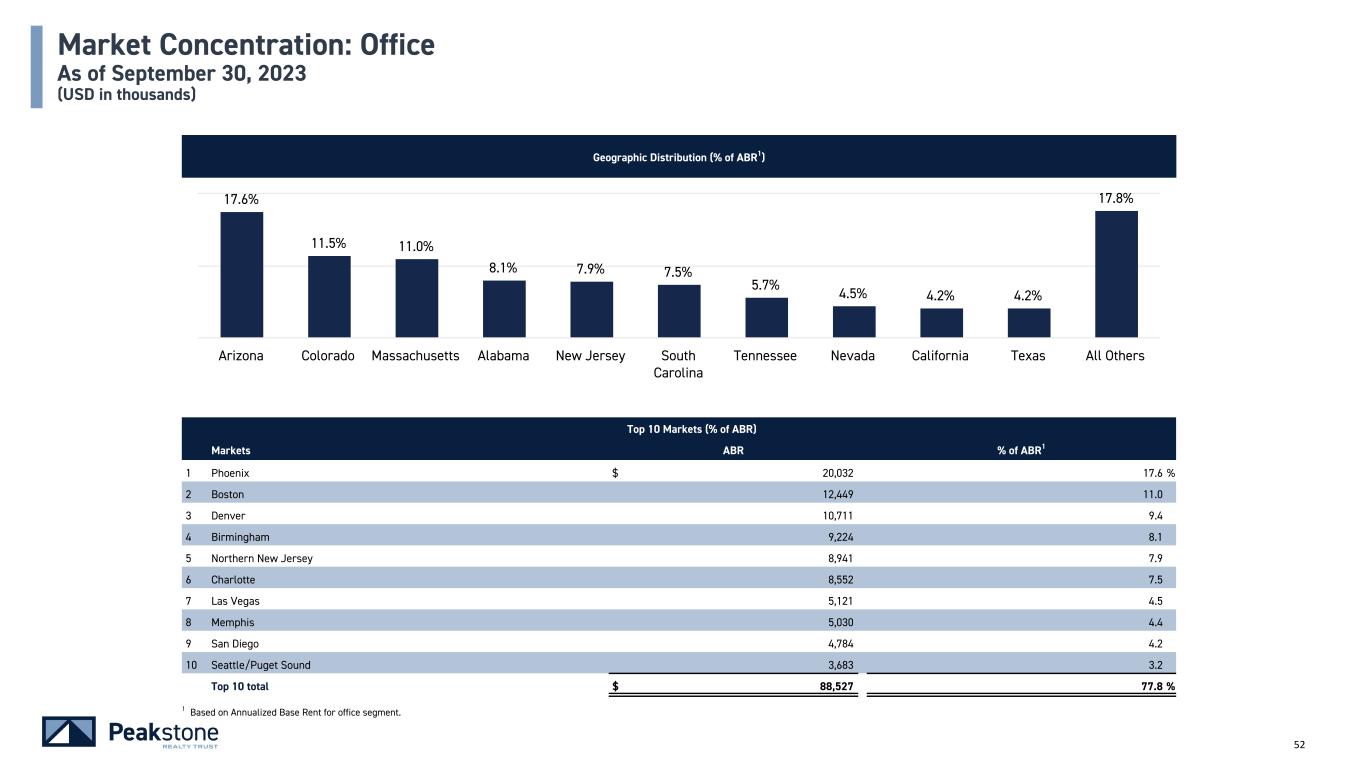

52 Geographic Distribution (% of ABR1) Market Concentration: Office As of September 30, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 20,032 17.6 % 2 Boston 12,449 11.0 3 Denver 10,711 9.4 4 Birmingham 9,224 8.1 5 Northern New Jersey 8,941 7.9 6 Charlotte 8,552 7.5 7 Las Vegas 5,121 4.5 8 Memphis 5,030 4.4 9 San Diego 4,784 4.2 10 Seattle/Puget Sound 3,683 3.2 Top 10 total $ 88,527 77.8 % 17.6% 11.5% 11.0% 8.1% 7.9% 7.5% 5.7% 4.5% 4.2% 4.2% 17.8% Arizona Colorado Massachusetts Alabama New Jersey South Carolina Tennessee Nevada California Texas All Others 1 Based on Annualized Base Rent for office segment.

