Minutes Show ECB Policymakers Agreed On Need To Counter Criticism

19 Mai 2016 - 12:15PM

RTTF2

European Central Bank policymakers agreed that there was a need

to reaffirm that its measures can achieve the aim of returning

inflation to its near-2 percent target, amid rising criticism

against its stimulus measures, minutes of the April 20-21

rate-setting session showed Thursday.

"There was general agreement that there was a need to counter

the perception that monetary policy could no longer contribute to a

return of inflation to the Governing Council's aim of below, but

close to, 2 percent," the minutes, which the ECB calls "account"

said.

The central bank left all three of its key interest rates

unchanged in the April session after reducing them unexpectedly in

March.

Policymakers also agreed that the ECB's monetary policy measures

were being effective and that there were grounds for cautious

optimism about the economy. However, patience was needed for the

measures to fully unfold over time in terms of output and

inflation, the minutes said.

The rate-setters also stressed that the Governing Council was

unanimous in its commitment to deliver on its mandate and on the

appropriateness of an expansionary monetary policy stance.

"In the light of recent public criticism that had appeared to

link the ECB's decisions to developments in the political sphere in

a Member State, it was viewed as important to reaffirm collectively

the independence of the ECB in the pursuit of its mandate," the

minutes said.

Eurozone was undergoing a moderate economic recovery, though the

risks remain tilted to the downside, members agreed. Meanwhile,

policymakers expressed some concern over the Eurocoin indicator

that registered its biggest fall in over three years during March.

The measure is often cited as a useful cyclical indicator of growth

in the euro area, the minutes said.

Citing the current oil futures prices, the ECB rate-setters

expect headline inflation to return to negative territory in the

next few months. Thereafter, inflation is forecast to rise in the

latter part of the year as a result of the upward impact of base

effects together with assumed increases in oil prices, as embedded

in the futures curve.

"In 2017-18 inflation was expected to pick up further, in line

with the projected economic recovery and supported by the ECB's

monetary policy measures," the minutes said.

Policymakers were worried that market-based inflation

expectations had not picked up from their low levels despite the

stabilization in oil prices.

"While euro area inflation was expected to pick up, it was

crucial to ensure that the very low inflation environment did not

become entrenched via second-round effects on wage and price

setting," the minutes said.

ECB rate-setters expressed regret that the very detailed,

country-specific recommendations for structural reforms given by

the EU were not being sufficiently followed up and implemented by

member states. They urged countries to strive for a more

growth-friendly composition of fiscal policies.

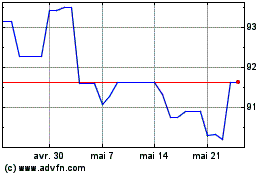

US Dollar vs RUB (FX:USDRUB)

Graphique Historique de la Devise

De Jan 2025 à Fév 2025

US Dollar vs RUB (FX:USDRUB)

Graphique Historique de la Devise

De Fév 2024 à Fév 2025