UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

(Check one): ☐

Form 10-K ☐ Form 20-F ☐

Form 11-K ☒ Form 10-Q ☐

Form N-SAR ☐ Form N-CSR

For Period Ended: June 30, 2023

| ☐ |

Transition Report on Form 10-K |

| ☐ |

Transition Report on Form 20-F |

| ☐ |

Transition Report on Form 11-K |

| ☐ |

Transition Report on Form 10-Q |

| ☐ |

Transition Report on Form N-SAR |

For the Transition Period Ended:

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein.

If the notification relates to a portion of the

filing checked above, identify the item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

INPIXON

Full Name of Registrant

Former Name if Applicable

2479 E. Bayshore Road

Suite 195

Address of Principal Executive Office

Palo Alto, CA 94303

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without

unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box

if appropriate)

| |

(a) |

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

|

|

| ☒ |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

|

|

| |

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K,

20-F, 11-K, 10-Q, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Inpixon (the “Registrant” or the “Company”)

has determined that it is not able to file its quarterly report on Form 10-Q for the six months ended June 30, 2023 (the “Form 10-Q”)

within the prescribed time period without unreasonable effort or expense. The Company requires additional time to allow its auditors to

complete the review of its condensed consolidated financial statements for the required periods ended June 30, 2023. The Registrant presently

expects to file the Form 10-Q within the extension period of five calendar days as provided under Rule 12b-25.

PART IV — OTHER INFORMATION

(1) Name and telephone number of person to contact

in regard to this notification

| Nadir Ali |

|

(408) |

|

702-2167 |

| (Name) |

|

(Area Code) |

|

(Telephone Number) |

(2) Have all other periodic reports required under

Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12

months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

Yes ☒ No ☐

(3) Is it anticipated that any significant change

in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof?

Yes ☒

No ☐

If so, attach an explanation of the anticipated

change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be

made.

The Registrant expects to report certain significant

changes in its results of operations. On August 14, 2023, the Registrant reported its preliminary unaudited financial results for the

quarter ended June 30, 2023. Among other things, the Registrant reported revenues for the three and six months ended June 30, 2023 of

$2.1 million and $5.2 million, respectively, compared to $2.6 million and $5.2 million, respectively, for the comparable periods in the

prior year. This quarter-over-quarter decrease was primarily attributable to the decrease in Indoor Intelligence sales due to delayed

shipments and lower sales for the SAVES product line. The Registrant also reported gross profit for the three and six months ended June

30, 2023 of $1.7 million and $4.0 million, respectively, compared to $1.7 million and $3.6 million for the 2022 respective periods. The

gross profit margin for the three and six months ended June 30, 2023, was 81% and 77%, compared to 67% and 68% for the three and six months

ended June 30, 2022, respectively. This increase in gross margin was primarily due to the lower cost of revenues on the SAVES product

line.

The Registrant also reported operating expenses

for the three months ended June 30, 2023 of $8.3 million and $11.1 million for the comparable period ended June 30, 2022. This decrease

of approximately $2.8 million is primarily attributable to the $2.0 million of goodwill impairment in the three months ended June 30,

2022 and lower compensation, professional fees and legal expenses in the three months ended June 30, 2023. The Registrant reported operating

expenses for the six months ended June 30, 2023 of $18.8 million and $22.2 million for the comparable period ended June 30, 2022. This

decrease of $3.4 million is primarily attributable to the $2.0 million of goodwill impairment in the six months ended June 30, 2022, lower

stock-based compensation and professional fees in the six months ended June 30, 2023 offset by $1.4 million of transaction costs in the

2023 period.

In addition, the Registrant reported net loss

from continuing operations for the three months ended June 30, 2023 of $7.33 million compared to $8.97 million for the comparable period

in the prior year. This decrease in loss of approximately $1.6 million was primarily attributable to the goodwill impairment of $2.0 million

in the three months ended June 30, 2022 and lower operating expenses in the three months ended June 30, 2023. The Registrant reported

net loss from continuing operations for both the six months ended June 30, 2023 and 2022 of $19.7 million.

The Registrant believes that its results contained

herein for the three and six months ended June 30, 2023 are materially correct; however, because management’s review is ongoing,

there can be no assurance that the financial and accounting information referred to in this filing will not change upon completion of

the audit and filing of the Form 10-Q.

Cautionary Note Regarding Forward-Looking Statements

This Form 12b-25 includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include, without limitation, statements about the timing of the filing of the Form 10-Q and the Company’s

expected financial results for the six months ended June 30, 2023. Although the Registrant believes that the expectations reflected in

such forward-looking statements are based upon reasonable assumptions, beliefs and expectations, there can be no assurance that its expectations

will be achieved. Except as otherwise may be required by law, the Registrant undertakes no obligation to update or publicly release any

revisions to forward-looking statements to reflect events, circumstances, or changes in expectations after the date of this Form 12b-25.

Inpixon

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its

behalf by the undersigned hereunto duly authorized.

| Dated: August 15, 2023 |

By: |

/s/ Nadir Ali |

| |

|

Nadir Ali |

| |

|

Chief Executive Officer |

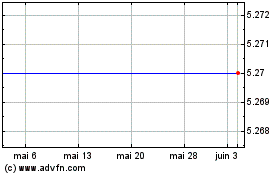

Inpixon (NASDAQ:INPX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Inpixon (NASDAQ:INPX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024