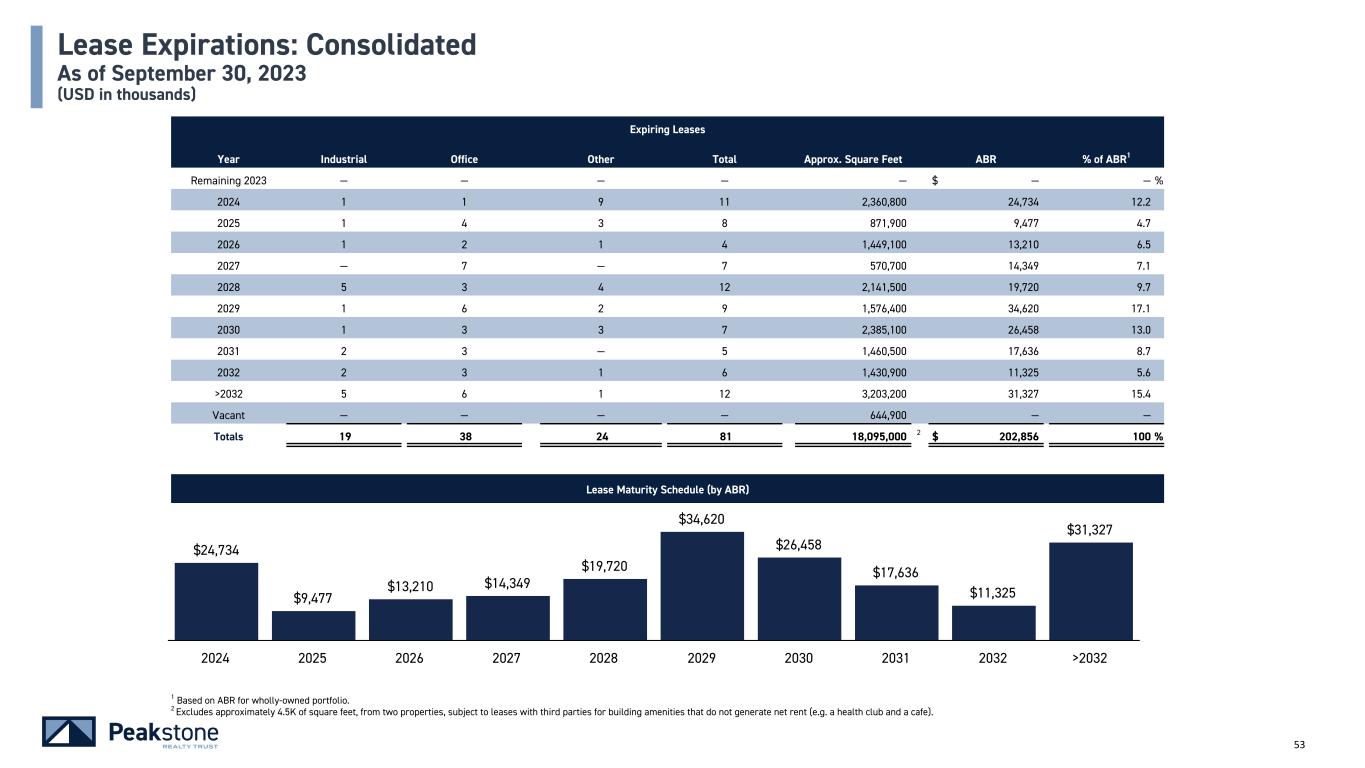

53 Lease Expirations: Consolidated As of September 30, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) 1 Based on ABR for wholly-owned portfolio. 2 Excludes approximately 4.5K of square feet, from two properties, subject to leases with third parties for building amenities that do not generate net rent (e.g. a health club and a cafe). $24,734 $9,477 $13,210 $14,349 $19,720 $34,620 $26,458 $17,636 $11,325 $31,327 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Industrial Office Other Total Approx. Square Feet ABR % of ABR1 Remaining 2023 — — — — — $ — — % 2024 1 1 9 11 2,360,800 24,734 12.2 2025 1 4 3 8 871,900 9,477 4.7 2026 1 2 1 4 1,449,100 13,210 6.5 2027 — 7 — 7 570,700 14,349 7.1 2028 5 3 4 12 2,141,500 19,720 9.7 2029 1 6 2 9 1,576,400 34,620 17.1 2030 1 3 3 7 2,385,100 26,458 13.0 2031 2 3 — 5 1,460,500 17,636 8.7 2032 2 3 1 6 1,430,900 11,325 5.6 >2032 5 6 1 12 3,203,200 31,327 15.4 Vacant — — — — 644,900 — — Totals 19 38 24 81 18,095,000 2 $ 202,856 100 %

54 Lease Expirations: Industrial and Office As of September 30, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $5,076 $4,717 $10,518 $14,349 $16,377 $27,026 $25,024 $17,636 $10,557 $31,025 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Industrial Office Approx. Square Feet ABR % of ABR1 Remaining 2023 — — — $ — — % 2024 1 1 875,700 5,076 3.1 2025 1 4 307,200 4,717 2.9 2026 1 2 1,338,800 10,518 6.5 2027 — 7 570,700 14,349 8.8 2028 5 3 1,876,800 16,377 10.1 2029 1 6 1,316,400 27,026 16.7 2030 1 3 2,311,700 25,024 15.4 2031 2 3 1,460,500 17,636 10.9 2032 2 3 1,374,300 10,557 6.5 >2032 5 6 3,185,100 31,025 19.1 Vacant — — 69,000 — — Totals 19 38 14,686,200 $ 162,305 100 % 1 Based on ABR for the industrial and office segments.

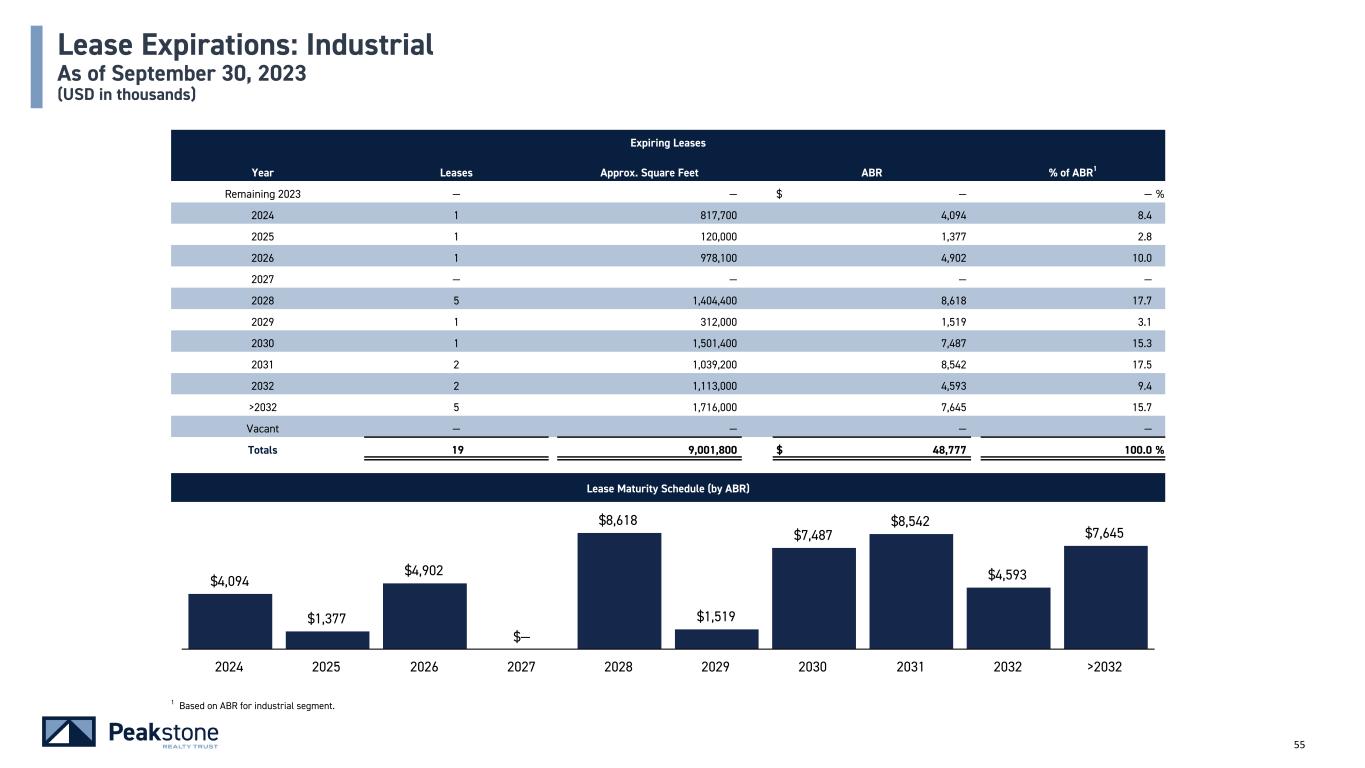

55 Lease Expirations: Industrial As of September 30, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $4,094 $1,377 $4,902 $— $8,618 $1,519 $7,487 $8,542 $4,593 $7,645 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Leases Approx. Square Feet ABR % of ABR1 Remaining 2023 — — $ — — % 2024 1 817,700 4,094 8.4 2025 1 120,000 1,377 2.8 2026 1 978,100 4,902 10.0 2027 — — — — 2028 5 1,404,400 8,618 17.7 2029 1 312,000 1,519 3.1 2030 1 1,501,400 7,487 15.3 2031 2 1,039,200 8,542 17.5 2032 2 1,113,000 4,593 9.4 >2032 5 1,716,000 7,645 15.7 Vacant — — — — Totals 19 9,001,800 $ 48,777 100.0 % 1 Based on ABR for industrial segment.

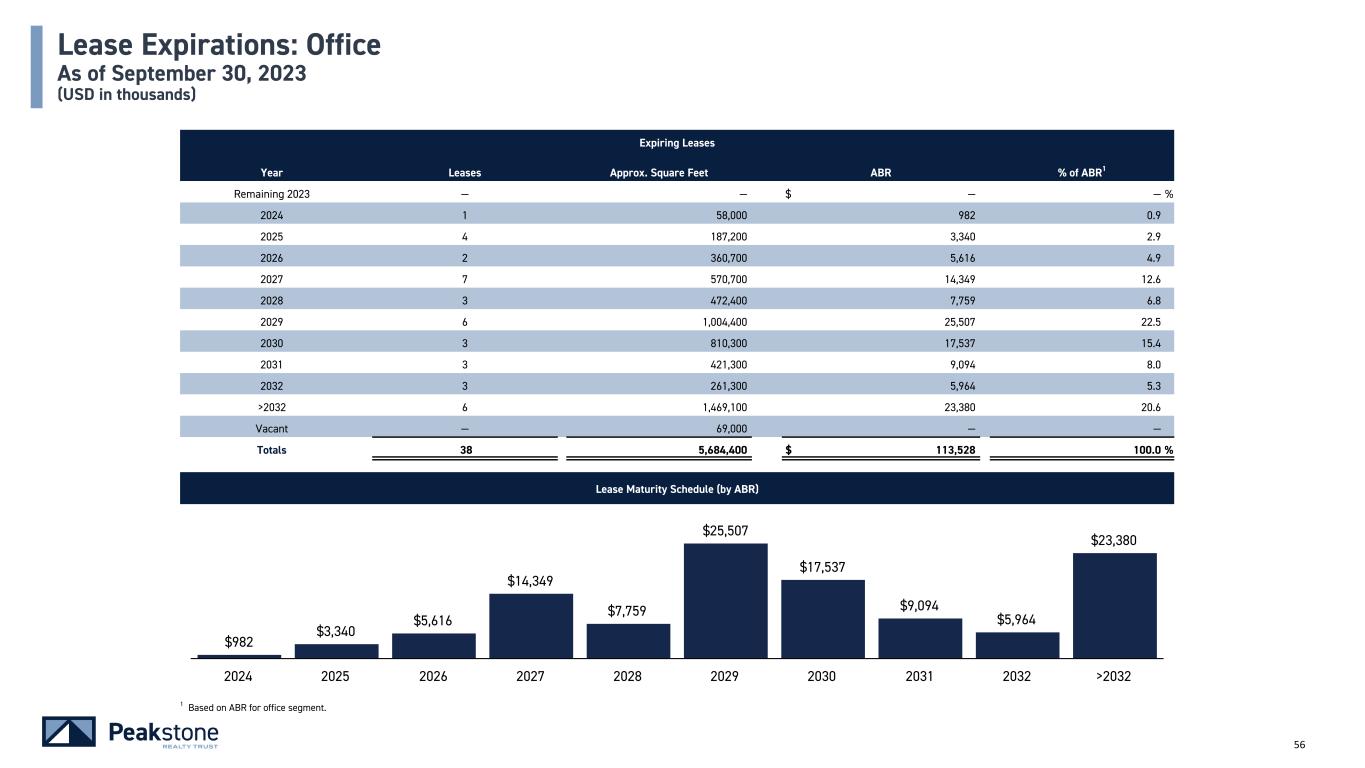

56 Lease Expirations: Office As of September 30, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $982 $3,340 $5,616 $14,349 $7,759 $25,507 $17,537 $9,094 $5,964 $23,380 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Leases Approx. Square Feet ABR % of ABR1 Remaining 2023 — — $ — — % 2024 1 58,000 982 0.9 2025 4 187,200 3,340 2.9 2026 2 360,700 5,616 4.9 2027 7 570,700 14,349 12.6 2028 3 472,400 7,759 6.8 2029 6 1,004,400 25,507 22.5 2030 3 810,300 17,537 15.4 2031 3 421,300 9,094 8.0 2032 3 261,300 5,964 5.3 >2032 6 1,469,100 23,380 20.6 Vacant — 69,000 — — Totals 38 5,684,400 $ 113,528 100.0 % 1 Based on ABR for office segment.

57 Lease Expirations: Other As of September 30, 2023 (USD in thousands) Lease Maturity Schedule (by ABR1) $19,658 $4,760 $2,692 $— $3,343 $7,594 $1,434 $— $768 $302 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Total Approx. Square Feet ABR % of ABR1 Remaining 2023 — — $ — — % 2024 9 1,485,100 19,658 48.5 2025 3 564,700 4,760 11.7 2026 1 110,300 2,692 6.6 2027 — — — — 2028 4 264,700 3,343 8.2 2029 2 260,000 7,594 18.7 2030 3 73,400 1,434 3.5 2031 — — — — 2032 1 56,600 768 1.9 >2032 1 18,100 302 0.7 Vacant — 575,900 — — Totals 24 3,408,800 $ 40,551 100.0 % 1 Based on ABR by expiring leases for other segment.

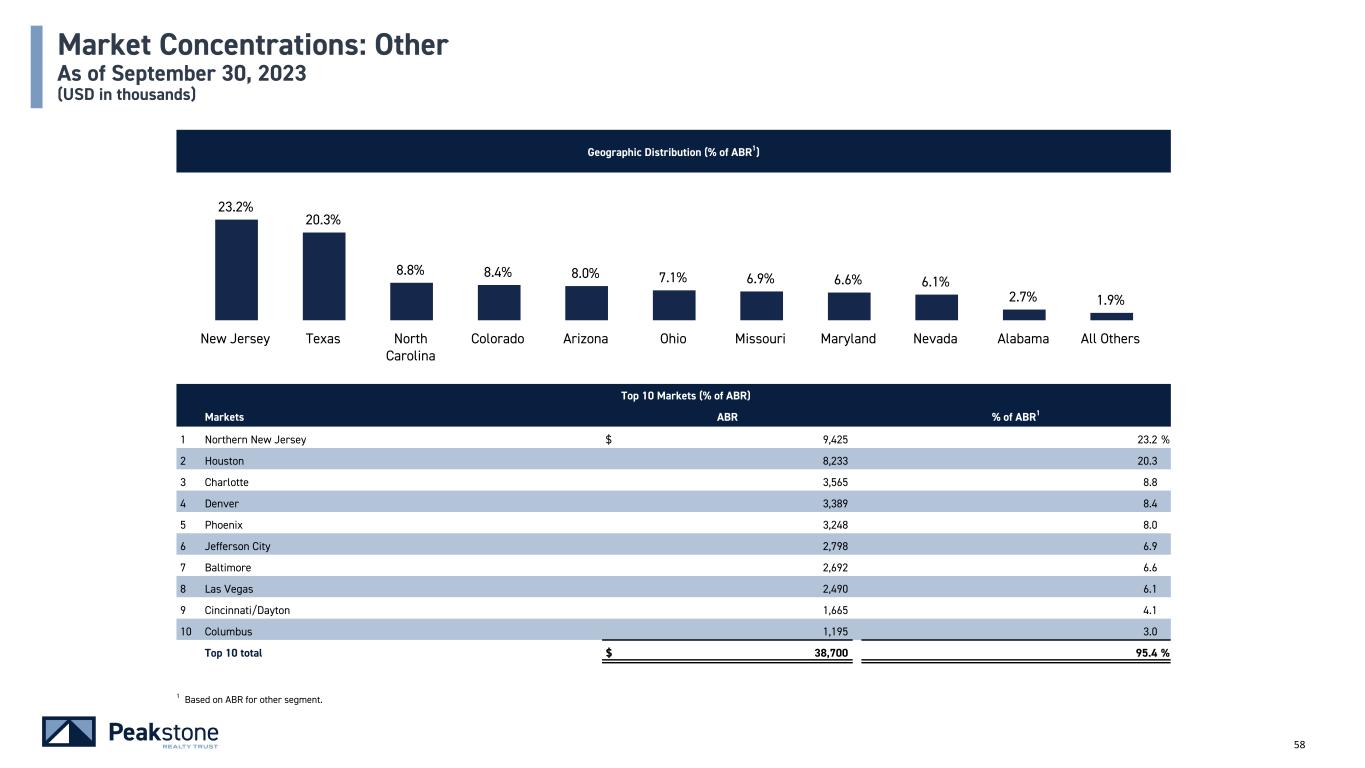

58 Geographic Distribution (% of ABR1) Market Concentrations: Other As of September 30, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Northern New Jersey $ 9,425 23.2 % 2 Houston 8,233 20.3 3 Charlotte 3,565 8.8 4 Denver 3,389 8.4 5 Phoenix 3,248 8.0 6 Jefferson City 2,798 6.9 7 Baltimore 2,692 6.6 8 Las Vegas 2,490 6.1 9 Cincinnati/Dayton 1,665 4.1 10 Columbus 1,195 3.0 Top 10 total $ 38,700 95.4 % 23.2% 20.3% 8.8% 8.4% 8.0% 7.1% 6.9% 6.6% 6.1% 2.7% 1.9% New Jersey Texas North Carolina Colorado Arizona Ohio Missouri Maryland Nevada Alabama All Others 1 Based on ABR for other segment.

Notes & Definitions